Description

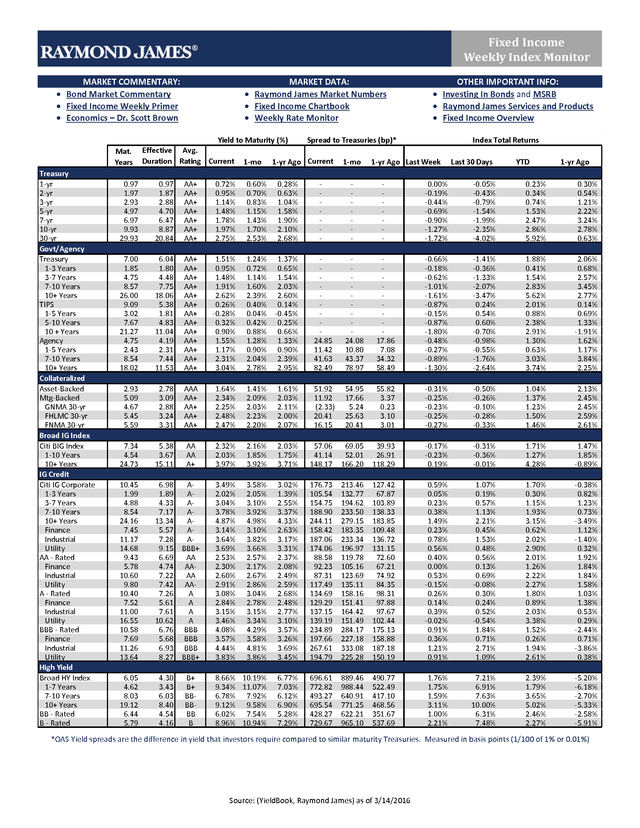

MARKET COMMENTARY:

• Bond Market Commentary

• Fixed Income Weekly Primer

• Economics – Dr. Scott Brown

Mat.

Years

Treasury

1-yr

2-yr

3-yr

5-yr

7-yr

10-yr

30-yr

Govt/Agency

Treasury

1-3 Years

3-7 Years

7-10 Years

10+ Years

TIPS

1-5 Years

5-10 Years

10 + Years

Agency

1-5 Years

7-10 Years

10+ Years

Collateralized

Asset-Backed

Mtg-Backed

GNMA 30-yr

FHLMC 30-yr

FNMA 30-yr

Broad IG Index

Citi BIG Index

1-10 Years

10+ Years

IG Credit

Citi IG Corporate

1-3 Years

3-7 Years

7-10 Years

10+ Years

Finance

Industrial

Utility

AA - Rated

Finance

Industrial

Utility

A - Rated

Finance

Industrial

Utility

BBB - Rated

Finance

Industrial

Utility

High Yield

Broad HY Index

1-7 Years

7-10 Years

10+ Years

BB - Rated

B - Rated

MARKET DATA:

• Raymond James Market Numbers

• Fixed Income Chartbook

• Weekly Rate Monitor

Yield to Maturity (%)

Spread to Treasuries (bp)*

Effective Avg.

Duration Rating Current 1-mo 1-yr Ago Current 1-mo 1-yr Ago Last Week

0.97

1.97

2.93

4.97

6.97

9.93

29.93

0.97

1.87

2.88

4.70

6.47

8.87

20.84

AA+

AA+

AA+

AA+

AA+

AA+

AA+

0.72%

0.95%

1.14%

1.48%

1.78%

1.97%

2.75%

0.60%

0.70%

0.83%

1.15%

1.43%

1.70%

2.53%

0.28%

0.63%

1.04%

1.58%

1.90%

2.10%

2.68%

7.00

1.85

4.75

8.57

26.00

9.09

3.02

7.67

21.27

4.75

2.43

8.54

18.02

6.04

1.80

4.48

7.75

18.06

5.38

1.81

4.83

11.04

4.19

2.31

7.44

11.53

AA+

AA+

AA+

AA+

AA+

AA+

AA+

AA+

AA+

AA+

AA+

AA+

AA+

1.51%

0.95%

1.48%

1.91%

2.62%

0.26%

-0.28%

0.32%

0.90%

1.55%

1.17%

2.31%

3.04%

1.24%

0.72%

1.14%

1.60%

2.39%

0.40%

0.04%

0.42%

0.88%

1.28%

0.90%

2.04%

2.78%

1.37%

0.65%

1.54%

2.03%

2.60%

0.14%

-0.45%

0.25%

0.66%

1.33%

0.90%

2.39%

2.95%

24.85

11.42

41.63

82.49

24.08

10.80

43.37

78.97

2.93

5.09

4.67

5.45

5.59

2.78

3.09

2.88

3.24

3.31

AAA

AA+

AA+

AA+

AA+

1.64%

2.34%

2.25%

2.48%

2.47%

1.41%

2.09%

2.03%

2.23%

2.20%

1.61%

2.03%

2.11%

2.00%

2.07%

51.92

11.92

(2.33)

20.41

16.15

7.34

4.54

24.73

5.38

3.67

15.11

AA

AA

A+

2.32%

2.03%

3.97%

2.16%

1.85%

3.92%

2.03%

1.75%

3.71%

10.45

1.99

4.88

8.54

24.16

7.45

11.17

14.68

9.43

5.78

10.60

9.80

10.40

7.52

11.00

16.55

10.58

7.69

11.26

13.64

6.98

A1.89

A4.33

A7.17

A13.34

A5.57

A7.28

A9.15 BBB+

6.69

AA

4.74 AA7.22

AA

7.42 AA7.26

A

5.61

A

7.61

A

10.62

A

6.76 BBB

5.68 BBB

6.93 BBB

8.27 BBB+

3.49%

2.02%

3.04%

3.78%

4.87%

3.14%

3.64%

3.69%

2.53%

2.30%

2.60%

2.91%

3.08%

2.84%

3.15%

3.46%

4.08%

3.57%

4.44%

3.83%

3.58%

2.05%

3.10%

3.92%

4.98%

3.10%

3.82%

3.66%

2.57%

2.17%

2.67%

2.86%

3.04%

2.78%

3.15%

3.34%

4.29%

3.58%

4.81%

3.86%

8.66% 10.19%

9.34% 11.07%

6.78% 7.92%

9.12% 9.58%

6.02% 7.54%

8.96% 10.94%

6.05

4.62

8.03

19.12

6.44

5.79

OTHER IMPORTANT INFO:

• Investing In Bonds and MSRB

• Raymond James Services and Products

• Fixed Income Overview

4.30

3.43

6.03

8.40

4.54

4.16

B+

B+

BBBBBB

B

-

-

-

Index Total Returns

Last 30 Days

YTD

1-yr Ago

0.00%

-0.19%

-0.44%

-0.69%

-0.90%

-1.27%

-1.72%

-0.05%

-0.43%

-0.79%

-1.54%

-1.99%

-2.35%

-4.02%

0.23%

0.34%

0.74%

1.53%

2.47%

2.86%

5.92%

0.30%

0.54%

1.21%

2.22%

3.24%

2.78%

0.63%

17.86

7.08

34.32

58.49

-0.66%

-0.18%

-0.62%

-1.01%

-1.61%

-0.87%

-0.15%

-0.87%

-1.80%

-0.48%

-0.27%

-0.89%

-1.30%

-1.41%

-0.36%

-1.33%

-2.07%

-3.47%

0.24%

0.54%

0.60%

-0.70%

-0.98%

-0.55%

-1.76%

-2.64%

1.88%

0.41%

1.54%

2.83%

5.62%

2.01%

0.88%

2.38%

2.91%

1.30%

0.63%

3.03%

3.74%

2.06%

0.68%

2.57%

3.45%

2.77%

0.14%

0.69%

1.33%

-1.91%

1.62%

1.17%

3.84%

2.25%

54.95

17.66

5.24

25.63

20.41

55.82

3.37

0.23

3.10

3.01

-0.31%

-0.25%

-0.23%

-0.25%

-0.27%

-0.50%

-0.26%

-0.10%

-0.28%

-0.33%

1.04%

1.37%

1.23%

1.50%

1.46%

2.13%

2.45%

2.45%

2.59%

2.61%

57.06

41.14

148.17

69.05

52.01

166.20

39.93

26.91

118.29

-0.17%

-0.23%

0.19%

-0.31%

-0.36%

-0.01%

1.71%

1.27%

4.28%

1.47%

1.85%

-0.89%

3.02%

1.39%

2.55%

3.37%

4.33%

2.63%

3.17%

3.31%

2.37%

2.08%

2.49%

2.59%

2.68%

2.48%

2.77%

3.10%

3.57%

3.26%

3.69%

3.45%

176.73

105.54

154.75

188.90

244.11

158.42

187.06

174.06

88.58

92.23

87.31

117.49

134.69

129.29

137.15

139.19

234.89

197.66

267.61

194.79

213.46

132.77

194.62

233.50

279.15

183.35

233.34

196.97

119.78

105.16

123.69

135.11

158.16

151.41

164.42

151.49

284.17

227.18

333.08

225.28

127.42

67.87

103.89

138.33

183.85

109.48

136.72

131.15

72.60

67.21

74.92

84.35

98.31

97.88

97.67

102.44

175.13

158.88

187.18

150.19

0.59%

0.05%

0.23%

0.38%

1.49%

0.23%

0.78%

0.56%

0.40%

0.00%

0.53%

-0.15%

0.26%

0.14%

0.39%

-0.02%

0.91%

0.36%

1.21%

0.91%

1.07%

0.19%

0.57%

1.13%

2.21%

0.45%

1.53%

0.48%

0.56%

0.13%

0.69%

-0.08%

0.30%

0.24%

0.52%

-0.54%

1.84%

0.71%

2.71%

1.09%

1.70%

0.30%

1.15%

1.93%

3.15%

0.62%

2.02%

2.90%

2.01%

1.26%

2.22%

2.27%

1.80%

0.89%

2.03%

3.38%

1.52%

0.26%

1.94%

2.61%

-0.38%

0.82%

1.23%

0.73%

-3.49%

1.12%

-1.40%

0.32%

1.92%

1.84%

1.84%

1.58%

1.03%

1.38%

0.53%

0.29%

-2.44%

0.71%

-3.86%

0.38%

6.77%

7.03%

6.12%

6.90%

5.28%

7.29%

696.61

772.82

493.27

695.54

428.27

729.67

889.46

988.44

640.91

771.25

622.21

965.10

490.77

522.49

417.10

468.56

351.67

537.69

1.76%

1.75%

1.59%

3.11%

1.00%

2.21%

7.21%

6.91%

7.63%

10.00%

6.31%

7.48%

2.39%

1.79%

3.65%

5.02%

2.46%

2.27%

-5.20%

-6.18%

-2.70%

-5.33%

-2.58%

-5.91%

*OAS Yield spreads are the difference in yield that investors require compared to similar maturity Treasuries. Measured in basis points (1/100 of 1% or 0.01%)

Source: (YieldBook, Raymond James) as of 3/14/2016

. Disclosures:

Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Past performance is no assurance of future results.

Diversification and asset allocation do not ensure a profit or protect against a loss. Investments are subject to market risk, including possible loss of principal.

This communication is intended to improve the efficiency with which Financial Advisors obtain information relevant to their client's taxable fixed income

holdings. This information should not be construed as a directive from the RJ&A Taxable Fixed Income Department to buy or sell the securities noted

above.

Prior to transacting in any security, investors are urged to discuss the suitability, potential returns, and associated risks of the transactions(s) with their Raymond James Financial Advisor. The information contained herein has been prepared from sources believed reliable but is not guaranteed by Raymond James & Associates, Inc. (RJA) and is not a complete summary or statement of all available data, nor is it to be construed as an offer to buy or sell any securities referred to herein. Trading ideas expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation or needs of individual investors.

Investors are urged to obtain and review the relevant documents in their entirety. RJA is providing this communication on the condition that it will not form the primary basis for any investment decision you may make. Furthermore, because these are only trade ideas, investors should assume that RJA will not produce any follow-up.

Employees of RJA or its affiliates may, at times, release written or oral commentary, technical analysis or trading strategies that differ from the opinions expressed within. RJA and/or its employees involved in the preparation or the issuance of this communication may have positions in the securities discussed herein. Securities identified herein are subject to availability and changes in price.

All prices and/or yields are indications for informational purposes only. Additional information is available upon request. A credit rating of a security is not a recommendation to buy, sell or hold securities and may be subject to review, revisions, suspension, reduction or withdrawal at any time by the assigning rating agency. All investment-grade fixed income index data provided by the Citi US Broad Investment Grade Bond Index (BIG) and its associated sub-indices. Inclusion in this index requires a stated coupon that is fixed, a minimum maturity of one year US Treasuries: US$5 billion public amount outstanding, US agencies and supranationals: US$1 billion, Corporate and asset-backed: US$250 million, Mortgage: Entry: US$1 billion minimum amount outstanding per origination year generic when the coupon has a minimum amount outstanding of US$5 billion.

Exit: An origination year generic will exit when its amount outstanding falls below US$1 billion. If the amount outstanding for the coupon falls below US$2.5 billion, all corresponding origination year generics will be removed from the index. Minimum quality is BBB-/Baa3 by either S&P or Moody’s. The Citigroup US BIG Corporate Index is a sub-index of the Citi BIG Index and follows the same parameters listed above but restricts securities to US and non-US corporate securities (excludes U.S.

Government Guaranteed and Non-US sovereign and provincial securities). Corporate industry sector classifications are based on Citi's proprietary Global Industry Code (GLIC) and Corporate Bond Sector Code (COBS) profiles which are derived from the North American Industry Classification System (NAICS). NAICS is the industry standard used by Federal statistical agencies in classifying business establishments for the purpose of collecting, analyzing and publishing statistical data related to the US business economy. High-yield bonds are not suitable for all investors.

The risk of default may increase due to changes in the issuer's credit quality. Price changes may occur due to changes in interest rates and the liquidity of the bond. When appropriate, these bonds should only comprise a modest portion of your portfolio. All high yield fixed income data provided by the Citi High-Yield Cash-Pay Index and its associated sub-indices.

Inclusion in this index requires US$100 million minimum outstanding per issue when the issuer has a minimum of US$400 million total outstanding debt that qualifies for inclusion, or US$200 million minimum outstanding per issue when the issuer does not meet the US$400 million minimum. A bond will exit when its amount outstanding falls below US$100 million par amount. An issuer that has already satisfied the US$400 million requirement will remain in the index — even if the total par amount outstanding of its bonds drops below the US$400 million minimum.

Minimum quality is C by S&P or Moody’s with a maximum quality of BB+/BA1 by both S&P and Moody’s. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed web sites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site's users and/or members. Index returns do not reflect the deduction of fees, trading costs or other expenses.

The Index is referred to for informational purposes only; the composition of each Index is different from the composition of the accounts managed by the investment manager. Investors may not make direct investments into any index. Past performance may not be indicative of future results. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise. U.S.

Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. Treasury bills are certificates reflecting short-term obligations of the U.S. government. Raymond James & Associates, Inc., member New York Stock Exchange/SIPC.

Raymond James Financial Services, Inc., member FINRA/SIPC. Ref. 2015-012322 until 03/30/2016 © 2015 Raymond James & Associates, Inc., member New York Stock Exchange/SIPC © 2015 Raymond James Financial Services, Inc., member FINRA/SIPC Raymond James Corporate Headquarters â— 880 Carillon Parkway, St. Petersburg, FL 33716 Source: (YieldBook, Raymond James) as of 3/14/2016 .

Prior to transacting in any security, investors are urged to discuss the suitability, potential returns, and associated risks of the transactions(s) with their Raymond James Financial Advisor. The information contained herein has been prepared from sources believed reliable but is not guaranteed by Raymond James & Associates, Inc. (RJA) and is not a complete summary or statement of all available data, nor is it to be construed as an offer to buy or sell any securities referred to herein. Trading ideas expressed are subject to change without notice and do not take into account the particular investment objectives, financial situation or needs of individual investors.

Investors are urged to obtain and review the relevant documents in their entirety. RJA is providing this communication on the condition that it will not form the primary basis for any investment decision you may make. Furthermore, because these are only trade ideas, investors should assume that RJA will not produce any follow-up.

Employees of RJA or its affiliates may, at times, release written or oral commentary, technical analysis or trading strategies that differ from the opinions expressed within. RJA and/or its employees involved in the preparation or the issuance of this communication may have positions in the securities discussed herein. Securities identified herein are subject to availability and changes in price.

All prices and/or yields are indications for informational purposes only. Additional information is available upon request. A credit rating of a security is not a recommendation to buy, sell or hold securities and may be subject to review, revisions, suspension, reduction or withdrawal at any time by the assigning rating agency. All investment-grade fixed income index data provided by the Citi US Broad Investment Grade Bond Index (BIG) and its associated sub-indices. Inclusion in this index requires a stated coupon that is fixed, a minimum maturity of one year US Treasuries: US$5 billion public amount outstanding, US agencies and supranationals: US$1 billion, Corporate and asset-backed: US$250 million, Mortgage: Entry: US$1 billion minimum amount outstanding per origination year generic when the coupon has a minimum amount outstanding of US$5 billion.

Exit: An origination year generic will exit when its amount outstanding falls below US$1 billion. If the amount outstanding for the coupon falls below US$2.5 billion, all corresponding origination year generics will be removed from the index. Minimum quality is BBB-/Baa3 by either S&P or Moody’s. The Citigroup US BIG Corporate Index is a sub-index of the Citi BIG Index and follows the same parameters listed above but restricts securities to US and non-US corporate securities (excludes U.S.

Government Guaranteed and Non-US sovereign and provincial securities). Corporate industry sector classifications are based on Citi's proprietary Global Industry Code (GLIC) and Corporate Bond Sector Code (COBS) profiles which are derived from the North American Industry Classification System (NAICS). NAICS is the industry standard used by Federal statistical agencies in classifying business establishments for the purpose of collecting, analyzing and publishing statistical data related to the US business economy. High-yield bonds are not suitable for all investors.

The risk of default may increase due to changes in the issuer's credit quality. Price changes may occur due to changes in interest rates and the liquidity of the bond. When appropriate, these bonds should only comprise a modest portion of your portfolio. All high yield fixed income data provided by the Citi High-Yield Cash-Pay Index and its associated sub-indices.

Inclusion in this index requires US$100 million minimum outstanding per issue when the issuer has a minimum of US$400 million total outstanding debt that qualifies for inclusion, or US$200 million minimum outstanding per issue when the issuer does not meet the US$400 million minimum. A bond will exit when its amount outstanding falls below US$100 million par amount. An issuer that has already satisfied the US$400 million requirement will remain in the index — even if the total par amount outstanding of its bonds drops below the US$400 million minimum.

Minimum quality is C by S&P or Moody’s with a maximum quality of BB+/BA1 by both S&P and Moody’s. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed web sites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site's users and/or members. Index returns do not reflect the deduction of fees, trading costs or other expenses.

The Index is referred to for informational purposes only; the composition of each Index is different from the composition of the accounts managed by the investment manager. Investors may not make direct investments into any index. Past performance may not be indicative of future results. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise. U.S.

Treasury bills are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. Treasury bills are certificates reflecting short-term obligations of the U.S. government. Raymond James & Associates, Inc., member New York Stock Exchange/SIPC.

Raymond James Financial Services, Inc., member FINRA/SIPC. Ref. 2015-012322 until 03/30/2016 © 2015 Raymond James & Associates, Inc., member New York Stock Exchange/SIPC © 2015 Raymond James Financial Services, Inc., member FINRA/SIPC Raymond James Corporate Headquarters â— 880 Carillon Parkway, St. Petersburg, FL 33716 Source: (YieldBook, Raymond James) as of 3/14/2016 .