Description

How Futures Can Simplify Securities Lending

Page 1 of 3

Market Commentary

How Futures Can Simplify Securities Lending

By Howard Simons

RealMoney.com Contributor

11/4/2008 6:59 AM EST

URL: http://www.thestreet.com/p/rmoney/marketcommentary/10445743.html

One of the enduring lessons of the 2007-2008 credit crunch will be how many behind-the-scenes markets were disrupted

beyond recognition. It is rather like the wiring in your building: You don't think about it until a short circuit causes a fire.

Mundane markets as different as auction-rate preferred stock, institutional money market funds, commercial paper and

securities lending either became illiquid or froze entirely.

In the case of securities lending business, venerable white-shoe banks such as Northern Trust (NTRS) , State Street

(STT) and Bank of New York Mellon (BK) came under fire from the institutional investors who had placed shares in

custody at those banks and participated in their securities lending programs.

Those programs, which lent shares to hedge funds, market makers and garden-variety short-sellers of all stripes, had

generated steady returns for both the beneficial owners and for the custodial banks for years. The programs were simple:

Shares were lent, collateral was pledged by the borrowers, and the investment income on that collateral was shared by

the banks and the beneficial owners.

What could go wrong here, besides restrictions placed on short-selling, refusals by custodians such as the California

State Retirement System to lend their shares, stock loan charges imposed by former investment banks and other Wall

Street firms being raised to prohibitive levels, and the collateral being revealed as toxic?

As I noted in July, single stock futures (SSFs) provide a better mechanism not only for going short but for facilitating the

securities lending process. As SSFs deliver seamlessly into their underlying stocks, long or short, both sides of the

securities lending trade can take advantage of this property by using the exchange of futures for physicals (EFP)

mechanism.

Two trades related to this EFP mechanism of particular importance are: 1. One trader selling a SSF against an existing long stock position ("selling the EFP"); and 2. A second trader such as such as a beneficial owner of shares in a custodial account replacing a long stock position with a long SSF ("buying the EFP"), which then: a.

Will deliver into the very same long stock position at expiration, replacing the shares, or b. Can be sold and replaced with another long SSF position expiring later. Two performance bonds, or initial margins, need to be considered. Any combination of long stock and short SSF, or vice versa, is margined at 5% of the current market value (CMV) of the more expensive leg.

The second is any outright long or short SSF position, including one held as a substitute for a long stock position, is margined at 20% of the SSF's CMV; this CMV varies with each day's close. Treasury bills can be posted in a margin account to satisfy the performance bond's requirements. One important thing to remember about EFP trades and indeed all futures trades is that the exchange clearinghouse, in this case the Options Clearing Corp., is the counterparty to both parties in the trade. Another great lesson of the credit crunch has been the superiority of central clearing to a series of bilateral counterparty credit risks; it is doubtful the bankruptcy of Lehman Brothers would have been so devastating had its various derivative positions been held at a clearinghouse. A second advantage of central clearing is that the holders of both long and the short SSF positions are free to do whatever they wish after the trade is initiated, independently of the original counterparty.

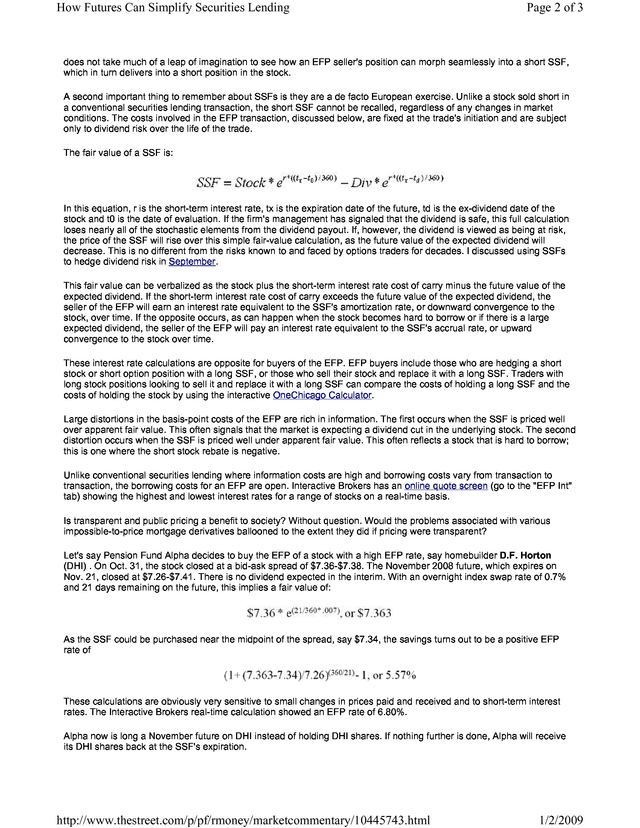

A trader who has sold the EFP and is short the SSF against an underlying stock position can, at a time and price of his or her choosing, sell the long stock position and retain the short SSF position or vice versa, buy back the short SSF and retain the long stock position. It http://www.thestreet.com/p/pf/rmoney/marketcommentary/10445743.html 1/2/2009 . How Futures Can Simplify Securities Lending Page 2 of 3 does not take much of a leap of imagination to see how an EFP seller's position can morph seamlessly into a short SSF, which in turn delivers into a short position in the stock. A second important thing to remember about SSFs is they are a de facto European exercise. Unlike a stock sold short in a conventional securities lending transaction, the short SSF cannot be recalled, regardless of any changes in market conditions. The costs involved in the EFP transaction, discussed below, are fixed at the trade's initiation and are subject only to dividend risk over the life of the trade. The fair value of a SSF is: In this equation, r is the short-term interest rate, tx is the expiration date of the future, td is the ex-dividend date of the stock and t0 is the date of evaluation. If the firm's management has signaled that the dividend is safe, this full calculation loses nearly all of the stochastic elements from the dividend payout.

If, however, the dividend is viewed as being at risk, the price of the SSF will rise over this simple fair-value calculation, as the future value of the expected dividend will decrease. This is no different from the risks known to and faced by options traders for decades. I discussed using SSFs to hedge dividend risk in September. This fair value can be verbalized as the stock plus the short-term interest rate cost of carry minus the future value of the expected dividend.

If the short-term interest rate cost of carry exceeds the future value of the expected dividend, the seller of the EFP will earn an interest rate equivalent to the SSF's amortization rate, or downward convergence to the stock, over time. If the opposite occurs, as can happen when the stock becomes hard to borrow or if there is a large expected dividend, the seller of the EFP will pay an interest rate equivalent to the SSF's accrual rate, or upward convergence to the stock over time. These interest rate calculations are opposite for buyers of the EFP. EFP buyers include those who are hedging a short stock or short option position with a long SSF, or those who sell their stock and replace it with a long SSF.

Traders with long stock positions looking to sell it and replace it with a long SSF can compare the costs of holding a long SSF and the costs of holding the stock by using the interactive OneChicago Calculator. Large distortions in the basis-point costs of the EFP are rich in information. The first occurs when the SSF is priced well over apparent fair value. This often signals that the market is expecting a dividend cut in the underlying stock.

The second distortion occurs when the SSF is priced well under apparent fair value. This often reflects a stock that is hard to borrow; this is one where the short stock rebate is negative. Unlike conventional securities lending where information costs are high and borrowing costs vary from transaction to transaction, the borrowing costs for an EFP are open. Interactive Brokers has an online quote screen (go to the "EFP Int" tab) showing the highest and lowest interest rates for a range of stocks on a real-time basis. Is transparent and public pricing a benefit to society? Without question.

Would the problems associated with various impossible-to-price mortgage derivatives ballooned to the extent they did if pricing were transparent? Let's say Pension Fund Alpha decides to buy the EFP of a stock with a high EFP rate, say homebuilder D.F. Horton (DHI) . On Oct.

31, the stock closed at a bid-ask spread of $7.36-$7.38. The November 2008 future, which expires on Nov. 21, closed at $7.26-$7.41.

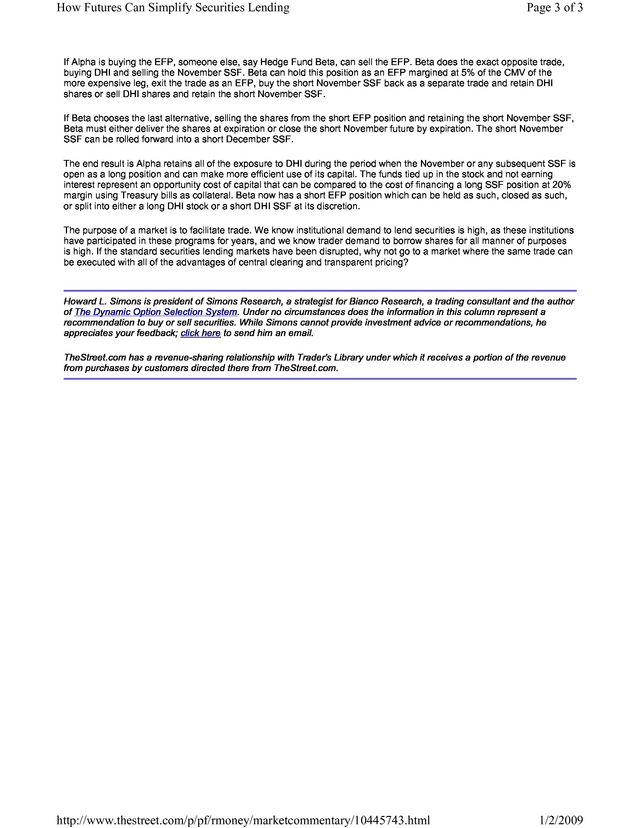

There is no dividend expected in the interim. With an overnight index swap rate of 0.7% and 21 days remaining on the future, this implies a fair value of: As the SSF could be purchased near the midpoint of the spread, say $7.34, the savings turns out to be a positive EFP rate of These calculations are obviously very sensitive to small changes in prices paid and received and to short-term interest rates. The Interactive Brokers real-time calculation showed an EFP rate of 6.80%. Alpha now is long a November future on DHI instead of holding DHI shares.

If nothing further is done, Alpha will receive its DHI shares back at the SSF's expiration. http://www.thestreet.com/p/pf/rmoney/marketcommentary/10445743.html 1/2/2009 . How Futures Can Simplify Securities Lending Page 3 of 3 If Alpha is buying the EFP, someone else, say Hedge Fund Beta, can sell the EFP. Beta does the exact opposite trade, buying DHI and selling the November SSF. Beta can hold this position as an EFP margined at 5% of the CMV of the more expensive leg, exit the trade as an EFP, buy the short November SSF back as a separate trade and retain DHI shares or sell DHI shares and retain the short November SSF. If Beta chooses the last alternative, selling the shares from the short EFP position and retaining the short November SSF, Beta must either deliver the shares at expiration or close the short November future by expiration. The short November SSF can be rolled forward into a short December SSF. The end result is Alpha retains all of the exposure to DHI during the period when the November or any subsequent SSF is open as a long position and can make more efficient use of its capital.

The funds tied up in the stock and not earning interest represent an opportunity cost of capital that can be compared to the cost of financing a long SSF position at 20% margin using Treasury bills as collateral. Beta now has a short EFP position which can be held as such, closed as such, or split into either a long DHI stock or a short DHI SSF at its discretion. The purpose of a market is to facilitate trade. We know institutional demand to lend securities is high, as these institutions have participated in these programs for years, and we know trader demand to borrow shares for all manner of purposes is high.

If the standard securities lending markets have been disrupted, why not go to a market where the same trade can be executed with all of the advantages of central clearing and transparent pricing? Howard L. Simons is president of Simons Research, a strategist for Bianco Research, a trading consultant and the author of The Dynamic Option Selection System. Under no circumstances does the information in this column represent a recommendation to buy or sell securities.

While Simons cannot provide investment advice or recommendations, he appreciates your feedback; click here to send him an email. TheStreet.com has a revenue-sharing relationship with Trader's Library under which it receives a portion of the revenue from purchases by customers directed there from TheStreet.com. http://www.thestreet.com/p/pf/rmoney/marketcommentary/10445743.html 1/2/2009 .

Two trades related to this EFP mechanism of particular importance are: 1. One trader selling a SSF against an existing long stock position ("selling the EFP"); and 2. A second trader such as such as a beneficial owner of shares in a custodial account replacing a long stock position with a long SSF ("buying the EFP"), which then: a.

Will deliver into the very same long stock position at expiration, replacing the shares, or b. Can be sold and replaced with another long SSF position expiring later. Two performance bonds, or initial margins, need to be considered. Any combination of long stock and short SSF, or vice versa, is margined at 5% of the current market value (CMV) of the more expensive leg.

The second is any outright long or short SSF position, including one held as a substitute for a long stock position, is margined at 20% of the SSF's CMV; this CMV varies with each day's close. Treasury bills can be posted in a margin account to satisfy the performance bond's requirements. One important thing to remember about EFP trades and indeed all futures trades is that the exchange clearinghouse, in this case the Options Clearing Corp., is the counterparty to both parties in the trade. Another great lesson of the credit crunch has been the superiority of central clearing to a series of bilateral counterparty credit risks; it is doubtful the bankruptcy of Lehman Brothers would have been so devastating had its various derivative positions been held at a clearinghouse. A second advantage of central clearing is that the holders of both long and the short SSF positions are free to do whatever they wish after the trade is initiated, independently of the original counterparty.

A trader who has sold the EFP and is short the SSF against an underlying stock position can, at a time and price of his or her choosing, sell the long stock position and retain the short SSF position or vice versa, buy back the short SSF and retain the long stock position. It http://www.thestreet.com/p/pf/rmoney/marketcommentary/10445743.html 1/2/2009 . How Futures Can Simplify Securities Lending Page 2 of 3 does not take much of a leap of imagination to see how an EFP seller's position can morph seamlessly into a short SSF, which in turn delivers into a short position in the stock. A second important thing to remember about SSFs is they are a de facto European exercise. Unlike a stock sold short in a conventional securities lending transaction, the short SSF cannot be recalled, regardless of any changes in market conditions. The costs involved in the EFP transaction, discussed below, are fixed at the trade's initiation and are subject only to dividend risk over the life of the trade. The fair value of a SSF is: In this equation, r is the short-term interest rate, tx is the expiration date of the future, td is the ex-dividend date of the stock and t0 is the date of evaluation. If the firm's management has signaled that the dividend is safe, this full calculation loses nearly all of the stochastic elements from the dividend payout.

If, however, the dividend is viewed as being at risk, the price of the SSF will rise over this simple fair-value calculation, as the future value of the expected dividend will decrease. This is no different from the risks known to and faced by options traders for decades. I discussed using SSFs to hedge dividend risk in September. This fair value can be verbalized as the stock plus the short-term interest rate cost of carry minus the future value of the expected dividend.

If the short-term interest rate cost of carry exceeds the future value of the expected dividend, the seller of the EFP will earn an interest rate equivalent to the SSF's amortization rate, or downward convergence to the stock, over time. If the opposite occurs, as can happen when the stock becomes hard to borrow or if there is a large expected dividend, the seller of the EFP will pay an interest rate equivalent to the SSF's accrual rate, or upward convergence to the stock over time. These interest rate calculations are opposite for buyers of the EFP. EFP buyers include those who are hedging a short stock or short option position with a long SSF, or those who sell their stock and replace it with a long SSF.

Traders with long stock positions looking to sell it and replace it with a long SSF can compare the costs of holding a long SSF and the costs of holding the stock by using the interactive OneChicago Calculator. Large distortions in the basis-point costs of the EFP are rich in information. The first occurs when the SSF is priced well over apparent fair value. This often signals that the market is expecting a dividend cut in the underlying stock.

The second distortion occurs when the SSF is priced well under apparent fair value. This often reflects a stock that is hard to borrow; this is one where the short stock rebate is negative. Unlike conventional securities lending where information costs are high and borrowing costs vary from transaction to transaction, the borrowing costs for an EFP are open. Interactive Brokers has an online quote screen (go to the "EFP Int" tab) showing the highest and lowest interest rates for a range of stocks on a real-time basis. Is transparent and public pricing a benefit to society? Without question.

Would the problems associated with various impossible-to-price mortgage derivatives ballooned to the extent they did if pricing were transparent? Let's say Pension Fund Alpha decides to buy the EFP of a stock with a high EFP rate, say homebuilder D.F. Horton (DHI) . On Oct.

31, the stock closed at a bid-ask spread of $7.36-$7.38. The November 2008 future, which expires on Nov. 21, closed at $7.26-$7.41.

There is no dividend expected in the interim. With an overnight index swap rate of 0.7% and 21 days remaining on the future, this implies a fair value of: As the SSF could be purchased near the midpoint of the spread, say $7.34, the savings turns out to be a positive EFP rate of These calculations are obviously very sensitive to small changes in prices paid and received and to short-term interest rates. The Interactive Brokers real-time calculation showed an EFP rate of 6.80%. Alpha now is long a November future on DHI instead of holding DHI shares.

If nothing further is done, Alpha will receive its DHI shares back at the SSF's expiration. http://www.thestreet.com/p/pf/rmoney/marketcommentary/10445743.html 1/2/2009 . How Futures Can Simplify Securities Lending Page 3 of 3 If Alpha is buying the EFP, someone else, say Hedge Fund Beta, can sell the EFP. Beta does the exact opposite trade, buying DHI and selling the November SSF. Beta can hold this position as an EFP margined at 5% of the CMV of the more expensive leg, exit the trade as an EFP, buy the short November SSF back as a separate trade and retain DHI shares or sell DHI shares and retain the short November SSF. If Beta chooses the last alternative, selling the shares from the short EFP position and retaining the short November SSF, Beta must either deliver the shares at expiration or close the short November future by expiration. The short November SSF can be rolled forward into a short December SSF. The end result is Alpha retains all of the exposure to DHI during the period when the November or any subsequent SSF is open as a long position and can make more efficient use of its capital.

The funds tied up in the stock and not earning interest represent an opportunity cost of capital that can be compared to the cost of financing a long SSF position at 20% margin using Treasury bills as collateral. Beta now has a short EFP position which can be held as such, closed as such, or split into either a long DHI stock or a short DHI SSF at its discretion. The purpose of a market is to facilitate trade. We know institutional demand to lend securities is high, as these institutions have participated in these programs for years, and we know trader demand to borrow shares for all manner of purposes is high.

If the standard securities lending markets have been disrupted, why not go to a market where the same trade can be executed with all of the advantages of central clearing and transparent pricing? Howard L. Simons is president of Simons Research, a strategist for Bianco Research, a trading consultant and the author of The Dynamic Option Selection System. Under no circumstances does the information in this column represent a recommendation to buy or sell securities.

While Simons cannot provide investment advice or recommendations, he appreciates your feedback; click here to send him an email. TheStreet.com has a revenue-sharing relationship with Trader's Library under which it receives a portion of the revenue from purchases by customers directed there from TheStreet.com. http://www.thestreet.com/p/pf/rmoney/marketcommentary/10445743.html 1/2/2009 .