Who Says You Can't Take it With You? Caring for your Collection—In the Afterlife

Convergent Wealth Advisors

Description

WHO SAYS YOU CAN’T TAKE IT WITH YOU?

Caring for Your Collections—in the Afterlife

— Douglas Wolford, CEO

I don’t know about you, but I really like collecting things. I’ve been a collector

my entire life. Stamps, coins, books, antiques, cars, artwork—my interests

keep changing, but each one has fed a lifelong hunger to learn, to beautify

my surroundings, to own a little piece of history.

I think that being a good collector means being a good steward of the history

we acquire. All collectors are, after all, merely caretakers of history,

preserving art and artifacts to be enjoyed by the next generation of collectors.

With ownership comes responsibility.

No one likes thinking about mortality, but when the end comes—what will

become of the collections I spent a lifetime acquiring? Unlike the Pharaohs

of ancient Egypt, I can’t fill a pyramid with my treasures and slap a curse on

anyone who comes calling.

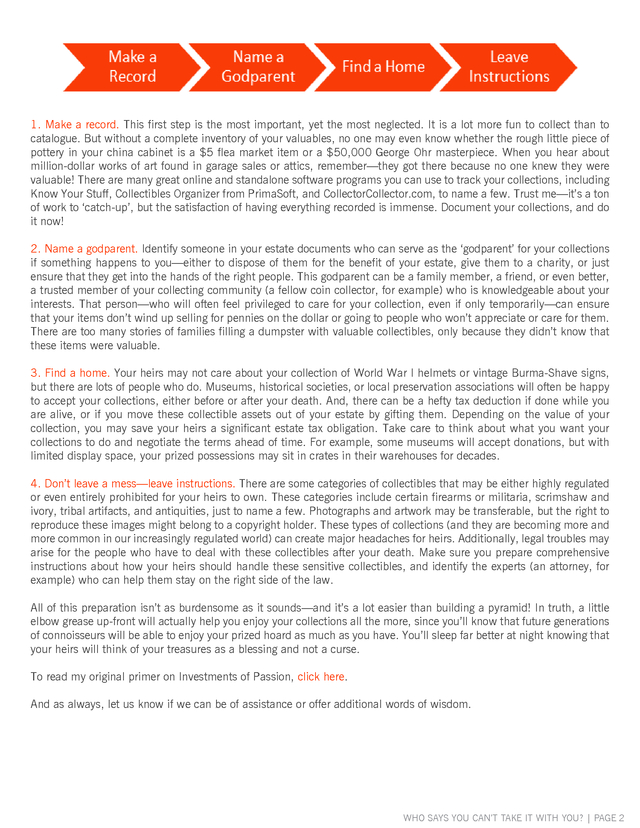

On the contrary, I want to ensure that generations after me will get to enjoy these items at least as much as I have. So, I would like to share with you four important steps I recommend to help you protect your collections in the afterlife. Unlike the Pharaohs of ancient Egypt, I can’t fill a pyramid with my treasures and slap a curse on anyone who comes calling. WHO SAYS YOU CAN’T TAKE IT WITH YOU? | PAGE 1 . 1. Make a record. This first step is the most important, yet the most neglected. It is a lot more fun to collect than to catalogue.

But without a complete inventory of your valuables, no one may even know whether the rough little piece of pottery in your china cabinet is a $5 flea market item or a $50,000 George Ohr masterpiece. When you hear about million-dollar works of art found in garage sales or attics, remember—they got there because no one knew they were valuable! There are many great online and standalone software programs you can use to track your collections, including Know Your Stuff, Collectibles Organizer from PrimaSoft, and CollectorCollector.com, to name a few. Trust me—it’s a ton of work to ‘catch-up’, but the satisfaction of having everything recorded is immense.

Document your collections, and do it now! 2. Name a godparent. Identify someone in your estate documents who can serve as the ‘godparent’ for your collections if something happens to you—either to dispose of them for the benefit of your estate, give them to a charity, or just ensure that they get into the hands of the right people.

This godparent can be a family member, a friend, or even better, a trusted member of your collecting community (a fellow coin collector, for example) who is knowledgeable about your interests. That person—who will often feel privileged to care for your collection, even if only temporarily—can ensure that your items don’t wind up selling for pennies on the dollar or going to people who won’t appreciate or care for them. There are too many stories of families filling a dumpster with valuable collectibles, only because they didn’t know that these items were valuable. 3. Find a home.

Your heirs may not care about your collection of World War I helmets or vintage Burma-Shave signs, but there are lots of people who do. Museums, historical societies, or local preservation associations will often be happy to accept your collections, either before or after your death. And, there can be a hefty tax deduction if done while you are alive, or if you move these collectible assets out of your estate by gifting them.

Depending on the value of your collection, you may save your heirs a significant estate tax obligation. Take care to think about what you want your collections to do and negotiate the terms ahead of time. For example, some museums will accept donations, but with limited display space, your prized possessions may sit in crates in their warehouses for decades. 4.

Don’t leave a mess—leave instructions. There are some categories of collectibles that may be either highly regulated or even entirely prohibited for your heirs to own. These categories include certain firearms or militaria, scrimshaw and ivory, tribal artifacts, and antiquities, just to name a few.

Photographs and artwork may be transferable, but the right to reproduce these images might belong to a copyright holder. These types of collections (and they are becoming more and more common in our increasingly regulated world) can create major headaches for heirs. Additionally, legal troubles may arise for the people who have to deal with these collectibles after your death.

Make sure you prepare comprehensive instructions about how your heirs should handle these sensitive collectibles, and identify the experts (an attorney, for example) who can help them stay on the right side of the law. All of this preparation isn’t as burdensome as it sounds—and it’s a lot easier than building a pyramid! In truth, a little elbow grease up-front will actually help you enjoy your collections all the more, since you’ll know that future generations of connoisseurs will be able to enjoy your prized hoard as much as you have. You’ll sleep far better at night knowing that your heirs will think of your treasures as a blessing and not a curse. To read my original primer on Investments of Passion, click here. And as always, let us know if we can be of assistance or offer additional words of wisdom. WHO SAYS YOU CAN’T TAKE IT WITH YOU? | PAGE 2 . Convergent’s Live Well Series is produced to advance dialogue on topics to help people “Invest TM Well. Manage Well. Live Well. ” It is our hope that these articles will illuminate, intrigue, and inspire—and we invite you to join the conversation. If you have questions, or wish to discuss any of our thought leadership articles, please contact your investment advisor or email us at: LiveWell@ConvergentWealth.com Disclosure: Past Performance Is No Guarantee Of Future Performance.

Any opinions expressed by Convergent employees are current only as of the time made and are subject to change without notice. This article may include estimates, projections or other forward looking statements, however, due to numerous factors, actual events may differ substantially from those presented. While we believe this information to be reliable, Convergent Wealth Advisors bears no responsibility for the advice or information provided in this article whatsoever or for any errors or omissions.

Moreover, the information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. This article is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client's accounts should or would be handled, as appropriate investment decisions depend upon the client's specific investment objectives.

Non-deposit investment products are not FDIC insured, are not deposits or other obligations of City National Bank, are not guaranteed by City National Bank and involve investment risks, including the possible loss of principal. WHO SAYS YOU CAN’T TAKE IT WITH YOU? | PAGE 3 . .

On the contrary, I want to ensure that generations after me will get to enjoy these items at least as much as I have. So, I would like to share with you four important steps I recommend to help you protect your collections in the afterlife. Unlike the Pharaohs of ancient Egypt, I can’t fill a pyramid with my treasures and slap a curse on anyone who comes calling. WHO SAYS YOU CAN’T TAKE IT WITH YOU? | PAGE 1 . 1. Make a record. This first step is the most important, yet the most neglected. It is a lot more fun to collect than to catalogue.

But without a complete inventory of your valuables, no one may even know whether the rough little piece of pottery in your china cabinet is a $5 flea market item or a $50,000 George Ohr masterpiece. When you hear about million-dollar works of art found in garage sales or attics, remember—they got there because no one knew they were valuable! There are many great online and standalone software programs you can use to track your collections, including Know Your Stuff, Collectibles Organizer from PrimaSoft, and CollectorCollector.com, to name a few. Trust me—it’s a ton of work to ‘catch-up’, but the satisfaction of having everything recorded is immense.

Document your collections, and do it now! 2. Name a godparent. Identify someone in your estate documents who can serve as the ‘godparent’ for your collections if something happens to you—either to dispose of them for the benefit of your estate, give them to a charity, or just ensure that they get into the hands of the right people.

This godparent can be a family member, a friend, or even better, a trusted member of your collecting community (a fellow coin collector, for example) who is knowledgeable about your interests. That person—who will often feel privileged to care for your collection, even if only temporarily—can ensure that your items don’t wind up selling for pennies on the dollar or going to people who won’t appreciate or care for them. There are too many stories of families filling a dumpster with valuable collectibles, only because they didn’t know that these items were valuable. 3. Find a home.

Your heirs may not care about your collection of World War I helmets or vintage Burma-Shave signs, but there are lots of people who do. Museums, historical societies, or local preservation associations will often be happy to accept your collections, either before or after your death. And, there can be a hefty tax deduction if done while you are alive, or if you move these collectible assets out of your estate by gifting them.

Depending on the value of your collection, you may save your heirs a significant estate tax obligation. Take care to think about what you want your collections to do and negotiate the terms ahead of time. For example, some museums will accept donations, but with limited display space, your prized possessions may sit in crates in their warehouses for decades. 4.

Don’t leave a mess—leave instructions. There are some categories of collectibles that may be either highly regulated or even entirely prohibited for your heirs to own. These categories include certain firearms or militaria, scrimshaw and ivory, tribal artifacts, and antiquities, just to name a few.

Photographs and artwork may be transferable, but the right to reproduce these images might belong to a copyright holder. These types of collections (and they are becoming more and more common in our increasingly regulated world) can create major headaches for heirs. Additionally, legal troubles may arise for the people who have to deal with these collectibles after your death.

Make sure you prepare comprehensive instructions about how your heirs should handle these sensitive collectibles, and identify the experts (an attorney, for example) who can help them stay on the right side of the law. All of this preparation isn’t as burdensome as it sounds—and it’s a lot easier than building a pyramid! In truth, a little elbow grease up-front will actually help you enjoy your collections all the more, since you’ll know that future generations of connoisseurs will be able to enjoy your prized hoard as much as you have. You’ll sleep far better at night knowing that your heirs will think of your treasures as a blessing and not a curse. To read my original primer on Investments of Passion, click here. And as always, let us know if we can be of assistance or offer additional words of wisdom. WHO SAYS YOU CAN’T TAKE IT WITH YOU? | PAGE 2 . Convergent’s Live Well Series is produced to advance dialogue on topics to help people “Invest TM Well. Manage Well. Live Well. ” It is our hope that these articles will illuminate, intrigue, and inspire—and we invite you to join the conversation. If you have questions, or wish to discuss any of our thought leadership articles, please contact your investment advisor or email us at: LiveWell@ConvergentWealth.com Disclosure: Past Performance Is No Guarantee Of Future Performance.

Any opinions expressed by Convergent employees are current only as of the time made and are subject to change without notice. This article may include estimates, projections or other forward looking statements, however, due to numerous factors, actual events may differ substantially from those presented. While we believe this information to be reliable, Convergent Wealth Advisors bears no responsibility for the advice or information provided in this article whatsoever or for any errors or omissions.

Moreover, the information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation. This article is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client's accounts should or would be handled, as appropriate investment decisions depend upon the client's specific investment objectives.

Non-deposit investment products are not FDIC insured, are not deposits or other obligations of City National Bank, are not guaranteed by City National Bank and involve investment risks, including the possible loss of principal. WHO SAYS YOU CAN’T TAKE IT WITH YOU? | PAGE 3 . .