Shearman & Sterling's Recent Trends and Patterns in the Enforcement of the Foreign Corrupt Practices Act (FCPA) Digest – January 4, 2016

Shearman & Sterling

Description

FCPA Digest

Cases and Review Releases Relating to Bribes to Foreign Officials

under the Foreign Corrupt Practices Act of 1977

JANUARY 2016

. Editorial Board

Editor In Chief:

Philip Urofsky

Washington, DC

London

+1.202.508.8060

purofsky@shearman.com

Managing Editor:

Zach Torres-Fowler

Contributing Editors:

Alexandra Munson

Digest Contributors:

Daria Anichkova, Avani Bhatt, Laura Caldwell, Johnston Chen, Juliana Clay, Erica Embree, Taylor

Hartstein, Simon Jerrum, Christina Lee, and Jordan Yeagley.

Founding Editor:

Danforth Newcomb

New York

+1.212.848.4184

dnewcomb@shearman.com

Past Contributors:

Jill Aberbach, Andrew Agor, Carolyn Bannon, Joseph Barden, Rachel Barnes, Jessica Bartlett, Zach Bench,

Paige Berges, Alexis Berkowitz, Parth Chanda, Jeannetta Craigwell-Graham, Erzulie Cruz, Bryan Dayton,

Maureen Dollinger, Kwame Dougan, Saamir Elshihabi, Teddy Flo, Helena Franceschi, Andrew Giddings,

Chris Glenn, Melissa Godwin, Helene Gogadze, Josh Goodman, Amanda Gossai, Mayer Grashin,

Christopher Greer, William Hauptman, Pasha Hsieh, Andrew Huang, Joshua Johnston, Meaghan Kelly,

Michael Kieval, Sue Kim, Amanda Kosonen, Michael Krauss, Debra Laboschin, Marlon Layton, Christopher

Le Mon, Grace Lee, Tal Machnes, Natalie Marjancik, Bronwen Mason, Mario Meeks, Hee Won (Marina)

Moon, Kyle Noonan, Mojoyin Onijala, Nicola Painter, Sushila Rao, Judith Reed, Matthew Reynolds,

Jennifer Rimm, Brian Scibetta, Rachel Schipper, Jeena Shah, Drew Shoals, Michael Steinke, Christopher

Trueax, Christian Urrutia, Natalie Waites, Ashley Walker, Molly Webster, Elizabeth Weiss, Gregory Wyckoff,

Andrei Vrabie, and Jung Yoo.

Board of Advisors:

Stephen Fishbein

New York

+1.212.848.4424

sfishbein@shearman.com

Jo Rickard

London

+44.20.7655.5781

josanne.rickard@shearman.com

Paula Howell Anderson

New York

+1.212.848.7727

paula.anderson@shearman.com

Brian Burke

Hong Kong

+852 2978 8040

brian.burke@shearman.com

Claudius O. Sokenu

New York

+1.212.848.4838

claudius.sokenu@shearman.com

Masahisa Ikeda

Tokyo

+81 (0)3.5251.1601

mikeda@shearman.com

Patrick D. Robbins

San Francisco

+1.415.616.1210

probbins@shearman.com

Robert Ellison

São Paulo

+55.11.3702.2220

robert.ellison@shearman.com

This memorandum is intended only as a general discussion of these issues. It should not be regarded as legal advice.

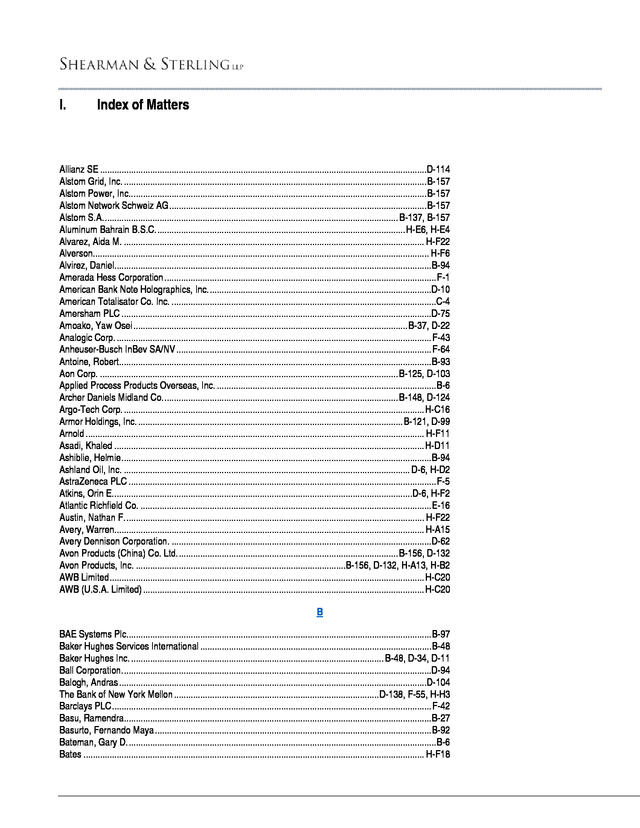

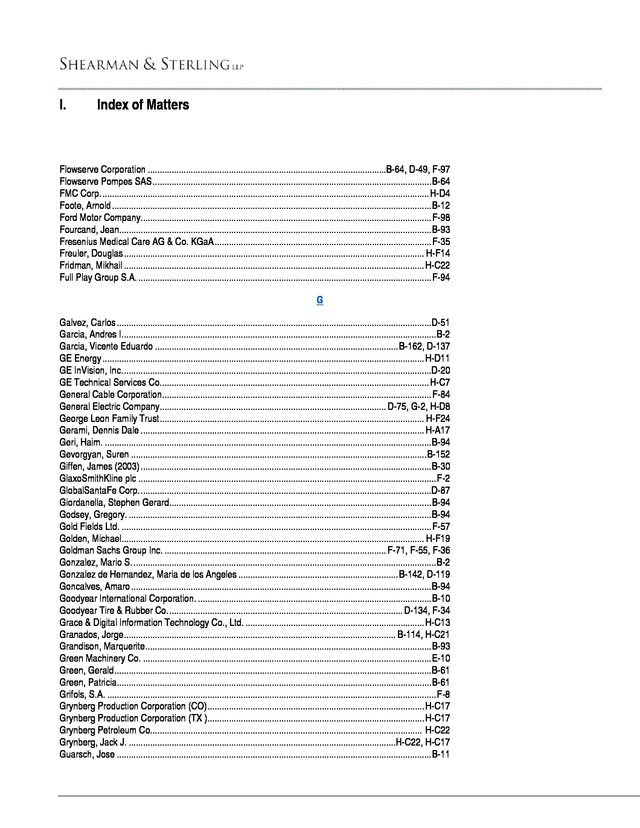

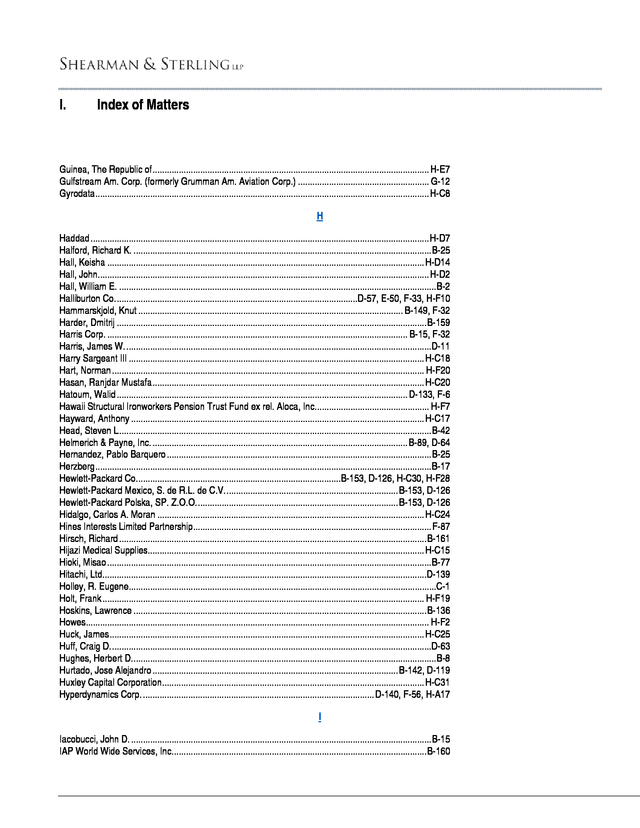

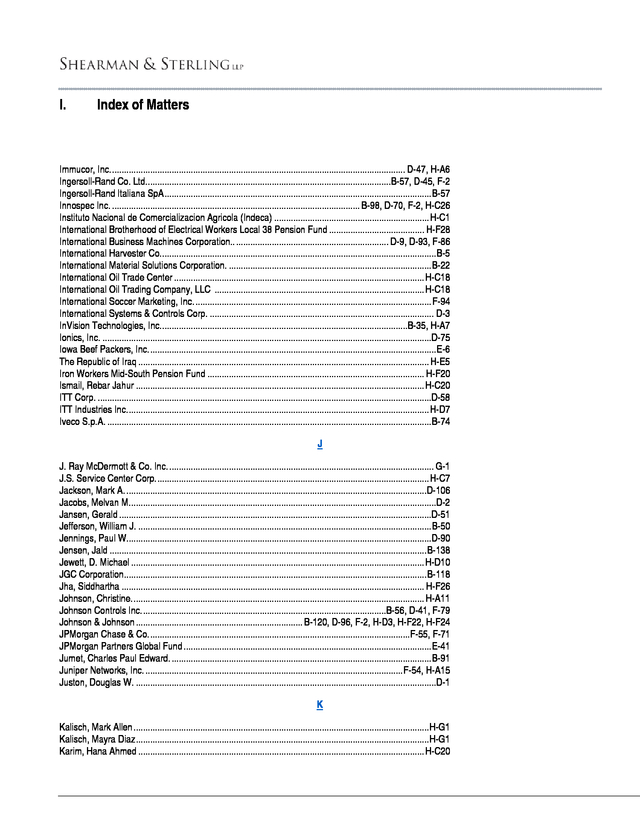

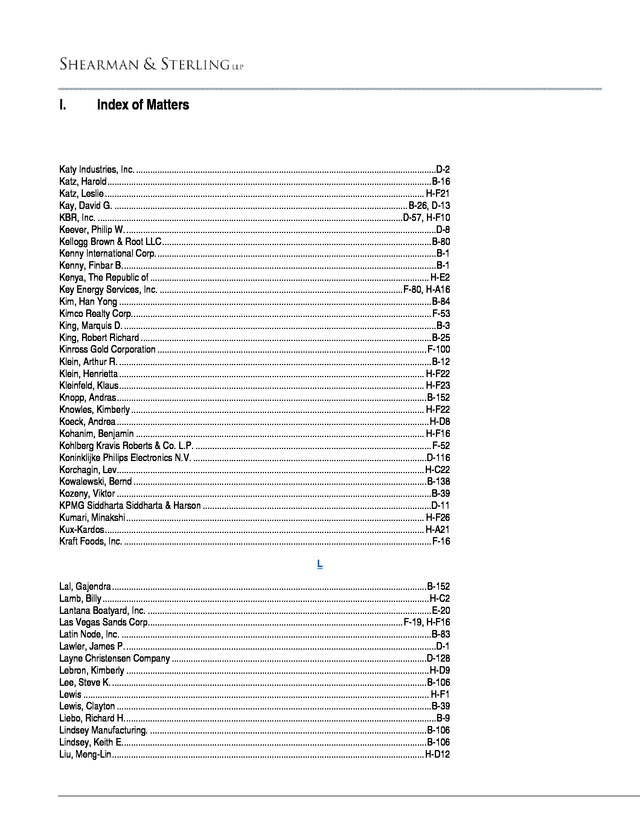

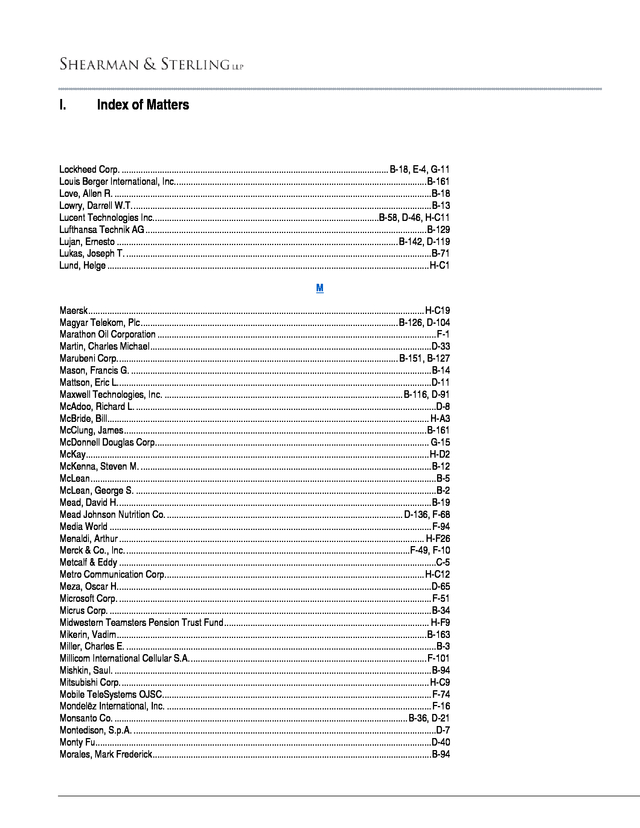

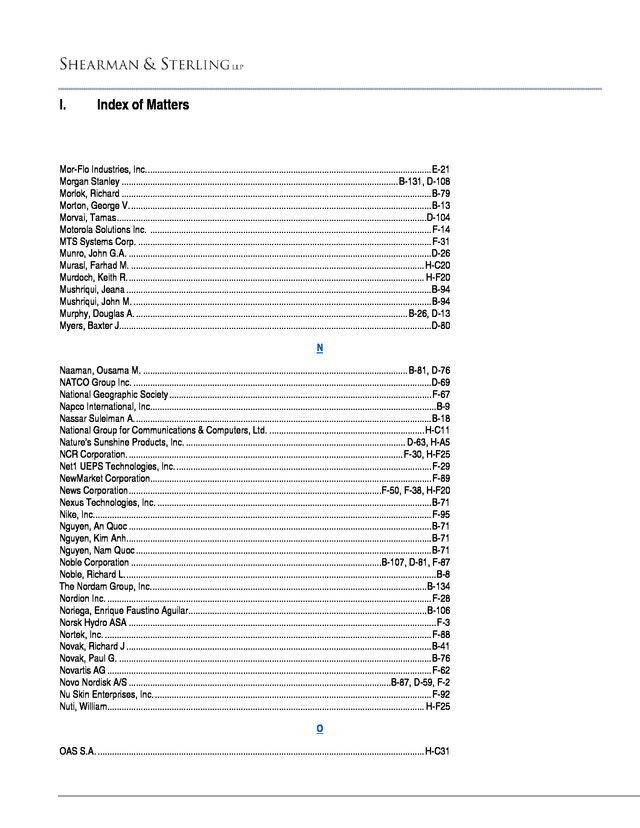

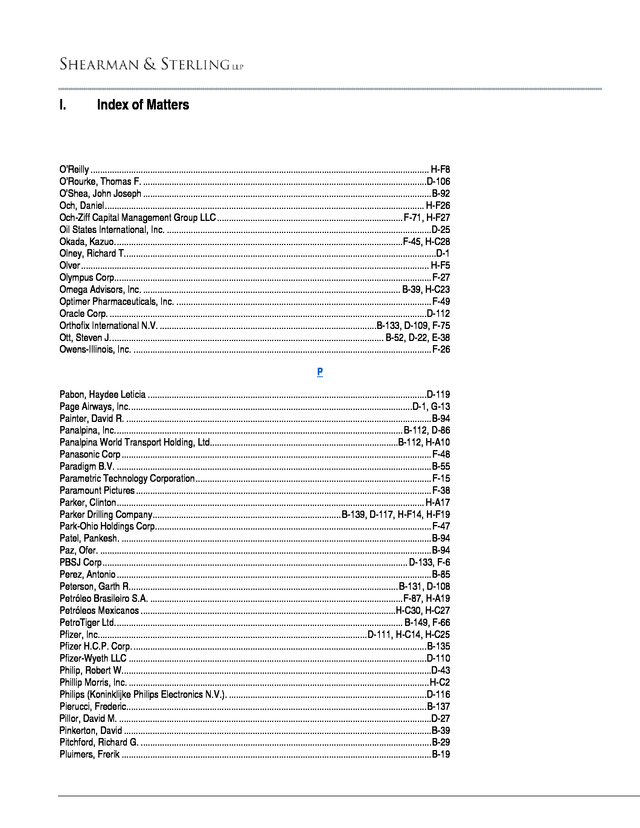

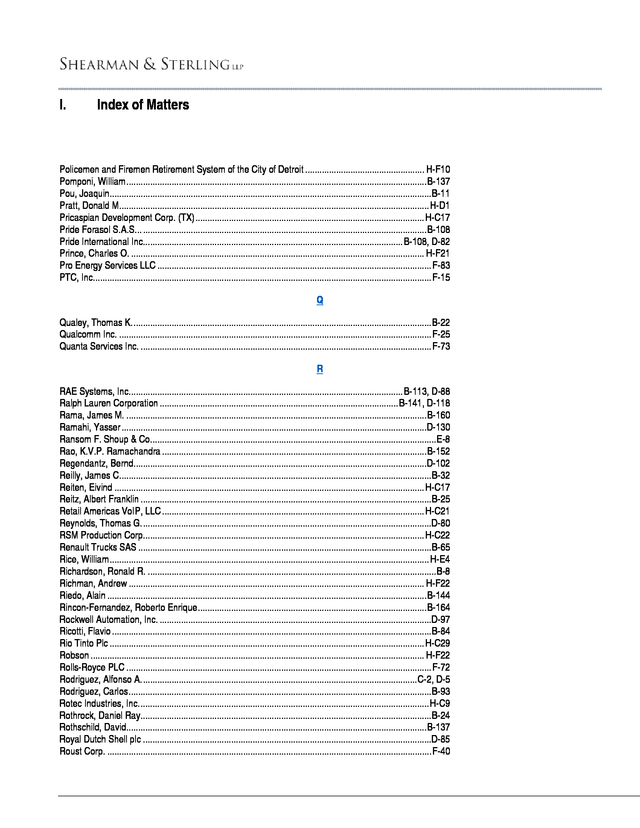

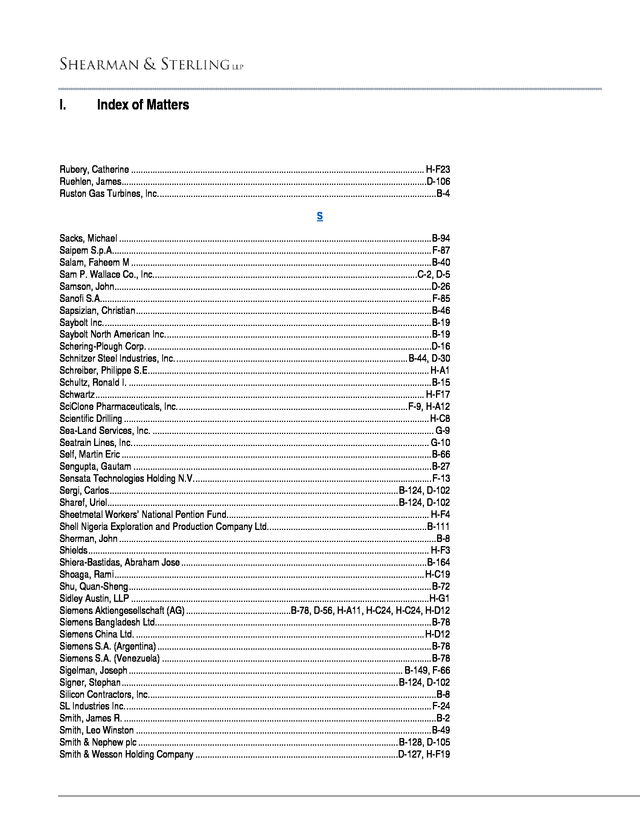

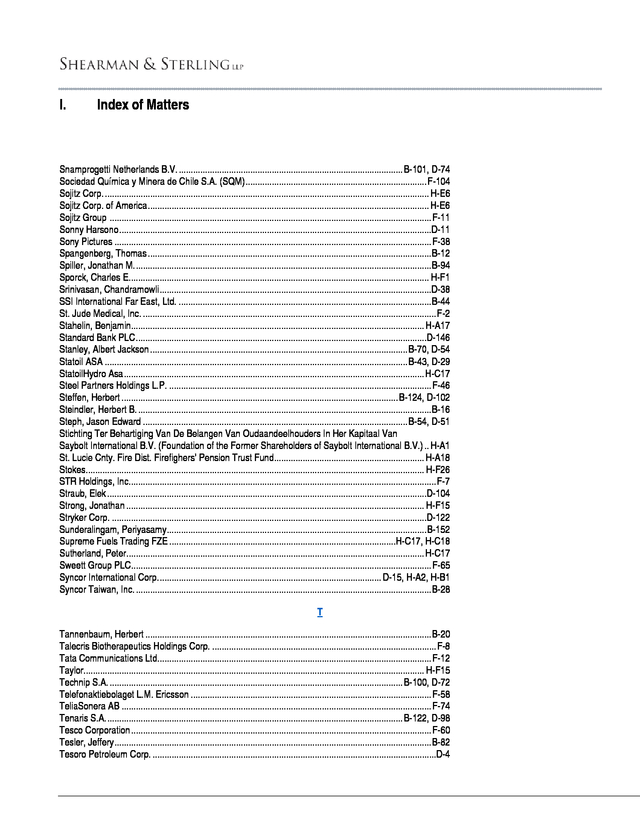

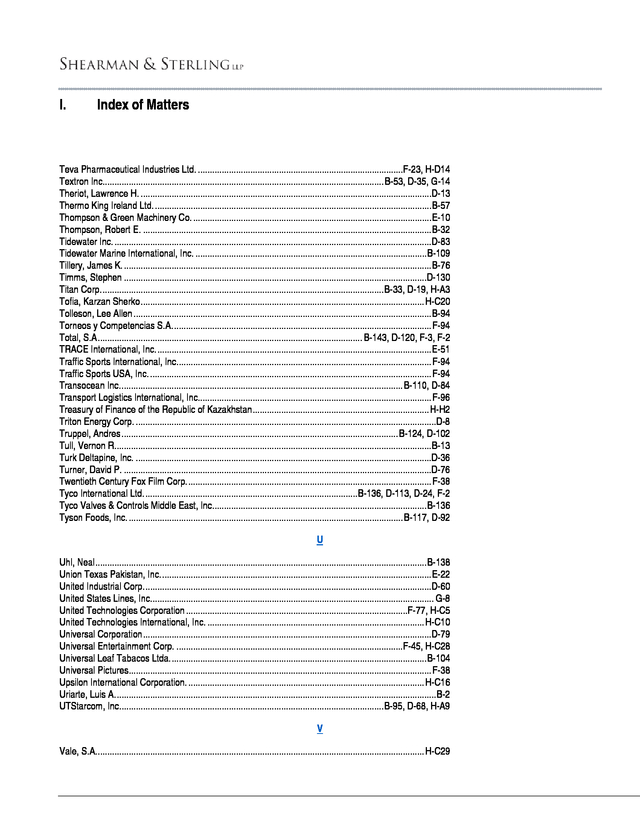

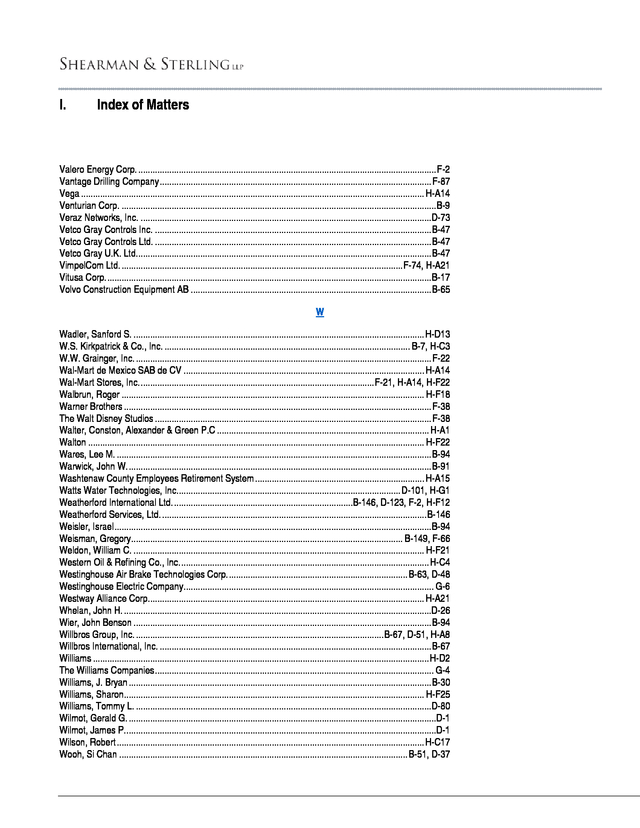

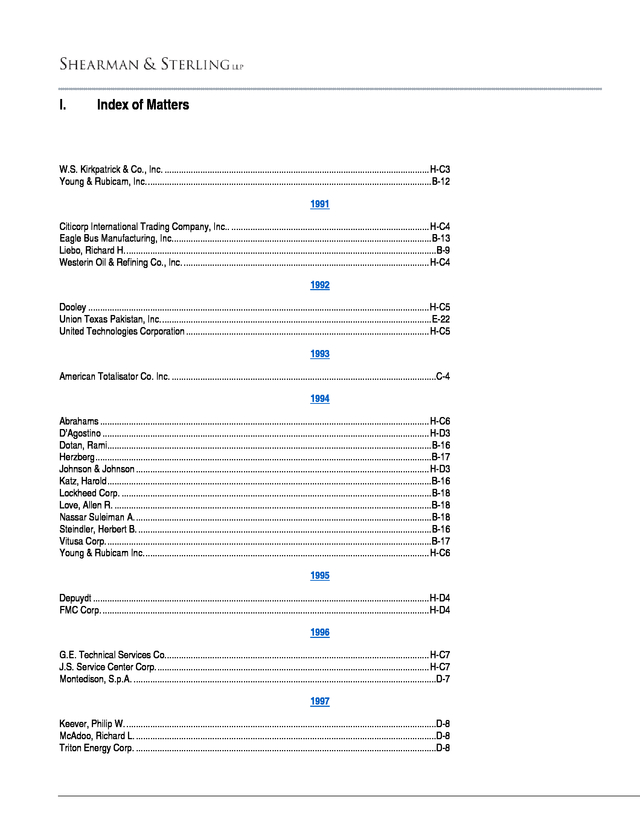

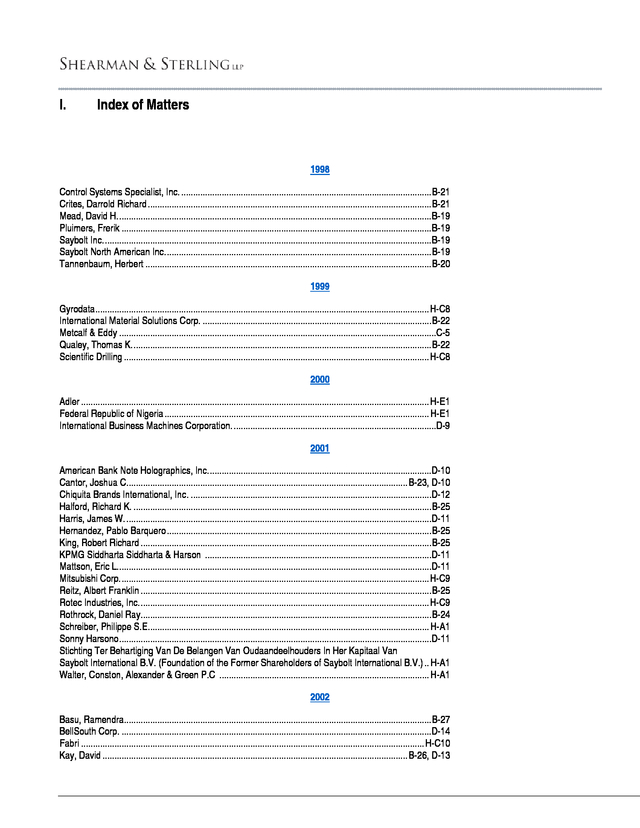

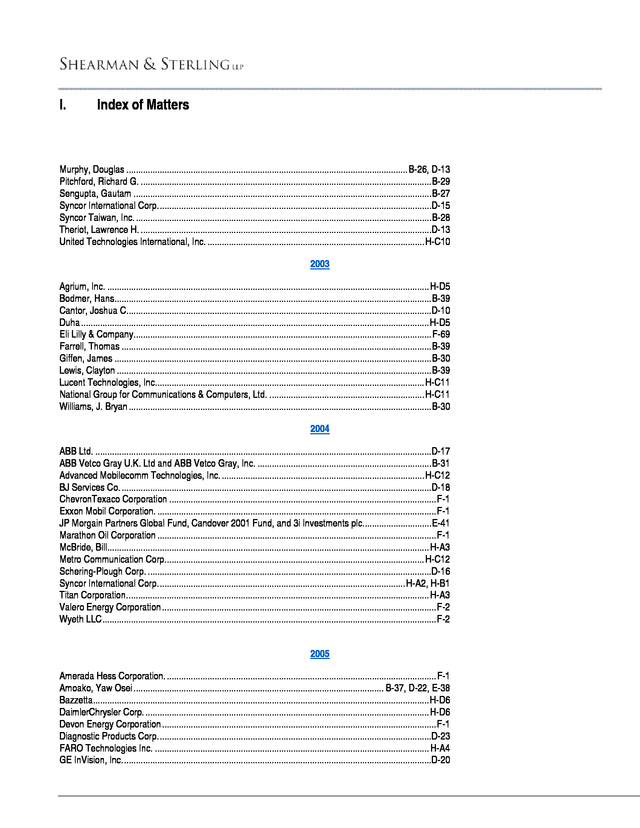

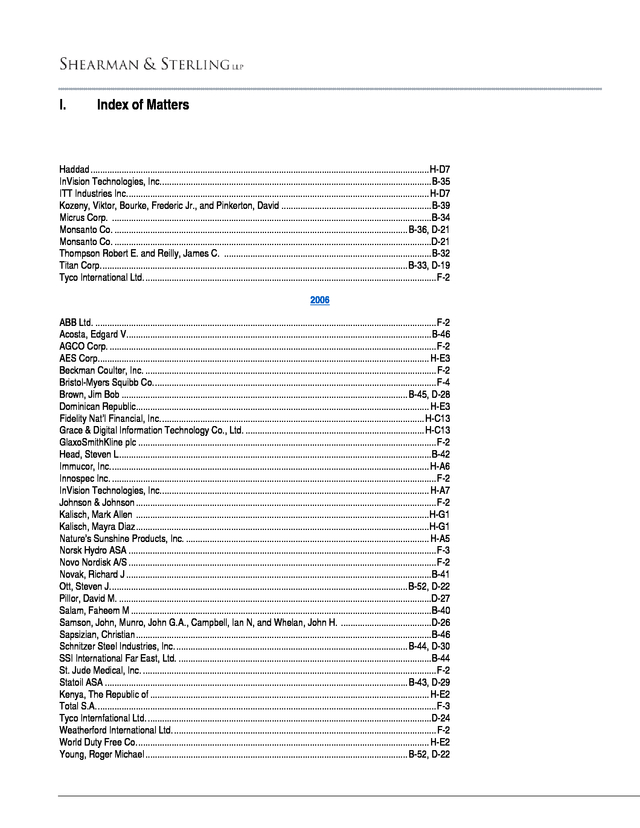

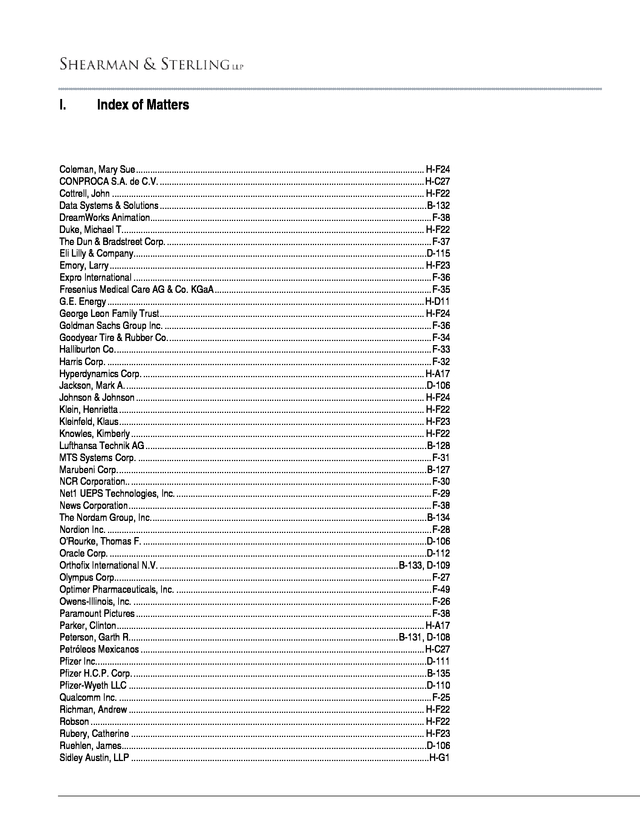

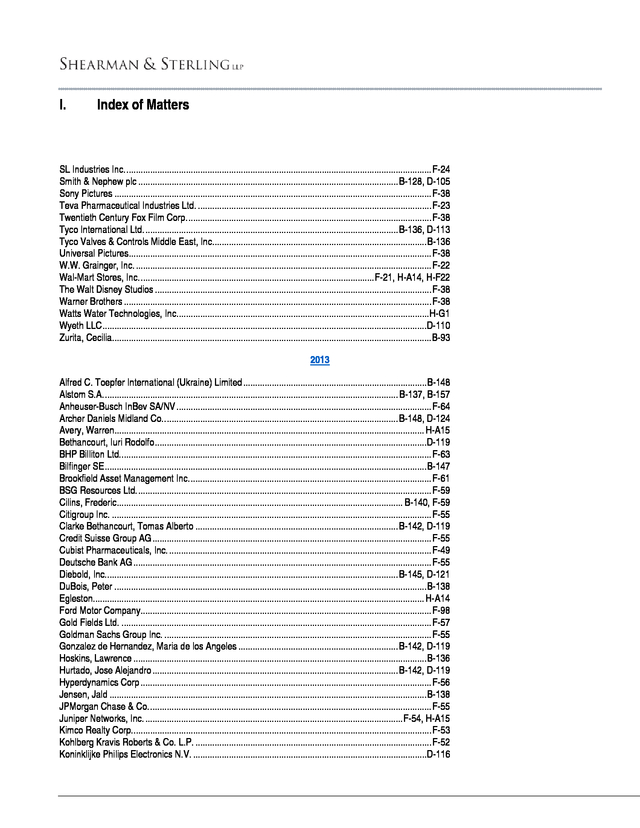

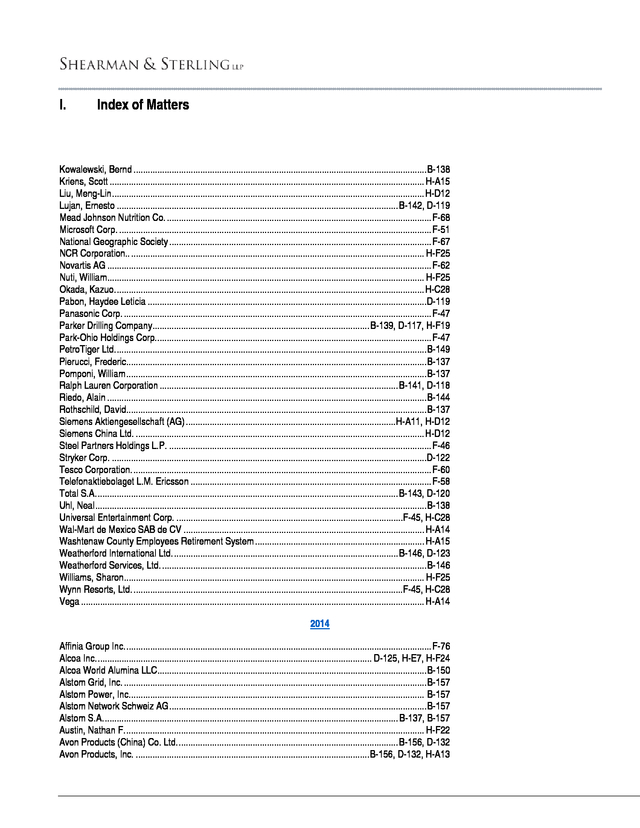

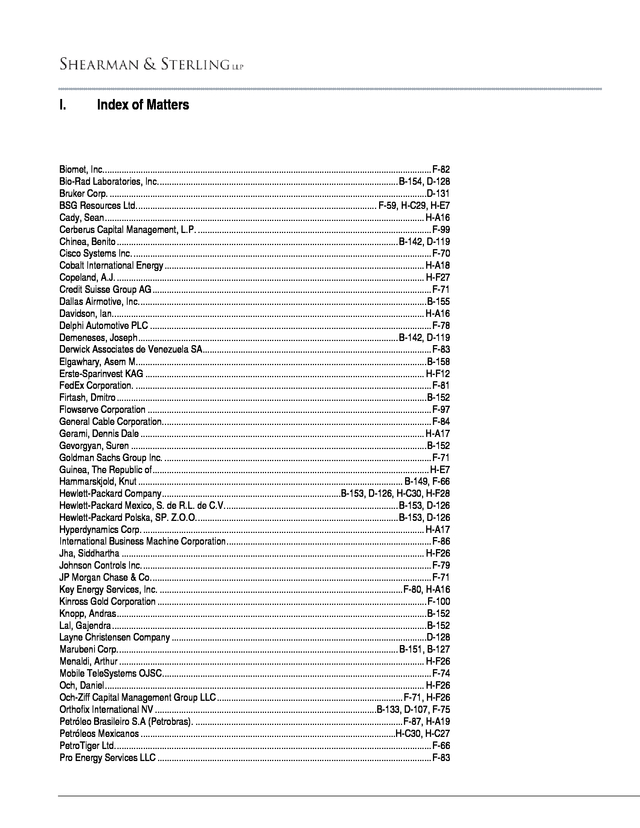

We would be pleased to provide additional details or advice about specific situations if desired. For more information on the topics covered in this issue, please contact Philip Urofsky, Danforth Newcomb, or members of the Board of Advisors. Copyright © 2016 Shearman & Sterling LLP. As used herein “Shearman & Sterling” refers to Shearman & Sterling LLP, a limited liability partnership organized under the laws of the State of Delaware. . Contents A. Recent Trends and Patterns in FCPA Enforcement i B. Foreign Bribery Criminal Prosecution Under the FCPA 1 C. Foreign Bribery Civil Actions Instituted by the Department of Justice under the FCPA 203 D.

SEC Actions Relating to Foreign Bribery 209 E. Department of Justice FCPA Opinion Procedure Releases 373 F. Ongoing Investigations Under the FCPA 435 G.

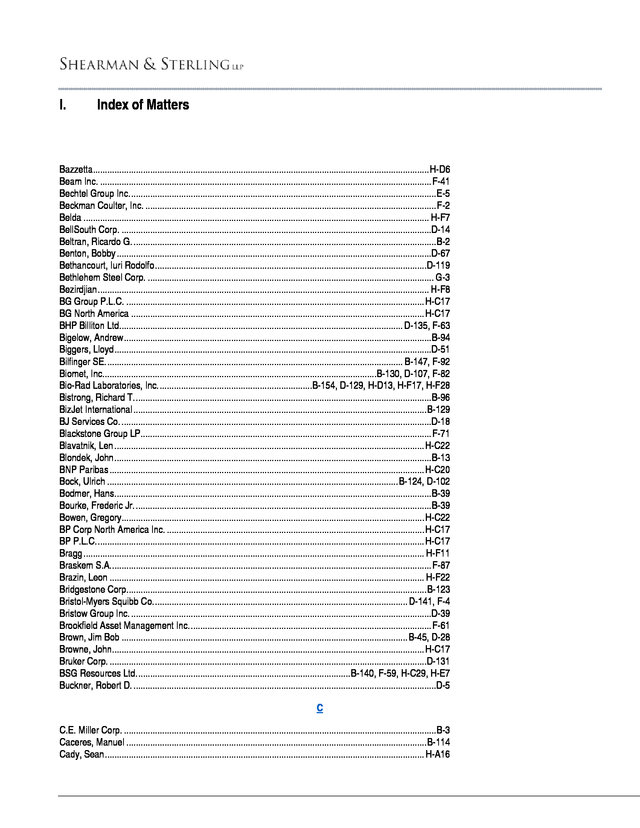

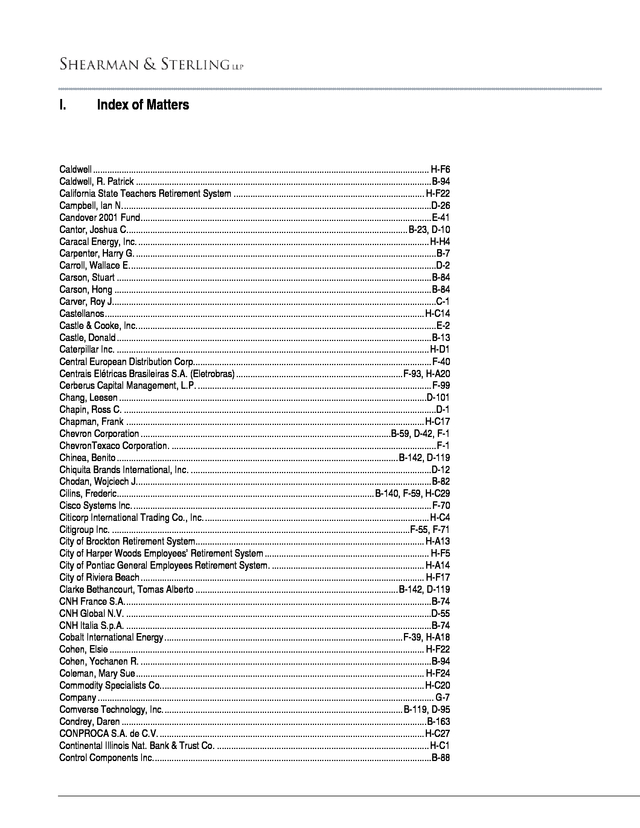

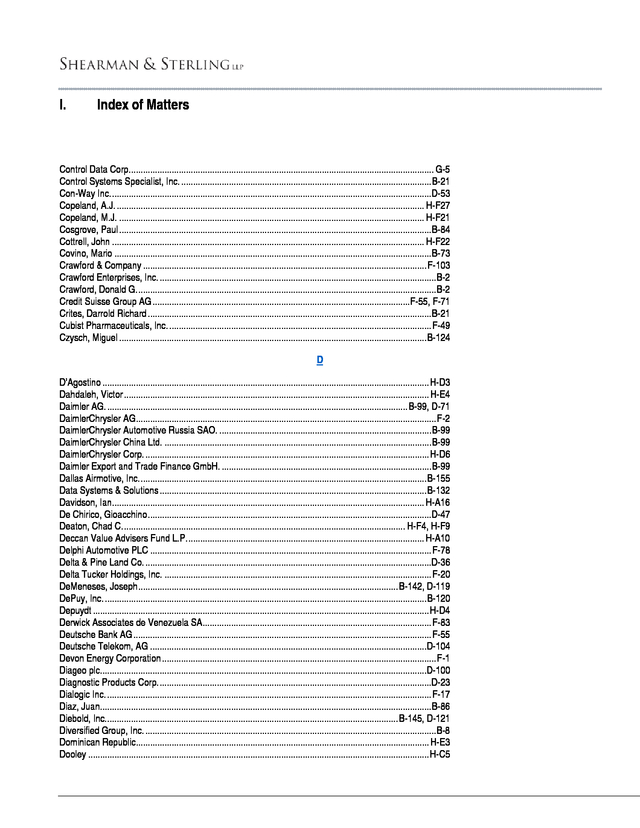

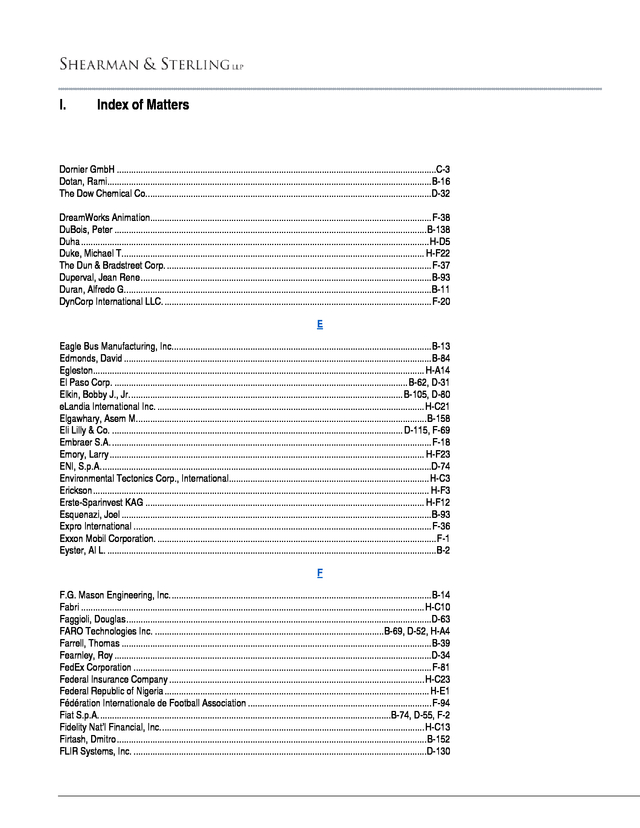

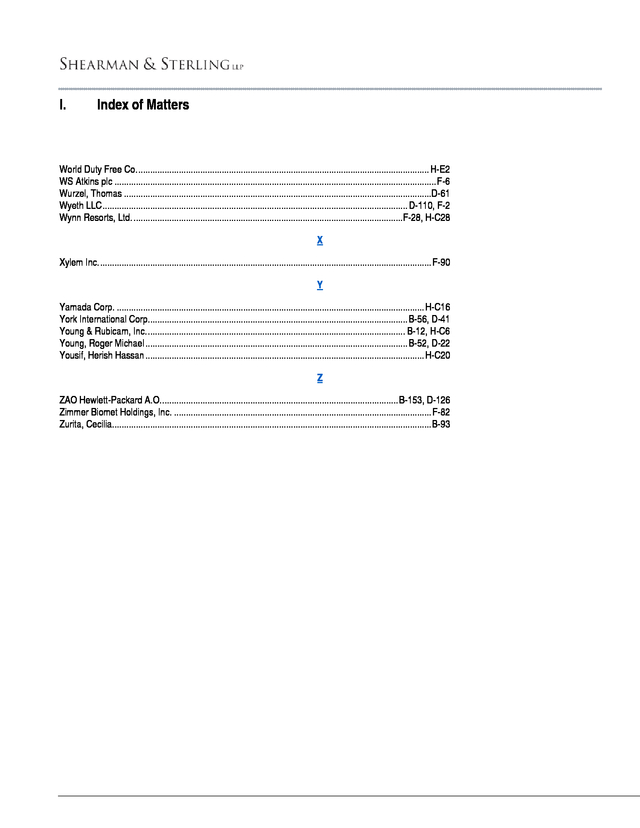

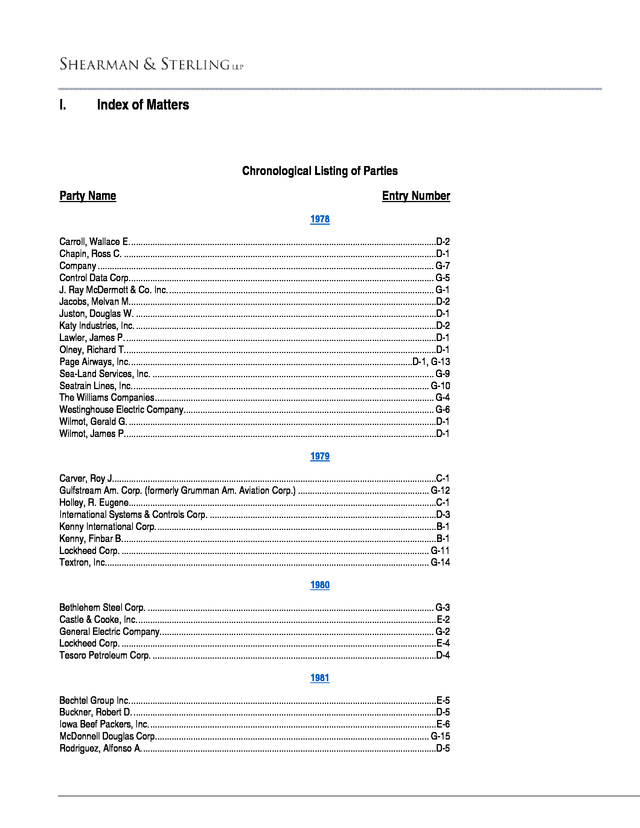

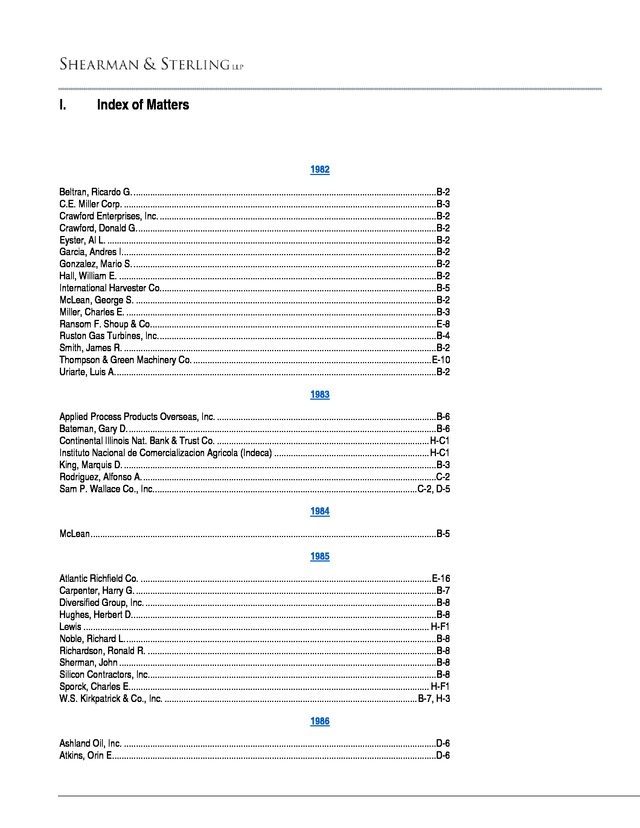

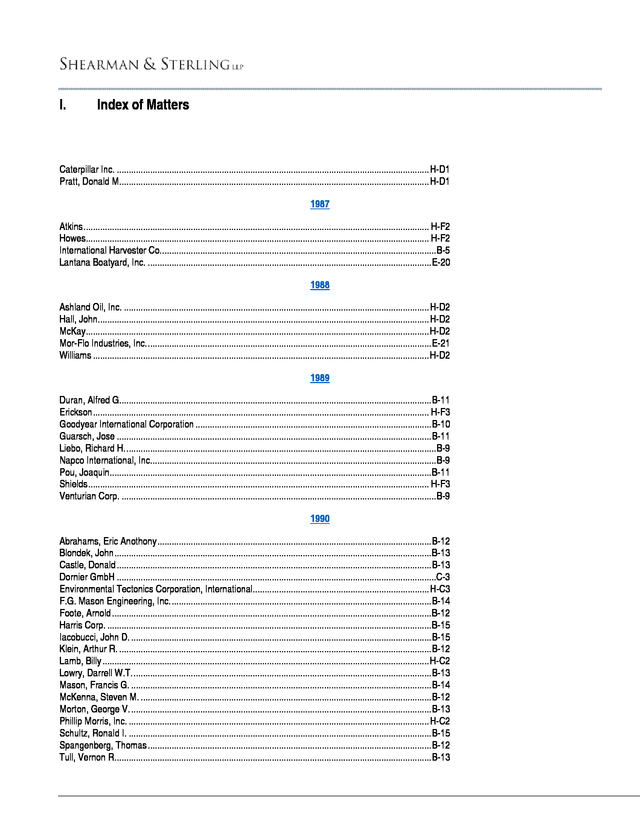

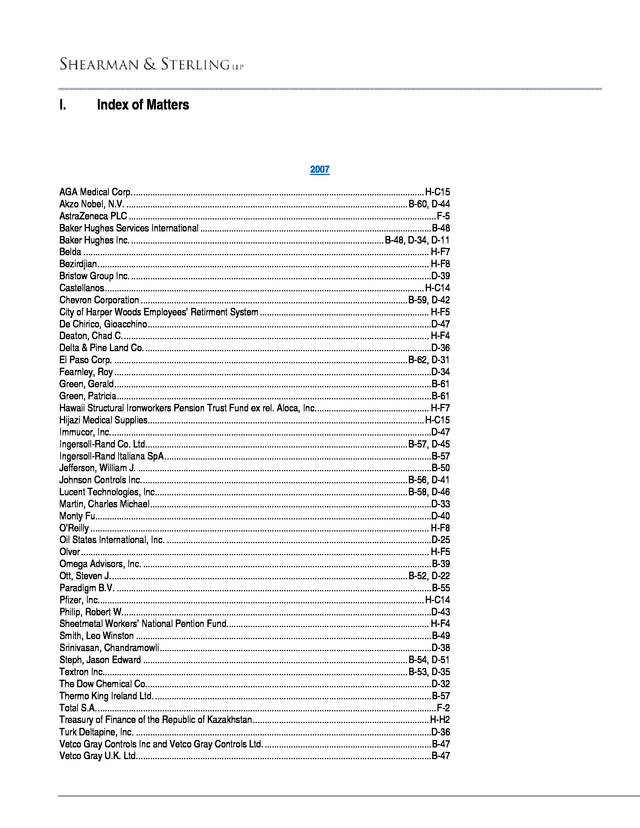

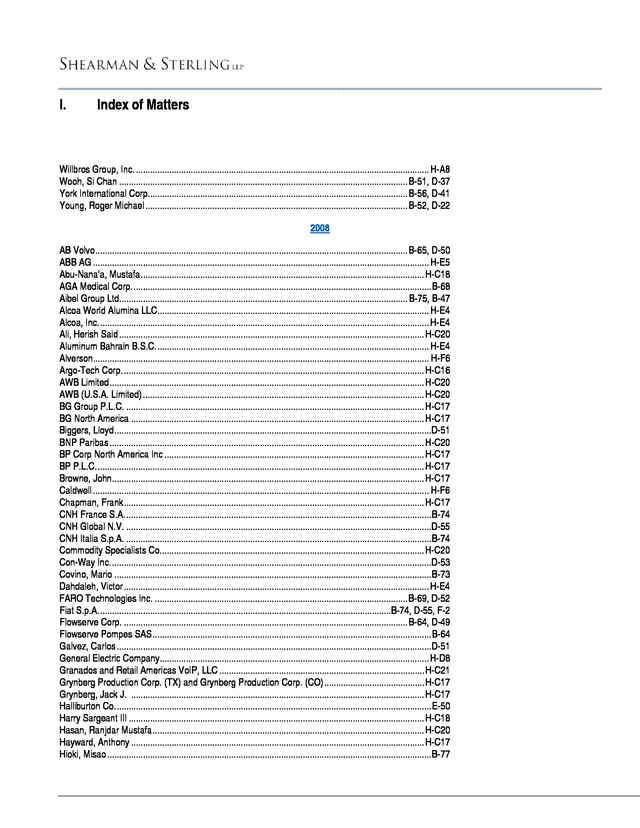

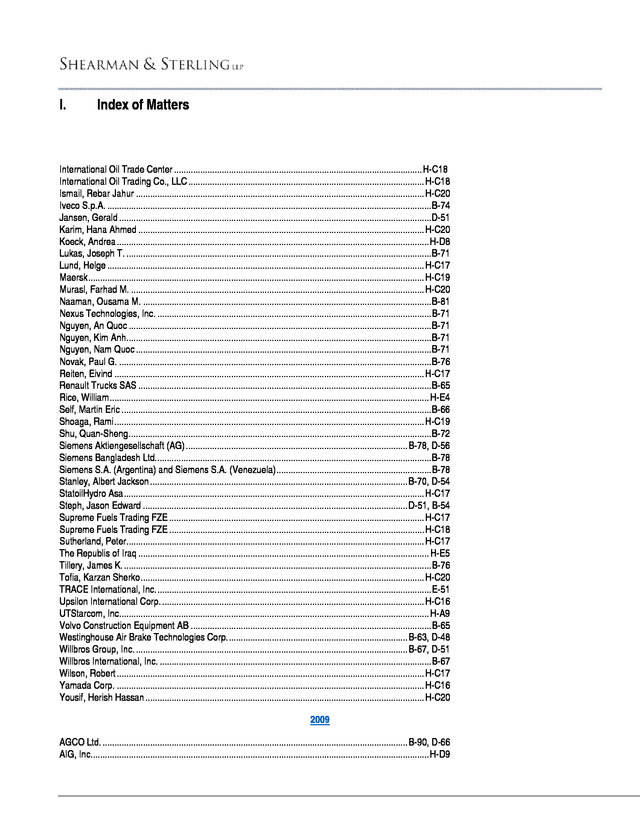

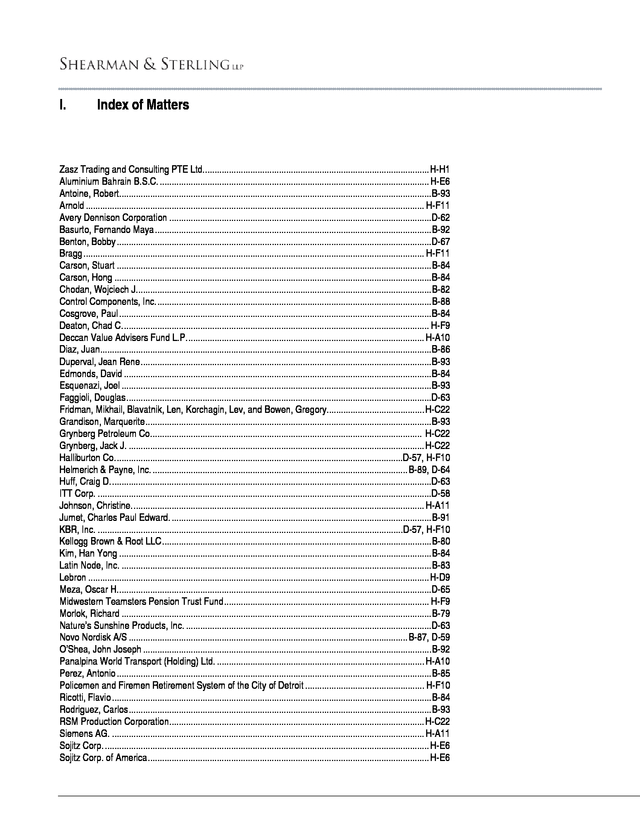

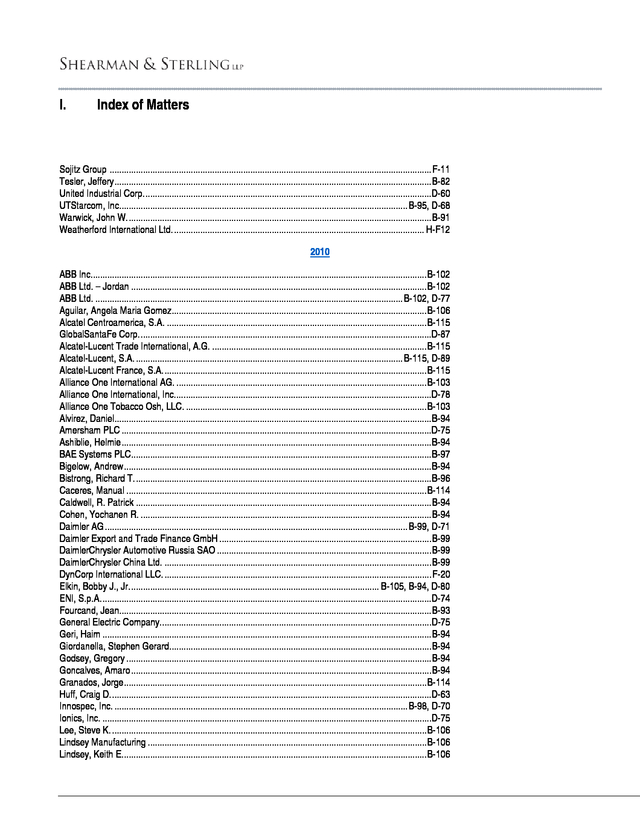

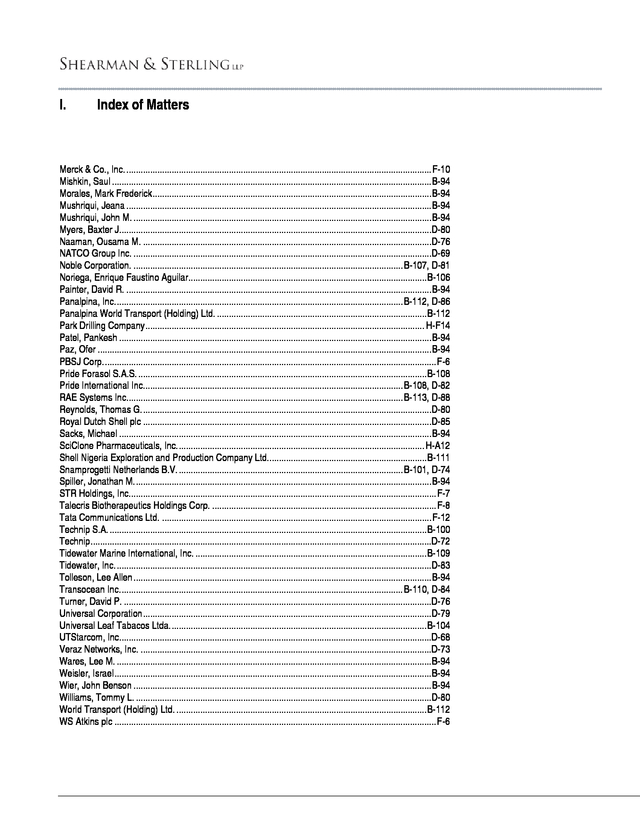

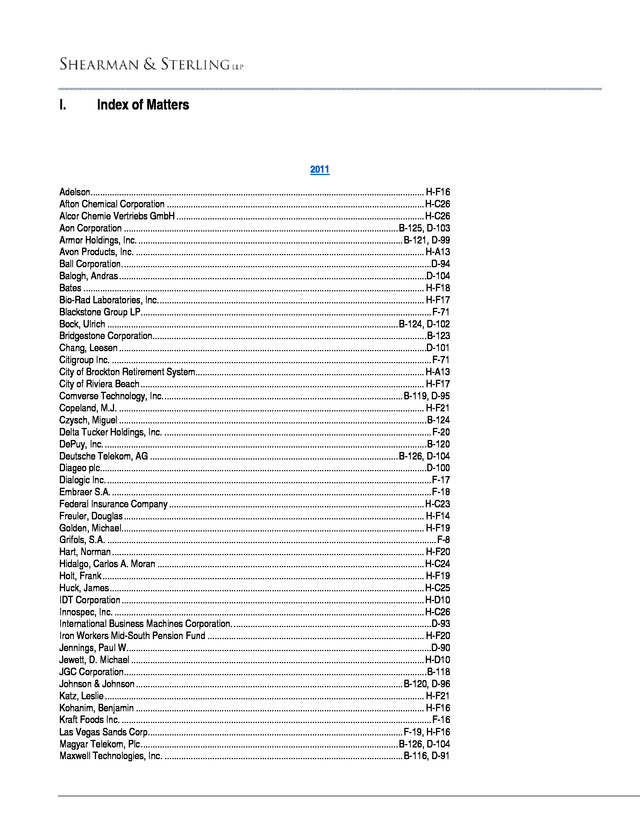

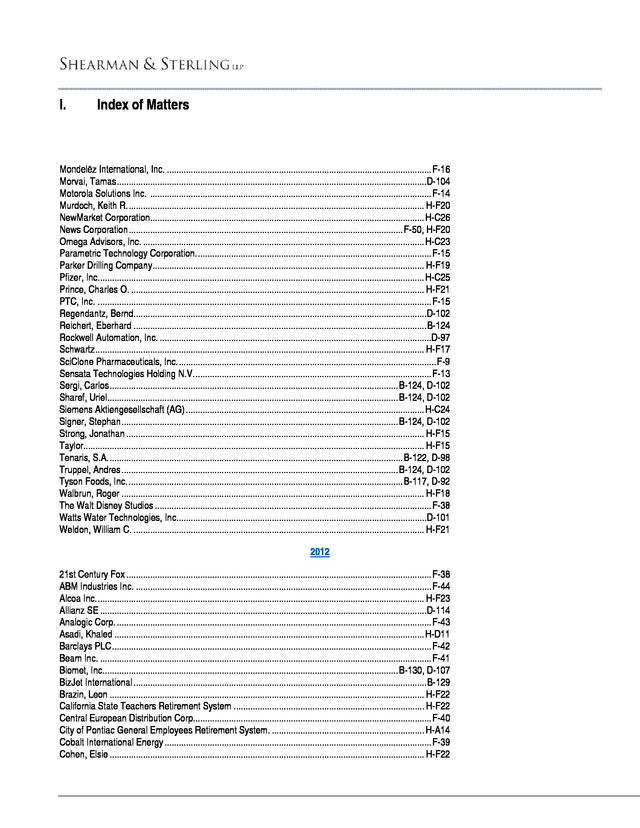

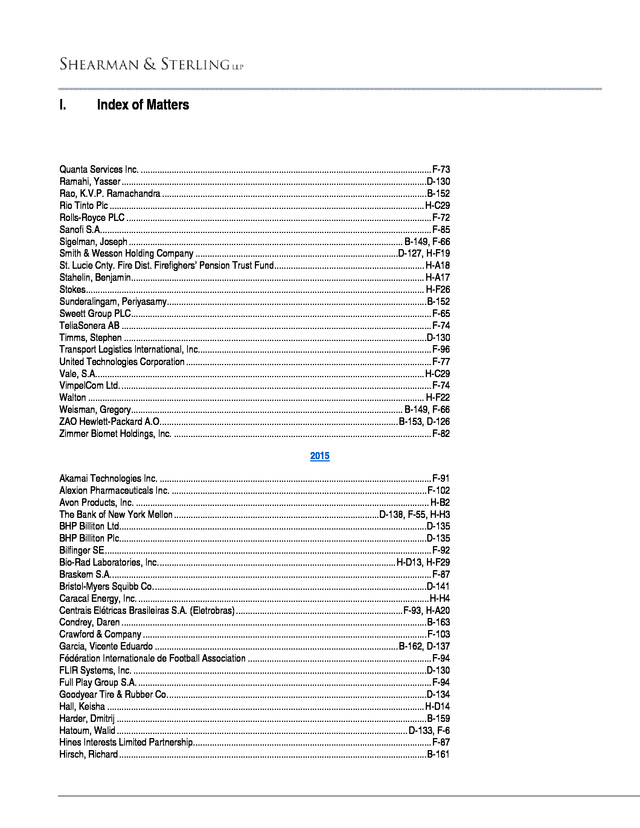

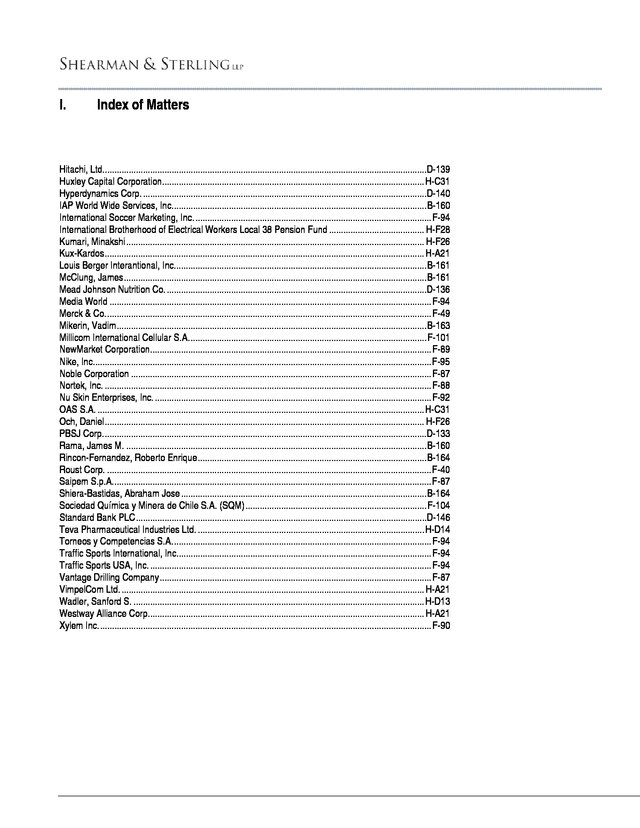

Pre-FCPA Prosecutions 544 H. Parallel Litigation 546 I. 657 Index of Matters FCPA Digest | January 2016 . A. Recent Trends and Patterns in FCPA Enforcement FCPA Digest | January 2016 . Table of Contents A. Recent Trends and Patterns in FCPA Enforcement Enforcement Actions and Strategies i Statistics i Types of Settlements v Elements of Settlements vi Case Developments vii Perennial Statutory Issues Instrumentality x x Foreign Officials – Public International Organization xii Foreign Political Parties xiii Anything of Value xiii Jurisdiction xiv Modes of Payment xiv Compliance Guidance xvi Yates Memo xvi Corporate Sponsorships and Global Sport xvii Self-Reporting xviii Multi-Jurisdictional Investigations and Information Sharing xix Specific Compliance Failures xix Unusual Developments xx Changes at the DOJ Reflect a New Dynamic in FCPA Enforcement xx Increased Enforcement Resources xxi SEC Admissions xxi Petrobras xxii Undercover Cooperating Defendants xxii Industry Alerts: Healthcare and Financial Services xxii Attorney-Client Privilege for Internal Investigations xxiii Divestment xxiii FCPA Digest | January 2016 ii . Table of Contents A. Recent Trends and Patterns in FCPA Enforcement Private Litigation xxiv Enforcement in the United Kingdom xxv SFO Update – First U.K. DPA Approved xxv The U.K.’s Anti-Corruption Plan xxvi Transparency International: Proposal to Introduce Unexplained Wealth Orders in the U.K. to Assist with Corrupt Asset Recovery ............................................................................................................... xxvi Conclusion FCPA Digest | January 2016 xxvii iii .

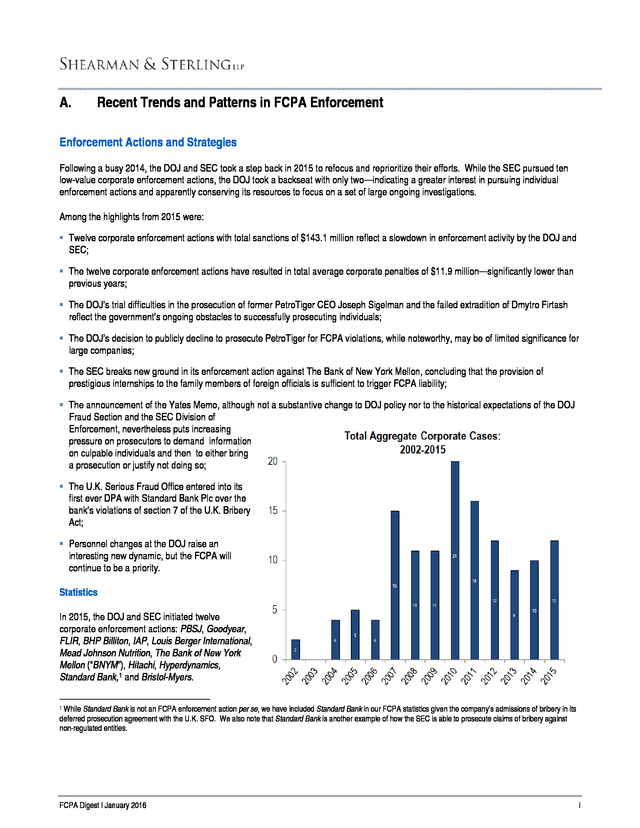

A. Recent Trends and Patterns in FCPA Enforcement Enforcement Actions and Strategies Following a busy 2014, the DOJ and SEC took a step back in 2015 to refocus and reprioritize their efforts. While the SEC pursued ten low-value corporate enforcement actions, the DOJ took a backseat with only two—indicating a greater interest in pursuing individual enforcement actions and apparently conserving its resources to focus on a set of large ongoing investigations. Among the highlights from 2015 were:  Twelve corporate enforcement actions with total sanctions of $143.1 million reflect a slowdown in enforcement activity by the DOJ and SEC;  The twelve corporate enforcement actions have resulted in total average corporate penalties of $11.9 million—significantly lower than previous years;  The DOJ’s trial difficulties in the prosecution of former PetroTiger CEO Joseph Sigelman and the failed extradition of Dmytro Firtash reflect the government’s ongoing obstacles to successfully prosecuting individuals;  The DOJ’s decision to publicly decline to prosecute PetroTiger for FCPA violations, while noteworthy, may be of limited significance for large companies;  The SEC breaks new ground in its enforcement action against The Bank of New York Mellon, concluding that the provision of prestigious internships to the family members of foreign officials is sufficient to trigger FCPA liability;  The announcement of the Yates Memo, although not a substantive change to DOJ policy nor to the historical expectations of the DOJ Fraud Section and the SEC Division of Enforcement, nevertheless puts increasing pressure on prosecutors to demand information on culpable individuals and then to either bring a prosecution or justify not doing so;  The U.K. Serious Fraud Office entered into its first ever DPA with Standard Bank Plc over the bank’s violations of section 7 of the U.K. Bribery Act;  Personnel changes at the DOJ raise an interesting new dynamic, but the FCPA will continue to be a priority. Statistics In 2015, the DOJ and SEC initiated twelve corporate enforcement actions: PBSJ, Goodyear, FLIR, BHP Billiton, IAP, Louis Berger International, Mead Johnson Nutrition, The Bank of New York Mellon (“BNYM”), Hitachi, Hyperdynamics, Standard Bank, 1 and Bristol-Myers. While Standard Bank is not an FCPA enforcement action per se, we have included Standard Bank in our FCPA statistics given the company’s admissions of bribery in its deferred prosecution agreement with the U.K.

SFO. We also note that Standard Bank is another example of how the SEC is able to prosecute claims of bribery against non-regulated entities. 1 FCPA Digest | January 2016 i . A. Recent Trends and Patterns in FCPA Enforcement Of the two enforcement agencies, the SEC has been, by far and away, the more active—responsible for ten of the twelve enforcement actions this year: PBSJ, Goodyear, FLIR, BHP Billiton, Mead Johnson Nutrition, BNYM, Hitachi, Hyperdynamics, Standard Bank, and Bristol-Myers. For its part, the DOJ remained relatively silent on the corporate front for most of the year, only announcing its settlement with IAP Worldwide Services, Inc. and Louis Berger International within the span of approximately a month in mid-2015 (though, as discussed below, the DOJ has been slightly more active in pursuing individuals). Notably, none of the twelve corporate enforcement actions have been joint enforcement actions by both the DOJ and SEC.

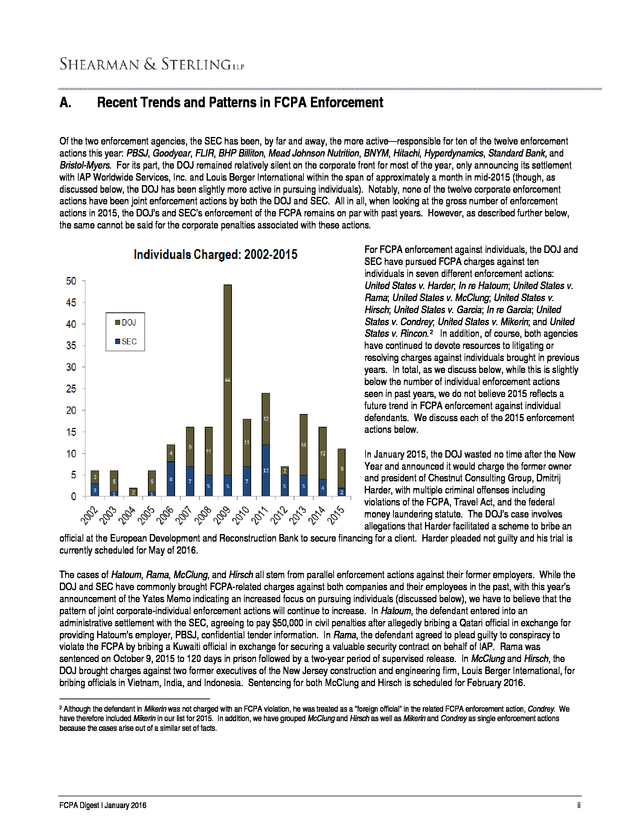

All in all, when looking at the gross number of enforcement actions in 2015, the DOJ’s and SEC’s enforcement of the FCPA remains on par with past years. However, as described further below, the same cannot be said for the corporate penalties associated with these actions. For FCPA enforcement against individuals, the DOJ and SEC have pursued FCPA charges against ten individuals in seven different enforcement actions: United States v. Harder; In re Hatoum; United States v. Rama; United States v.

McClung; United States v. Hirsch; United States v. Garcia; In re Garcia; United States v. Condrey; United States v.

Mikerin; and United States v. Rincon. 2 In addition, of course, both agencies have continued to devote resources to litigating or resolving charges against individuals brought in previous years.

In total, as we discuss below, while this is slightly below the number of individual enforcement actions seen in past years, we do not believe 2015 reflects a future trend in FCPA enforcement against individual defendants. We discuss each of the 2015 enforcement actions below. In January 2015, the DOJ wasted no time after the New Year and announced it would charge the former owner and president of Chestnut Consulting Group, Dmitrij Harder, with multiple criminal offenses including violations of the FCPA, Travel Act, and the federal money laundering statute. The DOJ’s case involves allegations that Harder facilitated a scheme to bribe an official at the European Development and Reconstruction Bank to secure financing for a client.

Harder pleaded not guilty and his trial is currently scheduled for May of 2016. The cases of Hatoum, Rama, McClung, and Hirsch all stem from parallel enforcement actions against their former employers. While the DOJ and SEC have commonly brought FCPA-related charges against both companies and their employees in the past, with this year’s announcement of the Yates Memo indicating an increased focus on pursuing individuals (discussed below), we have to believe that the pattern of joint corporate-individual enforcement actions will continue to increase. In Hatoum, the defendant entered into an administrative settlement with the SEC, agreeing to pay $50,000 in civil penalties after allegedly bribing a Qatari official in exchange for providing Hatoum’s employer, PBSJ, confidential tender information.

In Rama, the defendant agreed to plead guilty to conspiracy to violate the FCPA by bribing a Kuwaiti official in exchange for securing a valuable security contract on behalf of IAP. Rama was sentenced on October 9, 2015 to 120 days in prison followed by a two-year period of supervised release. In McClung and Hirsch, the DOJ brought charges against two former executives of the New Jersey construction and engineering firm, Louis Berger International, for bribing officials in Vietnam, India, and Indonesia.

Sentencing for both McClung and Hirsch is scheduled for February 2016. Although the defendant in Mikerin was not charged with an FCPA violation, he was treated as a “foreign official” in the related FCPA enforcement action, Condrey. We have therefore included Mikerin in our list for 2015. In addition, we have grouped McClung and Hirsch as well as Mikerin and Condrey as single enforcement actions because the cases arise out of a similar set of facts. 2 FCPA Digest | January 2016 ii .

A. Recent Trends and Patterns in FCPA Enforcement In Garcia, both the DOJ and SEC filed charges against Vicente Garcia, a former executive of the German software solutions provider, SAP SE, for allegedly bribing Panamanian officials in exchange for lucrative software contracts. Garcia marks one of only a handful of cases where both the DOJ and SEC decided to charge a single individual for violating the FCPA. Garcia settled the SEC’s case through an administrative proceeding in which he agreed to pay a $92,395 sanction. In the DOJ’s criminal action against him, Garcia pleaded guilty to one count of conspiracy to violate the FCPA and was sentenced to 22 months in prison on December 16, 2015. In the related cases, United States v.

Condrey and United States v. Mikerin, the DOJ charged the owner and executive of an unnamed transportation company (Condrey) with conspiracy to violate the FCPA after he allegedly bribed a director and president of two nuclear service providers owned by the Russian government (Mikerin). 3 Condrey pleaded guilty to the charge and is awaiting sentencing. Mikerin, the foreign official, was charged with and pleaded guilty to one count of conspiracy to commit money laundering.

Mikerin was sentenced to 48 months in prison on December 15, 2015—marking yet another example of how the DOJ has pursued criminal charges against foreign officials even where such officials are not subject to liability under the FCPA. Finally, and most recently, in the case of United States v. Rincon, the DOJ charged two individuals (Roberto Enrique Rincon Fernandez and Abraham Jose Shiera Bastidas) with FCPA related offenses in connection with the award of various project contracts from the Venezuelan stated-owned oil and natural gas producer, Petróleos de Venezuela S.A. (“PDVSA”) Specifically, Rincon and Shiera are accused of bribing PDVSA officials in exchange for essentially rigging the company’s competitive bidding process in their favor. Rincon pleaded not guilty to the charges.

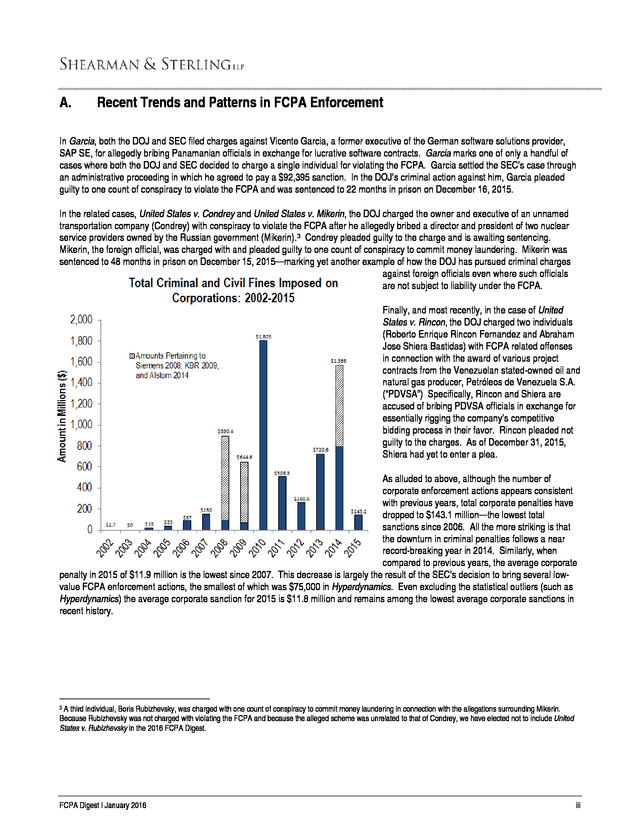

As of December 31, 2015, Shiera had yet to enter a plea. As alluded to above, although the number of corporate enforcement actions appears consistent with previous years, total corporate penalties have dropped to $143.1 million—the lowest total sanctions since 2006. All the more striking is that the downturn in criminal penalties follows a near record-breaking year in 2014. Similarly, when compared to previous years, the average corporate penalty in 2015 of $11.9 million is the lowest since 2007.

This decrease is largely the result of the SEC’s decision to bring several lowvalue FCPA enforcement actions, the smallest of which was $75,000 in Hyperdynamics. Even excluding the statistical outliers (such as Hyperdynamics) the average corporate sanction for 2015 is $11.8 million and remains among the lowest average corporate sanctions in recent history. A third individual, Boris Rubizhevsky, was charged with one count of conspiracy to commit money laundering in connection with the allegations surrounding Mikerin. Because Rubizhevsky was not charged with violating the FCPA and because the alleged scheme was unrelated to that of Condrey, we have elected not to include United States v. Rubizhevsky in the 2016 FCPA Digest. 3 FCPA Digest | January 2016 iii .

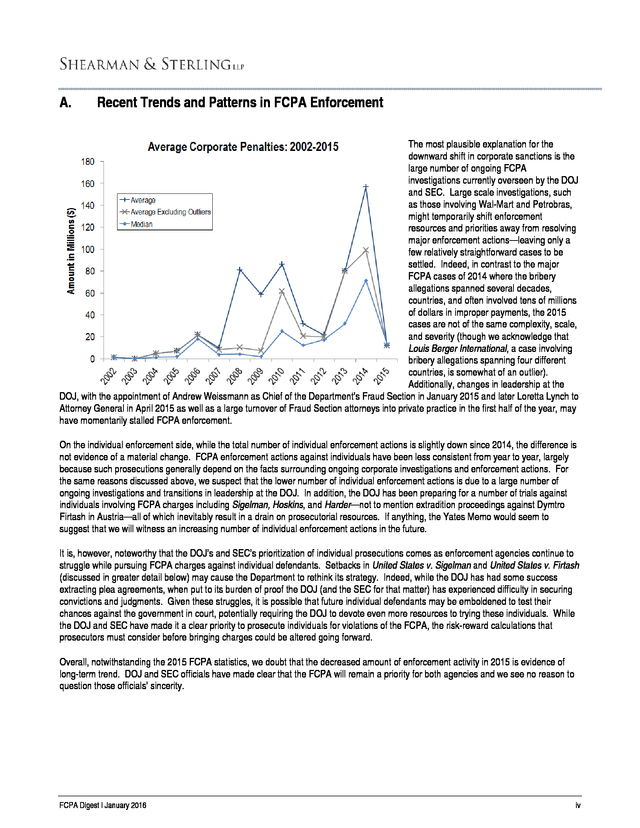

A. Recent Trends and Patterns in FCPA Enforcement The most plausible explanation for the downward shift in corporate sanctions is the large number of ongoing FCPA investigations currently overseen by the DOJ and SEC. Large scale investigations, such as those involving Wal-Mart and Petrobras, might temporarily shift enforcement resources and priorities away from resolving major enforcement actions—leaving only a few relatively straightforward cases to be settled. Indeed, in contrast to the major FCPA cases of 2014 where the bribery allegations spanned several decades, countries, and often involved tens of millions of dollars in improper payments, the 2015 cases are not of the same complexity, scale, and severity (though we acknowledge that Louis Berger International, a case involving bribery allegations spanning four different countries, is somewhat of an outlier). Additionally, changes in leadership at the DOJ, with the appointment of Andrew Weissmann as Chief of the Department’s Fraud Section in January 2015 and later Loretta Lynch to Attorney General in April 2015 as well as a large turnover of Fraud Section attorneys into private practice in the first half of the year, may have momentarily stalled FCPA enforcement. On the individual enforcement side, while the total number of individual enforcement actions is slightly down since 2014, the difference is not evidence of a material change. FCPA enforcement actions against individuals have been less consistent from year to year, largely because such prosecutions generally depend on the facts surrounding ongoing corporate investigations and enforcement actions.

For the same reasons discussed above, we suspect that the lower number of individual enforcement actions is due to a large number of ongoing investigations and transitions in leadership at the DOJ. In addition, the DOJ has been preparing for a number of trials against individuals involving FCPA charges including Sigelman, Hoskins, and Harder—not to mention extradition proceedings against Dymtro Firtash in Austria—all of which inevitably result in a drain on prosecutorial resources. If anything, the Yates Memo would seem to suggest that we will witness an increasing number of individual enforcement actions in the future. It is, however, noteworthy that the DOJ’s and SEC’s prioritization of individual prosecutions comes as enforcement agencies continue to struggle while pursuing FCPA charges against individual defendants.

Setbacks in United States v. Sigelman and United States v. Firtash (discussed in greater detail below) may cause the Department to rethink its strategy.

Indeed, while the DOJ has had some success extracting plea agreements, when put to its burden of proof the DOJ (and the SEC for that matter) has experienced difficulty in securing convictions and judgments. Given these struggles, it is possible that future individual defendants may be emboldened to test their chances against the government in court, potentially requiring the DOJ to devote even more resources to trying these individuals. While the DOJ and SEC have made it a clear priority to prosecute individuals for violations of the FCPA, the risk-reward calculations that prosecutors must consider before bringing charges could be altered going forward. Overall, notwithstanding the 2015 FCPA statistics, we doubt that the decreased amount of enforcement activity in 2015 is evidence of long-term trend.

DOJ and SEC officials have made clear that the FCPA will remain a priority for both agencies and we see no reason to question those officials’ sincerity. FCPA Digest | January 2016 iv . A. Recent Trends and Patterns in FCPA Enforcement Types of Settlements As the more active enforcement agency of 2015, the SEC has continued its trend of using administrative proceedings to resolve FCPA enforcement actions in Hatoum, Goodyear, FLIR, BHP Billiton, Mead Johnson Nutrition, Garcia, BNYM, Hyperdynamics, Standard Bank, and Bristol-Myers. Continued scrutiny of pre-trial settlements by U.S. federal court judges, including Judge Leon’s scathing rejection of the government’s DPA in United States v. Fokker, combined with the Commission’s difficulties in resolving its claims against individuals (e.g., the former officers and employees of Direct Access Partners, Rhuelan and Jackson), likely gives the SEC little appetite to try their hand at other forms of pre-trial settlement.

Although there have been a series of constitutional challenges to the SEC’s administrative proceedings mechanism over the course of 2015, to date, several courts of appeals, including the D.C. Circuit (Jarkesy v. SEC) and the Seventh Circuit (Bebo v.

SEC), have vindicated the SEC’s practices—paving the way for the SEC’s continued use of administrative proceedings. However, while the majority of the SEC’s FCPA enforcement actions have been resolved using administrative proceedings, both PBSJ and Hitachi stand as outliers. In PBSJ, the SEC resolved its claims against the company through a DPA—representing only the second time the SEC has used a DPA to settle an FCPA enforcement action (the first being the 2011 case of Tenaris). In Hitachi, the SEC resolved its case against the Japanese conglomerate through a consent decree after filing its complaint in the District of Columbia.

The use of these two settlement mechanisms appears to have been somewhat out of necessity. Both PBSJ (now controlled by the U.K. engineering firm WS Atkins plc) and Hitachi were no longer issuers at the time their respective settlements were reached, and although Dodd-Frank grants the SEC the authority to use administrative proceedings against non-issuers, the SEC can only seek civil penalties, not injunctive relief as part of an administrative proceeding. In each case, specific circumstances may have motivated the SEC to seek future leverage over the companies: in PBSJ, the DPA focused on cooperation with potential ongoing investigations, an obligation which is specifically extended to PBSJ’s acquirer, a foreign non-issuer; while in Hitachi, the SEC specifically noted that although the company had de-registered in 2012, it might re-enter the U.S.

markets in the future. Moreover, as a general rule, no agency, including the SEC, likes to be deprived of jurisdiction, and even if the companies would no longer be subject to SEC enforcement for future violations of the FCPA (as they would no longer be covered under section 30A of the 1934 Act (15 U.S.C. § 78dd-1), the terms of the PBSJ DPA and the Hitachi injunction give the SEC leverage to punish such violations under alternative grounds. The DOJ’s two corporate enforcement actions in 2015 against IAP and Louis Berger International were settled through an NPA and DPA respectively.

When explaining the basis for offering IAP and Louis Berger International an NPA and DPA, respectively, the DOJ cited a number of common factors seen in other settlement agreements in the past including: (1) offering significant cooperation including, conducting extensive internal investigations, making U.S. and foreign employees available for interviews, and collecting large amounts of documentation for review by the DOJ; (2) engaging in remediation, including disciplining culpable officers and employees, enhancing third-party due diligence, and instituting heightened reviews of proposals and other transactional documents; (3) enhancing their current compliance programs; and (4) agreeing to continue to cooperate with the government on any other ongoing investigations. In the DOJ’s DPA with Louis Berger International, the DOJ noted two additional factors not listed in the IAP NPA but commonly seen in other pre-trial settlement documents—that the company had self-reported the violation and the “nature and scope of the offense conduct.” While none of these considerations break new ground, it is peculiar that the government agreed to enter into an NPA with IAP (a slightly less severe form of pre-trial settlement) despite the fact that the company did not appear to self-report the violation—a factor (as discussed below) that the government repeatedly cites as being among the most critical for purposes of receiving credit during an investigation.

It therefore appears the DOJ placed greater weight on the “nature and scope” factor in distinguishing between these two companies for settlement purposes. Specifically, Louis Berger International’s FCPA violations—spanning four different countries—were enough to cause the DOJ to offer a DPA to Louis Berger International, while the relatively limited scope of the alleged bribery in IAP was sufficient to warrant an NPA in the DOJ’s eyes—notwithstanding the company’s failure to self-report. Another interesting development in the DOJ’s settlement decisions has been the series of recent declinations by the Department. Most significant among these has been the DOJ’s public declination of the British Virgin Island oil and gas company, PetroTiger Ltd.

The DOJ’s declination of PetroTiger marks only the second time the government has publicly announced its decision not to prosecute a company for FCPA violations (the first being Morgan Stanley in 2012 after the bank’s former employee, Garth Peterson, pleaded guilty to violating the FCPA). We discuss the implications of the PetroTiger declination further below. FCPA Digest | January 2016 v . A. Recent Trends and Patterns in FCPA Enforcement DOJ declinations of FCPA enforcement actions against numerous other companies also suggest that the Department may be more willing to not pursue an enforcement action where other agencies (including the SEC or foreign regulatory agencies) have already initiated or resolved charges against the company. Most recently, the DOJ has issued declinations in Eli Lilly, Goodyear, Smith & Wesson, Layne Christensen, BHP Billiton, Mead Johnson Nutrition, Hyperdynamics, and Bristol-Myers while the SEC brought enforcement actions against the companies. The DOJ, of course, has not provided an explanation for not proceeding against a company where the SEC had done so. We would like to think that the DOJ had concluded that additional charges provided limited benefit when the SEC had already forced the company to disgorge. We note however, in the cases of Eli Lilly, Goodyear, Mead Johnson Nutrition, Hyperdynamics, and Bristol-Myers, the DOJ’s declination decision might also be explained by a possible lack of jurisdiction.

Specifically, in each of the cases above, where all of the illicit conduct was committed by subsidiaries of the parent company, the DOJ may have concluded it was too difficult to prove that the subsidiaries’ conduct should be imputed on the corporate parent—bearing in mind that the DOJ has a higher burden of proof to sustain criminal FCPA charges against a company. 4 With the SEC’s decision to bring an enforcement action coupled with its own jurisdictional limitations, the DOJ could have concluded that additional criminal charges may not be justified. Regardless of its reasoning, the DOJ has followed a similar pattern when foreign regulatory agencies have initiated and concluded enforcement actions against a particular company. For example, in November 2014, the Dutch oil and gas services company, SBM Offshore, reached an agreement to pay Dutch authorities $240 million to settle allegations that it bribed government officials in Angola, Brazil, and Equatorial Guinea.

On the very same day, the DOJ announced that it would drop its investigation of the company. Most recently, on November 30, 2015, the U.K. Serious Fraud Office announced that a U.K.

court approved its first DPA with Standard Bank for violations of the U.K. Bribery Act resulting from payments related to a securities offering for the Government of Tanzania. On the very same day, the SEC announced that it too had settled a case against Standard Bank for failing to disclose the same payments in private placement offering documents provided to U.S.

investors in violation of U.S. securities laws (although not the FCPA, as Standard Bank is not an “issuer” for purposes of FCPA jurisdiction). In light of the SFO’s and SEC’s actions, the DOJ declined to bring charges. This trend should come as welcome news for multinational companies as it indicates that the DOJ is aware of the need to avoid regulatory pile-ons.

As Assistant Attorney General Leslie Caldwell recently stated in an interview: “We work hard to coordinate with other countries and, to the extent that a particular situation is really more in the interests of another country—the conduct occurred there and people are located there, it didn’t really affect the United States except in a tangential way—we’re willing to defer to foreign countries.” Elements of Settlements SEC Guidance. As mentioned above, the SEC’s enforcement action in PBSJ is only the second time that the Commission has used a DPA to settle charges against a company. The SEC’s DPA in Tenaris is largely the same both in substance and form, however, there a few changes.

Specifically, in the section “Undertakings,” which details the various items that the company must agree to comply with going forward, the SEC’s DPA included two additional terms that did not previously exist in the Tenaris DPA. These two additional terms state: h. i. 4 to maintain and enforce comprehensive procedures designed to address and prevent violations of the federal securities laws, including but not limited to compliance with the FCPA and other applicable anticorruption laws on or before January 22, 2016; and to identify and implement improved internal controls by, as necessary, adopting new or modifying existing internal controls, policies, and procedures designed to ensure the making and keeping of books, records, and accounts, which, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Respondent on or before January 22, 2016. See also Philip Urofsky, The Ralph Lauren FCPA Case: Are There Any Limits to Parent Corporation Liability?, BLOOMBERG (May 13, 2013). FCPA Digest | January 2016 vi . A. Recent Trends and Patterns in FCPA Enforcement Although these provisions are common in FCPA settlements, they have special significance in the PBSJ settlement, as PBSJ, although still based in the U.S. and thus subject to the FCPA’s anti-bribery provisions as a domestic concern, is no longer subject to the FCPA’s books and records provisions. Thus, by including these provisions, the SEC maintains the ability indirectly to punish the company for future violations of those provisions by declaring a breach of the DPA. Further, the DPA imposes certain cooperation obligations on PBSJ’s new owner, the U.K.-based WS Atkins company; although these cooperation obligations do not include the compliance provisions, the overall impact of the agreement is to force the new owners to ensure that PBSJ has sufficient controls and compliance procedures in place. The PBSJ DPA departs from the Tenaris template in one other significant aspect.

We previously noted, with respect to the Tenaris DPA, the incongruity of the SEC’s application of the traditional rule that criminal fines and civil penalties are not tax deductible to disgorgement, characterizing the contractual prohibition as a hidden additional penalty that the SEC could not have imposed in a judicially-approved settlement. 5 Significantly, the PBSJ DPA appears to distinguish between the civil monetary penalty (or its equivalent in a non-judicial settlement) and disgorgement, requiring only that the company “refrain from seeking or accepting a U.S. federal or state tax credit or detection for any civil monetary penalty paid pursuant to this Agreement.” Given that the civil penalty accounted for only $375,000 of the total amount of $3,407,875 required to be paid under the DPA, this is a significant distinction. Discounts.

In May 2015, Alstom S.A. posted a €719 million loss as a result of the company’s $772 million settlement with the DOJ in December 2014. DOJ officials have stated on multiple occasions that Alstom’s record-breaking settlement was due in large part to the company’s unwillingness to cooperate with the Department’s investigation.

As discussed in previous Trends & Patterns, 6 while the DOJ has been willing to grant a company a substantial discount from the recommended penalty under the Sentencing Guidelines because of financial hardship (see, e.g., Alcoa (2014) and NORDAM (2012)), Alstom’s loss shows that no amount of financial hardship will help to mitigate against a large corporate sanction if a company is unwilling to cooperate with the Department. While the specter of Arthur Andersen has loomed large over the DOJ after the Department’s prosecution of the accounting giant ultimately led to the firm’s implosion, Alstom’s €719 million loss shows that the DOJ’s fear of instigating another company’s collapse may be waning. Monitors. The DOJ’s DPA with Louis Berger International required the company to engage a compliance monitor for a three-year period. The terms of the requirement in the Louis Berger International DPA mirror those of other recent DPAs which imposed a compliance monitor (e.g., Avon).

While compliance monitors have become somewhat less common in recent years, the DOJ’s enforcement action against Louis Berger International indicates that the Department continues to believe that monitors can still serve as a useful tool to ensure a company adequately remedies its past mistakes, particularly in cases with conduct that spans time and space and where the Department may harbor concerns as to the sustainability of any remedial steps implemented in advance of the settlement. Reporting Requirements. For its part, the SEC has generally chosen to impose self-reporting requirements in some, but not all, of its 2015 FCPA enforcement actions. Specifically, in Goodyear, FLIR, BHP Billiton, and Bristol-Myers, the SEC required the companies to report to the Commission at regular nine or twelve-month intervals for a term of two to three years on the general status of the companies’ compliance efforts.

The SEC did not impose reporting requirements as part of its other 2015 enforcement actions: PBSJ, Mead Johnson Nutrition, BNYM, Hitachi, and Hyperdynamics. The SEC has provided no specific reason for why it decided to impose self-reporting requirements on certain companies but not others. Case Developments Direct Access Partners. Beginning in 2013, a series of executives and employees of the broker-dealer Direct Access Partners were charged with FCPA violations in connection with a bribery scheme involving an official at the Venezuelan development bank, Banco Desarrollo Económico y Social de Venezuela (BANDES).

In 2014, two more individuals were charged with violating the FCPA in For our critique of the Tenaris DPA, please see Shearman & Sterling, A New Tool and a Twist? The SEC’s first Deferred Prosecution Agreement and a Novel Punitive Measure (May 24, 2011). 5 For a further discussion of these issues, you may wish to refer to our prior client publication, available at Shearman & Sterling, FCPA Digest, Recent Trends and Patterns in the Enforcement of the Foreign Corrupt Practices Act (July 21, 2014). 6 FCPA Digest | January 2016 vii . A. Recent Trends and Patterns in FCPA Enforcement connection with the scheme. After entering into plea agreements with the government in 2013 and 2014, several of the defendants were finally sentenced over the course of 2015. First, on March 27, 2015, both Benito Chinea and Joseph DeMeneses, the former CEO and Managing Director, respectively, of Direct Access Partners, were sentenced to four years in prison after pleading guilty to one count of conspiracy to violate the FCPA and the Travel Act. Chinea was also ordered to forfeit $3.6 million while DeMenes was ordered to forfeit $2.7 million. On December 4 and 8, 2015, Ernesto Lujan and Tomas Clarke Bethancourt were each sentenced to two years in prison after pleading guilty to multiple criminal offenses including conspiracy to violate the FCPA and the Travel Act and to commit money laundering, as well as violations of the substantive offenses. Lujan and Clarke were also ordered to forfeit $18.5 million and $5.8 million, respectively. Subsequently, on December 15, 2015, Jose Alejandro Hurtado was sentenced to three years in prison and ordered to forfeit $11.9 million after pleading guilty to the same offenses as Lujan and Clarke. United States v.

Elgawhary. On March 23, 2015, the former vice president of Bechtel Corporation and general manager of a joint venture operated by Bechtel and an Egyptian utility company, Asem Elgawhary, was sentenced to 42 months in prison for accepting kickbacks totaling $5.2 million in exchange for lucrative power contracts. Elgawhary was among the “foreign officials” who allegedly received bribes from Alstom S.A. United States v.

Firtash. On April 30, 2015, an Austrian Court rejected the DOJ’s request to extradite the Ukrainian energy magnate, Dmtryo Firtash, to the United States to be prosecuted for alleged violations of the FCPA. In issuing his ruling, Austrian Judge Christoph Bauer characterized the evidence that the DOJ offered as incomplete and concluded that the extradition request was “politically motivated.” As a result, all defendants in Firtash, Dymtro Firtash, Andras Knopp, Suren Gevorgyan, Gajendra Lal, Periyasamy Sunderalingam, and K.V.P.

Ramachandra Rao, currently remain at large. We have previously questioned the utility of charging, with great fanfare and press releases, foreign nationals over whom the government is unlikely to obtain jurisdiction (or, even worse, obtain jurisdiction through happenstance years down the road when the evidence is stale and witnesses’ recollection faded). With a large number of FCPA cases remaining untried because foreign nationals have chosen not to avail themselves of the hospitality of the U.S. government, the Austrian court’s decision underscores the difficulty the DOJ and SEC have experienced while pursuing charges against foreign citizens who reside outside of the United States. United States v.

Sharef, et al. In the DOJ’s ongoing criminal case against eight former executives of Siemens stemming from charges related to the company’s 2008 settlement, Andres Truppel, the former chief financial officer, pleaded guilty to one count of conspiracy to violate the FCPA and admitted to engaging in a decade-long scheme to pay tens of millions of dollars in bribes to Argentine government officials in connection with a national identity card contract worth approximately $1 billion. According to the court docket, none of the other seven former Siemens executives have appeared in the case. United States v.

Dupreval. On February 9, 2015, the U.S. Court of Appeals for the Eleventh Circuit affirmed the conviction and nine-year sentence of Jean Rene Dupreval on multiple counts of conspiracy and money laundering as part of the Haiti Teleco FCPA enforcement action from 2009.

Dupreval was the first foreign official to be convicted at trial for money laundering as a result of an ongoing FCPA enforcement action. His appeal was based upon the argument that he was not a “foreign official” and therefore could not be guilty of money laundering because the payments he received did not result from a violation of the FCPA. In rejecting his appeal, the Eleventh Circuit upheld its earlier decision from United States v.

Esquenazi from 2014, where it concluded that Haiti Teleco qualified as a government “instrumentality.” Accordingly, the court concluded that Dupreval, as Assistant Director General and Director of International Affairs of Haiti Teleco, was in fact, a “foreign official” under the FCPA and thus, having engaged in transactions involving the proceeds of FCPA bribery, committed money laundering. PetroTiger: United States v. Hammarskjold; United States v. Weisman.

On September 10, 2015, Knut Hammarskjold and Gregory Weisman, the former Co-CEO and General Counsel of PetroTiger Ltd., respectively, were sentenced after each pleaded guilty to one count of conspiracy to violate the FCPA and the wire fraud statute. Hammarskjold was sentenced to time served and placed on supervised release for two years. Hammarskjold was also ordered to pay a $15,000 criminal fine and restitution of $106,592.93. Weisman was placed on probation for a two-year term and ordered to pay a criminal fine of $30,000. FCPA Digest | January 2016 viii .

A. Recent Trends and Patterns in FCPA Enforcement PetroTiger: United States v. Joseph Sigelman. On June 15, 2015, Joseph Sigelman, the former Co-CEO of PetroTiger Ltd., pleaded guilty to one count of conspiracy to violate the FCPA. There is some debate in the FCPA community as to whether this was nevertheless a setback for the DOJ.

Prosecutors can point to the fact that Sigelman did, in fact, plead guilty to a felony and admitted to having been part of a bribery conspiracy, thus, together with the other pleas noted above, validating the legitimacy of the DOJ’s investigation and prosecution. On the other hand, the conspiracy plea, and the subsequent lenient sentence, came only after the government was forced to offer Sigelman a favorable plea deal following the collapse of its case at trial. During the cross examination of PetroTiger’s former general counsel and the government’s star witness, Gregory Weisman, counsel for the defense caused Weisman to confess on the stand that he had given false testimony during the government’s direct examination. Shortly after Weisman’s admission, the trial judge ordered a recess of the trial for several days. During the recess period, Sigelman agreed to plead guilty to conspiracy and the government agreed to move to dismiss the remaining charges.

At sentencing, Sigelman was fined $100,000, ordered to pay $239,015 in restitution, and required to serve a one-year term of probation. That Sigelman was able to avoid jail time altogether is a reminder of the difficulties the DOJ has had in securing convictions for FCPA violations at trial. Sigelman was the first FCPA prosecution to go to trial since the Africa Sting case in 2012, where the DOJ saw its case collapse after the government’s key witness’s credibility was successfully impeached and the O’Shea case in which the court acquitted the defendant at the close of the government’s case, citing insufficient evidence of the alleged unlawful conduct. Only the year prior, in 2011, were the convictions of Keith Lindsey and Steve Lee overturned as a result of numerous findings of prosecutorial misconduct. For its part, the SEC has experienced similar difficulties in prosecuting individual defendants.

Just last year, during its lawsuit against the former executives of Noble Corporation, Mark Jackson and James Ruehlen, the SEC was forced to drop its case in exchange for a favorable stipulation with the defendants. Similarly, in its case against three former executives of Magyar Telekom—Elek Straub, Andras Balogh, and Tamas Morvai—the SEC, while stating it was merely “simplifying” its case in advance of trial, was forced to drop a large number of its claims citing the complexity and scope of the investigation. What remains of the case is currently the subject of competing summary judgment motions and as of December 2015 no trial date has been set. Taken together, along with the DOJ’s difficulties in Firtash, the inability of the DOJ and SEC to regularly secure convictions of FCPA violations when put to their burden is likely to embolden more defendants to test the government’s charges against them.

If the prosecution of individuals is truly a priority of the DOJ and SEC, the greater number of defendants who elect to go to trial will likely result in a greater drain on the government’s resources. On the other hand, an increase in the number of individual prosecutions going to trial may be welcome news for those seeking greater judicial guidance on the scope of the FCPA. With the trial of Lawrence Hoskins and Dmitrij Harder set for 2016, we will have to see whether the DOJ can rally from the setbacks it has suffered over the past year. PetroTiger Ltd.

As mentioned above, the DOJ’s recent public declination of PetroTiger marks only the second time the Department has publicly announced a declination decision. Key among the reasons the DOJ offered a declination appears to be the company’s willingness to implicate top ranking officials in the scheme. However, while the PetroTiger declination is noteworthy, it is important not to overstate the significance of the DOJ’s announcement.

PetroTiger’s willingness to identify key executives in the alleged bribery scheme appears to have influenced the Department’s declination decision but is not the only factor at play. In point of fact, PetroTiger is but one of several small, privately held companies whose officers were prosecuted for FCPA violations but not the company itself. Take for example the case of Harder, where the former owner and president of Chestnut Consulting Group Co. was charged with conspiracy to violate the FCPA but Chestnut Consulting Group Co. itself has yet to be charged with related violations. Similar scenarios have most recently played out with respect to DF Group in United States v.

Firtash and Direct Access Partners in United States v. Clarke, United States v. Lujan, and United States v.

Chinea. This pattern may simply be evidence of the fact that it is easier for small companies to implicate senior officials because there are fewer layers of management to insulate those executives from the day-to-day administration of a company. Furthermore, it may often be the case that small companies, such as PetroTiger, do not have the financial assets needed to pay a substantial FCPA sanction. Overall, PetroTiger is not a paradigm shift in FCPA enforcement practices. Certainly, taking the appropriate remedial steps to identify FCPA Digest | January 2016 ix .

A. Recent Trends and Patterns in FCPA Enforcement those responsible for violating the FCPA will undoubtedly help a company’s cause (as indicated by the Yates Memo), but companies should not expect that doing so will operate as a get-out-of-jail-free card. United States v. Siriwan, et al. In 2009, a grand jury from the Central District of California indicted Juthamas Siriwan, the former governor of the Tourism Authority of Thailand, and her daughter, Jittisopa Siriwan, for allegedly receiving bribes in exchange for awarding a Hollywood producer, Gerald Green, and his wife, Patricia Green, the rights to run the Bangkok Film Festival. The presiding judge, the Honorable George Wu, questioned the DOJ’s decision to charge the Siriwans and stated that he may dismiss the suit if Thai prosecutors filed charges against them.

Approximately six years later, in August 2015, reports surfaced that Thai prosecutors formally filed charges against the Siriwans for taking bribes in connection with awarding state contracts. The Thai prosecution has led to speculation whether the U.S. charges against the Siriwans will be dismissed. Declinations.

According to company filings, over the course of 2015 the DOJ and SEC have declined to bring enforcement actions against a number of companies including: Goodyear Tire & Rubber Co. (DOJ); Eli Lilly & Co. (DOJ); Hyperdynamics Corporation (DOJ); 21st Century Fox (DOJ); News Corp.

(DOJ); PetroTiger Ltd. (DOJ); Mead Johnson Nutrition Company (DOJ); BHP Billiton (DOJ); Affinia Group Inc. (DOJ); Cobalt International Energy Company (SEC); Net 1 UEPS Technologies (SEC); Gold Fields Ltd.

(SEC); NCR Corp. (SEC); Brookfield Asset Management Inc. (SEC); Xylem Inc. (SEC); NCR Corp.

(SEC). Biomet Inc. In March 2012, the orthopedic device maker, Biomet Inc., settled FCPA charges with the DOJ and SEC for $22.7 million as part of a DPA. According to the DOJ and SEC, Biomet was responsible for bribing doctors in Argentina, Brazil, and China from 2000 to 2008.

The Biomet DPA was set to expire on March 26, 2015, but following the voluntary disclosure from the company of the possibility of additional bribes in Brazil and Mexico pre-dating the 2012 DPA, the DOJ extended the agreement for an additional year. Lockheed Martin Corp. On May 29, 2015, U.S. Federal Judge Amit P.

Mehta granted an unopposed motion to modify the terms of a 1975 consent order between Lockheed Martin and the SEC stemming from allegations that Lockheed Martin had concealed corrupt payments to foreign government officials in the early 1970s. The settlement agreement previously required Lockheed Martin to file a Form 8-K with the SEC at least ten days in advance of the date when a scheduled change to its statements or policies and procedures was set to take place. Lockheed, without opposition from the SEC, successfully argued that subsequent changes in the securities laws obviated this requirement.

The SEC’s allegations against Lockheed Martin in the early 1970s served, in part, as the impetus behind the enactment of the FCPA in 1977. Oil For Food Scandal. On June 18, 2009, a French court acquitted fourteen companies for paying bribes in exchange for lucrative contracts as part of the U.N. Oil-For-Food Program.

Among the companies were Renault Trucks, Schnieder Electric, and Legrand. The U.N. Oil-For-Food Program required the sales proceeds of Iraqi oil to be deposited in a U.N.

bank account to be used for humanitarian aid. The Oil-For-Food Program scandal began when the Iraqi regime of Saddam Hussein began requiring companies to pay kickbacks in exchange for the oil sales. According to the French court, the prosecution had offered no evidence of bribery because no individuals benefited from the alleged graft, and the former Iraqi regime (for which the U.N. Oil-For-Food Program was set up) was not victimized by the scheme.

The French court’s decision aligns with the approach taken in the United States. Although the Justice Department has brought a number of cases against U.S. and foreign companies resulting from the Oil-For-Food scandal, none allege bribery in connection with the Oil-For-Food program itself (although some cases involved additional FCPA charges related to different bribery schemes, see, e.g., Innospec) and those cases are largely predicated on theories of fraud against the U.N.

or books-and-records violations by issuers. Perennial Statutory Issues Instrumentality The DOJ’s 2015 prosecution of Daren Condrey in United States v. Condrey raises some questions as to whether government prosecutors are remaining faithful to the government instrumentality test set out in the Eleventh Circuit’s 2014 decision in United States v. Esquenazi. For purposes of enforcing the FCPA, the DOJ and SEC heavily rely on the theory that government owned and operated FCPA Digest | January 2016 x .

A. Recent Trends and Patterns in FCPA Enforcement entities fall within the definition of the term government “instrumentality” and therefore any employee of those entities constitutes a “foreign official” according to the language of the statute. In summary, under Esquenazi, the Eleventh Circuit held that the government bore the burden of proving two conditions to establish that a particular entity should be considered an “instrumentality” under the FCPA: (i) the foreign government must control the relevant entity; and (ii) the entity must serve a government function. The Eleventh Circuit’s decision in Esquenazi largely vindicated the DOJ’s and SEC’s broad interpretation of the term. However, the “government function” element represented a slight deviation from the DOJ’s and SEC’s former practice, which had focused almost exclusively on government ownership and control. In Condrey, the defendant was charged with, and ultimately pleaded guilty to, conspiracy to violate the FCPA after he allegedly bribed a Director and President of a nuclear supply and servicing company known as JSC Techsnabexport (“Tenex”) and its U.S.

subsidiary, Tenam Corporation. Both Tenex and Tenam were indirectly owned by the Russian government. As a result, the DOJ claimed that Tenex and Tenam were “instrumentalities” and that, therefore, the Director/President was a “foreign official.” Thus, in the stipulated statement of facts attached to Condrey’s plea agreement, the government, in summary fashion states: TENEX supplied uranium and uranium enrichment services to nuclear power companies throughout the world on behalf of the government of the Russian Federation.

TENEX was indirectly owned and controlled by, and performed functions of, the government of the Russian Federation, and thus was an “agency” and “instrumentality” of a foreign government, as those terms are used in the FCPA, Title 15, United States Code, 78dd-2(h)(2). TENEX established a wholly-owned subsidiary company located in the United States in or about October 2010, Tenam Corporation (“TENAM”). TENAM was TENEX’s official representative in the United States. Tenam was indirectly owned and controlled by, and performed functions of, the government of the Russian Federation, and thus was an “agency” and “instrumentality” of a foreign government, as those terms are used in the FCPA, Title 15, United States Code, 78dd-2(h)(2). The statement that both Tenex and Tenam were “indirectly owned and controlled by, and performed functions of, the government of the Russian Federation” appears to be a direct nod to Esquenazi.

However, upon a review of the facts, the question is whether, if tested in court, Tenex and Tenam could satisfy the instrumentality test. While there seems to be little doubt that Tenam and Tenex were owned by the Russian government (in a parallel action against the foreign official, Vadim Mikerin, the DOJ disclosed additional details over the Russian government’s ownership of the companies), both Tenex and Tenam appear to serve primarily commercial roles as nuclear service providers and it is therefore debatable whether they served a government function. According to Esquenazi, the following non-exclusive factors are relevant to whether an entity serves a government function: (i) whether the entity has a monopoly over the function it exists to carry out; (ii) whether the government subsidizes the costs associated with the entity providing services; (iii) whether the entity provides services to the public at large in the foreign country; and (iv) whether the public and government of that foreign country generally perceive the entity to be performing a government function. Applying these factors to Tenex and Tenam leaves a much less clear picture than the stipulated facts suggest. First, Tenex and Tenam are but two companies within a much larger group of competing nuclear service providers—indicating that the two companies do not hold a monopoly over their industry (especially not within the United States where the bribes took place).

Second, whether the Russian government subsidizes the companies is not entirely clear, but because it seems that the Russian government indirectly owns Tenex and Tenam, it would not be surprising if the companies received some degree of government support. Third, Tenex and Tenam arguably do not serve the public at large of the foreign government because the two companies maintain operations outside Russia, and operate for what appear to be primarily commercial purposes. Fourth and for similar reasons, because the companies, arguably, appear to be serving a commercial role, whether the Russian government and public generally believe Tenex and Tenam serve a government function is debatable.

While we note the analysis above is far from perfect, it highlights how the Esquenazi court sought to carve out certain entities from the definition of “instrumentality,” and how the government’s summary analysis of the facts may be subject to challenge going forward. FCPA Digest | January 2016 xi . A. Recent Trends and Patterns in FCPA Enforcement Foreign Officials – Public International Organization The 2015 enforcement action in United States v. Harder is a reminder that officials of public international organizations, although not affiliated with any one specific government, may fall within the definition of “foreign official” under the FCPA. The language of the statute clearly states: (1)(A) The term “foreign official” means any officer or employee of . .

. a public international organization, or any person acting in an official capacity . .

. for or on behalf of any public international organization. (B) For purposes of subparagraph (A), the term “public international organization” means— (i) an organization that is designated by Executive Order pursuant to section 1 of the International Organizations Immunities Act (22 U.S.C. § 288); or (ii) any other international organization that is designated by the President by Executive order for the purposes of this section, effective as of the date of publication of such order in the Federal Register.

(emphasis added). In Harder, the former owner and president of Chestnut Consulting Group was charged with conspiracy to violate the FCPA as a result of an alleged scheme to pay approximately $3.5 million in illicit funds to an official at the European Bank for Reconstruction and Development. Although headquartered in London, the EBRD is owned by over 60 sovereign nations and most importantly was designated a “public international organization” on June 18, 1991 by Executive Order 12766. Harder is a reminder that companies that conduct business with multinational development organizations, such as the EBRD, the World Bank Group, International Monetary Fund, and other international financial institutions (IFIs), or projects funded by such IFIs, may be subject to the same FCPA compliance risks they face when conducting business with sovereign governments. Relatedly, the DOJ’s recent announcement of a 47-count indictment against various officials at the international government body of the sport of soccer, FIFA, presents the opposite side of the coin.

FIFA, unlike the EBRD, has not been designated a “public international organization” and therefore its officials are not “foreign officials” per se by virtue of their relationship to FIFA. Many have pointed out that this is among the primary reasons that the DOJ’s indictment did not charge the defendants in FIFA with FCPA violations. While these commentators are in large part correct—FIFA is not a “public international organization,” and therefore its officials do not automatically constitute “foreign officials” sufficient to generate FCPA liability upon receiving or being offered an illicit payment 7— companies should not assume that they will be free from FCPA risk for conducting business with international sporting bodies simply because they have not been designated a “public international organization” by the President of the United States. What is important for companies to consider when assessing FCPA risks in situations similar to that of FIFA, is what relationship a particular official has to other national entities.

As we have pointed out elsewhere, 8 many FIFA officials were appointed to their positions by virtue of their relationship with national soccer associations. Because many of these national soccer associations receive funding from government coffers and exert monopolistic control over large scale sporting events in that country, it is plausible under the “instrumentality” test defined by Esquenazi that these organizations could fall within the meaning of a government “instrumentality.” Moreover, with the scrutiny that FIFA is currently facing, it would seem plausible for governments to begin to assert even more control over its national athletic associations, only further raising the likelihood that those organizations would constitute an “instrumentality” under the FCPA. The same analysis governed the government’s charging decisions in the 2002 Salt Lake City Olympics case involving payments to International Olympic Committee members. 7 For a further discussion of these issues, you may wish to refer to our prior client publication, available at Shearman & Sterling, FIFA and BHP Billiton: The Unique FCPA Challenges Present In International Sports (June 15, 2015). 8 FCPA Digest | January 2016 xii . A. Recent Trends and Patterns in FCPA Enforcement Foreign Political Parties The FCPA is most commonly discussed in the context of its prohibition against offering or making illicit payments to a “foreign official.” Less commonly discussed is that the FCPA separately prohibits individuals and companies from offering or making illicit payments to “any foreign political party” irrespective of whether a specific individual is offered or receives the payment. The SEC’s enforcement action against Hitachi highlights this often ignored component of the FCPA. In Hitachi, the SEC accused the Japanese conglomerate of unlawfully passing funds to a joint venture partner that operated as a front company for the African National Congress, South Africa’s ruling party. Although, likely due to jurisdictional issues, the SEC charged Hitachi only under the FCPA’s books-and-records provisions and not its anti-bribery provision, the SEC’s complaint made clear that the Commission’s action was predicated on unlawful payments to a political party: Hitachi’s “books and records did not reflect that the [funds were], in fact, an amount due for payment to a foreign political party in exchange for its political influence in assisting Hitachi land two government contracts.” Thus, Hitachi is a reminder that companies should be cognizant of the possible FCPA risks when doing business with foreign political parties as a whole, not simply individual foreign officials. Anything of Value Since 2013, several Wall Street investment firms have reported investigations by the DOJ and SEC over allegations that the firms hired the children of well-connected government officials and clients to win business. In the first enforcement action arising out of the so called “Princeling Investigations,” BNYM breaks new ground. In most FCPA cases where a family member of a foreign official was hired by the defendant corporation (e.g., UTStarcom, DaimlerChrysler, Siemens, and Tyson Foods), the family member was used as a conduit to funnel monetary payments to the foreign official.

In other cases, such as Schering-Plough and Eli Lilly, while no tangible benefit was conveyed to the foreign official, the companies were charged with violating the FCPA after making charitable donations to a foundation managed by the official to obtain business. Significantly, the companies in Schering-Plough and Eli Lilly were only charged with violating the books-and-records and internal controls provisions of the FCPA, leaving the question open as to whether an intangible benefit, such as a charitable donation or the knowledge that a child was hired by a Wall Street bank, could actually violate the FCPA’s anti-bribery provisions. According to the SEC, its enforcement action against BNYM answers the question in the affirmative. In BNYM, the bank was accused of violating the FCPA’s anti-bribery provision after it provided a series of internships to the family members of a pair of officials at a Middle-Eastern sovereign wealth fund to maintain its current relationship with the fund and secure future business.

Under the SEC’s theory, the indirect benefit of providing a family member a prestigious internship was sufficient to satisfy the “anything of value” element of the FCPA. In our view, this theory is problematic and flies in the face of the statute’s clear and unambiguous language, that to violate the statute a person must conduct an “act in furtherance of an offer, payment, promise to pay, or authorization of the payment of any money [or] the giving of anything of value to any foreign official.” Given the novelty of the SEC’s theory, we have to ask whether, if tested in court, the SEC’s reading of the statute is a step too far. Indeed, despite the broad scope of the term “anything of value,” the statute clearly requires that “anything of value” be offered, promised, paid, or given to the foreign official. It is unlikely that Congress ever intended for the FCPA to be applied to benefits offered to third parties that were not passed on to the foreign official and simply made the official “feel good” about the company providing the benefit.

As many commentators have already pointed out, the practice of securing jobs and employment through family connections (whether rightly or wrongly) exists in nearly every industry in the United States and around the world. In some ways, this may be a case of bad alleged facts making bad law. The SEC appears to justify its case against BNYM by alleging that the internships were shams and that the family members who received the positions were not qualified and performed poorly. While these details may have atmospheric value, the legitimacy of the position and qualifications of the family member are irrelevant to question of whether a foreign official was offered or received “anything of value.” Under the SEC’s theory, even if the internships were entirely legitimate and the family members were well qualified, the subjective benefit received by a foreign official would technically be sufficient to trigger FCPA liability.

Indeed, this specific issue may be presented in the other “princeling” investigations, many of which appear to involve real jobs and real internships given to qualified and highly educated scions of senior Chinese officials, forcing the SEC and the FCPA Digest | January 2016 xiii . A. Recent Trends and Patterns in FCPA Enforcement DOJ to decide just how far they are willing to stretch the language of the statute to reach conduct potentially intended to influence officials but which does not involve conveying a tangible benefit, directly or indirectly, to the official. In the end, whether offering the family member of a foreign official a job leads to an FCPA violation may be more of a question of how the DOJ and SEC choose to enforce the law rather than what the statute actually says. It is fairly uncontroversial to hold that providing a scholarship to a foreign official’s child is conveying a benefit to the official—on the basis that otherwise the official would have had to pay tuition out of his own pocket. A similar theory supports application of the statute to providing “no show” jobs to officials’ family members and dependents. The BYNM case raises the issue of whether the same rule ought to apply to providing internships and jobs to allegedly unqualified and underperforming relatives, but, if so, the government’s allegations would appear to omit several critical facts, e.g., whether the job recipients were otherwise dependent upon the official, whether they were known to be unqualified before being employed (or only performed unsatisfactorily after being hired), whether the internal discussions at the company anticipated that the job recipients would be unqualified, would be held to different standards, and would not be expected to work, etc. Moreover, the government’s approach is bad policy.

For better or worse, some of the most educated and most qualified potential hires in many countries are the children of government officials—individuals who benefited from their parents’ privileges and had the opportunity to attend prestigious schools, learn foreign languages, etc. If the government infers an intent to apply corrupt influence from the potential hire’s relationship to government officials, it is likely to chill hiring of such individuals, resulting in a completely unnecessary disadvantage to U.S. and other companies covered by the FCPA. Jurisdiction According to the FCPA Guide published by the DOJ and the SEC staff, individuals or companies can be found guilty of conspiracy to violate the FCPA “even if they are not, or could not be, independently charged with a substantive FCPA violation.” This application of U.S.

criminal law allows the DOJ and SEC effectively to enforce the FCPA against individuals or companies that are not (i) issuers or (ii) domestic concerns or, (iii) did not take actions in furtherance of a corrupt payment within the United States (i.e., the three jurisdictional bases of the FCPA). By way of an example, the FCPA Guide states: “For instance, a foreign, non-issuer company could be convicted of conspiring with a domestic concern to violate the FCPA.” This theory was used to prosecute the three non-U.S. companies in the TSKJ consortium, by alleging that each of them had conspired with KBR to bribe Nigerian officials.

In those actions, although the DOJ and SEC hinted at a more expansive view of territorial jurisdiction over non-U.S. companies, the facts carefully articulated conspiratorial meetings in the United States. In the ongoing proceedings leading up to the government’s prosecution of the former Alstom official, Lawrence Hoskins, Judge Janet Bond Arterton (D. Conn.) recently threw the DOJ’s and FCPA Guide’s theories on the government’s authority to charge an individual with conspiracy to violate the FCPA into question.

In its charging documents, the DOJ alleged inter alia that Hoskins was guilty of conspiring to violate the FCPA because he acted in concert with a U.S. subsidiary of Alstom to pay bribes to officials in Indonesia. Upon reviewing Hoskins’ motion to dismiss, Judge Arterton concluded that for the DOJ to make its case for conspiracy, the DOJ would have to show that the defendant met one of the three jurisdictional bases of the FCPA.

According to Judge Arterton, “[t]he clearest indication of legislative intent is the text and structure of the FCPA, which carefully delineates the classes of people subject to liability and excludes nonresident foreign nationals where they are not agents of a domestic concern or did not take actions in furtherance of a corrupt payment within the territory of the United States.” In so ruling, Judge Arterton has provided valuable guidance on how both the government and defendants should understand the application of conspiracy jurisdiction to the FCPA. Modes of Payment The 2015 FCPA enforcement actions have generally exhibited schemes similar to those seen in the past. As with most alleged bribery schemes, the issues concerning the modes of payment are (i) how the defendant acquired the funds to be used as bribes and (ii) how the defendant funneled those bribes to a foreign official. Fictitious Receipts/Invoices/Contracts. Goodyear and Bristol-Myers provide examples of how companies and their employees are able to secure funds used for bribes through the submission of falsified reimbursement forms or receipts.

Beginning with Goodyear, the SEC FCPA Digest | January 2016 xiv . A. Recent Trends and Patterns in FCPA Enforcement cited two methods by which Goodyear’s subsidiaries acquired the funds to pay the alleged bribes. In the case of Goodyear’s Kenyan subsidiary, managers and directors are alleged to have approved phony payments for promotional products and instructed the finance department to write-out checks in cash. After the checks were cashed, the money was allegedly used as bribes to foreign officials. In the case of Goodyear’s Angolan subsidiary, a former manager falsely marked-up the cost of the subsidiary’s tires by adding phony custom and clearance costs to the invoices.

When the tires were sold, the mark-ups were used to bribe officials through direct payments and wire transfers. Similarly, in Bristol-Myers, company employees were accused of falsifying reimbursement claims to acquire funds used to pay rebates, provide entertainment, and fund gift cards for foreign officials. Kickbacks. In PBSJ/Hatoum and IAP/Rama, the funds used for the alleged improper payments were derived from the profits generated by the project contracts obtained through bribery.

For example, in PBSJ/Hatoum, the defendants used a large percentage of the profits from two construction projects to bribe a senior Qatari official. The funds were subsequently transferred through a local subcontractor that was controlled by the foreign official. Similarly, in IAP/Rama, the defendants allegedly used approximately 50% of the profits from a service contract to bribe Kuwaiti foreign officials.

The payments were made through a relatively sophisticated kickback scheme whereby funds were transferred through several entities. Family Members. The use of family members to funnel and conceal bribe payments continued to be a common mode of payment in the 2015 enforcement actions. As mentioned above, in PBSJ/Hatoum, the defendants funneled the alleged bribe payments to the foreign official through a local subcontractor.

In a further attempt to conceal the alleged bribes, Hatoum allegedly arranged for PBSJ to open a joint bank account with the local subcontractor to which the foreign official’s wife had access. Similarly, in Rincon, the DOJ accused the defendants of wiring funds to bank accounts controlled by the relatives of the foreign officials as a means of funneling the illicit payments to the foreign officials without detection. Lastly, in Harder, the defendant is alleged to have funneled bribes to the foreign official by wiring the funds to a bank account controlled by the foreign official’s sister. Gifts and Travel.

In FLIR and BHP Billiton, the companies were liable for violating the FCPA as a result of improper gift giving. While FLIR’s conduct was the result of purposeful acts of a pair of employees who offered foreign officials extravagant travel and gifts, the violations in BHP Billiton were the result of a hospitality program that the company failed to appropriately monitor and detect whether foreign officials (with the ability to influence BHP Billiton business) were being offered travel and entertainment during the 2008 Summer Olympics in Beijing. While FLIR indicates that the government is willing to initiate enforcement actions against companies purely on the basis of improper gift giving, BHP Billiton exhibits that the failure to appropriately monitor hospitality programs can unwittingly lead to FCPA liability. Product Discounts.

Both Garcia and Mead Johnson Nutrition exhibited how defendants were able to use product discounts, offered to third-party partners or distributors, to generate funds used to pay bribes. Specifically, according to the SEC’s cease-and-desist order against Garcia, Garcia was able to generate the funds allegedly used to bribe Panamanian officials by securing a high discount on the sales price of SAP software for a local partner who in turn would resell the software to the Panamanian government at the normal price. Because the profit margins from the sale of SAP software to the Panamanian government were so high, portions of the profits were used as a bribe. Similarly, in Mead Johnson Nutrition, the company’s Chinese subsidiary sold its products to local distributors at a discounted price. The local distributors used the additional profit margins, allegedly at the company’s direction, to provide employees of government owned hospitals cash and other benefits in exchange for recommending Mead Johnson Nutrition’s products. Foundations.

The SEC’s enforcement action against Louis Berger International provides an example of how a company allegedly used a charitable organization to funnel bribe payments to foreign officials. Although the allegations contained in Louis Berger International are many, in Vietnam, Louis Berger International officials allegedly disguised bribe money as “donations,” which were paid to a local nongovernment organization that Louis Berger International engaged as its local sponsor to secure labor and operation support. Success Fees/Commitment Fees/Agency Fees. A number of the 2015 FCPA enforcement actions, including Harder, Louis Berger International, and Hitachi, illustrated examples of how companies attempted to mask bribe payments by referring to them as “success fees,” “commitment fees,” “agency fees,” etc.

As the DOJ highlighted in its DPA with Louis Berger International, the company allegedly FCPA Digest | January 2016 xv . A. Recent Trends and Patterns in FCPA Enforcement paid “commitment fees” and “counterpart per diems” in Indonesia in connection with contracts with the government. After the company began its internal investigation, an internal email directing scrutiny at the alleged wrongdoers stated that a “[c]ommittment fee is the misnomer for bribe money.” In Harder, the DOJ claims that a portion of the bribes were derived from “success fees” that Harder and his company, Chestnut Group, received in exchange for securing financing from the EBRD on behalf of his clients. In Hitachi, the company allegedly entered into a side agreement with its joint venture partner—an entity controlled by the ruling party in South Africa—where Hitachi would pay the joint venture partner a “success fee” in the event Hitachi was able to secure a contract award with the assistance of the partner (and by inference the political party). Compliance Guidance Yates Memo On September 9, 2015, the DOJ released, under the signature of Deputy Attorney General Sally Yates, a memo that expounded on its position vis a vis cooperation credit for corporations. Although viewed by some as a change to the DOJ’s policy, the Yates Memo is more in the nature of emphasizing the Department’s long-standing expectations that its prosecutors should pursue both corporate and individual wrongdoers and that corporations purporting to cooperate may not protect, and indeed must disclose, the identity of wrongdoing executives, employees, and individuals (sometimes referred to as “throwing under the bus” or “diming out”).

In short, the Yates Memo outlined six steps that prosecutors would be expected to follow when investigating and pursuing charges against corporations. Each of these steps was aimed at the Department’s overarching goal of increasing the number of prosecutions and convictions of individuals for corporate wrongdoing. Key among the steps was the requirement that prosecutors only give corporations credit for cooperating with a DOJ investigation if the corporation provides “all relevant facts relating to individuals responsible for the misconduct.” While there has been a significant amount of commentary on the Yates Memo already (which we won’t rehash here), there are a few takeaways that we thought important to highlight. First, the Yates Memo is not a sea change; it simply documents what has for a long time been relatively common practice at the DOJ.

If anything, this year’s collection of FCPA enforcement actions, where the DOJ (and SEC) have brought charges against both the company and employees on multiple occasions, is only further evidence that the Yates Memo memorializes a practice that was already well understood at the Fraud Section and in many U.S. Attorneys Offices. What the Yates Memo will change, however, is the timing of certain stages of a corporation’s cooperation and the government’s parallel investigations.