Description

CONSUMER FINANCIAL PROTECTION BUREAU

Strategic plan, budget,

and performance

plan and report

March 2014

. Table of Contents

Letter from the Director.........................................................................................................4

Overview of the CFPB............................................................................................................ 6

Plan Overview.......................................................................................................................10

Budget Overview.................................................................................................................. 11

Budget by strategic goal..................................................................................... 12

Budget by program............................................................................................

13 FTE by program................................................................................................. 15 Budget by object class........................................................................................ 16 Summary of key investments............................................................................

17 Budget authority............................................................................................... 20 Goal 1......................................................................................................................................23 Outcome 1.1........................................................................................................25 Outcome 1.2...................................................................................................... 30 Outcome 1.3......................................................................................................

30 Goal 2...................................................................................................................................... 41 Outcome 2.1.......................................................................................................43 Outcome 2.2.......................................................................................................50 Goal 3......................................................................................................................................62 Outcome 3.1.......................................................................................................63 Outcome 3.2...................................................................................................... 66 2 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT .

Goal 4...................................................................................................................................... 71 Outcome 4.1.......................................................................................................72 Outcome 4.2......................................................................................................76 Outcome 4.3...................................................................................................... 80 Outcome 4.4..................................................................................................... 84 Appendix A............................................................................................................................

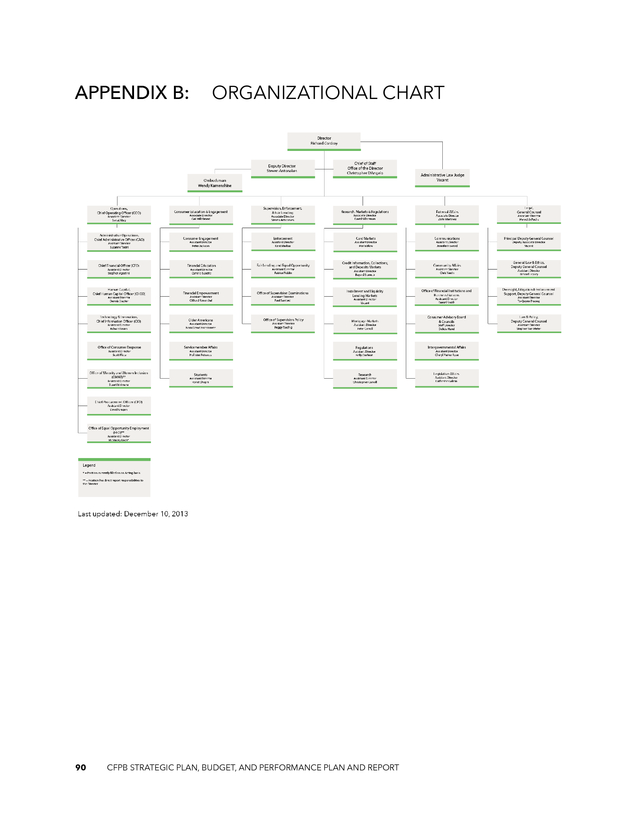

87 Appendix B: Organizational chart......................................................................................90 3 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Message from Richard Cordray Director of the CFPB Last year, we delivered the first integrated view of the Consumer Financial Protection Bureau’s (CFPB’s or Bureau’s) Strategic Plan for fiscal years 2013–2017, as well as the Budget and Annual Performance Plan and Report. This holistic presentation of the Bureau’s goals, budget, performance measures, and accomplishments achieves our goal to increase transparency and make information accessible to American consumers and other key stakeholders, including Congress as well as Federal, and state agencies. Building on the established integrated framework, we are presenting a comprehensive review of progress that the CFPB achieved in fiscal year (FY) 2013 across its four established Strategic Goals for FY 2013–2017. The document also contains the Bureau’s most current view of budget projections for FY 2014–2015 and corresponding performance measures across the full set of performance goals. To share a few highlights, in FY 2013, the CFPB: §§ Launched 160 supervision activities at various financial institutions; §§ Handled approximately 144,000 consumer complaints about credit cards, mortgages, and other financial products; §§ Provided digital content, materials, and decision tools to over 1.9 million consumers; §§ Established key infrastructure for the Civil Penalty Fund to distribute payments to identified victims. These accomplishments clearly signal that the Bureau maintains an unwavering focus on leveraging available resources wisely and carefully. The CFPB remains committed to data-driven 4 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT .

and objective decision-making processes, as well as the robustness, completeness, and reliability of performance information. Congress created this independent bureau within the Federal Reserve System as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 in direct response to a severe financial crisis. The Bureau is dedicated to fulfilling its consumer protection mission by providing research insights, making sound policy, delivering informational resources, and overseeing financial markets. The CFPB will continue to work closely with Congress, businesses, consumer advocates, and its Federal, state, and local partners to strengthen accountability for consumer financial protection. Sincerely, Richard Cordray, Director March 2014 5 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Overview of the CFPB The Bureau of Consumer Financial Protection, known as the Consumer Financial Protection Bureau (CFPB), was established on July 21, 2010 under Title X of the Dodd-Frank Wall Street Reform and Consumer Protection Act Public Law No. 111-203 (Dodd-Frank Act). The CFPB was established as an independent bureau within the Federal Reserve System. The Bureau is an Executive agency as defined in Section 105 of Title 5, United States Code. The Dodd-Frank Act authorizes the CFPB to exercise its authorities to ensure that, with respect to consumer financial products and services: 1. Consumers are provided with timely and understandable information to make responsible decisions about financial transactions; 2. Consumers are protected from unfair, deceptive, or abusive acts and practices and from discrimination; 3. Outdated, unnecessary, or unduly burdensome regulations are regularly identified and addressed in order to reduce unwarranted regulatory burdens; 4. Federal consumer financial law is enforced consistently in order to promote fair competition; and 5. Markets for consumer financial products and services operate transparently and efficiently to facilitate access and innovation. Under the Dodd-Frank Act, on the designated transfer date, July 21, 2011, certain authorities and functions of several agencies relating to Federal consumer financial law transferred to the CFPB in order to accomplish the above objectives.

These authorities were transferred from the Board of Governors of the Federal Reserve System (Board of Governors), Office of the Comptroller of the Currency (OCC), Office of Thrift Supervision (OTS), Federal Deposit Insurance Corporation (FDIC), National Credit Union Administration (NCUA), and the Department of Housing and Urban Development (HUD). In addition, Congress vested the Bureau with authority to enforce in certain circumstances the Federal Trade Commission’s (FTC) Telemarketing Sales Rule and its rules under the FTC Act, although the FTC retains full authority over these rules. The Dodd6 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT .

Frank Act also provided the CFPB with certain other Federal consumer financial regulatory authorities. Our organization Under the Dodd-Frank Act, the Secretary of the Treasury was responsible for establishing the CFPB and performing certain functions of the Bureau until a Director of the CFPB was in place. The Bureau’s day-to-day operations were managed by the Special Advisor to the Secretary of the Treasury for the Consumer Financial Protection Bureau until January 4, 2012, when President Obama recess appointed Richard Cordray as the first Director of the CFPB. Subsequently, the U.S. Senate confirmed the appointment of Richard Cordray on July 16, 2013, and Director Cordray was sworn in as the first Senate confirmed Director of the CFPB on July 17, 2013. To accomplish its mission, the CFPB is organized into six primary divisions: 1. Consumer Education and Engagement: works to empower consumers with the knowledge, tools, and capabilities they need in order to make better-informed financial decisions by engaging them in the right moments of their financial lives, while addressing the unique financial challenges faced by four specific populations. 2. Supervision, Enforcement and Fair Lending: ensures compliance with Federal consumer financial laws by supervising market participants and bringing enforcement actions when appropriate. 3. Research, Markets and Regulations: conducts research to understand consumer financial markets and consumer behavior, evaluates whether there is a need for regulation, and determines the costs and benefits of potential or existing regulations. 4. Legal Division: ensures the Bureau’s compliance with all applicable laws and provides advice to the Director and the Bureau’s divisions. 5. External Affairs: manages the Bureau’s relationships with external stakeholders and ensures that the Bureau maintains robust dialogue with interested stakeholders to promote understanding, transparency, and accountability. 6. Operations: builds and sustains the CFPB’s operational infrastructure to support the entire organization and hears directly from consumers about challenges they face in the marketplaces through their complaints, questions, and feedback. 7 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Our mission The CFPB is a 21st century agency that helps consumer finance markets work by making rules more effective, by consistently and fairly enforcing those rules, and by empowering consumers to take more control over their economic lives. Our vision If we achieve our mission, then we will have encouraged the development of a consumer finance marketplace §§ where customers can see prices and risks up front and where they can easily make product comparisons; §§ in which no one can build a business model around unfair, deceptive, or abusive practices; §§ that works for American consumers, responsible providers, and the economy as a whole. We will achieve our mission and vision through: Data-driven analysis The CFPB is a data-driven agency. We take in data, manage it, store it, share it appropriately, and protect it from unauthorized access. Our aim is to use data purposefully, to analyze and distill data to enable informed decision-making in all internal and external functions. Innovative use of technology Technology is core to the CFPB accomplishing its mission. This means developing and leveraging technology to enhance the CFPB’s reach, impact, and effectiveness.

We strive to be recognized as an innovative, 21st century agency whose approach to technology serves as a model within government. Valuing the best people and great teamwork At the CFPB, we believe our people are our greatest asset. Therefore, we invest in world-class training and support in order to create a diverse and inclusive environment that encourages employees at all levels to tackle complex challenges. We also believe effective teamwork extends outside the walls of the CFPB. We seek input from and collaborate with consumers, industry, government entities, and other external stakeholders. 8 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT .

We aim to embody the following values in everything we do: Service Our mission begins with service to the consumer and our country. We serve our colleagues by listening to one another and by sharing our collective knowledge and experience. Leadership Fostering leadership and collaboration at all levels is at the core of our success. We believe in investing in the growth of our colleagues and in creating an organization that is accountable to the American people. Innovation Our organization embraces new ideas and technology. We are focused on continuously improving, learning, and pushing ourselves to be great. 9 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Plan overview Our strategic plan articulates four goals Goal 1 Prevent financial harm to consumers while promoting good practices that benefit them. Goal 2 Empower consumers to live better financial lives. Goal 3 Inform the public, policy makers, and the CFPB’s own policy-making with data-driven analysis of consumer finance markets and consumer behavior. Goal 4 Advance the CFPB’s performance by maximizing resource productivity and enhancing impact. In support of each goal we outline Budget Outcomes Desired outcomes that further define the focus of our work. Strategies & investments Strategies and investments that lay out the actions we will take to accomplish our outcomes. Performance goals 10 Resource allocations we will make in order to achieve our goals. Specific, measurable goals we will use to assess our progress along with associated measures and indicators. CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Budget overview The CFPB’s operations are funded principally by transfers made by the Board of Governors of the Federal Reserve System from the combined earnings of the Federal Reserve System, up to the limits set forth in the Dodd-Frank Act. The Director of the CFPB requests transfers from the Federal Reserve System in amounts that he has determined are reasonably necessary to carry out the Bureau’s mission without exceeding the limits in the Dodd-Frank Act. Transfers through FY 2013 are capped at set percentages of the total 2009 operating expenses of the Federal Reserve System. In fiscal years 2014 and beyond, the cap is adjusted annually based on the percentage increase in the employment cost index for the total compensation for State and local government workers published by the Federal Government.

Transfers from the Federal Reserve System are capped at $608.4 million for FY 2014. For FY 2015, the funding cap is currently estimated to be $618.7 million. Funds transferred from the Federal Reserve System are deposited into the Bureau of Consumer Financial Protection Fund (Bureau Fund), which is maintained at the Federal Reserve Bank of New York. Pursuant to the Dodd-Frank Act, the CFPB is also authorized to collect and retain for specified purposes civil penalties obtained from any person for violations of Federal consumer financial laws.

The CFPB generally is authorized to use these funds for payments to the victims of activities for which civil penalties have been imposed, and may also use the funds for consumer education and financial literacy programs under certain circumstances. Funds collected by the CFPB under this authority are deposited into the Consumer Financial Civil Penalty Fund (Civil Penalty Fund) maintained at the Federal Reserve Bank of New York. Bureau Fund The CFPB FY 2014 and FY 2015 budget estimates included in this report will support the operations of the Bureau while it continues to grow and mature as a Federal agency. These resources will enable the Bureau to continue to fulfill its statutory obligations and its mission to 11 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT .

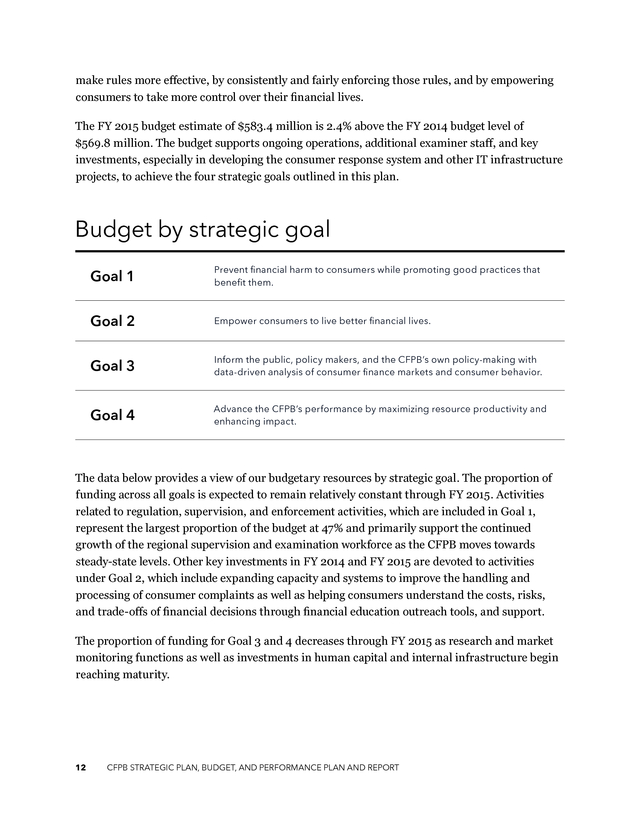

make rules more effective, by consistently and fairly enforcing those rules, and by empowering consumers to take more control over their financial lives. The FY 2015 budget estimate of $583.4 million is 2.4% above the FY 2014 budget level of $569.8 million. The budget supports ongoing operations, additional examiner staff, and key investments, especially in developing the consumer response system and other IT infrastructure projects, to achieve the four strategic goals outlined in this plan. Budget by strategic goal Goal 1 Prevent financial harm to consumers while promoting good practices that benefit them. Goal 2 Empower consumers to live better financial lives. Goal 3 Inform the public, policy makers, and the CFPB’s own policy-making with data-driven analysis of consumer finance markets and consumer behavior. Goal 4 Advance the CFPB’s performance by maximizing resource productivity and enhancing impact. The data below provides a view of our budgetary resources by strategic goal. The proportion of funding across all goals is expected to remain relatively constant through FY 2015. Activities related to regulation, supervision, and enforcement activities, which are included in Goal 1, represent the largest proportion of the budget at 47% and primarily support the continued growth of the regional supervision and examination workforce as the CFPB moves towards steady-state levels.

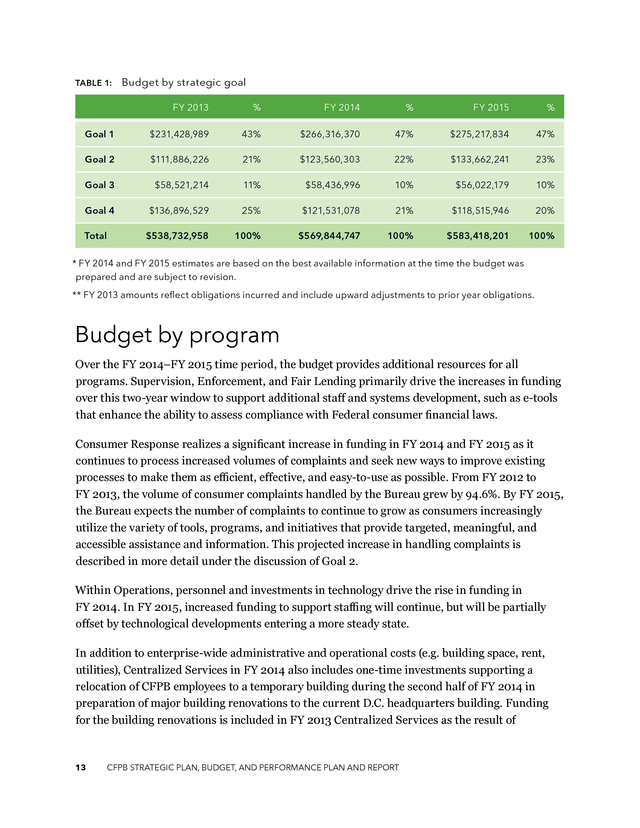

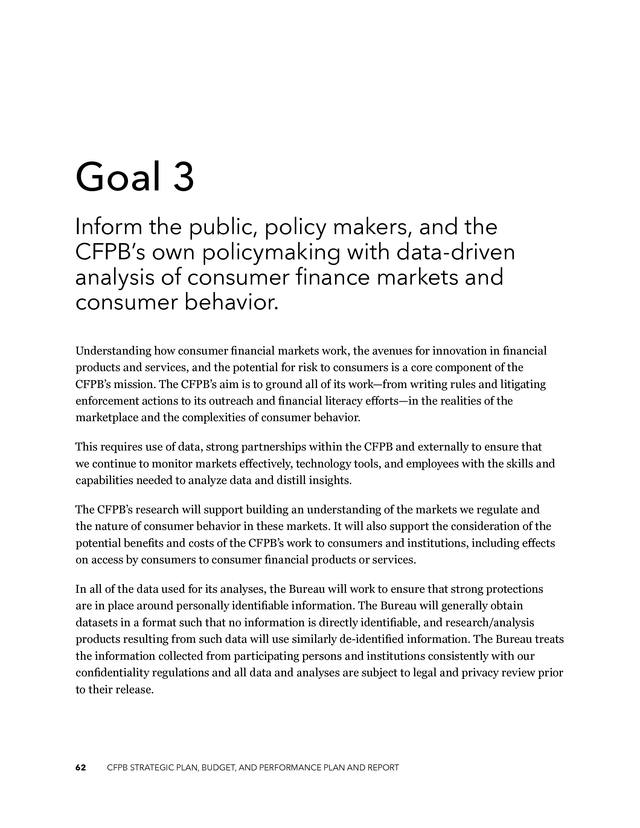

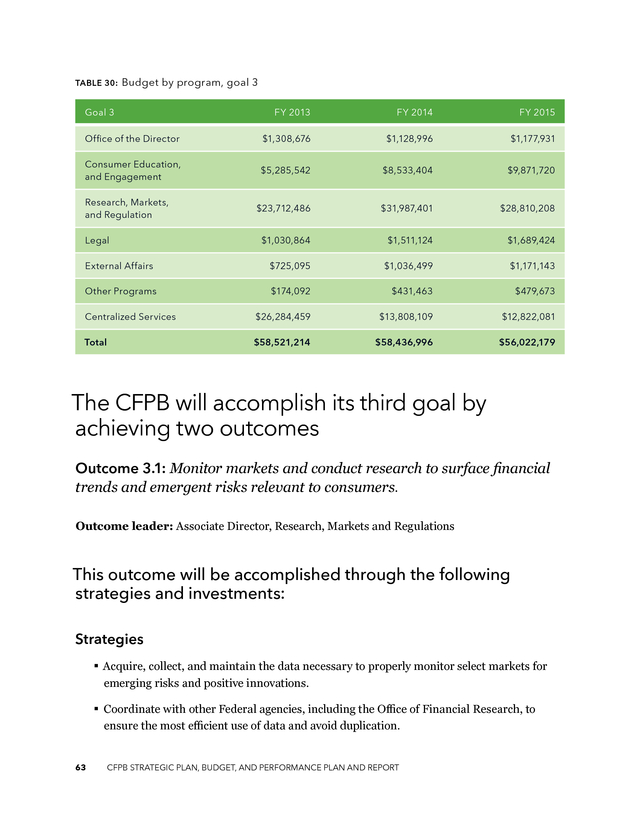

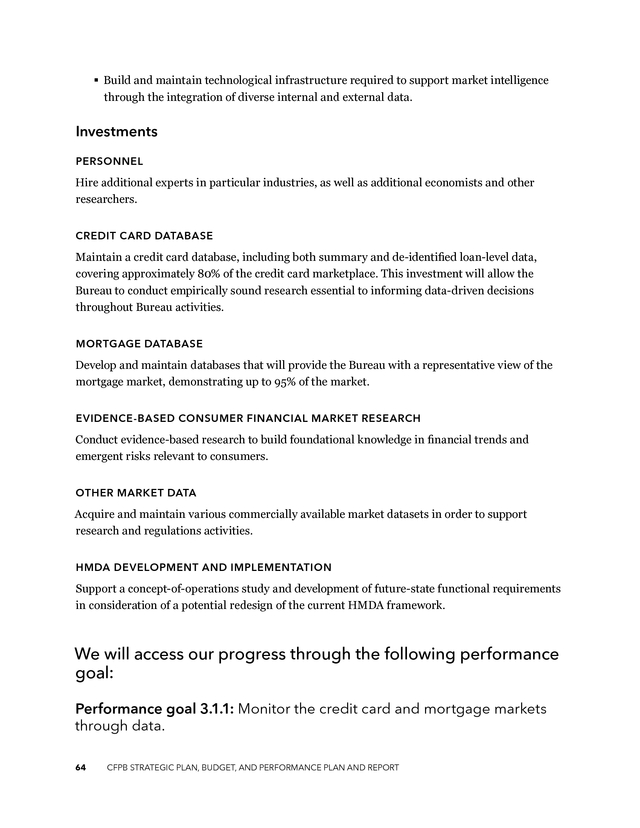

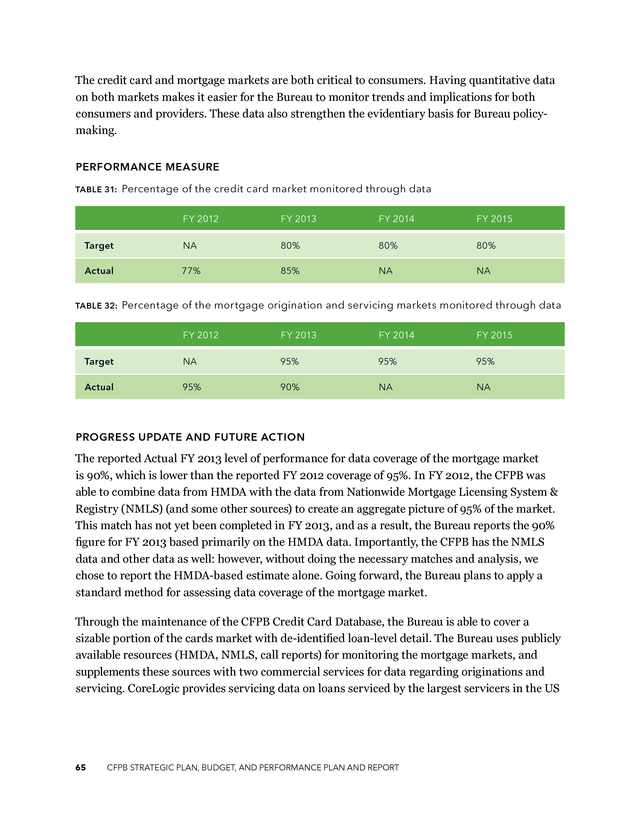

Other key investments in FY 2014 and FY 2015 are devoted to activities under Goal 2, which include expanding capacity and systems to improve the handling and processing of consumer complaints as well as helping consumers understand the costs, risks, and trade-offs of financial decisions through financial education outreach tools, and support. The proportion of funding for Goal 3 and 4 decreases through FY 2015 as research and market monitoring functions as well as investments in human capital and internal infrastructure begin reaching maturity. 12 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . TABLE 1: Budget by strategic goal FY 2013 % FY 2014 % FY 2015 % Goal 1 $231,428,989 43% $266,316,370 47% $275,217,834 47% Goal 2 $111,886,226 21% $123,560,303 22% $133,662,241 23% Goal 3 $58,521,214 11% $58,436,996 10% $56,022,179 10% Goal 4 $136,896,529 25% $121,531,078 21% $118,515,946 20% $538,732,958 100% $569,844,747 100% $583,418,201 100% Total * FY 2014 and FY 2015 estimates are based on the best available information at the time the budget was prepared and are subject to revision. ** FY 2013 amounts reflect obligations incurred and include upward adjustments to prior year obligations. Budget by program Over the FY 2014–FY 2015 time period, the budget provides additional resources for all programs. Supervision, Enforcement, and Fair Lending primarily drive the increases in funding over this two-year window to support additional staff and systems development, such as e-tools that enhance the ability to assess compliance with Federal consumer financial laws. Consumer Response realizes a significant increase in funding in FY 2014 and FY 2015 as it continues to process increased volumes of complaints and seek new ways to improve existing processes to make them as efficient, effective, and easy-to-use as possible. From FY 2012 to FY 2013, the volume of consumer complaints handled by the Bureau grew by 94.6%. By FY 2015, the Bureau expects the number of complaints to continue to grow as consumers increasingly utilize the variety of tools, programs, and initiatives that provide targeted, meaningful, and accessible assistance and information.

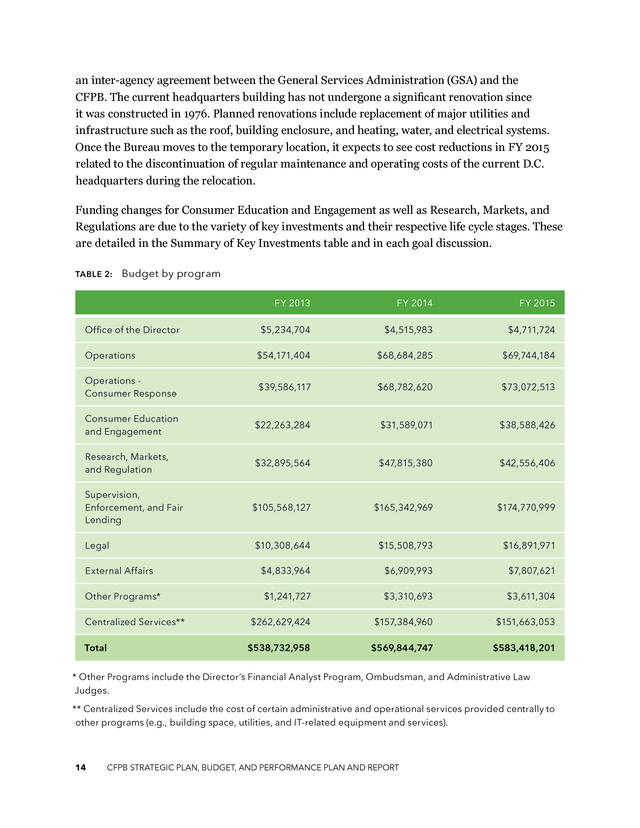

This projected increase in handling complaints is described in more detail under the discussion of Goal 2. Within Operations, personnel and investments in technology drive the rise in funding in FY 2014. In FY 2015, increased funding to support staffing will continue, but will be partially offset by technological developments entering a more steady state. In addition to enterprise-wide administrative and operational costs (e.g. building space, rent, utilities), Centralized Services in FY 2014 also includes one-time investments supporting a relocation of CFPB employees to a temporary building during the second half of FY 2014 in preparation of major building renovations to the current D.C.

headquarters building. Funding for the building renovations is included in FY 2013 Centralized Services as the result of 13 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . an inter-agency agreement between the General Services Administration (GSA) and the CFPB. The current headquarters building has not undergone a significant renovation since it was constructed in 1976. Planned renovations include replacement of major utilities and infrastructure such as the roof, building enclosure, and heating, water, and electrical systems. Once the Bureau moves to the temporary location, it expects to see cost reductions in FY 2015 related to the discontinuation of regular maintenance and operating costs of the current D.C. headquarters during the relocation. Funding changes for Consumer Education and Engagement as well as Research, Markets, and Regulations are due to the variety of key investments and their respective life cycle stages. These are detailed in the Summary of Key Investments table and in each goal discussion. TABLE 2: Budget by program FY 2013 FY 2014 FY 2015 $5,234,704 $4,515,983 $4,711,724 Operations $54,171,404 $68,684,285 $69,744,184 Operations Consumer Response $39,586,117 $68,782,620 $73,072,513 Consumer Education and Engagement $22,263,284 $31,589,071 $38,588,426 Research, Markets, and Regulation $32,895,564 $47,815,380 $42,556,406 Supervision, Enforcement, and Fair Lending $105,568,127 $165,342,969 $174,770,999 Legal $10,308,644 $15,508,793 $16,891,971 $4,833,964 $6,909,993 $7,807,621 $1,241,727 $3,310,693 $3,611,304 $262,629,424 $157,384,960 $151,663,053 $538,732,958 $569,844,747 $583,418,201 Office of the Director External Affairs Other Programs* Centralized Services** Total * Other Programs include the Director’s Financial Analyst Program, Ombudsman, and Administrative Law Judges. ** Centralized Services include the cost of certain administrative and operational services provided centrally to other programs (e.g., building space, utilities, and IT-related equipment and services). 14 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT .

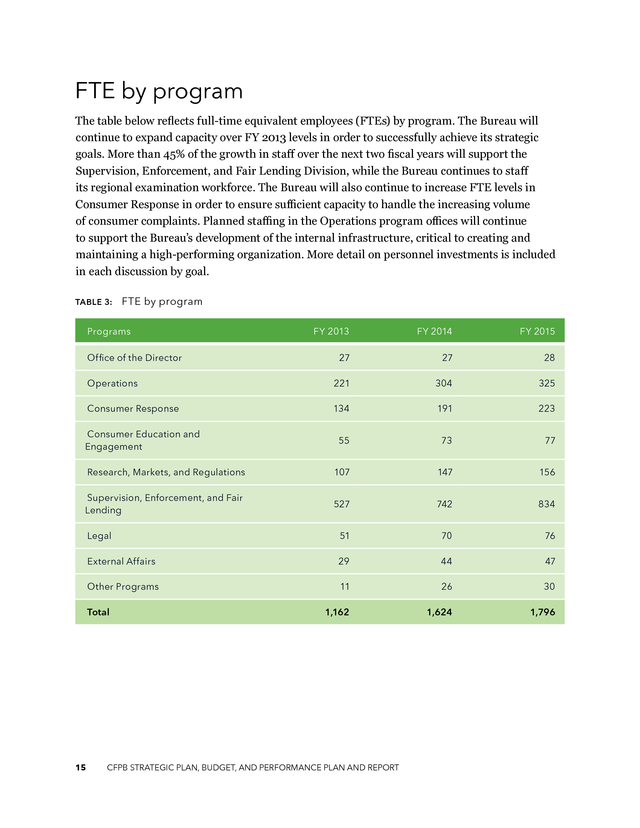

FTE by program The table below reflects full-time equivalent employees  (FTEs) by program. The Bureau will continue to expand capacity over FY 2013 levels in order to successfully achieve its strategic goals. More than 45% of the growth in staff over the next two fiscal years will support the Supervision, Enforcement, and Fair Lending Division, while the Bureau continues to staff its regional examination workforce. The Bureau will also continue to increase FTE levels in Consumer Response in order to ensure sufficient capacity to handle the increasing volume of consumer complaints.

Planned staffing in the Operations program offices will continue to support the Bureau’s development of the internal infrastructure, critical to creating and maintaining a high-performing organization. More detail on personnel investments is included in each discussion by goal. TABLE 3: FTE by program Programs FY 2013 FY 2014 FY 2015 27 27 28 Operations 221 304 325 Consumer Response 134 191 223 55 73 77 Research, Markets, and Regulations 107 147 156 Supervision, Enforcement, and Fair Lending 527 742 834 Legal 51 70 76 External Affairs 29 44 47 Other Programs 11 26 30 1,162 1,624 1,796 Office of the Director Consumer Education and Engagement Total 15 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Budget by object class The table below provides a view of the CFPB’s budget by spending category or object classification. Personnel compensation and benefits represent the largest increases over the two-year horizon as the Bureau continues to hire additional personnel as described above. Total travel expenses are also projected to increase over time as the examination workforce continues to grow and conduct various examination activities across the country. The growth in funds allocated to rents, communications, and miscellaneous charges represent the costs related to temporarily relocating CFPB employees during the renovation of the D.C.

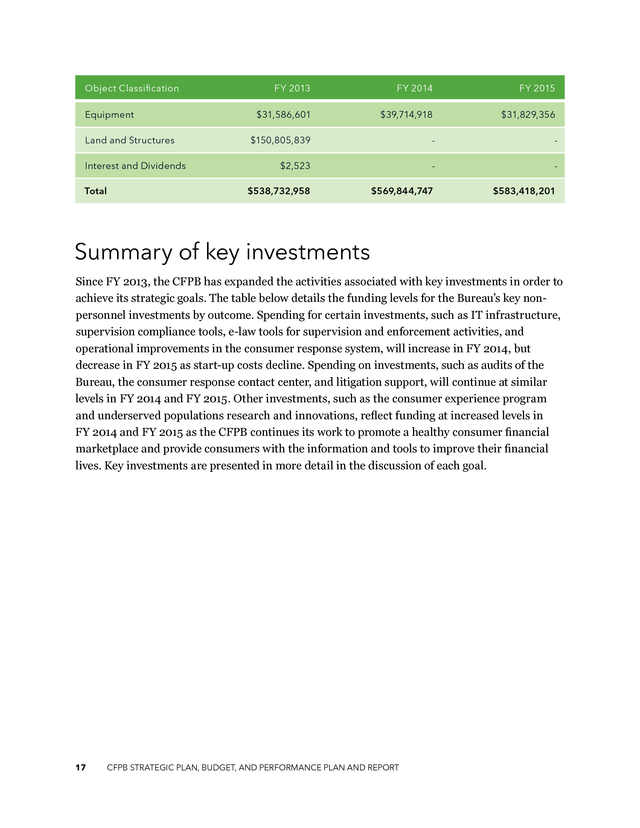

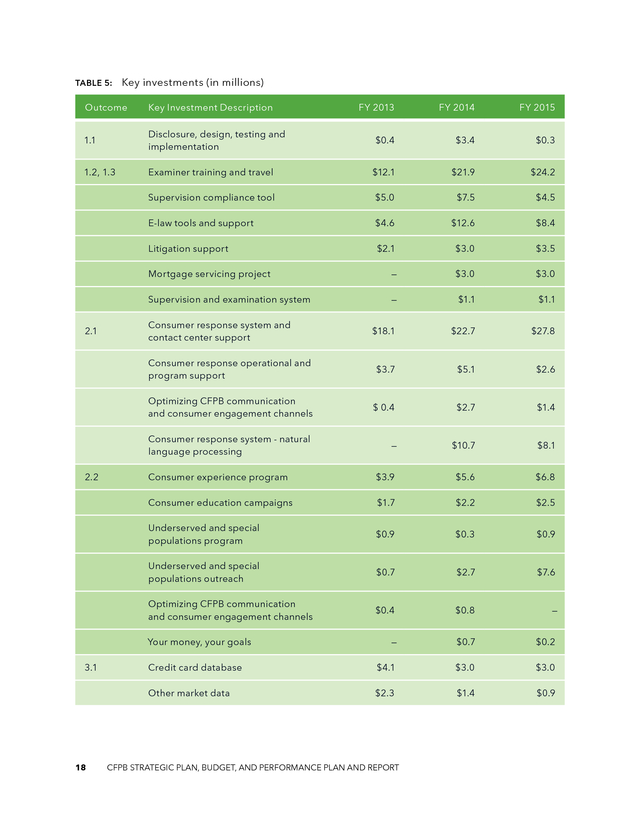

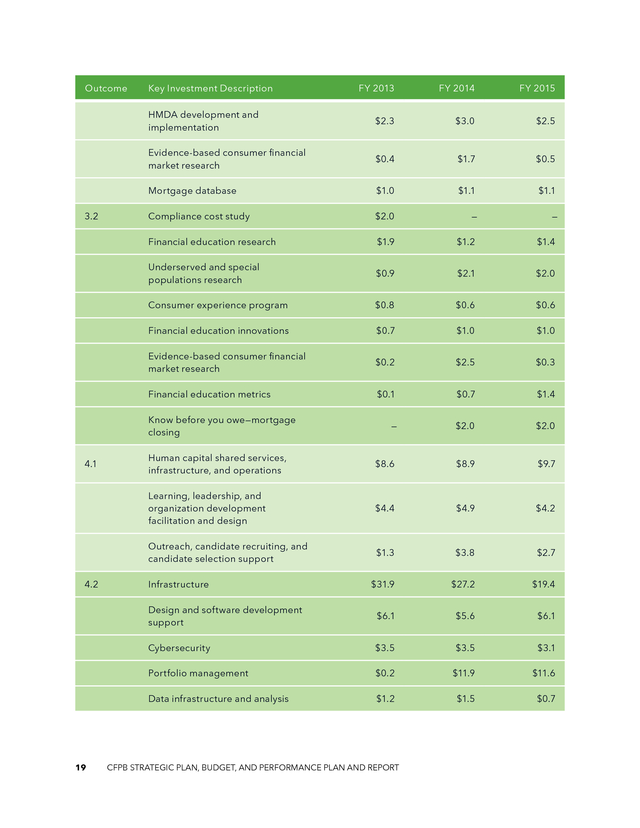

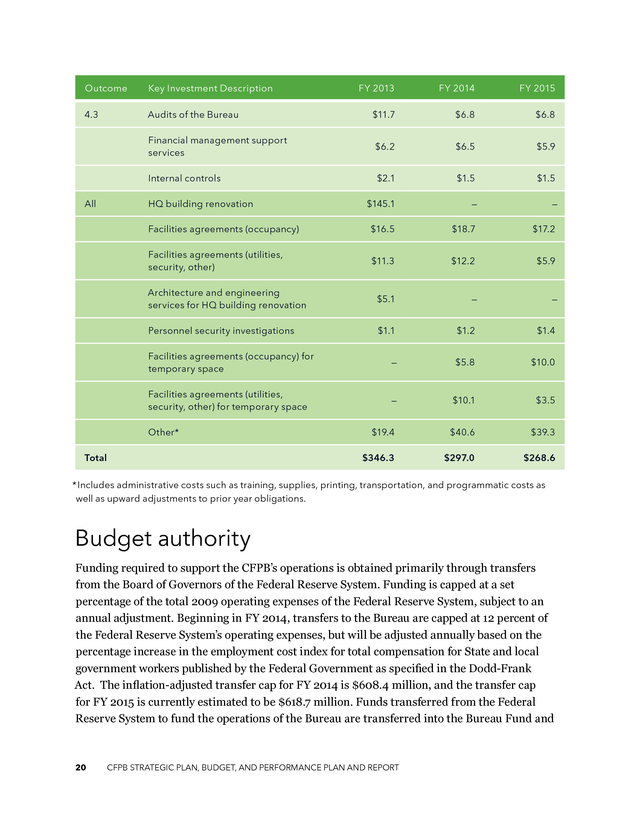

headquarters, which is scheduled to begin in the latter part of FY 2014. The FY 2014 increase in funding for other for “Other Contractual Services” and “Equipment” indicates various technology investments that support the continued development of IT infrastructure throughout the Bureau. Lower budget estimates in these categories in FY 2015 reflect the short-term nature of these investments. TABLE 4: Budget by object classification Object Classification FY 2013 FY 2014 FY 2015 $143,341,164 $203,079,639 $234,551,540 Personnel Benefits $48,998,214 $69,575,962 $79,940,993 Benefits to Former Personnel $70,856 $223,381 $282,990 Travel and Transportation of Persons $14,484,205 $22,555,217 $26,129,269 Transportation of Things $154,148 $25,000 $30,000 Rents, Communications, and Misc Charges $5,611,501 $12,775,278 $17,622,000 Printing and Reproduction $2,227,637 $2,007,011 $2,943,411 $136,790,301 $215,081,450 $185,154,321 $4,659,968 $4,806,891 $4,934,321 Personnel Compensation Other Contractual Services Supplies and Materials 16 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Object Classification Land and Structures Interest and Dividends Total FY 2014 FY 2015 $31,586,601 $39,714,918 $31,829,356 $150,805,839 - - $2,523 - - $538,732,958 Equipment FY 2013 $569,844,747 $583,418,201 Summary of key investments Since FY 2013, the CFPB has expanded the activities associated with key investments in order to achieve its strategic goals. The table below details the funding levels for the Bureau’s key nonpersonnel investments by outcome. Spending for certain investments, such as IT infrastructure, supervision compliance tools, e-law tools for supervision and enforcement activities, and operational improvements in the consumer response system, will increase in FY 2014, but decrease in FY 2015 as start-up costs decline. Spending on investments, such as audits of the Bureau, the consumer response contact center, and litigation support, will continue at similar levels in FY 2014 and FY 2015.

Other investments, such as the consumer experience program and underserved populations research and innovations, reflect funding at increased levels in FY 2014 and FY 2015 as the CFPB continues its work to promote a healthy consumer financial marketplace and provide consumers with the information and tools to improve their financial lives. Key investments are presented in more detail in the discussion of each goal. 17 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . TABLE 5: Key investments (in millions) Outcome Key Investment Description 1.1 Disclosure, design, testing and implementation 1.2, 1.3 FY 2015 $0.4 $3.4 $0.3 Examiner training and travel $12.1 $21.9 $24.2 $5.0 $7.5 $4.5 E-law tools and support $4.6 $12.6 $8.4 Litigation support $2.1 $3.0 $3.5 Mortgage servicing project — $3.0 $3.0 Supervision and examination system — $1.1 $1.1 $18.1 $22.7 $27.8 Consumer response operational and program support $3.7 $5.1 $2.6 Optimizing CFPB communication and consumer engagement channels $ 0.4 $2.7 $1.4 Consumer response system - natural language processing — $10.7 $8.1 Consumer experience program $3.9 $5.6 $6.8 Consumer education campaigns $1.7 $2.2 $2.5 Underserved and special populations program $0.9 $0.3 $0.9 Underserved and special populations outreach $0.7 $2.7 $7.6 Optimizing CFPB communication and consumer engagement channels $0.4 $0.8 — — $0.7 $0.2 Credit card database $4.1 $3.0 $3.0 Other market data 2.2 FY 2014 Supervision compliance tool 2.1 FY 2013 $2.3 $1.4 $0.9 Consumer response system and contact center support Your money, your goals 3.1 18 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Outcome FY 2013 FY 2014 FY 2015 HMDA development and implementation $2.3 $3.0 $2.5 Evidence-based consumer financial market research $0.4 $1.7 $0.5 Mortgage database $1.0 $1.1 $1.1 Compliance cost study $2.0 — — Financial education research $1.9 $1.2 $1.4 Underserved and special populations research $0.9 $2.1 $2.0 Consumer experience program $0.8 $0.6 $0.6 Financial education innovations $0.7 $1.0 $1.0 Evidence-based consumer financial market research $0.2 $2.5 $0.3 Financial education metrics $0.1 $0.7 $1.4 — $2.0 $2.0 Human capital shared services, infrastructure, and operations $8.6 $8.9 $9.7 Learning, leadership, and organization development facilitation and design $4.4 $4.9 $4.2 Outreach, candidate recruiting, and candidate selection support $1.3 $3.8 $2.7 $31.9 $27.2 $19.4 Design and software development support $6.1 $5.6 $6.1 Cybersecurity $3.5 $3.5 $3.1 Portfolio management $0.2 $11.9 $11.6 Data infrastructure and analysis 3.2 Key Investment Description $1.2 $1.5 $0.7 Know before you owe—mortgage closing 4.1 4.2 19 Infrastructure CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Outcome Key Investment Description 4.3 FY 2014 FY 2015 Audits of the Bureau $11.7 $6.8 $6.8 Financial management support services $6.2 $6.5 $5.9 Internal controls $2.1 $1.5 $1.5 $145.1 — — Facilities agreements (occupancy) $16.5 $18.7 $17.2 Facilities agreements (utilities, security, other) $11.3 $12.2 $5.9 Architecture and engineering services for HQ building renovation $5.1 — — Personnel security investigations $1.1 $1.2 $1.4 Facilities agreements (occupancy) for temporary space — $5.8 $10.0 Facilities agreements (utilities, security, other) for temporary space All FY 2013 — $10.1 $3.5 $19.4 $40.6 $39.3 $346.3 $297.0 $268.6 HQ building renovation Other* Total * Includes administrative costs such as training, supplies, printing, transportation, and programmatic costs as well as upward adjustments to prior year obligations. Budget authority Funding required to support the CFPB’s operations is obtained primarily through transfers from the Board of Governors of the Federal Reserve System. Funding is capped at a set percentage of the total 2009 operating expenses of the Federal Reserve System, subject to an annual adjustment. Beginning in FY 2014, transfers to the Bureau are capped at 12 percent of the Federal Reserve System’s operating expenses, but will be adjusted annually based on the percentage increase in the employment cost index for total compensation for State and local government workers published by the Federal Government as specified in the Dodd-Frank Act. The inflation-adjusted transfer cap for FY 2014 is $608.4 million, and the transfer cap for FY 2015 is currently estimated to be $618.7 million.

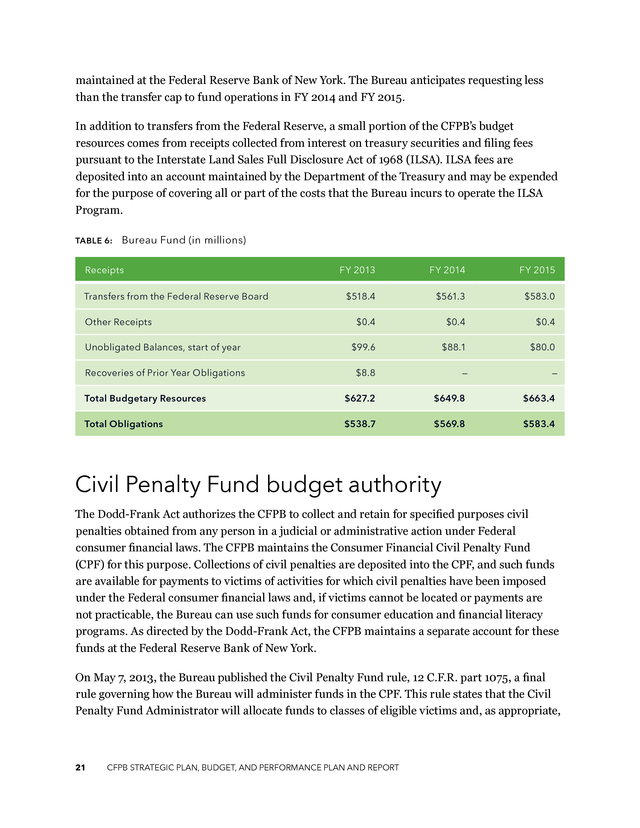

Funds transferred from the Federal Reserve System to fund the operations of the Bureau are transferred into the Bureau Fund and 20 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . maintained at the Federal Reserve Bank of New York. The Bureau anticipates requesting less than the transfer cap to fund operations in FY 2014 and FY 2015. In addition to transfers from the Federal Reserve, a small portion of the CFPB’s budget resources comes from receipts collected from interest on treasury securities and filing fees pursuant to the Interstate Land Sales Full Disclosure Act of 1968 (ILSA). ILSA fees are deposited into an account maintained by the Department of the Treasury and may be expended for the purpose of covering all or part of the costs that the Bureau incurs to operate the ILSA Program. TABLE 6: Bureau Fund (in millions) Receipts FY 2013 FY 2014 FY 2015 $518.4 $561.3 $583.0 $0.4 $0.4 $0.4 Unobligated Balances, start of year $99.6 $88.1 $80.0 Recoveries of Prior Year Obligations $8.8 — — Total Budgetary Resources $627.2 $649.8 $663.4 Total Obligations $538.7 $569.8 $583.4 Transfers from the Federal Reserve Board Other Receipts Civil Penalty Fund budget authority The Dodd-Frank Act authorizes the CFPB to collect and retain for specified purposes civil penalties obtained from any person in a judicial or administrative action under Federal consumer financial laws. The CFPB maintains the Consumer Financial Civil Penalty Fund (CPF) for this purpose.

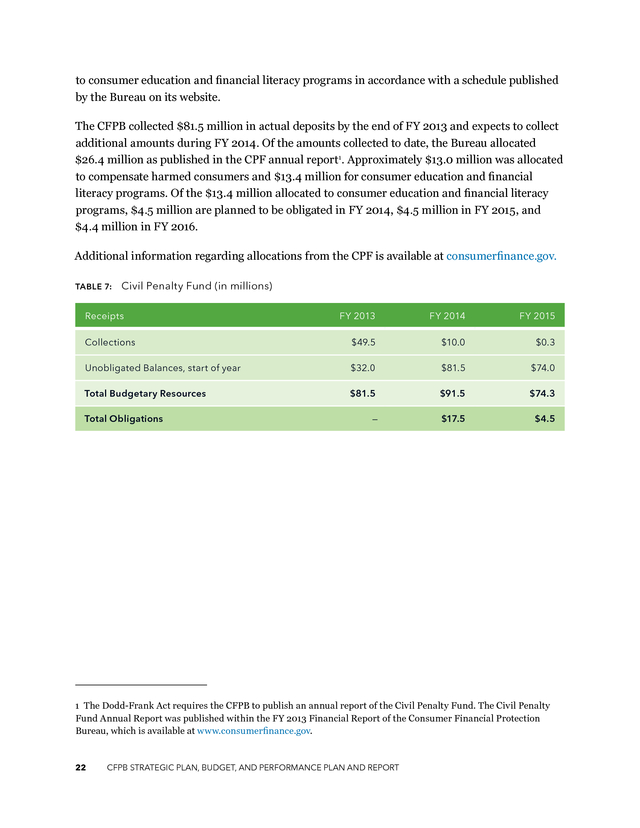

Collections of civil penalties are deposited into the CPF, and such funds are available for payments to victims of activities for which civil penalties have been imposed under the Federal consumer financial laws and, if victims cannot be located or payments are not practicable, the Bureau can use such funds for consumer education and financial literacy programs. As directed by the Dodd-Frank Act, the CFPB maintains a separate account for these funds at the Federal Reserve Bank of New York. On May 7, 2013, the Bureau published the Civil Penalty Fund rule, 12 C.F.R. part 1075, a final rule governing how the Bureau will administer funds in the CPF.

This rule states that the Civil Penalty Fund Administrator will allocate funds to classes of eligible victims and, as appropriate, 21 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . to consumer education and financial literacy programs in accordance with a schedule published by the Bureau on its website. The CFPB collected $81.5 million in actual deposits by the end of FY 2013 and expects to collect additional amounts during FY 2014. Of the amounts collected to date, the Bureau allocated $26.4 million as published in the CPF annual report1. Approximately $13.0 million was allocated to compensate harmed consumers and $13.4 million for consumer education and financial literacy programs. Of the $13.4 million allocated to consumer education and financial literacy programs, $4.5 million are planned to be obligated in FY 2014, $4.5 million in FY 2015, and $4.4 million in FY 2016. Additional information regarding allocations from the CPF is available at consumerfinance.gov. TABLE 7: Civil Penalty Fund (in millions) Receipts FY 2013 FY 2014 FY 2015 Collections $49.5 $10.0 $0.3 Unobligated Balances, start of year $32.0 $81.5 $74.0 Total Budgetary Resources $81.5 $91.5 $74.3 — $17.5 $4.5 Total Obligations 1 The Dodd-Frank Act requires the CFPB to publish an annual report of the Civil Penalty Fund.

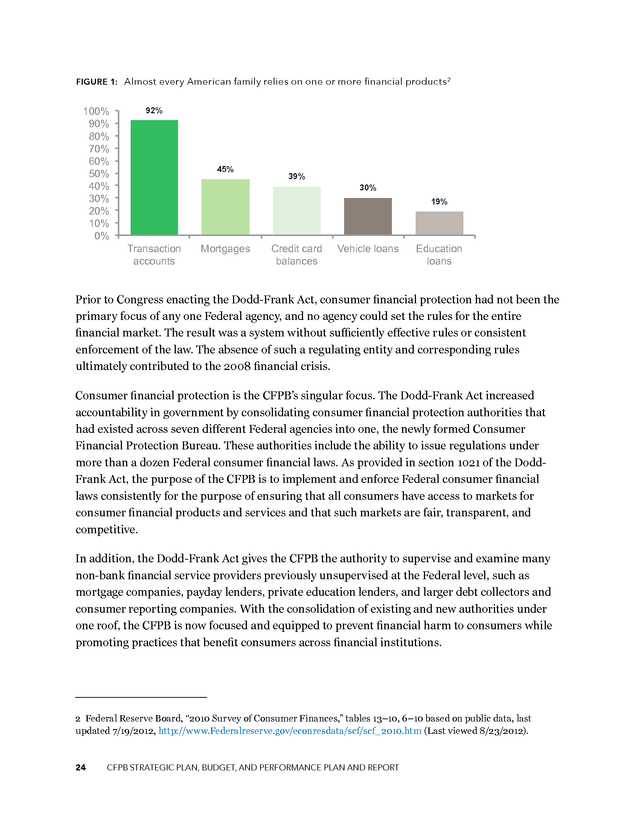

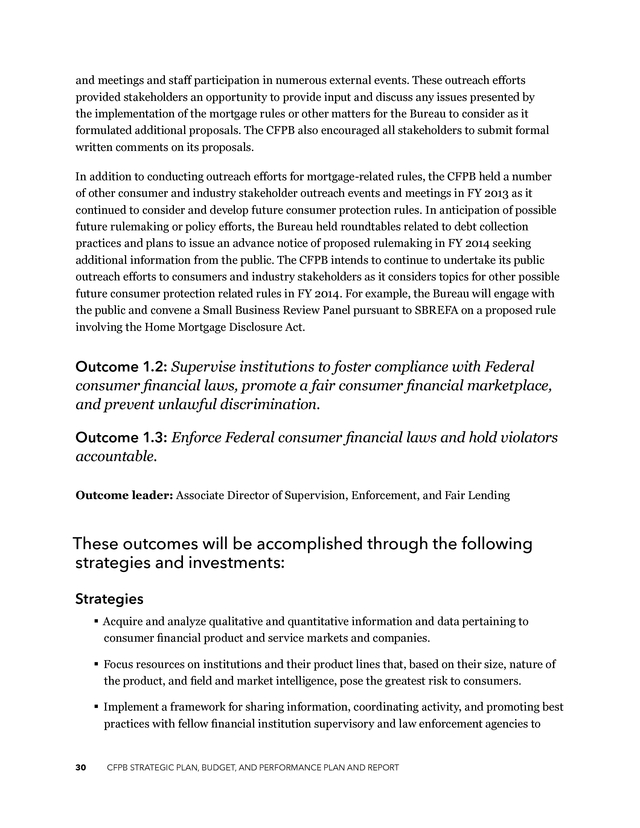

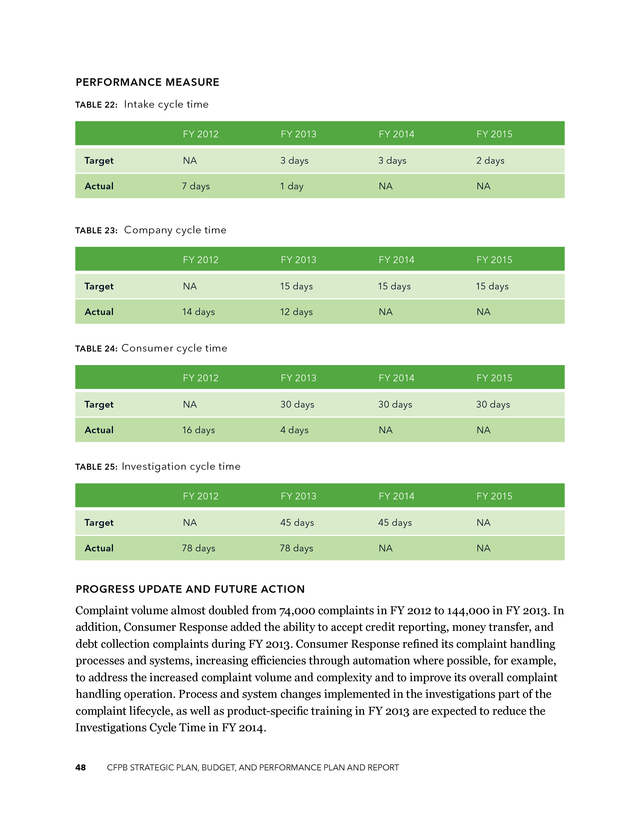

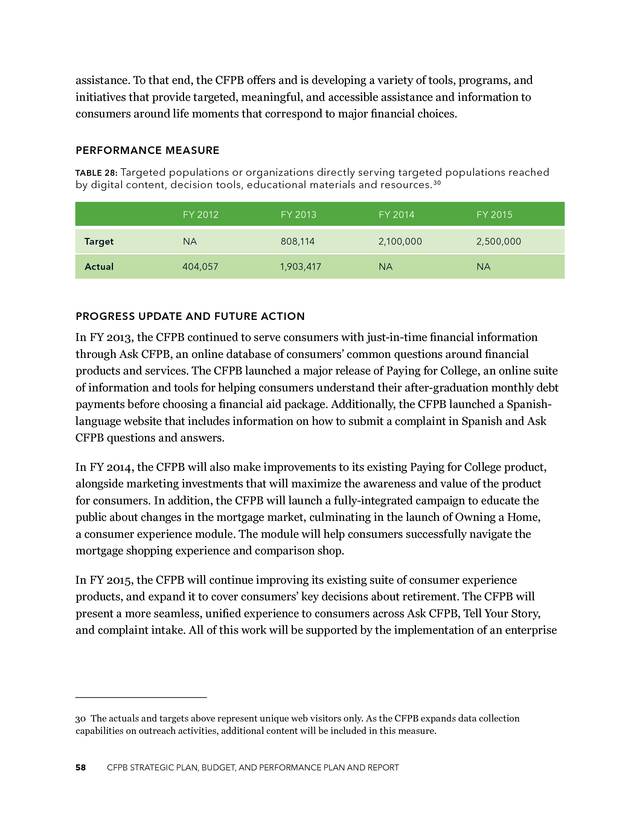

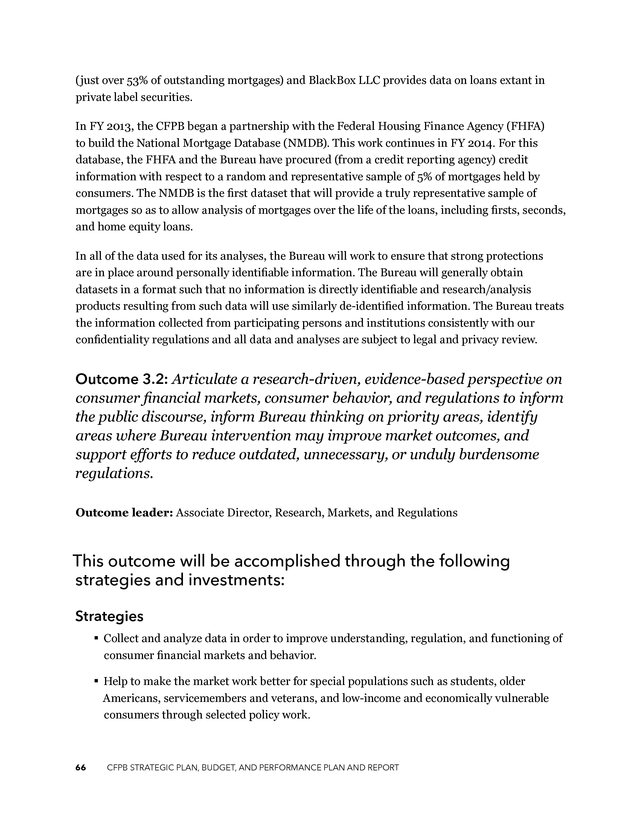

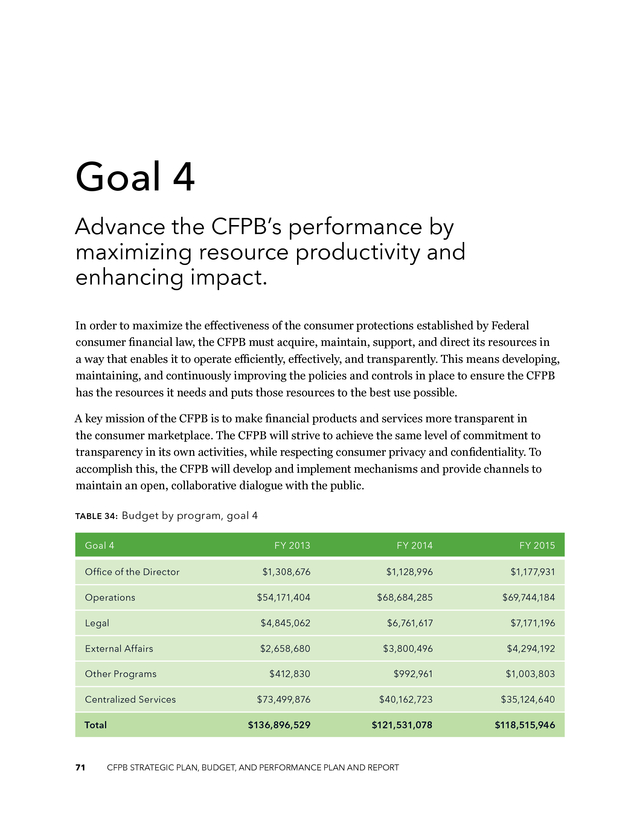

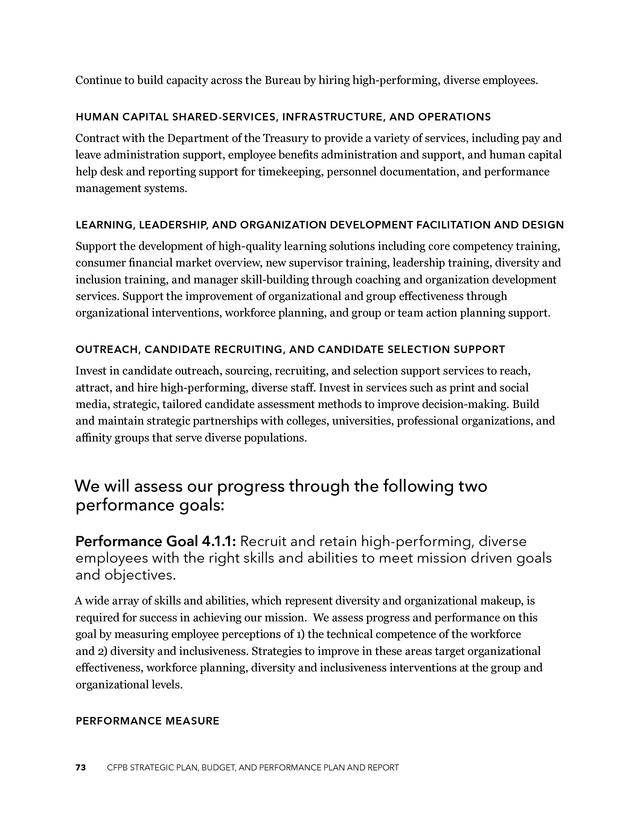

The Civil Penalty Fund Annual Report was published within the FY 2013 Financial Report of the Consumer Financial Protection Bureau, which is available at www.consumerfinance.gov. 22 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Goal 1 Prevent financial harm to consumers while promoting good practices that benefit them. TABLE 8: Budget by program, goal 1 Goal 1 FY 2013 FY 2014 FY 2015 Office of the Director $1,308,676 $1,128,996 $1,177,931 Research, Markets, and Regulation $9,183,078 $15,827,979 $13,746,198 $105,568,127 $165,342,969 $174,770,999 $3,711,112 $6,090,703 $6,776,617 External Affairs $725,095 $1,036,499 $1,171,143 Other Programs $613,303 $1,750,401 $1,980,440 $110,319,599 $75,138,823 $75,594,506 $231,428,989 $266,316,370 $275,217,834 Supervision, Enforcement, and Fair Lending Legal Centralized Services Total 23 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . FIGURE 1: Almost every American family relies on one or more financial products 2 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 92% 45% 39% 30% 19% Transaction accounts Mortgages Credit card balances Vehicle loans Education loans Prior to Congress enacting the Dodd-Frank Act, consumer financial protection had not been the primary focus of any one Federal agency, and no agency could set the rules for the entire financial market. The result was a system without sufficiently effective rules or consistent enforcement of the law. The absence of such a regulating entity and corresponding rules ultimately contributed to the 2008 financial crisis. Consumer financial protection is the CFPB’s singular focus. The Dodd-Frank Act increased accountability in government by consolidating consumer financial protection authorities that had existed across seven different Federal agencies into one, the newly formed Consumer Financial Protection Bureau.

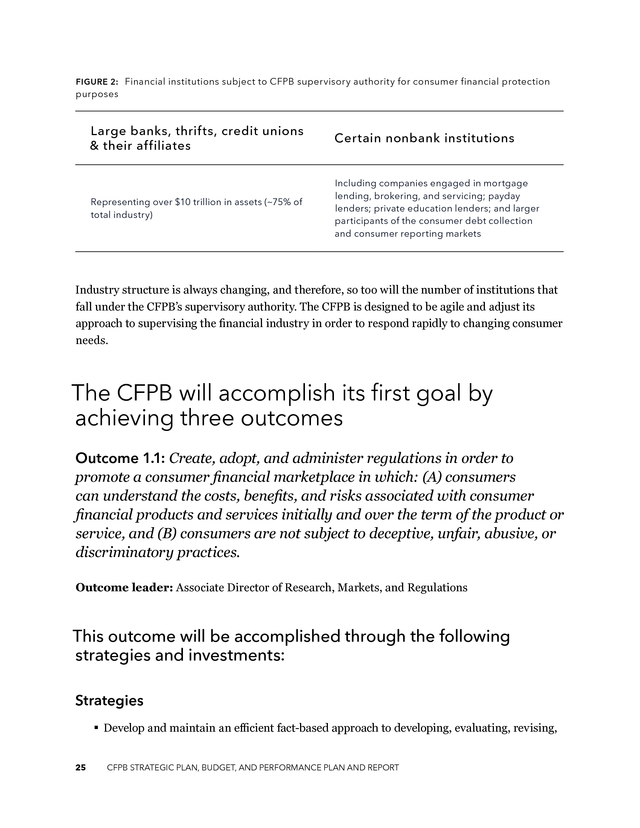

These authorities include the ability to issue regulations under more than a dozen Federal consumer financial laws. As provided in section 1021 of the DoddFrank Act, the purpose of the CFPB is to implement and enforce Federal consumer financial laws consistently for the purpose of ensuring that all consumers have access to markets for consumer financial products and services and that such markets are fair, transparent, and competitive. In addition, the Dodd-Frank Act gives the CFPB the authority to supervise and examine many non-bank financial service providers previously unsupervised at the Federal level, such as mortgage companies, payday lenders, private education lenders, and larger debt collectors and consumer reporting companies. With the consolidation of existing and new authorities under one roof, the CFPB is now focused and equipped to prevent financial harm to consumers while promoting practices that benefit consumers across financial institutions. 2 Federal Reserve Board, “2010 Survey of Consumer Finances,” tables 13–10, 6–10 based on public data, last updated 7/19/2012, http://www.Federalreserve.gov/econresdata/scf/scf_2010.htm (Last viewed 8/23/2012). 24 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT .

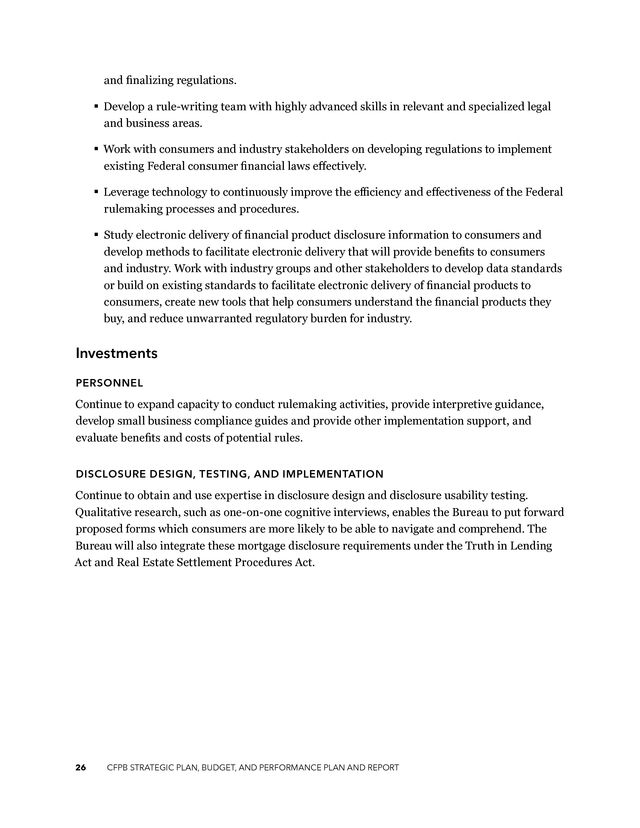

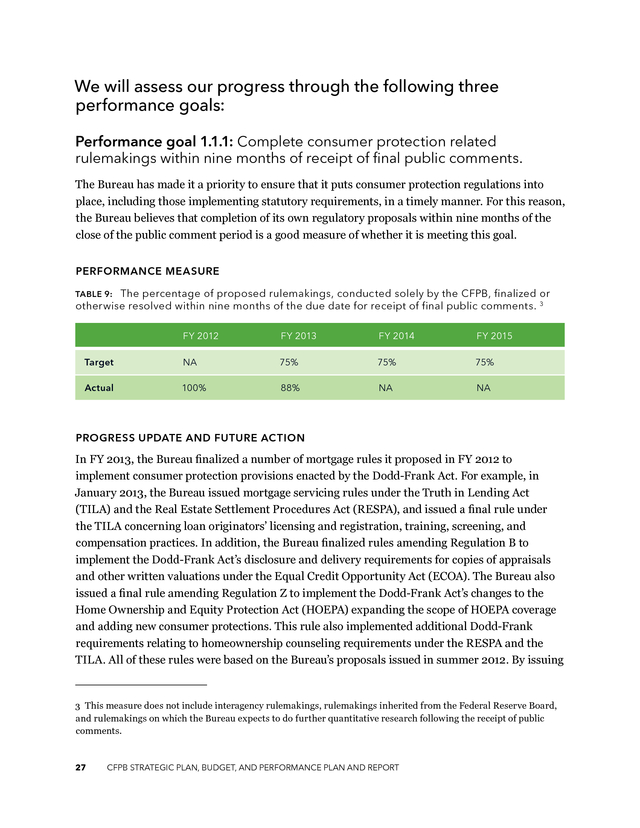

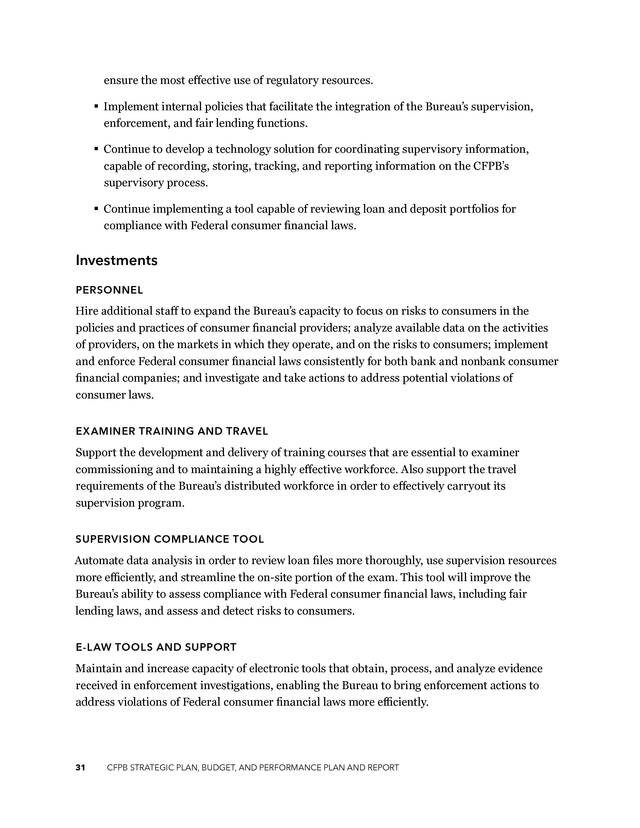

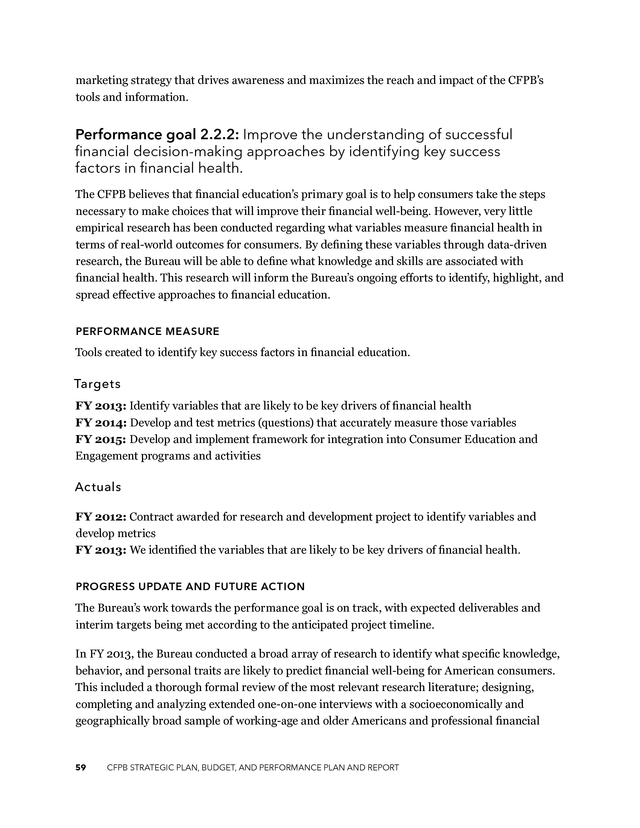

FIGURE 2: Financial institutions subject to CFPB supervisory authority for consumer financial protection purposes Large banks, thrifts, credit unions & their affiliates Certain nonbank institutions Representing over $10 trillion in assets (~75% of total industry) Including companies engaged in mortgage lending, brokering, and servicing; payday lenders; private education lenders; and larger participants of the consumer debt collection and consumer reporting markets Industry structure is always changing, and therefore, so too will the number of institutions that fall under the CFPB’s supervisory authority. The CFPB is designed to be agile and adjust its approach to supervising the financial industry in order to respond rapidly to changing consumer needs. The CFPB will accomplish its first goal by achieving three outcomes Outcome 1.1: Create, adopt, and administer regulations in order to promote a consumer financial marketplace in which: (A) consumers can understand the costs, benefits, and risks associated with consumer financial products and services initially and over the term of the product or service, and (B) consumers are not subject to deceptive, unfair, abusive, or discriminatory practices. Outcome leader: Associate Director of Research, Markets, and Regulations This outcome will be accomplished through the following strategies and investments: Strategies §§ Develop and maintain an efficient fact-based approach to developing, evaluating, revising, 25 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . and finalizing regulations. §§ Develop a rule-writing team with highly advanced skills in relevant and specialized legal and business areas. §§ Work with consumers and industry stakeholders on developing regulations to implement existing Federal consumer financial laws effectively. §§ Leverage technology to continuously improve the efficiency and effectiveness of the Federal rulemaking processes and procedures. §§ Study electronic delivery of financial product disclosure information to consumers and develop methods to facilitate electronic delivery that will provide benefits to consumers and industry. Work with industry groups and other stakeholders to develop data standards or build on existing standards to facilitate electronic delivery of financial products to consumers, create new tools that help consumers understand the financial products they buy, and reduce unwarranted regulatory burden for industry. Investments PERSONNEL Continue to expand capacity to conduct rulemaking activities, provide interpretive guidance, develop small business compliance guides and provide other implementation support, and evaluate benefits and costs of potential rules. DISCLOSURE DESIGN, TESTING, AND IMPLEMENTATION Continue to obtain and use expertise in disclosure design and disclosure usability testing. Qualitative research, such as one-on-one cognitive interviews, enables the Bureau to put forward proposed forms which consumers are more likely to be able to navigate and comprehend. The Bureau will also integrate these mortgage disclosure requirements under the Truth in Lending Act and Real Estate Settlement Procedures Act. 26 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . We will assess our progress through the following three performance goals: Performance goal 1.1.1: Complete consumer protection related rulemakings within nine months of receipt of final public comments. The Bureau has made it a priority to ensure that it puts consumer protection regulations into place, including those implementing statutory requirements, in a timely manner. For this reason, the Bureau believes that completion of its own regulatory proposals within nine months of the close of the public comment period is a good measure of whether it is meeting this goal. PERFORMANCE MEASURE The percentage of proposed rulemakings, conducted solely by the CFPB, finalized or otherwise resolved within nine months of the due date for receipt of final public comments. 3 TABLE 9: FY 2012 FY 2013 FY 2014 FY 2015 Target NA 75% 75% 75% Actual 100% 88% NA NA PROGRESS UPDATE AND FUTURE ACTION In FY 2013, the Bureau finalized a number of mortgage rules it proposed in FY 2012 to implement consumer protection provisions enacted by the Dodd-Frank Act. For example, in January 2013, the Bureau issued mortgage servicing rules under the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA), and issued a final rule under the TILA concerning loan originators’ licensing and registration, training, screening, and compensation practices.

In addition, the Bureau finalized rules amending Regulation B to implement the Dodd-Frank Act’s disclosure and delivery requirements for copies of appraisals and other written valuations under the Equal Credit Opportunity Act (ECOA). The Bureau also issued a final rule amending Regulation Z to implement the Dodd-Frank Act’s changes to the Home Ownership and Equity Protection Act (HOEPA) expanding the scope of HOEPA coverage and adding new consumer protections. This rule also implemented additional Dodd-Frank requirements relating to homeownership counseling requirements under the RESPA and the TILA.

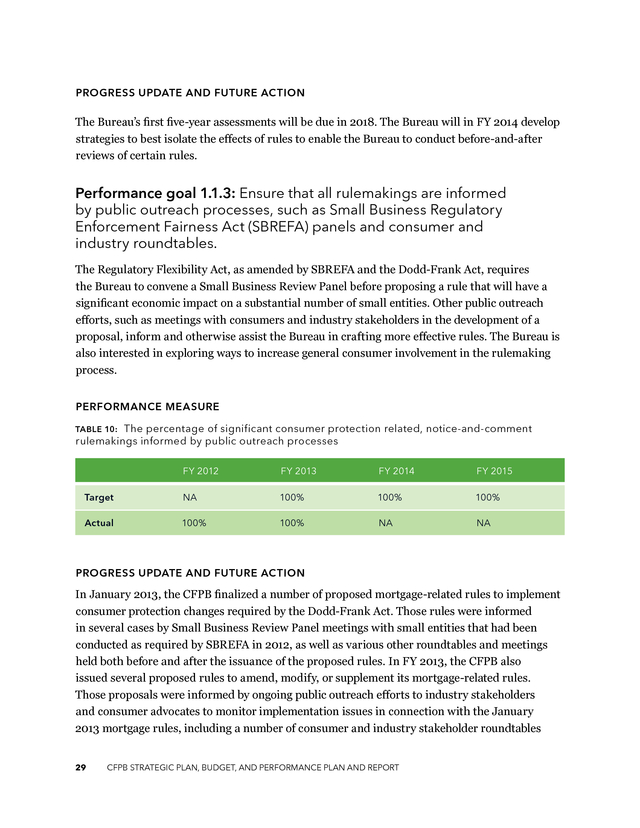

All of these rules were based on the Bureau’s proposals issued in summer 2012. By issuing 3 This measure does not include interagency rulemakings, rulemakings inherited from the Federal Reserve Board, and rulemakings on which the Bureau expects to do further quantitative research following the receipt of public comments. 27 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . these and other final rules in January 2013 and meeting its statutory deadlines in addition to the strategic goals, the Bureau also demonstrated its commitment to timely issuance of regulations. During FY 2013, the Bureau also issued a proposed and final rule modifying earlier remittances regulations that it had issued in 2012.4 In addition, the Bureau issued a number of clarifying and technical amendments to the January 2013 mortgage rules. Going forward, early in FY 2014, the Bureau will finalize its proposed rulemaking to integrate certain mortgage disclosures under the RESPA and the TILA. Performance goal 1.1.2: Complete all five-year regulation assessments on schedule. Section 1022(d) of the Dodd-Frank Act requires the CFPB to assess each significant rule the Bureau adopts and publish a report of the assessment within five years of the effective date. The assessment addresses, among other factors, the rule’s effectiveness in meeting the purposes and objectives of the Dodd-Frank Act, Title X and the specific goals the Bureau states for the rule. PERFORMANCE MEASURE The percentage of five-year regulation assessments completed on schedule. Targets FY 2012: N/A FY 2013: Develop a plan for meeting a pre-rule baseline FY 2014: Develop strategies to best isolate the effects of rules FY 2015: Begin collection and analysis of relevant quantitative and qualitative information. Actuals FY 2013: The Bureau began identifying existing data that may be useful for establishing baselines and for analysis of potential changes from those baselines, identifying gaps in the necessary data, and planning for the acquisition of additional data to fill those gaps. 4 This rule amended the Bureau’s February 2012 final remittance rule, which finalized a rulemaking initiated by the Federal Reserve Board. 28 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . PROGRESS UPDATE AND FUTURE ACTION The Bureau’s first five-year assessments will be due in 2018. The Bureau will in FY 2014 develop strategies to best isolate the effects of rules to enable the Bureau to conduct before-and-after reviews of certain rules. Performance goal 1.1.3: Ensure that all rulemakings are informed by public outreach processes, such as Small Business Regulatory Enforcement Fairness Act (SBREFA) panels and consumer and industry roundtables. The Regulatory Flexibility Act, as amended by SBREFA and the Dodd-Frank Act, requires the Bureau to convene a Small Business Review Panel before proposing a rule that will have a significant economic impact on a substantial number of small entities. Other public outreach efforts, such as meetings with consumers and industry stakeholders in the development of a proposal, inform and otherwise assist the Bureau in crafting more effective rules. The Bureau is also interested in exploring ways to increase general consumer involvement in the rulemaking process. PERFORMANCE MEASURE The percentage of significant consumer protection related, notice-and-comment rulemakings informed by public outreach processes TABLE 10: FY 2012 FY 2013 FY 2014 FY 2015 Target NA 100% 100% 100% Actual 100% 100% NA NA PROGRESS UPDATE AND FUTURE ACTION In January 2013, the CFPB finalized a number of proposed mortgage-related rules to implement consumer protection changes required by the Dodd-Frank Act.

Those rules were informed in several cases by Small Business Review Panel meetings with small entities that had been conducted as required by SBREFA in 2012, as well as various other roundtables and meetings held both before and after the issuance of the proposed rules. In FY 2013, the CFPB also issued several proposed rules to amend, modify, or supplement its mortgage-related rules. Those proposals were informed by ongoing public outreach efforts to industry stakeholders and consumer advocates to monitor implementation issues in connection with the January 2013 mortgage rules, including a number of consumer and industry stakeholder roundtables 29 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . and meetings and staff participation in numerous external events. These outreach efforts provided stakeholders an opportunity to provide input and discuss any issues presented by the implementation of the mortgage rules or other matters for the Bureau to consider as it formulated additional proposals. The CFPB also encouraged all stakeholders to submit formal written comments on its proposals. In addition to conducting outreach efforts for mortgage-related rules, the CFPB held a number of other consumer and industry stakeholder outreach events and meetings in FY 2013 as it continued to consider and develop future consumer protection rules. In anticipation of possible future rulemaking or policy efforts, the Bureau held roundtables related to debt collection practices and plans to issue an advance notice of proposed rulemaking in FY 2014 seeking additional information from the public.

The CFPB intends to continue to undertake its public outreach efforts to consumers and industry stakeholders as it considers topics for other possible future consumer protection related rules in FY 2014. For example, the Bureau will engage with the public and convene a Small Business Review Panel pursuant to SBREFA on a proposed rule involving the Home Mortgage Disclosure Act. Outcome 1.2: Supervise institutions to foster compliance with Federal consumer financial laws, promote a fair consumer financial marketplace, and prevent unlawful discrimination. Outcome 1.3: Enforce Federal consumer financial laws and hold violators accountable. Outcome leader: Associate Director of Supervision, Enforcement, and Fair Lending These outcomes will be accomplished through the following strategies and investments: Strategies §§ Acquire and analyze qualitative and quantitative information and data pertaining to consumer financial product and service markets and companies. §§ Focus resources on institutions and their product lines that, based on their size, nature of the product, and field and market intelligence, pose the greatest risk to consumers. §§ Implement a framework for sharing information, coordinating activity, and promoting best practices with fellow financial institution supervisory and law enforcement agencies to 30 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . ensure the most effective use of regulatory resources. §§ Implement internal policies that facilitate the integration of the Bureau’s supervision, enforcement, and fair lending functions. §§ Continue to develop a technology solution for coordinating supervisory information, capable of recording, storing, tracking, and reporting information on the CFPB’s supervisory process. §§ Continue implementing a tool capable of reviewing loan and deposit portfolios for compliance with Federal consumer financial laws. Investments PERSONNEL Hire additional staff to expand the Bureau’s capacity to focus on risks to consumers in the policies and practices of consumer financial providers; analyze available data on the activities of providers, on the markets in which they operate, and on the risks to consumers; implement and enforce Federal consumer financial laws consistently for both bank and nonbank consumer financial companies; and investigate and take actions to address potential violations of consumer laws. EX AMINER TRAINING AND TRAVEL Support the development and delivery of training courses that are essential to examiner commissioning and to maintaining a highly effective workforce. Also support the travel requirements of the Bureau’s distributed workforce in order to effectively carryout its supervision program. SUPERVISION COMPLIANCE TOOL Automate data analysis in order to review loan files more thoroughly, use supervision resources more efficiently, and streamline the on-site portion of the exam. This tool will improve the Bureau’s ability to assess compliance with Federal consumer financial laws, including fair lending laws, and assess and detect risks to consumers. E-L AW TOOLS AND SUPPORT Maintain and increase capacity of electronic tools that obtain, process, and analyze evidence received in enforcement investigations, enabling the Bureau to bring enforcement actions to address violations of Federal consumer financial laws more efficiently. 31 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . LITIGATION SUPPORT Employ standard investigatory tools to compel documents and testimony and to seek injunctive and monetary remedies through civil actions or administrative proceedings. These functions require the use of services such as expert witnesses, court reporters, and transcription services. MORTGAGE SERVICING PROJECT Lay the groundwork for the development of systems to assist consumers during the loan modification process and collect and analyze information on loan servicer performance. Investments will inform the CFPB’s efforts, particularly in the development of evaluative materials. SUPERVISION AND EX AMINATION SYSTEM Continue developing and implementing a replacement system that will organize entities by institution product line, capture relationships between entities, support supervisory workflows, and document the supervision process. We will assess our progress through the following eight performance goals: Performance goal 1.2.1 / 1.3.1: Perform supervision activities at financial services institutions under the CFPB’s jurisdiction to foster compliance with Federal consumer financial laws. The CFPB’s Supervision Examinations, Supervision Policy, Enforcement, and Fair Lending Offices collaborate to conduct supervisory activities at bank and nonbank institutions. The CFPB’s supervisory authority includes banks, thrifts, and credit unions with over $10 billion in assets, and their affiliates, as well as certain nonbank consumer financial service providers, such as mortgage lenders, brokers, and servicers; private education lenders; payday lenders; and larger participants of the consumer reporting and debt collection markets. These supervisory activities will foster compliance with Federal consumer financial laws, promote a fair consumer financial marketplace, and prevent unlawful discrimination. 32 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT .

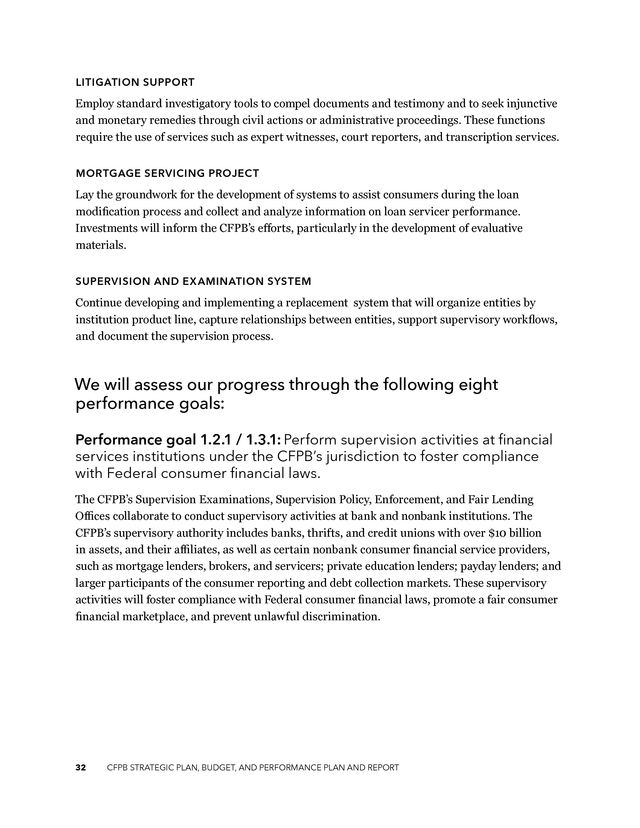

Performance measure TABLE 11: Supervision activities opened during the fiscal year FY 2012 Actual FY 2013 FY 2014 FY 2015 149 160 NA NA PROGRESS UPDATE AND FUTURE ACTION In FY 2013, the Bureau continued to implement its supervision program, opening 160 supervisory actions during FY 2013 at large banks and nonbank financial institutions. These activities included continuing existing supervision programs across product areas including mortgage origination, mortgage servicing, credit cards, deposits, student lending, and shortterm, small dollar loans. They also included the first ever review of consumer reporting agencies and nonbank debt collectors. The CFPB expanded its Supervision and Examination Manual by adding chapters on: §§ Debt collection examination procedures (October 2012), §§ Education loan examination procedures (December 2012), §§ Truth in Lending Act interim procedures (June 2013) §§ Equal Credit Opportunity Act (ECOA) interim procedures (appraisal and valuation requirements) (June 2013) §§ ECOA baseline review procedures (July 2013) §§ Real Estate Settlement Procedures Act interim procedures (August 2013) §§ Short-term, small-dollar lending procedures (September 2013) The Bureau also continued to coordinate with Federal and state regulators to minimize unnecessary regulatory burden, avoid unnecessary duplication of effort, and decrease the risk of conflicting supervisory directives. In May 2013, the Bureau entered into a framework with state financial regulatory authorities that established a dynamic and flexible process for coordination on supervision and enforcement matters. Throughout FY 2013, the Bureau also focused on continuing to recruit and hire the staff to execute the work of the supervision program.

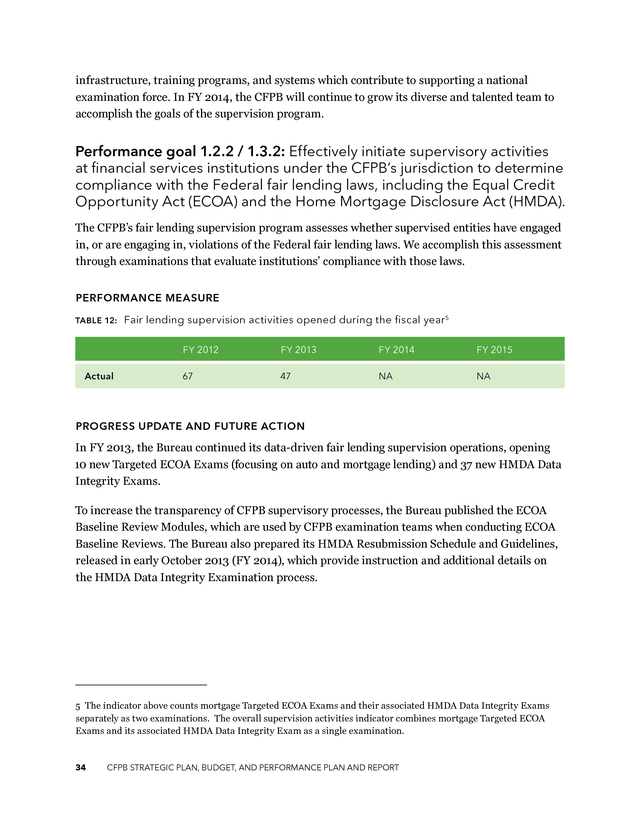

These efforts included hiring of additional 114 examiners across the country and completing the permanent hiring of all four Regional Directors. The CFPB also made significant investments to build out the Washington, D.C. 33 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . infrastructure, training programs, and systems which contribute to supporting a national examination force. In FY 2014, the CFPB will continue to grow its diverse and talented team to accomplish the goals of the supervision program. Performance goal 1.2.2 / 1.3.2: Effectively initiate supervisory activities at financial services institutions under the CFPB’s jurisdiction to determine compliance with the Federal fair lending laws, including the Equal Credit Opportunity Act (ECOA) and the Home Mortgage Disclosure Act (HMDA). The CFPB’s fair lending supervision program assesses whether supervised entities have engaged in, or are engaging in, violations of the Federal fair lending laws. We accomplish this assessment through examinations that evaluate institutions’ compliance with those laws. PERFORMANCE MEASURE TABLE 12: Fair lending supervision activities opened during the fiscal year 5 FY 2012 Actual FY 2013 FY 2014 FY 2015 67 47 NA NA PROGRESS UPDATE AND FUTURE ACTION In FY 2013, the Bureau continued its data-driven fair lending supervision operations, opening 10 new Targeted ECOA Exams (focusing on auto and mortgage lending) and 37 new HMDA Data Integrity Exams. To increase the transparency of CFPB supervisory processes, the Bureau published the ECOA Baseline Review Modules, which are used by CFPB examination teams when conducting ECOA Baseline Reviews. The Bureau also prepared its HMDA Resubmission Schedule and Guidelines, released in early October 2013 (FY 2014), which provide instruction and additional details on the HMDA Data Integrity Examination process. 5 The indicator above counts mortgage Targeted ECOA Exams and their associated HMDA Data Integrity Exams separately as two examinations.

The overall supervision activities indicator combines mortgage Targeted ECOA Exams and its associated HMDA Data Integrity Exam as a single examination. 34 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Performance goal 1.2.3 / 1.3.3: Issue examination reports within the CFPB’s established time periods following the close of examinations. Effective supervision of financial institutions to foster compliance with Federal consumer financial laws requires prompt notice to institutions of matters requiring their attention and action to avoid further violations or consumer harm. A thorough report development and review process ensures high-quality reports that appropriately explain what the examination team found and why corrective actions, if any, are required. PERFORMANCE MEASURE Percentage of examination reports issued within an established period following the close of the examination TABLE 13: FY 2012 FY 2013 FY 2014 FY 2015 Target NA Baseline 50% 60% Actual NA 15% NA NA PROGRESS UPDATE AND FUTURE ACTION The CFPB is focused on issuing high-quality examination reports in a timely manner. The established time period for issuance of reports will be refined as the CFPB continues to examine more institutions (both bank and nonbank) and our review process is refined. To that end, the CFPB recently initiated a comprehensive evaluation of the report review process at both the headquarters and regional levels.

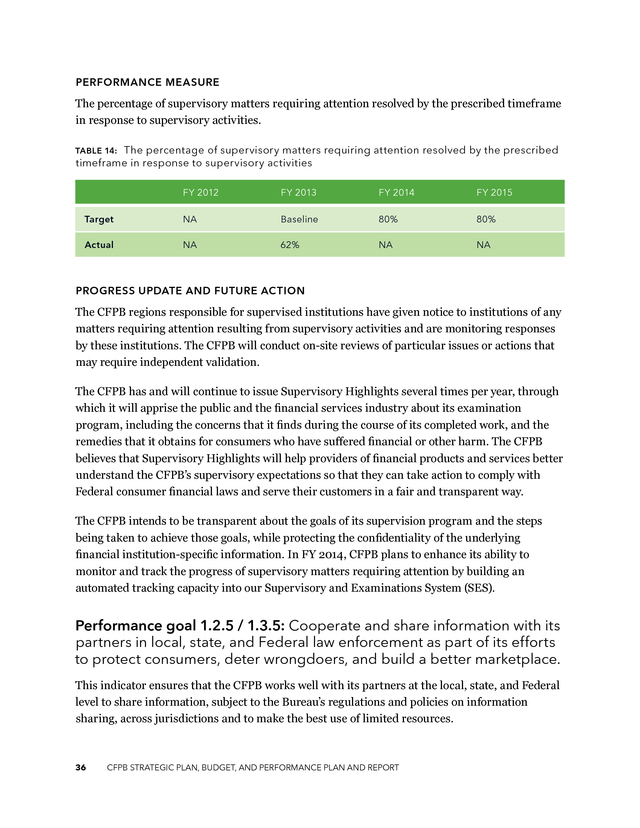

The initial review findings were released to CFPB senior leadership in December 2013 with implementation of recommendations scheduled to begin in the second quarter of FY 2014. Even after recommended improvements are implemented, the CFPB will continue to review and analyze its processes to determine methods for improvement and increased effectiveness and efficiency. Performance goal 1.2.4 / 1.3.4: Supervisory matters requiring attention resolved by the prescribed timeframe. The CFPB monitors institutions receiving notice of matters requiring attention to ensure that corrective actions are taken by the prescribed timeframe in response to supervisory activities, which foster compliance with Federal consumer financial laws and promote a fair consumer financial marketplace. 35 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . PERFORMANCE MEASURE The percentage of supervisory matters requiring attention resolved by the prescribed timeframe in response to supervisory activities. The percentage of supervisory matters requiring attention resolved by the prescribed timeframe in response to supervisory activities TABLE 14: FY 2012 FY 2013 FY 2014 FY 2015 Target NA Baseline 80% 80% Actual NA 62% NA NA PROGRESS UPDATE AND FUTURE ACTION The CFPB regions responsible for supervised institutions have given notice to institutions of any matters requiring attention resulting from supervisory activities and are monitoring responses by these institutions. The CFPB will conduct on-site reviews of particular issues or actions that may require independent validation. The CFPB has and will continue to issue Supervisory Highlights several times per year, through which it will apprise the public and the financial services industry about its examination program, including the concerns that it finds during the course of its completed work, and the remedies that it obtains for consumers who have suffered financial or other harm. The CFPB believes that Supervisory Highlights will help providers of financial products and services better understand the CFPB’s supervisory expectations so that they can take action to comply with Federal consumer financial laws and serve their customers in a fair and transparent way. The CFPB intends to be transparent about the goals of its supervision program and the steps being taken to achieve those goals, while protecting the confidentiality of the underlying financial institution-specific information. In FY 2014, CFPB plans to enhance its ability to monitor and track the progress of supervisory matters requiring attention by building an automated tracking capacity into our Supervisory and Examinations System (SES). Performance goal 1.2.5 / 1.3.5: Cooperate and share information with its partners in local, state, and Federal law enforcement as part of its efforts to protect consumers, deter wrongdoers, and build a better marketplace. This indicator ensures that the CFPB works well with its partners at the local, state, and Federal level to share information, subject to the Bureau’s regulations and policies on information sharing, across jurisdictions and to make the best use of limited resources. 36 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT .

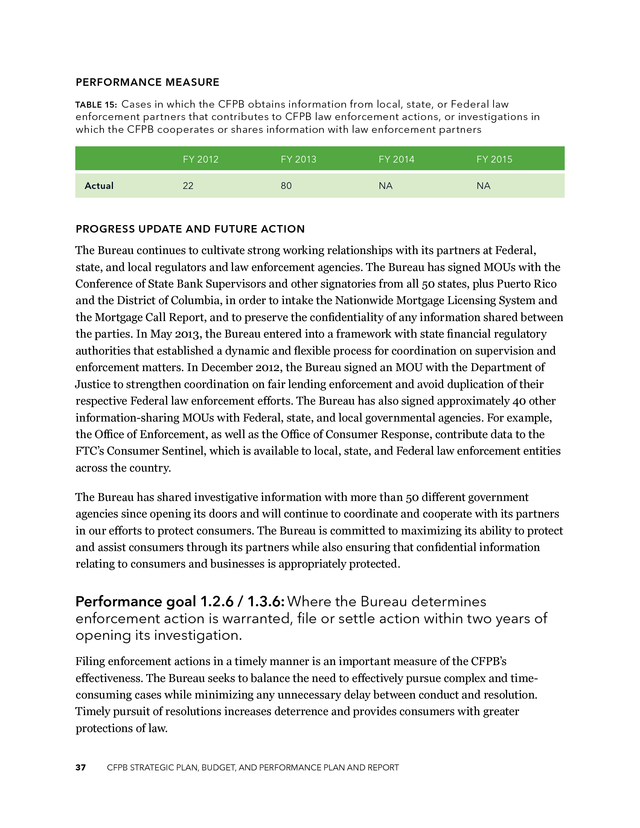

PERFORMANCE MEASURE Cases in which the CFPB obtains information from local, state, or Federal law enforcement partners that contributes to CFPB law enforcement actions, or investigations in which the CFPB cooperates or shares information with law enforcement partners TABLE 15: FY 2012 Actual FY 2013 FY 2014 FY 2015 22 80 NA NA PROGRESS UPDATE AND FUTURE ACTION The Bureau continues to cultivate strong working relationships with its partners at Federal, state, and local regulators and law enforcement agencies. The Bureau has signed MOUs with the Conference of State Bank Supervisors and other signatories from all 50 states, plus Puerto Rico and the District of Columbia, in order to intake the Nationwide Mortgage Licensing System and the Mortgage Call Report, and to preserve the confidentiality of any information shared between the parties. In May 2013, the Bureau entered into a framework with state financial regulatory authorities that established a dynamic and flexible process for coordination on supervision and enforcement matters. In December 2012, the Bureau signed an MOU with the Department of Justice to strengthen coordination on fair lending enforcement and avoid duplication of their respective Federal law enforcement efforts.

The Bureau has also signed approximately 40 other information-sharing MOUs with Federal, state, and local governmental agencies. For example, the Office of Enforcement, as well as the Office of Consumer Response, contribute data to the FTC’s Consumer Sentinel, which is available to local, state, and Federal law enforcement entities across the country. The Bureau has shared investigative information with more than 50 different government agencies since opening its doors and will continue to coordinate and cooperate with its partners in our efforts to protect consumers. The Bureau is committed to maximizing its ability to protect and assist consumers through its partners while also ensuring that confidential information relating to consumers and businesses is appropriately protected. Performance goal 1.2.6 / 1.3.6: Where the Bureau determines enforcement action is warranted, file or settle action within two years of opening its investigation. Filing enforcement actions in a timely manner is an important measure of the CFPB’s effectiveness.

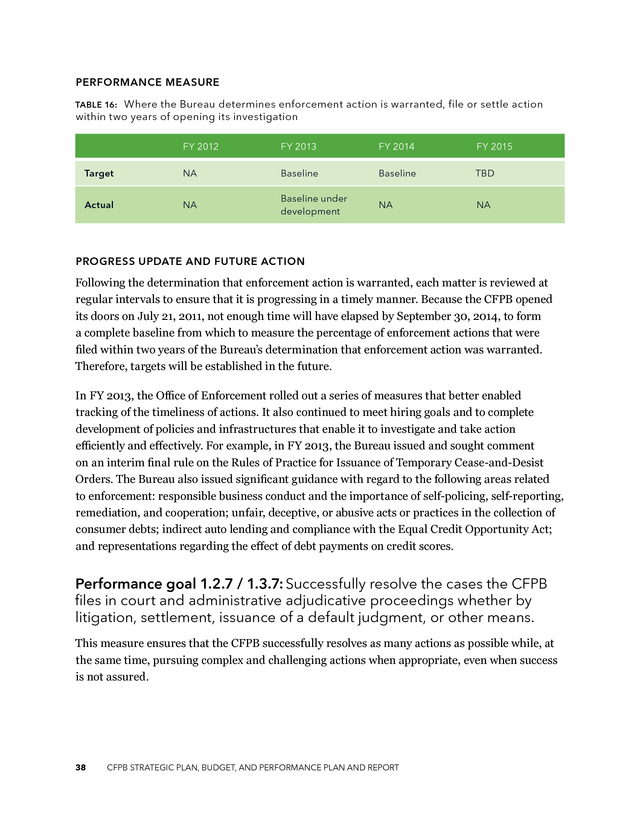

The Bureau seeks to balance the need to effectively pursue complex and timeconsuming cases while minimizing any unnecessary delay between conduct and resolution. Timely pursuit of resolutions increases deterrence and provides consumers with greater protections of law. 37 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . PERFORMANCE MEASURE Where the Bureau determines enforcement action is warranted, file or settle action within two years of opening its investigation TABLE 16: FY 2012 FY 2013 FY 2014 FY 2015 Target NA Baseline Baseline TBD Actual NA Baseline under development NA NA PROGRESS UPDATE AND FUTURE ACTION Following the determination that enforcement action is warranted, each matter is reviewed at regular intervals to ensure that it is progressing in a timely manner. Because the CFPB opened its doors on July 21, 2011, not enough time will have elapsed by September 30, 2014, to form a complete baseline from which to measure the percentage of enforcement actions that were filed within two years of the Bureau’s determination that enforcement action was warranted. Therefore, targets will be established in the future. In FY 2013, the Office of Enforcement rolled out a series of measures that better enabled tracking of the timeliness of actions. It also continued to meet hiring goals and to complete development of policies and infrastructures that enable it to investigate and take action efficiently and effectively. For example, in FY 2013, the Bureau issued and sought comment on an interim final rule on the Rules of Practice for Issuance of Temporary Cease-and-Desist Orders.

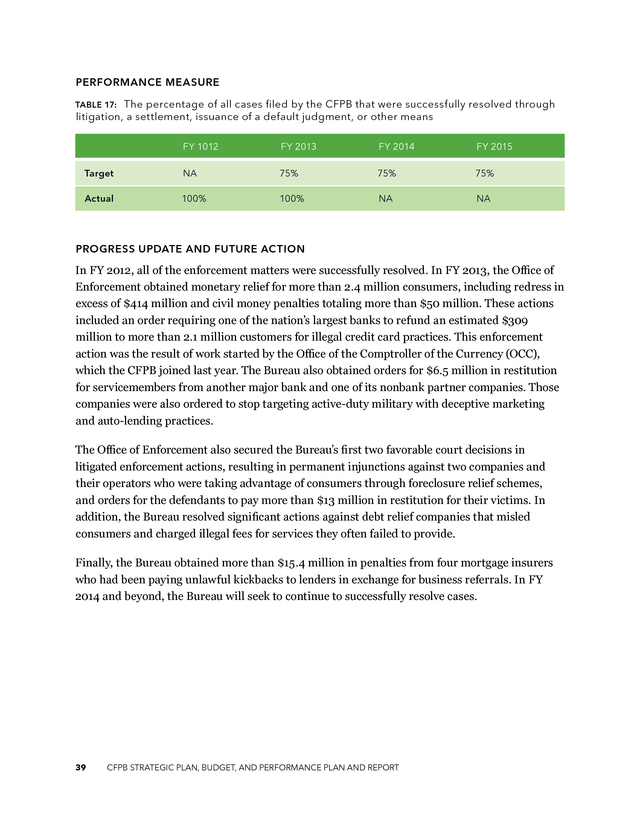

The Bureau also issued significant guidance with regard to the following areas related to enforcement: responsible business conduct and the importance of self-policing, self-reporting, remediation, and cooperation; unfair, deceptive, or abusive acts or practices in the collection of consumer debts; indirect auto lending and compliance with the Equal Credit Opportunity Act; and representations regarding the effect of debt payments on credit scores. Performance goal 1.2.7 / 1.3.7: Successfully resolve the cases the CFPB files in court and administrative adjudicative proceedings whether by litigation, settlement, issuance of a default judgment, or other means. This measure ensures that the CFPB successfully resolves as many actions as possible while, at the same time, pursuing complex and challenging actions when appropriate, even when success is not assured. 38 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . PERFORMANCE MEASURE The percentage of all cases filed by the CFPB that were successfully resolved through litigation, a settlement, issuance of a default judgment, or other means TABLE 17: FY 1012 FY 2013 FY 2014 FY 2015 Target NA 75% 75% 75% Actual 100% 100% NA NA PROGRESS UPDATE AND FUTURE ACTION In FY 2012, all of the enforcement matters were successfully resolved. In FY 2013, the Office of Enforcement obtained monetary relief for more than 2.4 million consumers, including redress in excess of $414 million and civil money penalties totaling more than $50 million. These actions included an order requiring one of the nation’s largest banks to refund an estimated $309 million to more than 2.1 million customers for illegal credit card practices. This enforcement action was the result of work started by the Office of the Comptroller of the Currency (OCC), which the CFPB joined last year.

The Bureau also obtained orders for $6.5 million in restitution for servicemembers from another major bank and one of its nonbank partner companies. Those companies were also ordered to stop targeting active-duty military with deceptive marketing and auto-lending practices. The Office of Enforcement also secured the Bureau’s first two favorable court decisions in litigated enforcement actions, resulting in permanent injunctions against two companies and their operators who were taking advantage of consumers through foreclosure relief schemes, and orders for the defendants to pay more than $13 million in restitution for their victims. In addition, the Bureau resolved significant actions against debt relief companies that misled consumers and charged illegal fees for services they often failed to provide. Finally, the Bureau obtained more than $15.4 million in penalties from four mortgage insurers who had been paying unlawful kickbacks to lenders in exchange for business referrals.

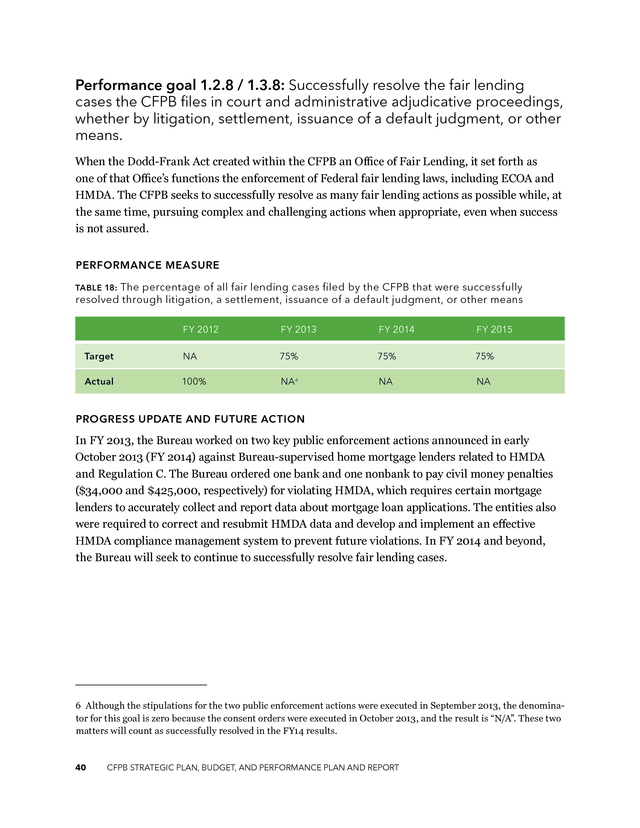

In FY 2014 and beyond, the Bureau will seek to continue to successfully resolve cases. 39 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Performance goal 1.2.8 / 1.3.8: Successfully resolve the fair lending cases the CFPB files in court and administrative adjudicative proceedings, whether by litigation, settlement, issuance of a default judgment, or other means. When the Dodd-Frank Act created within the CFPB an Office of Fair Lending, it set forth as one of that Office’s functions the enforcement of Federal fair lending laws, including ECOA and HMDA. The CFPB seeks to successfully resolve as many fair lending actions as possible while, at the same time, pursuing complex and challenging actions when appropriate, even when success is not assured. PERFORMANCE MEASURE TABLE 18: The percentage of all fair lending cases filed by the CFPB that were successfully resolved through litigation, a settlement, issuance of a default judgment, or other means FY 2012 FY 2013 FY 2014 FY 2015 Target NA 75% 75% 75% Actual 100% NA 6 NA NA PROGRESS UPDATE AND FUTURE ACTION 6 In FY 2013, the Bureau worked on two key public enforcement actions announced in early October 2013 (FY 2014) against Bureau-supervised home mortgage lenders related to HMDA and Regulation C. The Bureau ordered one bank and one nonbank to pay civil money penalties ($34,000 and $425,000, respectively) for violating HMDA, which requires certain mortgage lenders to accurately collect and report data about mortgage loan applications. The entities also were required to correct and resubmit HMDA data and develop and implement an effective HMDA compliance management system to prevent future violations.

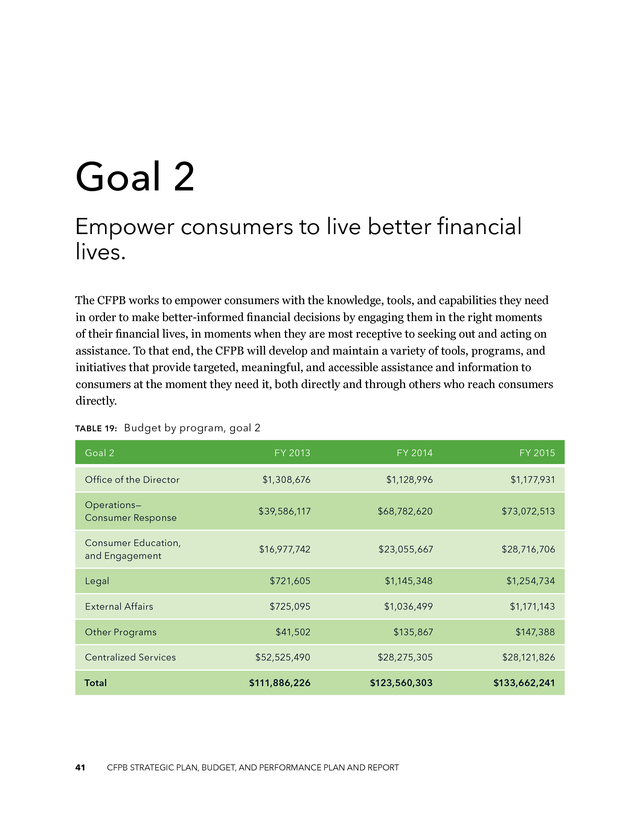

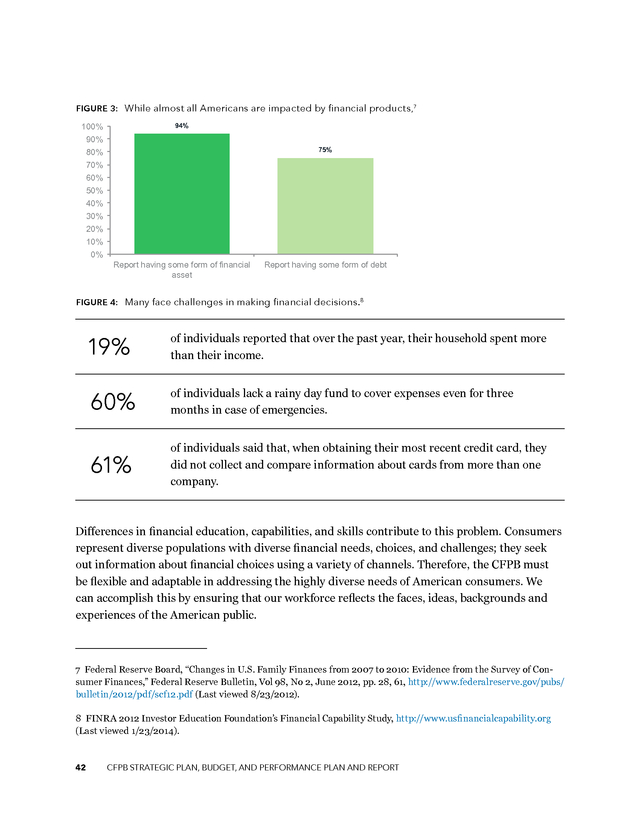

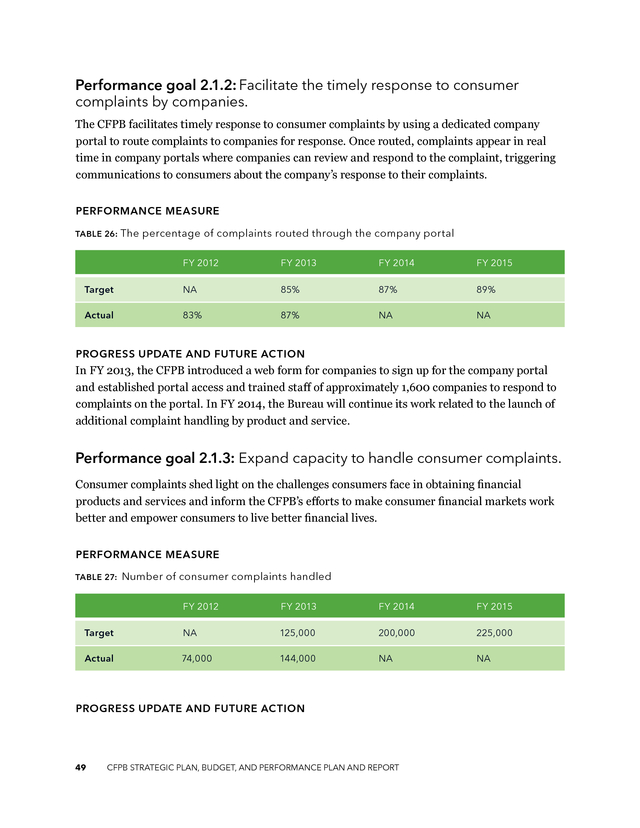

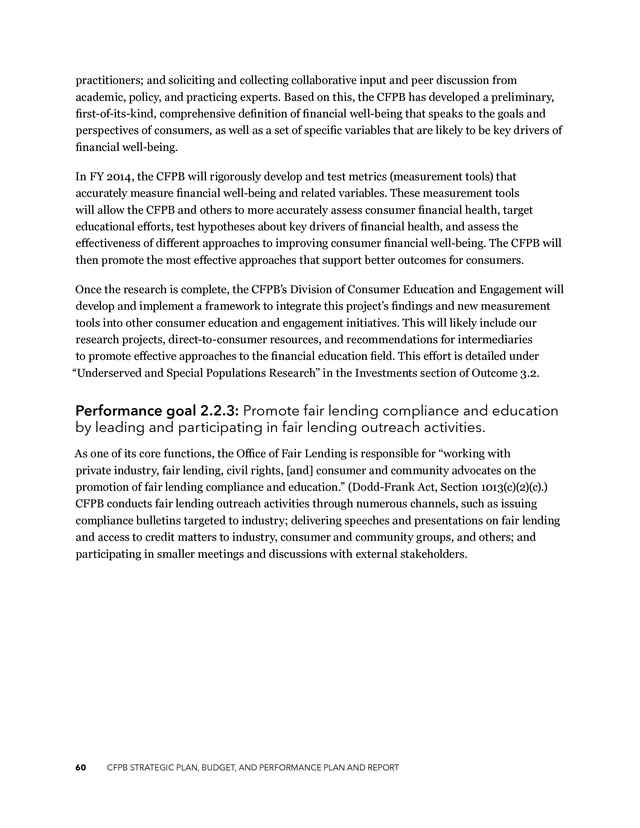

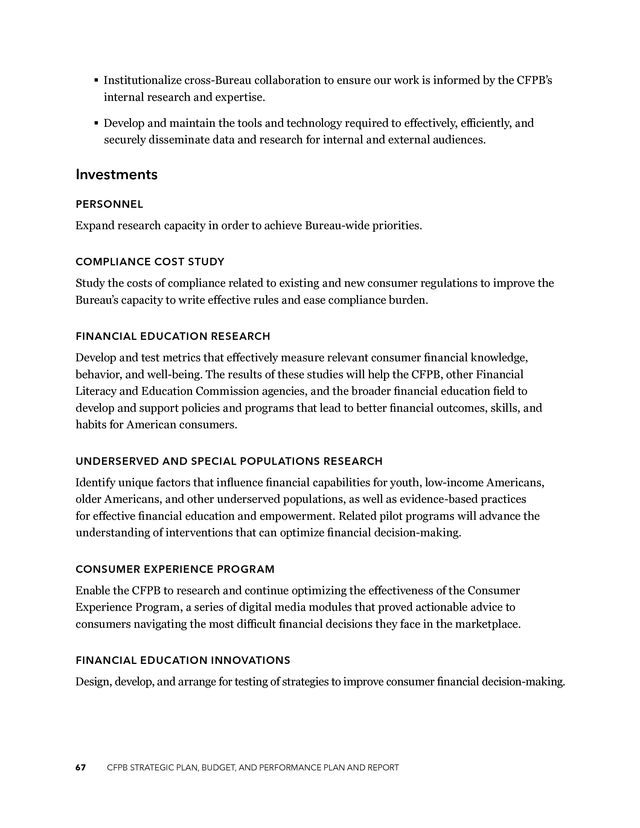

In FY 2014 and beyond, the Bureau will seek to continue to successfully resolve fair lending cases. 6 Although the stipulations for the two public enforcement actions were executed in September 2013, the denominator for this goal is zero because the consent orders were executed in October 2013, and the result is “N/A”. These two matters will count as successfully resolved in the FY14 results. 40 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . Goal 2 Empower consumers to live better financial lives. The CFPB works to empower consumers with the knowledge, tools, and capabilities they need in order to make better-informed financial decisions by engaging them in the right moments of their financial lives, in moments when they are most receptive to seeking out and acting on assistance. To that end, the CFPB will develop and maintain a variety of tools, programs, and initiatives that provide targeted, meaningful, and accessible assistance and information to consumers at the moment they need it, both directly and through others who reach consumers directly. TABLE 19: Budget by program, goal 2 Goal 2 FY 2013 FY 2014 FY 2015 Office of the Director $1,308,676 $1,128,996 $1,177,931 Operations— Consumer Response $39,586,117 $68,782,620 $73,072,513 Consumer Education, and Engagement $16,977,742 $23,055,667 $28,716,706 Legal $721,605 $1,145,348 $1,254,734 External Affairs $725,095 $1,036,499 $1,171,143 $41,502 $135,867 $147,388 $52,525,490 $28,275,305 $28,121,826 $111,886,226 $123,560,303 $133,662,241 Other Programs Centralized Services Total 41 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT . FIGURE 3: While almost all Americans are impacted by financial products,7 94% 100% 90% 75% 80% 70% 60% 50% 40% 30% 20% 10% 0% Report having some form of financial asset Report having some form of debt FIGURE 4: Many face challenges in making financial decisions. 8 19% of individuals reported that over the past year, their household spent more than their income. 60% of individuals lack a rainy day fund to cover expenses even for three months in case of emergencies. 61% of individuals said that, when obtaining their most recent credit card, they did not collect and compare information about cards from more than one company. Differences in financial education, capabilities, and skills contribute to this problem. Consumers represent diverse populations with diverse financial needs, choices, and challenges; they seek out information about financial choices using a variety of channels. Therefore, the CFPB must be flexible and adaptable in addressing the highly diverse needs of American consumers.

We can accomplish this by ensuring that our workforce reflects the faces, ideas, backgrounds and experiences of the American public. 7 Federal Reserve Board, “Changes in U.S. Family Finances from 2007 to 2010: Evidence from the Survey of Consumer Finances,” Federal Reserve Bulletin, Vol 98, No 2, June 2012, pp. 28, 61, http://www.federalreserve.gov/pubs/ bulletin/2012/pdf/scf12.pdf (Last viewed 8/23/2012). 8 FINRA 2012 Investor Education Foundation’s Financial Capability Study, http://www.usfinancialcapability.org (Last viewed 1/23/2014). 42 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT .

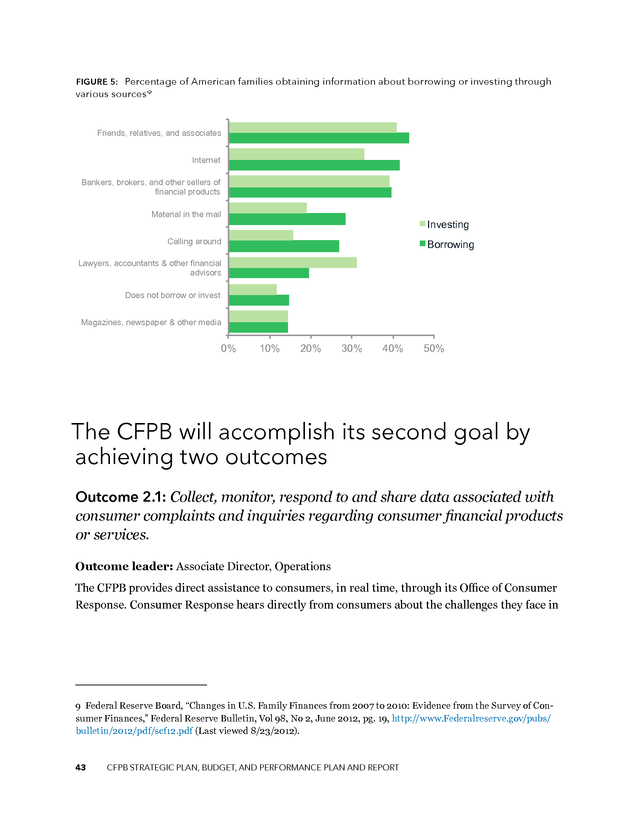

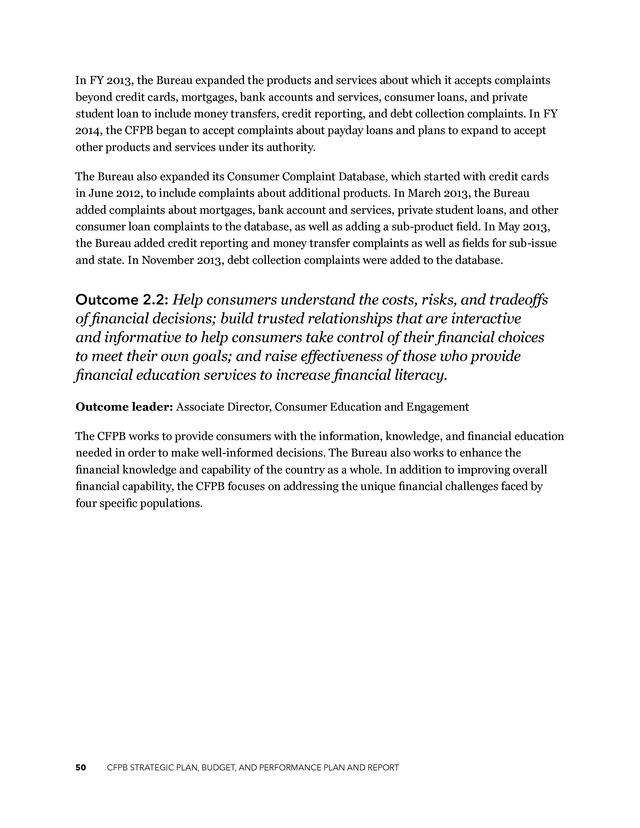

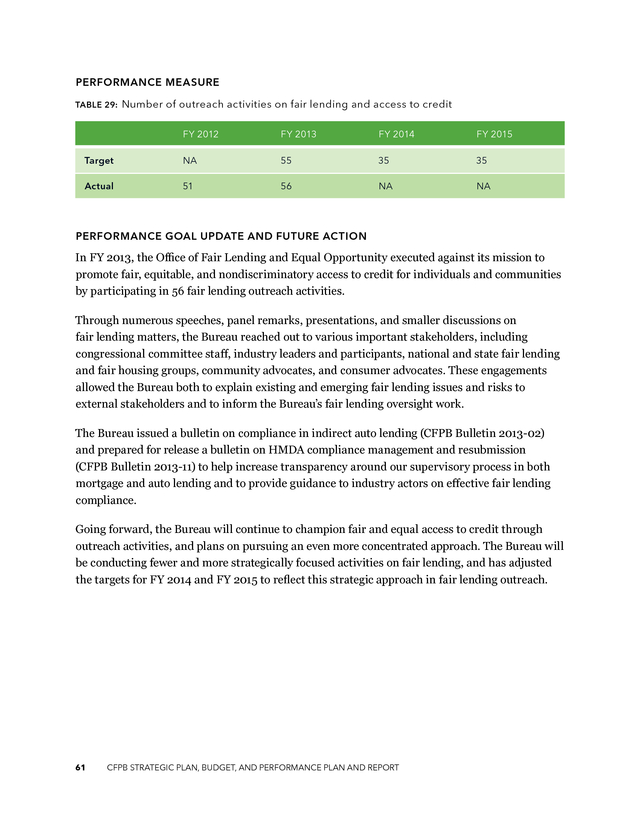

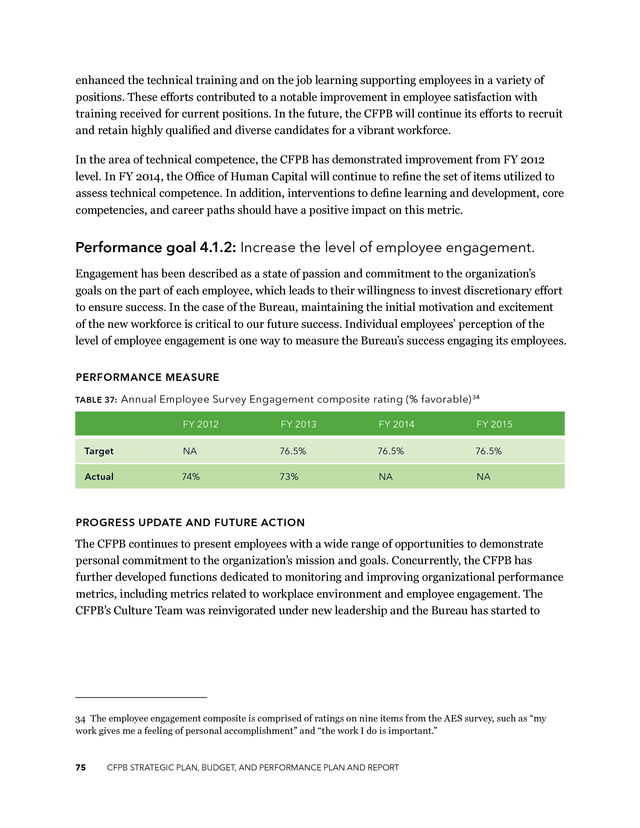

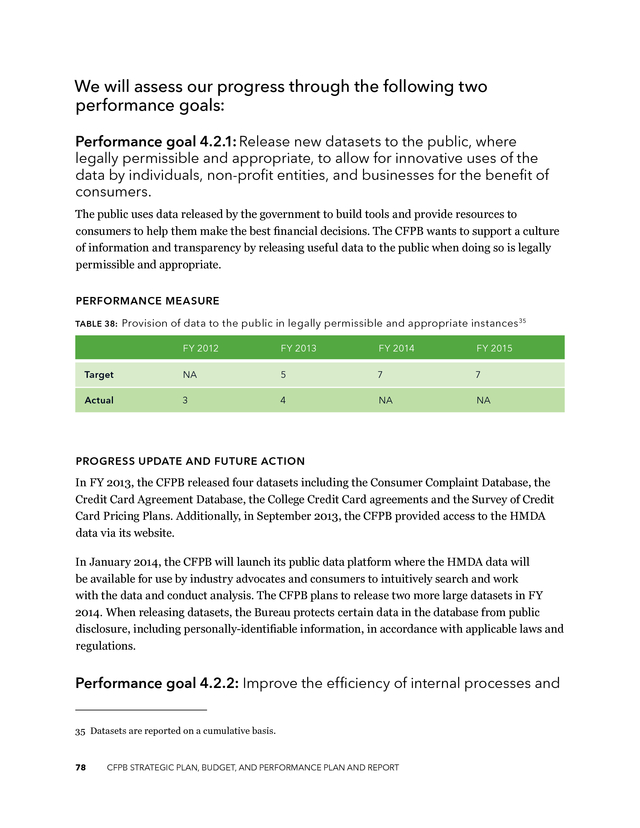

FIGURE 5: Percentage of American families obtaining information about borrowing or investing through various sources 9 Friends, relatives, and associates Internet Bankers, brokers, and other sellers of financial products Material in the mail Investing Calling around Borrowing Lawyers, accountants & other financial advisors Does not borrow or invest Magazines, newspaper & other media 0% 10% 20% 30% 40% 50% The CFPB will accomplish its second goal by achieving two outcomes Outcome 2.1: Collect, monitor, respond to and share data associated with consumer complaints and inquiries regarding consumer financial products or services. Outcome leader: Associate Director, Operations The CFPB provides direct assistance to consumers, in real time, through its Office of Consumer Response. Consumer Response hears directly from consumers about the challenges they face in 9 Federal Reserve Board, “Changes in U.S. Family Finances from 2007 to 2010: Evidence from the Survey of Consumer Finances,” Federal Reserve Bulletin, Vol 98, No 2, June 2012, pg. 19, http://www.Federalreserve.gov/pubs/ bulletin/2012/pdf/scf12.pdf (Last viewed 8/23/2012). 43 CFPB STRATEGIC PLAN, BUDGET, AND PERFORMANCE PLAN AND REPORT .