Description

PAYDEN US DOLLAR LIQUIDITY FUND - UCITS

31 JANUARY 2016

FUND HIGHLIGHTS & STRATEGY

MARKET

§ Invests in short-term investment-grade US dollar-denominated instruments

§ The year began with heightened market volatility on concerns over economic conditions and a

continued slide in oil prices. The Federal Reserve left the Fed Funds rate unchanged, but has not

ruled out another hike in March. Two-year maturity Treasuries ended the month at 0.77%.

§ Fund investments in US Government and agency securities provide high degree of liquidity

§ Over $100 billion was issued in the primary markets for investment-grade corporate securities, but

could have been higher as some issuers stood down given the market conditions.

Commodity-sensitive businesses led the declines in the corporate sector.

§ Diversified portfolio holdings

§ Moody’s placed 55 metals and mining companies on review for a downgrade, adding to the

challenging environment that these companies operate in.

OUTLOOK

§ The Federal Open Market Committee should continue to raise the Fed funds target if solid economic

data persists, hiking at least twice this year.

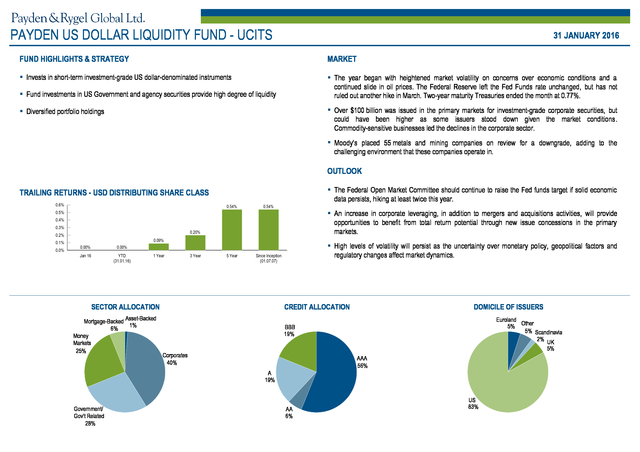

TRAILING RETURNS - USD DISTRIBUTING SHARE CLASS

0.6%

0.54%

0.54%

§ An increase in corporate leveraging, in addition to mergers and acquisitions activities, will provide

opportunities to benefit from total return potential through new issue concessions in the primary

markets.

0.5%

0.4%

0.3%

0.20%

0.2%

0.1%

0.0%

0.09%

0.00%

YTD

(31.01.16)

§ High levels of volatility will persist as the uncertainty over monetary policy, geopolitical factors and

regulatory changes affect market dynamics.

0.00%

Jan 16

1 Year

3 Year

5 Year

Since Inception

(01.07.07)

SECTOR ALLOCATION

Asset-Backed

Mortgage-Backed

1%

6%

Money

Markets

25%

CREDIT ALLOCATION

DOMICILE OF ISSUERS

Euroland

5% Other

5% Scandinavia

2%

UK

5%

BBB

19%

Corporates

40%

AAA

56%

A

19%

Government/

Gov't Related

28%

AA

6%

US

83%

. PAYDEN US DOLLAR LIQUIDITY FUND - UCITS

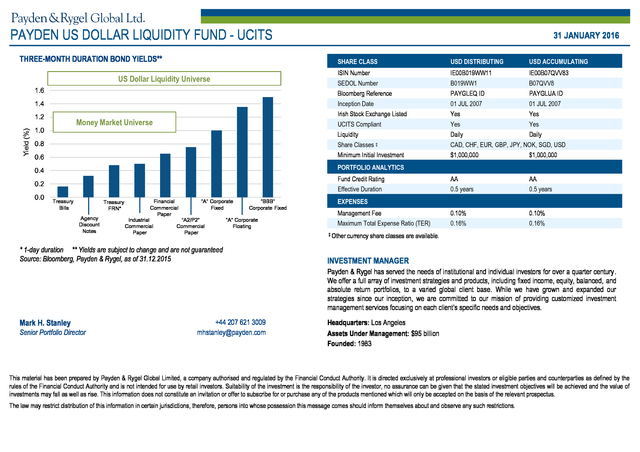

THREE-MONTH DURATION BOND YIELDS**

31 JANUARY 2016

SHARE CLASS

USD DISTRIBUTING

USD ACCUMULATING

ISIN Number

SEDOL Number

IE00B019WW11

B019WW1

IE00B07QVV83

B07QVV8

Bloomberg Reference

Inception Date

Irish Stock Exchange Listed

UCITS Compliant

PAYGLEQ ID

01 JUL 2007

PAYGLUA ID

01 JUL 2007

Yes

Yes

Yes

Yes

0.8

Liquidity

Share Classes ‡

Daily

Daily

CAD, CHF, EUR, GBP, JPY, NOK, SGD, USD

0.6

Minimum Initial Investment

$1,000,000

$1,000,000

0.4

PORTFOLIO ANALYTICS

Fund Credit Rating

Effective Duration

AA

0.5 years

AA

0.5 years

EXPENSES

Management Fee

Maximum Total Expense Ratio (TER)

0.10%

0.16%

0.10%

0.16%

US Dollar Liquidity Universe

1.6

1.4

Yield (%)

1.2

Money Market Universe

1.0

0.2

0.0

Treasury

Bills

Treasury

FRN*

Agency

Discount

Notes

Financial

Commercial

Paper

Industrial

Commercial

Paper

“A” Corporate

Fixed

“A2/P2”

Commercial

Paper

“BBB”

Corporate Fixed

“A” Corporate

Floating

* 1-day duration ** Yields are subject to change and are not guaranteed

Source: Bloomberg, Payden & Rygel, as of 31.12.2015

‡ Other

currency share classes are available.

INVESTMENT MANAGER

Payden & Rygel has served the needs of institutional and individual investors for over a quarter century.

We offer a full array of investment strategies and products, including fixed income, equity, balanced, and

absolute return portfolios, to a varied global client base. While we have grown and expanded our

strategies since our inception, we are committed to our mission of providing customized investment

management services focusing on each client’s specific needs and objectives.

Mark H. Stanley

Senior Portfolio Director

+44 207 621 3009

mhstanley@payden.com

Headquarters: Los Angeles

Assets Under Management: $95 billion

Founded: 1983

This material has been prepared by Payden & Rygel Global Limited, a company authorised and regulated by the Financial Conduct Authority. It is directed exclusively at professional investors or eligible parties and counterparties as defined by the

rules of the Financial Conduct Authority and is not intended for use by retail investors.

Suitability of the investment is the responsibility of the investor, no assurance can be given that the stated investment objectives will be achieved and the value of investments may fall as well as rise. This information does not constitute an invitation or offer to subscribe for or purchase any of the products mentioned which will only be accepted on the basis of the relevant prospectus. The law may restrict distribution of this information in certain jurisdictions, therefore, persons into whose possession this message comes should inform themselves about and observe any such restrictions. .

Suitability of the investment is the responsibility of the investor, no assurance can be given that the stated investment objectives will be achieved and the value of investments may fall as well as rise. This information does not constitute an invitation or offer to subscribe for or purchase any of the products mentioned which will only be accepted on the basis of the relevant prospectus. The law may restrict distribution of this information in certain jurisdictions, therefore, persons into whose possession this message comes should inform themselves about and observe any such restrictions. .