Year-End Accounting and Financial Reporting Issues for Commercial Entities – February 2016

Crowe Horwath

Description

February 2016

Year-End Accounting and Financial

Reporting Issues for Commercial Entities

Closing Out 2015 and Preparing for 2016

Audit | Tax | Advisory | Risk | Performance

. Crowe Horwath LLP

This publication discusses accounting

and financial reporting topics applicable

to companies that are finalizing 2015 and

preparing for 2016. Topics that address

standards for both public and nonpublic

business entities are included.

2

. Year-End Accounting and

Financial Reporting Issues for

Commercial Entities: Closing Out

2015 and Preparing for 2016

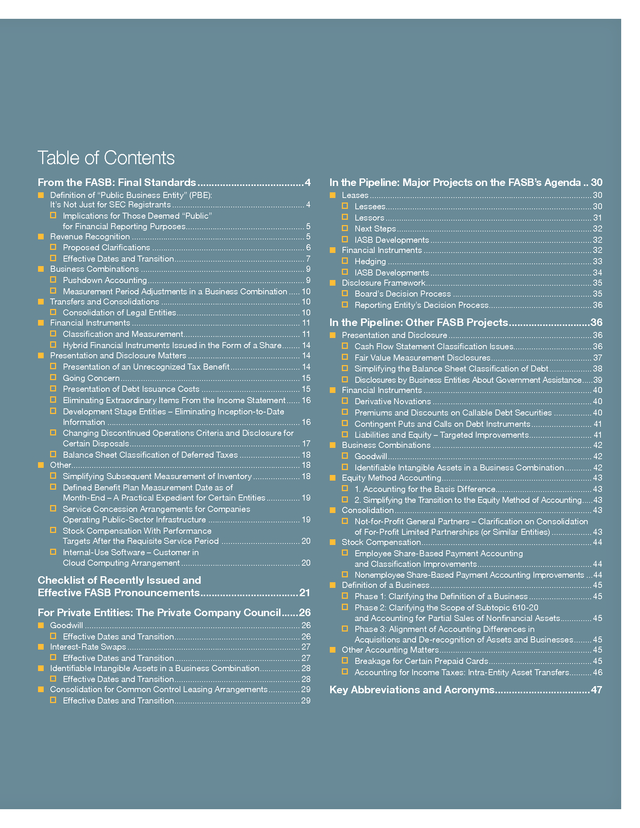

Table of Contents

From the FASB: Final Standards.......................................4

In the Pipeline: Major Projects on the FASB’s Agenda... 30

â– â– Definition of “Public Business Entity” (PBE):

It’s Not Just for SEC Registrants............................................................ 4

Implications for Those Deemed “Public”

for Financial Reporting Purposes...................................................... 5

â– â– Revenue Recognition..............................................................................

5 Proposed Clarifications..................................................................... 6 Effective Dates and Transition........................................................... 7 â– â– Business Combinations..........................................................................

9 Pushdown Accounting....................................................................... 9 Measurement Period Adjustments in a Business Combination...... 10 â– â– Transfers and Consolidations...............................................................

10 Consolidation of Legal Entities........................................................ 10 â– â– Financial Instruments............................................................................ 11 Classification and Measurement.....................................................

11 Hybrid Financial Instruments Issued in the Form of a Share......... 14 â– â– Presentation and Disclosure Matters................................................... 14 Presentation of an Unrecognized Tax Benefit................................

14 Going Concern................................................................................. 15 Presentation of Debt Issuance Costs............................................. 15 Eliminating Extraordinary Items From the Income Statement.......

16 Development Stage Entities – Eliminating Inception-to-Date Information....................................................................................... 16 Changing Discontinued Operations Criteria and Disclosure for Certain Disposals............................................................................. 17 Balance Sheet Classification of Deferred Taxes............................

18 â– â– Other....................................................................................................... 18 Simplifying Subsequent Measurement of Inventory...................... 18 Defined Benefit Plan Measurement Date as of Month-End – A Practical Expedient for Certain Entities................

19 Service Concession Arrangements for Companies Operating Public-Sector Infrastructure.......................................... 19 Stock Compensation With Performance Targets After the Requisite Service Period .................................... 20 Internal-Use Software – Customer in Cloud Computing Arrangement......................................................

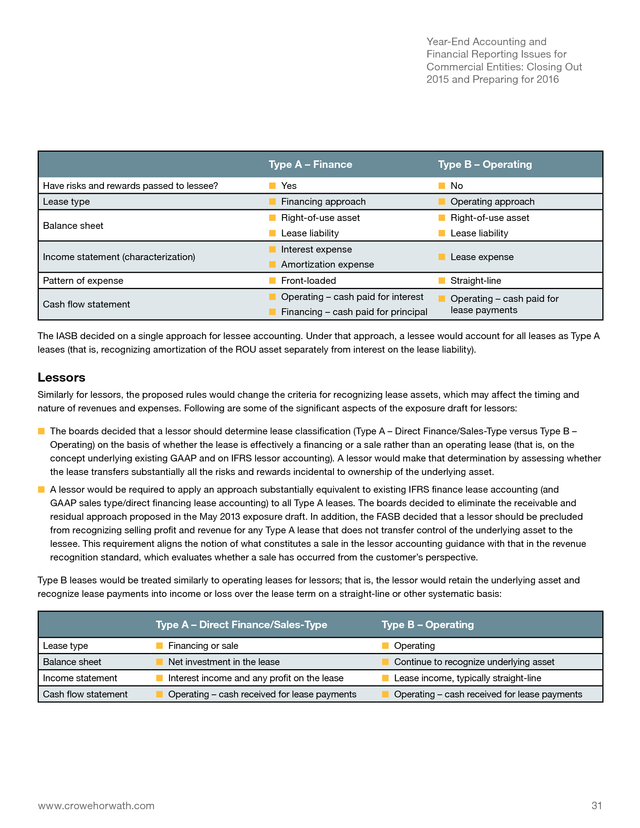

20 â– â– Leases.................................................................................................... 30 Lessees............................................................................................ 30 Lessors.............................................................................................

31 Next Steps........................................................................................ 32 IASB Developments......................................................................... 32 â– â– Financial Instruments............................................................................

32 Hedging............................................................................................ 33 IASB Developments......................................................................... 34 â– â– Disclosure Framework...........................................................................

35 Board’s Decision Process............................................................... 35 Reporting Entity’s Decision Process............................................... 36 Checklist of Recently Issued and Effective FASB Pronouncements....................................21 For Private Entities: The Private Company Council.......26 â– â– Goodwill.................................................................................................

26 Effective Dates and Transition......................................................... 26 â– â– Interest-Rate Swaps.............................................................................. 27 Effective Dates and Transition.........................................................

27 â– â– Identifiable Intangible Assets in a Business Combination.................. 28 Effective Dates and Transition......................................................... 28 â– â– Consolidation for Common Control Leasing Arrangements...............

29 Effective Dates and Transition......................................................... 29 www.crowehorwath.com In the Pipeline: Other FASB Projects..............................36 â– â– Presentation and Disclosure................................................................. 36 Cash Flow Statement Classification Issues...................................

36 Fair Value Measurement Disclosures.............................................. 37 Simplifying the Balance Sheet Classification of Debt.................... 38 Disclosures by Business Entities About Government Assistance......39 â– â– Financial Instruments............................................................................

40 Derivative Novations........................................................................ 40 Premiums and Discounts on Callable Debt Securities.................. 40 Contingent Puts and Calls on Debt Instruments............................

41 Liabilities and Equity – Targeted Improvements............................. 41 â– â– Business Combinations........................................................................ 42 Goodwill............................................................................................

42 Identifiable Intangible Assets in a Business Combination............. 42 â– â– Equity Method Accounting.................................................................... 43 1.

Accounting for the Basis Difference........................................... 43 2. Simplifying the Transition to the Equity Method of Accounting......43 â– â– Consolidation.........................................................................................

43 Not-for-Profit General Partners – Clarification on Consolidation of For-Profit Limited Partnerships (or Similar Entities)................... 43 â– â– Stock Compensation............................................................................. 44 Employee Share-Based Payment Accounting and Classification Improvements....................................................

44 Nonemployee Share-Based Payment Accounting Improvements....44 â– â– Definition of a Business......................................................................... 45 Phase 1: Clarifying the Definition of a Business............................. 45 Phase 2: Clarifying the Scope of Subtopic 610-20 and Accounting for Partial Sales of Nonfinancial Assets...............

45 Phase 3: Alignment of Accounting Differences in Acquisitions and De-recognition of Assets and Businesses......... 45 â– â– Other Accounting Matters..................................................................... 45 Breakage for Certain Prepaid Cards...............................................

45 Accounting for Income Taxes: Intra-Entity Asset Transfers........... 46 Key Abbreviations and Acronyms...................................47 3 . Crowe Horwath LLP From the FASB: Final Standards Definition of “Public Business Entity” (PBE): It’s Not Just for SEC Registrants Over the decades, the Financial Accounting Standards Board (FASB) often has divided entities into the categories of “public” and “private.” That dividing line was used to draw a distinction for purposes of scope, disclosure, and effective dates, and varying definitions of “public” and “private” have been created along the way. As a result, the FASB Accounting Standards Codification (ASC) includes several definitions of “nonpublic” and “public.” For “public,” among the definitions are several variations of both “public entity” and “publicly traded company.” All of the definitions include, with slight variations, those entities whose stock trades in a public market, including those traded on a stock exchange or in the over-the counter (OTC) market (including securities quoted only locally or regionally). In early 2012, the FASB added to its agenda a project to re-examine the definition of public. The decision was based on requests to clarify the existing definitions and address questions about which definition of “nonpublic entity” was being used in various projects. There was also a similar need for clarity about the definition of a nonpublic entity with respect to guidance issued by the Private Company Council (PCC). On Dec. 23, 2013, the FASB issued Accounting Standards Update (ASU) No. 2013-12, “Definition of a Public Business Entity: An Addition to the Master Glossary,” to provide a single definition of a “public business entity” (PBE) to be used in future financial accounting and reporting guidance.

The definition the new standard provides does not affect existing requirements, but it applies to all standards issued after ASU 2013-12. At essentially one paragraph long, it is one of the shortest standards ever issued. However, its impact has been significant for those now deemed to be “public” for financial reporting purposes, given that those entities must now adopt some standards more quickly or provide more disclosure than private entities. The ASC continues to include multiple definitions of the terms “nonpublic entity” and “public entity.” In PCC Issue No. 14-01, “Definition of a Public Business Entity – Phase II,” the PCC reported its decision not to change the existing definitions of a nonpublic entity and noted that the existing definitions will remain in the ASC until potentially amended by the FASB. Following is the definition in ASU 2013-12: Public Business Entity “A public business entity is a business entity meeting any one of the criteria below.

Neither a not-for-profit entity nor an employee benefit plan is a business entity. a. It is required by the U.S. Securities and Exchange Commission (SEC) to file or furnish financial statements, or does file or furnish financial statements (including voluntary filers), with the SEC (including other entities whose financial statements or financial information are required to be or are included in a filing). b. It is required by the Securities Exchange Act of 1934 (the Act), as amended, or rules or regulations promulgated under the Act, to file or furnish financial statements with a regulatory agency other than the SEC. c. It is required to file or furnish financial statements with a foreign or domestic regulatory agency in preparation for the sale of or for purposes of issuing securities that are not subject to contractual restrictions on transfer. 4 . Year-End Accounting and Financial Reporting Issues for Commercial Entities: Closing Out 2015 and Preparing for 2016 d. It has issued, or is a conduit bond obligor for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market. e. It has one or more securities that are not subject to contractual restrictions on transfer, and it is required by law, contract, or regulation to prepare U.S. GAAP financial statements (including footnotes) and make them publicly available on a periodic basis (for example, interim or annual periods). An entity must meet both of these conditions to meet this criterion. An entity may meet the definition of a public business entity solely because its financial statements or financial information is included in another entity’s filing with the SEC. In that case, the entity is only a public business entity for purposes of financial statements that are filed or furnished with the SEC.” Implications for Those Deemed “Public” for Financial Reporting Purposes The implications of being public for financial reporting purposes stand to be significant.

Following are the main differences between being public and nonpublic: â– â– Recognition and Measurement. An entity deemed a PBE would be unable to elect any guidance issued by the PCC. â– â– Effective Dates. For many standards issued by the FASB, the effective dates are earlier for PBEs.

An entity deemed to be a PBE will follow earlier effective dates. â– â– Disclosures. For some standards, more disclosures are required for public entities. An entity deemed a PBE would be subject to more disclosures for those standards that do have differences. Because the determination of PBE or non-PBE drives the effective dates, disclosures, and perhaps recognition and measurement – and drives the use of the PCC alternatives as well – we encourage each institution to evaluate carefully whether it is considered “public” for financial reporting purposes. Revenue Recognition In current U.S.

generally accepted accounting principles (GAAP), many different methods, as well as various depths of guidance, address revenue recognition, and they are often grounded in industry-specific guidance. In an effort to remedy the situation, the FASB and the International Accounting Standards Board (IASB) took on a joint project to clarify the principles for recognizing revenue and to develop a common revenue standard for GAAP and International Financial Reporting Standards (IFRS). On May 28, 2014, the two boards jointly issued their converged standard on the recognition of revenue from contracts with customers.

ASU No. 2014-09, “Revenue From Contracts With Customers (Topic 606),”1 consists of three sections: â– â– Section A – “Summary and Amendments That Create Revenue From Contracts With Customers (Topic 606) and Other Assets and Deferred Costs – Contracts With Customers (Subtopic 340-40)” â– â– Section B – “Conforming Amendments to Other Topics and Subtopics in the Codification and Status Tables” â– â– Section C – “Background Information and Basis for Conclusions” The new standard is intended to substantially enhance the quality and consistency of how revenue is reported while also improving the comparability of the financial statements of companies using GAAP and those using IFRS. The standard will replace previous GAAP guidance on revenue recognition in ASC Topic 605. At just more than 700 pages, the new standard is the longest the FASB has ever issued and a major undertaking by the boards.

Given the magnitude of the standard and the fact that it is not industryspecific, it is taking some time to digest. www.crowehorwath.com 5 . Crowe Horwath LLP The core principle of ASU 2014-09 is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. To achieve this principle, the following five steps are applied: â– â– Step 1: Identify the contract with a customer. â– â– Step 2: Identify the performance obligations (promises) in the contract. â– â– Step 3: Determine the transaction price. â– â– Step 4: Allocate the transaction price to the performance obligations in the contract. â– â– Step 5: Recognize revenue when (or as) the reporting organization satisfies a performance obligation. The challenge will be to take the core principle and accompanying steps and discern how the guidance applies. The AICPA has formed 16 industry task forces to help develop a new accounting guide on revenue recognition that will provide helpful hints and illustrative examples for how to apply the new standard. In addition, the FASB and the IASB have formed a joint Transition Resource Group (TRG), which includes preparers, auditors, regulators, users, and other stakeholders. The TRG’s objective is to promote effective implementation and transition. The implementation of this standard is expected to be significant, and all areas of an entity’s business will need to be evaluated. Proposed Clarifications At this point, the FASB has the following three projects that address issues identified by the TRG. 1.

Identifying Performance Obligations and Licensing On May 12, 2015, the FASB issued a proposed ASU, “Revenue From Contracts With Customers (Topic 606): Identifying Performance Obligations and Licensing.” The proposed amendments would add guidance for identifying performance obligations by clarifying that identification in a contract of goods and services that are immaterial would not be required. It also would provide additional guidance for evaluating the criterion of “separately identifiable” when determining if promised goods and services are distinct. This proposal would also clarify that under the new revenue recognition guidance of Topic 606, shipping and handling that occur before the customer obtains control of the related good would be fulfillment activities. In addition, an entity could make an accounting policy election to similarly account for the costs of the shipping and handling that occur as fulfillment activities after the customer has obtained control of a good.

This proposed ASU would address concerns some constituents have about the new revenue recognition rules requiring shipping and handling activities to be treated as a separate performance obligation. Under current guidance, revenue generally is not allocated to shipping and handling activities, and, accordingly, this proposed ASU, if adopted, would reduce the potential impact of the new revenue recognition rules on shipping and handling activities. Furthermore, if revenue is recognized before contractually agreed-upon shipping and handling activities occur, the costs of those activities would be accrued to match the timing of the revenue recognition.

In effect, shipping and handling activities would not be a separate performance obligation under typical free-on-board (FOB) shipping point terms. In addition, the proposed amendments are intended to clarify the licensing implementation guidance by discussing whether an entity’s licensing obligations are satisfied over time or at a point in time. At the Oct. 5, 2015, meeting, the FASB decided to proceed with issuing a final ASU based on the proposal. 6 . Year-End Accounting and Financial Reporting Issues for Commercial Entities: Closing Out 2015 and Preparing for 2016 2. Principal Versus Agent (Reporting Gross Versus Net) On Aug. 31, 2015, the FASB issued a proposed ASU, “Revenue From Contracts With Customers (Topic 606): Principal Versus Agent Considerations (Reporting Revenue Gross Versus Net),” to improve understanding of the implementation guidance for the principal versus agent considerations in the new revenue recognition standard. The proposed amendments clarify the following: â– â– The determination of whether an entity is principal or agent for each specified good or service, which is a distinct good or service or distinct bundle of goods or services, promised to the customer is made by the entity.

A contract with a customer may include more than one specified good or service, and an entity may be a principal for some specified goods or services and an agent for others. â– â– Whether a specified good or service is a good, a service, or a right to a good or service is determined by the entity. â– â– When there is another party involved in providing a customer with goods or services, an entity that is a principal controls: (a) a good or another asset from the other party that it then transfers to the customer, (b) a right to a service that another party will perform, which allows the entity to direct that party to provide the service to the customer on the entity’s behalf, or (c) a good or service from the other party that it combines with other goods or services to provide the specified good or service to the customer. â– â– Indicators in ASC 606-10-55-39 are designed to support or assist in the assessment of control. The proposed amendments in ASC 606-10-55-39A provide guidance that facts and circumstances affect whether the indicators may be more or less relevant to the control assessment and that one or more indicator may be more or less persuasive to the control assessment. Comments were due Oct. 15, 2015. 3.

Narrow-Scope Improvements and Practical Expedients On Sept. 30, 2015, the FASB issued a proposed ASU, “Revenue From Contracts With Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients,” to address implementation issues related to collectibility, presentation of sales taxes, noncash consideration, contract modifications, and completed contracts at transition. Comments were due Nov. 16, 2015. Effective Dates and Transition For this standard, the FASB uses the term “public entity,” which it defines as: "1. public business entity  A    2. A not-for-profit entity that has issued, or is a conduit bond obligor for securities that are traded, listed, or quoted on an exchange or an over the-counter market    3. An employee benefit plan that files or furnishes financial statements to the SEC.” Prior to the effective date deferral discussed below, for public entities as defined above, the ASU was going to be effective for annual reporting periods beginning after Dec.

15, 2016, including interim reporting periods within that reporting period. For other entities, the ASU would have been effective for annual reporting periods beginning after Dec. 15, 2017, and interim and annual reporting periods beginning after Dec.

15, 2018. www.crowehorwath.com 7 . Crowe Horwath LLP On Aug. 12, 2015, the FASB issued ASU No. 2015-14, “Revenue From Contracts With Customers (Topic 606): Deferral of the Effective Date,” to defer the effective date of ASU 2014-09, “Revenue From Contracts With Customers (Topic 606),” by one year. Following are the revised effective dates, which are based on the definition of a PBE rather than a public entity (as defined above): â– â– Public entities (as defined above) – Annual reporting periods beginning after Dec.

15, 2017, including interim reporting periods within that reporting period. Earlier application is permitted only as of annual reporting periods beginning after Dec. 15, 2016, including interim reporting periods within that reporting period. â– â– All other entities – Annual reporting periods beginning after Dec.

15, 2018, and interim reporting periods within annual reporting periods beginning after Dec. 15, 2019. Early application is permitted as follows: An annual reporting period beginning after Dec.

15, 2016, including interim reporting periods within that reporting period; or An annual reporting period beginning after Dec. 15, 2016, and interim reporting periods within annual reporting periods beginning one year after the annual reporting period in which an entity first applies the guidance Transition is allowed with the selection of one of two methods: 1. Retrospective application to each prior reporting period presented, and an election of any of the following practical expedients: Completed contracts that begin and end within the same annual reporting period do not need to be restated. When variable consideration is included in completed contracts, the transaction price at the contract completion date may be used to record revenue rather than estimating variable consideration amounts in the comparative reporting periods. In reporting periods prior to the date of initial application, disclosure may be omitted for the amount of the transaction price allocated to remaining performance obligations and an explanation of when the entity expects to recognize that remaining revenue. 2. Retrospective application with a cumulative effect adjustment to the opening retained earnings balance. Under this method, an entity must disclose the following in the interim and annual reporting periods that include the initial application: The quantitative impact in the current reporting period, by financial statement line item, of the application of the new revenue recognition standard as compared to prior GAAP An explanation of the reasons for significant changes The FASB published, in May 2014 and revised in January 2016, a “FASB in Focus” article and a three-part video series that recap the new standard. As a reminder, for SEC registrants, Staff Accounting Bulletin (SAB) No.

74 (Topic 11.M), “Disclosure of the Impact That Recently Issued Accounting Standards Will Have on the Financial Statements of the Registrant When Adopted in a Future Period,” requires disclosure of the potential effects of adoption of recently issued accounting standards in registration statements and reports filed with the SEC. The objectives should be to (1) notify readers of the issuance of a standard that the registrant will be required to adopt in the future and (2) assist readers in assessing the significance of the impact the standard will have, when adopted, on the financial statements of the registrant. As the standard is evaluated by stakeholders, including preparers and auditors, industry implementation guidance is expected to emerge, and the impact on registrants will unfold over time. If the impact is unknown or cannot be estimated reasonably, a statement to that effect may be made.

The staff expects the level of disclosures to increase as more information becomes available between now and adoption.2 Until the actual impact is known, disclosure could be in the form of a range or directional trend (rather than a statement that the impact is unknown). 8 . Year-End Accounting and Financial Reporting Issues for Commercial Entities: Closing Out 2015 and Preparing for 2016 Business Combinations Pushdown Accounting Current GAAP offered limited guidance for determining whether and when a new accounting and reporting basis (pushdown accounting) should be established in an acquired entity’s separate financial statements. All of the following previously provided guidance on pushdown accounting for entities registered with the SEC: SEC SAB Topic 5.J, “New Basis of Accounting Required in Certain Circumstances”; Emerging Issues Task Force (EITF) Topic D-97, “Push-Down Accounting”; and other comments made by the SEC observer at EITF meetings (all of which are included in ASC 805-50-S99-1 through S99-4). In general, the SEC required pushdown accounting when 95 percent or more of an entity’s ownership was acquired, permitted it when 80 percent to 95 percent is acquired, and prohibited it when less than 80 percent is acquired. Because the SEC staff’s guidance was applicable only to SEC registrants, there was diversity in practice among other entities with respect to the application of pushdown accounting. In addition, GAAP (for example, consolidation guidance) had evolved since the previously issued SEC guidance that posed implementation challenges. To provide authoritative guidance on whether and at what threshold an acquired entity should apply pushdown accounting, the FASB issued ASU No. 2014-17, “Business Combinations (Topic 805): Pushdown Accounting,” on Nov.

18, 2014. This ASU provides an acquired entity with the option to apply pushdown accounting in its separate financial statements when an acquirer obtains control of the entity. The threshold for applying pushdown accounting is consistent with the threshold for change-in-control events in ASC Topic 805, “Business Combinations,” and ASC Topic 810, “Consolidation.” An acquired entity may elect to apply pushdown accounting for each individual change-in-control event. If pushdown accounting is elected for an individual change-in-control event, that election is irrevocable.

If pushdown accounting is not applied during the period in which the change-in-control event occurs, an acquired entity still will have the option to elect to apply pushdown accounting in a subsequent period to the most recent change-in-control event. An acquired entity electing to apply pushdown accounting will reflect in separate financial statements the new basis of accounting established by the acquirer for the individual assets and liabilities of the acquired entity. Any goodwill resulting from the acquisition is recognized in the separate financial statements of the acquired entity, but it will not recognize a bargain purchase gain in its separate income statement. Any acquisition-related debt incurred by the acquirer should be recognized by the acquired entity only if other standards (for example, the guidance on obligations from joint and several liability arrangements) require the debt to be recognized by the acquired entity. Disclosures are required for acquirees that elect to apply pushdown accounting to allow financial statement users to evaluate the effect of pushdown accounting on the current reporting period. Effective Date and Transition ASU 2014-17 was effective as of its issuance date, Nov.

18, 2014. After the effective date, an acquired entity can make an election to apply the guidance to future change-in-control events or to its most recent change-in-control event. On the same day ASU 2014-17 was issued, the SEC’s Office of the Chief Accountant and Division of Corporation Finance released SAB No. 115, which rescinds SAB Topic 5.J and brings SEC guidance into conformity with ASU 2014-17. On May 8, 2015, the FASB issued ASU No.

2015-08, “Business Combinations (Topic 805): Pushdown Accounting – Amendments to SEC Paragraphs Pursuant to Staff Accounting Bulletin No. 115.” This ASU updates various SEC paragraphs of Topic 805 based on SEC SAB No. 115, which was effective Nov.

21, 2014. www.crowehorwath.com 9 . Crowe Horwath LLP Measurement Period Adjustments in a Business Combination As a result of feedback the FASB received about accounting for measurement period adjustments in business combinations as part of its simplification initiative, the FASB added a project to its agenda and ultimately, on Sept. 25, 2015, issued ASU No. 2015-16, “Business Combinations (Topic 805): Simplifying the Accounting for Measurement-Period Adjustments.” Under existing GAAP, when an acquirer obtains new information about facts and circumstances that existed on the acquisition date and the acquirer determines that, if known, that information would have affected the measurement of the amounts initially recognized or resulted in the recognition of an asset or liability, the acquirer retrospectively adjusts the amounts recognized at the acquisition date to reflect those facts and circumstances. A change to the amount is offset with a corresponding adjustment to goodwill.

The acquirer then revises comparative information for prior periods presented in financial statements as needed. This includes making any changes to depreciation, amortization, or other income effects that were recognized under the initial accounting to reflect the effect of the new information. The measurement period ends once the acquirer is able to determine that it has obtained all necessary information that existed as of the acquisition date or once the acquirer has determined that such information is unavailable. Under the amendments, an acquirer recognizes adjustments to provisional amounts identified during the measurement period in the reporting period in which the adjustment amount is determined.

In the same period’s financial statements, the acquirer records the effect on earnings of changes in depreciation, amortization, or other income effects, if any, that were the result of the change to the provisional amounts calculated as if the accounting had been completed at the acquisition date. The amendments eliminate the requirement to retrospectively revise prior-period financial statements as a result of measurementperiod adjustments; however, disclosure of measurement period adjustments recorded in the current period related to provisional amounts recorded in prior periods is required. Specifically, disclosure either on the face of the income statement or in the notes to the financial statements, by line item, is required for adjustments to provisional amounts that were reported in the current period but would have been reported in prior periods if the adjustments had been recognized as of the acquisition date. At transition, only disclosure of the nature of and reason for the change in accounting principle is required in the first annual period after the entity’s adoption date and in the interim periods within that annual period if there is a measurement-period adjustment during that annual period. Effective Dates and Transition For PBEs, the amendments are effective for annual periods beginning after Dec.

15, 2015, including interim periods within those fiscal years. For all other entities, the amendments are effective for fiscal years beginning after Dec. 15, 2016, and interim periods within fiscal years beginning after Dec.

15, 2017. An entity should apply the amendments prospectively to adjustments to provisional amounts that occur after the effective date. Earlier application is permitted for financial statements that have not been issued by a PBE or made available for issuance by other entities. Transfers and Consolidations Consolidation of Legal Entities In order to improve targeted areas of consolidation guidance for legal entities such as limited partnerships, limited liability corporations, and securitization structures (for example, collateralized debt obligations (CDOs), collateralized loan oblitations (CLOs), and mortgagebacked security (MBS) transactions), the FASB issued ASU No. 2015-02, “Consolidation (Topic 810): Amendments to the Consolidation Analysis,” on Feb.

18, 2015. The ASU focuses on the evaluation for determining whether certain legal entities should be consolidated. Current GAAP requires a qualitative evaluation of power over and economics from a variable-interest entity (VIE) to determine whether it should be consolidated. For some, the outcome has been consolidation of a VIE that resulted in less useful information about the financial position and operating results of the reporting entity. 10 .

Year-End Accounting and Financial Reporting Issues for Commercial Entities: Closing Out 2015 and Preparing for 2016 A second objective of ASU 2015-02 is to simplify. There are currently two models (formerly FASB Interpretation No. (FIN) 46R and Financial Accounting Standard (FAS) 167) for VIE consolidation and two models for voting interests consolidation (presuming that the general partner in a limited partnership consolidates). By eliminating the specialized guidance for limited partnerships in the voting interest model and the VIE model applied by certain investment companies, the ASU reduces the number of models. The FASB believes the new standard improves current GAAP in the following ways: â– â– It emphasizes loss risk when determining a controlling financial interest.

When certain criteria are met, an entity may no longer have to consolidate a legal entity based solely on its fee arrangement. â– â– It reduces the frequency of related-party guidance application when determining a controlling financial interest in a VIE. â– â– It reduces the number of consolidation models. â– â– It revises consolidation analysis (at times resulting in a different consolidation conclusion) in several industries that typically use VIEs or limited partnerships. Effective Dates and Transition The amendments are effective as follows: â– â– PBEs – Fiscal years, and for interim periods within those fiscal years, beginning after Dec. 15, 2015. â– â– Non-PBEs – Fiscal years beginning after Dec. 15, 2016, and for interim periods within fiscal years beginning after Dec.

15, 2017. Early adoption is permitted, including adoption in an interim period. If an entity early adopts the amendments in an interim period, any adjustments should be reflected as of the beginning of the fiscal year that includes that interim period. The amendments may be adopted using a modified retrospective approach by recording a cumulative-effect adjustment to equity as of the beginning of the fiscal year of adoption. The amendments also may be applied retrospectively. Financial Instruments Classification and Measurement Background What began as a convergence project of the FASB and the IASB to address accounting for financial instruments became two separate projects, one for each board.

The FASB’s financial instruments project was divided into three components, and one of the components, classification and measurement, culminated in the issuance of a final standard, ASU No. 2016-01, “Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities,” on Jan. 5, 2016. Refer to the “In the Pipeline: Major Projects on the FASB’s Agenda” section later in this publication for a discussion of credit and hedging, the other two components of the FASB’s financial instruments project. The FASB issued its initial exposure draft, “Accounting for Financial Instruments and Revisions to the Accounting for Derivative Instruments and Hedging Activities – Financial Instruments (Topic 825) and Derivatives and Hedging (Topic 815),” on May 26, 2010. Subsequently, the board issued a re-proposal on Feb.

14, 2013, intended to improve reporting for financial instruments by developing a consistent, comprehensive framework for classifying those instruments. The proposed ASU, “Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities,” also offered the possibility of closer convergence with the IASB. www.crowehorwath.com 11 . Crowe Horwath LLP On April 12, 2013, the FASB issued an additional proposed ASU, “Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities – Proposed Amendments to the FASB Accounting Standards Codification.” This 345-page companion proposal provided a marked version of the FASB ASC changes proposed in the recognition and measurement exposure draft. The board began formal re-deliberations in late 2013 and continued them through 2015. The deliberations moved the project from what would have been a significant change in practice to only targeted improvements to the existing security and loan accounting models. Final Standard The final standard reflects a meaningful change from the board’s February 2013 proposal by choosing to retain the existing accounting models for securities and loans and making only targeted improvements to the models. However, the final standard includes substantive changes for equity securities, deferred-tax assets (DTAs) on available-for-sale (AFS) securities, and disclosures. â– â– Classification and measurement of financial instruments – Retains the current GAAP classification and measurement models for financial instruments (both assets and liabilities), except for certain equity investments as discussed in the next item. The guidance also retains the separate models in existing GAAP for determining classification of loans (held for investment (HFI) and held for sale (HFS)) and securities (held to maturity (HTM), AFS, and trading).

During deliberations, the board directed the staff to analyze the current GAAP definition of a security to determine whether changes are needed to more clearly distinguish the instruments to be evaluated using the securities classification model. â– â– Equity Investments – Requires equity investments to be measured at fair value with changes in fair value recognized in net income (FV/NI), except for certain investments that are accounted for under the equity method of accounting and those that qualify for the practicability exception to fair value measurement. This eliminates the current AFS option for equity investments. Practicability exception for investments without a “readily determinable fair value”: Measure at cost minus impairment, if any, plus or minus changes resulting from observable price changes in orderly transactions for an identical investment or a similar investment of the same issuer. In a significant change from existing guidance, upward adjustments to fair value will be recorded. Test for impairment under the one-step model, which includes an assessment of indicators identified in the standard, and when an impairment indicator is identified, the investment must be measured at fair value. This exception is not available for broker-dealers (ASC Topic 940), investment companies (ASC Topic 946), or investments in an equity security that qualifies for the practical expedient to estimate fair value in accordance with paragraph ASC 820-1035-59 (net asset value (NAV) practical expedient). â– â– Fair value option – Retains the unconditional fair value option in existing GAAP under ASC Topic 825, “Financial Instruments.” However, for financial liabilities that are measured at fair value under the fair value option election, the portion of the total fair value change caused by a change in instrument-specific credit risk should be presented separately in other comprehensive income (OCI).

Under current GAAP, this amount is presented on the income statement and can create counterintuitive changes in income when an institution’s own credit risk changes. As noted under “Effective Dates and Transition” below, early adoption of this specific provision is permitted for all entities immediately, as of the beginning of the fiscal year, for interim or annual financial statements of fiscal years or interim periods that have not yet been issued (by PBEs) or that have not yet been made available for issuance (by non-PBEs). For calendar year-end entities, early adoption of this provision is allowed within financial statements for the year ended Dec. 31, 2015, that have not yet been issued (by PBEs) or made available for issuance (by non-PBEs). â– â– Valuation allowance on a DTA related to debt securities classified as AFS – Requires a DTA valuation allowance related to an AFS debt security to be assessed in combination with other DTAs. 12 .

Year-End Accounting and Financial Reporting Issues for Commercial Entities: Closing Out 2015 and Preparing for 2016 â– â– Disclosure – The board distinguished between PBEs and non-PBEs for certain disclosures. In addition, consistent with existing GAAP, trade receivables and payables under one year are outside the scope of the new standard for disclosures. Assets and liabilities – On the balance sheet or in the footnotes, disclose all financial assets and financial liabilities grouped by measurement category and form (for example, securities or loans and receivables) of financial assets. Fair value for amortized cost financial instruments – For the fair value disclosure of financial instruments measured at amortized cost in accordance with ASC 825, “Financial Instruments” (formerly known as FASB Statement No. 107, “Disclosures About Fair Value of Financial Instruments”), the board decided the following: For non-PBEs, the FASB is removing the table completely. As noted under “Effective Dates and Transition” below, early adoption of this provision is permitted immediately for financial statements that have not yet been made available for issuance.

For calendar year-ends, early adoption of this provision is allowed for Dec. 31, 2015, annual financial statements that have not yet been made available for issuance. For PBEs, fair values of all financial instruments in this table must be based on an exit price. This requirement could present challenges, particularly for loan portfolios, given that common practice for those portfolios is to rely on the current exception in GAAP (ASC 825-10-55-3) to measure financial instruments using an entry price. The disclosure of methods and assumptions used to estimate the fair value amounts in this table is eliminated. An entity will disclose the level of the fair value hierarchy within which the fair value measurement of financial instruments measured at amortized cost is categorized in its entirety (Level 1, 2, or 3).

Certain public companies (under the definitions before ASU 2013-12) already have this requirement, which was established by ASU No. 2011-04, “Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs.” Equity securities using the practical expedient – Disclose the carrying amount of investments that are measured using the practicability exception, as well as the amount of adjustments made to the carrying amount due to observable changes and impairment charge during the period.

An entity would not have to disclose the information it considered to reach the carrying amount and upward or downward adjustments resulting from observable price changes. Effective Dates and Transition For PBEs, the standard will be effective in fiscal years beginning after Dec. 15, 2017, including interim periods within those fiscal years. For non-PBEs, the standard will be effective for fiscal years beginning after Dec. 15, 2018, and interim periods beginning after Dec. 15, 2019.

Non-PBEs may early adopt the standard using the PBE effective dates. For two items, early adoption is permitted immediately as of the beginning of the fiscal year for interim or annual financial statements that have not yet been issued (for PBEs) or that have not yet been made available for issuance (for non-PBEs) for the following: â– â– Fair value change resulting from own credit risk for financial liabilities measured under the fair value option recognized through OCI â– â– The elimination of fair value disclosure requirements for financial instruments not recognized at fair value by entities that are not PBEs Making the transition to ASU 2016-01 compliance will require an entity to make a cumulative-effect adjustment to the statement of financial position as of the beginning of the first reporting period in which the guidance is effective (that is, to take a modifiedretrospective approach). The practical expedient for equity securities without readily determinable fair values will be applied prospectively. Resource An article published by Crowe, “It’s Just an Oil Change After All: FASB Issues Final Standard for Recognition and Measurement of Financial Instruments,” provides an in-depth discussion of the final standard. www.crowehorwath.com 13 . Crowe Horwath LLP Hybrid Financial Instruments Issued in the Form of a Share On Nov. 3, 2014, the FASB issued ASU No. 2014-16, “Derivatives and Hedging (Topic 815): Determining Whether the Host Contract in a Hybrid Financial Instrument Issued in the Form of a Share Is More Akin to Debt or to Equity (a Consensus of the FASB Emerging Issues Task Force).” The ASU applies to all entities that are issuers of, or investors in, hybrid financial instruments that are issued in the form of a share. It does not change the existing guidance for determining when certain embedded derivative features in a hybrid financial instrument must be separated, but is intended to clarify the requirements and reduce existing diversity with respect to the consideration of redemption features in relation to other features when determining the nature of the host for purposes of the clearly and closely related criteria for bifurcation of embedded derivatives. The amendments in the ASU clarify that an entity should evaluate the nature of the host contract by assessing the substance of all relevant terms and features (that is, the relative strength of the debt-like or equity-like terms and features given the facts and circumstances), including the embedded derivative feature being evaluated for bifurcation, when considering how to weight those terms and features.

Specifically, according to the standard, the assessment should take into account all of the following: “(1) the characteristics of the terms and features themselves (for example, contingent versus noncontingent, in-the-money versus out-of-the-money), (2) the circumstances under which the hybrid financial instrument was issued or acquired (for example, issuerspecific characteristics, such as whether the issuer is thinly capitalized or profitable and well-capitalized), and (3) the potential outcomes of the hybrid financial instrument (for example, the instrument may be settled by the issuer issuing a fixed number of shares, the instrument may be settled by the issuer transferring a specified amount of cash, or the instrument may remain legalform equity), as well as the likelihood of those potential outcomes.” Effective Dates and Transition The amendments in ASU 2014-16 are effective for PBEs for fiscal years, and interim periods within those fiscal years, beginning after Dec. 15, 2015. For all other entities, the amendments are effective for fiscal years beginning after Dec.

15, 2015, and interim periods within fiscal years beginning after Dec. 15, 2016. Early adoption, including adoption in an interim period, is permitted. The effects of initial adoption should be applied on a modified retrospective basis to existing hybrid financial instruments issued in the form of a share as of the beginning of the fiscal year for which the amendments are effective.

Retrospective application is permitted to all relevant prior periods. Presentation and Disclosure Matters Presentation of an Unrecognized Tax Benefit The practices for presenting unrecognized tax benefits have been diverging. Some entities present unrecognized tax benefits as a liability, while others present unrecognized tax benefits as a reduction of a DTA. The EITF concluded that an unrecognized tax benefit, or a portion of one, must be presented in the statement of financial position as a reduction of a DTA for a net operating loss (NOL) carryforward or a tax credit carryforward with two exceptions: if either (1) an NOL or tax credit carryforward at the reporting date is not available in the applicable tax jurisdiction to settle additional taxes resulting from the disallowance of a tax position, or (2) the applicable tax jurisdiction does not require and the entity does not intend to use the DTA to settle additional taxes resulting from the disallowance of a tax position. In these exceptional situations, the unrecognized tax benefit is presented as a liability and not combined with DTAs. The consensus was issued on July 18, 2013, in ASU No.

2013-11, “Income Taxes (Topic 740): Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists (A Consensus of the FASB Emerging Issues Task Force).” 14 . Year-End Accounting and Financial Reporting Issues for Commercial Entities: Closing Out 2015 and Preparing for 2016 Effective Dates and Transition This ASU is applied prospectively for public entities for fiscal years, and interim reporting periods within those years, beginning after Dec. 15, 2013. For nonpublic entities, the guidance is effective for fiscal years, and interim periods within those years, beginning after Dec. 15, 2014.

Early adoption and adoption on a retrospective basis are permitted. No additional disclosures are required. Going Concern On Aug. 27, 2014, the FASB issued ASU No.

2014-15, “Presentation of Financial Statements – Going Concern (Subtopic 205-40): Disclosure of Uncertainties About an Entity’s Ability to Continue as a Going Concern.” The guidance defines management’s responsibility to evaluate whether there is substantial doubt about an entity’s ability to continue as a going concern and to provide related disclosures in the notes to the financial statements. Under existing U.S. auditing standards and federal securities laws, auditors are responsible for performing this evaluation.

Until the issuance of ASU 2014-15, there was no guidance in GAAP about management’s responsibilities in this regard. Guidance in ASU 2014-15 provides principles and definitions that are intended to assist management in determining when and how the financial statements should disclose conditions and events that raise substantial doubt about the entity’s ability to continue as a going concern for a period of one year from the date the financial statements are issued or, for nonpublic entities, are available to be issued. Effective Dates The amendments in ASU 2014-15 are effective for the annual period ending after Dec. 15, 2016, and for interim and annual periods thereafter. Early application is permitted. The FASB also published a “FASB in Focus” article recapping the ASU. Presentation of Debt Issuance Costs As part of its simplification initiative, the FASB issued ASU No.

2015-03, “Interest – Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs,” on April 7, 2015. The ASU requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability rather than as a deferred charge (an asset). This change is consistent with the treatments for debt discounts and premiums.

The amendments generally do not change the recognition and measurement guidance for debt issuance costs. ASU 2015-03 did not address debt issuance costs for line-of-credit arrangements. During an EITF meeting, the SEC staff observed that it would not object if an entity defers debt issuance costs, presents them as an asset, and subsequently amortizes the deferred debt issuance costs ratably over the term of the line-of-credit arrangement, regardless of whether it has any outstanding borrowings on the line of credit. To codify the SEC view, the FASB issued ASU No.

2015-15, “Interest – Imputation of Interest (Subtopic 835-30): Presentation and Subsequent Measurement of Debt Issuance Costs Associated With Line-of-Credit Arrangements – Amendments to SEC Paragraphs Pursuant to Staff Announcement at June 18, 2015 EITF Meeting,” on Aug. 18, 2015. Effective Dates and Transition For PBEs, the amendments are effective for financial statements issued for fiscal years beginning after Dec. 15, 2015, and interim periods within those fiscal years.

For all other entities, the amendments are effective for financial statements issued for fiscal years beginning after Dec. 15, 2015, and interim periods within fiscal years beginning after Dec. 15, 2016.

Early adoption is permitted for financial statements that have not been issued previously. The amendments are to be applied on a retrospective basis, with the period-specific effects of applying the new guidance reflected on the balance sheet of each period presented. Upon transition, the applicable disclosures for a change in an accounting principle should be followed, including disclosing the nature of and reason for the change and describing the method of transition, the retrospectively adjusted prior-period information, and the effect of the change on the financial statement line items. www.crowehorwath.com 15 . Crowe Horwath LLP Eliminating Extraordinary Items From the Income Statement On Jan. 5, 2015, the FASB issued ASU No. 2015-01 to simplify financial reporting by no longer requiring an entity to determine whether certain events and transactions are extraordinary. This standard, “Income Statement – Extraordinary and Unusual Items (Subtopic 225-20): Simplifying Income Statement Presentation by Eliminating the Concept of Extraordinary Items,” removes the extraordinary items concept from GAAP, but the presentation and disclosure requirements in ASC 225-20 for items that are unusual in nature or occur infrequently are retained and expanded to include those items that are both unusual and infrequent.

Items that are unusual or infrequent will continue to be reported as a separate component of income from continuing operations or in the notes to the financial statements. Once this standard is adopted, items that are both unusual and infrequent will be reported in the same manner. Given the disclosure requirement for unusual and infrequent events or transactions, this standard should not result in a loss of information for users. Effective Dates and Transition For all entities, the guidance is effective for interim and annual periods beginning after Dec. 15, 2015, with early adoption permitted provided the guidance is applied from the beginning of the fiscal year of adoption. Entities will be permitted to elect either prospective or retrospective application.

If prospective application is elected, an entity is required to disclose the nature and the amount of an item included in income from continuing operations after adoption that adjusts an extraordinary item previously classified and presented before the date of adoption. If retrospective application is elected, all disclosures required by ASC 250-10-50-1 through ASC 250-10-50-2 must be provided. Development Stage Entities – Eliminating Inception-to-Date Information A development stage entity is an entity devoting substantially all of its efforts to establishing a new business and for which either the planned principal operations have not commenced, or the planned principal operations have commenced but there have been no significant revenues from those operations. Entities determined to be in the development stage were required to be identified as such and to provide inception-to-date information and certain other disclosures.

Feedback to the FASB from users of financial statements indicated this information had limited relevance, was generally not decision-useful, and that it was costly and sometimes complex to prepare. After consideration of the feedback, the FASB has removed all incremental financial reporting guidance specific to development stage entities from GAAP. ASU No. 2014-10, “Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation,” issued in June 2014, is intended to reduce the cost and complexity associated with the previous requirements to provide information about development stage entities.

The guidance eliminates the requirements for development stage entities to “(1) present inception-to-date information in the statements of income, cash flows, and shareholder equity, (2) label the financial statements as those of a development stage entity, (3) disclose a description of the development stage activities in which the entity is engaged, and (4) disclose in the first year in which the entity is no longer a development stage entity that in prior years it had been in the development stage.” In addition to removing the reporting requirements, the ASU: â– â– Adds to ASC Topic 275, “Risks and Uncertainties,” an example disclosure about the risks and uncertainties related to current activities of an entity that has not begun planned principal operations â– â– Removes from ASC Topic 810, “Consolidation,” an exception provided to development stage entities for determining whether the entity is a variable-interest entity Effective Dates and Transition Amendments in the ASU related to the elimination of inception-to-date information and other disclosure requirements in ASC Topic 915 should be applied retrospectively. The addition to ASC 275 should be applied prospectively. For PBEs, these amendments are effective for interim and annual reporting periods beginning after Dec.

15, 2014. For other entities, the amendments are effective for annual reporting periods beginning after Dec. 15, 2014, and interim reporting periods beginning after Dec.

15, 2015. Early adoption is permitted. 16 . Year-End Accounting and Financial Reporting Issues for Commercial Entities: Closing Out 2015 and Preparing for 2016 The amendments to ASC 810 should be applied retrospectively. For PBEs, this amendment is effective for interim and annual reporting periods beginning after Dec. 15, 2015. For all other entities, the amendments to ASC 810 are effective for annual reporting periods beginning after Dec.

15, 2016, and interim reporting periods beginning after Dec. 15, 2017. Changing Discontinued Operations Criteria and Disclosure for Certain Disposals Existing GAAP required an entity to report in discontinued operations the results of operations of a component of the entity that either has been disposed or was classified as HFS if both of the following conditions are met: â– â– The operations and cash flows of the component have been, or will be, eliminated from the ongoing operations of the entity as a result of the disposal transaction. â– â– The entity will not have any significant continuing involvement in the operations of the component after the disposal transaction. Stakeholders reported to the FASB that under this guidance too many recurring routine disposals of small groups of assets were being presented in financial statements as discontinued operations. In April 2014, the FASB responded by issuing ASU No.

201408, “Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity.” The new guidance changes the requirements for reporting a discontinued operation. Only a disposal representing a strategic shift that has a major effect on the entity’s operations and financial results will have to be reported as a discontinued operation. Examples of strategic shifts meeting the new criteria include a disposal of a major geographic area, a major line of business, or a major equity-method investment. Under this new guidance, many disposals that might be routine and not a change in an entity’s strategy no longer will be reported as discontinued operations.

The new guidance also reduces complexity in GAAP by removing the complex and extensive implementation guidance and illustrations that were necessary to apply the previous definition of a discontinued operation. The new guidance requires that, for each comparative period, an entity’s statement of financial position must present separately the assets and liabilities of a disposal group qualifying as a discontinued operation. The ASU requires additional disclosures about the assets, liabilities, revenues, expenses, and cash flows of a discontinued operation. An entity also will be required to disclose the pretax income or loss attributable to a disposal of a significant component that does not qualify for discontinued operations presentation. Effective Dates and Transition PBEs and not-for-profit entities that have issued, or are a conduit bond obligor for, securities that are traded, listed, or quoted on an exchange or an over-the-counter market should apply the amendments prospectively to both of the following: â– â– All disposals (or classifications as HFS) of components of an entity that occur within interim and annual periods beginning on or after Dec.

15, 2014 â– â– All businesses or not-for-profit activities that, on acquisition, are classified as HFS and occur within interim and annual periods beginning on or after Dec. 15, 2014 All other entities should apply the amendments prospectively to both of the following: â– â– All disposals (or classifications as HFS) of components of an entity that occur within annual periods beginning on or after Dec. 15, 2014, and interim periods beginning on or after Dec.

15, 2015 â– â– All businesses or not-for-profit activities that, on acquisition, are classified as HFS and occur within annual periods beginning on or after Dec. 15, 2014, and interim periods beginning on or after Dec. 15, 2015 An entity should not apply the amendments to a component of an entity, or a business or not-for-profit activity, that is classified as HFS before the effective date, even if the component of an entity, or a business or not-for-profit activity, is disposed of after the effective date. Early adoption is permitted only for disposals (or classifications as HFS) that have not been reported in financial statements previously issued or available for issuance. www.crowehorwath.com 17 .

Crowe Horwath LLP Balance Sheet Classification of Deferred Taxes As part of the FASB’s simplification initiative to reduce complexity in accounting standards, the board issued “Two Proposed Accounting Standards Updates, Income Taxes (Topic 740): I. Intra-Entity Asset Transfers and II. Balance Sheet Classification of Deferred Taxes” on Jan. 22, 2015.

On Oct. 5, 2015, the board re-deliberated the two proposed updates and asked the staff to draft a final standard on the balance sheet classification of deferred taxes. In November 2015, the FASB issued ASU No.

2015-17, “Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes.” For the classification of deferred taxes, current GAAP requires an entity to separate deferred-income tax liabilities and assets into current and noncurrent amounts in a classified statement of financial position. The board received feedback that such classification does not result in useful information because the classification does not always align with the time frame for settling the deferred-tax amounts. The board issued guidance that deferred-tax liabilities and assets be classified as noncurrent in a classified statement of financial position. The guidance does not amend the current requirement that deferred-tax liabilities and assets of a tax-paying component of an entity be offset and presented as a single amount. Effective Dates and Transition For PBEs, the amendments are effective for annual periods beginning after Dec.

15, 2016, and interim periods within those annual periods. For all other entities, the amendments are effective for annual periods beginning after Dec. 15, 2017, and interim periods within annual periods beginning after Dec.

15, 2018. Early application is permitted, and either prospective or retrospective application is permitted for all entities. Other Simplifying Subsequent Measurement of Inventory In July 2015, the FASB issued ASU No. 2015-11, “Inventory (Topic 330): Simplifying the Measurement of Inventory,” to amend inventory measurement guidance and require that inventory measured using first-in, first-out (FIFO) or average cost be measured at the lower of cost and net realizable value. The current definition of net realizable value – the estimated selling prices in the ordinary course of business, less reasonably predictable completion, disposal, and transportation costs – is retained. This standard eliminates the existing requirements in GAAP to consider market value when measuring inventory using either FIFO or average cost.

Market value in this context includes three values: (1) replacement cost, (2) net realizable value less a normal profit margin, and (3) net realizable value. Inventory measured using either last-in, first-out (LIFO) or the retail inventory method were excluded from the scope of this guidance because the transition for those methods could have resulted in significant costs and not in simplification. Although these amendments result in the introduction of an additional impairment model for measuring inventory under U.S. GAAP, they are expected to result in simplification for a subset of entities that measure inventory using FIFO or average cost, as well as substantial convergence of U.S. GAAP and IFRS for those entities. Effective Dates and Transition For PBEs, the amendments are effective for interim and annual periods beginning after Dec.

15, 2016. For all other entities, the amendments are effective for annual periods beginning after Dec. 15, 2016, and interim periods beginning after Dec.

15, 2017. Early application is permitted as of the beginning of an interim or annual period. The amendments should be applied prospectively. If, before the adoption of the amendments, an entity has written down inventory measured using FIFO or average cost below its cost, that reduced amount is considered the cost upon adoption.

Disclosure of the nature of and reason for the change in accounting principle in the first interim and annual period of adoption is required. 18 . Year-End Accounting and Financial Reporting Issues for Commercial Entities: Closing Out 2015 and Preparing for 2016 Defined Benefit Plan Measurement Date as of MonthEnd – A Practical Expedient for Certain Entities In April 2015, the FASB issued ASU No. 2015-04, “Update 2015-04—Compensation—Retirement Benefits (Topic 715): Practical Expedient for the Measurement Date of an Employer’s Defined Benefit Obligation and Plan Assets,” to simplify the measurement of plan assets for defined benefit plans at entities (except for employee benefit plan entities) with fiscal year-ends that do not fall on a month-end. The amendments eliminate the need for those entities to adjust the fair value of plan assets obtained from a third-party service provider reported as of month-end to reflect the fair value as of fiscal year-end. As an example, under existing GAAP, an entity with a fiscal year-end of December 15 needs to adjust the fair value provided by a third-party service provider as of monthend (November 30) to reflect the fair value as of December 15. Typically, information about the fair value and classes of plan assets of a defined benefit pension or other post-retirement benefit plan obtained from third-party service providers is reported as of a month-end.

The standard provides a practical expedient for those entities, permitting them to measure defined benefit plan assets and obligations as of the month-end that is closest to its fiscal year-end and to follow that measurement methodology consistently from year to year for all plans. If a contribution or significant event (such as a plan amendment, settlement, or curtailment that requires remeasurement) occurs between the month-end measurement date and an entity’s fiscal year-end, an entity that applies this practical expedient should adjust the measurement of defined benefit plan assets and obligations to reflect those contributions or significant events. Adjustments should not be made for other events that occur between the month-end measurement date and fiscal year-end that are not a result of the entity’s actions, such as changes in market prices and interest rates. In addition, if a significant event occurs during an interim period and remeasurement is required, the standard provides a similar practical expedient to remeasure the plan assets and obligations using the month-end that is closest to the date of the significant event. An entity is required to disclose its election to use this practical expedient as well as the alternative date used for measuring defined benefit plan assets and obligations. Effective Dates and Transition For PBEs, the amendments are effective for interim and annual periods beginning after Dec.

15, 2015. For all other entities, the amendments are effective for annual periods beginning after Dec. 15, 2016, and interim periods in fiscal years beginning after Dec. 15, 2017.

Early application is permitted. Prospective application is required. Service Concession Arrangements for Companies Operating Public-Sector Infrastructure An EITF consensus, ASU No. 2014-05, “Service Concession Arrangements (Topic 853) (a consensus of the FASB Emerging Issues Task Force),” specifies that an operating entity should not account for a service concession arrangement that is within the scope of the ASU as a lease in accordance with ASC 840. Rather, it should refer to other ASC guidance, as applicable, to account for various aspects of a service concession arrangement.

Under a service concession arrangement between a public-sector entity grantor and an operating entity, the operating entity operates the grantor’s infrastructure (airports, roads, and bridges, for example) and also may provide services such as construction, upgrading, or maintenance of the grantor’s infrastructure. This ASU also specifies that the infrastructure used in a service concession arrangement should not be recognized as property, plant, and equipment of the operating entity. The amendments are effective for PBEs for annual periods, and interim periods within those annual periods, beginning after Dec. 15, 2014. For entities other than PBEs, the amendments are effective for annual periods beginning after Dec.

15, 2014, and interim periods within annual periods beginning after Dec. 15, 2015. Early adoption is permitted, and the amendments should be applied on a modified retrospective basis to service concession arrangements that exist at the beginning of an entity’s fiscal year of adoption. www.crowehorwath.com 19 .

Crowe Horwath LLP Stock Compensation With Performance Targets After the Requisite Service Period In June 2014, the FASB issued ASU No. 2014-12, “Compensation – Stock Compensation (Topic 718): Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved After the Requisite Service Period (a consensus of the FASB Emerging Issues Task Force).” The new guidance addresses situations in which an employee would be eligible to vest in a share-based payment award regardless of whether the employee is still rendering service on the date the performance target is achieved. The ASU requires that a performance target that affects vesting and that could be achieved after the requisite service period should be treated as a performance condition. Compensation cost should be recognized in the period in which it becomes probable that the performance target will be achieved. The amount to be recognized should represent the compensation cost attributable to the period or periods for which the requisite service already has been rendered.

If it becomes probable that the performance target will be achieved before the end of the requisite service period, the remaining unrecognized compensation cost should be recognized prospectively over the remaining requisite service period. Effective Dates and Transition The amendments in this update are effective for annual periods and interim periods within those annual periods beginning after Dec. 15, 2015. Earlier adoption is permitted. Entities may apply the amendments in the ASU either retrospectively or prospectively only to awards granted or modified after the effective date. Internal-Use Software – Customer in Cloud Computing Arrangement The FASB issued ASU No. 2015-05, “Intangibles – Goodwill and Other – Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement,” to provide guidance on whether a cloud computing arrangement or other hosting arrangement includes a software license, because currently no explicit guidance is available to customers for such arrangements.

Specifically, the standard addresses whether a software license is purchased by the customer in such an arrangement, and it indicates that cloud computing arrangements include hosting arrangements such as software as a service (SaaS) as well as platforms and infrastructure as services. If a cloud computing arrangement includes a software license for internal use, the customer should account for the software license element of the arrangement as it would for the acquisition of other software licenses, by capitalizing the software license as an intangible asset license. The criteria for recognizing an asset in accordance with the new guidance include (1) a contractual right to take possession of the software at any time without significant cost or reduction in usefulness or value, and (2) the ability to run the software on the customer’s own hardware or to contract with a separate vendor to host the software. If a cloud computing arrangement does not include a software license for internal use, it should be accounted for as a service contract expense, pursuant to guidance within ASC 720. Some entities may be required to change their historical accounting methodology for these contracts given that, under the current guidance, entities were analogizing to operating lease guidance to determine whether such arrangements included a software license asset.

These entities must consider the previously noted criteria. Effective Dates and Transition For PBEs, the amendments are effective for interim and annual periods beginning after Dec. 15, 2015. For all other entities, the amendments are effective for annual periods beginning after Dec.

15, 2015, and interim periods in annual periods beginning after Dec. 15, 2016. Early adoption is permitted, and entities can elect to adopt the amendments either retrospectively or prospectively. 20 .

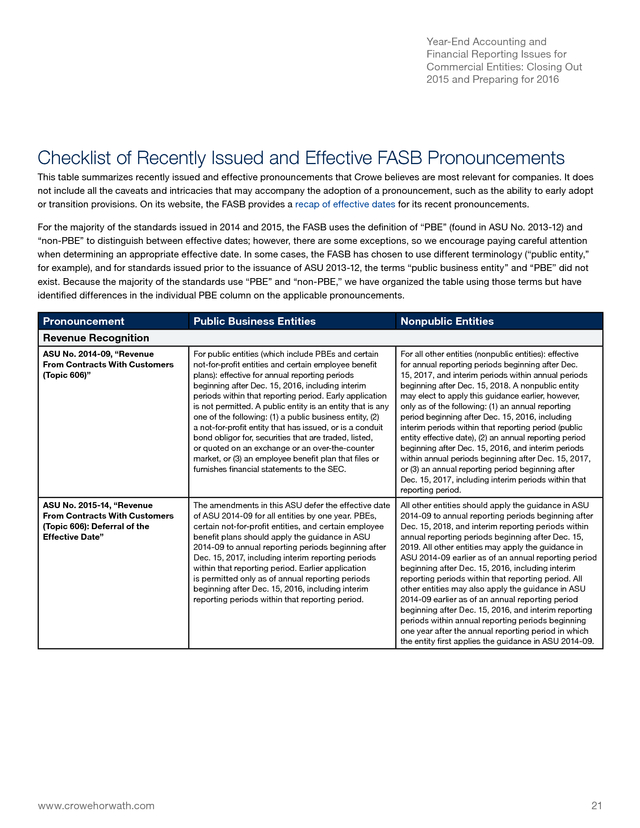

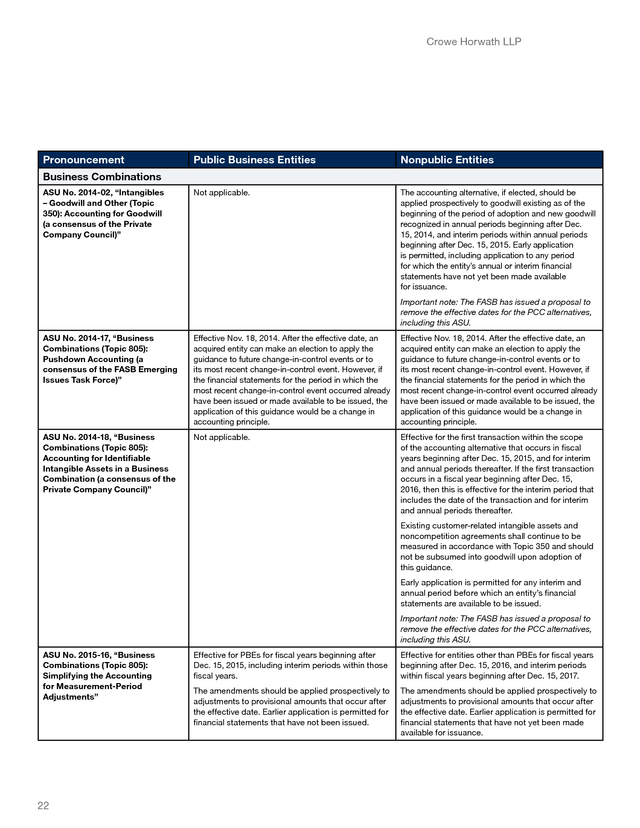

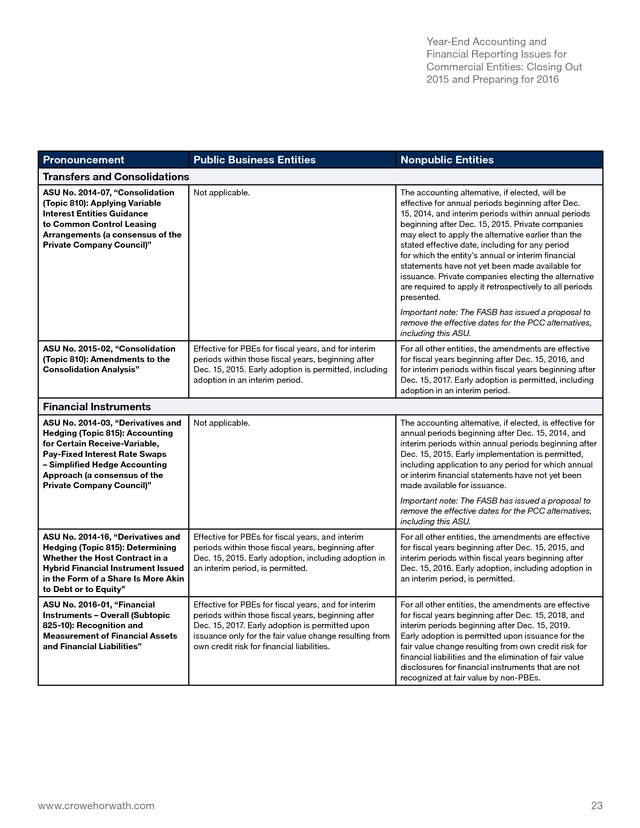

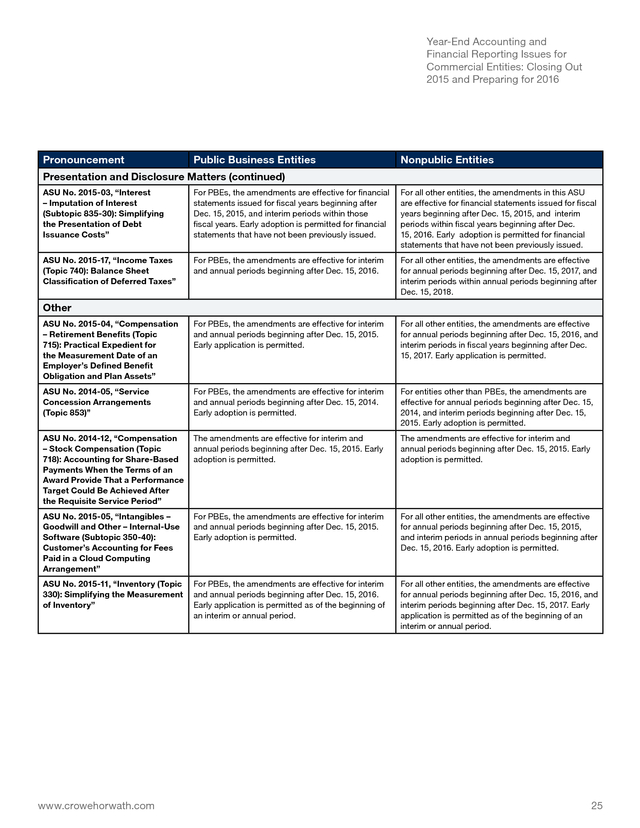

Year-End Accounting and Financial Reporting Issues for Commercial Entities: Closing Out 2015 and Preparing for 2016 Checklist of Recently Issued and Effective FASB Pronouncements This table summarizes recently issued and effective pronouncements that Crowe believes are most relevant for companies. It does not include all the caveats and intricacies that may accompany the adoption of a pronouncement, such as the ability to early adopt or transition provisions. On its website, the FASB provides a recap of effective dates for its recent pronouncements. For the majority of the standards issued in 2014 and 2015, the FASB uses the definition of “PBE” (found in ASU No. 2013-12) and “non-PBE” to distinguish between effective dates; however, there are some exceptions, so we encourage paying careful attention when determining an appropriate effective date.

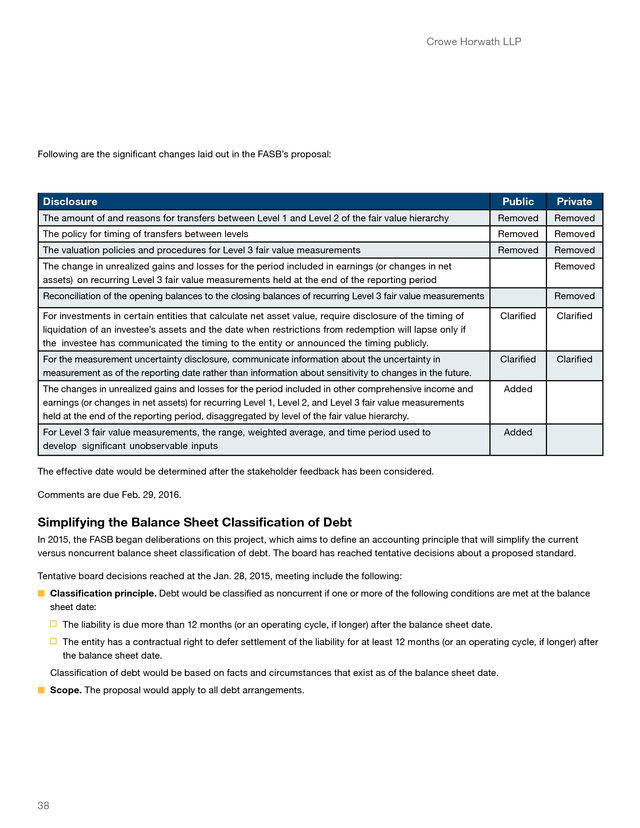

In some cases, the FASB has chosen to use different terminology (“public entity,” for example), and for standards issued prior to the issuance of ASU 2013-12, the terms “public business entity” and “PBE” did not exist. Because the majority of the standards use “PBE” and “non-PBE,” we have organized the table using those terms but have identified differences in the individual PBE column on the applicable pronouncements. Pronouncement Public Business Entities Nonpublic Entities ASU No. 2014-09, “Revenue From Contracts With Customers (Topic 606)” For public entities (which include PBEs and certain not-for-profit entities and certain employee benefit plans): effective for annual reporting periods beginning after Dec.