Description

Press Release

Andrea Weidemann

andrea.weidemann@stoxx.com

Phone: +41 583993568

Zurich | Feb. 23, 2016

Results of the first regular quarterly review to be effective Mar. 21, 2016

STOXX Limited, a leading provider of innovative, tradable and global index concepts, today announced the

new composition of STOXX Benchmarks and their sub and sector indices, among them the STOXX

Europe 600 Index, STOXX North America 600 Index and STOXX Asia/Pacific 600 Index.

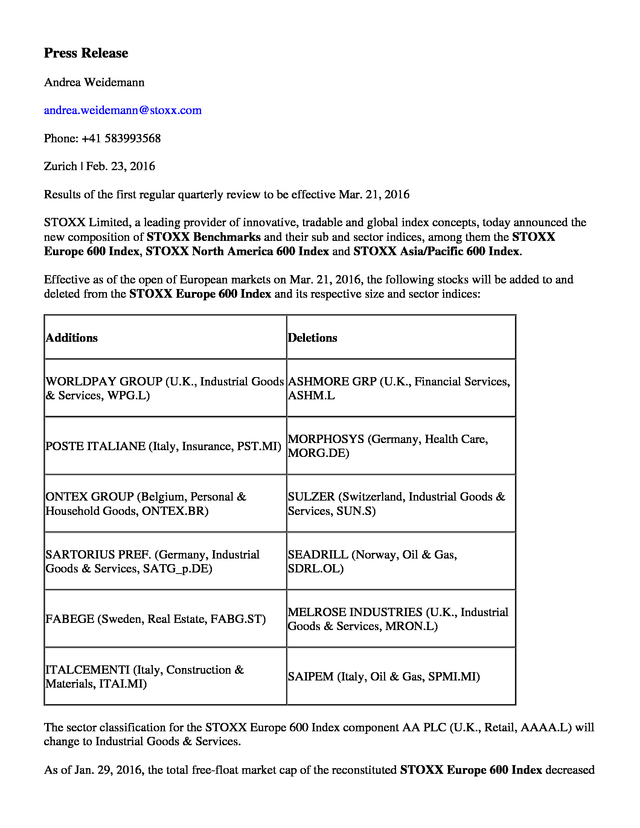

Effective as of the open of European markets on Mar. 21, 2016, the following stocks will be added to and

deleted from the STOXX Europe 600 Index and its respective size and sector indices:

Additions

Deletions

WORLDPAY GROUP (U.K., Industrial Goods ASHMORE GRP (U.K., Financial Services,

& Services, WPG.L)

ASHM.L

POSTE ITALIANE (Italy, Insurance, PST.MI)

MORPHOSYS (Germany, Health Care,

MORG.DE)

ONTEX GROUP (Belgium, Personal &

Household Goods, ONTEX.BR)

SULZER (Switzerland, Industrial Goods &

Services, SUN.S)

SARTORIUS PREF.

(Germany, Industrial Goods & Services, SATG_p.DE) SEADRILL (Norway, Oil & Gas, SDRL.OL) FABEGE (Sweden, Real Estate, FABG.ST) MELROSE INDUSTRIES (U.K., Industrial Goods & Services, MRON.L) ITALCEMENTI (Italy, Construction & Materials, ITAI.MI) SAIPEM (Italy, Oil & Gas, SPMI.MI) The sector classification for the STOXX Europe 600 Index component AA PLC (U.K., Retail, AAAA.L) will change to Industrial Goods & Services. As of Jan. 29, 2016, the total free-float market cap of the reconstituted STOXX Europe 600 Index decreased . from 7.2751 trillion euros to 7.2396 trillion euros due to the extraordinary deletion of BG Group. The STOXX Global 1800 Index, STOXX North America 600 Index and STOXX Asia/Pacific 600 Index are also part of this regular quarterly review. Additions to and deletions from these indices can be found at: http://www.stoxx.com/download/indices/methodology/fixed_component_changes.xls. Furthermore, the STOXX Europe Total Market Index, STOXX EU Enlarged Total Market, STOXX Eastern Europe Total Market and STOXX Eastern Europe 300 indices are also part of this regular quarterly review. Their new composition can be found on the respective page at www.stoxx.com on Mar. 21, 2016. Changes are being announced today after the conclusion of a regular quarterly component review.

The adjusted component weightings, including the number of shares and free-float factors, will be announced on Mar. 11, 2016 after the close of markets. All changes will be effective as of the open of markets on Mar.

21, 2016. In the case of upcoming mergers and acquisitions occurring until the final implementation date, the composition of the indices may change. ### Media contacts: Andrea Weidemann, andrea.weidemann@stoxx.com, Phone: +41 58 399 3568 Lara Atkinson, lara.atkinson@stoxx.com, Phone: +49 69 211 12977 Note to Editors: About STOXX Limited STOXX Ltd. is a global index provider, currently calculating a global, comprehensive index family of over 7,500 strictly rules-based and transparent indices.

Best known for the leading European equity indices EURO STOXX 50, STOXX Europe 50 and STOXX Europe 600, STOXX Ltd. maintains and calculates the STOXX Global index family which consists of total market, broad and blue-chip indices for the regions Americas, Europe, Asia/Pacific and sub-regions Latin America and BRIC (Brazil, Russia, India and China) as well as global markets. To provide market participants with optimal transparency, STOXX indices are classified into three categories. Regular âSTOXXâ indices include all standard, theme and strategy indices that are part of STOXXâs integrated index family and follow a strict rules-based methodology.

The âiSTOXXâ brand typically comprises less standardized index concepts that are not integrated in the STOXX Global index family, but are nevertheless strictly rules-based. While indices that are branded âSTOXXâ and âiSTOXXâ are developed by STOXX for a broad range of market participants, the âSTOXX Customizedâ brand covers indices that are specifically developed for clients and do not carry the STOXX brand in the index name. STOXX indices are licensed to more than 500 companies around the world as underlyings for Exchange Traded Funds (ETFs), futures and options, structured products and passively managed investment funds. . Three of the top ETFs in Europe and approximately 25% of all assets under management are based on STOXX indices. STOXX Ltd. holds Europe's number one and the world's number two position in the derivatives segment. STOXX is part of Deutsche Boerse Group, and markets the DAX indices. www.stoxx.com STOXX, Deutsche Boerse Group and their licensors, research partners or data providers do not make any warranties or representations, express or implied, with respect to the timeliness, sequence, accuracy, completeness, currentness, merchantability, quality or fitness for any particular purpose of its index data and exclude any liability in connection therewith.

STOXX, Deutsche Boerse Group and their licensors, research partners or data providers are not providing investment advice through the publication of indices or in connection therewith. In particular, the inclusion of a company in an index, its weighting, or the exclusion of a company from an index, does not in any way reflect an opinion of STOXX, Deutsche Boerse Group or their licensors, research partners or data providers on the merits of that company. Financial instruments based on the STOXX® indices, DAX® indices or on any other indices supported by STOXX are in no way sponsored, endorsed, sold or promoted by STOXX, Deutsche Boerse Group or their licensors, research partners or data providers. .

(Germany, Industrial Goods & Services, SATG_p.DE) SEADRILL (Norway, Oil & Gas, SDRL.OL) FABEGE (Sweden, Real Estate, FABG.ST) MELROSE INDUSTRIES (U.K., Industrial Goods & Services, MRON.L) ITALCEMENTI (Italy, Construction & Materials, ITAI.MI) SAIPEM (Italy, Oil & Gas, SPMI.MI) The sector classification for the STOXX Europe 600 Index component AA PLC (U.K., Retail, AAAA.L) will change to Industrial Goods & Services. As of Jan. 29, 2016, the total free-float market cap of the reconstituted STOXX Europe 600 Index decreased . from 7.2751 trillion euros to 7.2396 trillion euros due to the extraordinary deletion of BG Group. The STOXX Global 1800 Index, STOXX North America 600 Index and STOXX Asia/Pacific 600 Index are also part of this regular quarterly review. Additions to and deletions from these indices can be found at: http://www.stoxx.com/download/indices/methodology/fixed_component_changes.xls. Furthermore, the STOXX Europe Total Market Index, STOXX EU Enlarged Total Market, STOXX Eastern Europe Total Market and STOXX Eastern Europe 300 indices are also part of this regular quarterly review. Their new composition can be found on the respective page at www.stoxx.com on Mar. 21, 2016. Changes are being announced today after the conclusion of a regular quarterly component review.

The adjusted component weightings, including the number of shares and free-float factors, will be announced on Mar. 11, 2016 after the close of markets. All changes will be effective as of the open of markets on Mar.

21, 2016. In the case of upcoming mergers and acquisitions occurring until the final implementation date, the composition of the indices may change. ### Media contacts: Andrea Weidemann, andrea.weidemann@stoxx.com, Phone: +41 58 399 3568 Lara Atkinson, lara.atkinson@stoxx.com, Phone: +49 69 211 12977 Note to Editors: About STOXX Limited STOXX Ltd. is a global index provider, currently calculating a global, comprehensive index family of over 7,500 strictly rules-based and transparent indices.

Best known for the leading European equity indices EURO STOXX 50, STOXX Europe 50 and STOXX Europe 600, STOXX Ltd. maintains and calculates the STOXX Global index family which consists of total market, broad and blue-chip indices for the regions Americas, Europe, Asia/Pacific and sub-regions Latin America and BRIC (Brazil, Russia, India and China) as well as global markets. To provide market participants with optimal transparency, STOXX indices are classified into three categories. Regular âSTOXXâ indices include all standard, theme and strategy indices that are part of STOXXâs integrated index family and follow a strict rules-based methodology.

The âiSTOXXâ brand typically comprises less standardized index concepts that are not integrated in the STOXX Global index family, but are nevertheless strictly rules-based. While indices that are branded âSTOXXâ and âiSTOXXâ are developed by STOXX for a broad range of market participants, the âSTOXX Customizedâ brand covers indices that are specifically developed for clients and do not carry the STOXX brand in the index name. STOXX indices are licensed to more than 500 companies around the world as underlyings for Exchange Traded Funds (ETFs), futures and options, structured products and passively managed investment funds. . Three of the top ETFs in Europe and approximately 25% of all assets under management are based on STOXX indices. STOXX Ltd. holds Europe's number one and the world's number two position in the derivatives segment. STOXX is part of Deutsche Boerse Group, and markets the DAX indices. www.stoxx.com STOXX, Deutsche Boerse Group and their licensors, research partners or data providers do not make any warranties or representations, express or implied, with respect to the timeliness, sequence, accuracy, completeness, currentness, merchantability, quality or fitness for any particular purpose of its index data and exclude any liability in connection therewith.

STOXX, Deutsche Boerse Group and their licensors, research partners or data providers are not providing investment advice through the publication of indices or in connection therewith. In particular, the inclusion of a company in an index, its weighting, or the exclusion of a company from an index, does not in any way reflect an opinion of STOXX, Deutsche Boerse Group or their licensors, research partners or data providers on the merits of that company. Financial instruments based on the STOXX® indices, DAX® indices or on any other indices supported by STOXX are in no way sponsored, endorsed, sold or promoted by STOXX, Deutsche Boerse Group or their licensors, research partners or data providers. .