Description

MARKET FLASH REPORT

February 2016

KEY TAKEAWAYS

•

Equity markets took it on the chin in January, with the S&P 500 falling back into correction territory (down more

than 10% from November's peak). The usual suspects hammered away at investor sentiment, including turmoil in

China, cratering oil prices, a contraction in manufacturing, and stalling corporate profits. Nevertheless, recent data

suggests the U.S. economy, despite an array of challenges, is stalling but not crashing.

As such, the odds appear tilted toward it being only a temporary setback and not the start of a 2008-style market plunge. • So what's up with January? For a third year in a row, the normally optimistic month has notched a stock market loss. If it is any solace, the so-called January Barometer (as January goes, so goes the year) has not worked lately, with the last four negative occurrences seeing subsequent gains over the course of the rest of the year. • After raising rates in December, the Federal Reserve stood pat following their January meeting. The Fed continues to reiterate that monetary policy will be data dependent, and that they are unlikely to hike rates again until it is clear the economy remains on track. That said, one or two increases later in the year are still on the table, perhaps as early as March. • The Bank of Japan delivered a surprise at the end of the month with its adoption of negative interest rates.

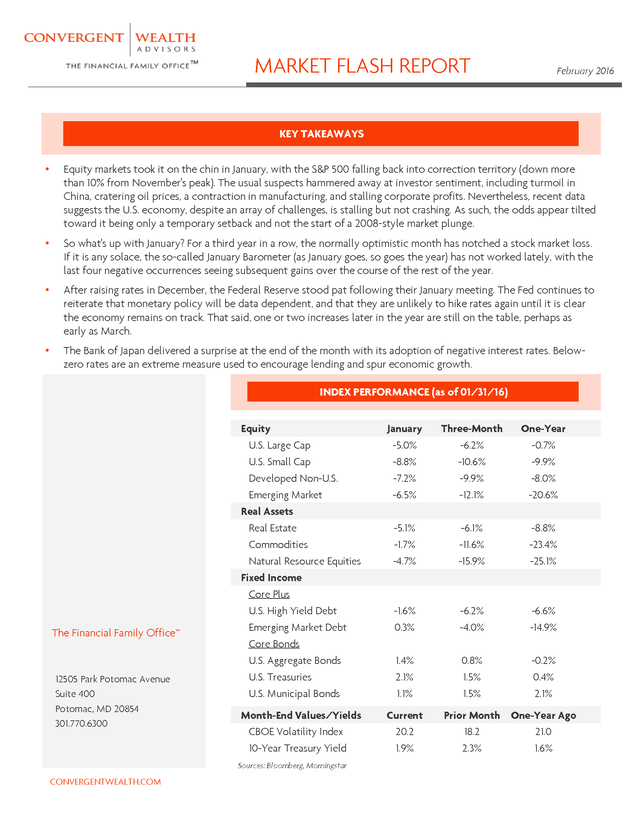

Belowzero rates are an extreme measure used to encourage lending and spur economic growth. INDEX PERFORMANCE (as of 01/31/16) Equity January Three-Month One-Year U.S. Large Cap -5.0% -6.2% -0.7% U.S. Small Cap -8.8% -10.6% -9.9% Developed Non-U.S. -7.2% -9.9% -8.0% Emerging Market -6.5% -12.1% -20.6% -5.1% -6.1% -8.8% Real Assets Real Estate Commodities -1.7% -11.6% -23.4% Natural Resource Equities -4.7% -15.9% -25.1% U.S.

High Yield Debt -1.6% -6.2% -6.6% Emerging Market Debt 0.3% -4.0% -14.9% U.S. Aggregate Bonds 1.4% 0.8% -0.2% U.S. Treasuries 2.1% 1.5% 0.4% U.S.

Municipal Bonds 1.1% 1.5% 2.1% Fixed Income Core Plus The Financial Family Office™ 12505 Park Potomac Avenue Suite 400 Potomac, MD 20854 301.770.6300 Core Bonds Month-End Values/Yields Current Prior Month One-Year Ago CBOE Volatility Index 20.2 18.2 21.0 10-Year Treasury Yield 1.9% 2.3% 1.6% Sources: Bloomberg, Morningstar CONVERGENTWEALTH.COM . DISCLOSURE Past Performance Is No Guarantee Of Future Performance. Any opinions expressed are current only as of the time made and are subject to change without notice. This report may include estimates, projections or other forward looking statements, however, due to numerous factors, actual events may differ substantially from those presented. The graphs and tables making up this report have been based on unaudited, third-party data and performance information provided to us by one or more commercial databases.

Additionally, please be aware that past performance is not a guide to the future performance of any manager or strategy, and that the performance results and historical information provided displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, caution must be used in inferring that these results are indicative of the future performance of any strategy, index, fund, manager or group of managers. All performance numbers shown herein are net of actual fees and expenses and include the reinvestment of dividends and other income, as reported by the manager and/or by the commercial databases involved.

While we believe this information to be reliable, Convergent Wealth Advisors bears no responsibility whatsoever for any errors or omissions. Index benchmarks contained in this report are provided so that performance can be compared with the performance of well-known and widely recognized indices. The volatility of these indices may be materially different from that of the fund. You cannot invest directly in an index.

Index results assume the reinvestment of all dividends and interest. Moreover, the information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation.

Any investment advice provided by Convergent is client specific based on each clients' risk tolerance and investment objectives. This presentation is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client's accounts should or would be handled, as appropriate investment decisions depend upon the client's specific investment objectives. U.S. Large Cap Equity is represented by the S&P 500 Index, with dividends reinvested.

U.S. Small Cap Equity is represented by the Russell 2000 Index. Developed Non-U.S. Equity is represented by the MSCI EAFE Index.

Emerging Market Equity is represented by the MSCI EM Index. Real Estate is represented by the S&P Global Property Index. Commodities are represented by the DJ UBS Commodity Index.

Natural Resource Equities are represented by the S&P North American Natural Resources Index. U.S. High Yield Debt is represented by the Barclays U.S.

Corporate High Yield Index. Emerging Market Debt is represented by the JPM GMI-EM Global Diversified Index. U.S. Aggregate Bonds is represented by the Barclays U.S.

Aggregate Bond Index. U.S. Treasuries is represented by the Barclays U.S.

Treasury Index. U.S. Municipal Bonds is represented by the Barclays Municipal 1-10yr Index. Non-deposit investment products are not FDIC insured, are not deposits or other obligations of Convergent Wealth Advisors, are not guaranteed by Convergent Wealth Advisors and involve investment risks, including the possible loss of principal. 2 | CONVERGENTWEALTH.COM .

As such, the odds appear tilted toward it being only a temporary setback and not the start of a 2008-style market plunge. • So what's up with January? For a third year in a row, the normally optimistic month has notched a stock market loss. If it is any solace, the so-called January Barometer (as January goes, so goes the year) has not worked lately, with the last four negative occurrences seeing subsequent gains over the course of the rest of the year. • After raising rates in December, the Federal Reserve stood pat following their January meeting. The Fed continues to reiterate that monetary policy will be data dependent, and that they are unlikely to hike rates again until it is clear the economy remains on track. That said, one or two increases later in the year are still on the table, perhaps as early as March. • The Bank of Japan delivered a surprise at the end of the month with its adoption of negative interest rates.

Belowzero rates are an extreme measure used to encourage lending and spur economic growth. INDEX PERFORMANCE (as of 01/31/16) Equity January Three-Month One-Year U.S. Large Cap -5.0% -6.2% -0.7% U.S. Small Cap -8.8% -10.6% -9.9% Developed Non-U.S. -7.2% -9.9% -8.0% Emerging Market -6.5% -12.1% -20.6% -5.1% -6.1% -8.8% Real Assets Real Estate Commodities -1.7% -11.6% -23.4% Natural Resource Equities -4.7% -15.9% -25.1% U.S.

High Yield Debt -1.6% -6.2% -6.6% Emerging Market Debt 0.3% -4.0% -14.9% U.S. Aggregate Bonds 1.4% 0.8% -0.2% U.S. Treasuries 2.1% 1.5% 0.4% U.S.

Municipal Bonds 1.1% 1.5% 2.1% Fixed Income Core Plus The Financial Family Office™ 12505 Park Potomac Avenue Suite 400 Potomac, MD 20854 301.770.6300 Core Bonds Month-End Values/Yields Current Prior Month One-Year Ago CBOE Volatility Index 20.2 18.2 21.0 10-Year Treasury Yield 1.9% 2.3% 1.6% Sources: Bloomberg, Morningstar CONVERGENTWEALTH.COM . DISCLOSURE Past Performance Is No Guarantee Of Future Performance. Any opinions expressed are current only as of the time made and are subject to change without notice. This report may include estimates, projections or other forward looking statements, however, due to numerous factors, actual events may differ substantially from those presented. The graphs and tables making up this report have been based on unaudited, third-party data and performance information provided to us by one or more commercial databases.

Additionally, please be aware that past performance is not a guide to the future performance of any manager or strategy, and that the performance results and historical information provided displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Therefore, caution must be used in inferring that these results are indicative of the future performance of any strategy, index, fund, manager or group of managers. All performance numbers shown herein are net of actual fees and expenses and include the reinvestment of dividends and other income, as reported by the manager and/or by the commercial databases involved.

While we believe this information to be reliable, Convergent Wealth Advisors bears no responsibility whatsoever for any errors or omissions. Index benchmarks contained in this report are provided so that performance can be compared with the performance of well-known and widely recognized indices. The volatility of these indices may be materially different from that of the fund. You cannot invest directly in an index.

Index results assume the reinvestment of all dividends and interest. Moreover, the information provided is not intended to be, and should not be construed as, investment, legal or tax advice. Nothing contained herein should be construed as a recommendation or advice to purchase or sell any security, investment, or portfolio allocation.

Any investment advice provided by Convergent is client specific based on each clients' risk tolerance and investment objectives. This presentation is not meant as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client's accounts should or would be handled, as appropriate investment decisions depend upon the client's specific investment objectives. U.S. Large Cap Equity is represented by the S&P 500 Index, with dividends reinvested.

U.S. Small Cap Equity is represented by the Russell 2000 Index. Developed Non-U.S. Equity is represented by the MSCI EAFE Index.

Emerging Market Equity is represented by the MSCI EM Index. Real Estate is represented by the S&P Global Property Index. Commodities are represented by the DJ UBS Commodity Index.

Natural Resource Equities are represented by the S&P North American Natural Resources Index. U.S. High Yield Debt is represented by the Barclays U.S.

Corporate High Yield Index. Emerging Market Debt is represented by the JPM GMI-EM Global Diversified Index. U.S. Aggregate Bonds is represented by the Barclays U.S.

Aggregate Bond Index. U.S. Treasuries is represented by the Barclays U.S.

Treasury Index. U.S. Municipal Bonds is represented by the Barclays Municipal 1-10yr Index. Non-deposit investment products are not FDIC insured, are not deposits or other obligations of Convergent Wealth Advisors, are not guaranteed by Convergent Wealth Advisors and involve investment risks, including the possible loss of principal. 2 | CONVERGENTWEALTH.COM .