Description

Teachers’ Retirement Law

Volume I

January 1, 2015

Lake Tahoe, CA

Volume II of Teachers’ Retirement Law is available online only at CalSTRS.com/information-about-CalSTRS

. TEACHERS’ RETIREMENT LAW

As of January 1, 2015

Volume 1

.

. TEACHERS’ RETIREMENT LAW

As of January 1, 2015

FOREWORD

The Legislature, at the special session of June 1944, revised the State Teachers’ Retirement Act.

Benefits and contributions were increased and the System was placed on a better financial basis.

Amendments to the law were made in 1945, 1947, 1951, 1953, 1954, 1955, 1956, 1957, 1958, 1959,

1961, 1963, 1965 and annually starting in 1967. The 1959 session renumbered the sections of the

code. The 1969 and 1994 sessions recodified the law. In 1995, the Legislature established the Cash

Balance Benefit Program, which is contained in Part 14.

In 1999, the Legislature added Part 13.5, which provides for a Health Benefits Program. Volume 1 of the Teachers’ Retirement Law contains all of the provisions set forth in Parts 13, 13.5 and 14 of Division 1 of the California Education Code along with the rules and regulations of the Teachers’ Retirement Board, which are in the California Code of Regulations. Volume 2, which is available online only at www.calstrs.com/information-about-calstrs, contains pertinent code sections from California statute and from the United States Code. The Teachers’ Retirement Law is issued for the convenience of all persons interested in the California State Teachers’ Retirement System who have a need to reference or work with the up-to-date provisions of the law.

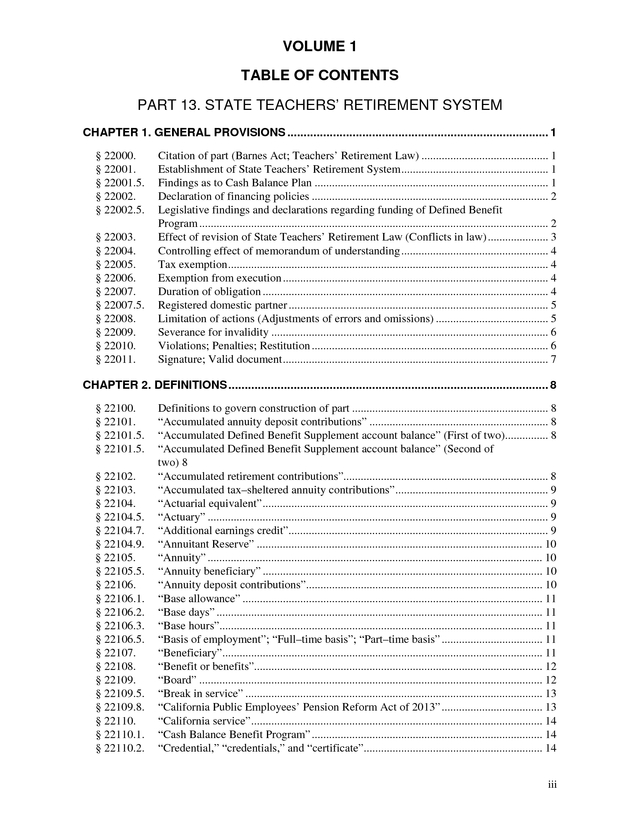

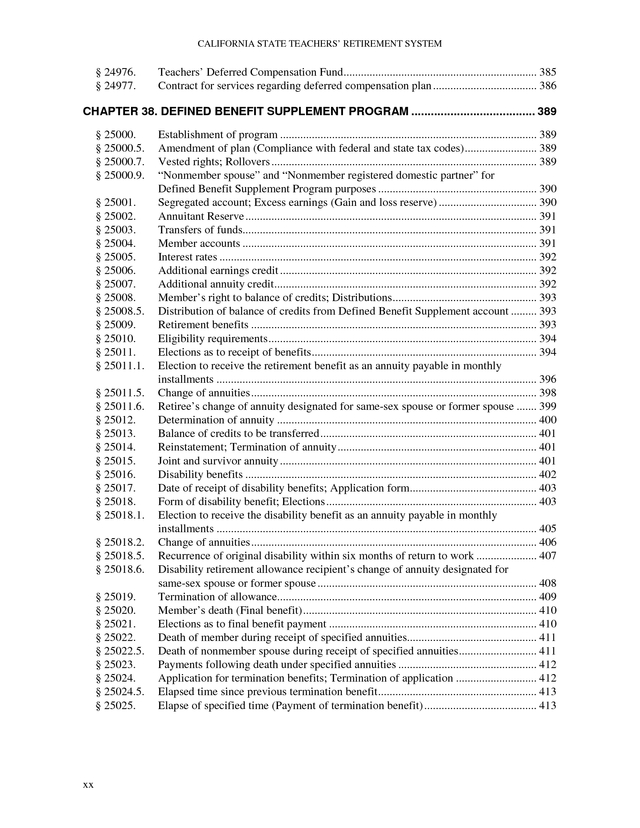

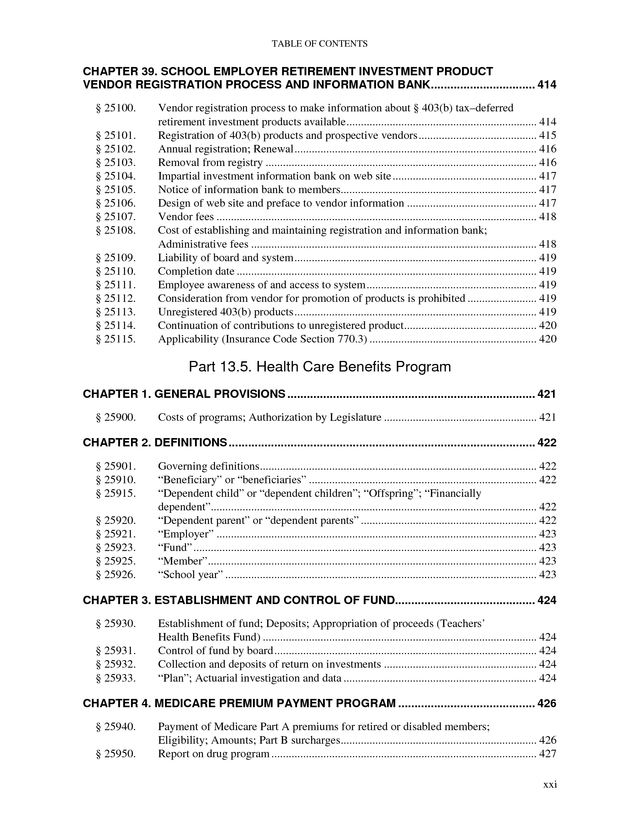

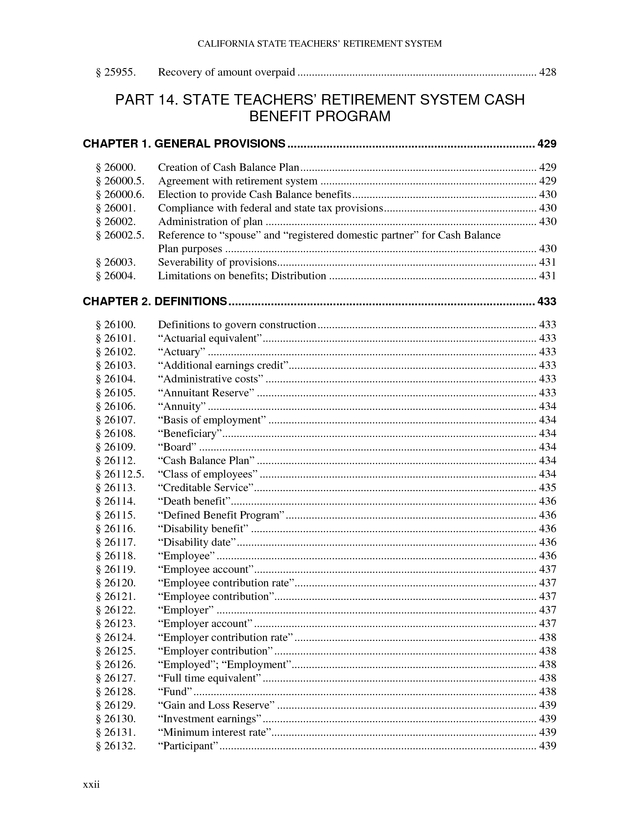

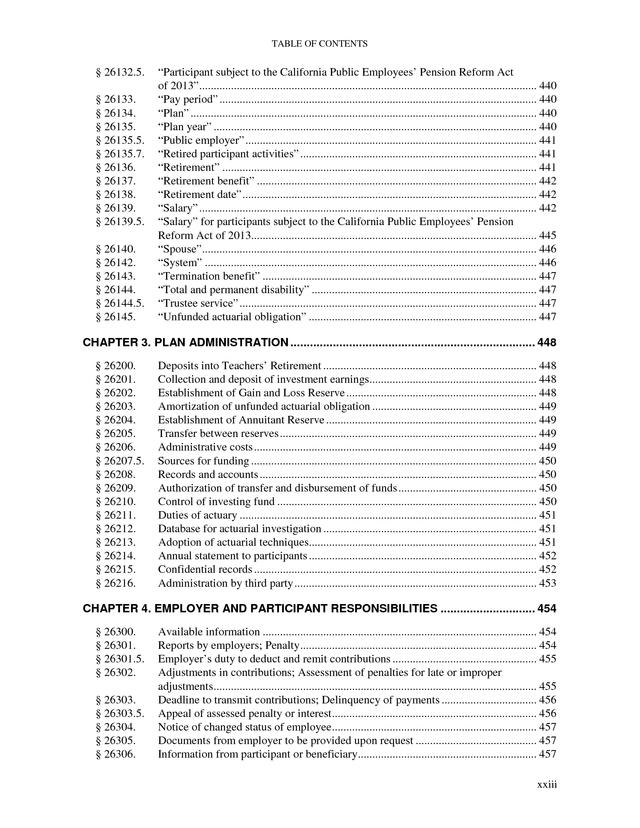

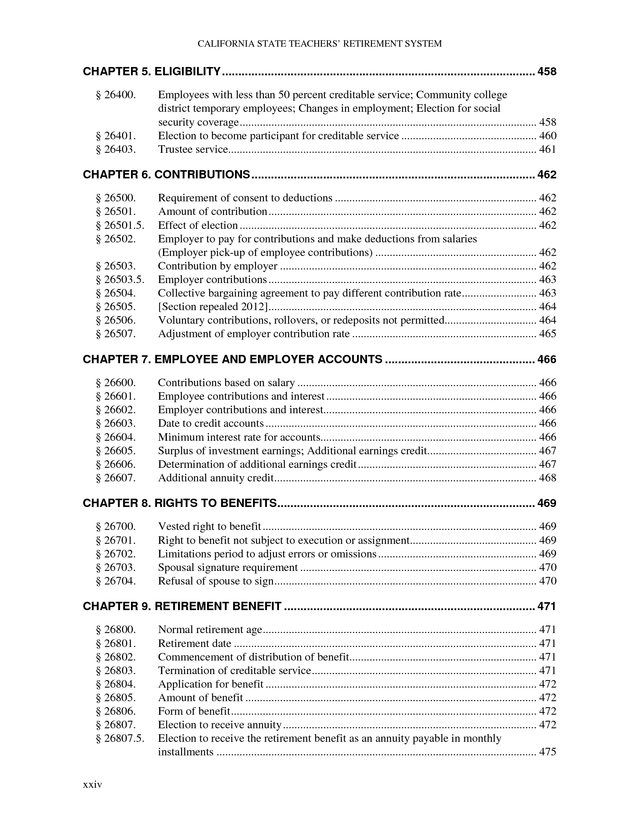

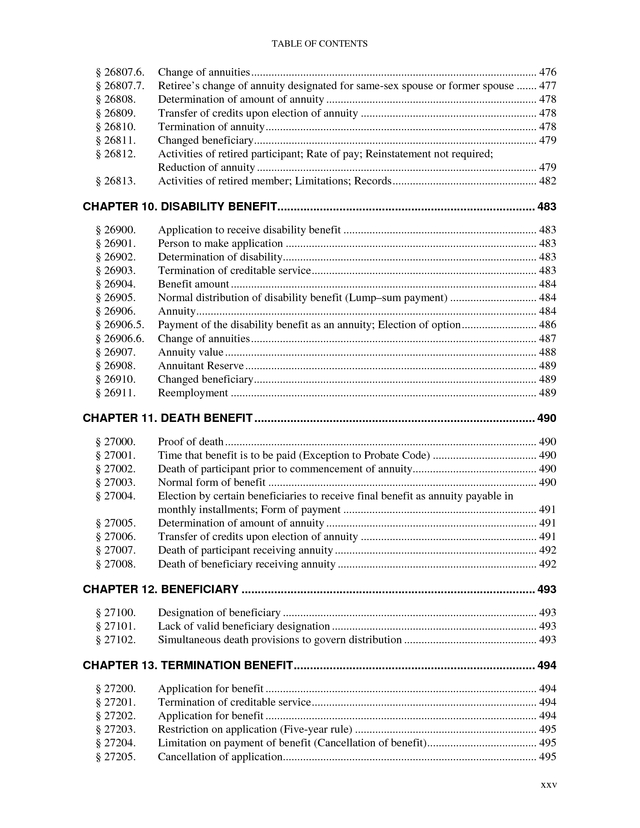

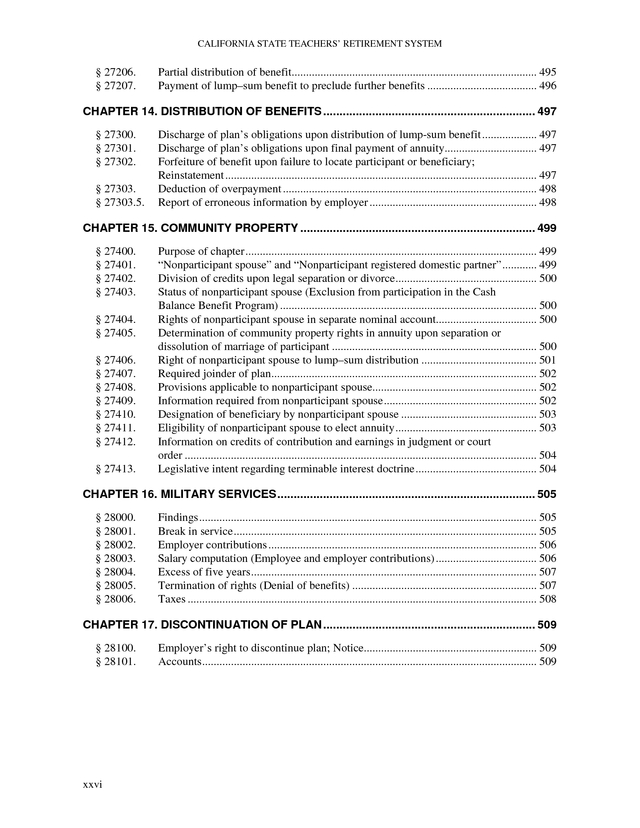

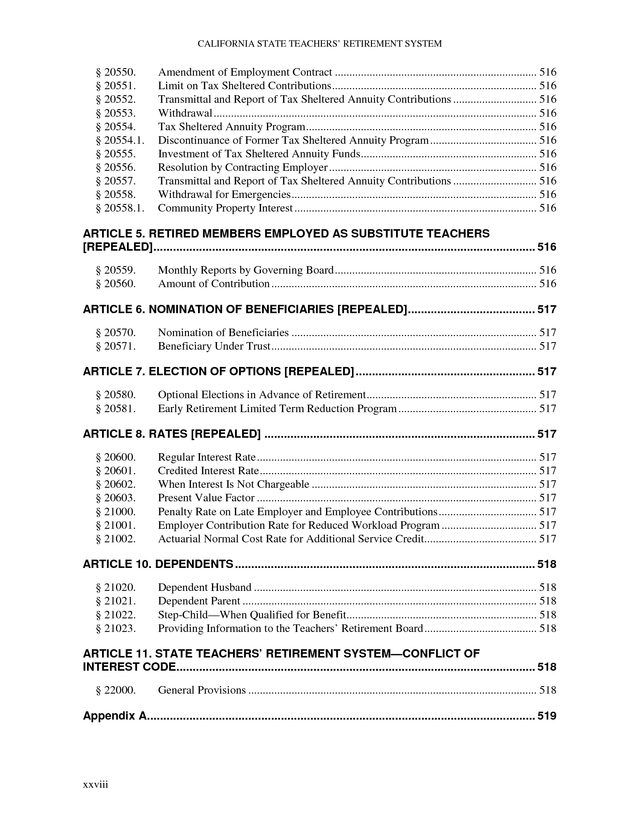

It is intended particularly to assist school administrators and public officials who have duties to perform in connection with the System. In the event that this publication conflicts with actual statute, the statute takes precedence. TEACHERS’ RETIREMENT BOARD . . VOLUME 1 TABLE OF CONTENTS PART 13. STATE TEACHERS’ RETIREMENT SYSTEM CHAPTER 1. GENERAL PROVISIONS ................................................................................ 1 § 22000. § 22001. § 22001.5. § 22002. § 22002.5. § 22003. § 22004. § 22005. § 22006. § 22007. § 22007.5. § 22008. § 22009. § 22010. § 22011. Citation of part (Barnes Act; Teachers’ Retirement Law) ............................................

1 Establishment of State Teachers’ Retirement System ................................................... 1 Findings as to Cash Balance Plan ................................................................................. 1 Declaration of financing policies ..................................................................................

2 Legislative findings and declarations regarding funding of Defined Benefit Program ......................................................................................................................... 2 Effect of revision of State Teachers’ Retirement Law (Conflicts in law) ..................... 3 Controlling effect of memorandum of understanding ...................................................

4 Tax exemption ............................................................................................................... 4 Exemption from execution ............................................................................................ 4 Duration of obligation ...................................................................................................

4 Registered domestic partner .......................................................................................... 5 Limitation of actions (Adjustments of errors and omissions) ....................................... 5 Severance for invalidity ................................................................................................

6 Violations; Penalties; Restitution .................................................................................. 6 Signature; Valid document ............................................................................................ 7 CHAPTER 2.

DEFINITIONS .................................................................................................. 8 § 22100. § 22101. § 22101.5. § 22101.5. § 22102. § 22103. § 22104. § 22104.5. § 22104.7. § 22104.9. § 22105. § 22105.5. § 22106. § 22106.1. § 22106.2. § 22106.3. § 22106.5. § 22107. § 22108. § 22109. § 22109.5. § 22109.8. § 22110. § 22110.1. § 22110.2. Definitions to govern construction of part .................................................................... 8 “Accumulated annuity deposit contributions” ..............................................................

8 “Accumulated Defined Benefit Supplement account balance” (First of two)............... 8 “Accumulated Defined Benefit Supplement account balance” (Second of two) 8 “Accumulated retirement contributions”....................................................................... 8 “Accumulated tax–sheltered annuity contributions” .....................................................

9 “Actuarial equivalent” ................................................................................................... 9 “Actuary” ...................................................................................................................... 9 “Additional earnings credit”..........................................................................................

9 “Annuitant Reserve” ................................................................................................... 10 “Annuity” .................................................................................................................... 10 “Annuity beneficiary” .................................................................................................

10 “Annuity deposit contributions”.................................................................................. 10 “Base allowance” ........................................................................................................ 11 “Base days” .................................................................................................................

11 “Base hours”................................................................................................................ 11 “Basis of employment”; “Full–time basis”; “Part–time basis” ................................... 11 “Beneficiary”...............................................................................................................

11 “Benefit or benefits”.................................................................................................... 12 “Board” ....................................................................................................................... 12 “Break in service” .......................................................................................................

13 “California Public Employees’ Pension Reform Act of 2013” ................................... 13 “California service” ..................................................................................................... 14 “Cash Balance Benefit Program” ................................................................................

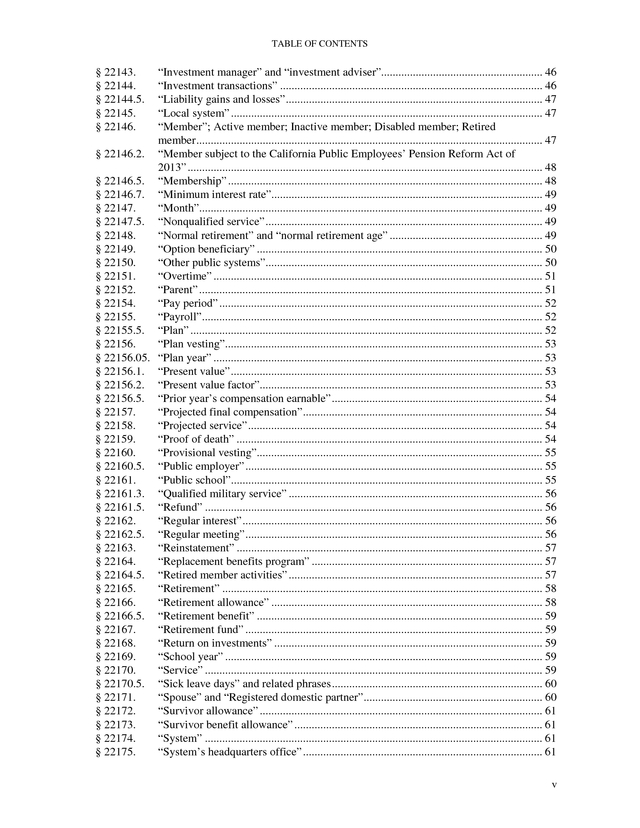

14 “Credential,” “credentials,” and “certificate”.............................................................. 14 iii . CALIFORNIA STATE TEACHERS’ RETIREMENT SYSTEM § 22110.5. § 22111. § 22112.5. § 22112.6. § 22113. § 22115. § 22115.2. § 22115.5. § 22117. § 22118. § 22119. § 22119.2. § 22119.3. § 22119.5. § 22120. § 22121. § 22122. § 22122.4. § 22122.5. § 22122.7. § 22123. § 22123.5. § 22124. § 22126. § 22127. § 22127.2. § 22128. § 22129. § 22130. § 22131. § 22132. § 22133. § 22133.5. § 22134. § 22134.5. § 22135. § 22136. § 22137. § 22138. § 22138.5. § 22138.5. § 22138.6. § 22139.5. § 22140. § 22141. § 22142. iv “Certificated” .............................................................................................................. 14 “Child’s portion” or “children’s portion”.................................................................... 14 “Class of employees” .................................................................................................. 15 Days of service for classes of employees ....................................................................

15 “Comparable level position” ....................................................................................... 16 “Compensation earnable” ............................................................................................ 16 “Concurrent membership” (Other retirement systems, membership) .........................

18 “Concurrent retirement” (Other retirement systems, retirement) ................................ 18 “Contribution rate for additional service credit” ......................................................... 19 “County”; “City and county” ......................................................................................

19 “County superintendent” ............................................................................................. 19 “Creditable compensation” (2% at 60)........................................................................ 20 “Creditable compensation” (2% at 62)........................................................................

23 “Creditable service” .................................................................................................... 25 “Credited interest” ....................................................................................................... 26 “Credited service” .......................................................................................................

26 “Custodian” ................................................................................................................. 27 “Death payment” ......................................................................................................... 27 “Defined Benefit Program” .........................................................................................

27 “Defined Benefit Supplement contributions”.............................................................. 27 “Dependent child” under disability allowance and family allowance programs ...................................................................................................................... 27 “Dependent child” under disability retirement and survivor benefit allowance programs ......................................................................................................................

28 “Dependent parent” ..................................................................................................... 29 “Disability” or “disabled” ........................................................................................... 29 “Disability allowance” ................................................................................................

30 “Disability benefit” ..................................................................................................... 31 “Early retirement” and “early retirement age” ............................................................ 31 “Educational institution” .............................................................................................

32 “Effective date” ........................................................................................................... 32 “Employer” or “employing agency” ........................................................................... 32 “Employed”; “Employment”.......................................................................................

33 “Family allowance” ..................................................................................................... 33 “Final benefit” ............................................................................................................. 34 “Final compensation” (Three-year) .............................................................................

34 Determination of final compensation (One-year)........................................................ 35 “Final compensation” by classroom teacher ............................................................... 37 “Final compensation” when salary has been reduced .................................................

39 “Final compensation” of managerial or supervisory employee .................................. 40 “Final vesting” ............................................................................................................ 40 “Full time”; Minimum standard for prekindergarten through grade 12; Minimum standard for community colleges ...............................................................

40 “Full-time”; Minimum standard for kindergarten through grade 12; Minimum standard for community colleges (Second of two; Operative July 1, 2013) ....................................................................................................................... 42 “Full–time equivalent” ................................................................................................ 43 “Gain and Loss Reserve” ............................................................................................

43 “Improvement factor” (2% increase) .......................................................................... 43 “Improvement factor” as increase of minimum unmodified allowance ...................... 45 “Indexed final compensation” .....................................................................................

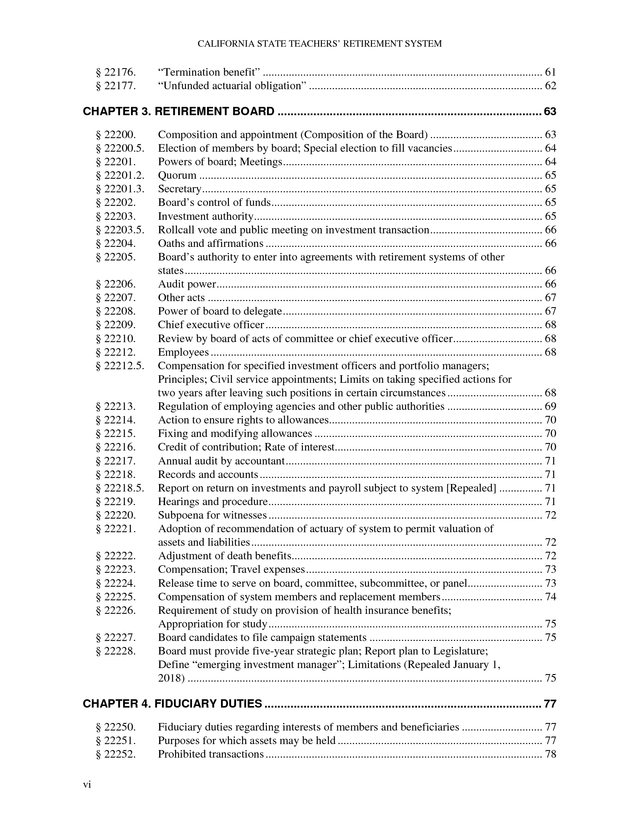

45 . TABLE OF CONTENTS § 22143. § 22144. § 22144.5. § 22145. § 22146. “Investment manager” and “investment adviser”........................................................ 46 “Investment transactions” ........................................................................................... 46 “Liability gains and losses” ......................................................................................... 47 “Local system” ............................................................................................................

47 “Member”; Active member; Inactive member; Disabled member; Retired member ........................................................................................................................ 47 § 22146.2. “Member subject to the California Public Employees’ Pension Reform Act of 2013” ...........................................................................................................................

48 § 22146.5. “Membership” ............................................................................................................. 48 § 22146.7.

“Minimum interest rate”.............................................................................................. 49 § 22147. “Month”....................................................................................................................... 49 § 22147.5.

“Nonqualified service” ................................................................................................ 49 § 22148. “Normal retirement” and “normal retirement age” ..................................................... 49 § 22149. “Option beneficiary” ...................................................................................................

50 § 22150. “Other public systems”................................................................................................ 50 § 22151. “Overtime” .................................................................................................................. 51 § 22152. “Parent” .......................................................................................................................

51 § 22154. “Pay period” ................................................................................................................ 52 § 22155. “Payroll” ...................................................................................................................... 52 § 22155.5.

“Plan” .......................................................................................................................... 52 § 22156. “Plan vesting”.............................................................................................................. 53 § 22156.05.

“Plan year” .................................................................................................................. 53 § 22156.1. “Present value” ............................................................................................................

53 § 22156.2. “Present value factor”.................................................................................................. 53 § 22156.5.

“Prior year’s compensation earnable” ......................................................................... 54 § 22157. “Projected final compensation” ................................................................................... 54 § 22158. “Projected service” ......................................................................................................

54 § 22159. “Proof of death” .......................................................................................................... 54 § 22160. “Provisional vesting”................................................................................................... 55 § 22160.5.

“Public employer” ....................................................................................................... 55 § 22161. “Public school”............................................................................................................ 55 § 22161.3.

“Qualified military service” ........................................................................................ 56 § 22161.5. “Refund” .....................................................................................................................

56 § 22162. “Regular interest” ........................................................................................................ 56 § 22162.5. “Regular meeting” .......................................................................................................

56 § 22163. “Reinstatement” .......................................................................................................... 57 § 22164. “Replacement benefits program” ................................................................................ 57 § 22164.5.

“Retired member activities” ........................................................................................ 57 § 22165. “Retirement” ............................................................................................................... 58 § 22166. “Retirement allowance” ..............................................................................................

58 § 22166.5. “Retirement benefit” ................................................................................................... 59 § 22167. “Retirement fund” .......................................................................................................

59 § 22168. “Return on investments” ............................................................................................. 59 § 22169. “School year” .............................................................................................................. 59 § 22170. “Service” .....................................................................................................................

59 § 22170.5. “Sick leave days” and related phrases ......................................................................... 60 § 22171. “Spouse” and “Registered domestic partner” ..............................................................

60 § 22172. “Survivor allowance” .................................................................................................. 61 § 22173. “Survivor benefit allowance” ...................................................................................... 61 § 22174. “System” .....................................................................................................................

61 § 22175. “System’s headquarters office” ................................................................................... 61 v . CALIFORNIA STATE TEACHERS’ RETIREMENT SYSTEM § 22176. § 22177. “Termination benefit” ................................................................................................. 61 “Unfunded actuarial obligation” ................................................................................. 62 CHAPTER 3. RETIREMENT BOARD .................................................................................

63 § 22200. § 22200.5. § 22201. § 22201.2. § 22201.3. § 22202. § 22203. § 22203.5. § 22204. § 22205. § 22206. § 22207. § 22208. § 22209. § 22210. § 22212. § 22212.5. § 22213. § 22214. § 22215. § 22216. § 22217. § 22218. § 22218.5. § 22219. § 22220. § 22221. § 22222. § 22223. § 22224. § 22225. § 22226. § 22227. § 22228. Composition and appointment (Composition of the Board) ....................................... 63 Election of members by board; Special election to fill vacancies ............................... 64 Powers of board; Meetings ..........................................................................................

64 Quorum ....................................................................................................................... 65 Secretary ...................................................................................................................... 65 Board’s control of funds..............................................................................................

65 Investment authority.................................................................................................... 65 Rollcall vote and public meeting on investment transaction ....................................... 66 Oaths and affirmations ................................................................................................

66 Board’s authority to enter into agreements with retirement systems of other states ............................................................................................................................ 66 Audit power ................................................................................................................. 66 Other acts ....................................................................................................................

67 Power of board to delegate .......................................................................................... 67 Chief executive officer ................................................................................................ 68 Review by board of acts of committee or chief executive officer ...............................

68 Employees ................................................................................................................... 68 Compensation for specified investment officers and portfolio managers; Principles; Civil service appointments; Limits on taking specified actions for two years after leaving such positions in certain circumstances ................................. 68 Regulation of employing agencies and other public authorities .................................

69 Action to ensure rights to allowances.......................................................................... 70 Fixing and modifying allowances ............................................................................... 70 Credit of contribution; Rate of interest........................................................................

70 Annual audit by accountant ......................................................................................... 71 Records and accounts .................................................................................................. 71 Report on return on investments and payroll subject to system [Repealed] ...............

71 Hearings and procedure............................................................................................... 71 Subpoena for witnesses ............................................................................................... 72 Adoption of recommendation of actuary of system to permit valuation of assets and liabilities .....................................................................................................

72 Adjustment of death benefits....................................................................................... 72 Compensation; Travel expenses .................................................................................. 73 Release time to serve on board, committee, subcommittee, or panel..........................

73 Compensation of system members and replacement members ................................... 74 Requirement of study on provision of health insurance benefits; Appropriation for study ............................................................................................... 75 Board candidates to file campaign statements ............................................................

75 Board must provide five-year strategic plan; Report plan to Legislature; Define “emerging investment manager”; Limitations (Repealed January 1, 2018) ........................................................................................................................... 75 CHAPTER 4. FIDUCIARY DUTIES .....................................................................................

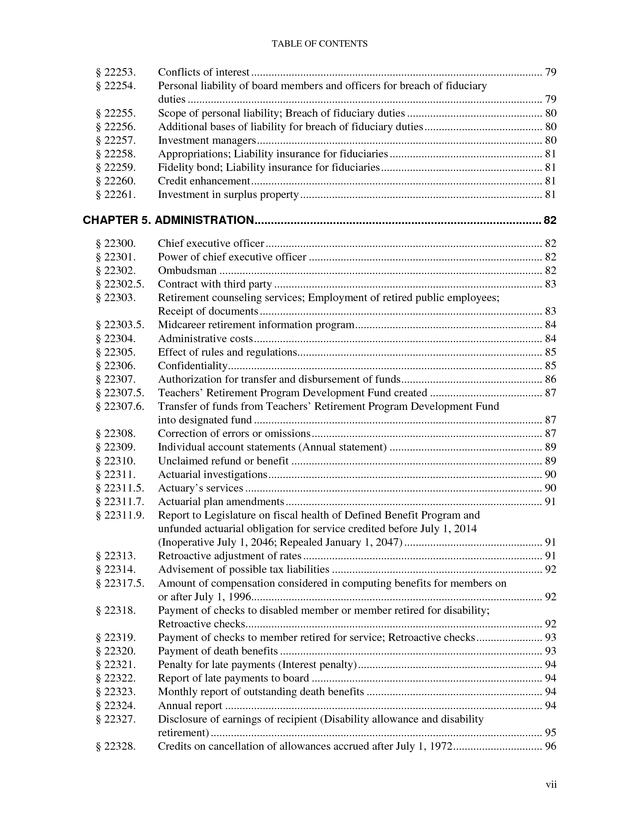

77 § 22250. § 22251. § 22252. vi Fiduciary duties regarding interests of members and beneficiaries ............................ 77 Purposes for which assets may be held ....................................................................... 77 Prohibited transactions ................................................................................................

78 . TABLE OF CONTENTS § 22253. § 22254. § 22255. § 22256. § 22257. § 22258. § 22259. § 22260. § 22261. Conflicts of interest ..................................................................................................... 79 Personal liability of board members and officers for breach of fiduciary duties ........................................................................................................................... 79 Scope of personal liability; Breach of fiduciary duties ............................................... 80 Additional bases of liability for breach of fiduciary duties .........................................

80 Investment managers ................................................................................................... 80 Appropriations; Liability insurance for fiduciaries ..................................................... 81 Fidelity bond; Liability insurance for fiduciaries ........................................................

81 Credit enhancement ..................................................................................................... 81 Investment in surplus property .................................................................................... 81 CHAPTER 5.

ADMINISTRATION........................................................................................ 82 § 22300. § 22301. § 22302. § 22302.5. § 22303. § 22303.5. § 22304. § 22305. § 22306. § 22307. § 22307.5. § 22307.6. § 22308. § 22309. § 22310. § 22311. § 22311.5. § 22311.7. § 22311.9. § 22313. § 22314. § 22317.5. § 22318. § 22319. § 22320. § 22321. § 22322. § 22323. § 22324. § 22327. § 22328. Chief executive officer ................................................................................................ 82 Power of chief executive officer .................................................................................

82 Ombudsman ................................................................................................................ 82 Contract with third party ............................................................................................. 83 Retirement counseling services; Employment of retired public employees; Receipt of documents ..................................................................................................

83 Midcareer retirement information program................................................................. 84 Administrative costs .................................................................................................... 84 Effect of rules and regulations.....................................................................................

85 Confidentiality............................................................................................................. 85 Authorization for transfer and disbursement of funds................................................. 86 Teachers’ Retirement Program Development Fund created .......................................

87 Transfer of funds from Teachers’ Retirement Program Development Fund into designated fund .................................................................................................... 87 Correction of errors or omissions ................................................................................ 87 Individual account statements (Annual statement) .....................................................

89 Unclaimed refund or benefit ....................................................................................... 89 Actuarial investigations ............................................................................................... 90 Actuary’s services .......................................................................................................

90 Actuarial plan amendments ......................................................................................... 91 Report to Legislature on fiscal health of Defined Benefit Program and unfunded actuarial obligation for service credited before July 1, 2014 (Inoperative July 1, 2046; Repealed January 1, 2047) ................................................ 91 Retroactive adjustment of rates ...................................................................................

91 Advisement of possible tax liabilities ......................................................................... 92 Amount of compensation considered in computing benefits for members on or after July 1, 1996..................................................................................................... 92 Payment of checks to disabled member or member retired for disability; Retroactive checks.......................................................................................................

92 Payment of checks to member retired for service; Retroactive checks ....................... 93 Payment of death benefits ........................................................................................... 93 Penalty for late payments (Interest penalty) ................................................................

94 Report of late payments to board ................................................................................ 94 Monthly report of outstanding death benefits ............................................................. 94 Annual report ..............................................................................................................

94 Disclosure of earnings of recipient (Disability allowance and disability retirement) ................................................................................................................... 95 Credits on cancellation of allowances accrued after July 1, 1972 ............................... 96 vii .

CALIFORNIA STATE TEACHERS’ RETIREMENT SYSTEM § 22329. § 22330. § 22335. § 22337. Toll–free telephone assistance .................................................................................... 97 Analysis of asset and liability implications of bills affecting investment strategy, funding, or benefit structure; Appropriation ................................................. 97 Disbursement of moneys in Teachers Tax–Sheltered Annuity Fund (Operative term contingent) ........................................................................................ 98 Mode of notice, issuance, and time limitations for specific system communications ..........................................................................................................

98 CHAPTER 6. INVESTMENTS ............................................................................................. 99 § 22350. § 22351. § 22352. § 22353. § 22354. § 22355. § 22356. § 22359. § 22360. § 22360.5. § 22361. § 22362. § 22363. § 22364. Legislative declaration; Investment expertise .............................................................

99 Legislative intent; Expertise of investment advisers ................................................... 99 Contract for investment services ................................................................................. 99 Requirement of separate individual investment advisers ............................................

99 Duties of investment managers ................................................................................. 100 Employment of investment personnel also serving as investment staff .................... 100 Reduction of book value of securities .......................................................................

100 Custodian services ..................................................................................................... 101 State Teachers’ Retirement System Home Loan Program Act; Authority to enter correspondent agreements with private lending institutions to assist retirement fund to invest in residential mortgages .................................................... 101 State Teachers’ Retirement System Home Loan Program Act; Procedure for member to obtain 100 percent residential financing .................................................

103 Loans from retirement fund for repair or rebuilding of homes damaged by natural disaster........................................................................................................... 104 Investment guidelines................................................................................................ 104 Closed session on vendor or contractor (Campaign contributions of gifts) ..............

106 Communication with interested party ....................................................................... 106 CHAPTER 7. SYSTEM HEADQUARTERS .......................................................................

107 § 22375. § 22376. § 22377. § 22378. § 22379. § 22380. Acquisition of real property to establish permanent facility ..................................... 107 Excess building space................................................................................................ 107 Contract for state agency assistance ..........................................................................

107 Condemnation; Purchase of selected property .......................................................... 107 Award of contract to lowest responsible bidder ........................................................ 108 Building account; Insurance; Accounting procedures...............................................

108 CHAPTER 8. ESTABLISHMENT AND CONTROL OF FUNDS ........................................ 109 § 22400. § 22401. § 22402. § 22403. § 22404. Establishment of Teachers’ Retirement Fund ...........................................................

109 Collection and deposit of return on investments and other receipts .......................... 109 Use of earned interest not credited ............................................................................ 109 Findings as to Cash Balance transfer of funds ..........................................................

110 Benefit adjustments (Threshold for payments and collections) ................................ 110 CHAPTER 9. MEMBER AND EMPLOYER DUTIES .........................................................

111 § 22450. § 22451. § 22451.5. § 22451.7. § 22453. viii Information affecting status of member or beneficiary ............................................. 111 Information required ................................................................................................. 111 Proof of date of birth .................................................................................................

112 Withholding of benefit payments until receipt of proof of birth ............................... 112 Signature of spouse on application............................................................................ 112 .

TABLE OF CONTENTS § 22454. § 22455. § 22455.5. § 22456. § 22457. § 22458. § 22459. § 22460. § 22461. Refusal of spouse to sign application ........................................................................ 113 County superintendent required to furnish information ............................................ 114 Requirement that public employers provide employees with coverage by social security or in qualified retirement plan (Right to elect Defined Benefit membership) .............................................................................................................. 114 Information to be furnished by employer ..................................................................

115 Notice of employment, death, resignation, or discharge ........................................... 115 Provision of documents regarding compensation ..................................................... 115 Withholding of salary on failure to file information or pay amount due ..................

116 Notification to terminating employee of benefits...................................................... 116 Obligation to advise reemployed retired member of earnings limitation and to report earnings ........................................................................................................... 117 CHAPTER 10.

MEMBERSHIP .......................................................................................... 118 § 22500. § 22501. § 22502. § 22503. § 22504. § 22508. § 22508.5. § 22508.6. § 22509. § 22510. § 22511. § 22512. § 22513. § 22514. § 22515. § 22516. Status of members (June 30, 1996) ........................................................................... 118 Employees as members .............................................................................................

118 Part–time employees ................................................................................................. 118 Substitute employees ................................................................................................. 119 Part–time employees on hourly or daily basis...........................................................

119 Effect of change of employment (Right of election) ................................................. 120 Election of retirement system .................................................................................... 122 Subsequent employment of members (Right to elect Defined Benefit membership) ..............................................................................................................

122 Notice of right to election of membership; Procedure for election ........................... 123 Election to transfer membership to Public Employees’ Retirement System ............. 123 Certain members who elect to remain in plan; Limitation on benefits .....................

124 Effect of election of membership in Public Employees’ Retirement System ........... 124 Retention of survivor and disability benefits; Plan vesting ....................................... 124 Qualification when plan vesting not achieved ..........................................................

125 Election to join plan by substitute teachers and part–time employees ...................... 125 Persons not excluded from membership ................................................................... 126 CHAPTER 11.

EXCLUSIONS FROM MEMBERSHIP ....................................................... 127 § 22601. § 22601.5. § 22602. § 22604. Exchange or sojourn teachers .................................................................................... 127 Exclusion of part–time employees from mandatory membership.............................

127 Substitute teachers ..................................................................................................... 127 Part–time employees working on hourly or daily basis ............................................ 128 CHAPTER 12.

COMMUNITY PROPERTY ........................................................................ 130 § 22650. § 22651. § 22652. § 22653. § 22655. § 22656. § 22657. § 22658. Power of court; Rights of nonmember spouses ......................................................... 130 “Nonmember spouse” and “Nonmember registered domestic partner” for community property purposes ...................................................................................

130 Judgment or court order (Court ordered deduction) .................................................. 131 Entitlement of nonmember spouse ............................................................................ 132 Determination of community property rights in retirement allowance of retired member ..........................................................................................................

133 Joinder of plan as party to action and service of judgment or court order ................ 135 Application of other provisions to nonmember spouse ............................................. 135 Separate administration of accounts of nonmember spouse......................................

136 ix . CALIFORNIA STATE TEACHERS’ RETIREMENT SYSTEM § 22659. § 22660. § 22661. § 22662. § 22663. § 22664. § 22665. § 22666. Requisite information from nonmember spouse ....................................................... 137 Designation of beneficiaries ...................................................................................... 137 Refund of accumulated retirement contributions ...................................................... 138 Redeposit of accumulated retirement contributions previously refunded to member ......................................................................................................................

139 Purchase of additional service credit by nonmember spouse .................................... 141 Right to service retirement allowance ....................................................................... 142 Determination of eligibility of member for retirement or disability allowance (Service credit awarded to nonmember spouse)........................................................

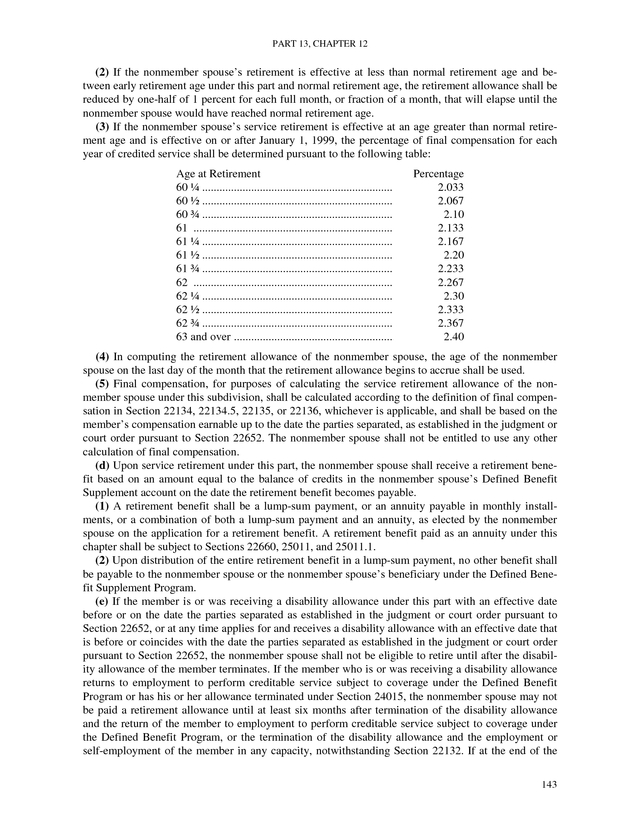

145 Legislative intent (Terminable interest doctrine abolishment).................................. 146 CHAPTER 13. SERVICE CREDIT .....................................................................................

147 § 22700. § 22701. § 22703. § 22704. § 22705. § 22705.5. § 22706. § 22708. § 22709. § 22710. § 22711. § 22712. § 22712.5. § 22713. § 22714. § 22715. § 22716. § 22717. § 22717.5. § 22718. § 22719. § 22720. § 22721. § 22724. Provisions governing inclusion of time ..................................................................... 147 Computation of service to be credited....................................................................... 147 Computation of service (Defined Benefit and Defined Benefit Supplement Program) ....................................................................................................................

147 Computation of year–round or continuous school programs .................................... 148 Exclusion of service covered by other public retirement program............................ 149 Exclusion of service covered under San Francisco City and County Retirement System ....................................................................................................

149 Exclusion of service while covered by retirement or disability ................................ 150 Credit for leave under personal leave program or due to mandatory furlough ......... 150 Credit when member prevented from performing service ........................................

151 Credit for service performed on payment of prescribed contributions (Credit for job related injury or illness) ................................................................................. 151 Service as elected officer of employee organization ................................................. 152 Service as exchange teacher ......................................................................................

152 Service performed that does not qualify (Community service teacher) .................... 153 Regulations allowing reduction in workload to part time duties; Contributions; Termination of agreement ................................................................. 153 Credit for additional years to encourage retirement of certificated or academic employees (Retirement incentive; certificated or academic employees) ................................................................................................................

156 Credit for additional years to encourage retirement (Retirement incentive; state employees) ........................................................................................................ 158 Effect of subsequent service on service credit granted under statute (Retirement incentive; CSU employees) ................................................................... 160 Computation of service credit for accumulated and unused leave ............................

160 Crediting of service retirement .................................................................................. 161 Billing of school employers for service credit awarded for sick leave (Excess sick leave).................................................................................................................. 162 Prohibition on restoring sick leave upon reinstatement ............................................

163 Exclusion from final compensation (Exclusion of sick leave service benefits from final compensation) .......................................................................................... 164 Payment for accumulated sick leave ......................................................................... 164 Determination of excess sick leave days at time of retirement .................................

165 CHAPTER 14. PERMISSIVE AND ADDITIONAL SERVICE CREDIT ............................... 166 § 22800. x Claims for creditable service; Corroboration; Affidavit ...........................................

166 . TABLE OF CONTENTS § 22801. § 22801.5. § 22802. § 22803. § 22804. § 22805. § 22806. § 22807. § 22808. § 22809. § 22810. § 22811. Purchase of additional service credits; Computation of contributions; Cancellation of purchase (Permissive service) .......................................................... 166 Election of coverage by Defined Benefit Program; Contributions (State educational employees; 7/1/91 through 9/11/00) ...................................................... 168 Purchase of service credit by member previously excluded from membership in plan (Consolidation of benefits) ............................................................................ 169 Services for which member may elect to purchase credit .........................................

170 When war with foreign power exists......................................................................... 172 Credit for military or Red Cross services .................................................................. 172 Credit for military or Merchant Marine service ........................................................

173 Credit for time served during extension of military service ...................................... 173 Contributions exemption (Military service) .............................................................. 174 Credit for service performed in war relocation center...............................................

175 Election to receive credit for services performed prior to July 1, 1944 in certain locations other than California ...................................................................... 175 Transfer of funds from eligible retirement plans into Teachers’Retirement Fund 176 CHAPTER 14.2. OUT-OF-STATE SERVICE CREDIT ......................................................

177 § 22820. § 22821. § 22822. § 22823. § 22824. § 22825. § 22826. § 22827. § 22828. § 22829. Right to purchase out-of-state service credit; Procedure; Limits on use of service purchased ...................................................................................................... 177 Submission of request to purchase (Out-of-state service credit) ............................... 178 Time for request of purchase .....................................................................................

178 Time and manner of payment of contributions for out-of-state service credits ........ 179 Conflict with Internal Revenue Code (Internal Revenue Code Section 415)............ 180 Operative date of chapter ..........................................................................................

180 Purchase of credit for nonqualified service; Payment of contributions..................... 180 Purchase credit for out-of-state service ..................................................................... 181 Time and manner of request to purchase out-of-state service credit .........................

181 Time and manner of payment of contributions for out-of-state service credits requested pursuant to § 22827; Cancellation ............................................................ 182 CHAPTER 14.5. MILITARY SERVICE ..............................................................................

183 § 22850. § 22851. § 22852. § 22853. § 22853.5. § 22854. § 22855. § 22856. Legislative intent; Definitions ................................................................................... 183 Calculation of benefits for member returning to same employer; Payment of member contributions................................................................................................ 183 Employer’s liability for contributions .......................................................................

184 Computation of employee’s compensation earnable................................................. 185 Computation of service credit of deceased member.................................................. 186 Rights of reemployed member absent for more than five years................................

186 Factors triggering disqualification for benefits ......................................................... 187 Effect of adverse tax consequences ........................................................................... 187 CHAPTER 15.

EMPLOYEE CONTRIBUTIONS ................................................................ 188 § 22900. § 22901. § 22901.3. § 22901.5. § 22901.7. Consent for deductions .............................................................................................. 188 Contributions to retirement fund ...............................................................................

188 Normal rate of contribution for state employees ....................................................... 189 Crediting to account [Repealed] ................................................................................ 190 Increases in required contributions (Operative term contingent) ..............................

190 xi . CALIFORNIA STATE TEACHERS’ RETIREMENT SYSTEM § 22902. § 22903. § 22904. § 22905. § 22906. § 22907. § 22908. § 22909. Computation of members’ accumulated contributions.............................................. 190 Pick–up of employee contributions towards retirement ............................................ 190 Pick–up of member contributions by state through salary reduction program.......... 191 Contributions to be credited to Defined Benefit and Defined Benefit Supplement accounts; Pretax and posttax contributions (Operative date contingent).................................................................................................................

192 Contributions for service for which no credit may be granted; Refund .................... 193 Adjustments due to change in recorded birth date .................................................... 193 Annuity deposit contributions for additional benefits ...............................................

194 Payment of contributions by employer ..................................................................... 194 CHAPTER 16. EMPLOYER AND STATE CONTRIBUTIONS ...........................................

196 § 22950. § 22950.5. § 22951. § 22951.5. § 22954. § 22954.1. § 22954.5. § 22955. § 22955.1. § 22955.5. § 22956. § 22957. § 22958. Monthly contributions ............................................................................................... 196 Increases in required contributions; Rate adjustment to eliminate unfunded actuarial obligation for service credited before July 1, 2014 (Operative term contingent; Repeal contingent).................................................................................. 197 Contribution of percentage of members’ monthly salary (Sick leave service credit) ........................................................................................................................

198 Increase in contribution rate (Supplemental Benefit Maintenance Account)............ 198 Continuous appropriation .......................................................................................... 198 Quadrennial evaluation; Report to Legislature on system’s ability to provide purchasing power protection; Appropriation (Inoperative July 1, 2036; Repealed January 1, 2037) (Supplemental Benefit Maintenance Account) ..............

200 Additional appropriations for Supplemental Benefit Maintenance Account in the Teachers’ Retirement Fund ................................................................................. 202 Transfer to retirement fund (Continuous appropriation) ........................................... 202 Continuous appropriation for transfer to Teachers’ Retirement Fund; Increases to appropriation (Operative term contingent; Repeal contingent) .............

204 “Creditable compensation” ....................................................................................... 205 Allocation of employer and state contributions ........................................................ 205 Legislative findings and declarations regarding Section 22950.5; Challenge to findings; Annual determinations by Director of Finance; Notification of determinations ...........................................................................................................

206 Action challenging validity of matter authorized by act ........................................... 207 CHAPTER 17. EMPLOYER COLLECTION AND REPORTING PROCEDURES ..............

208 § 23000. § 23001. § 23002. § 23002.5. § 23003. § 23004. § 23005. § 23006. § 23007. § 23008. § 23009. § 23010. xii Mandatory deductions and payments ........................................................................ 208 Requisitions for contributions ................................................................................... 208 When contributions are due and payable and delinquent ..........................................

209 Contributions for year–round or continuous school programs .................................. 209 Assessment of penalties; Interest charges ................................................................. 209 Monthly reports .........................................................................................................

210 When monthly reports are due and delinquent.......................................................... 210 Assessment of penalties for late or unacceptable reports .......................................... 210 Failure of county superintendent to make payment of assessments ..........................

211 Adjustment for incorrect contributions; Penalty ....................................................... 211 Adjustment with interest ........................................................................................... 212 Appeal of assessed penalties or interest ....................................................................

212 . TABLE OF CONTENTS CHAPTER 18. REFUND OF CONTRIBUTIONS ............................................................... 213 § 23100. § 23101. § 23102. § 23103. § 23104. § 23106. § 23107. Payment on certain terminations (Contributions to be refunded) ............................. 213 Forfeiture of rights to service credit benefit ..............................................................

213 Certification of termination of employment .............................................................. 214 Request for refund ..................................................................................................... 214 Mailing and cancellation of warrant refunding contributions ...................................

214 Refund or crediting of service in another system ...................................................... 216 Refund of accumulated annuity deposits................................................................... 216 CHAPTER 19.

REDEPOSIT OF CONTRIBUTIONS.......................................................... 217 § 23200. § 23201. § 23202. § 23203. Redeposit of contributions ........................................................................................ 217 Receipt of other retirement allowance (Right to redeposit) ......................................

217 Time of election to redeposit; Consideration as election to repay; Cancellation when not received; Election after cancellation .................................... 218 Redeposit of refunded accumulated retirement contributions ................................... 219 CHAPTER 20.

BENEFICIARY DESIGNATION ................................................................. 220 § 23300. § 23301. § 23302. § 23303. § 23304. Designation of beneficiary ........................................................................................ 220 Designation of other beneficiaries.............................................................................

221 Full discharge of liability .......................................................................................... 221 Payment of funeral expenses ..................................................................................... 221 Payment to estate in absence of beneficiary designation ..........................................

222 CHAPTER 21. PRE-1972 BENEFITS................................................................................ 223 § 23400. § 23401. § 23402. § 23403. § 23404. Reduction of disability retirement allowance (Earnings limitation) .........................

223 Medical Examinations (Continuing qualification) .................................................... 223 Continuation of certain death benefits....................................................................... 224 Continuation of certain survivor benefits ..................................................................

224 Credits on termination of retirement allowance ........................................................ 224 CHAPTER 21.5. ELECTION OF DISABILITY AND DEATH BENEFIT COVERAGE ........

226 § 23700. § 23701. § 23702. § 23703. § 23704. § 23705. § 23706. Effective date of new survivor benefit and disability retirement programs; Purpose of chapter ..................................................................................................... 226 Time for election of disability and death benefit programs ...................................... 226 Eligibility to make irrevocable election ....................................................................

226 Requirements of election of coverage ....................................................................... 227 Refusal of spouse to sign election document ............................................................ 228 Acknowledgment notice............................................................................................

228 Failure to file election ............................................................................................... 228 CHAPTER 22. ACTIVE DEATH BENEFITS: FAMILY ALLOWANCE...............................

229 § 23800. § 23801. § 23802. § 23803. § 23804. § 23805. Application of chapter; “Members” .......................................................................... 229 Payment of benefits ................................................................................................... 229 Components of payment (Refund upon death of member) .......................................

230 Time of payment (Exception to Probate Code) ......................................................... 231 Payment of family allowance; Conditions ................................................................ 231 Priority of payment of family allowance...................................................................

232 xiii . CALIFORNIA STATE TEACHERS’ RETIREMENT SYSTEM § 23805.5. § 23806. § 23809. § 23810. § 23811. § 23812. Indicia of dependency for parents claiming benefits................................................. 234 Payment of family allowance to children .................................................................. 234 Reduction in family allowance for unmodified benefits payable from other systems ...................................................................................................................... 235 Termination of family allowance ..............................................................................

235 Lump sum payment on termination of family allowance.......................................... 235 Resumption of benefits for deceased member’s surviving spouse who had lost benefits due to remarriage .................................................................................. 236 CHAPTER 23.

ACTIVE DEATH BENEFITS: SURVIVOR BENEFITS ............................... 237 § 23850. § 23851. § 23852. § 23853. § 23854. § 23855. § 23856. § 23858. § 23859. Application of chapter; “Member” ............................................................................ 237 Payment on death to beneficiary ...............................................................................

237 Election of surviving spouse; Dependent child; Beneficiary (Refund of benefits upon death of member) ................................................................................ 238 Request for death payments and return of contributions (Exception to Probate Code) ......................................................................................................................... 239 Survivor benefit allowance (Payment conditions) ....................................................

239 Computation of survivor benefit allowance .............................................................. 240 Eligible dependent children....................................................................................... 241 Termination of allowance on death of beneficiary....................................................

242 Remaining balance paid to estate of spouse on termination of allowance ................ 242 CHAPTER 24. RETIRED DEATH BENEFITS ...................................................................

243 § 23880. § 23881. § 23882. Payment to beneficiary (Death benefit)..................................................................... 243 Payment to beneficiary or option beneficiary (Return of contributions and interest) ...................................................................................................................... 243 Request for death payments and return of contributions (Exception to Probate Code) .........................................................................................................................

244 CHAPTER 25. DISABILITY ALLOWANCE ....................................................................... 245 § 24001. § 24001.5. § 24002. § 24003. § 24004. § 24005. § 24006. § 24007. § 24009. § 24010. § 24011. § 24012. § 24013. § 24014. § 24015. § 24016. xiv Application for disability allowance (Eligibility requirements)................................

245 Eligibility of officers of employee organizations ...................................................... 246 Time and conditions for application for disability allowance ................................... 247 Medical documentation of impairment; Examination; Request for reasonable accommodation; Administrative appeal ....................................................................

248 Limitation of disability allowance in certain areas (Limited-term disability benefit coverage A) ................................................................................................... 249 Effective date of disability allowance; Notification of last day of service................ 250 Amount of disability allowance ................................................................................

251 Calculation of allowance on credited service ............................................................ 251 Reduction when eligible dependent children become ineligible ............................... 252 Reduction for benefits paid or payable under other public systems ..........................

252 Treatment program for impairment amenable to treatment ...................................... 252 Participation in rehabilitation program; Effect of willful failure to participate; Costs .......................................................................................................................... 253 Medical examinations (Continuing qualification) .....................................................

253 Employment of disabled member to perform creditable service............................... 254 Effect of employment on disability allowance (Earnings limitation) ....................... 254 Effect of excessive earnings on allowance ................................................................

255 . TABLE OF CONTENTS § 24017. § 24018. Effect of excessive earnings on allowance of person enrolled in approved rehabilitation program ............................................................................................... 255 Recurrence of original disability within six months of return................................... 255 CHAPTER 26. DISABILITY RETIREMENT .......................................................................

257 § 24100. § 24101. § 24101.5. § 24102. § 24103. § 24104. § 24105. § 24106. § 24107. § 24108. § 24109. § 24110. § 24111. § 24112. § 24113. § 24114. § 24116. § 24117. § 24118. § 24119. Applicability of chapter............................................................................................. 257 Application for disability retirement (Eligibility requirements) ............................... 257 Eligibility for disability while officer of organization ..............................................

259 Time for application for disability retirement allowance (Conditions for application) ................................................................................................................ 259 Medical documentation of impairment; Examination; Request for reasonable accommodation; Administrative appeal .................................................................... 260 Limitation of disability retirement period in certain cases (Limited-term disability benefit coverage B) ...................................................................................

262 Effective date of disability retirement allowance; Notification of last day of service ....................................................................................................................... 263 Components of retirement allowance ........................................................................ 264 Options modifying allowance ...................................................................................

264 Reduction when eligible dependent children become ineligible ............................... 265 Reduction for workers’ compensation benefits paid or payable ............................... 265 Program for impairment amenable to treatment........................................................

265 Participation in rehabilitation program; Effect of willful failure to participate; Costs .......................................................................................................................... 266 Medical examinations (Continuing qualification) ..................................................... 266 Employment of member retired for disability ...........................................................

267 Employment or self–employment of retired member; Earnings limitation............... 268 Service by certain retired teachers of California State University (Postretirement earnings limitations) ................................................................................ 269 Termination of disability retirement allowance ........................................................

269 Credit to member’s account on termination of disability retirement allowance ....... 270 Recurrence of original disability within six months of return................................... 270 CHAPTER 27.

SERVICE RETIREMENT ........................................................................... 271 § 24201. § 24201.5. § 24202. § 24202.5. § 24202.6. § 24202.7. § 24202.8. § 24203. § 24203.5. § 24203.6. § 24204. § 24205. Application for retirement; Conditions ..................................................................... 271 Service retirement during an evaluation of a disability application ..........................

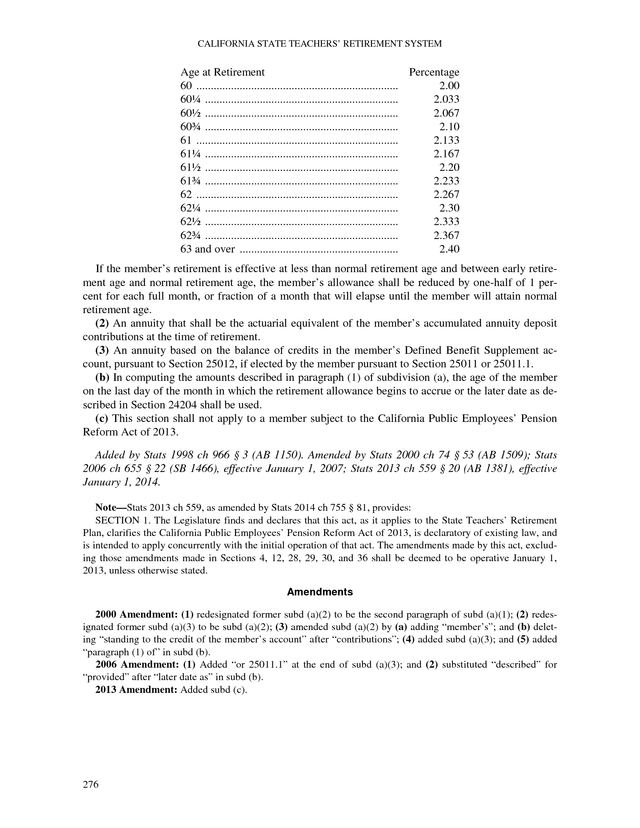

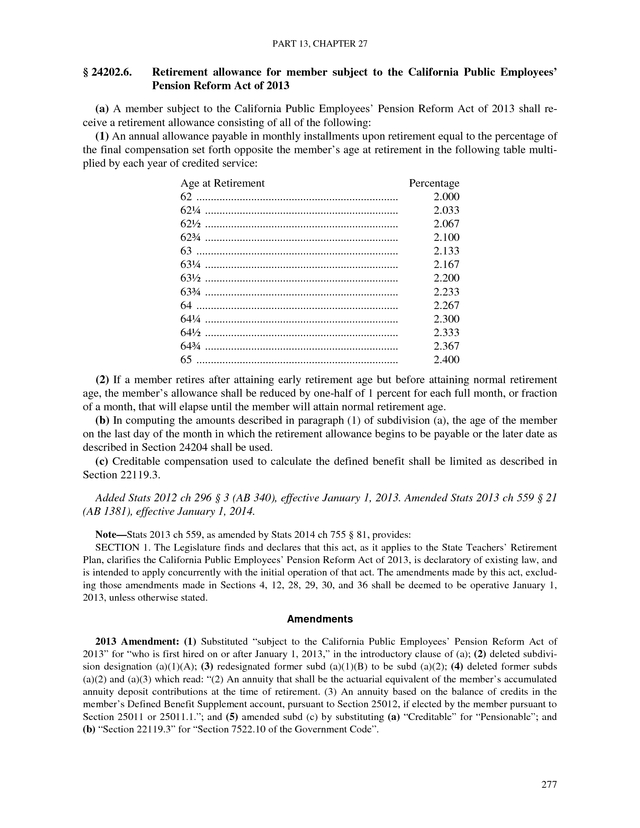

272 Retirement allowance for member retiring after June 30, 1972 ................................ 274 Retirement allowance for member retiring on or after January 1, 1999 ................... 275 Retirement allowance for member subject to the California Public Employees’ Pension Reform Act of 2013 .................................................................

277 Minimum retirement age for member subject to the California Public Employees’ Pension Reform Act of 2013 ................................................................. 278 Implementation of changes established in Sections 24202.6 and 24202.7 ............... 278 Retirement allowance; Early retirement versus normal retirement (“30 and out”)...........................................................................................................................

278 Percentage of final compensation to be increased (“Career factor”)......................... 279 Increase in monthly allowance (“Longevity bonus”) ................................................ 280 Service retirement allowance; Conditions (Benefit effective date) ...........................

281 Option to receive partial allowance upon early retirement and revert to full allowance for normal retirement age (Early Retirement Limited Term Reduction Program) .................................................................................................. 283 xv . CALIFORNIA STATE TEACHERS’ RETIREMENT SYSTEM § 24206. § 24207. § 24208. § 24209. § 24209.3. § 24210. § 24211. § 24212. § 24213. § 24214. § 24214. § 24214.5. § 24215. § 24216. § 24216.5. § 24216.6. § 24217. § 24218. § 24219. § 24221. Minimum unmodified allowance .............................................................................. 284 Minimum allowance for retired member terminating service retirement allowance and retiring under part .............................................................................. 285 Termination of retirement allowance (Reinstatement) .............................................. 286 Retirement for service following reinstatement ........................................................

286 Service retirement benefits for member who perform creditable service for two or more years following reinstatement ............................................................... 288 Retirement following prior disability retirement that was terminated ...................... 290 Allowance of member granted disability allowance who returns to employment subject to coverage under program ......................................................

291 Termination before retirement of allowance to member who does not return to employment ........................................................................................................... 292 Termination of disability allowance on retirement (Disability allowance to service retirement) ..................................................................................................... 293 Activities of retired member; Compensation; Limitations; Applicability of limitations; Documentation to substantiate exemption; Contents of documentation (First of two; Inoperative July 1, 2017; Repealed January 1, 2018) .........................................................................................................................

295 Activities of retired member; Compensation; Limitations; Applicability of limitations; Employee of third party (Second of two; Operative July 1, 2017) ........ 299 Postretirement compensation limitation; Exemption from limitation; Contents of resolution; Documentation; Reduction of retirement allowance ........... 302 Service by certain retired teachers of California State University ............................

304 Exemption from limits on compensation for retirees hired in connection with certain emergency situations [Repealed]................................................................... 304 Exemption from limits on compensation for retirees needed for class size reduction program [Repealed] ................................................................................... 305 Conditions for exemption of compensation of member retired for service from certain provisions of § 24214; Records [Repealed] ..........................................

305 Annuity retirement allowance; Option (Savings clause) ........................................... 305 Calculation of part–time service credit (7/1/1956 through 6/30/1968) ..................... 305 Local teachers’ retirement system retirees; Permanent fund benefit computations .............................................................................................................

306 Election of lump-sum payment and actuarially reduced monthly allowance (Partial lump-sum)..................................................................................................... 306 CHAPTER 27.1. RETIREMENT OPTION PROGRAM ......................................................

308 CHAPTER 27.5. REPLACEMENT BENEFITS PROGRAM ............................................... 309 § 24250. § 24252. § 24255. § 24260. § 24270. § 24275. Legislative intent .......................................................................................................

309 Chapter not applicable to a member subject to the California Public Employees’ Pension Reform Act of 2013 ................................................................. 309 Teachers’ Replacement Benefits Program Fund; Deposits and disbursements of money.................................................................................................................... 309 Establishment of program; Annual benefits (Replacement Benefits Program) ........

310 Reduced annual benefits............................................................................................ 311 Benefits subject to limitation (Internal Revenue Code Section 415) ........................ 311 CHAPTER 28.

OPTIONS .................................................................................................. 312 § 24300. xvi Election of options .................................................................................................... 312 .

TABLE OF CONTENTS § 24300.1. § 24300.2. § 24300.5. § 24300.6. § 24301. § 24302. § 24303. § 24304. § 24305. § 24305.3. § 24305.5. § 24306. § 24306.5. § 24306.7. § 24307. § 24307.5. § 24308. § 24309. § 24310. § 24311. § 24312. § 24312.1. § 24313. § 24320. § 24321. § 24322. § 24323. § 24324. § 24330. § 24331. § 24332. § 24333. § 24340. § 24341. § 24342. § 24343. § 24344. § 24345. § 24346. § 24347. § 24348. Election of option beneficiary; Revocation or change; Death of option beneficiary before member; Community property interest; Plan amendment .......... 315 [Section renumbered 2015.] ...................................................................................... 317 [Section renumbered 2015.] ...................................................................................... 317 [Section renumbered 2015.] ......................................................................................

317 [Section renumbered 2015.] ...................................................................................... 317 [Section renumbered 2015.] ...................................................................................... 317 [Section renumbered 2015.] ......................................................................................

317 [Section renumbered 2015.] ...................................................................................... 317 [Section renumbered 2015.] ...................................................................................... 317 [Section renumbered 2015.] ......................................................................................

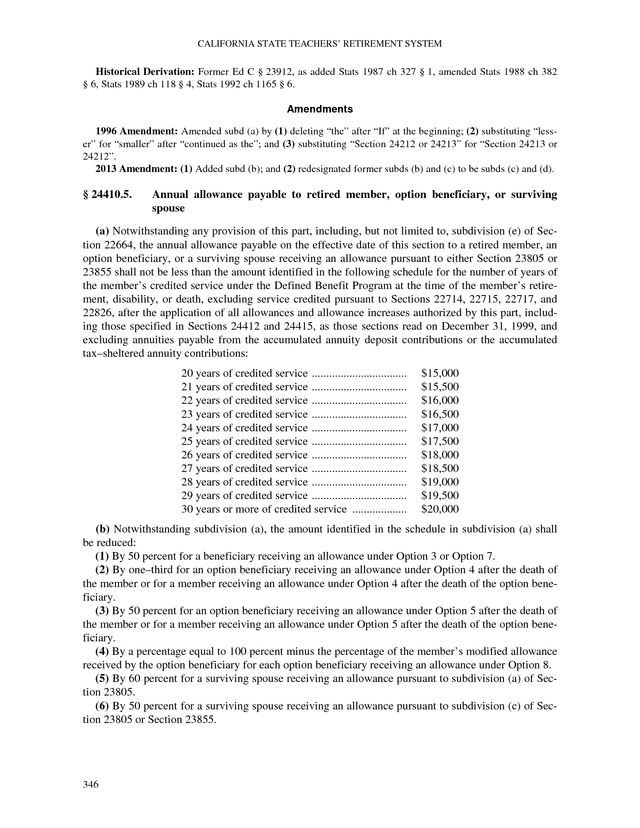

318 [Section renumbered 2015.] ...................................................................................... 318 [Section renumbered 2015.] ...................................................................................... 318 [Section renumbered 2015.] ......................................................................................