Description

Study

Outlines

for the

Futures Industry

Examinations

National Futures Association

300 South Riverside Plaza

Suite 1800

Chicago, Illinois 60606-6615

(312) 781-1410

(800) 621-3570

Website:

www.nfa.futures.org

e-mail: information@nfa.futures.org

April 2015

. INTRODUCTION

The following information is intended to serve as an aid for candidates preparing for the futures industry

exams. This guide discusses the procedures for signing up for the various exams, general administrative

issues about taking the exams, details regarding the various exam types, the topics covered on each exam

and references to study materials available for preparing for the exams.

Please note that by simply passing one of the futures industry exams does not allow an individual to act as

a registered commodity broker. You must first file an online registration application with National Futures

Association (NFA); submit the appropriate fee(s), fingerprint cards and any other necessary filings. To find

out more about NFA’s online registration process, please click on the following link:

http://www.nfa.futures.org/NFA-registration/online-registration-system-overview.HTML

You may also call NFA’s Information Center at (800) 621-3570 or (312) 781-1410.

2

.

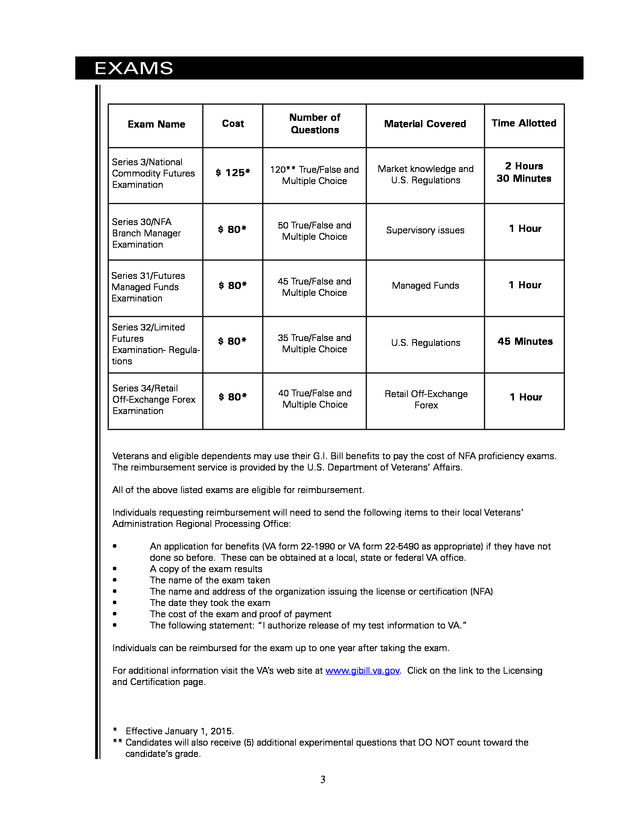

Exams Cost Number of Questions Material Covered Time Allotted Series 3/National Commodity Futures Examination $ 125* 120** True/False and Multiple Choice Market knowledge and U.S. Regulations 2 Hours 30 Minutes Series 30/NFA Branch Manager Examination $ 80* 50 True/False and Multiple Choice Supervisory issues 1 Hour Series 31/Futures Managed Funds Examination $ 80* 45 True/False and Multiple Choice Managed Funds 1 Hour Series 32/Limited Futures Examination- Regulations $ 80* 35 True/False and Multiple Choice U.S. Regulations 45 Minutes Series 34/Retail Off-Exchange Forex Examination $ 80* 40 True/False and Multiple Choice Retail Off-Exchange Forex 1 Hour Exam Name Veterans and eligible dependents may use their G.I. Bill benefits to pay the cost of NFA proficiency exams. The reimbursement service is provided by the U.S.

Department of Veterans’ Affairs. All of the above listed exams are eligible for reimbursement. Individuals requesting reimbursement will need to send the following items to their local Veterans’ Administration Regional Processing Office: • • • • • • • An application for benefits (VA form 22-1990 or VA form 22-5490 as appropriate) if they have not done so before. These can be obtained at a local, state or federal VA office. A copy of the exam results The name of the exam taken The name and address of the organization issuing the license or certification (NFA) The date they took the exam The cost of the exam and proof of payment The following statement: “I authorize release of my test information to VA.” Individuals can be reimbursed for the exam up to one year after taking the exam. For additional information visit the VA’s web site at www.gibill.va.gov. Click on the link to the Licensing and Certification page. * Effective January 1, 2015. ** Candidates will also receive (5) additional experimental questions that DO NOT count toward the candidate’s grade. 3 .

TAKING THE EXAMS Please arrive at the exam center about 30 minutes prior to your scheduled appointment time. To gain admission to the center, the applicant will be required to provide a valid form of government issued identification with the applicant’s picture and signature. Acceptable forms of identification include a valid driver’s license, passport or military ID. If you do not have the required ID, you must cancel your appointment until you acquire it.

The applicant will also be required to provide his/her signature upon arrival at the exam center, agree to the rules of conduct and provide a finger imprint(s). Calculators may not be brought into the exam center. However, the exam center will provide the applicant with a calculator upon request. Note: Expired applicant ID will not be accepted under any circumstances. Exam sessions are closed-book.

When you enter the center, you are not permitted to bring personal possessions, such as books, briefcases, purses, electronic devices, and notes into the testing/training room. You may take only authorized material issued by center staff into the testing/training room. The center staff is not responsible for articles you take to the session.

Center staff will provide scratch paper for your use during the session. All materials, including used and unused scratch paper, must be returned to the center staff at the end of the session. Severe penalties will be imposed on anyone who cheats on a FINRA-administered exam. Either at the end of the allowed exam time or when the applicant voluntarily stops the exam, the test system will determine the applicant’s score and display the grade result. The grade result will show whether the applicant passed the exam.

Next, the overall percentage score and the percent of questions answered correctly in each section will appear. The applicant will receive a printout of the exam scores. The exam center will send the exam scores to FINRA. The minimum passing score for the futures exams is 70 percent.

On the National Commodity Futures Examination – Series 3, the candidate must receive a score of 70 percent on both parts of the exam (market knowledge and regulations) in order to pass. It is the candidate’s responsibility to keep a record of the exam results. To access Frequently Asked Questions regarding testing, please click on the following link: http://www. finra.org/Industry/registration-qualification-exams-faq. 4 . SIGNING UP FOR THE futures industry EXAMS To sign up for any of the futures industry exams, the applicant must submit a Form U10 and applicable fee to the Financial Industry Regulatory Authority (FINRA). The Form U10 is only available for online submission. This online process provides convenient credit card and electronic (ACH) payment options. Fees are not refundable. Please note that a sponsor is not required for any of the futures industry exams. An applicant without a sponsor should indicate his/her own name, address and phone number in the section of the Form U10 that asks for the firm’s name, address and phone number.

To access the online Form U10, please click on the following link: http://www.finra.org/Industry/form-U10 Candidates that do not pass the exam will be subject to waiting periods before they are allowed to sign up to retake the exam. See page 6 for an explanation of these waiting periods. Scheduling an appointment to take the exams General Information After the Form U10 and fee has been submitted to FINRA and confirmation has been received from FINRA, the applicant may schedule an appointment to take the exam. The applicant will have 120 days in which to schedule and take the exam. 5 .

Scheduling an appointment to take the exams, continued To schedule an individual appointment, you may call either Thompson-Prometric at (800) 578-6273 or Pearson VUE at (866) 396-6273. You may also schedule an appointment and see testing center locations by clicking on one of the following links: http://www.prometric.com/finra http://www.pearsonvue.com/finra Please keep in mind the following tips when scheduling an exam: • If you are calling to schedule an appointment, call after 10:00 A.M. to avoid any early morning activity that normally takes place at the centers. • Plan ahead to secure a preferred testing date; allow two to three weeks lead time when scheduling an exam. • Provide the name exactly as it appears on the Form U10 as the registration validation process matches the first initial of the first name. • Provide a back-up telephone number in addition to a primary number. Exam staff will attempt to contact the candidate if it is necessary to cancel or reschedule the exam session if the enrollment can not be validated.

This number could also be used to notify the candidate of any emergency closings due to weather or a system outage. • Note the appointment tracking number. This number will be helpful if an appointment needs to be rescheduled or cancelled. • Make appointments through the local exam center if scheduling an appointment less than four calendar days from the current date. Rescheduling for candidates that do not pass the exam If the candidate does not pass the exam, he/she will need to re-file another Form U10 and fee with FINRA and then re-register to take the exam. Another exam can not be scheduled until re-registration has taken place. Candidates will be subject to the following waiting periods between exams if they have failed the Series 3, Series 30, Series 31, Series 32 or Series 34 within the past two years: • A minimum of 30 days after failing the first exam before the second taking of the exam can be scheduled: • A minimum of 30 days after failing the second exam before the third taking of the exam can be scheduled: • A minimum of 180 days after failing the exam for the third time before the fourth taking of the exam (and each subsequent taking) can be scheduled. 6 .

Scheduling an appointment to take the exams, continued Questions Regarding Exam Issues The FINRA’s Field Support Service at (800) 999-6647 is available Monday through Friday from 8:00 AM to 6:00 PM, Eastern Time to assist test candidates with questions pertaining to candidate enrollments, exam delivery policy and procedure, and extensions to a candidate’s validation window. Questions may also be addressed by sending an email to gatewayweb@finra.org. Scheduling Multiple or Group Appointments A multiple appointment is when five or more candidates are being scheduled for multiple exams for various dates and testing center locations. Multiple appointments are handled directly by the exam vendors. Please contact either Pearson Professional Centers at 1-866-396-6273 or Prometric Testing Centers at 1-800-578-6273 to schedule multiple appointments. A group appointment is when five or more candidates are being scheduled to take the exact same exam at the same time at the same testing center location.

Procedures for scheduling a group appointment can be found by clicking on one of the following link: Prometric: https://www.prometric.com/en-us/clients/finra/Pages/ezSeatTesting.aspx Pearson Vue: http://www.pearsonvue.com/finra/reserveseats/ Scheduling an exam in a location outside of the United States FINRA administers exams abroad in selected foreign cities. For more information on foreign exam locations, phone numbers for scheduling appointments at a foreign location or foreign test center policies and procedures, click on the following link: http://apps.finra.org/TestCenter/1/locations.aspx Limited English Proficiency (LEP) (previously known as English as a Second Language) Candidates with LEP are persons who (1) do not speak English as their primary language and (2) have limited ability to read, speak, write and understand the English language. FINRA requires the firm or the candidate (if there is not a sponsoring firm) to submit to FINRA a request for additional time prior to the LEP candidate scheduling an examination. A LEP Request Form that the candidate is LEP-eligible must be completed.

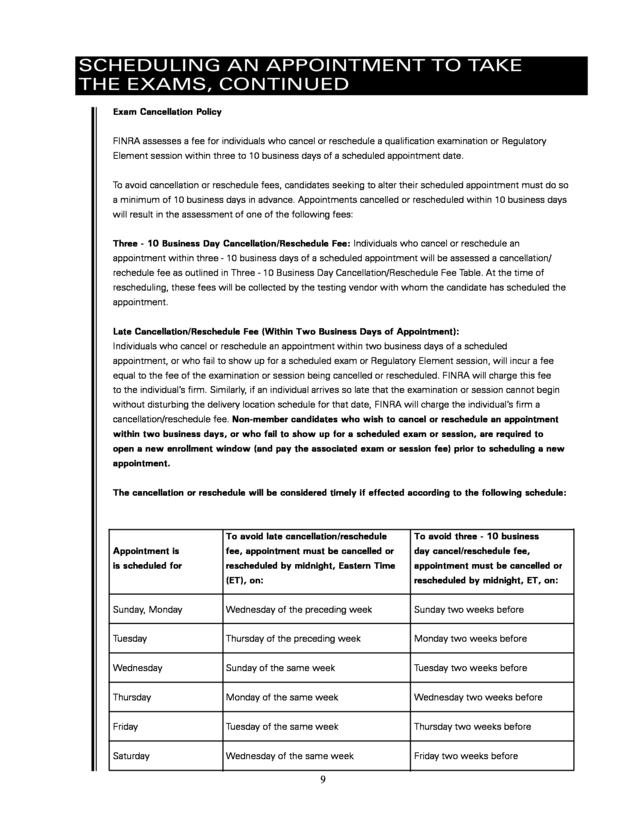

Also, the firm or candidate will attest to the accuracy of the information on the form and acknowledge that any misrepresentation of the candidate’s LEP-eligibility may result in a disciplinary proceeding. FINRA will notify its test delivery vendors that a candidate is eligible to receive additional time to complete the examination. (LEP information continued on next page) 7 . Scheduling an appointment to take the exams, continued Testing Center personnel are not authorized to grant the additional time to candidates based on LEP. For exams up to 2 hours, an extra 30 minutes will be added to the session. For exams longer than 2 hours, an extra 60 minutes will be added to the session. Procedures for requesting additional time for your exam session can be found by clicking on the following link: http://www.finra.org/industry/limited-english-proficiency Special Accommodations FINRA in compliance with the provisions of the American with Disabilities Act (ADA) provides testing modifications and aids to candidates with disabilities and/or learning impairments that substantially limit a major life activity (e.g., learning, speaking, hearing, vision). FINRA makes arrangements to offer examinations/sessions in a place and manner appropriate to persons with disabilities according to the ADA. Procedures and forms for requesting special accommodations for taking an exam can be found by clicking on the following links: http://www.finra.org/Industry/special-accommodations Note: Candidates with transitory or temporary conditions that are not “impairments or disabilities” (e.g., pregnancy, sprains, fractures) are not eligible for special testing accommodations under the ADA. Those in need of accommodations should contact FINRA for information about a possible special testing arrangement that can be handled on a case-by-case basis. 8 . Scheduling an appointment to take the exams, continued Exam Cancellation Policy FINRA assesses a fee for individuals who cancel or reschedule a qualification examination or Regulatory Element session within three to 10 business days of a scheduled appointment date. To avoid cancellation or reschedule fees, candidates seeking to alter their scheduled appointment must do so a minimum of 10 business days in advance. Appointments cancelled or rescheduled within 10 business days will result in the assessment of one of the following fees: Three - 10 Business Day Cancellation/Reschedule Fee: Individuals who cancel or reschedule an appointment within three - 10 business days of a scheduled appointment will be assessed a cancellation/ rechedule fee as outlined in Three - 10 Business Day Cancellation/Reschedule Fee Table. At the time of rescheduling, these fees will be collected by the testing vendor with whom the candidate has scheduled the appointment. Late Cancellation/Reschedule Fee (Within Two Business Days of Appointment): Individuals who cancel or reschedule an appointment within two business days of a scheduled appointment, or who fail to show up for a scheduled exam or Regulatory Element session, will incur a fee equal to the fee of the examination or session being cancelled or rescheduled. FINRA will charge this fee to the individual’s firm.

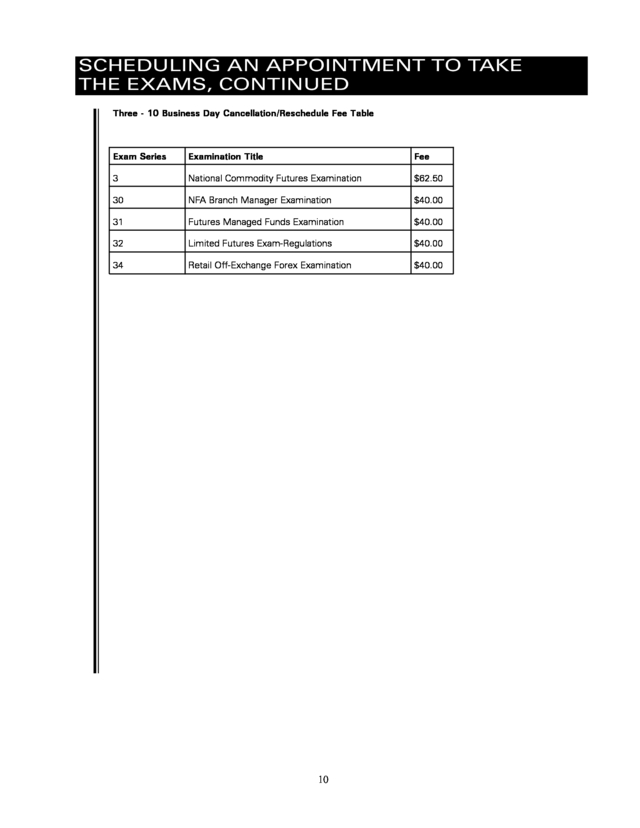

Similarly, if an individual arrives so late that the examination or session cannot begin without disturbing the delivery location schedule for that date, FINRA will charge the individual’s firm a cancellation/reschedule fee. Non-member candidates who wish to cancel or reschedule an appointment within two business days, or who fail to show up for a scheduled exam or session, are required to open a new enrollment window (and pay the associated exam or session fee) prior to scheduling a new appointment. The cancellation or reschedule will be considered timely if effected according to the following schedule: To avoid late cancellation/reschedule To avoid three - 10 business Appointment is fee, appointment must be cancelled or day cancel/reschedule fee, is scheduled for rescheduled by midnight, Eastern Time appointment must be cancelled or (ET), on: rescheduled by midnight, ET, on: Sunday, Monday Wednesday of the preceding week Sunday two weeks before Tuesday Thursday of the preceding week Monday two weeks before Wednesday Sunday of the same week Tuesday two weeks before Thursday Monday of the same week Wednesday two weeks before Friday Tuesday of the same week Thursday two weeks before Saturday Wednesday of the same week Friday two weeks before 9 . Scheduling an appointment to take the exams, continued Three - 10 Business Day Cancellation/Reschedule Fee Table Exam Series Examination Title Fee 3 National Commodity Futures Examination $62.50 30 NFA Branch Manager Examination $40.00 31 Futures Managed Funds Examination $40.00 32 Limited Futures Exam-Regulations $40.00 34 Retail Off-Exchange Forex Examination 10 $40.00 . EXCHANGE RULEBOOKS AND MARKET LITERATURE In addition to the official rulebooks of the exchanges, literature on trading futures, options on futures, and individual markets is helpful in preparing for the examination. Please contact individual exchanges in order to obtain pricing lists, publication catalogs and order forms. Various departments within each exchange may be of assistance: Public Relations, Marketing, Literature, Member Services and Education. CME Group www.cmegroup.com ICE Futures U.S. www.theice.com Minneapolis Grain Exchange www.mgex.com NASDAQ OMX Futures Exchange www.nasdaqtrader.com/Micro.aspx?id=PBOToverview OneChicago LLC Futures Exchange www.onechicago.com CBOE Futures Exchange www.cfe.cboe.com 11 . OTHER PUBLICATIONS National Futures Association NFA Manual The NFA Manual contains NFA’s Articles of Incorporation, Bylaws, Compliance Rules, Code of Arbitration, Member Arbitration Rules, Financial Requirements, Registration Rules, and various interpretations of NFA rules and bylaws. Regulatory GuideS NFA publishes several booklets to help its Members met their regulatory obligations. These include: • • NFA Regulatory Requirements for FCMs, IBs, CPOs and CTAs the Public and Promotional Material A Guide to NFA Compliance Rules 2-29 and 2-36: Communications with • Disclosure Documents: A Guide for CPOs and CTAs • Self-Examination Questionnaire: For FCMs, FDMs, IBs, CPOs and CTAs To order a copy of these publications or to obtain an NFA Publication List, contact NFA’s Information Center at (312) 781-1410 or (800) 621-3570 or e-mail NFA’s Information Center at information@nfa.futures.org. The Commodity Futures Trading Commission The rules and regulations of the CFTC are encompassed in the Commodity Exchange Act as Amended and Regulations Thereunder. Updated periodically. Current editions may be ordered directly from the publisher: Commerce Clearing House 4025 West Peterson Avenue Chicago, Illinois 60646 (773) 583-8500 (800) 248-3248 Fee may be applicable When published as promulgated, U.S.

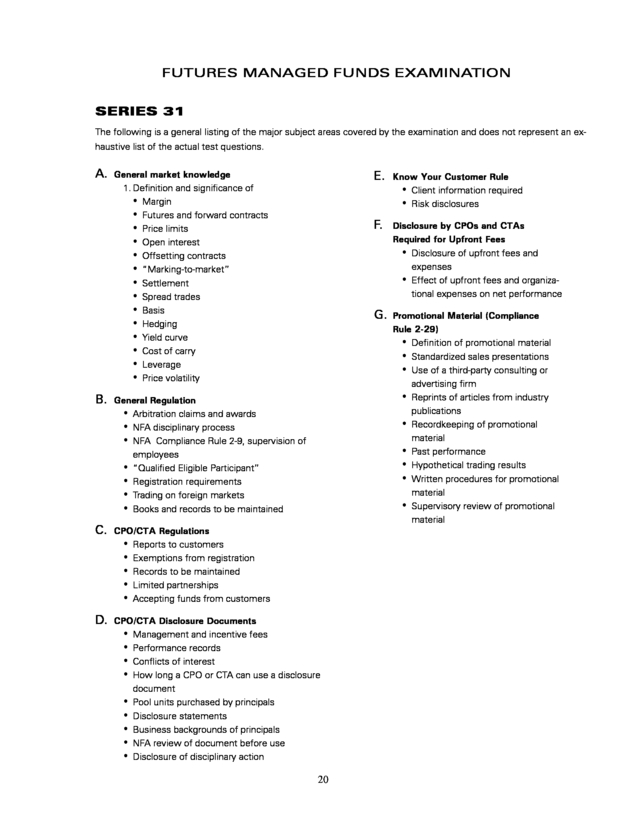

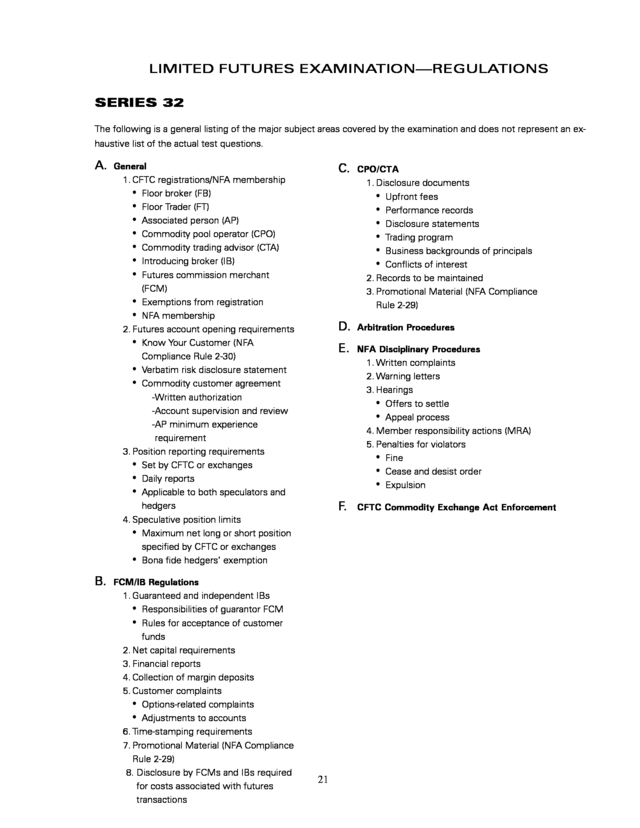

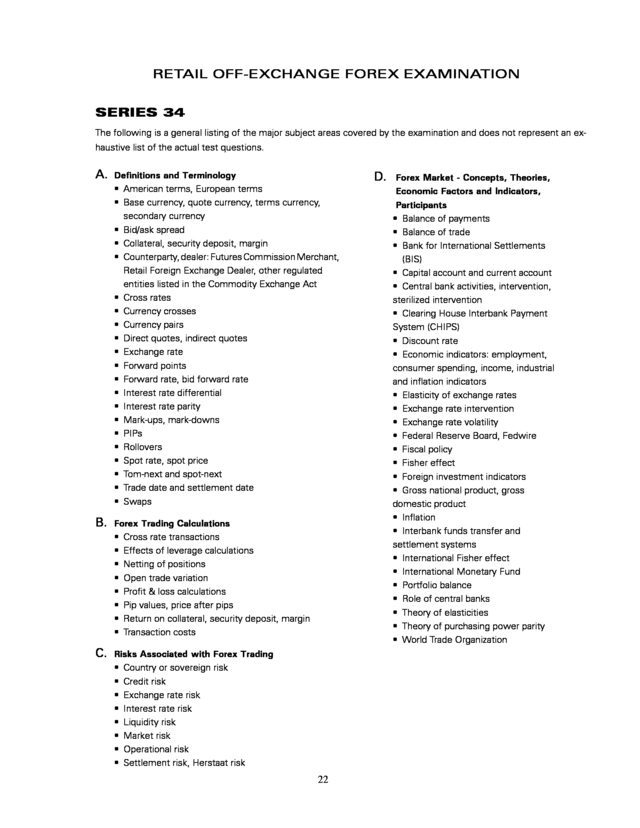

Public Laws, federal regulations and decisions of administrative and executive agencies and courts of the United States are in the public domain. However, their arrangement and compilation, and historical, statutory, and other notes and references, along with all other material in this publication, are subject to the copyright notice. All Rights Reserved 12 . EXAMINATION SUBJECT AREAS National Commodity Futures Examination SERIES 3 The following is a general listing of the major subject areas covered by the examination and does not represent an exhaustive list of the actual test questions. Part 1 FUTURES TRADING THEORY AND BASIC FUNCTIONS TERMINOLOGY E. Speculative Theory A. General Theory 1. Development of futures markets 2. Futures and securities compared • Rights • Obligations • Transfer of ownership F. General Futures Terminology Associated Person Floor Broker Basis Floor Trader Bucketing Forward contract Carrying charges Intoducing broker Churning Inverted market Clearinghouse Limit up/down Convergence Lock limit Commodity Pool Long Operator Normal market Commodity Trading Pit Advisor Position Trader Deferred Retender Discount Scalper Expit Short Futures Commission Spot Merchant Variation call First Notice Day Warehouse receipt G. General Options Terminology At-the-money Out-of-the-money Call Premium Conversion Put Delta Spread Exercise Straddle Expiration Strangle Grantor Synthetic In-the-money Options/Futures Intrinsic Value Time value Writer B. The Futures Contract 1. Futures and forward contracts compared 2. Offset provisions 3. The clearinghouse function • Clearing members • Non-clearing members 4. Delivery provisions • Basis grade • Premiums • Discounts C. The Structure of Futures Markets 1. Normal markets • Carrying charges • “Full carry” markets 2. Inverted markets • Supply shortages • Other factors D. Hedging Theory 1. Risk reduction • Unhedged position • Effect on pricing of cash markets 2. Short hedging • Typical short hedgers: farmers, producers, holders of inventory • Effect on pricing of cash markets 3. Long hedging • Typical long hedgers: processors, manufacturers, exporters • Protection against price rise 1. Leverage 2. Risk 3. Market liquidity 4. Price volatility 13 .

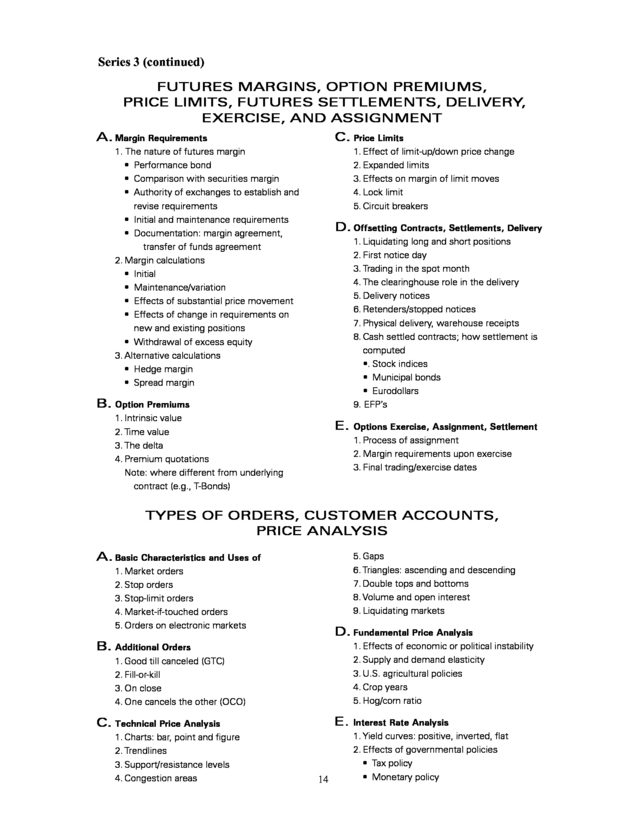

Series 3 (continued) FUTURES MARGINS, OPTION PREMIUMS, PRICE LIMITS, FUTURES SETTLEMENTS, DELIVERY, EXERCISE, AND ASSIGNMENT A. Margin Requirements C. Price Limits 1. The nature of futures margin • Performance bond • Comparison with securities margin • Authority of exchanges to establish and revise requirements • Initial and maintenance requirements • Documentation: margin agreement, transfer of funds agreement 2. Margin calculations • Initial • Maintenance/variation • Effects of substantial price movement • Effects of change in requirements on new and existing positions • Withdrawal of excess equity 3. Alternative calculations • Hedge margin • Spread margin B. Option Premiums 1. Intrinsic value 2. Time value 3. The delta 4. Premium quotations Note: where different from underlying contract (e.g., T-Bonds) 1. Effect of limit-up/down price change 2. Expanded limits 3. Effects on margin of limit moves 4. Lock limit 5. Circuit breakers D. Offsetting Contracts, Settlements, Delivery 1. Liquidating long and short positions 2. First notice day 3. Trading in the spot month 4. The clearinghouse role in the delivery 5. Delivery notices 6. Retenders/stopped notices 7. Physical delivery, warehouse receipts 8. Cash settled contracts; how settlement is computed •. Stock indices • Municipal bonds • Eurodollars 9. EFP’s E. Options Exercise, Assignment, Settlement 1. Process of assignment 2. Margin requirements upon exercise 3. Final trading/exercise dates TYPES OF ORDERS, CUSTOMER ACCOUNTS, PRICE ANALYSIS A. Basic Characteristics and Uses of 1. Market orders 2. Stop orders 3. Stop-limit orders 4. Market-if-touched orders 5. Orders on electronic markets B. Additional Orders 1. Good till canceled (GTC) 2. Fill-or-kill 3. On close 4. One cancels the other (OCO) C. Technical Price Analysis 1. Charts: bar, point and figure 2. Trendlines 3. Support/resistance levels 4. Congestion areas 5. Gaps 6. Triangles: ascending and descending 7. Double tops and bottoms 8. Volume and open interest 9. Liquidating markets D. Fundamental Price Analysis 1. Effects of economic or political instability 2. Supply and demand elasticity 3. U.S. agricultural policies 4. Crop years 5. Hog/corn ratio E. Interest Rate Analysis 14 1. Yield curves: positive, inverted, flat 2. Effects of governmental policies • Tax policy • Monetary policy .

Series 3 (continued) BASIC HEDGING, BASIS CALCULATIONS, HEDGING FUTURES A. Short Hedging and Long Hedging 4. The basis in financial markets • Short-term rates vs. long-term rates • “Implied repo rate” C. Hedging Calculations 1. Net result of hedge 2. Net price received upon purchase or sale Examples: Grains T-Notes, T-Bonds Livestock T-Bills, Eurodollars Foodstuffs Municipals Metals Currencies Energy Stock indices Lumber 1. Anticipatory hedges 2. Long the basis/short the basis B. The Basis 1. How determined 2. Effect of basis charge on • The short hedger • The long hedger 3. Effect on price of commodity actually delivered or purchased • Transportation costs • Variation in deliverable grades SPREADING A. Spread Trading B. Common Types of Spreads 1. Order execution 2. Expectations • Narrowing or widening basis • Normal or inverted market strategies 1. Carrying charge or limited risk spreads • Intra-market • Inter-delivery 2. Bull and bear spreads 3. Intermarket spreads SPECULATING IN FUTURES A. Profit/loss calculations for speculative B. Trading Applications 1. Recommend appropriate speculative trades given certain economic or technical circumstances 2. Use appropriate orders both to initiate and protect position trades (including spreads) 1. Gross profit on speculative trades: single or multiple contract positions 2. Effect of commissions on gross profits 3. Return on (margin) equity calculations Examples: Grains T-Notes, T-Bonds Livestock T-Bills, Eurodollars Foodstuff Municipals Metals Currencies Energy Stock indices Lumber 15 . Series 3 (continued) OPTION HEDGING, SPECULATING, SPREADING A. Option Theory D. Option Spread Strategies/Calculations 1. Long • Limited risk • Increased leverage • Total loss of investment (premium) possible 2. Short • Increased risk • Earn premium • Loss may exceed premium received B. Option Hedge Strategies/Calculations 1. Long put as alternative to short futures hedge 2. Long call as alternative to long futures hedge 3. Allows for increased profit once breakeven point is reached C. Option Speculative Strategies/Calculations 1. Long call as substitute for long futures • Risk limited to premium • Breakeven point • Profit and return on equity 2. Long put as substitute for short futures • Risk limited to premium • Breakeven point • Profit and return on equity 3. Long call to protect short futures (synthetic long put) 4. Long put to protect long futures (synthetic long call) 5. Long futures-short call (covered call) 6. Conversions 7. Reverse conversions (reversals) 16 1. Call bull spreads • Spread to widen • Maximum profit/loss 2. Call bear spreads • Spread to narrow • Maximum profit/loss 3. Put bull spreads • Spread to narrow • Maximum profit/loss 4. Put bear spreads • Spread to widen • Maximum profit/loss 5. Calendar spreads 6. Arbitrage spreads . Series 3 (continued) Part 2 REGULATIONS A. General 1. CFTC registrations/NFA membership Floor Broker (FB) • • Floor Trader (FT) • Associated Person (AP) • Commodity Pool Operator (CPO) • Commodity Trading Advisor (CTA) • Introducing Broker (IB) • Futures Commission Merchant (FCM) • Exemptions from registration • NFA membership 2. Futures account opening requirements • Know Your Customer (NFA Compliance Rule 2-30) • Verbatim risk disclosure statement • Commodity customer agreement • Discretionary accounts – Written authorization – Account supervision and review – AP minimum experience requirement 3. Position reporting requirements • Set by CFTC or exchanges • Daily reports • Applicable to both speculators and hedgers 4. Speculative position limits • Maximum net long or short position specified by CFTC or exchanges • Bona fide hedgers’ exemption • Rules for acceptance of customer funds 2. Net capital requirements 3. Financial reports 4. Collection of margin deposits 5. Customer complaints • Options-related complaints • Adjustments to accounts 6. Time-stamping requirements 7. Promotional Material (NFA Compliance Rule 2-29) 8. Disclosure by FCMs and IBs required for costs associated with futures transactions C. CPO/CTA 1. Disclosure documents • Upfront fees • Performance records • Disclosure statements • Trading program • Five-year business background of principals • Conflicts of interest 2. Records to be maintained Bunched orders • 3. Promotional Material (NFA Compliace Rule 2-29) D. Arbitration Procedures E. NFA Disciplinary Procedures 1. Guaranteed and independent IBs • Responsibilities of guarantor FCM 1. Formal complaints 2. Warning letters 3. Hearings • Offers to settle • Appeal process 4. Member responsibility actions (MRA) 5. Penalties for violators • Fine • Cease and desist order • Expulsion F. B. FCM/IB Regulations CFTC Commodity Exchange Act Enforcement 17 . NFA BRANCH MANAGER EXAMINATION SERIES 30 The following is a general listing of the major subject areas covered by the examination and does not represent an exhaustive list of the actual test questions. A. General • Books and records, preparation and D. NFA Know Your Customer Rule • Client information required • Responsibility to obtain additional client retention • Order tickets, preparation and retention • Written option procedures • Handling of customer deposits • NFA Compliance Rule 2-9, supervision of employees • Business Continuity and Disaster Recovery Plan • Registration requirements—who needs to be registered, sponsor verification, NFA Bylaw 1101, AP termination notices, temporary licenses • NFA disciplinary process • Reportable positions • NFA Arbitration Rules • On-site audits of branch offices • Bona fide hedging transactions • Trading on foreign exchanges B. information • Risk disclosures E. Disclosure by CPOs and CTAs Required for Costs Associated with Futures Transactions • Disclosure of upfront fees and expenses • Effect of upfront fees and organizational expenses on net performance F. G. IB General • Accepting funds from customers • Guarantee agreements • Responsibilities of guarantor FCM • Minimum net capital requirements • Timestamping of order tickets • Books and records to be maintained CPO/CTA General • Registration requirements • Books and records to be maintained • Reports to customers • Bunched orders H. General Account Handling and Exchange Regulations • Risk Disclosure Statement • Margin requirements • Stop loss orders • Preparing orders • Proprietary accounts • Positions limits and reporting requirements • Trade confirmations C. CPO/CTA Disclosure Documents • Management and incentive fees • Performance records • How long a CPO or CTA can use a disclosure document • Conflicts of interest • Pool units purchased by principals • Business backgrounds of principals • Amendments to disclosure documents • Disclosure of disciplinary actions • NFA review of document before each use Disclosure by FCMs and IBs Required for Costs Associated with Futures Transactions • Explanation of fees and charges to customers 18 . Series 30 (continued) NFA BRANCH MANAGER EXAMINATION I. Discretionary Account Regulation • Requirements relating to discretionary accounts • Supervision and review of discretionary accounts J. Promotional Material (Compliance Rule 2-29) • Definition of promotional material • Standardized sales presentations • Use of a third-party consulting or advertising firm • Reprints of articles from industry publications • Recordkeeping of promotional material • Past performance • Hypothetical trading results • Written procedures for promotional material • Supervisory review of promotional material K. Anti-Money Laundering Requirements • Developing policies, procedures and internal controls • Customer identification program and recordkeeping • Detection and reporting of suspicious activity • Training staff to monitor trading activity • Recordkeeping • Designation of individual or individuals (“compliance officer”) to be responsible for overseeing the program • Employee training program Independent audit function 19 . FUTURES MANAGED FUNDS EXAMINATION SERIES 31 The following is a general listing of the major subject areas covered by the examination and does not represent an exhaustive list of the actual test questions. A. General market knowledge E. Know Your Customer Rule • Client information required • Risk disclosures 1. Definition and significance of • Margin • Futures and forward contracts • Price limits • Open interest • Offsetting contracts • “Marking-to-market” • Settlement • Spread trades • Basis • Hedging • Yield curve • Cost of carry • Leverage • Price volatility B. General Regulation • Arbitration claims and awards • NFA disciplinary process • NFA Compliance Rule 2-9, supervision of F. Disclosure by CPOs and CTAs Required for Upfront Fees • Disclosure of upfront fees and expenses • Effect of upfront fees and organiza- tional expenses on net performance G. Promotional Material (Compliance employees • “Qualified Eligible Participant” • Registration requirements • Trading on foreign markets • Books and records to be maintained C. CPO/CTA Regulations • Reports to customers • Exemptions from registration • Records to be maintained • Limited partnerships • Accepting funds from customers D. CPO/CTA Disclosure Documents • Management and incentive fees • Performance records • Conflicts of interest • How long a CPO or CTA can use a disclosure document • Pool units purchased by principals • Disclosure statements • Business backgrounds of principals • NFA review of document before use • Disclosure of disciplinary action Rule 2-29) • Definition of promotional material • Standardized sales presentations • Use of a third-party consulting or advertising firm • Reprints of articles from industry publications • Recordkeeping of promotional material • Past performance • Hypothetical trading results • Written procedures for promotional material • Supervisory review of promotional material 20 . LIMITED FUTURES EXAMINATION—REGULATIONs SERIES 32 The following is a general listing of the major subject areas covered by the examination and does not represent an exhaustive list of the actual test questions. A. General 1. CFTC registrations/NFA membership • Floor broker (FB) • Floor Trader (FT) • Associated person (AP) • Commodity pool operator (CPO) • Commodity trading advisor (CTA) • Introducing broker (IB) • Futures commission merchant (FCM) • Exemptions from registration • NFA membership 2. Futures account opening requirements • Know Your Customer (NFA Compliance Rule 2-30) • Verbatim risk disclosure statement • Commodity customer agreement -Written authorization -Account supervision and review -AP minimum experience requirement 3. Position reporting requirements • Set by CFTC or exchanges • Daily reports • Applicable to both speculators and hedgers 4. Speculative position limits • Maximum net long or short position specified by CFTC or exchanges • Bona fide hedgers’ exemption B. FCM/IB Regulations 1. Guaranteed and independent IBs • Responsibilities of guarantor FCM • Rules for acceptance of customer funds 2. Net capital requirements 3. Financial reports 4. Collection of margin deposits 5. Customer complaints • Options-related complaints • Adjustments to accounts 6. Time-stamping requirements 7. Promotional Material (NFA Compliance Rule 2-29) 8. Disclosure by FCMs and IBs required 21 for costs associated with futures transactions C. CPO/CTA 1. Disclosure documents • Upfront fees • Performance records • Disclosure statements • Trading program • Business backgrounds of principals • Conflicts of interest 2. Records to be maintained 3. Promotional Material (NFA Compliance Rule 2-29) D. Arbitration Procedures E. NFA Disciplinary Procedures 1. Written complaints 2. Warning letters 3. Hearings • Offers to settle • Appeal process 4. Member responsibility actions (MRA) 5. Penalties for violators • Fine • Cease and desist order • Expulsion F. CFTC Commodity Exchange Act Enforcement . retail off-exchange forex examination SERIES 34 The following is a general listing of the major subject areas covered by the examination and does not represent an exhaustive list of the actual test questions. A. Definitions and Terminology • American terms, European terms • Base currency, quote currency, terms currency, secondary currency • Bid/ask spread • Collateral, security deposit, margin • Counterparty, dealer: Futures Commission Merchant, Retail Foreign Exchange Dealer, other regulated entities listed in the Commodity Exchange Act • Cross rates • Currency crosses • Currency pairs • Direct quotes, indirect quotes • Exchange rate • Forward points • Forward rate, bid forward rate • Interest rate differential • Interest rate parity • Mark-ups, mark-downs • PIPs • Rollovers • Spot rate, spot price • Tom-next and spot-next • Trade date and settlement date • Swaps B. Forex Trading Calculations • Cross rate transactions • Effects of leverage calculations • Netting of positions • Open trade variation • Profit & loss calculations • Pip values, price after pips • Return on collateral, security deposit, margin • Transaction costs C. Risks Associated with Forex Trading • Country or sovereign risk • Credit risk • Exchange rate risk • Interest rate risk • Liquidity risk • Market risk • Operational risk • Settlement risk, Herstaat risk 22 D. Forex Market - Concepts, Theories, Economic Factors and Indicators, Participants • Balance of payments • Balance of trade • Bank for International Settlements (BIS) • Capital account and current account • Central bank activities, intervention, sterilized intervention • Clearing House Interbank Payment System (CHIPS) • Discount rate • Economic indicators: employment, consumer spending, income, industrial and inflation indicators • Elasticity of exchange rates • Exchange rate intervention • Exchange rate volatility • Federal Reserve Board, Fedwire • Fiscal policy • Fisher effect • Foreign investment indicators • Gross national product, gross domestic product • Inflation • Interbank funds transfer and settlement systems • International Fisher effect • International Monetary Fund • Portfolio balance • Role of central banks • Theory of elasticities • Theory of purchasing power parity • World Trade Organization . Series 34 (continued) retail off-exchange forex examination SERIES 34 E. Forex Regulatory Requirements • CFTC Regulations - Close out of offsetting positions - Disclosure of profitable vs. non-profitable accounts - Prohibition of guarantees against loss - Registration requirements - Re-quoting - Security deposits - Specific authorization for trades • CFTC jurisdiction and jurisdictional limitations • Conflicts of interest • Disclosures to customers • Jurisdictional & regulatory framework • Know your customer • NFA Interpretive Notices - The Allocation of Bunched Retail Forex Orders for Multiple Accounts - Forex Transactions - Requirements for Forex Transactions - Supervision of the Use of Electronic Trading Systems - Prohibition on the Use of Certain Electronic Funding Mechanisms (Effective January 31, 2015) • NFA membership and associate membership requirements • Promotional material & solicitation • Reports to customers, confirmations, monthly summaries • Security deposit rules • Security of customer funds, no segregation 23 .

Exams Cost Number of Questions Material Covered Time Allotted Series 3/National Commodity Futures Examination $ 125* 120** True/False and Multiple Choice Market knowledge and U.S. Regulations 2 Hours 30 Minutes Series 30/NFA Branch Manager Examination $ 80* 50 True/False and Multiple Choice Supervisory issues 1 Hour Series 31/Futures Managed Funds Examination $ 80* 45 True/False and Multiple Choice Managed Funds 1 Hour Series 32/Limited Futures Examination- Regulations $ 80* 35 True/False and Multiple Choice U.S. Regulations 45 Minutes Series 34/Retail Off-Exchange Forex Examination $ 80* 40 True/False and Multiple Choice Retail Off-Exchange Forex 1 Hour Exam Name Veterans and eligible dependents may use their G.I. Bill benefits to pay the cost of NFA proficiency exams. The reimbursement service is provided by the U.S.

Department of Veterans’ Affairs. All of the above listed exams are eligible for reimbursement. Individuals requesting reimbursement will need to send the following items to their local Veterans’ Administration Regional Processing Office: • • • • • • • An application for benefits (VA form 22-1990 or VA form 22-5490 as appropriate) if they have not done so before. These can be obtained at a local, state or federal VA office. A copy of the exam results The name of the exam taken The name and address of the organization issuing the license or certification (NFA) The date they took the exam The cost of the exam and proof of payment The following statement: “I authorize release of my test information to VA.” Individuals can be reimbursed for the exam up to one year after taking the exam. For additional information visit the VA’s web site at www.gibill.va.gov. Click on the link to the Licensing and Certification page. * Effective January 1, 2015. ** Candidates will also receive (5) additional experimental questions that DO NOT count toward the candidate’s grade. 3 .

TAKING THE EXAMS Please arrive at the exam center about 30 minutes prior to your scheduled appointment time. To gain admission to the center, the applicant will be required to provide a valid form of government issued identification with the applicant’s picture and signature. Acceptable forms of identification include a valid driver’s license, passport or military ID. If you do not have the required ID, you must cancel your appointment until you acquire it.

The applicant will also be required to provide his/her signature upon arrival at the exam center, agree to the rules of conduct and provide a finger imprint(s). Calculators may not be brought into the exam center. However, the exam center will provide the applicant with a calculator upon request. Note: Expired applicant ID will not be accepted under any circumstances. Exam sessions are closed-book.

When you enter the center, you are not permitted to bring personal possessions, such as books, briefcases, purses, electronic devices, and notes into the testing/training room. You may take only authorized material issued by center staff into the testing/training room. The center staff is not responsible for articles you take to the session.

Center staff will provide scratch paper for your use during the session. All materials, including used and unused scratch paper, must be returned to the center staff at the end of the session. Severe penalties will be imposed on anyone who cheats on a FINRA-administered exam. Either at the end of the allowed exam time or when the applicant voluntarily stops the exam, the test system will determine the applicant’s score and display the grade result. The grade result will show whether the applicant passed the exam.

Next, the overall percentage score and the percent of questions answered correctly in each section will appear. The applicant will receive a printout of the exam scores. The exam center will send the exam scores to FINRA. The minimum passing score for the futures exams is 70 percent.

On the National Commodity Futures Examination – Series 3, the candidate must receive a score of 70 percent on both parts of the exam (market knowledge and regulations) in order to pass. It is the candidate’s responsibility to keep a record of the exam results. To access Frequently Asked Questions regarding testing, please click on the following link: http://www. finra.org/Industry/registration-qualification-exams-faq. 4 . SIGNING UP FOR THE futures industry EXAMS To sign up for any of the futures industry exams, the applicant must submit a Form U10 and applicable fee to the Financial Industry Regulatory Authority (FINRA). The Form U10 is only available for online submission. This online process provides convenient credit card and electronic (ACH) payment options. Fees are not refundable. Please note that a sponsor is not required for any of the futures industry exams. An applicant without a sponsor should indicate his/her own name, address and phone number in the section of the Form U10 that asks for the firm’s name, address and phone number.

To access the online Form U10, please click on the following link: http://www.finra.org/Industry/form-U10 Candidates that do not pass the exam will be subject to waiting periods before they are allowed to sign up to retake the exam. See page 6 for an explanation of these waiting periods. Scheduling an appointment to take the exams General Information After the Form U10 and fee has been submitted to FINRA and confirmation has been received from FINRA, the applicant may schedule an appointment to take the exam. The applicant will have 120 days in which to schedule and take the exam. 5 .

Scheduling an appointment to take the exams, continued To schedule an individual appointment, you may call either Thompson-Prometric at (800) 578-6273 or Pearson VUE at (866) 396-6273. You may also schedule an appointment and see testing center locations by clicking on one of the following links: http://www.prometric.com/finra http://www.pearsonvue.com/finra Please keep in mind the following tips when scheduling an exam: • If you are calling to schedule an appointment, call after 10:00 A.M. to avoid any early morning activity that normally takes place at the centers. • Plan ahead to secure a preferred testing date; allow two to three weeks lead time when scheduling an exam. • Provide the name exactly as it appears on the Form U10 as the registration validation process matches the first initial of the first name. • Provide a back-up telephone number in addition to a primary number. Exam staff will attempt to contact the candidate if it is necessary to cancel or reschedule the exam session if the enrollment can not be validated.

This number could also be used to notify the candidate of any emergency closings due to weather or a system outage. • Note the appointment tracking number. This number will be helpful if an appointment needs to be rescheduled or cancelled. • Make appointments through the local exam center if scheduling an appointment less than four calendar days from the current date. Rescheduling for candidates that do not pass the exam If the candidate does not pass the exam, he/she will need to re-file another Form U10 and fee with FINRA and then re-register to take the exam. Another exam can not be scheduled until re-registration has taken place. Candidates will be subject to the following waiting periods between exams if they have failed the Series 3, Series 30, Series 31, Series 32 or Series 34 within the past two years: • A minimum of 30 days after failing the first exam before the second taking of the exam can be scheduled: • A minimum of 30 days after failing the second exam before the third taking of the exam can be scheduled: • A minimum of 180 days after failing the exam for the third time before the fourth taking of the exam (and each subsequent taking) can be scheduled. 6 .

Scheduling an appointment to take the exams, continued Questions Regarding Exam Issues The FINRA’s Field Support Service at (800) 999-6647 is available Monday through Friday from 8:00 AM to 6:00 PM, Eastern Time to assist test candidates with questions pertaining to candidate enrollments, exam delivery policy and procedure, and extensions to a candidate’s validation window. Questions may also be addressed by sending an email to gatewayweb@finra.org. Scheduling Multiple or Group Appointments A multiple appointment is when five or more candidates are being scheduled for multiple exams for various dates and testing center locations. Multiple appointments are handled directly by the exam vendors. Please contact either Pearson Professional Centers at 1-866-396-6273 or Prometric Testing Centers at 1-800-578-6273 to schedule multiple appointments. A group appointment is when five or more candidates are being scheduled to take the exact same exam at the same time at the same testing center location.

Procedures for scheduling a group appointment can be found by clicking on one of the following link: Prometric: https://www.prometric.com/en-us/clients/finra/Pages/ezSeatTesting.aspx Pearson Vue: http://www.pearsonvue.com/finra/reserveseats/ Scheduling an exam in a location outside of the United States FINRA administers exams abroad in selected foreign cities. For more information on foreign exam locations, phone numbers for scheduling appointments at a foreign location or foreign test center policies and procedures, click on the following link: http://apps.finra.org/TestCenter/1/locations.aspx Limited English Proficiency (LEP) (previously known as English as a Second Language) Candidates with LEP are persons who (1) do not speak English as their primary language and (2) have limited ability to read, speak, write and understand the English language. FINRA requires the firm or the candidate (if there is not a sponsoring firm) to submit to FINRA a request for additional time prior to the LEP candidate scheduling an examination. A LEP Request Form that the candidate is LEP-eligible must be completed.

Also, the firm or candidate will attest to the accuracy of the information on the form and acknowledge that any misrepresentation of the candidate’s LEP-eligibility may result in a disciplinary proceeding. FINRA will notify its test delivery vendors that a candidate is eligible to receive additional time to complete the examination. (LEP information continued on next page) 7 . Scheduling an appointment to take the exams, continued Testing Center personnel are not authorized to grant the additional time to candidates based on LEP. For exams up to 2 hours, an extra 30 minutes will be added to the session. For exams longer than 2 hours, an extra 60 minutes will be added to the session. Procedures for requesting additional time for your exam session can be found by clicking on the following link: http://www.finra.org/industry/limited-english-proficiency Special Accommodations FINRA in compliance with the provisions of the American with Disabilities Act (ADA) provides testing modifications and aids to candidates with disabilities and/or learning impairments that substantially limit a major life activity (e.g., learning, speaking, hearing, vision). FINRA makes arrangements to offer examinations/sessions in a place and manner appropriate to persons with disabilities according to the ADA. Procedures and forms for requesting special accommodations for taking an exam can be found by clicking on the following links: http://www.finra.org/Industry/special-accommodations Note: Candidates with transitory or temporary conditions that are not “impairments or disabilities” (e.g., pregnancy, sprains, fractures) are not eligible for special testing accommodations under the ADA. Those in need of accommodations should contact FINRA for information about a possible special testing arrangement that can be handled on a case-by-case basis. 8 . Scheduling an appointment to take the exams, continued Exam Cancellation Policy FINRA assesses a fee for individuals who cancel or reschedule a qualification examination or Regulatory Element session within three to 10 business days of a scheduled appointment date. To avoid cancellation or reschedule fees, candidates seeking to alter their scheduled appointment must do so a minimum of 10 business days in advance. Appointments cancelled or rescheduled within 10 business days will result in the assessment of one of the following fees: Three - 10 Business Day Cancellation/Reschedule Fee: Individuals who cancel or reschedule an appointment within three - 10 business days of a scheduled appointment will be assessed a cancellation/ rechedule fee as outlined in Three - 10 Business Day Cancellation/Reschedule Fee Table. At the time of rescheduling, these fees will be collected by the testing vendor with whom the candidate has scheduled the appointment. Late Cancellation/Reschedule Fee (Within Two Business Days of Appointment): Individuals who cancel or reschedule an appointment within two business days of a scheduled appointment, or who fail to show up for a scheduled exam or Regulatory Element session, will incur a fee equal to the fee of the examination or session being cancelled or rescheduled. FINRA will charge this fee to the individual’s firm.

Similarly, if an individual arrives so late that the examination or session cannot begin without disturbing the delivery location schedule for that date, FINRA will charge the individual’s firm a cancellation/reschedule fee. Non-member candidates who wish to cancel or reschedule an appointment within two business days, or who fail to show up for a scheduled exam or session, are required to open a new enrollment window (and pay the associated exam or session fee) prior to scheduling a new appointment. The cancellation or reschedule will be considered timely if effected according to the following schedule: To avoid late cancellation/reschedule To avoid three - 10 business Appointment is fee, appointment must be cancelled or day cancel/reschedule fee, is scheduled for rescheduled by midnight, Eastern Time appointment must be cancelled or (ET), on: rescheduled by midnight, ET, on: Sunday, Monday Wednesday of the preceding week Sunday two weeks before Tuesday Thursday of the preceding week Monday two weeks before Wednesday Sunday of the same week Tuesday two weeks before Thursday Monday of the same week Wednesday two weeks before Friday Tuesday of the same week Thursday two weeks before Saturday Wednesday of the same week Friday two weeks before 9 . Scheduling an appointment to take the exams, continued Three - 10 Business Day Cancellation/Reschedule Fee Table Exam Series Examination Title Fee 3 National Commodity Futures Examination $62.50 30 NFA Branch Manager Examination $40.00 31 Futures Managed Funds Examination $40.00 32 Limited Futures Exam-Regulations $40.00 34 Retail Off-Exchange Forex Examination 10 $40.00 . EXCHANGE RULEBOOKS AND MARKET LITERATURE In addition to the official rulebooks of the exchanges, literature on trading futures, options on futures, and individual markets is helpful in preparing for the examination. Please contact individual exchanges in order to obtain pricing lists, publication catalogs and order forms. Various departments within each exchange may be of assistance: Public Relations, Marketing, Literature, Member Services and Education. CME Group www.cmegroup.com ICE Futures U.S. www.theice.com Minneapolis Grain Exchange www.mgex.com NASDAQ OMX Futures Exchange www.nasdaqtrader.com/Micro.aspx?id=PBOToverview OneChicago LLC Futures Exchange www.onechicago.com CBOE Futures Exchange www.cfe.cboe.com 11 . OTHER PUBLICATIONS National Futures Association NFA Manual The NFA Manual contains NFA’s Articles of Incorporation, Bylaws, Compliance Rules, Code of Arbitration, Member Arbitration Rules, Financial Requirements, Registration Rules, and various interpretations of NFA rules and bylaws. Regulatory GuideS NFA publishes several booklets to help its Members met their regulatory obligations. These include: • • NFA Regulatory Requirements for FCMs, IBs, CPOs and CTAs the Public and Promotional Material A Guide to NFA Compliance Rules 2-29 and 2-36: Communications with • Disclosure Documents: A Guide for CPOs and CTAs • Self-Examination Questionnaire: For FCMs, FDMs, IBs, CPOs and CTAs To order a copy of these publications or to obtain an NFA Publication List, contact NFA’s Information Center at (312) 781-1410 or (800) 621-3570 or e-mail NFA’s Information Center at information@nfa.futures.org. The Commodity Futures Trading Commission The rules and regulations of the CFTC are encompassed in the Commodity Exchange Act as Amended and Regulations Thereunder. Updated periodically. Current editions may be ordered directly from the publisher: Commerce Clearing House 4025 West Peterson Avenue Chicago, Illinois 60646 (773) 583-8500 (800) 248-3248 Fee may be applicable When published as promulgated, U.S.

Public Laws, federal regulations and decisions of administrative and executive agencies and courts of the United States are in the public domain. However, their arrangement and compilation, and historical, statutory, and other notes and references, along with all other material in this publication, are subject to the copyright notice. All Rights Reserved 12 . EXAMINATION SUBJECT AREAS National Commodity Futures Examination SERIES 3 The following is a general listing of the major subject areas covered by the examination and does not represent an exhaustive list of the actual test questions. Part 1 FUTURES TRADING THEORY AND BASIC FUNCTIONS TERMINOLOGY E. Speculative Theory A. General Theory 1. Development of futures markets 2. Futures and securities compared • Rights • Obligations • Transfer of ownership F. General Futures Terminology Associated Person Floor Broker Basis Floor Trader Bucketing Forward contract Carrying charges Intoducing broker Churning Inverted market Clearinghouse Limit up/down Convergence Lock limit Commodity Pool Long Operator Normal market Commodity Trading Pit Advisor Position Trader Deferred Retender Discount Scalper Expit Short Futures Commission Spot Merchant Variation call First Notice Day Warehouse receipt G. General Options Terminology At-the-money Out-of-the-money Call Premium Conversion Put Delta Spread Exercise Straddle Expiration Strangle Grantor Synthetic In-the-money Options/Futures Intrinsic Value Time value Writer B. The Futures Contract 1. Futures and forward contracts compared 2. Offset provisions 3. The clearinghouse function • Clearing members • Non-clearing members 4. Delivery provisions • Basis grade • Premiums • Discounts C. The Structure of Futures Markets 1. Normal markets • Carrying charges • “Full carry” markets 2. Inverted markets • Supply shortages • Other factors D. Hedging Theory 1. Risk reduction • Unhedged position • Effect on pricing of cash markets 2. Short hedging • Typical short hedgers: farmers, producers, holders of inventory • Effect on pricing of cash markets 3. Long hedging • Typical long hedgers: processors, manufacturers, exporters • Protection against price rise 1. Leverage 2. Risk 3. Market liquidity 4. Price volatility 13 .

Series 3 (continued) FUTURES MARGINS, OPTION PREMIUMS, PRICE LIMITS, FUTURES SETTLEMENTS, DELIVERY, EXERCISE, AND ASSIGNMENT A. Margin Requirements C. Price Limits 1. The nature of futures margin • Performance bond • Comparison with securities margin • Authority of exchanges to establish and revise requirements • Initial and maintenance requirements • Documentation: margin agreement, transfer of funds agreement 2. Margin calculations • Initial • Maintenance/variation • Effects of substantial price movement • Effects of change in requirements on new and existing positions • Withdrawal of excess equity 3. Alternative calculations • Hedge margin • Spread margin B. Option Premiums 1. Intrinsic value 2. Time value 3. The delta 4. Premium quotations Note: where different from underlying contract (e.g., T-Bonds) 1. Effect of limit-up/down price change 2. Expanded limits 3. Effects on margin of limit moves 4. Lock limit 5. Circuit breakers D. Offsetting Contracts, Settlements, Delivery 1. Liquidating long and short positions 2. First notice day 3. Trading in the spot month 4. The clearinghouse role in the delivery 5. Delivery notices 6. Retenders/stopped notices 7. Physical delivery, warehouse receipts 8. Cash settled contracts; how settlement is computed •. Stock indices • Municipal bonds • Eurodollars 9. EFP’s E. Options Exercise, Assignment, Settlement 1. Process of assignment 2. Margin requirements upon exercise 3. Final trading/exercise dates TYPES OF ORDERS, CUSTOMER ACCOUNTS, PRICE ANALYSIS A. Basic Characteristics and Uses of 1. Market orders 2. Stop orders 3. Stop-limit orders 4. Market-if-touched orders 5. Orders on electronic markets B. Additional Orders 1. Good till canceled (GTC) 2. Fill-or-kill 3. On close 4. One cancels the other (OCO) C. Technical Price Analysis 1. Charts: bar, point and figure 2. Trendlines 3. Support/resistance levels 4. Congestion areas 5. Gaps 6. Triangles: ascending and descending 7. Double tops and bottoms 8. Volume and open interest 9. Liquidating markets D. Fundamental Price Analysis 1. Effects of economic or political instability 2. Supply and demand elasticity 3. U.S. agricultural policies 4. Crop years 5. Hog/corn ratio E. Interest Rate Analysis 14 1. Yield curves: positive, inverted, flat 2. Effects of governmental policies • Tax policy • Monetary policy .

Series 3 (continued) BASIC HEDGING, BASIS CALCULATIONS, HEDGING FUTURES A. Short Hedging and Long Hedging 4. The basis in financial markets • Short-term rates vs. long-term rates • “Implied repo rate” C. Hedging Calculations 1. Net result of hedge 2. Net price received upon purchase or sale Examples: Grains T-Notes, T-Bonds Livestock T-Bills, Eurodollars Foodstuffs Municipals Metals Currencies Energy Stock indices Lumber 1. Anticipatory hedges 2. Long the basis/short the basis B. The Basis 1. How determined 2. Effect of basis charge on • The short hedger • The long hedger 3. Effect on price of commodity actually delivered or purchased • Transportation costs • Variation in deliverable grades SPREADING A. Spread Trading B. Common Types of Spreads 1. Order execution 2. Expectations • Narrowing or widening basis • Normal or inverted market strategies 1. Carrying charge or limited risk spreads • Intra-market • Inter-delivery 2. Bull and bear spreads 3. Intermarket spreads SPECULATING IN FUTURES A. Profit/loss calculations for speculative B. Trading Applications 1. Recommend appropriate speculative trades given certain economic or technical circumstances 2. Use appropriate orders both to initiate and protect position trades (including spreads) 1. Gross profit on speculative trades: single or multiple contract positions 2. Effect of commissions on gross profits 3. Return on (margin) equity calculations Examples: Grains T-Notes, T-Bonds Livestock T-Bills, Eurodollars Foodstuff Municipals Metals Currencies Energy Stock indices Lumber 15 . Series 3 (continued) OPTION HEDGING, SPECULATING, SPREADING A. Option Theory D. Option Spread Strategies/Calculations 1. Long • Limited risk • Increased leverage • Total loss of investment (premium) possible 2. Short • Increased risk • Earn premium • Loss may exceed premium received B. Option Hedge Strategies/Calculations 1. Long put as alternative to short futures hedge 2. Long call as alternative to long futures hedge 3. Allows for increased profit once breakeven point is reached C. Option Speculative Strategies/Calculations 1. Long call as substitute for long futures • Risk limited to premium • Breakeven point • Profit and return on equity 2. Long put as substitute for short futures • Risk limited to premium • Breakeven point • Profit and return on equity 3. Long call to protect short futures (synthetic long put) 4. Long put to protect long futures (synthetic long call) 5. Long futures-short call (covered call) 6. Conversions 7. Reverse conversions (reversals) 16 1. Call bull spreads • Spread to widen • Maximum profit/loss 2. Call bear spreads • Spread to narrow • Maximum profit/loss 3. Put bull spreads • Spread to narrow • Maximum profit/loss 4. Put bear spreads • Spread to widen • Maximum profit/loss 5. Calendar spreads 6. Arbitrage spreads . Series 3 (continued) Part 2 REGULATIONS A. General 1. CFTC registrations/NFA membership Floor Broker (FB) • • Floor Trader (FT) • Associated Person (AP) • Commodity Pool Operator (CPO) • Commodity Trading Advisor (CTA) • Introducing Broker (IB) • Futures Commission Merchant (FCM) • Exemptions from registration • NFA membership 2. Futures account opening requirements • Know Your Customer (NFA Compliance Rule 2-30) • Verbatim risk disclosure statement • Commodity customer agreement • Discretionary accounts – Written authorization – Account supervision and review – AP minimum experience requirement 3. Position reporting requirements • Set by CFTC or exchanges • Daily reports • Applicable to both speculators and hedgers 4. Speculative position limits • Maximum net long or short position specified by CFTC or exchanges • Bona fide hedgers’ exemption • Rules for acceptance of customer funds 2. Net capital requirements 3. Financial reports 4. Collection of margin deposits 5. Customer complaints • Options-related complaints • Adjustments to accounts 6. Time-stamping requirements 7. Promotional Material (NFA Compliance Rule 2-29) 8. Disclosure by FCMs and IBs required for costs associated with futures transactions C. CPO/CTA 1. Disclosure documents • Upfront fees • Performance records • Disclosure statements • Trading program • Five-year business background of principals • Conflicts of interest 2. Records to be maintained Bunched orders • 3. Promotional Material (NFA Compliace Rule 2-29) D. Arbitration Procedures E. NFA Disciplinary Procedures 1. Guaranteed and independent IBs • Responsibilities of guarantor FCM 1. Formal complaints 2. Warning letters 3. Hearings • Offers to settle • Appeal process 4. Member responsibility actions (MRA) 5. Penalties for violators • Fine • Cease and desist order • Expulsion F. B. FCM/IB Regulations CFTC Commodity Exchange Act Enforcement 17 . NFA BRANCH MANAGER EXAMINATION SERIES 30 The following is a general listing of the major subject areas covered by the examination and does not represent an exhaustive list of the actual test questions. A. General • Books and records, preparation and D. NFA Know Your Customer Rule • Client information required • Responsibility to obtain additional client retention • Order tickets, preparation and retention • Written option procedures • Handling of customer deposits • NFA Compliance Rule 2-9, supervision of employees • Business Continuity and Disaster Recovery Plan • Registration requirements—who needs to be registered, sponsor verification, NFA Bylaw 1101, AP termination notices, temporary licenses • NFA disciplinary process • Reportable positions • NFA Arbitration Rules • On-site audits of branch offices • Bona fide hedging transactions • Trading on foreign exchanges B. information • Risk disclosures E. Disclosure by CPOs and CTAs Required for Costs Associated with Futures Transactions • Disclosure of upfront fees and expenses • Effect of upfront fees and organizational expenses on net performance F. G. IB General • Accepting funds from customers • Guarantee agreements • Responsibilities of guarantor FCM • Minimum net capital requirements • Timestamping of order tickets • Books and records to be maintained CPO/CTA General • Registration requirements • Books and records to be maintained • Reports to customers • Bunched orders H. General Account Handling and Exchange Regulations • Risk Disclosure Statement • Margin requirements • Stop loss orders • Preparing orders • Proprietary accounts • Positions limits and reporting requirements • Trade confirmations C. CPO/CTA Disclosure Documents • Management and incentive fees • Performance records • How long a CPO or CTA can use a disclosure document • Conflicts of interest • Pool units purchased by principals • Business backgrounds of principals • Amendments to disclosure documents • Disclosure of disciplinary actions • NFA review of document before each use Disclosure by FCMs and IBs Required for Costs Associated with Futures Transactions • Explanation of fees and charges to customers 18 . Series 30 (continued) NFA BRANCH MANAGER EXAMINATION I. Discretionary Account Regulation • Requirements relating to discretionary accounts • Supervision and review of discretionary accounts J. Promotional Material (Compliance Rule 2-29) • Definition of promotional material • Standardized sales presentations • Use of a third-party consulting or advertising firm • Reprints of articles from industry publications • Recordkeeping of promotional material • Past performance • Hypothetical trading results • Written procedures for promotional material • Supervisory review of promotional material K. Anti-Money Laundering Requirements • Developing policies, procedures and internal controls • Customer identification program and recordkeeping • Detection and reporting of suspicious activity • Training staff to monitor trading activity • Recordkeeping • Designation of individual or individuals (“compliance officer”) to be responsible for overseeing the program • Employee training program Independent audit function 19 . FUTURES MANAGED FUNDS EXAMINATION SERIES 31 The following is a general listing of the major subject areas covered by the examination and does not represent an exhaustive list of the actual test questions. A. General market knowledge E. Know Your Customer Rule • Client information required • Risk disclosures 1. Definition and significance of • Margin • Futures and forward contracts • Price limits • Open interest • Offsetting contracts • “Marking-to-market” • Settlement • Spread trades • Basis • Hedging • Yield curve • Cost of carry • Leverage • Price volatility B. General Regulation • Arbitration claims and awards • NFA disciplinary process • NFA Compliance Rule 2-9, supervision of F. Disclosure by CPOs and CTAs Required for Upfront Fees • Disclosure of upfront fees and expenses • Effect of upfront fees and organiza- tional expenses on net performance G. Promotional Material (Compliance employees • “Qualified Eligible Participant” • Registration requirements • Trading on foreign markets • Books and records to be maintained C. CPO/CTA Regulations • Reports to customers • Exemptions from registration • Records to be maintained • Limited partnerships • Accepting funds from customers D. CPO/CTA Disclosure Documents • Management and incentive fees • Performance records • Conflicts of interest • How long a CPO or CTA can use a disclosure document • Pool units purchased by principals • Disclosure statements • Business backgrounds of principals • NFA review of document before use • Disclosure of disciplinary action Rule 2-29) • Definition of promotional material • Standardized sales presentations • Use of a third-party consulting or advertising firm • Reprints of articles from industry publications • Recordkeeping of promotional material • Past performance • Hypothetical trading results • Written procedures for promotional material • Supervisory review of promotional material 20 . LIMITED FUTURES EXAMINATION—REGULATIONs SERIES 32 The following is a general listing of the major subject areas covered by the examination and does not represent an exhaustive list of the actual test questions. A. General 1. CFTC registrations/NFA membership • Floor broker (FB) • Floor Trader (FT) • Associated person (AP) • Commodity pool operator (CPO) • Commodity trading advisor (CTA) • Introducing broker (IB) • Futures commission merchant (FCM) • Exemptions from registration • NFA membership 2. Futures account opening requirements • Know Your Customer (NFA Compliance Rule 2-30) • Verbatim risk disclosure statement • Commodity customer agreement -Written authorization -Account supervision and review -AP minimum experience requirement 3. Position reporting requirements • Set by CFTC or exchanges • Daily reports • Applicable to both speculators and hedgers 4. Speculative position limits • Maximum net long or short position specified by CFTC or exchanges • Bona fide hedgers’ exemption B. FCM/IB Regulations 1. Guaranteed and independent IBs • Responsibilities of guarantor FCM • Rules for acceptance of customer funds 2. Net capital requirements 3. Financial reports 4. Collection of margin deposits 5. Customer complaints • Options-related complaints • Adjustments to accounts 6. Time-stamping requirements 7. Promotional Material (NFA Compliance Rule 2-29) 8. Disclosure by FCMs and IBs required 21 for costs associated with futures transactions C. CPO/CTA 1. Disclosure documents • Upfront fees • Performance records • Disclosure statements • Trading program • Business backgrounds of principals • Conflicts of interest 2. Records to be maintained 3. Promotional Material (NFA Compliance Rule 2-29) D. Arbitration Procedures E. NFA Disciplinary Procedures 1. Written complaints 2. Warning letters 3. Hearings • Offers to settle • Appeal process 4. Member responsibility actions (MRA) 5. Penalties for violators • Fine • Cease and desist order • Expulsion F. CFTC Commodity Exchange Act Enforcement . retail off-exchange forex examination SERIES 34 The following is a general listing of the major subject areas covered by the examination and does not represent an exhaustive list of the actual test questions. A. Definitions and Terminology • American terms, European terms • Base currency, quote currency, terms currency, secondary currency • Bid/ask spread • Collateral, security deposit, margin • Counterparty, dealer: Futures Commission Merchant, Retail Foreign Exchange Dealer, other regulated entities listed in the Commodity Exchange Act • Cross rates • Currency crosses • Currency pairs • Direct quotes, indirect quotes • Exchange rate • Forward points • Forward rate, bid forward rate • Interest rate differential • Interest rate parity • Mark-ups, mark-downs • PIPs • Rollovers • Spot rate, spot price • Tom-next and spot-next • Trade date and settlement date • Swaps B. Forex Trading Calculations • Cross rate transactions • Effects of leverage calculations • Netting of positions • Open trade variation • Profit & loss calculations • Pip values, price after pips • Return on collateral, security deposit, margin • Transaction costs C. Risks Associated with Forex Trading • Country or sovereign risk • Credit risk • Exchange rate risk • Interest rate risk • Liquidity risk • Market risk • Operational risk • Settlement risk, Herstaat risk 22 D. Forex Market - Concepts, Theories, Economic Factors and Indicators, Participants • Balance of payments • Balance of trade • Bank for International Settlements (BIS) • Capital account and current account • Central bank activities, intervention, sterilized intervention • Clearing House Interbank Payment System (CHIPS) • Discount rate • Economic indicators: employment, consumer spending, income, industrial and inflation indicators • Elasticity of exchange rates • Exchange rate intervention • Exchange rate volatility • Federal Reserve Board, Fedwire • Fiscal policy • Fisher effect • Foreign investment indicators • Gross national product, gross domestic product • Inflation • Interbank funds transfer and settlement systems • International Fisher effect • International Monetary Fund • Portfolio balance • Role of central banks • Theory of elasticities • Theory of purchasing power parity • World Trade Organization . Series 34 (continued) retail off-exchange forex examination SERIES 34 E. Forex Regulatory Requirements • CFTC Regulations - Close out of offsetting positions - Disclosure of profitable vs. non-profitable accounts - Prohibition of guarantees against loss - Registration requirements - Re-quoting - Security deposits - Specific authorization for trades • CFTC jurisdiction and jurisdictional limitations • Conflicts of interest • Disclosures to customers • Jurisdictional & regulatory framework • Know your customer • NFA Interpretive Notices - The Allocation of Bunched Retail Forex Orders for Multiple Accounts - Forex Transactions - Requirements for Forex Transactions - Supervision of the Use of Electronic Trading Systems - Prohibition on the Use of Certain Electronic Funding Mechanisms (Effective January 31, 2015) • NFA membership and associate membership requirements • Promotional material & solicitation • Reports to customers, confirmations, monthly summaries • Security deposit rules • Security of customer funds, no segregation 23 .