Description

DATE:

April 9, 2015

TO:

MIAX Members

FROM:

MIAX Regulatory Department

RE:

Market Maker Requirements Currently in Effect at MIAX

-----------------------------------------------------------------------------------------------------------------------------The following is a summary of Market Maker quoting requirements and the corresponding

MIAX rule.

MIAX Rule 604 Market Maker Quotations

PLMM Quoting Requirements

ï‚· PLMMs assigned in a particular class must enter a valid width quote within one

minute following the dissemination of a quote or trade by the primary market for the

underlying security.

ï‚· PLMMs must quote Long Term Options (LTO) in assigned classes.

ï‚· There is no opening quoting requirement.

ï‚· There is no adjusted option quoting requirement.

ï‚· There is no intraday add quote requirement (only on the day it is added).

ï‚· PLMMs must quote the lesser of 99% of available series or 100% of series minus one

call/put pair for 90% of trade day.

o Call/put pair definition – same underlying, same expiration date, same strike.

ï‚· Continuous quoting obligations will apply daily to all appointed classes collectively for

each PLMM, rather than on a class-by-class basis per day.

ï‚· Compliance with the continuous quoting obligation will be determined on a monthly

basis.

ï‚· In-the-money options1 can have a bid/ask differential as wide as the quote on the

primary market of the underlying issue.

LMM Quoting Requirements

ï‚· LMMs have no LTO quoting requirement in assigned classes.

ï‚· There is no opening quoting requirement.

ï‚· There is no adjusted option quoting requirement.

ï‚· There is no intraday add quote requirement (only on the day it is added).

1

In the Money is calculated using the underlying stock bid price for puts and the underlying ask price for calls. If

the call strike price is below the underlying ask price or last sale price (whichever is higher) the option is in the

money. If the put strike price is above the underlying bid price or last sale price (whichever is lower) the option is in

the money.

Page 1 of 3

. ï‚·

ï‚·

ï‚·

ï‚·

LMMs must quote a minimum of 90% of available series for 90% of trade day.

Quoting obligations will apply daily to all appointed classes collectively for each LMM,

rather than on a class-by-class basis per day.

Compliance with the continuous quoting obligation will be determined on a monthly

basis.

In-the-money options can have a bid/ask differential as wide as the quote on the

primary market of the underlying issue.

RMM Quoting Requirements

ï‚· RMMs have no LTO quoting requirement in assigned classes.

ï‚· There is no opening quoting requirement.

ï‚· There is no adjusted option quoting requirement.

ï‚· There is no intraday add quote requirement (only on the day it is added).

ï‚· RMMs must quote a minimum of 60% of available series for 90% of trade day.

ï‚· Quoting obligations will apply daily to all appointed classes collectively for each

RMM, rather than on a class-by-class basis per day.

ï‚· RMMs have no Quarterly Option quote requirement.

ï‚· Compliance with the continuous quoting obligation will be determined on a monthly

basis.

ï‚· In-the-money options can have a bid/ask differential as wide as the quote on the

primary market of the underlying issue.

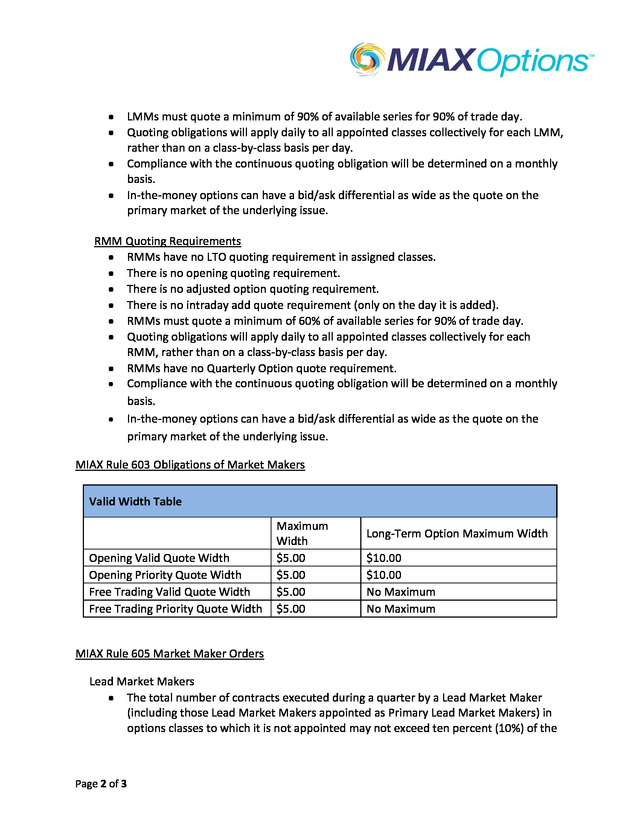

MIAX Rule 603 Obligations of Market Makers

Valid Width Table

Opening Valid Quote Width

Opening Priority Quote Width

Free Trading Valid Quote Width

Free Trading Priority Quote Width

Maximum

Width

$5.00

$5.00

$5.00

$5.00

Long-Term Option Maximum Width

$10.00

$10.00

No Maximum

No Maximum

MIAX Rule 605 Market Maker Orders

Lead Market Makers

ï‚· The total number of contracts executed during a quarter by a Lead Market Maker

(including those Lead Market Makers appointed as Primary Lead Market Makers) in

options classes to which it is not appointed may not exceed ten percent (10%) of the

Page 2 of 3

. total number of contracts traded by such Lead Market Maker in classes to which it is

appointed and with respect to which it was quoting pursuant to Rule 604(e)(1).

Registered Market Makers

ï‚· The total number of contracts executed during a quarter by a Registered Market

Maker in options classes to which it is not appointed may not exceed twenty-five

percent (25%) of the total number of contracts traded by such Registered Market

Maker in classes to which it is appointed and with respect to which it was quoting

pursuant to Rule 604(e) in any calendar quarter.

Please direct questions to the Regulatory Department at Regulatory@miaxoptions.com or 609897-7309.

Page 3 of 3

.