First Eagle Global Value Team - Annual Letter - Shaky Start to 2016 - December 31, 2015

First Eagle Asset Management

Description

Year-End 2015

First Eagle Global Value Team

Annual Letter

Shaky Start to 2016

As we reflect on 2015, we want to begin by acknowledging the market events that

unfolded in the opening weeks of 2016.

Markets started 2016 on a weak note, with the MSCI World Index down 6% in

the first week of January, led by more pronounced weakness in Chinese equities

and a sudden devaluation of the yuan. At First Eagle, we have been highlighting

for some time—through our commentaries and Annual Report—the slowdown

and adjustment risk in China, which has experienced a large-scale capital investment and credit boom, but may in fact be headed for a hard landing.1 We have also

commented on the relatively full valuations of global risk assets—prompted by a

cocktail of high margins and easy policy conditions—that have persisted despite

1 The Caixin Manufacturing Purchasing Managers’ Index has contracted for 10 straight

months and China’s producer price index has hit a multi-year low. Source: Bloomberg

First Eagle Investment Management has approximately $92 billion in assets under management (as of 12/31/2015) and a heritage dating to 1864.

Over its long history, the firm has helped its clients to preserve purchasing power and earn attractive returns through widely varied economic

cycles—a tradition that is central to its mission today. For more information visit www.feim.com.

.

First Eagle Global Value Team the risks posed by a slowdown in emerging markets, rising geopolitical tensions and weakened sovereign balance sheets. In our view, it is healthy to see markets now price in some of this risk, with sectors like energy, commodities and capital goods in more obvious distress. The dynamic in the past year has been one of relatively choppy sideways-moving markets with many individual stocks weakening while a few mostly highly valued companies have done well and supported overall market index levels. This narrow market environment is reminiscent of some of the more challenging environments of the past 15 years, but with broad valuation levels that remain less than compelling. Our cash levels have drifted downward in a measured way as, in periods of market weakness, we have capitalized on bottom-up opportunities one stock at a time. However, we retain what we feel is a reasonable amount of potential ballast in cash, cash equivalents, gold and gold-related investments as we keep a wary eye on macro developments. We don’t know what 2016 will bring—the crystal ball is foggy at best—but we do feel risk perception is at least more palpable today than a year ago. Our approach remains measured and centered on identifying businesses priced below our estimate of their intrinsic value.

Should conditions get more challenging, we are poised to use our liquidity to take advantage of more attractive prices. On the other hand, should the stimulative impact of lower oil prices and sound economic momentum in global services industries lead to more of a muddle-through environment, we are also poised to participate through our existing ownership of enterprise at what we believe are sound prices. We strive to create an all-weather portfolio rather than to predict the market’s zigs and zags. Geopolitical Complexities In 2015 we saw the wholesale reemergence of geopolitical risk. A rising conflict between Shia and Sunni Muslims manifested itself in many ways: strife in Syria, escalating tensions between Saudi Arabia and Iran, conflict between Saudi Arabia and Yemen, growing threats from ISIS, a flood of refugees and emerging terrorism in Europe.

In addition to that, we’ve seen increased assertiveness on the part of the Chinese: corruption purges, naval activities in the South China Sea, allegations of cyber hacking. We’ve also seen increased assertiveness on the part of Russia, not just in Crimea and Ukraine, but also in Syria. Economic Headwinds In the developed world, these geopolitical risks have arisen in a period when government balance sheets are already strained by high levels of debt. As a result, the economic consequence of any global conflagration would be very challenging Page 2 of 8 .

Annual Letter—Year-End 2015 for sovereign finances. Meanwhile, governments’ preferred adjustment process for their excessive sovereign debt remains largely unchanged: a combination of financial repression (keeping interest rates low) and fiscal tightening (but only at the margins). Quantitative easing by central banks has promoted monetary growth and confidence in the financial system and has bolstered economic performance and asset prices, but, in our view, it has also put future profit margins at risk. By accelerating current growth in demand, central banks have likely reduced future growth in demand. Simultaneously, they have stimulated capital spending and growth in supply.

If demand grows sluggishly but supply grows normally, profit margins could well be compressed. And we’ve already seen this kind of margin pressure strike in the oil, commodities and manufacturing sectors of the world economy— sectors that often provide an early warning that ill winds are starting to blow. In our view, the combination of low bond yields, above-average P/E ratios and prospective pressure on earnings growth creates an environment of below-average prospective returns for most securities. We believe a well-balanced index portfolio may deliver, at best, low-single-digit real returns and mid-single-digit nominal returns.

This is well below the annual crediting rates most endowments, foundations and pension funds require in order to preserve the real value of their corpus. The need to dip into real capital to sustain spending may drive some institutions (and individuals) to reduce their spending. This would be a further headwind for economic growth and margins. Furthermore, in contrast to the synchronized policy easing that we saw across the world in the wake of the global financial crisis, we now see divergence. Policy is tightening in the US while China has embarked on a managed weakening of its exchange rate.

Against the backdrop of continued monetary expansion in Europe and Japan, these are new negatives for markets. In addition to this divergence in monetary policy, there remains a latent need for fiscal tightening around the world. The biggest negative in our minds, other than the geopolitical and policy issues we’ve discussed, is the deepening slowdown in China, and the somewhat related crises that we see in Brazil and Russia, as weaker commodity prices exacerbate the effects of inefficient capital spending in their prior booms. These countries, combined, were the largest source of marginal demand growth for most of the past decade, but also the largest source of marginal growth in debt.2 As the Chinese manufacturing economy has slowed, we believe China is likely to ease both monetary and fiscal policy and to let its currency depreciate in a managed way.

However, the negative momentum in Chinese manufacturing and construction markets is meaningful, the problem assets in Chinese banks are still surfacing, and unemployment in China has yet to rise. The Chinese authorities are trying to put multiple fingers in the dike, but the fact is, they’ve been investing far more capital than makes sense. Even if they manage to avoid a crisis, the Chinese economy could be disappointing for some years if the government tries to amortize 2 First Eagle Investment Management/BIS/Haver Page 3 of 8 .

First Eagle Global Value Team the problems across time. Finally, anticorruption purges are paralyzing the senior policymaking apparatus in China at a time when flexibility and policy responsiveness are becoming more important. The biggest positive for the world, in our minds, is lower oil prices, which not only may stimulate economic activity and help raise consumer disposable incomes and savings, but also may put financial brakes on assertive regimes such as Russia, Iran and ISIS. The biggest positive for the world, in our minds, is lower oil prices, which not only may stimulate economic activity and help raise consumer disposable incomes and savings, but also may put financial brakes on assertive regimes such as Russia, Iran and ISIS. Expensive Equities In this global environment of high debt, high margins and high political risk, the prices of risk assets remain, to our minds, pretty full. As we’ve said before, if the world has too much debt and geopolitical risk is growing, you’d think that equities would be cheap relative to historical norms. But instead, in our view, they’re expensive. The reason for this is that investors are comparing what look like below-average, but still reasonable, earnings yields (E/P) to very depressed bond yields.

This illusion of relative opportunity is policy distortion at work, as easy money has improved earnings yields by front-end-loading demand while simultaneously repressing real interest rates for bonds. If this policy distortion eases over the next few years, constricted margins and rising real rates could pressure these relativeyield comparisons. If, instead, margin pressure leads to disappointing earnings growth or even to reductions in earnings, the outcome could be a moderation in fixed capital investment. In this case, real rates might not be able to fully normalize as quickly as usual.

This is what happened in Japan, where rates flatlined at low levels for Page 4 of 8 . Annual Letter—Year-End 2015 decades and equity markets gradually derated—albeit with volatile cycles. We could become stuck in a similar rut of low nominal growth in interest rates, with choppy equity markets that seemingly go nowhere but still provide a fair share of gut-wrenching slides. With this kind of sideways-moving market, real productivity might slowly improve and enlarge the economic pie, but the process could take a decade or more. On the other hand, corrective deflationary prices could shrink the world’s bloated balance sheets in considerably less time.

Given a choice between these slower and faster approaches, most policymakers would choose the former. Democracies and autocracies alike have limited appetite for deflationary adjustments. Gold Gold remains an important potential hedge for us. The price of gold is depressed relative to risk assets, and it is low enough to dissuade growth in supply. There is a dearth of new discoveries, and projects and ore grades for existing mine bodies are trending downward. Meanwhile, gold has performed well relative to other commodities—such as oil, copper and wheat—that display more sensitivity to macroeconomic trends.

This means that while gold is, arguably, cheap, it’s neither as cheap as it has been in earlier troughs nor as cheap as it has been relative to other commodities. Gold remains unique as a market-insensitive real asset that is hard to replicate at current prices. Holding gold, which produces no income, normally imposes an opportunity cost, but given the low level of interest rates relative to history and the low level of sovereign creditworthiness relative to history, the opportunity cost of holding gold is, arguably, low.

If weak earnings performance undermines the path to interest rate normalization, gold may once again find its footing as more attractive potential ballast than low-returning, human-made money, which is far easier to print than gold reserves are to find, develop, extract, maintain and extend. Opportunities in Impatient Markets Within a fully valued market and a nominally flat world economy, we’re actually seeing a bifurcation of prospects, with many manufacturing and commodity-linked businesses already in recession while service and Internet businesses generally have been growing healthily. Emerging markets have been struggling, and are, arguably, also in recession, whereas developed markets are grinding out growth, with Europe actually gaining ground. The net result of this is that we are seeing some value emerge within our portfolio in areas such as industrials and commodities.

Because valuations have moderated to some degree, our cash and cash equivalent levels have drifted downward over the year, as we’ve put more money to work. In a world of scarce growth, the market has generally been impatient. It has paid for growth and left value to underperform growth. Some high-growth stocks, which we did not own, continued to appreciate in 2015, despite their high valuations and the strength of the US dollar.

There are, however, some modestly positive Page 5 of 8 . First Eagle Global Value Team signs: There are pockets of value; the market has drifted lower for a year; risk perception has mounted (for example, implied volatility above 20%3); and manufacturing purchasing manager indexes have been under pressure around the world. As long as there are pockets of risk perception, there may be pockets of lower-risk opportunity. We believe valuations are high overall, but not outrageously so, and beneath the surface of the market, there are some underpriced securities. We are seeing some value emerge within our portfolio in areas such as industrials and commodities. Because valuations have moderated to some degree, our cash and cash equivalent levels have drifted downward over the year, as we’ve put more money to work. In order for US profit margins to expand against the backdrop of tightening monetary and fiscal policy, the United States needs the rest of the world’s economic momentum to improve. To remove the currency headwinds that US companies have been facing, non-US currencies will have to appreciate somewhat relative to the US dollar.

In the absence of this development, many US corporations will be able to sustain margins only if household spending goes up once again, savings rates go down once again, and consumer debt goes up once again. This could fuel another credit crisis. At First Eagle, we believe that geopolitical imbalances at a global level, combined with negative momentum across the BRICs, could lead to a more disruptive market environment. We strive to build portfolios that can be resilient in disruptive scenarios by deploying cash in what we consider a prudent manner and investing in securities trading below our estimate of their intrinsic value. 3 CBOE/Bloomberg Page 6 of 8 .

Annual Letter—Year-End 2015 In summary, the central banks of the world have succeeded in inflating security prices, which means prospectively lower and choppier returns. Meanwhile, through their actions, central banks have also delayed the necessary shrinking in global debt, which remains elevated and magnifies the consequences of growing geopolitical risk. Lots of risk and not much reward seem to be the mantra for the day, but this may be as good as we can reasonably expect in a world of continued financial repression, where the authorities try to amortize crises across time rather than taking bitter medicine up front. While we see more opportunity than we did a year ago and thus are holding less cash, this is not a time to throw caution to the wind. For us, prudence remains the order of the day.

We remain firmly committed to our allweather approach, which means that we may look too defensive in a rising market, and resilient but soft when markets decline. So, we may never look the best in any given state of the world, but we think that this approach is well-suited to the current environment. Our Team In the past year, we strengthened our team to better address opportunities in the global markets. We deepened our research bench by adding a number of new analysts—Idanna Appio, who is helping us analyze sovereign credits; Benjamin Bahr, who focuses on energy exploration and production, agricultural commodities, chemicals and banks; and Shan Wang, who is a small-cap generalist.

Matt Lamphier was promoted to the important job of director of research—a reflection of the fact that our team of analysts has grown. We want to close by thanking our long-standing clients for sharing our commitment to patient and disciplined investing. We look forward to serving as prudent stewards of your capital in the years ahead. Sincerely, Matthew McLennan T. Kimball Brooker, Jr. Head of the Global Value Team Portfolio Manager Global, Overseas, U.S.

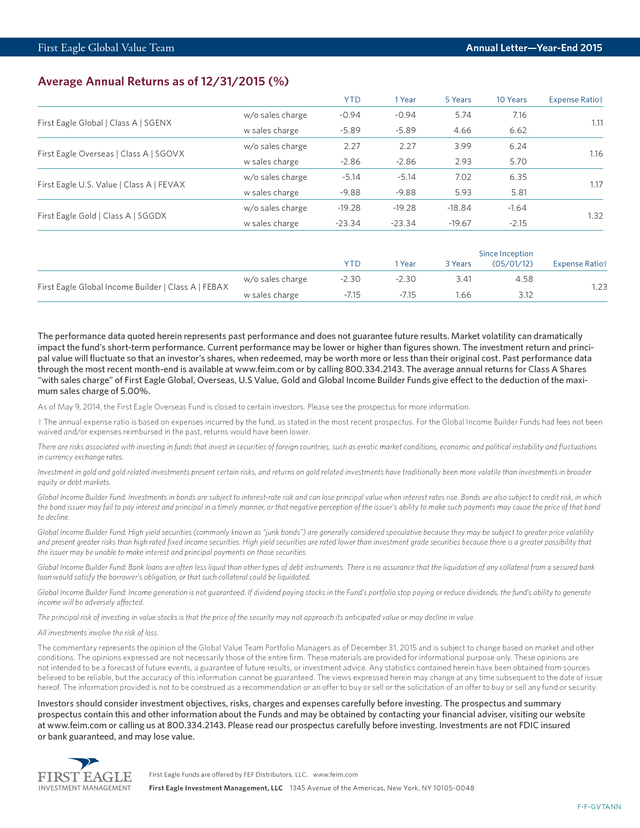

Value and Gold Funds Deputy Head of the Global Value Team Portfolio Manager Global, Overseas and U.S. Value Funds Page 7 of 8 . Annual Letter—Year-End 2015 First Eagle Global Value Team Average Annual Returns as of 12/31/2015 (%) YTD First Eagle Overseas | Class A | SGOVX First Eagle U.S. Value | Class A | FEVAX First Eagle Gold | Class A | SGGDX First Eagle Global Income Builder | Class A | FEBAX w/o sales charge -0.94 -0.94 5.74 7.16 w sales charge -5.89 -5.89 4.66 6.62 2.27 2.27 3.99 6.24 w sales charge -2.86 -2.86 2.93 5.70 w/o sales charge -5.14 -5.14 7.02 6.35 w sales charge -9.88 -9.88 5.93 5.81 w/o sales charge -19.28 -19.28 -18.84 -1.64 w sales charge -23.34 -23.34 -19.67 -2.15 YTD First Eagle Global | Class A | SGENX 1 Year 1 Year 3 Years Since Inception (05/01/12) -2.30 -2.30 3.41 4.58 -7.15 -7.15 1.66 3.12 w/o sales charge w/o sales charge w sales charge 5 Years 10 Years Expense Ratio† 1.11 1.16 1.17 1.32 Expense Ratio† 1.23 The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund’s short-term performance. Current performance may be lower or higher than figures shown.

The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month-end is available at www.feim.com or by calling 800.334.2143. The average annual returns for Class A Shares “with sales charge” of First Eagle Global, Overseas, U.S Value, Gold and Global Income Builder Funds give effect to the deduction of the maximum sales charge of 5.00%. As of May 9, 2014, the First Eagle Overseas Fund is closed to certain investors.

Please see the prospectus for more information. † The annual expense ratio is based on expenses incurred by the fund, as stated in the most recent prospectus. For the Global Income Builder Funds had fees not been waived and/or expenses reimbursed in the past, returns would have been lower. There are risks associated with investing in funds that invest in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. Investment in gold and gold related investments present certain risks, and returns on gold related investments have traditionally been more volatile than investments in broader equity or debt markets. Global Income Builder Fund: Investments in bonds are subject to interest-rate risk and can lose principal value when interest rates rise. Bonds are also subject to credit risk, in which the bond issuer may fail to pay interest and principal in a timely manner, or that negative perception of the issuer’s ability to make such payments may cause the price of that bond to decline. Global Income Builder Fund: High yield securities (commonly known as “junk bonds”) are generally considered speculative because they may be subject to greater price volatility and present greater risks than high rated fixed income securities.

High yield securities are rated lower than investment grade securities because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. Global Income Builder Fund: Bank loans are often less liquid than other types of debt instruments. There is no assurance that the liquidation of any collateral from a secured bank loan would satisfy the borrower’s obligation, or that such collateral could be liquidated. Global Income Builder Fund: Income generation is not guaranteed. If dividend paying stocks in the Fund’s portfolio stop paying or reduce dividends, the fund’s ability to generate income will be adversely affected. The principal risk of investing in value stocks is that the price of the security may not approach its anticipated value or may decline in value. All investments involve the risk of loss. The commentary represents the opinion of the Global Value Team Portfolio Managers as of December 31, 2015 and is subject to change based on market and other conditions.

The opinions expressed are not necessarily those of the entire firm. These materials are provided for informational purpose only. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice.

Any statistics contained herein have been obtained from sources believed to be reliable, but the accuracy of this information cannot be guaranteed. The views expressed herein may change at any time subsequent to the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security. Investors should consider investment objectives, risks, charges and expenses carefully before investing.

The prospectus and summary prospectus contain this and other information about the Funds and may be obtained by contacting your financial adviser, visiting our website at www.feim.com or calling us at 800.334.2143. Please read our prospectus carefully before investing. Investments are not FDIC insured or bank guaranteed, and may lose value. First Eagle Funds are offered by FEF Distributors, LLC.

www.feim.com First Eagle Investment Management, LLC 1345 Avenue of the Americas, New York, NY 10105-0048 F-F-GVTANN .

First Eagle Global Value Team the risks posed by a slowdown in emerging markets, rising geopolitical tensions and weakened sovereign balance sheets. In our view, it is healthy to see markets now price in some of this risk, with sectors like energy, commodities and capital goods in more obvious distress. The dynamic in the past year has been one of relatively choppy sideways-moving markets with many individual stocks weakening while a few mostly highly valued companies have done well and supported overall market index levels. This narrow market environment is reminiscent of some of the more challenging environments of the past 15 years, but with broad valuation levels that remain less than compelling. Our cash levels have drifted downward in a measured way as, in periods of market weakness, we have capitalized on bottom-up opportunities one stock at a time. However, we retain what we feel is a reasonable amount of potential ballast in cash, cash equivalents, gold and gold-related investments as we keep a wary eye on macro developments. We don’t know what 2016 will bring—the crystal ball is foggy at best—but we do feel risk perception is at least more palpable today than a year ago. Our approach remains measured and centered on identifying businesses priced below our estimate of their intrinsic value.

Should conditions get more challenging, we are poised to use our liquidity to take advantage of more attractive prices. On the other hand, should the stimulative impact of lower oil prices and sound economic momentum in global services industries lead to more of a muddle-through environment, we are also poised to participate through our existing ownership of enterprise at what we believe are sound prices. We strive to create an all-weather portfolio rather than to predict the market’s zigs and zags. Geopolitical Complexities In 2015 we saw the wholesale reemergence of geopolitical risk. A rising conflict between Shia and Sunni Muslims manifested itself in many ways: strife in Syria, escalating tensions between Saudi Arabia and Iran, conflict between Saudi Arabia and Yemen, growing threats from ISIS, a flood of refugees and emerging terrorism in Europe.

In addition to that, we’ve seen increased assertiveness on the part of the Chinese: corruption purges, naval activities in the South China Sea, allegations of cyber hacking. We’ve also seen increased assertiveness on the part of Russia, not just in Crimea and Ukraine, but also in Syria. Economic Headwinds In the developed world, these geopolitical risks have arisen in a period when government balance sheets are already strained by high levels of debt. As a result, the economic consequence of any global conflagration would be very challenging Page 2 of 8 .

Annual Letter—Year-End 2015 for sovereign finances. Meanwhile, governments’ preferred adjustment process for their excessive sovereign debt remains largely unchanged: a combination of financial repression (keeping interest rates low) and fiscal tightening (but only at the margins). Quantitative easing by central banks has promoted monetary growth and confidence in the financial system and has bolstered economic performance and asset prices, but, in our view, it has also put future profit margins at risk. By accelerating current growth in demand, central banks have likely reduced future growth in demand. Simultaneously, they have stimulated capital spending and growth in supply.

If demand grows sluggishly but supply grows normally, profit margins could well be compressed. And we’ve already seen this kind of margin pressure strike in the oil, commodities and manufacturing sectors of the world economy— sectors that often provide an early warning that ill winds are starting to blow. In our view, the combination of low bond yields, above-average P/E ratios and prospective pressure on earnings growth creates an environment of below-average prospective returns for most securities. We believe a well-balanced index portfolio may deliver, at best, low-single-digit real returns and mid-single-digit nominal returns.

This is well below the annual crediting rates most endowments, foundations and pension funds require in order to preserve the real value of their corpus. The need to dip into real capital to sustain spending may drive some institutions (and individuals) to reduce their spending. This would be a further headwind for economic growth and margins. Furthermore, in contrast to the synchronized policy easing that we saw across the world in the wake of the global financial crisis, we now see divergence. Policy is tightening in the US while China has embarked on a managed weakening of its exchange rate.

Against the backdrop of continued monetary expansion in Europe and Japan, these are new negatives for markets. In addition to this divergence in monetary policy, there remains a latent need for fiscal tightening around the world. The biggest negative in our minds, other than the geopolitical and policy issues we’ve discussed, is the deepening slowdown in China, and the somewhat related crises that we see in Brazil and Russia, as weaker commodity prices exacerbate the effects of inefficient capital spending in their prior booms. These countries, combined, were the largest source of marginal demand growth for most of the past decade, but also the largest source of marginal growth in debt.2 As the Chinese manufacturing economy has slowed, we believe China is likely to ease both monetary and fiscal policy and to let its currency depreciate in a managed way.

However, the negative momentum in Chinese manufacturing and construction markets is meaningful, the problem assets in Chinese banks are still surfacing, and unemployment in China has yet to rise. The Chinese authorities are trying to put multiple fingers in the dike, but the fact is, they’ve been investing far more capital than makes sense. Even if they manage to avoid a crisis, the Chinese economy could be disappointing for some years if the government tries to amortize 2 First Eagle Investment Management/BIS/Haver Page 3 of 8 .

First Eagle Global Value Team the problems across time. Finally, anticorruption purges are paralyzing the senior policymaking apparatus in China at a time when flexibility and policy responsiveness are becoming more important. The biggest positive for the world, in our minds, is lower oil prices, which not only may stimulate economic activity and help raise consumer disposable incomes and savings, but also may put financial brakes on assertive regimes such as Russia, Iran and ISIS. The biggest positive for the world, in our minds, is lower oil prices, which not only may stimulate economic activity and help raise consumer disposable incomes and savings, but also may put financial brakes on assertive regimes such as Russia, Iran and ISIS. Expensive Equities In this global environment of high debt, high margins and high political risk, the prices of risk assets remain, to our minds, pretty full. As we’ve said before, if the world has too much debt and geopolitical risk is growing, you’d think that equities would be cheap relative to historical norms. But instead, in our view, they’re expensive. The reason for this is that investors are comparing what look like below-average, but still reasonable, earnings yields (E/P) to very depressed bond yields.

This illusion of relative opportunity is policy distortion at work, as easy money has improved earnings yields by front-end-loading demand while simultaneously repressing real interest rates for bonds. If this policy distortion eases over the next few years, constricted margins and rising real rates could pressure these relativeyield comparisons. If, instead, margin pressure leads to disappointing earnings growth or even to reductions in earnings, the outcome could be a moderation in fixed capital investment. In this case, real rates might not be able to fully normalize as quickly as usual.

This is what happened in Japan, where rates flatlined at low levels for Page 4 of 8 . Annual Letter—Year-End 2015 decades and equity markets gradually derated—albeit with volatile cycles. We could become stuck in a similar rut of low nominal growth in interest rates, with choppy equity markets that seemingly go nowhere but still provide a fair share of gut-wrenching slides. With this kind of sideways-moving market, real productivity might slowly improve and enlarge the economic pie, but the process could take a decade or more. On the other hand, corrective deflationary prices could shrink the world’s bloated balance sheets in considerably less time.

Given a choice between these slower and faster approaches, most policymakers would choose the former. Democracies and autocracies alike have limited appetite for deflationary adjustments. Gold Gold remains an important potential hedge for us. The price of gold is depressed relative to risk assets, and it is low enough to dissuade growth in supply. There is a dearth of new discoveries, and projects and ore grades for existing mine bodies are trending downward. Meanwhile, gold has performed well relative to other commodities—such as oil, copper and wheat—that display more sensitivity to macroeconomic trends.

This means that while gold is, arguably, cheap, it’s neither as cheap as it has been in earlier troughs nor as cheap as it has been relative to other commodities. Gold remains unique as a market-insensitive real asset that is hard to replicate at current prices. Holding gold, which produces no income, normally imposes an opportunity cost, but given the low level of interest rates relative to history and the low level of sovereign creditworthiness relative to history, the opportunity cost of holding gold is, arguably, low.

If weak earnings performance undermines the path to interest rate normalization, gold may once again find its footing as more attractive potential ballast than low-returning, human-made money, which is far easier to print than gold reserves are to find, develop, extract, maintain and extend. Opportunities in Impatient Markets Within a fully valued market and a nominally flat world economy, we’re actually seeing a bifurcation of prospects, with many manufacturing and commodity-linked businesses already in recession while service and Internet businesses generally have been growing healthily. Emerging markets have been struggling, and are, arguably, also in recession, whereas developed markets are grinding out growth, with Europe actually gaining ground. The net result of this is that we are seeing some value emerge within our portfolio in areas such as industrials and commodities.

Because valuations have moderated to some degree, our cash and cash equivalent levels have drifted downward over the year, as we’ve put more money to work. In a world of scarce growth, the market has generally been impatient. It has paid for growth and left value to underperform growth. Some high-growth stocks, which we did not own, continued to appreciate in 2015, despite their high valuations and the strength of the US dollar.

There are, however, some modestly positive Page 5 of 8 . First Eagle Global Value Team signs: There are pockets of value; the market has drifted lower for a year; risk perception has mounted (for example, implied volatility above 20%3); and manufacturing purchasing manager indexes have been under pressure around the world. As long as there are pockets of risk perception, there may be pockets of lower-risk opportunity. We believe valuations are high overall, but not outrageously so, and beneath the surface of the market, there are some underpriced securities. We are seeing some value emerge within our portfolio in areas such as industrials and commodities. Because valuations have moderated to some degree, our cash and cash equivalent levels have drifted downward over the year, as we’ve put more money to work. In order for US profit margins to expand against the backdrop of tightening monetary and fiscal policy, the United States needs the rest of the world’s economic momentum to improve. To remove the currency headwinds that US companies have been facing, non-US currencies will have to appreciate somewhat relative to the US dollar.

In the absence of this development, many US corporations will be able to sustain margins only if household spending goes up once again, savings rates go down once again, and consumer debt goes up once again. This could fuel another credit crisis. At First Eagle, we believe that geopolitical imbalances at a global level, combined with negative momentum across the BRICs, could lead to a more disruptive market environment. We strive to build portfolios that can be resilient in disruptive scenarios by deploying cash in what we consider a prudent manner and investing in securities trading below our estimate of their intrinsic value. 3 CBOE/Bloomberg Page 6 of 8 .

Annual Letter—Year-End 2015 In summary, the central banks of the world have succeeded in inflating security prices, which means prospectively lower and choppier returns. Meanwhile, through their actions, central banks have also delayed the necessary shrinking in global debt, which remains elevated and magnifies the consequences of growing geopolitical risk. Lots of risk and not much reward seem to be the mantra for the day, but this may be as good as we can reasonably expect in a world of continued financial repression, where the authorities try to amortize crises across time rather than taking bitter medicine up front. While we see more opportunity than we did a year ago and thus are holding less cash, this is not a time to throw caution to the wind. For us, prudence remains the order of the day.

We remain firmly committed to our allweather approach, which means that we may look too defensive in a rising market, and resilient but soft when markets decline. So, we may never look the best in any given state of the world, but we think that this approach is well-suited to the current environment. Our Team In the past year, we strengthened our team to better address opportunities in the global markets. We deepened our research bench by adding a number of new analysts—Idanna Appio, who is helping us analyze sovereign credits; Benjamin Bahr, who focuses on energy exploration and production, agricultural commodities, chemicals and banks; and Shan Wang, who is a small-cap generalist.

Matt Lamphier was promoted to the important job of director of research—a reflection of the fact that our team of analysts has grown. We want to close by thanking our long-standing clients for sharing our commitment to patient and disciplined investing. We look forward to serving as prudent stewards of your capital in the years ahead. Sincerely, Matthew McLennan T. Kimball Brooker, Jr. Head of the Global Value Team Portfolio Manager Global, Overseas, U.S.

Value and Gold Funds Deputy Head of the Global Value Team Portfolio Manager Global, Overseas and U.S. Value Funds Page 7 of 8 . Annual Letter—Year-End 2015 First Eagle Global Value Team Average Annual Returns as of 12/31/2015 (%) YTD First Eagle Overseas | Class A | SGOVX First Eagle U.S. Value | Class A | FEVAX First Eagle Gold | Class A | SGGDX First Eagle Global Income Builder | Class A | FEBAX w/o sales charge -0.94 -0.94 5.74 7.16 w sales charge -5.89 -5.89 4.66 6.62 2.27 2.27 3.99 6.24 w sales charge -2.86 -2.86 2.93 5.70 w/o sales charge -5.14 -5.14 7.02 6.35 w sales charge -9.88 -9.88 5.93 5.81 w/o sales charge -19.28 -19.28 -18.84 -1.64 w sales charge -23.34 -23.34 -19.67 -2.15 YTD First Eagle Global | Class A | SGENX 1 Year 1 Year 3 Years Since Inception (05/01/12) -2.30 -2.30 3.41 4.58 -7.15 -7.15 1.66 3.12 w/o sales charge w/o sales charge w sales charge 5 Years 10 Years Expense Ratio† 1.11 1.16 1.17 1.32 Expense Ratio† 1.23 The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund’s short-term performance. Current performance may be lower or higher than figures shown.

The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month-end is available at www.feim.com or by calling 800.334.2143. The average annual returns for Class A Shares “with sales charge” of First Eagle Global, Overseas, U.S Value, Gold and Global Income Builder Funds give effect to the deduction of the maximum sales charge of 5.00%. As of May 9, 2014, the First Eagle Overseas Fund is closed to certain investors.

Please see the prospectus for more information. † The annual expense ratio is based on expenses incurred by the fund, as stated in the most recent prospectus. For the Global Income Builder Funds had fees not been waived and/or expenses reimbursed in the past, returns would have been lower. There are risks associated with investing in funds that invest in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. Investment in gold and gold related investments present certain risks, and returns on gold related investments have traditionally been more volatile than investments in broader equity or debt markets. Global Income Builder Fund: Investments in bonds are subject to interest-rate risk and can lose principal value when interest rates rise. Bonds are also subject to credit risk, in which the bond issuer may fail to pay interest and principal in a timely manner, or that negative perception of the issuer’s ability to make such payments may cause the price of that bond to decline. Global Income Builder Fund: High yield securities (commonly known as “junk bonds”) are generally considered speculative because they may be subject to greater price volatility and present greater risks than high rated fixed income securities.

High yield securities are rated lower than investment grade securities because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. Global Income Builder Fund: Bank loans are often less liquid than other types of debt instruments. There is no assurance that the liquidation of any collateral from a secured bank loan would satisfy the borrower’s obligation, or that such collateral could be liquidated. Global Income Builder Fund: Income generation is not guaranteed. If dividend paying stocks in the Fund’s portfolio stop paying or reduce dividends, the fund’s ability to generate income will be adversely affected. The principal risk of investing in value stocks is that the price of the security may not approach its anticipated value or may decline in value. All investments involve the risk of loss. The commentary represents the opinion of the Global Value Team Portfolio Managers as of December 31, 2015 and is subject to change based on market and other conditions.

The opinions expressed are not necessarily those of the entire firm. These materials are provided for informational purpose only. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice.

Any statistics contained herein have been obtained from sources believed to be reliable, but the accuracy of this information cannot be guaranteed. The views expressed herein may change at any time subsequent to the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security. Investors should consider investment objectives, risks, charges and expenses carefully before investing.

The prospectus and summary prospectus contain this and other information about the Funds and may be obtained by contacting your financial adviser, visiting our website at www.feim.com or calling us at 800.334.2143. Please read our prospectus carefully before investing. Investments are not FDIC insured or bank guaranteed, and may lose value. First Eagle Funds are offered by FEF Distributors, LLC.

www.feim.com First Eagle Investment Management, LLC 1345 Avenue of the Americas, New York, NY 10105-0048 F-F-GVTANN .