Description

THE CHINA EFFECT ON

GLOBAL INNOVATION

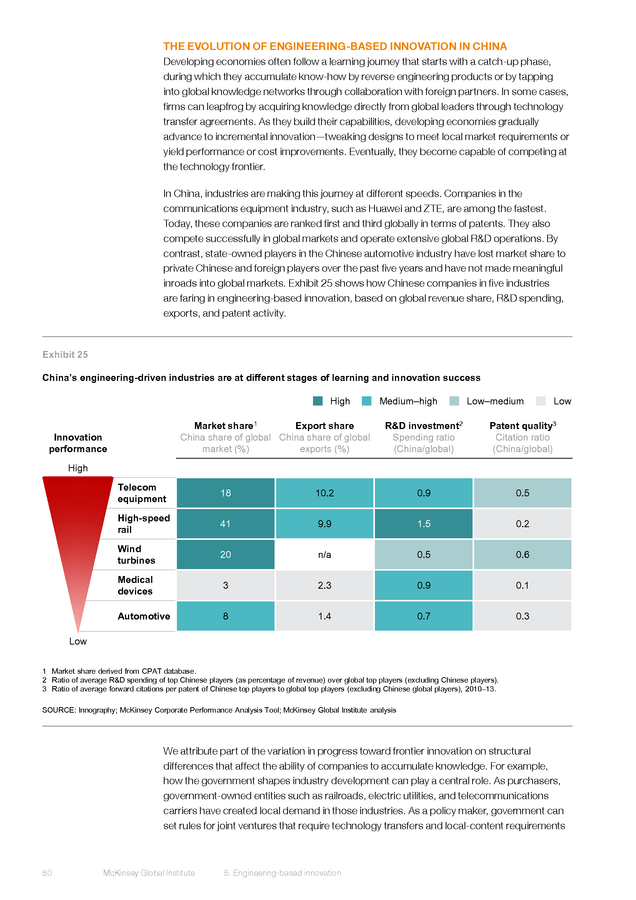

OCTOBER 2015

HIGHLIGHTS

15

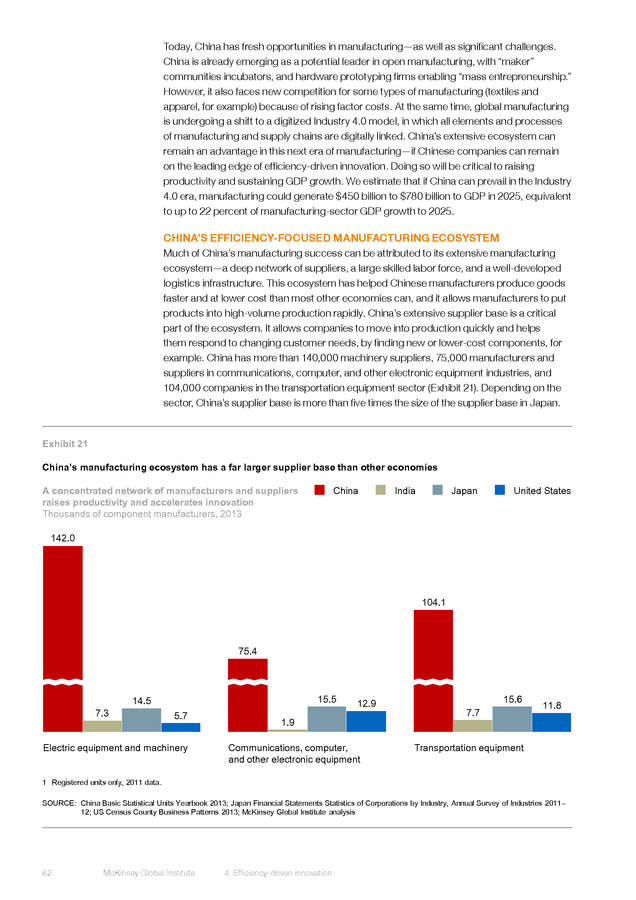

The innovation

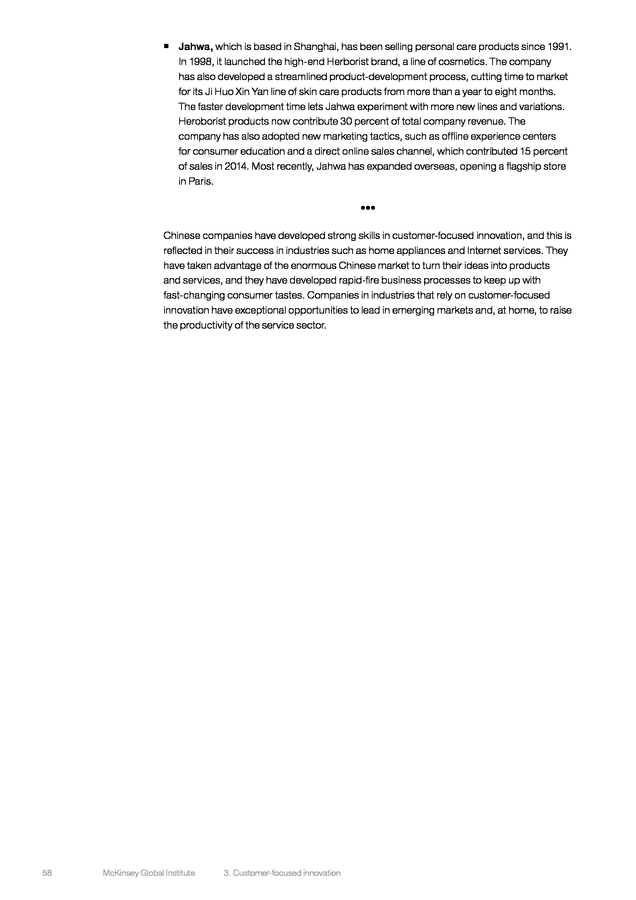

imperative

Long-standing sources of

growth are waning

27

Innovation in China

today

Mapping China’s innovation

performance

103

Cheaper, faster,

more global

China’s impact on

innovation around the

world

. In the 25 years since its founding, the McKinsey Global Institute (MGI) has sought to develop

a deeper understanding of the evolving global economy. As the business and economics

research arm of McKinsey & Company, MGI aims to provide leaders in commercial,

public, and social sectors with the facts and insights on which to base management and

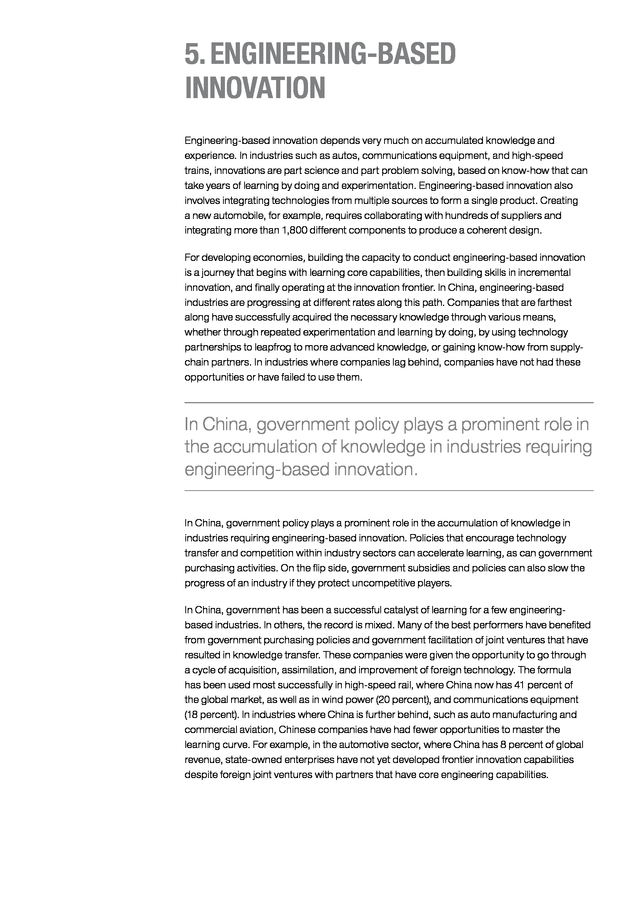

policy decisions.

MGI research combines the disciplines of economics and management, employing the

analytical tools of economics with the insights of business leaders. Our “micro-to-macro”

methodology examines microeconomic industry trends to better understand the broad

macroeconomic forces affecting business strategy and public policy. MGI’s in-depth reports

have covered more than 20 countries and 30 industries.

Current research focuses on six themes: productivity and growth, natural resources, labor

markets, the evolution of global financial markets, the economic impact of technology and

innovation, and urbanization.

Recent reports have assessed global flows; the economies of Brazil, Japan, Mexico, and Nigeria; China’s digital transformation; India’s path from poverty to empowerment; affordable housing; and the effects of global debt. MGI is led by three McKinsey & Company directors: Richard Dobbs, James Manyika, and Jonathan Woetzel. Michael Chui, Susan Lund, and Jaana Remes serve as MGI partners. Project teams are led by the MGI partners and a group of senior fellows, and include consultants from McKinsey offices around the world. MGI teams draw on McKinsey partners and experts.

Leading economists, including Nobel laureates, serve as MGI advisers. The partners of McKinsey & Company fund MGI’s research; it is not commissioned by any business, government, or other institution. For further information about MGI and to download reports, please visit www.mckinsey.com/mgi. MCKINSEY IN CHINA The McKinsey Greater China Office serves clients across a broad range of industry and functional areas.

Since the first office in the region was established in Hong Kong 30 years ago, McKinsey has completed more than 2,500 client engagements across more than 15 industries. We advise clients on strategy and a wide range of issues. In addition to providing strategic advice, we work closely with clients to redesign their organizations for higher performance, improve their operations, market their products more effectively, integrate acquisitions, improve risk management, reduce costs, streamline supply chains, and get better value out of their IT investments.

For more information about McKinsey Greater China, please visit www.mckinseychina.com. Copyright © McKinsey & Company 2015 . THE CHINA EFFECT ON GLOBAL INNOVATION OCTOBER 2015 Jonathan Woetzel | Shanghai Yougang Chen | Hong Kong James Manyika | San Francisco Erik Roth | Shanghai Jeongmin Seong | Shanghai Jason Lee | Houston . PREFACE How innovative is China? How innovative does it need to be? These are the fundamental questions underlying this research. The answers are somewhat surprising. In many ways, we find, Chinese industry is more innovative than is generally acknowledged. Chinese companies have established strong positions in two types of innovation—developing new products and services that address consumer needs, and process innovations that make manufacturing more efficient.

We also find that China has a growing need to innovate more broadly, across more industries, and raise innovation performance in engineering and science. China needs to evolve from an innovation “sponge” to an innovation leader to sustain GDP growth in the coming decade as other drivers of growth—an expanding labor force and capital investment—decline. We conclude that China has the potential to meet its “innovation imperative” and to emerge as a driving force in innovation globally. The “China effect” in global innovation would be felt in several ways.

As the nation with the largest population and the second-largest economy in GDP terms, China will be a growing source of innovation to serve the needs of an enormous and increasingly demanding consumer market. It is also a logical location for R&D and rapid commercialization of new ideas by global companies—for China, for other emerging markets, and for the rest of the world. Finally, the Chinese model of rapid, low-cost innovation can be applied around the world, potentially disrupting a range of industries. This research is a joint effort by the McKinsey Global Institute and the McKinsey Greater China office.

It was led by Jonathan Woetzel, an MGI director based in Shanghai; Jeongmin Seong, an MGI senior fellow based in Shanghai; Yougang Chen, a partner based in Shanghai; James Manyika, an MGI director in San Francisco; and Erik Roth, a McKinsey director based in Shanghai. We also thank Gordon Orr, a former McKinsey director in China, for his thoughtful guidance throughout this research effort, as well as Jacques Bughin, a McKinsey director based in Brussels. The research team was led by Jason Lee and included Sizhe Chen, Denise Lee, Chao Li, Luke Li, Xiujun Lillian Li, Ganesh Raj, Yi Shao, Jimmy Wu, Anting Xu, and Colin Zhu. Geoffrey Lewis provided editorial support. We thank Marisa Carder and Patrick White for design, and Julie Philpot, MGI’s production manager.

We also thank MGI colleagues Tim Beacom, Matt Cooke, and Deadra Henderson. We are grateful to McKinsey Greater China staff members: Bo Jiang, Glenn Leibowitz, Lin Lin, Karen Schuster, Ruwen Shen, and Rebecca Zhang. . McKinsey colleagues from around the world and across many disciplines gave generously of their time and expertise. We thank Andre Adonian, Tera Allas, Nick Arnold, Stephan Binder, Matthias Breunig, Giovanni Bruni, Albert Chang, Mei-Jung Chen, Siva Chen, Jayson Chi, Michael Chui, Marc de Jong, Karel Eloot, Fang Gong, Paul Gao, Martin Hirt, Sheng Hong, Richard Kelly, Jean-Frederic Kuentz, Alan Lau, Franck Le Deu, Martin Lehnich, Nicolas Leung, Guangyu Li, Matteo Mancini, Nathan Marston, Alexander Ng, Joe Ngai, Felix Poh, Sree Ramaswamy, Oliver Ramsbottom, Jaana Remes, Dave Rogers, Sha Sha, Kevin Sneader, Min Su, Tony Tan, Florian Then, Christopher Thomas, Peet Van Biljon, Jin Wang, Bill Wiseman, David Xu, Fangning Zhang, Haimeng Zhang, and Gaobo Zhou. We thank the many business leaders, experts, investors, and entrepreneurs who shared their insights confidentially. We are deeply indebted to our academic adviser, Martin N. Baily, Bernard L. Schwartz Chair in Economy Policy Development and senior fellow and director of the Business and Public Policy Initiative at the Brookings Institution. This report contributes to MGI’s mission to help business and policy leaders understand the forces transforming the global economy, identify strategic locations, and prepare for the next wave of growth. As with all MGI research, this work is independent and has not been commissioned or sponsored in any way by any business, government, or other institution.

We welcome your comments on the research at MGI@mckinsey.com. Richard Dobbs Director, McKinsey Global Institute London James Manyika Director, McKinsey Global Institute San Francisco Jonathan Woetzel Director, McKinsey Global Institute Shanghai October 2015 . © Alamy . CONTENTS HIGHLIGHTS In brief 41 Executive summary Page 1 How China can become a global leader in innovation 1. China’s innovation imperative Page 15 To sustain projected growth, China must raise productivity Customer-focused innovation 2. The current state of Chinese innovation: An archetype view Page 27 Where China is succeeding in innovation—and where it’s not 61 3. Customer-focused innovation: The Chinese commercialization machine Page 41 An enormous consumer market helps commercialize innovations rapidly 4.

Efficiency-driven innovation: The ecosystem advantage Page 61 Chinese manufacturers benefit from an extensive ecosystem Efficiency-driven innovation 79 5. Engineering-based innovation: Learning by serving local markets Page 79 Accelerated learning is essential 6. Science-based innovation: Catching up, using novel Chinese approaches Page 93 China has built a strong foundation in science, but is not yet an innovation leader Engineering-based innovation 93 7.

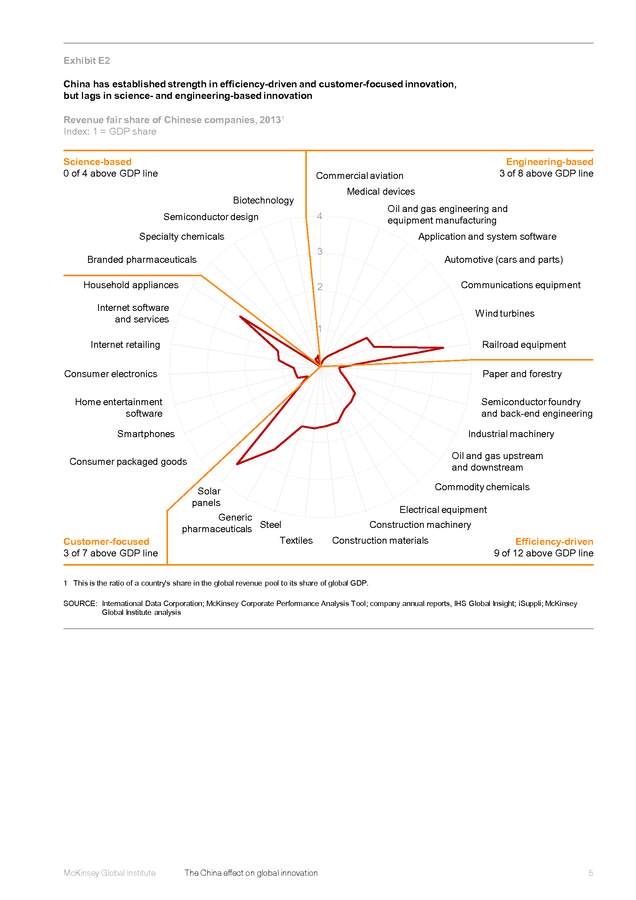

The China effect on global innovation Page 103 China’s approach to low-cost, rapid, and large-scale innovation could alter global competition Bibliography Page 119 Science-based innovation Technical appendix A complete technical appendix describing the methodology and data sources used in this research and are available at www.mckinsey.com/mgi. . IN BRIEF CHINA CAN BECOME A GLOBAL INNOVATION LEADER China has the potential to evolve from an innovation sponge—absorbing and adapting global technologies and knowledge—to an innovation leader. Chinese companies are performing well in some types of innovation, by filling consumer needs with better products and services and wielding the power of China’s manufacturing ecosystem to make innovations in production processes. China has yet to take the lead in more challenging forms of innovation, such as scientific discovery and engineering, but Chinese companies are using a distinctly Chinese way to nimbly accelerate experimentation and learning on a large scale. ƒƒ China faces an innovation imperative. As two sources of growth—labor force expansion and heavy capital investment—fade, innovation (broadly defined) will need to contribute up to half of GDP growth by 2025, or $3 trillion to $5 trillion in value per year. We identify opportunities to create value of $1 trillion to $2.2 trillion per year in 2025 through innovations to expand and raise the productivity of the service sector and further improve manufacturing efficiency through digitization. ƒƒ Performance varies across the four “archetypes” of innovation.

We gauge innovation impact by examining 30 industries in four innovation archetypes. China performs well in customerfocused and efficiency-driven archetypes, but is catching up in engineering- and sciencebased archetypes. ƒƒ China’s large and dynamic market gives it an edge in customer-focused innovation. Chinese innovators use China’s massive consumer market (more than 100 million mainstream consumer households today) to commercialize new ideas quickly.

Chinese consumers enable innovation by accepting early iterations of products and services and providing feedback for rapid refinement. ƒƒ China’s manufacturing ecosystem enables efficiency-driven innovation. China has the world’s most extensive manufacturing ecosystem, with more than five times the supplier base of Japan, 150 million manufacturing workers, and modern infrastructure. ƒƒ Accelerated learning is essential for engineering-based innovation. Purchasing by government-owned enterprises, facilitation of technology transfers, and introduction of market discipline are accelerating learning needed for engineering-based innovation in such industries as communications equipment, wind power, and high-speed rail. ƒƒ Chinese companies are trying to catch up in science-based innovation using novel approaches.

The government push to raise R&D spending, train scientists, and file for patents has yet to give China a lead in science-based innovation. Today, Chinese companies in science-based industries are developing their own approaches to catch up—taking advantage of China’s lower cost and large pool of researchers to industrialize and accelerate experimentation and discovery. In the next ten years the “China effect” on innovation will be felt around the world as more companies use China as a location for low-cost and rapid innovation. The overall China effect could be disruptive, bringing large-scale yet nimble innovation to serve unmet needs in emerging markets and produce new varieties of goods and services for advanced economies.

Around the world consumers could benefit from better goods at lower prices. . China can become a global innovation leader China faces an innovation imperative The labor force is no longer growing Two traditional sources of growth are fading... Aging is expected to reduce the working-age population by 16% by 2050 Return on ï¬xed asset investment is declining It takes 60% more capital to generate a unit of GDP than it did from 1990 to 2010 ...so to sustain 5.5–6.5% growth rates through 2025, innovation would need to contribute up to 50% of GDP growth1 Productivity share of GDP growth 48% 40% 1990–2000 Up to 50% $3T–$5T by 2025 30% 2000–2010 2010–2014 2015–2025 EN C F EER GINSED I BA IENC SC ASED E B NG TOM US CUSEDE O R China’s advantages CIE FFDIRIVENN CY E China has opportunities in 4 “archetypes” of innovation Extensive manufacturing ecosystem (suppliers, labor, infrastructure) Massive domestic market for rapid commercialization Government creates local demand, enables learning Rapidly increasing, low-cost R&D capacity Current performance2 Strong Rapidly improving Mixed Opportunities • Solar panels (51%) • Construction machinery (19%) • Household appliances (36%) • Internet software (15%) • High-speed rail (41%) • Commercial aviation (1%) • Branded pharmaceuticals (<1%) • Semiconductor design (3%) Future opportunity Next-generation manufacturing ($450B–$780B by 2025) Internet-enabled innovation in service sector ($550B–$1.4T by 2025) Opportunities in targeted industries, including nuclear power, medical equipment Drug discovery, genomics Accelerating the China effect to make innovation cheaper, faster, and more global Make bigger bets Enable innovators Invest more in China-based innovation Remove barriers and encourage competition Operate at China speed Rapid, nimble innovation processes Discover new sources of insights Raise the bar for quality Companies Find ideas through open innovation processes Build a Chinese talent pool Recruit and develop talent in novel ways 1 Innovation measured as contribution from multifactor productivity growth. 2 % = Chinese companies’ share of global revenue pool. Government As purchaser, be a demanding customer Reward innovators Reform capital-raising processes and strengthen intellectual property protection Support innovation clusters Improve lifestyle factors to attract top talent . © Alamy viii McKinsey Global Institute  . EXECUTIVE SUMMARY How innovative is the Chinese economy? By some common measures of innovation, China has already become a global innovation leader. Each year it spends more than $200 billion on research (second only to the United States) and turns out close to 30,000 PhDs in science and engineering. It leads the world in patent applications (more than 820,000 in 2013). However, when it comes to the actual impact of innovation—as measured by the success of companies in commercializing new ideas and competing in global markets—the picture is mixed.

China has become a strong innovator in some industries, largely by serving domestic demand. In the more challenging types of innovation, such as creating new drugs and designing new commercial airliners, China is still not globally competitive. In this research we have examined the state of innovation across major sectors of the Chinese economy—identifying factors that drive successful innovation in different types of industries and the policies that can advance innovation. We find that China has some unique strengths in innovation, including the largest base of consumers of any country, which enables rapid commercialization of new ideas.

It also has the world’s most extensive manufacturing ecosystem, enabling continuous innovations in production processes that reduce costs and improve quality. And, thanks to investments over the past three decades, China has created capacity for research with a growing number of universities and research institutions, as well as an expanding pool of talent. We also have identified obstacles to innovation, such as slow regulatory processes and weak intellectual property protections. $1.0– 2.2T Value of specific innovation opportunities in manufacturing and services Our conclusion is that China has the potential to build on its strengths in innovation and become a global leader—creating a “China effect” on innovation around the world. This conclusion is based on China’s momentum in consumer-facing industries and manufacturing, and its growing capacity for innovation in industries where it is not yet globally competitive.

Not only can China serve as the locus of innovation for a growing number of companies that want to penetrate China and other fast-growing emerging markets, but the Chinese approach to innovation also can spread, helping companies everywhere turn ideas into products and services more quickly and for less cost. Completing the journey from innovation sponge—absorbing and adapting existing technology and knowledge from around the world—to global innovation leader is not just a way to signal China’s progress as an economy and society. The boost to productivity that innovation provides is critically important for sustaining China’s growth. We also identify specific innovation opportunities in manufacturing and service industries that can contribute $1.0 trillion to $2.2 trillion in value by 2025, or equivalent to as much as 24 percent of total GDP growth. .

CHINA’S INNOVATION IMPERATIVE As the events of 2015 have illustrated, China is in the midst of a very challenging transition to a slower-growing, more consumption-driven economy. For 30 years, from 1985 to 2015, China’s GDP rose by 9.4 percent per year on average. However, two forces that helped to drive this growth—a constant flow of new workers into the labor force and massive investments in housing, infrastructure, and industrial capacity—are receding. Because of aging, China’s labor force will soon peak—perhaps as soon as 2016—and begin a long decline that could reduce its size by 16 percent by 2050.

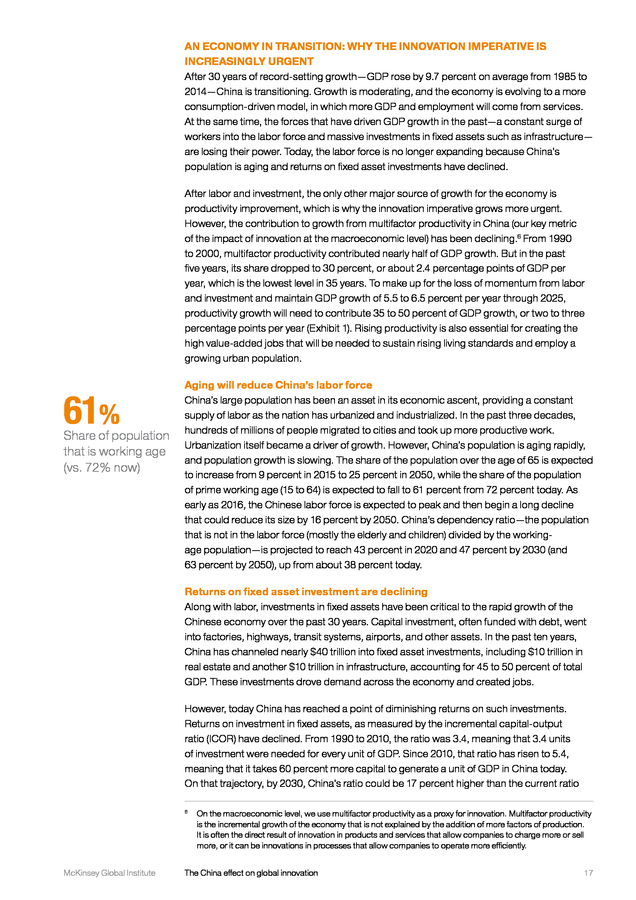

And macroeconomic returns on fixed asset investments have fallen: it now takes 60 percent more capital to produce one unit of GDP in China than it did, on average, from 1990 to 2010.1 Investment is also constrained by China’s debt, which, at 282 percent of GDP, exceeds debt-to-GDP ratios in the United States and Germany. It now takes 60 percent more capital to produce one unit of GDP in China than it did, on average, from 1990 to 2010. Without labor force expansion and investment to propel growth, China must rely more heavily on innovation that can improve productivity. We use multifactor productivity—growth that does not come from factors of production such as labor and capital investment—as a proxy for the macroeconomic impact of innovation broadly defined (including productivity gain from catch-up). The contribution to GDP of multifactor productivity has been falling in China, from nearly half of yearly GDP growth in the 1990 to 2000 decade to 30 percent in the past five years.

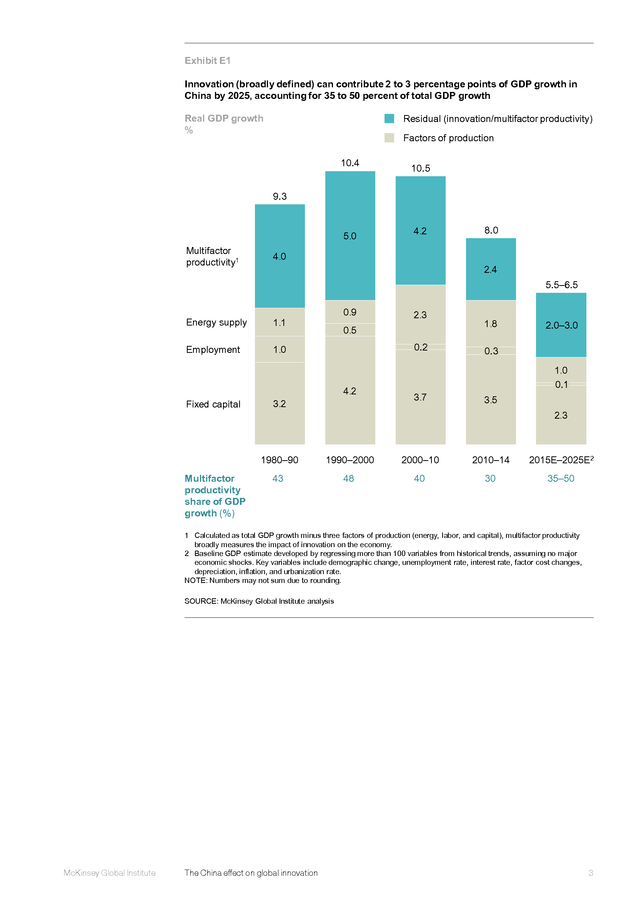

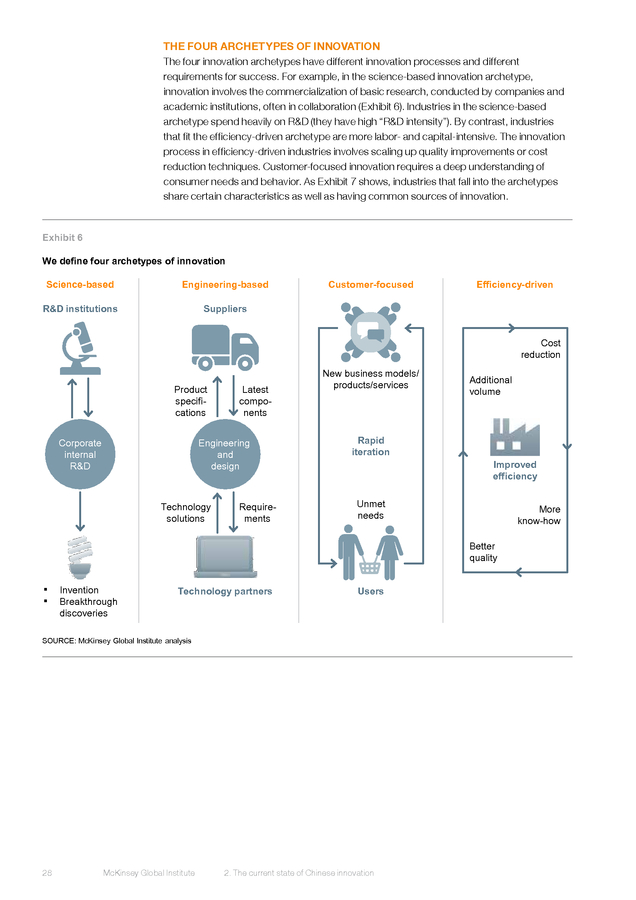

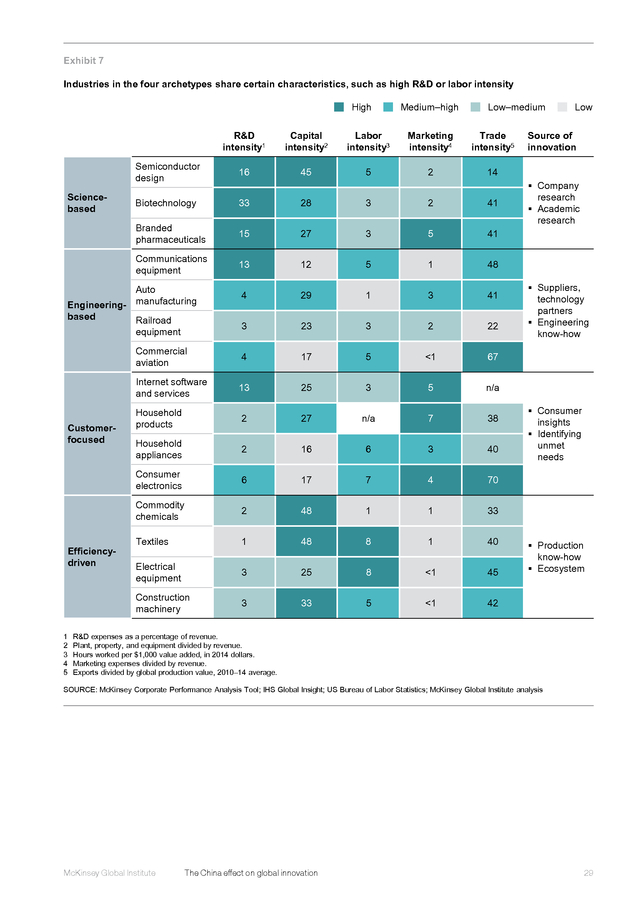

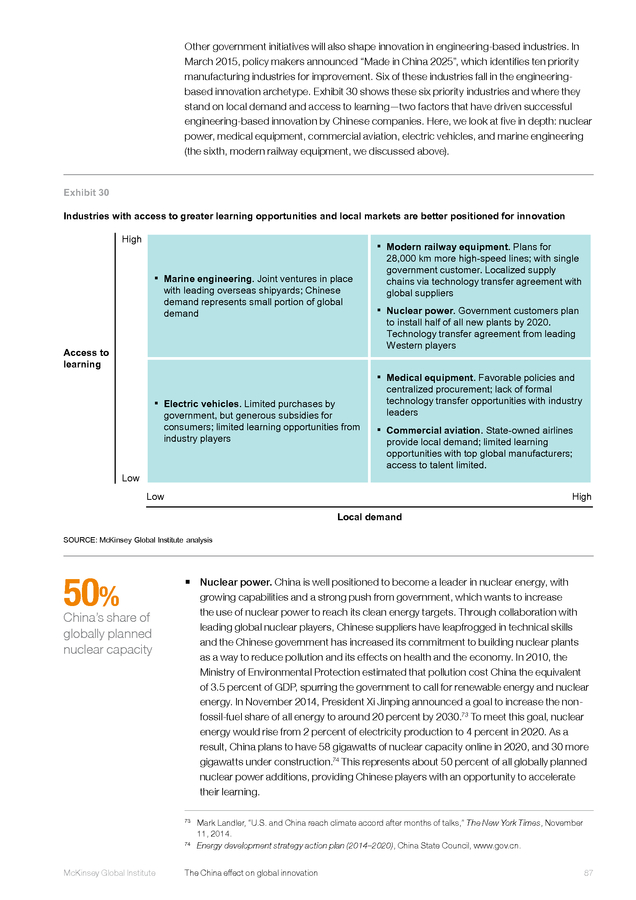

To reach the growth target of 5.5 to 6.5 percent per year (the current consensus view from five leading economic institutions), multifactor productivity growth will need to contribute 35 to 50 percent of GDP growth, or two to three percentage points per year of GDP (Exhibit E1).2 Improving innovation performance would have additional benefits—helping China’s transition to a more balanced, consumption-driven economy by expanding the service sector and providing more high value-added jobs. Rising productivity is also critical for creation of the well-paying jobs that can raise living standards and employ a growing urban population. This is based on the incremental capital-output ratio (ICOR), which averaged 3.4 from 1990 to 2010 and stood at 5.4 in 2010 to 2014. 2 Consensus is based on projections from The Economist Intelligence Unit, IHS Global Insight, the International Monetary Fund, the Oxford Economics Forecast, and the World Bank. 1 2 McKinsey Global Institute Executive summary . Exhibit E1 Innovation (broadly defined) can contribute 2 to 3 percentage points of GDP growth in China by 2025, accounting for 35 to 50 percent of total GDP growth Real GDP growth % Residual (innovation/multifactor productivity) Factors of production 10.4 10.5 9.3 5.0 Multifactor productivity1 4.2 4.0 8.0 2.4 5.5–6.5 Energy supply Employment 0.9 1.1 1.0 Fixed capital 2.3 0.5 0.2 4.2 3.2 3.7 1.8 2.0–3.0 0.3 1.0 0.1 3.5 2.3 1980–90 Multifactor productivity share of GDP growth (%) 1990–2000 2000–10 2010–14 2015E–2025E2 43 48 40 30 35–50 1 Calculated as total GDP growth minus three factors of production (energy, labor, and capital), multifactor productivity broadly measures the impact of innovation on the economy. 2 Baseline GDP estimate developed by regressing more than 100 variables from historical trends, assuming no major economic shocks. Key variables include demographic change, unemployment rate, interest rate, factor cost changes, depreciation, inflation, and urbanization rate. NOTE: Numbers may not sum due to rounding. SOURCE: McKinsey Global Institute analysis REPEATS as exh 1 China innovation Executive summary 1012 mc McKinsey Global Institute The China effect on global innovation 3 . HOW INNOVATION HAPPENS: FOUR DIFFERENT ARCHETYPES To develop a view of the impact of innovation, we identify four archetypes of innovation: customer-focused, efficiency-driven, engineering-based, and science-based. We believe the archetype-based analysis produces a more nuanced picture of innovation performance than national-level metrics and provides more useful insights on which to base company strategies and public policy. We gauge the success of innovation in industries in these archetypes by metrics such as the share of global revenue and profits and the share of global exports that companies have achieved. Industries that fall into the four archetypes innovate in very different ways. Household appliance and smartphone manufacturing and Internet services fall into our customerfocused archetype.

For these businesses, innovation involves identifying and addressing customer needs to develop new products, services, and business models—then using market feedback for frequent modifications and updates. Efficiency-driven innovation involves improving processes in production, product design, and supplychain management to reduce cost and accelerate time to market. In engineering-based industries such as autos and aerospace, companies innovate by solving engineering problems using accumulated know-how and integrating technologies from suppliers and partners—to engineer cars for better fuel economy, for example.

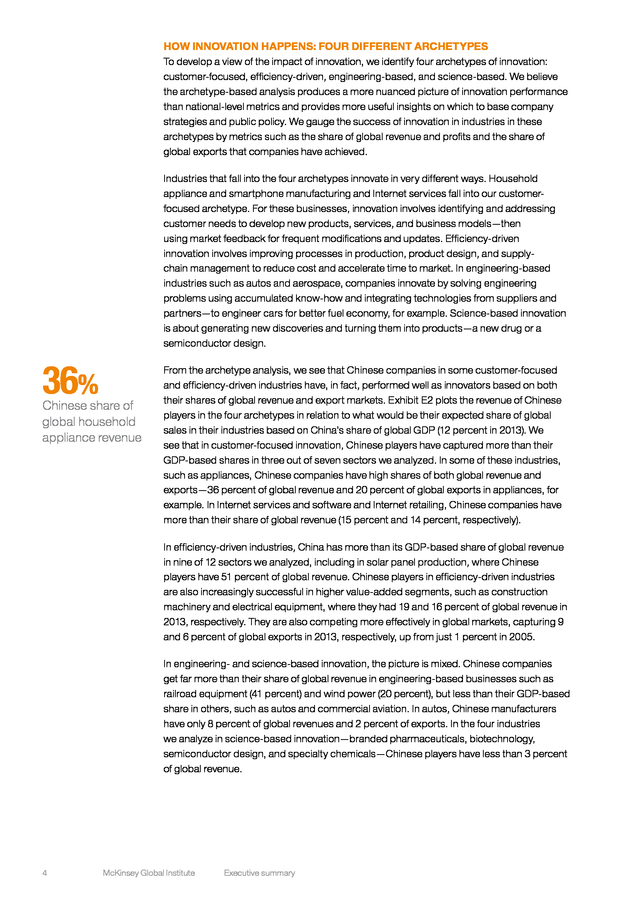

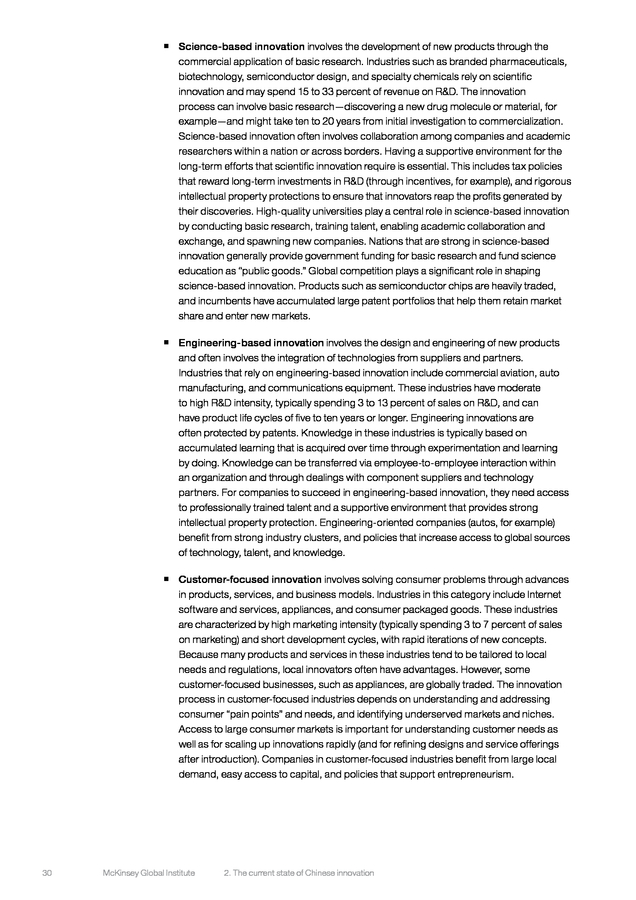

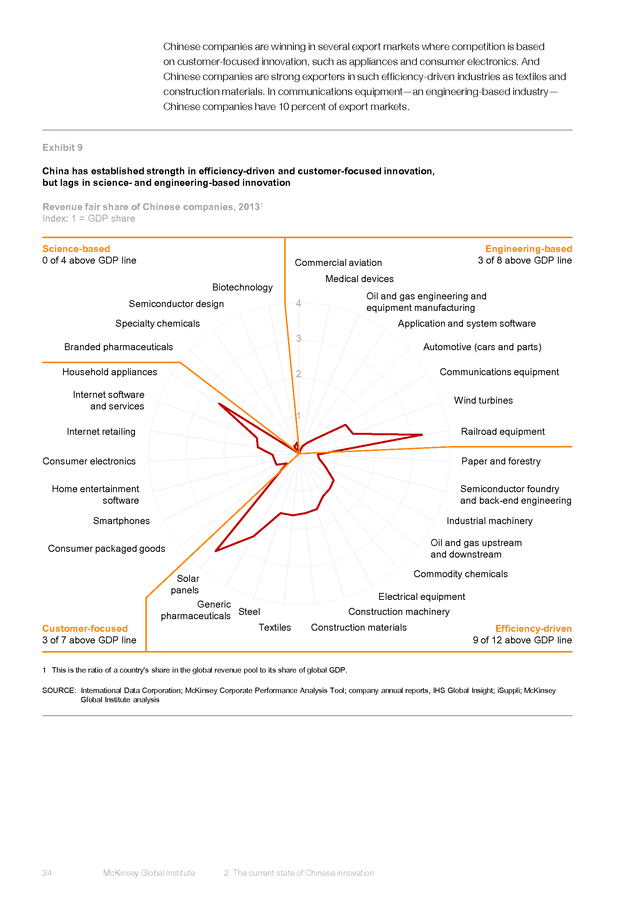

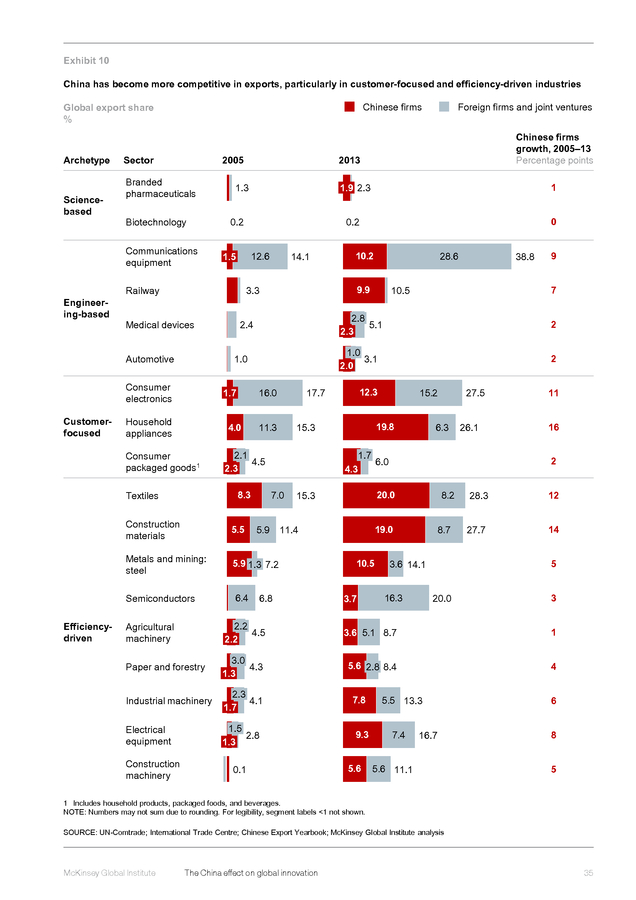

Science-based innovation is about generating new discoveries and turning them into products—a new drug or a semiconductor design. 36% Chinese share of global household appliance revenue From the archetype analysis, we see that Chinese companies in some customer-focused and efficiency-driven industries have, in fact, performed well as innovators based on both their shares of global revenue and export markets. Exhibit E2 plots the revenue of Chinese players in the four archetypes in relation to what would be their expected share of global sales in their industries based on China’s share of global GDP (12 percent in 2013). We see that in customer-focused innovation, Chinese players have captured more than their GDP-based shares in three out of seven sectors we analyzed.

In some of these industries, such as appliances, Chinese companies have high shares of both global revenue and exports—36 percent of global revenue and 20 percent of global exports in appliances, for example. In Internet services and software and Internet retailing, Chinese companies have more than their share of global revenue (15 percent and 14 percent, respectively). In efficiency-driven industries, China has more than its GDP-based share of global revenue in nine of 12 sectors we analyzed, including in solar panel production, where Chinese players have 51 percent of global revenue. Chinese players in efficiency-driven industries are also increasingly successful in higher value-added segments, such as construction machinery and electrical equipment, where they had 19 and 16 percent of global revenue in 2013, respectively.

They are also competing more effectively in global markets, capturing 9 and 6 percent of global exports in 2013, respectively, up from just 1 percent in 2005. In engineering- and science-based innovation, the picture is mixed. Chinese companies get far more than their share of global revenue in engineering-based businesses such as railroad equipment (41 percent) and wind power (20 percent), but less than their GDP-based share in others, such as autos and commercial aviation. In autos, Chinese manufacturers have only 8 percent of global revenues and 2 percent of exports.

In the four industries we analyze in science-based innovation—branded pharmaceuticals, biotechnology, semiconductor design, and specialty chemicals—Chinese players have less than 3 percent of global revenue. 4 McKinsey Global Institute Executive summary . Exhibit E2 China has established strength in efficiency-driven and customer-focused innovation, but lags in science- and engineering-based innovation Revenue fair share of Chinese companies, 20131 Index: 1 = GDP share Science-based 0 of 4 above GDP line Engineering-based 3 of 8 above GDP line Commercial aviation Medical devices Biotechnology Semiconductor design Oil and gas engineering and equipment manufacturing 4 Specialty chemicals Branded pharmaceuticals Household appliances Application and system software 3 Automotive (cars and parts) Communications equipment 2 Internet software and services Wind turbines 1 Railroad equipment Internet retailing Consumer electronics Paper and forestry Semiconductor foundry and back-end engineering Home entertainment software Industrial machinery Smartphones Oil and gas upstream and downstream Consumer packaged goods Customer-focused 3 of 7 above GDP line Solar panels Generic pharmaceuticals Steel Textiles Commodity chemicals Electrical equipment Construction machinery Construction materials Efficiency-driven 9 of 12 above GDP line 1 This is the ratio of a country's share in the global revenue pool to its share of global GDP. SOURCE: International Data Corporation; McKinsey Corporate Performance Analysis Tool; company annual reports, IHS Global Insight; iSuppli; McKinsey Global Institute analysis REPEATS as exh 9 McKinsey Global Institute The China effect on global innovation 5 . HOW CHINESE COMPANIES ARE INNOVATING TODAY AND HOW INNOVATION IS EVOLVING Looking at innovation across the Chinese economy, we see not only that companies in certain archetype industries are doing better than others, but we also see that their success often relies on their ability to take advantage of certain characteristics of the Chinese economy. Internet services and other constituents of our customer-focused archetype, for example, benefit enormously from the sheer size of China’s consumer market, which enables rapid and large-scale commercialization of new ideas. Indeed, in China, a niche market such as online gaming is bigger than a major industry such as autos in other countries. For industries that depend on efficiency-driven innovation, China’s unique advantage is its extensive manufacturing ecosystem, which provides an unmatched environment for process innovation, with the world’s largest supplier base, a massive manufacturing workforce, and a modern supply-chain infrastructure.

In the engineering-based group, government policy has played an important role—accelerating innovation by creating local demand in high-speed rail and wind power, for example. And while the massive government push to raise research and development (R&D) spending, train more scientists, and file for more patents has not yet led to leadership in sciencebased innovation, we see that Chinese companies are taking advantage of China’s unique characteristics to catch up. In biotech, for example, companies are using massive scale to speed up the process of drug discovery. Here we look at the state of Chinese innovation in the four archetypes and consider what’s next for innovation for players in each archetype industry. 200M+ Mainstream consumer households by 2025 Customer-focused innovation: The Chinese commercialization machine As China’s consuming class has grown (it now numbers more than 100 million households and is expected to reach more than 200 million by 2025), Chinese companies have learned to read the needs of a rapidly urbanizing nation and quickly scale up new products and services to meet those needs.3 The first wave of customer-focused innovators were manufacturers of appliances and other household goods whose innovations were “good enough” products—refrigerators or TV sets that had perhaps 80 percent of the features and quality of products made by global players, but that sold for a fraction of the price. Lately, consumer expectations have been rising along with incomes, and for a growing segment, good enough products no longer suffice.

Now companies such as Xiaomi are responding with “cheaper and better” products that are intended to be as good as the models of global brands but are still priced for the Chinese market (Exhibit E3). Xiaomi also exemplifies another trait of customer-focused innovators in China—it uses consumers as collaborators in innovation. Chinese consumers are willing to buy 1.0 versions of products and give feedback that helps manufacturers (or service providers) refine their offerings. Xiaomi relies on more than one million “fans” who vote online for new features that then appear in weekly software updates. Internet services have been a major source of customer-focused innovation in China.

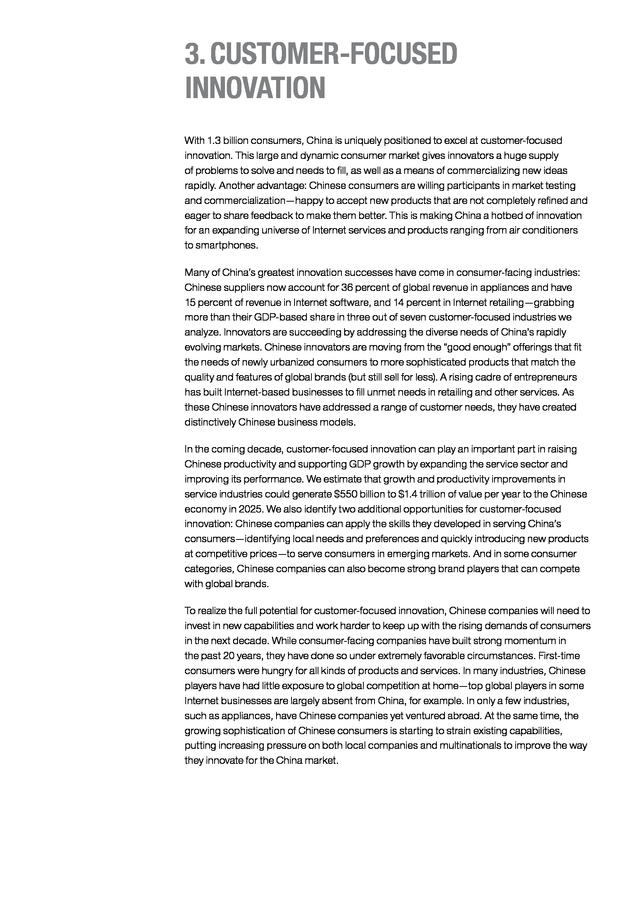

In addition to Alibaba, companies such as Tencent and Baidu have become global leaders in online services simply by serving the Chinese market. These companies have found new ways to meet the needs of the Chinese market. With its online bazaar, for example, Alibaba addressed the need for better retail options for Chinese consumers, particularly those residing in smaller cities and rural areas.

Among its innovations to make the online market work in China was Alipay, a service that holds vendor payments in escrow until goods are delivered. Tencent has built a very different model than other social media platforms use for monetizing traffic to its sites. Rather than depending on advertising, which is a relatively We define the mainstream consuming class as households with disposable annual income of 103,000 to 222,000 renminbi ($16,000 to $34,000). 3 6 McKinsey Global Institute Executive summary .

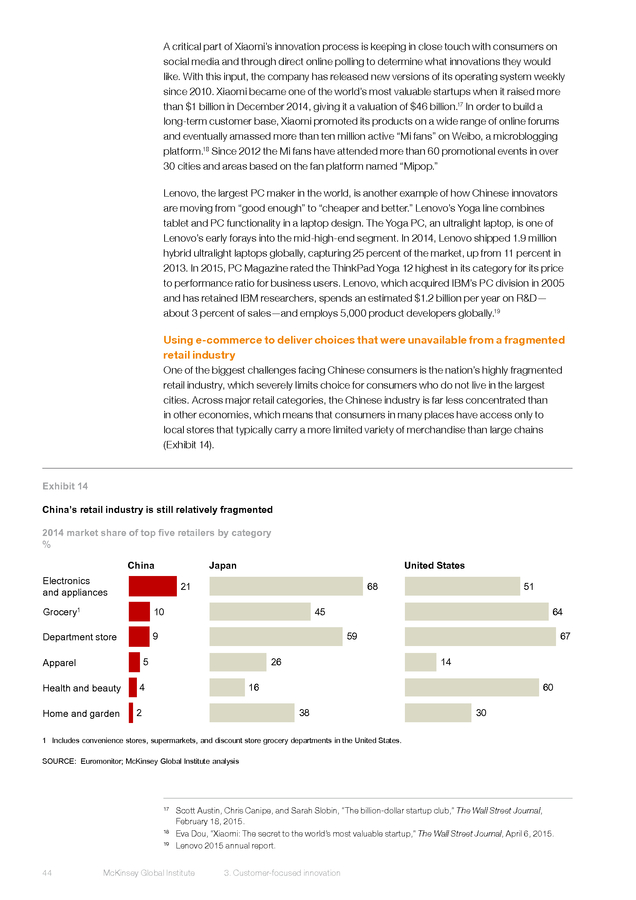

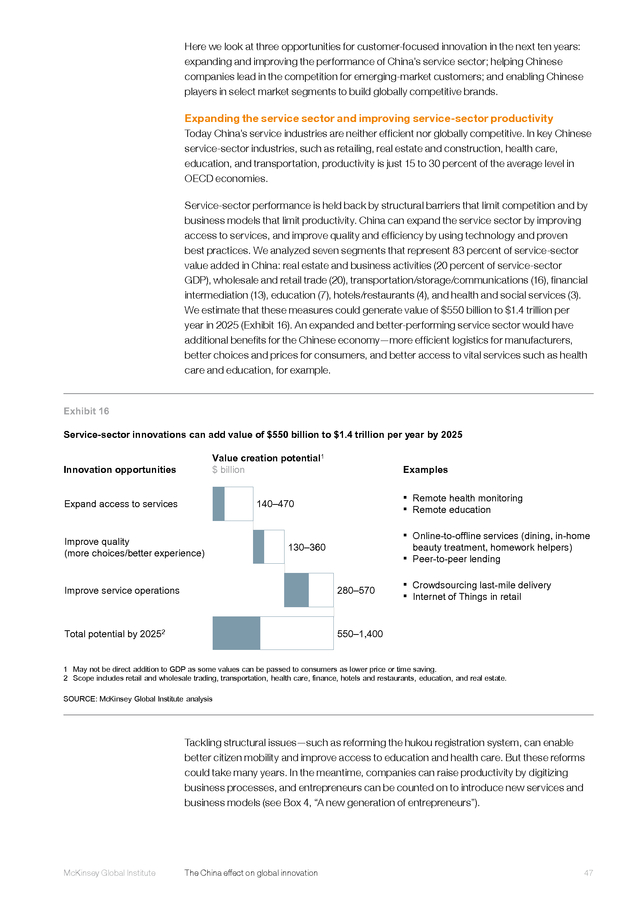

small business in China, Tencent makes 90 percent of its revenue from sales of virtual goods to online gamers, payments, and e‑commerce. In 2014, this innovative business model allowed the company to generate $6 more revenue per user than Facebook did. Exhibit E3 “Cheaper and better” innovation is helping Chinese brands gain share in smartphones Average selling price of smartphones in China1 $ Chinese brand market share % 320 80 300 70 280 60 260 50 240 40 220 30 200 20 180 10 160 0 2008 09 10 11 12 13 2014 1 Real value, using 2013 constant prices. SOURCE: International Data Corporation; Euromonitor; McKinsey Global Institute analysis $550B– 1.4T Potential value per year from service sector innovations by 2025 In the coming decade, we see an enormous opportunity for customer-focused innovation to reshape large swaths of China’s service sector, where productivity is just 15 to 30 percent of the average for service businesses across Organisation for Economic Co-operation and Development (OECD) economies. The government is pushing modernization of traditional businesses through the “Internet Plus” initiative announced in March 2015. Innovations are needed to expand access to services (through remote health monitoring using Internet of Things technology, for example), improve quality (more choices and better customer experiences), and optimize operations (higher asset utilization).

We expect more platforms and apps to connect online consumers to services in the physical world (cab hailing via smartphone, for example). We estimate that innovation in service-sector businesses could generate value of $550 billion to $1.4 trillion per year by 2025, equivalent to 11 to 29 percent of service-sector growth. These innovations would not only raise Chinese productivity, but growing the service sector would also help make the economy more consumption-driven, while also benefiting consumers with better services, greater convenience, and lower cost. REPEATS as exh 13 Another opportunity for Chinese companies is to use their skills in customer-focused innovation to take the lead in emerging markets.

The experience of Chinese consumer goods suppliers in their home market and China’s cost advantages give these companies a potential edge over other global players in defining and meeting the needs of new middle- and low-income consumers in developing economies. In Myanmar, Huawei already dominates the mobile phone market with a 50 percent share, and in Brazil, Midea has almost 35 percent of the air conditioner market. There are many similar opportunities in emerging markets for Chinese players—if they can build the sales and marketing skills to turn innovation into market share. McKinsey Global Institute The China effect on global innovation 7 .

To achieve the potential growth in customer-focused industries in the next ten years, companies will need to build new capabilities. For the most part, Chinese companies have enjoyed unusually favorable circumstances—serving rising domestic demand from a rapidly expanding consuming class and, in many industries, facing no foreign competition. As Chinese consumers become more demanding, more markets open, and Chinese companies compete abroad, success in customer-driven innovation will be more difficult. Efficiency-driven innovation: The ecosystem advantage In becoming the “factory to the world,” China also became a leading innovator in efficiencydriven innovation. No longer simply a source of low-cost labor, Chinese manufacturing companies are gaining in knowledge-intensive manufacturing categories such as electrical equipment (16 percent of global revenue and 9 percent of global exports) and construction equipment (19 percent of revenue and 6 percent of exports). This progress has been enabled by the vast scale of China’s manufacturing ecosystem.

China has more than five times the supplier base of Japan, 150 million factory workers, and modern transportation. The combination of supply-chain advantages from this ecosystem and large scale gives Chinese solar panel manufacturers a cost advantage of 22 cents per watt, or about 15 to 20 percent, over foreign peers, according to a Massachusetts Institute of Technology study.4 Chinese companies are driving efficiency in a variety of ways, including agile manufacturing, modular design, and a flexible approach to automation. Everstar, an apparel manufacturer, has invested in automated equipment and online design and e‑commerce systems that allow consumers to customize clothing and receive finished goods within 72 hours. Modularization saves money by breaking products down into subassemblies. This approach is even being used to industrialize construction.

Broad Construction assembled a 57-story hotel in Changsha in 19 days from prefabricated components to demonstrate its innovations. And, while China has become the number one purchaser of robots, companies such as Chint, a maker of electrical equipment, have found that semiautomation—selectively mixing robots and other machinery with labor—provides greater efficiency and flexibility than full automation. An important development in efficiency-driven innovation is the evolution of open manufacturing platforms. The “maker” movement has taken off in China, and the ecosystem that supports individuals and small entrepreneurs can also work on a global scale.

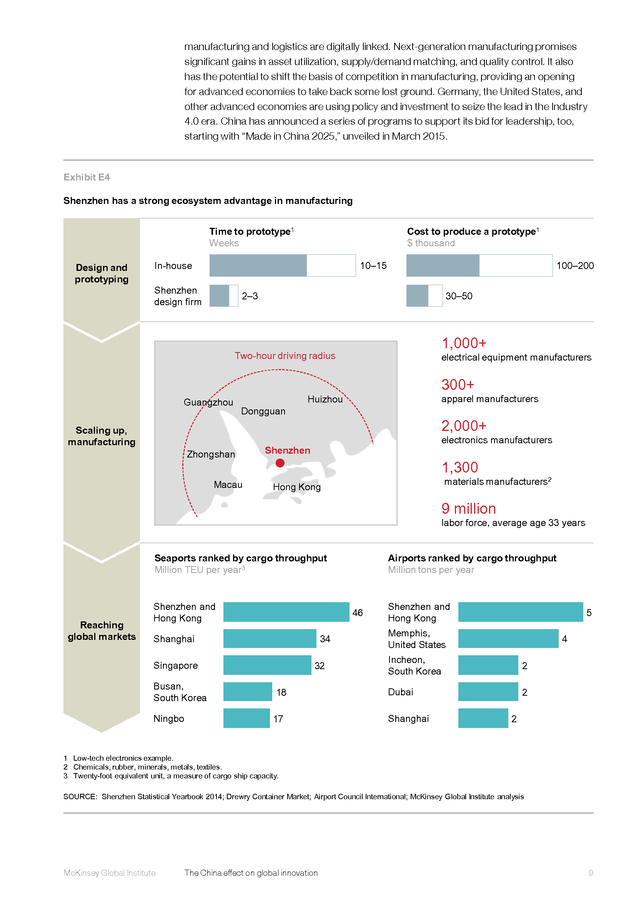

In Shenzhen, a network of component suppliers, design services, business incubators, and outsourced assembly capacity is enabling rapid prototyping and scaling up of manufacturing businesses. HAX Accelerator operates incubators in Shenzhen and San Francisco and brings startup teams from around the world to Shenzhen when they are ready for prototyping. Open manufacturing platforms are made possible by the rich Chinese manufacturing ecosystem, which is exemplified by Shenzhen itself. The city has 2,000 electronic component and product manufacturers, more than 1,000 makers of electrical parts and equipment, 300 apparel makers, and a labor force of nine million (Exhibit E4).

Design firms in Shenzhen can turn ideas into prototypes in as little as one-fifth the time and at half the cost for doing such work in-house. The city’s modern infrastructure then speeds goods to world markets. Chinese companies will have to innovate in new ways to retain China’s lead in manufacturing. Not only are rising wages in China making it a less competitive site for labor-intensive work such as low-end apparel manufacturing, but there is also a worldwide shift in the manufacturing sector to the “Industry 4.0” model in which major processes of 4 8 Alan C.

Goodrich et al., “Assessing the drivers of regional trends in solar PV manufacturing,” Energy & Environmental Science, issue 10, October 2013. McKinsey Global Institute Executive summary . manufacturing and logistics are digitally linked. Next-generation manufacturing promises significant gains in asset utilization, supply/demand matching, and quality control. It also has the potential to shift the basis of competition in manufacturing, providing an opening for advanced economies to take back some lost ground. Germany, the United States, and other advanced economies are using policy and investment to seize the lead in the Industry 4.0 era.

China has announced a series of programs to support its bid for leadership, too, starting with “Made in China 2025,” unveiled in March 2015. Exhibit E4 Shenzhen has a strong ecosystem advantage in manufacturing Time to prototype1 Weeks Design and prototyping Cost to produce a prototype1 $ thousand In-house 10–15 Shenzhen design firm 100–200 2–3 30–50 1,000+ Two-hour driving radius Guangzhou Scaling up, manufacturing Dongguan Zhongshan Macau electrical equipment manufacturers 300+ apparel manufacturers Huizhou 2,000+ electronics manufacturers Shenzhen 1,300 materials manufacturers2 Hong Kong 9 million labor force, average age 33 years Airports ranked by cargo throughput Million tons per year Seaports ranked by cargo throughput Million TEU per year3 Reaching global markets Shenzhen and Hong Kong 46 Shanghai 34 Singapore Busan, South Korea Ningbo 32 18 17 Shenzhen and Hong Kong 5 Memphis, United States 4 Incheon, South Korea 2 Dubai 2 Shanghai 2 1 Low-tech electronics example. 2 Chemicals, rubber, minerals, metals, textiles. 3 Twenty-foot equivalent unit, a measure of cargo ship capacity. SOURCE: Shenzhen Statistical Yearbook 2014; Drewry Container Market; Airport Council International; McKinsey Global Institute analysis McKinsey Global Institute The China effect on global innovation REPEATS as exh 23 9 . $450B– 780B Potential annual value of nextgeneration manufacturing approaches in 2025 As Chinese companies move to the next-generation manufacturing model, the nation’s manufacturing ecosystem can provide additional advantages—extending benefits beyond individual factories and across a digitally linked ecosystem that can enable a new level of rapid, flexible manufacturing, and mass customization. With a massive supplier base, factories can be adapted to many types of manufacturing, modern logistics, and digital links to customers around the world. Chinese companies can become virtual manufacturing resources, offering manufacturing as a service to companies around the world and even filling custom orders for individual consumers. We estimate that if China can prevail in the Industry 4.0 era, manufacturing could create value of $450 billion to $780 billion per year in 2025, equivalent to 12 to 22 percent of GDP growth in manufacturing by 2025. Engineering-based innovation: Succeeding in “learning” industries Engineering-based innovation is part science, part art, and it almost always requires deep experience and learning.

For developing economies that are trying to catch up with global competitors in engineering-based industries such as autos, high-speed rail, and wind turbines, gaining knowledge and experience is critical. China has had mixed success in engineering-based innovation. The best performers have been in markets where government has supported an infant industry by providing local demand, while also facilitating technology transfer agreements with foreign partners.

This formula has been used most successfully in high-speed rail, where China now has 41 percent of the global market, as well as in wind power (20 percent) and communications equipment (18 percent). Learning and innovation have been slower in automotive manufacturing, where exploding demand and strong profits from joint ventures have limited the need for stateowned enterprises to learn and innovate. Chinese automakers have relied on platforms contributed by their global partners or designs that they have commissioned from outside design firms to get products to market more rapidly.

As a result, even though China has become the world’s largest car market, Chinese companies have only an 8 percent share of global revenue. Chinese companies that have succeeded in engineering-based innovation have acquired the knowledge they need in a variety of ways. In wind power, for example, the government’s Wind Power Concession Project, launched in 2003, sparked a massive investment in wind generation and a rapid transfer of knowledge to Chinese players. The plan required 50 percent local content, which led foreign suppliers to establish joint-venture plants in China.

This helped spread knowledge. In high-speed rail, the Ministry of Railways launched a 3 billion renminbi ($470 million5) program in 2008 to develop a new generation of highspeed trains. The Chinese high-speed rail initiative has driven 86 percent of global growth in the market since 2008, while technology transfers from overseas partners have helped Chinese companies build the knowledge to innovate on their own.

The CRH380, the first locomotive designed by the Chinese industry, has a top speed of 380 km/hour. Telecom equipment maker Huawei set out to systematically acquire “end-to-end” engineering knowledge when it realized that its foreign partners were not likely to share cutting-edge technology. Through a painful trial-and-error process, Huawei began creating increasingly sophisticated designs of its own; it spends 12 percent of revenue on R&D and operates 19 innovation centers around the world with joint-venture partners. In the next ten years, Chinese players are likely to catch up in other forms of engineeringbased innovation. The government has identified several industries for policy support, including nuclear power, medical equipment, and electric vehicles.

Based on recent history, the success of government interventions will depend on two core elements—creating local market demand and ensuring that Chinese companies gain knowledge they need to 5 10 Renminbi to US dollar conversion is for reference. We use average exchange rate in 2014 throughout the report (1 USD = 6.14 RMB). McKinsey Global Institute Executive summary . innovate on their own. Of the targeted industries, nuclear power has progressed furthest on the learning curve, thanks to an ambitious government plan to build 58 gigawatts of capacity by 2020 to help meet the goal of getting 30 percent of energy from renewable sources by 2030. Construction of the Hualong One, China’s Generation III reactor design, is underway and export agreements have already been signed. Progress is also being made in medical equipment. A new crop of players, such as Mindray and United Imaging, are making inroads against foreign suppliers in categories such as CT scanners and MRI machines, thanks in part to government subsidies of hospital purchases of Chinese-made equipment.

Both are strengthening R&D capabilities, and both are pushing into overseas markets. Mindray spends 10 percent of its revenue on R&D and makes 55 percent of its sales outside of China. 30% goal for supply of energy from renewable sources by 2030 Other industries have not had similar opportunities to gain engineering know-how. Commercial aircraft are massively complex—even global leaders are challenged to manage the millions of components that go into a plane—and China’s nascent industry has fallen behind schedule in delivering its first commercial passenger jets. In electric vehicles, the government has invested 37 billion RMB ($6 billion) in research, subsidies, and recharging infrastructure, but electric hybrids and fully electric vehicles (plug-ins) still represent a far smaller share of auto sales in China than in advanced economies.

Barriers include high tariffs on imports and buyer subsidies that apply only to cars produced in China—limiting competition and learning. Science-based innovation: Catching up, using novel Chinese approaches China has made science-based innovation an important priority and has invested substantially in building the institutions and capabilities needed for discovery and invention. Chinese companies are making progress in science-based businesses such as biotechnology, but China is not yet a top global competitor: it has less than a 1 percent share of global revenue in branded pharmaceuticals, 3 percent in biotech, semiconductor design, and specialty chemicals. However, we also find that Chinese companies are taking distinctively Chinese approaches to speeding up science innovation. In our research we identify a number of reasons for slow progress in science-based innovation, not least of which is that this type of work takes a long time to pay off: it might be 10 to 15 years before an idea moves from a laboratory to a bottle of pills in a hospital dispensary.

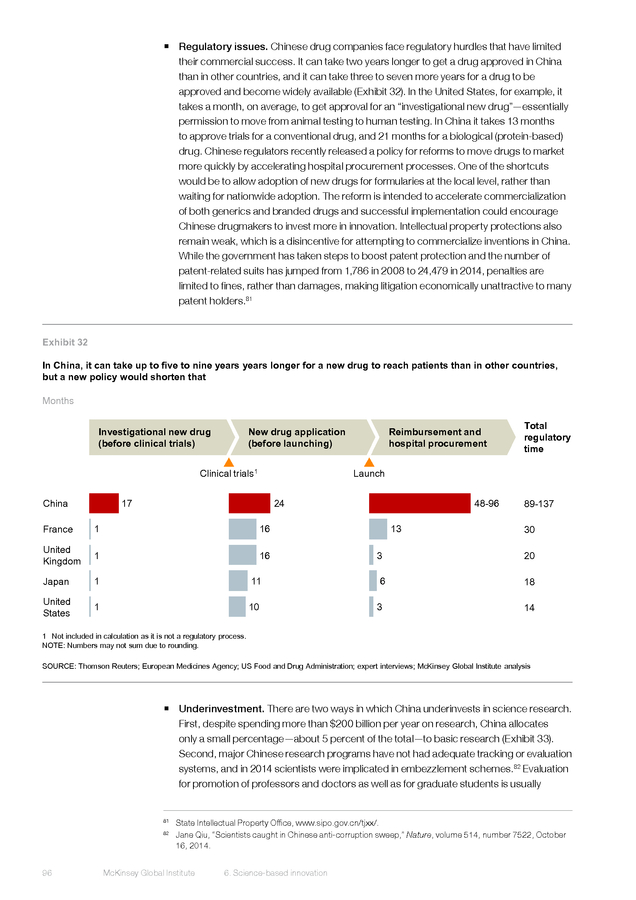

Among the issues that are seen to inhibit science-based innovation in China are slow regulatory processes, questions about intellectual property protection, inefficient allocation of government research funding, and underinvestment by private-sector players. And, despite the large numbers of Chinese students being trained in scientific and technical fields, companies still struggle to find capable talent. The government is addressing some of these obstacles. Reforms to the drug approval process could reduce the time it takes to get a new drug to patients by two years.

Also, efforts such as the Thousand Talents program are helping to bring overseas Chinese scientists home to work in industry and universities and to launch companies. In the meantime, Chinese drug companies are taking innovative approaches to speed up drug development. BeiGene has created an approach to accelerate drug discovery by using a proprietary system to test substances on human tissue (cancerous tumors, for example) to get an early indication of potential issues during human trials. WuXi AppTec, a contract research organization, uses an industrial approach to accelerate drug discovery by deploying massive scale.

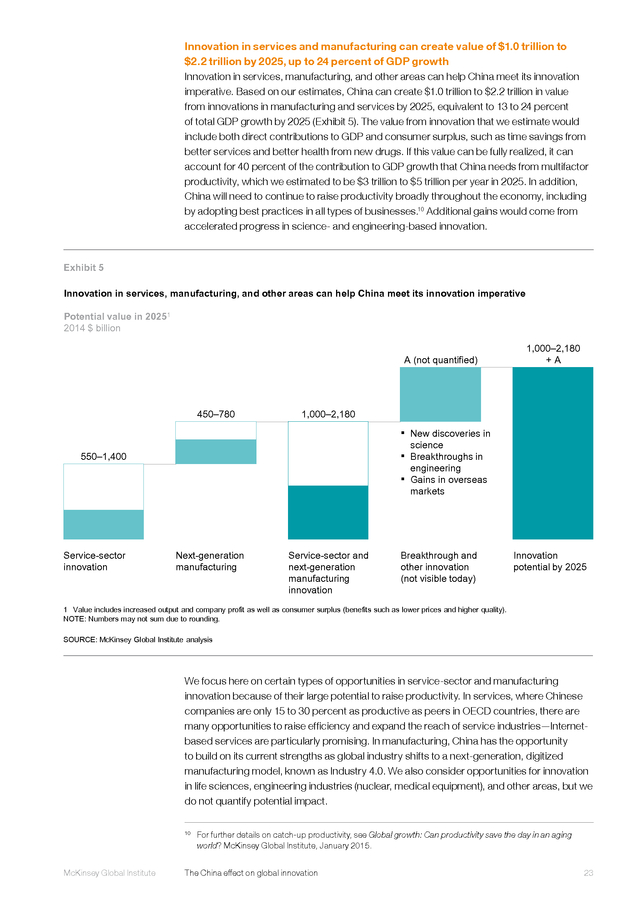

It employs 7,500 researchers and is expanding the scope of its service scope from preclinical testing through clinical trials. In genomics research, BGI, a biotech company, is also using massive scale—more than 2,000 PhDs and more than 200 gene-sequencing machines—to power through science problems. McKinsey Global Institute The China effect on global innovation 11 . THE CHINA EFFECT ON GLOBAL INNOVATION : CHEAPER, FASTER AND GLOBALLY CONNECTED Based on the recent performance of Chinese industries, the investments made to build innovative capacity, and the opportunities for greater innovation success we outline above, we believe that China can not only meet its innovation imperative, but can also emerge as a dominant force in innovation globally. We estimate that progress in service- and manufacturing-sector innovation can contribute $1.0 trillion to $2.2 trillion per year in value to the Chinese economy by 2025. Additional value can arise from innovations in science- and engineering-based innovations, which we do not estimate (Exhibit E5). Equally important, we would expect to see a “China effect” on innovation globally, which could disrupt markets and industries.

China can become a platform for accelerated innovation, not just for Chinese companies, but also for foreign multinationals that want to take advantage of Chinese cost and speed to produce innovations for China, emerging markets, and the world. Moreover, the Chinese model for rapid, low-cost, and nimble innovation can be adapted for use around the world. The overall effect could be accelerated innovation globally, challenges to market leaders from new innovators, and new, lower-cost products and services that fill unmet needs of emerging-market consumers and keep up with the shifting demands of consumers in advanced economies. Exhibit E5 Innovation in services, manufacturing, and other areas can help China meet its innovation imperative Potential value in 20251 2014 $ billion A (not quantified) 450–780 1,000–2,180 +A 1,000–2,180 â–ª New discoveries in 550–1,400 science â–ª Breakthroughs in engineering â–ª Gains in overseas markets Service-sector innovation Next-generation manufacturing Service-sector and next-generation manufacturing innovation Breakthrough and other innovation (not visible today) Innovation potential by 2025 1 Value includes increased output and company profit as well as consumer surplus (benefits such as lower prices and higher quality). NOTE: Numbers may not sum due to rounding. SOURCE: McKinsey Global Institute analysis What companies can do to accelerate innovation in China Companies can start by making a larger commitment to innovation in China.

For foreign companies, this could mean locating more R&D activity in China, as Microsoft has done with the 3,000 scientists and engineers in its Asia-Pacific Research and Development Group in Beijing, which does global research. Or, as Phillips and GE have done, companies might relocate global headquarters of entire business units to China to take advantage of low-cost R&D talent and get closer to Chinese customers. Similarly, Chinese companies can strengthen innovation capabilities by adding R&D facilities in other markets or using overseas R&D joint ventures.

Lenovo executives credit having dual headquarters in Beijing and North Carolina with helping the company achieve global leadership in PC sales. REPEATS as exh 5 12 McKinsey Global Institute Executive summary . Both domestic and foreign companies in China can adopt the rapid development and commercialization processes—“China speed”—that have helped China’s innovation leaders. Chinese companies can speed up innovation by flattening hierarchical organizations and empowering all workers to suggest ideas for products or process improvements. Organizational changes to accelerate decision making and innovation processes in China can also benefit global companies. All companies operating in China can discover new ideas and commercialize them faster by tapping into China’s emerging open innovation ecosystem. Some are already crowdsourcing ideas internally and externally through competitions and incentives. What Chinese policy makers can do to support innovation For Chinese policy makers to support and accelerate innovation, it will be important to continue to craft coordinated, coherent policies that set the conditions for innovation by market competitors. Broadening access to funding for entrepreneurs and small and medium-sized enterprises, for example, can help more Internet innovators commercialize their ideas and more small manufacturers innovate process improvements.

Small manufacturing companies also can benefit from programs that provide free or subsidized training in innovation skills, which countries such as the Netherlands have used. Government can raise the bar for innovation by being a demanding purchaser and as an educator for end consumers. Market creation in high-speed rail and wind-turbine industries certainly helped local innovation, but “guaranteed” markets for local players can impede innovation in the future. Government can raise the bar for innovation by requesting challenging tasks, as the National Health Service in the United Kingdom did with its purchasing policies to encourage innovations in medical products.

At the same time, the government can educate the public to speed the acceptance of innovation. Fuel-economy and energy labeling standards have helped drive innovations in motor vehicles and appliances in advanced economies. Continuing market reforms that open up more areas of the economy to competition will lead to more innovation, too. And reforms to the initial public offering process (simpler and more predictable listing based on clear rules) and stronger intellectual property enforcement can ensure that innovators enjoy the rewards of their labors—and encourage more Chinese to pursue their creative ideas. Finally, in addition to providing enabling infrastructure, government can help make China’s innovation clusters more attractive to top talent.

The success of an innovation cluster depends heavily on the quality of talent it can attract, and top talent can afford to be picky about quality-of-life issues such as housing costs, cultural diversity, and pollution. In these “soft” factors, Chinese cities are currently at a disadvantage. ••• China has reached a point where innovation is no longer a conceptual idea—an aspiration that would reflect the rising power and sophistication of the Chinese economy. In the coming decade, innovation will be a vital tool for China to raise productivity and sustain growth.

Innovation will be key to retaining and extending China’s competitiveness in global markets. At the same time, China can become a global center of innovation and its rapid, nimble approaches could be adopted around the world. A decade from now, the world may acknowledge a “China effect” on innovation. McKinsey Global Institute The China effect on global innovation 13 .

© Alamy . 1. CHINA’S INNOVATION IMPERATIVE As we write this, China is in the midst of a challenging transition. After three decades of rapid growth that has transformed the nation and made China the second-largest economy in the world (by GDP), growth is slowing. The population is aging, and the labor force will soon start to shrink.

Debt has been rising rapidly to fund investment in infrastructure, but returns on fixed asset investment are declining. Therefore, China can no longer count on additions to the labor force and fixed asset investment to sustain GDP growth, even at the more moderate rates (compared with the past 30 years) predicted for the coming decade. Like the United States, Japan, and the mature economies of Europe, China must now rely increasingly on rising productivity to drive GDP growth. This, then, is China’s innovation imperative: to raise productivity sufficiently to make up for the loss of momentum from labor and investment.

China has the potential to complete the evolution from an innovation “sponge” that absorbs knowledge and technologies from abroad to a leader in all forms of innovation (see Box 1, “The challenge to define and measure innovation”). The contribution of innovation (measured as multifactor productivity growth) will need to rise to 35 to 50 percent of GDP, or $3 trillion to $5 trillion, by 2025. Our analysis suggests that China could realize about 40 percent of its innovation imperative through further gains in manufacturing, mostly driven by digitization, and innovation in service industries, particularly the use of the Internet to expand access to services, improve quality, and raise efficiency. The remainder of the productivity growth would come from productivity gains in other industries as well as from innovations in science and engineering. The contribution of multifactor productivity to growth would need to rise to 35 to 50 percent of GDP, or $3 trillion to $5 trillion, by 2025. The innovation imperative is not news to Chinese policy makers.

The government has long recognized the need to expand the economy’s innovative capabilities so that more output will come from higher value-added products and services and more Chinese workers can be employed in high-paying, high value-added work. Government programs have focused on raising R&D spending, training scientists and engineers, and building research institutions. However, these investments have not yet translated into the successfully commercialized innovations that can substantially raise productivity in the economy. Indeed, the growth contribution of multifactor productivity has declined since 2000, despite these investments. For China to reverse that trend and seize the opportunity to lead in global innovation, policy makers should think about policies that enable innovation, rather than continuing to focus on inputs such as numbers of PhDs and patents.

More productive approaches would include ways to increase access to funding for entrepreneurs, ensure that innovators receive their full rewards (by protecting intellectual property, for example), and support innovation clusters These measures are discussed in depth in Chapter 7. . Box 1. The challenge to define and measure innovation Innovation can be defined and quantified in many ways. In 1911, Joseph Schumpeter identified five types of innovation: new products, new methods of production, the exploitation of new markets, new sources of supply, and new methods of organizing business.1 Since that time, other researchers have introduced different approaches. Clayton Christensen of Harvard University has focused on the nature of the innovation, looking at whether innovation is sustaining (new models, for example) or disruptive (advances that can displace established players).2 Similarly, there is no single best way to measure innovation.

One challenge is simply identifying whether something is an innovation: must it be truly novel, or can it be an incremental change? Another challenge is obtaining data that enable standardized comparisons across economies. As a result, innovation at the national level is often measured by inputs and intermediate outputs—the number of patents or PhDs an economy produces every year, for example— rather than actual impact. In this report, we apply a broad definition of innovation, encompassing both “frontier” and “incremental” innovation. We define frontier innovation as the implementation of substantially new products, processes, or business models to solve problems for customers and create new value, while incremental innovation refers to smaller improvements.

In developing economies, there are also catch-up activities, which involve the absorption and adoption of existing technologies or approaches for local applications—such as adapting cars or mobile phones to meet the needs of consumers in emerging markets.3 The way an economy innovates changes over time as developing economies evolve from adapters and incremental innovators to frontier innovators. To assess the impact of innovation, we look at both national and firm-level data. At the national level, we use multifactor productivity as a proxy for innovation. Multifactor productivity measures the growth of the economy that is not explained by the addition of more inputs.

It is often the result of the new technologies, better processes, and greater know-how associated with innovation. We assess innovation at the firm level by looking at such metrics as a share of global industry revenue, profits, and exports. We believe these metrics capture the impact of innovation; ultimately, the proof of successful innovation is the ability of companies to expand revenue and raise profits with new products and services and with improvements in design, manufacturing, or business models.

Competitiveness of companies can be affected by noninnovation factors such as industry structure and factor costs, but we believe innovation is a primary contributor to revenue and profit growth.4 Joseph A. Schumpeter, The theory of economic development: an inquiry into profits, capital, credit, interest, and the business cycle, Transaction Books, 1983 (translated from the original German, Theorie der wirtschaftlichen Entwicklung, 1911, by Redvers Opie). 2 Clayton M. Christensen and Michael E.

Raynor, The innovator’s solution: Creating and sustaining successful growth, Harvard Business School Press, 2003. 3 Chris Freeman and Luc Soete, The economics of industrial innovation, 3rd ed., MIT Press, 1997. 4 For further reading on innovation’s impact on competitiveness, also see Michael Porter, “The competitive advantage of nations,” Harvard Business Review, March-April 1990, and John Cantwell, “Innovation and competitiveness,” in The Oxford handbook of innovation, Jan Fagerberg, David C. Mowery, and Richard R. Nelson, eds., Oxford University Press, 2006. 1 16 McKinsey Global Institute 1.

China’s innovation imperative . AN ECONOMY IN TRANSITION: WHY THE INNOVATION IMPERATIVE IS INCREASINGLY URGENT After 30 years of record-setting growth—GDP rose by 9.7 percent on average from 1985 to 2014—China is transitioning. Growth is moderating, and the economy is evolving to a more consumption-driven model, in which more GDP and employment will come from services. At the same time, the forces that have driven GDP growth in the past—a constant surge of workers into the labor force and massive investments in fixed assets such as infrastructure— are losing their power. Today, the labor force is no longer expanding because China’s population is aging and returns on fixed asset investments have declined. After labor and investment, the only other major source of growth for the economy is productivity improvement, which is why the innovation imperative grows more urgent. However, the contribution to growth from multifactor productivity in China (our key metric of the impact of innovation at the macroeconomic level) has been declining.6 From 1990 to 2000, multifactor productivity contributed nearly half of GDP growth. But in the past five years, its share dropped to 30 percent, or about 2.4 percentage points of GDP per year, which is the lowest level in 35 years.

To make up for the loss of momentum from labor and investment and maintain GDP growth of 5.5 to 6.5 percent per year through 2025, productivity growth will need to contribute 35 to 50 percent of GDP growth, or two to three percentage points per year (Exhibit 1). Rising productivity is also essential for creating the high value-added jobs that will be needed to sustain rising living standards and employ a growing urban population. 61% Share of population that is working age (vs. 72% now) Aging will reduce China’s labor force China’s large population has been an asset in its economic ascent, providing a constant supply of labor as the nation has urbanized and industrialized.

In the past three decades, hundreds of millions of people migrated to cities and took up more productive work. Urbanization itself became a driver of growth. However, China’s population is aging rapidly, and population growth is slowing. The share of the population over the age of 65 is expected to increase from 9 percent in 2015 to 25 percent in 2050, while the share of the population of prime working age (15 to 64) is expected to fall to 61 percent from 72 percent today.

As early as 2016, the Chinese labor force is expected to peak and then begin a long decline that could reduce its size by 16 percent by 2050. China’s dependency ratio—the population that is not in the labor force (mostly the elderly and children) divided by the workingage population—is projected to reach 43 percent in 2020 and 47 percent by 2030 (and 63 percent by 2050), up from about 38 percent today. Returns on fixed asset investment are declining Along with labor, investments in fixed assets have been critical to the rapid growth of the Chinese economy over the past 30 years. Capital investment, often funded with debt, went into factories, highways, transit systems, airports, and other assets.

In the past ten years, China has channeled nearly $40 trillion into fixed asset investments, including $10 trillion in real estate and another $10 trillion in infrastructure, accounting for 45 to 50 percent of total GDP. These investments drove demand across the economy and created jobs. However, today China has reached a point of diminishing returns on such investments. Returns on investment in fixed assets, as measured by the incremental capital-output ratio (ICOR) have declined. From 1990 to 2010, the ratio was 3.4, meaning that 3.4 units of investment were needed for every unit of GDP.

Since 2010, that ratio has risen to 5.4, meaning that it takes 60 percent more capital to generate a unit of GDP in China today. On that trajectory, by 2030, China’s ratio could be 17 percent higher than the current ratio 6 McKinsey Global Institute On the macroeconomic level, we use multifactor productivity as a proxy for innovation. Multifactor productivity is the incremental growth of the economy that is not explained by the addition of more factors of production. It is often the direct result of innovation in products and services that allow companies to charge more or sell more, or it can be innovations in processes that allow companies to operate more efficiently. The China effect on global innovation 17 . for the other BRIC countries (Brazil, Russia, and India) and near the current level of more advanced economies such as the United States and South Korea (Exhibit 2). Decades of investment have left China with high levels of debt in the private sector and in the funding vehicles used by local governments to pay for infrastructure and housing projects. China’s overall debt ratio jumped from 158 percent of GDP in 2007 to 282 percent of GDP in mid-2014, leaving it with a higher debt burden relative to GDP than the United States or Germany and less borrowing capacity to fund future investment.7 About a third of this new debt is concentrated in real estate and related industries. Exhibit 1 Innovation (broadly defined) can contribute 2 to 3 percentage points of GDP growth in China by 2025, accounting for 35 to 50 percent of total GDP growth Real GDP growth % Residual (innovation/multifactor productivity) Factors of production 10.4 10.5 9.3 Multifactor productivity1 8.0 4.2 5.0 4.0 2.4 5.5–6.5 Energy supply Employment 0.9 1.1 2.3 1.0 0.2 4.2 3.2 Fixed capital 1.8 0.5 2.0–3.0 0.3 1.0 0.1 3.7 3.5 2.3 1980–90 Multifactor productivity share of GDP growth (%) 1990–2000 2000–10 2010–14 2015E–2025E2 43 48 40 30 35–50 1 Calculated as total GDP growth minus three factors of production (energy, labor, and capital), multifactor productivity broadly measures the impact of innovation on the economy. 2 Baseline GDP estimate developed by regressing more than 100 variables from historical trends, assuming no major economic shocks. Key variables include demographic change, unemployment rate, interest rate, factor cost changes, depreciation, inflation, and urbanization rate. NOTE: Numbers may not sum due to rounding. SOURCE: McKinsey Global Institute analysis DUPLICATE of E1 7 18 Debt and (not much) deleveraging, McKinsey Global Institute, February 2015. McKinsey Global Institute 1. China’s innovation imperative . Exhibit 2 Returns on fixed investments in China have declined: it takes 60 percent more capital to produce a unit of GDP growth Capital cost to produce 1 unit of GDP % China Other countries, 2010–14 8.7 8.8 7.6 6.5 5.4 3.4 1990–2010 2010–14 2025–30E BRI(C) United States South Korea SOURCE: IHS Global Insight; McKinsey Global Institute analysis 11% Annual wage increase between 2009 and 2014 Rising wages and urbanization require more high value-added jobs China also will need to find new ways to create higher value-added employment as incomes rise, citizens continue to migrate to cities, and the share of employment in manufacturing declines. From 2009 to 2014, average wages rose by 11 percent per year; in manufacturing they grew by a 12 percent compound annual rate. An estimated 100 million more Chinese are expected to migrate to cities by 2020, and these workers will need employment that can support higher costs of living in China’s cities. It is estimated that China will need to create ten million urban jobs every year to keep up with the growing urban population. Providing high-wage jobs in sufficient numbers is a particular challenge for countries that are transitioning from low- to middle-income status, as China is doing.

As countries grow wealthier, consumption patterns change and more GDP and job growth come from services, while hiring in manufacturing—often a key source of well-paid jobs—slows. Typically, manufacturing employment rises rapidly as economies develop and demand expands for manufactured goods for domestic use and for export. According to our analysis of six advanced economies, manufacturing GDP tends to peak when per capita GDP reaches $7,000 to $10,000 (adjusted for purchasing power parity, using 1999 dollars). At that point, manufacturing typically contributes 35 to 40 percent of GDP and 25 to 35 percent of employment.8 In advanced economies, service sectors generate 60 to 80 percent of GDP and account for up to 80 percent of employment. Today, China is at an early stage of the shift from manufacturing to a more servicebased economy: in 2015, services accounted for just 49 percent of GDP and 40 percent of employment.

The Chinese government’s goal is to raise service-sector output to 55 percent of GDP by 2020. China’s service sector is not only relatively small, but it also has low productivity compared with global norms—15 to 30 percent of the OECD average, depending on the service industry (Exhibit 3). 8 McKinsey Global Institute Manufacturing the future: The next era of global growth and innovation, McKinsey Global Institute, November 2012. The China effect on global innovation 19 . Exhibit 3 China’s services sector is underdeveloped, and has approximately 15 to 30 percent of the productivity of service businesses across the OECD Productivity comparison, 2011 2011 $ thousand (nominal) per employee Wholesale and retail trade Hotels and restaurants Transport 6x 61 OECD average 5x 65 China Factor gap between China and OECD average Real estate and business activities 5x 32 5x 977 Financial intermediation 3x 143 57 12 10 6 203 NOTE: Not to scale. SOURCE: IHS Global Insights; China Bureau of Statistics; World Input-Output Database; McKinsey Global Institute analysis CHINA HAS THE POTENTIAL TO EVOLVE FROM AN INNOVATION SPONGE TO INNOVATION LEADER AND MEET THE INNOVATION IMPERATIVE Innovation already plays a critical role in China’s economy. Like other developing economies, China has been an innovation sponge, absorbing and adapting existing technology and knowledge from around the world. Indeed, China may be the most successful innovation sponge in history, systematically mastering technologies and acquiring know-how as it has industrialized. As a result, over the past three decades, China has come further and industrialized faster than any other economy in history.

In China, industrialization raised GDP per capita to $8,000 from $1,000 in just 30 years—a third of the time it took Japan and about one-sixth of the time it took the United States. In the process, China has lifted more than 400 million people out of poverty and started to climb the global value chain: China ranks second in the world in knowledge-intensive flows—the movement of knowledge-intensive goods and services and foreign direct investment.9 The next step is to progress from innovation sponge to innovation leader. From our sectorbased analysis of innovation in the Chinese economy, which is the focus of Chapter 2, we see that China already has strong positions in industries such as Internet services and appliances, where innovation involves solving consumer problems.

In serving consumer needs, Chinese companies have created a unique innovation model that takes advantage of the size and speed of the Chinese market. China also has had success in efficiency-driven innovation in manufacturing, based on its ecosystem advantages. In engineering-based industries, such as telecommunications equipment and autos, the picture is mixed, and the most progress is needed in science-based innovation.

The government has invested heavily in building capabilities in engineering and science, which have created a strong foundation for future innovation (see Box 2, “China’s innovation policy approach”). 9 20 Global flows in a digital age, McKinsey Global Institute, April 2014. McKinsey Global Institute 1. China’s innovation imperative . Box 2. China’s innovation policy approach Chinese policy makers have long been aware of the innovation imperative and have devoted substantial resources to building capacity for innovation. China’s total investment in R&D has risen from $30 billion in 2005 to more than $200 billion in 2014. That makes China the No.

2 nation for R&D spending (in absolute terms), behind the United States, which spent about $500 billion in 2014. China now spends about 2 percent of GDP on R&D, which is comparable to the level of the Netherlands and the United Kingdom, but below the levels of South Korea (4.4 percent), Japan (3.3 percent), and Austria (2.9 percent). Chinese policy and public investment have built a solid foundation of innovation institutions and talent.

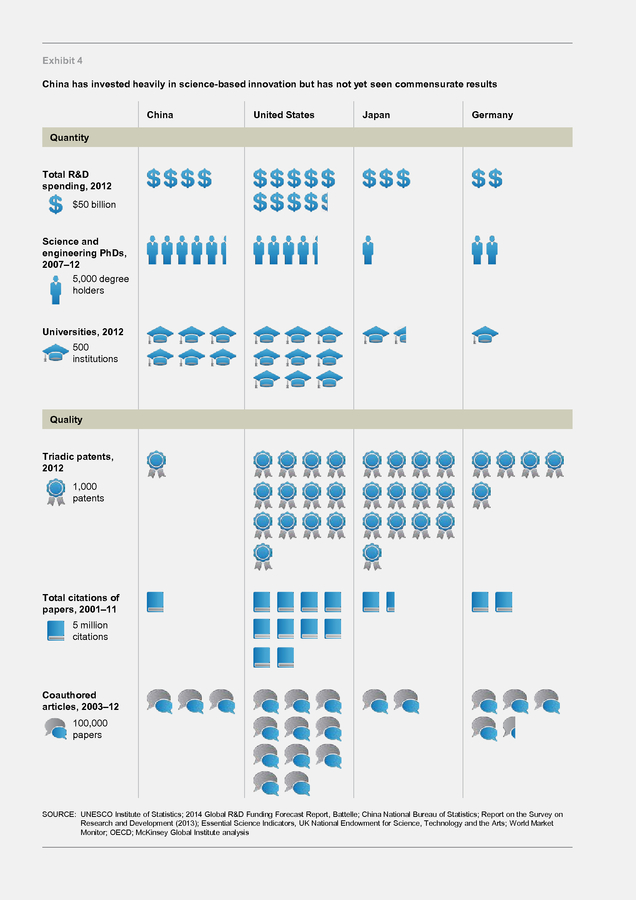

Chinese universities confer 28,700 PhDs in science and engineering per year, the largest number in the world. Chinese researchers published more than 420,000 scientific papers in 2013, second only to the United States. Based on metrics of innovation prowess such as patent awards, the government’s investments should have put China well on its way to becoming a global innovation leader. Yet these input-based approaches have not produced the commercial successes that raise productivity. Moreover, while the magnitude of the effort is impressive, there are some questions about quality (Exhibit 4).

For example, the number of claims per Chinese patent—a widely regarded sign of a patent’s strength—is 30 to 50 percent less than for US patents. Also, only 998 of 650,000 Chinese patents filed in 2012 were triadic, meaning that they were filed in the United States and Japan and with the European Patent Office. Triadic filing is another indicator of patent quality; US and Japanese companies filed more than ten times as many triadic patents as China. The government has continued to expand innovation policies in recent years, such as the “mass entrepreneurship and innovation” initiative, announced by Premier Li Keqiang as a way to counter China’s slowing growth.

The State Council followed with a series of policies to improve the environment for entrepreneurship by offering funding and streamlining administrative processes to lower barriers to starting a business. The moves are aimed at encouraging college students, scientists, and engineers to start new businesses. In March 2015, Li announced the “Internet Plus” plan to boost the economy through digitization. It calls for greater adoption of the mobile Internet, cloud computing, big data, and the Internet of Things to encourage e‑commerce, industrial networks, and Internet banking, and to help Internet companies increase their international presence.

These initiatives could prove very helpful in efforts to raise service-sector productivity by providing the connectivity to make businesses more efficient. The government also has launched a comprehensive blueprint to maintain the nation’s lead in manufacturing. The effort includes three ten-year plans that are expected to culminate in 2049, the centennial of the People’s Republic of China. It is aimed at driving further efficiencies in manufacturing while raising the value added of Chinese manufacturing output by encouraging companies to move into goods such as numerical control machine tools for automation, robotics, and aerospace equipment. Many of these initiatives can be characterized as enablers of innovation and are not focused as intensely on inputs as earlier top-down policies were.

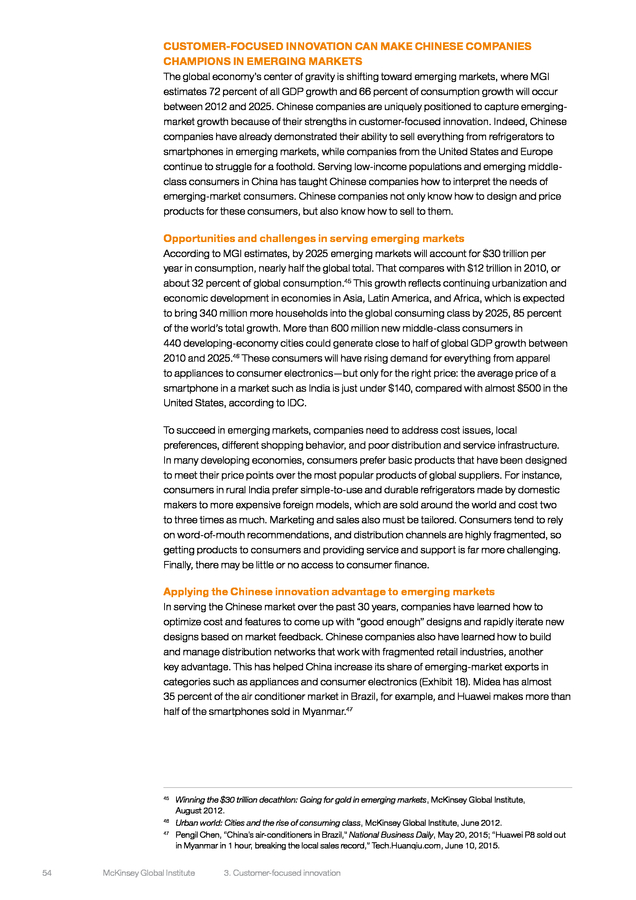

Policies to create enabling infrastructure such as cloud computing and programs to encourage mass innovation and entrepreneurship are aimed at unleashing innovation at the grass roots. In Chapter 7, we discuss additional policy considerations that would clear obstacles to innovation. McKinsey Global Institute The China effect on global innovation 21 . Exhibit 4 China has invested heavily in science-based innovation but has not yet seen commensurate results China United States Japan Germany Quantity Total R&D spending, 2012 $50 billion Science and engineering PhDs, 2007–12 5,000 degree holders Universities, 2012 500 institutions Quality Triadic patents, 2012 1,000 patents Total citations of papers, 2001–11 5 million citations Coauthored articles, 2003–12 100,000 papers SOURCE: UNESCO Institute of Statistics; 2014 Global R&D Funding Forecast Report, Battelle; China National Bureau of Statistics; Report on the Survey on Research and Development (2013); Essential Science Indicators, UK National Endowment for Science, Technology and the Arts; World Market Monitor; OECD; McKinsey Global Institute analysis 22 McKinsey Global Institute 1. China’s innovation imperative . Innovation in services and manufacturing can create value of $1.0 trillion to $2.2 trillion by 2025, up to 24 percent of GDP growth Innovation in services, manufacturing, and other areas can help China meet its innovation imperative. Based on our estimates, China can create $1.0 trillion to $2.2 trillion in value from innovations in manufacturing and services by 2025, equivalent to 13 to 24 percent of total GDP growth by 2025 (Exhibit 5). The value from innovation that we estimate would include both direct contributions to GDP and consumer surplus, such as time savings from better services and better health from new drugs. If this value can be fully realized, it can account for 40 percent of the contribution to GDP growth that China needs from multifactor productivity, which we estimated to be $3 trillion to $5 trillion per year in 2025.