Description

GASB’s New Pension Standards

. GASB’s New Pension Standards

Table of Contents

BACKGROUND & OVERVIEW .................................................................................................................................. 3

ACCOUNTING OVERVIEW .................................................................................................................................................3

SCOPE ..........................................................................................................................................................................4

KEY PROVISIONS .................................................................................................................................................... 4

OVERVIEW ....................................................................................................................................................................4

TYPES OF BENEFIT PLANS & BENEFIT PLAN ARRANGEMENTS ..................................................................................................5

ACCOUNTING CHANGES......................................................................................................................................... 6

CHANGES AFFECTING SINGLE-EMPLOYER & AGENT-EMPLOYER PLANS .....................................................................................6

Net Pension Liability..............................................................................................................................................6

Calculating Total Pension Liability ........................................................................................................................7

CHANGES AFFECTING MULTIEMPLOYER COST-SHARING PLANS .............................................................................................11

SPECIAL FUNDING SITUATIONS ........................................................................................................................................12

DISCLOSURE REQUIREMENTS ..........................................................................................................................................12

IMPLEMENTATION & TRANSITION .......................................................................................................................

15 STATEMENT 67 ............................................................................................................................................................15 STATEMENT 68 ............................................................................................................................................................16 HOW THESE CHANGES COULD AFFECT YOU ......................................................................................................... 16 NEW PROCESS & PROCEDURES .......................................................................................................................................16 FINANCIAL RATIOS ........................................................................................................................................................16 SPECIAL CONSIDERATIONS FOR MULTIEMPLOYER COST-SHARING PLANS .................................................................................16 CONCLUSION ....................................................................................................................................................... 16 CONTRIBUTOR .....................................................................................................................................................

17 2 . GASB’s New Pension Standards Implementation of GASB Statement No. 67 is effective now—with fiscal years beginning after June 15, 2013. Statement No. 68 is effective one year later, for fiscal years beginning after June 15, 2014. Since their issuance in 2012, the effects of pension accounting and reporting changes have been on the minds of the Governmental Accounting Standards Board (GASB) and government employers alike.

Early implementation is encouraged, retrospective application is required to the extent practical and the measurement and recognition amendments are significant. To clarify and elaborate on the standard, GASB developed implementation guides for statements No. 67 and No.

68, and in November 2013, issued GASB Statement No. 71, Pension Transition for Contributions Made Subsequent to the Measurement Date—an amendment of GASB Statement No. 68, addressing the transition provisions of Statement No.

68. Statement No. 67 defines the financial reporting standards for pension plans. In most respects, the requirements for pension plan financial statements remain unchanged from the prior standards.

A defined benefit pension plan will continue to present two financial statements: a statement of fiduciary net position (the amount held in a trust for paying retirement benefits) and a statement of changes in fiduciary net position. Statement No. 67 enhances note disclosures and required supplementary information (RSI) for defined benefit and defined contribution pension plans. Statement No.

68 significantly revamps accounting and financial reporting for government employers (and nonemployer contributing entities) that provide pension benefits through a qualifying trust—requiring a “net pension liability” on the statement of net position. Historically, an unfunded pension obligation for employers in a cost-sharing plan was considered a liability to be reported in future periods, and information about the total liability—unfunded and funded—was disclosed only in the notes to the financial statements and as required supplemental information. Financial statements of governments participating in cost-sharing plans now will reflect a net pension liability based on a model similar to single- and agent-employer plans.

Single- and agent-employer plans must adhere to more stringent requirements for total pension liability measurement including projecting and discounting of benefit payments, as well as a more comprehensive measure of pension expense. Because of these changes, affected governmental employers may realize a larger pension expense and liabilities than under current standards. Annual pension expense will be based on a comprehensive measurement of the annual cost of pension benefits and no longer will be a simple function of annual funding amounts. In essence, GASB de-linked annual funding in relation to the plan document from pension accounting.

Government employers also will feel the effect of significantly increased note disclosure and RSI requirements. Governments participating in defined contribution benefit plans are covered under the scope of GASB 68 but will be minimally affected by the new requirements and will essentially continue to follow the existing requirements. Background & Overview This article provides in-depth measurement and reporting guidance for governmental entities with pensions affected by Statements No. 67, Financial Reporting for Pension Plans – an amendment of GASB Statement No. 25, and No.

68, Accounting and Financial Reporting for Pensions – an amendment of GASB No.27, including a discussion of the potential employer ramifications. The revised standards will apply to most defined benefit pension plans. Accounting Overview Major fund accounting applies to governmental funds and proprietary funds but does not apply to fiduciary funds such as pension trust funds. Resources such as pension plan assets cannot be used to finance a governmental entity’s activities and, therefore, financial statements of fiduciary funds are not presented in governmentwide financial statements.

Instead, an entity reports fiduciary funds in the financial statements by fund type at the fund level, e.g., pension trust fund. Because the governmental entity is financially accountable for those resources and obligations, even though they belong to other parties, the balances and activities of pension trust funds are presented in the government’s financial statements in a Statement of Fiduciary Net Position and a Statement of Changes in Fiduciary Net Position at the fund financial statement level. The Statement of Plan Net Position reports 3 .

GASB’s New Pension Standards the pension plans’ assets and liabilities; net position is identified as “net position held in trust for pension benefits.” At the governmental employer level, Statement No. 68 establishes standards affecting all elements of employer pension plan accounting including expense and liability recognition and the recognition of deferred outflows of resources and inflows of resources. Employers will recognize the unfunded pension benefits promised to their employees through a qualified trust in their financial statements, regardless of the type of benefit plan arrangement used. In addition, the statement more narrowly defines the methods and assumptions to project benefit payments, discount projected benefit payments to their actuarial present value and attribute that present value to periods of employee service. Scope Similar to the broad application of Statement No.

67, the new financial reporting requirements of Statement No. 68 will apply to most governments that provide their employees with pensions, as well as nonemployer governments with a legal obligation to contribute to those plans. Issuance of Statements No. 67 and No.

68 represents a conceptual alignment with the GASB and U.S. GAAP accounting and reporting frameworks. During their pension project deliberations, the board affirmed that a government employer’s net pension liability meets the definition of a liability under Concepts Statement No.

4, Elements of Financial Statements, issued in June 2007. Concepts Statement No. 4 also establishes that deferred outflows of resources and deferred inflows of resources— an integral part of pension accounting—are not assets and liabilities and should not be reported as such in a statement of financial position. (Deferrals result from inflows and outflows of resources that have already taken place but are not ready to be recognized in the financial statements as revenues and expenses because some future event has yet to occur).

Likewise, GASB Statement No. 34, Basic Financial Statements – and Management’s Discussion and Analysis – for State and Local Governments, issued in June 1999, paved the way for pension accounting and reporting change by requiring government financial statements to be prepared using the economic resources measurement focus and the accrual basis of accounting. Neither Concepts Statement No.

4 nor Statement No. 34 was drafted when the existing pension standards were issued in 1994. “Deferred outflow” and “deferred inflow” accounts are new concepts to GASB pension accounting. For financial statement presentation purposes, the deferred accounts are reported in a separate section below the assets and liabilities section, depending on whether the difference is favorable or unfavorable, respectively. The scope of the standard does not include other postemployment benefits (OPEB).

GASB is considering the possibility of improvements to the current standards of accounting and financial reporting for OPEBs. The project entails assessing the effectiveness of current OPEB standards (Statements No. 43 and No.

45) and applying a common framework to all post-employment benefits considering the changes made to pension reporting by the issuance of Statements No. 67 and No. 68. Key Provisions Overview The general requirement for recognition of a liability is the recording of obligations for goods or services received and unpaid as of a specified point in time.

Statements 67 and 68 provide an alignment of this economic matching principle. Under the new standards, for government employers participating in single-employer and agent multiemployer plans, and nonemployer contributing entities, the employer’s share is 100 percent of the liability and related pension components. Employers participating in cost sharing plans will be required to report their proportionate share of the amount of unfunded pension obligation as a liability on the statement of net position. The pension liability will be measured based on accounting principles and no longer on the government’s 4 .

GASB’s New Pension Standards intentions relevant to the plan document. Each employer likewise will be required to recognize its estimated allocated share of the plan’s collective pension expense in the applicable flows statement (100 percent of the pension expense for single employer or agent plans). Statement 68 establishes standards for a more comprehensive measure of pension expense. It has changed pension expense variables by identifying the method and assumptions that should be used to project and discount benefit payments, as well as how to attribute the actuarial present value to periods of employee service. A government’s current period pension expense primarily results from changes in the components of the net pension liability (NPL). NPL is computed as the difference between the employer’s obligation to provide pension benefits earned and funding of those benefits (the plan assets held in trust); pension amounts earned by current and former employees for past services are recorded as a liability in current statements, not in future statements. Most causes of change in the net pension liability will be included in pension expense immediately.

Changes resulting from certain causes will be introduced into pension expense over multiple periods. NPL is a new concept for multiemployer government employers. Cost-sharing employers will reflect an obligation for their proportionate share of the collective total pension liability not covered by pension assets and are expected to be the most affected by the new standards. Prior to Statement 68, cost-sharing multiemployer government employers could be in a position of substantial unfunded NPL and show little or no liability for defined pension benefit obligations in their consolidated annual financial report (CAFR).

Statement No. 68 affects special funding situations in a similar manner, where an entity other than the employer government is legally responsible for making some or all of the employer’s contributions to the plan, often defined in terms of a fixed amount. Disclosure of pension information in the notes to the financial statements and the information following the notes or RSI still is important. However, financial statement notes and RSI now are supplemental to the liability recorded on the face of the financial statement, rather than its replacement. Governments will be required to report the net pension liability in their accrual-based financial statements, e.g., the governmentwide statement of net position, disclosing the pension liability on an equal footing with other long-term liabilities and clearly denoting the unfunded liability as an obligation of the plan employer and not the plan itself. Types of Benefit Plans & Benefit Plan Arrangements Consistent with the prior requirements, two sets of criteria are used to differentiate and classify pension plans. Plans first are classified based on how the benefit terms are defined as either a defined benefit or defined contribution plan.

Defined benefit plans then are classified based on the number of governments participating in a particular plan and whether pension plan assets and pension obligations are shared among the participating governments. For purposes of pension plan classification, a primary government and its separately audited component units, funds, programs or departments are considered one employer. Under a defined benefit plan, an employee’s income or benefits to be received post-employment are defined by the benefit terms. Under a defined contribution plan, an employee’s income or benefits will depend on the contributions to the employee’s account and actual earnings on investments of those contributions, notwithstanding other plan and nonplan-related factors.

Governments with defined contribution pensions will recognize pension expenses equal to the amount of contributions or credits to the employees’ accounts, absent forfeited amounts. These governments will recognize a pension liability for the difference between amounts recognized as the expense and actual contributions made to the defined contribution pension plan. Consistent with the prior rules, the new standards classify employers into either single employer or agent employer depending on the type of defined benefit plan arrangement they provide to their employees. Single employer pension plans are plans where one employer participates and benefits are provided to the employees of that one employer.

Multiemployer pension plans provide pension benefits to the employees of more than one employer. Agent multiemployer plans are plans where assets of multiple employers are pooled for investment 5 . GASB’s New Pension Standards purposes but legally segregated by employer to pay the benefits of only that employer’s employees, i.e., agent multiple-employer defined benefit pension plans. Cost-sharing multiemployer plans are plans where participating employers pool or share their obligations to provide pensions to their employees. Plan assets of cost sharing plans are available to pay employee pension obligation of any participating plan. All employers, regardless of the type of benefit plan arrangement used, are required to recognize the obligation associated with the pension benefits promised to their employees through a qualified trust in their financial statements. Accounting Changes Changes Affecting Single-Employer & Agent-Employer Plans Under Statement 68, government employers no longer are required to disclose information related to the adequacy of their funding policy in comparison to actuarially calculated funding benchmarks, or the annual required contribution (ARC).

Statement 68’s objective is to focus instead on a government’s present obligation to pay projected future pension benefit payments, in comparison to the amount of plan assets available for paying benefits to current employees, retirees and their beneficiaries. Net Pension Liability A single or agent employer that does not have a special funding situation is required to recognize a liability equal to the net pension liability, calculated as the difference between the total pension liability and the pension plan’s net position. A government’s total pension liability is the government’s present obligation to pay the pension benefits in the future, calculated as the present value of the projected future benefit payments attributable to current and former employees’ services rendered—in other words, that part of an employee’s compensation earned and deferred. The pension plan’s net position is equivalent to the net plan assets formally set aside in a trust and restricted to paying pension plan benefits to current employees, retirees and their beneficiaries.

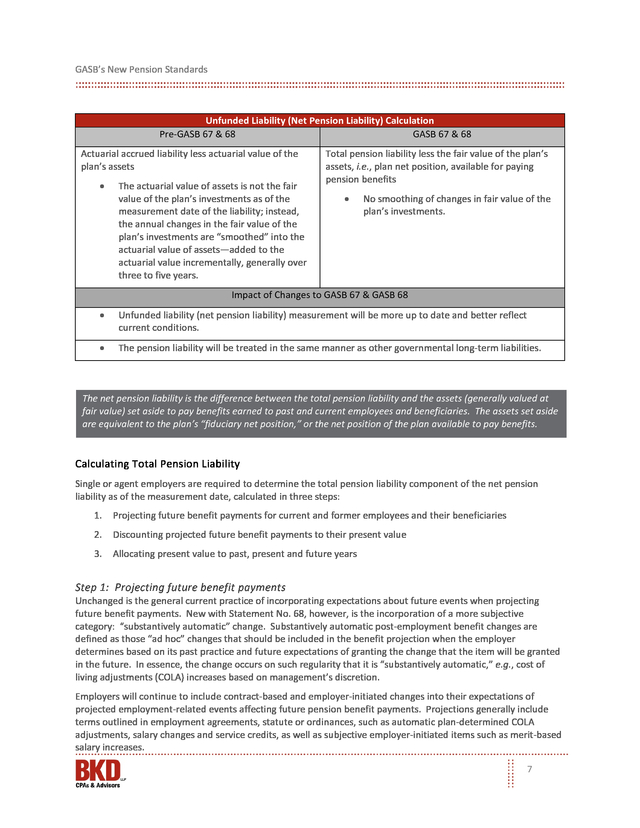

The pension plan’s net position available for paying benefits is to be measured using the same valuation methods used by the pension plan for purposes of preparing its financial statements, including measuring investments at fair value. The net pension liability is measured as of a date no earlier than the end of the employer’s prior fiscal year, consistently applied from period to period, i.e., the measurement date. If the employer reports a net pension liability measured as of a date other than its fiscal year-end and significant changes occur between the measurement date and its fiscal year-end, the employer should disclose information about the nature of the change and, if known, an estimate of the financial impact of the change. 6 . GASB’s New Pension Standards Unfunded Liability (Net Pension Liability) Calculation Pre-GASB 67 & 68 GASB 67 & 68 Actuarial accrued liability less actuarial value of the plan’s assets • The actuarial value of assets is not the fair value of the plan’s investments as of the measurement date of the liability; instead, the annual changes in the fair value of the plan’s investments are “smoothed” into the actuarial value of assets—added to the actuarial value incrementally, generally over three to five years. Total pension liability less the fair value of the plan’s assets, i.e., plan net position, available for paying pension benefits • No smoothing of changes in fair value of the plan’s investments. Impact of Changes to GASB 67 & GASB 68 • Unfunded liability (net pension liability) measurement will be more up to date and better reflect current conditions. • The pension liability will be treated in the same manner as other governmental long-term liabilities. The net pension liability is the difference between the total pension liability and the assets (generally valued at fair value) set aside to pay benefits earned to past and current employees and beneficiaries. The assets set aside are equivalent to the plan’s “fiduciary net position,” or the net position of the plan available to pay benefits. Calculating Total Pension Liability Single or agent employers are required to determine the total pension liability component of the net pension liability as of the measurement date, calculated in three steps: 1. Projecting future benefit payments for current and former employees and their beneficiaries 2. Discounting projected future benefit payments to their present value 3. Allocating present value to past, present and future years Step 1: Projecting future benefit payments Unchanged is the general current practice of incorporating expectations about future events when projecting future benefit payments. New with Statement No. 68, however, is the incorporation of a more subjective category: “substantively automatic” change.

Substantively automatic post-employment benefit changes are defined as those “ad hoc” changes that should be included in the benefit projection when the employer determines based on its past practice and future expectations of granting the change that the item will be granted in the future. In essence, the change occurs on such regularity that it is “substantively automatic,” e.g., cost of living adjustments (COLA) increases based on management’s discretion. Employers will continue to include contract-based and employer-initiated changes into their expectations of projected employment-related events affecting future pension benefit payments. Projections generally include terms outlined in employment agreements, statute or ordinances, such as automatic plan-determined COLA adjustments, salary changes and service credits, as well as subjective employer-initiated items such as merit-based salary increases. 7 .

GASB’s New Pension Standards The potential of including “substantively automatic” post-employment benefit changes in measuring the government’s total pension liability may result in an increased net pension liability compared to prior years. Actuarial Valuations Unchanged is the requirement that single and agent government employers have actuarial valuations performed at least every two years, with more frequent valuations encouraged. Actuarial valuations can be performed as of the measurement date, but when not performed as of the measurement date, the total pension liability will be based on a roll-forward of the information from a prior actuarial valuation to the measurement date. The rollforward valuation must be dated no more than 30 months and one day prior to the employer’s most recent fiscal year. Step 2: Discounting projected future benefit payments to their present value Discount Rate Governments will continue to apply a discount rate equal to the long-term expected rate of return on the investments of the pension plan. In accordance with the new standards, the long-term rate of return on plan assets is used only to the extent plan assets are projected to be greater than the projected benefit payments.

In other words, the long-term rate of return will be used to discount only that portion of the liability expected to be paid with plan assets. At the crossover point where plan assets cease to be greater than projected benefit payments, governments will discount projected benefit payments using a tax-exempt, high-quality 20-year municipal bond index rate. Although the present value of the projected benefits includes projected benefits for future expected years of service, only the portion attributable to the employees’ past and current periods of service is recognized on the face of the financial statements as net pension liability. This concept is in line with GASB’s matching principle. For example, for each future year of projected pension plan payments, the amount of the projected plan assets would be compared to the projected benefit payments.

If the plan assets are projected to be equal to or greater than the projected benefit payments, governments will discount those projected benefit payments using the expected rate of return on the investments of the pension plan over the long term. Instances where the projected plan assets are less that the projected benefit payments in a given year, the liability is discounted beginning at the crossover point where projected benefit payments exceeds projected plan assets. The change in methodology depicts the obligation as ultimately that of the employer government to be paid with its general resources— consistent with other long-term liabilities.

Unchanged from the old standards, the return on assets in an irrevocable trust, not the assets themselves, will be used to offset the recorded liability. When the municipal bond index rate component is lower than the rate of return on the plan’s investments, the blended rate will be lower than under the prior rules, resulting in a higher liability present value. In future years, the reverse may be true, causing volatility based on the plan’s investment portfolio and the overall investment market. Step 3: Allocating Present Value of Projected Benefits to Past, Present & Future Years Once the projected benefit payments are discounted to their present value, they are to be allocated between past, present and future years of employee service (years during which employees are expected to work for a government and earn benefits). Under the new statements, governments will use a single entry-age actuarial cost method to allocate present value and do so as a level percentage of payroll.

The present value is attributed to each plan member’s expected periods of employment starting from when the employee first begins to earn benefits through to plan member retirement. 8 . GASB’s New Pension Standards The use of one actuarial method by all employers is considered by most a contributing factor to improving the consistency and comparability between government financial statements, versus the six available allocation methods available under the current standards. Annual Pension Expense Annual pension expense measurement is no longer plan-based or ARC-driven. Instead, pension expense in the employer’s accrual-based financial statements is based on changes in the related net pension liability, representing a comprehensive measurement of the annual cost of pension benefits. Most changes in the net pension liability will be included in pension expense immediately in the year of change. Other components of pension expense will be recognized over a closed period determined by the average remaining service period of the plan members (both current and former employees, including retirees), or over a closed five-year period resembling a typical market cycle.

Those not included in pension expense in the year of change are recorded on the statement of net position as either “deferred outflow of resources” or “deferred inflow of resources,” respectively. Similar to the total pension liability, the annual pension expense calculation will be more comprehensive under the new standards. A government’s net pension liability changes from year to year due to changes in two components: total pension liability and the fair value of pension plan net position available to pay pension benefits. The cumulative effect of these changes from year to year is the annual pension expense. 9 . GASB’s New Pension Standards Comparability of Annual Pension Expense Calculation Attribute Pre-GASB 68 Post GASB 68 Pension Expense Calculation Method Annual required contribution (ARC) Included in Pension Expense in Current Year Benefits earned each year (service costs) x x Interest accrued on the outstanding total pension liability x x Changes in plan assets other than from investments, such as contributions made and benefit paid x x (1) x x x The effects of differences between expected earnings on plan investments and actual earnings on plan investments (1) x The effects of differences between assumed and actual economic and demographic factors, e.g., experience gains and losses (1) x The effects of selecting different economic and demographic assumptions (1) x Effect of changes in net pension liability Effect of changes in benefit terms Projected earnings on plan’s investments (reduces expense) Recorded initially as deferred outflows or inflows of resources amortized into expense over a closed, five-year period, beginning in the year in which they occur Recorded initially as deferred outflows or inflows of resources amortized into pension expense systematically and rationally over a closed period equal to the average of the expected remaining service lives all employees that are provided with benefits through the pension plan (active and inactive), beginning in the year in which they occur x x (1) Deferred and amortized into pension expense over a period of up to 30 years, beginning with the current period 10 . GASB’s New Pension Standards Comparability of Annual Pension Expense Calculation Impact of GASB 67 & GASB 68 • The potential for including ad hoc COLAs in the projection of benefits will mean the amount of projected future pension benefit payments may be higher for some governments under the new requirements. Consequently, the present value of the future benefit payments and the net pension liability will be larger than without COLA. • Pension expense will be closely linked with the period over which the pension benefits are earned, as the employees provide service. • The full impact of changes in pension benefit features would be recognized as an expense immediately, rather than gradually over up to 30 years as has been allowed. • Deferred outflows of resources and deferred inflows of resources attributable to economic and demographic factors and changes in assumptions would be included in pension expense over the average remaining years of employment of employees (active employees and inactive employees, including retirees), expected to be significantly shorter than 30 years under current standards. • Changes in the value of plan assets were recognized as expense over a period up to 30 years. The new, accelerated five-year expense recognition period is intended to reflect a typical market cycle. The revised annual expense recognition calculation results in an accelerated operating statement impact, most probably accelerated expense recognition attributed at least partially to benefit changes recognized solely in the current period under the new standards. Changes Affecting Multiemployer Cost-Sharing Plans As defined above, a defined benefit pension plan used to provide pensions to the employees of more than one employer is classified for financial reporting purposes as a multiemployer defined benefit pension plan. One of the primary objectives of GASB 68 is to align the measurement, reporting and disclosure concepts of multiemployer cost-sharing plans with single-employer and agent-employer plans. Prior to Statements No. 67 and 68, employers participating in cost-sharing multiemployer plans were not required to record a liability for the net pension liability and only disclosure information relating to the plan’s actuarial information was required in the employer’s financial statements. The only required liability relating to pensions for these types of employers was the difference between the required contributions, statutorily or otherwise established, and the contributions actually made.

Instead, detailed information relating to the plan’s unfunded liability was presented in the pension plan’s own financial statement disclosures for all of the participating governments combined. To give users of the financial statements of cost-sharing employers information comparable with single and agent employers, cost-sharing employers now are required to report a net pension liability, pension expense and pension-related deferred inflows and outflows of resources based on their proportionate share of the collective amounts for the plan. An employer’s proportion is required to be determined on a basis consistent with the manner in which contributions to the pension plan are determined. Each government’s share of the liability is calculated as that entity’s projected portion of future contributions into the plan (the plan’s expected contributions to the plan divided by those of all governments in the plan).

The net liability is measured as of a date no earlier than the end of the employer’s prior fiscal year. This allows employers with plan years differing from their fiscal year to continue to measure the net pension liability as of the plan year-end when it falls within the employer’s fiscal yearend. 11 . GASB’s New Pension Standards Governments participating in multiemployer plans now are required to measure and recognize a liability effectively corresponding to their single-employer and agent-employer counterparts. Pre Statement No. 68, this information was required to be disclosed only in the cost-sharing pension plan’s own financial statement footnotes for all of the participating governments combined. Likewise, and as required by single and agent plans, employers participating in multiemployer cost sharing plans will be required to recognize their proportionate share of the plan’s collective pension expense and deferred outflows/inflows of resources related to pensions. With equivalent information required about cost-sharing plans, financial statement readers will have essentially the same pension information about individual governments’ pensions irrespective of the type of plan they participate in—increasing transparency and comparability. Special Funding Situations Special funding situations are defined as circumstances in which a nonemployer entity is legally responsible for making contributions directly to a pension plan that is used to provide benefits to the employees of another entity or entities, when certain contribution criteria are met. Statement No.

68 requires employers with a special funding situation to adjust their pension liabilities and deferred inflows of resources or deferred outflows of resources for the involvement of nonemployer contributing entities. This means they are required first to calculate their net pension liability, pension expense and deferrals prior to the nonemployer government’s support in certain cases. The employer is required to recognize its proportionate share of the collective pension expense, as well as the additional pension expense and revenue for the pension support of the nonemployer contributing entities, and disclose the support arrangement in the notes to the financial statements. Special rules apply to cost-sharing employers and governmental nonemployer contributing entities. The nonemployer essentially has assumed a portion of the employer’s pension obligation as its own. Consequently, if the nonemployer is a government, it will be required to follow the requirements of Statement No. 68 and record its proportionate share of the employer’s net pension liability, pension expense and deferrals. Disclosure Requirements Statement 68 enhances accountability, comparability and transparency through increased note and RSI disclosures.

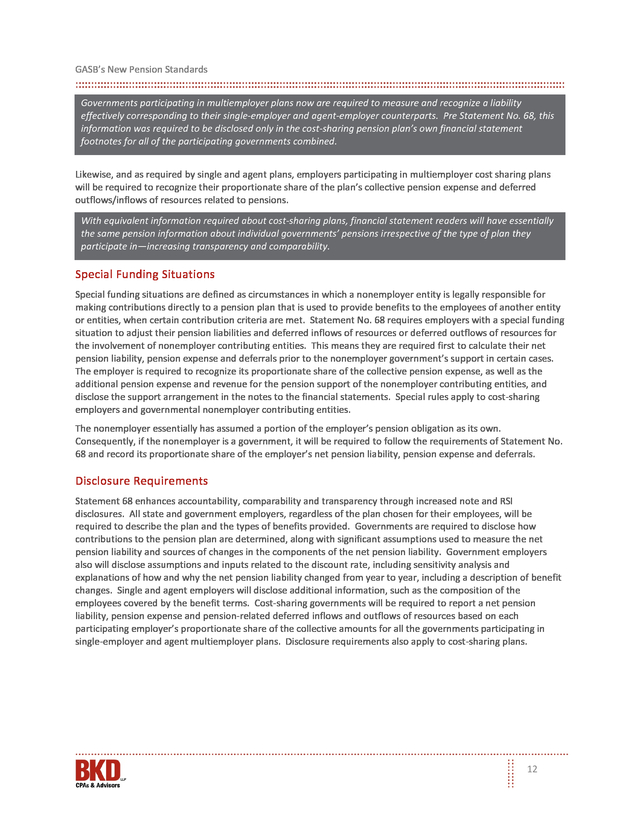

All state and government employers, regardless of the plan chosen for their employees, will be required to describe the plan and the types of benefits provided. Governments are required to disclose how contributions to the pension plan are determined, along with significant assumptions used to measure the net pension liability and sources of changes in the components of the net pension liability. Government employers also will disclose assumptions and inputs related to the discount rate, including sensitivity analysis and explanations of how and why the net pension liability changed from year to year, including a description of benefit changes.

Single and agent employers will disclose additional information, such as the composition of the employees covered by the benefit terms. Cost-sharing governments will be required to report a net pension liability, pension expense and pension-related deferred inflows and outflows of resources based on each participating employer’s proportionate share of the collective amounts for all the governments participating in single-employer and agent multiemployer plans. Disclosure requirements also apply to cost-sharing plans. 12 .

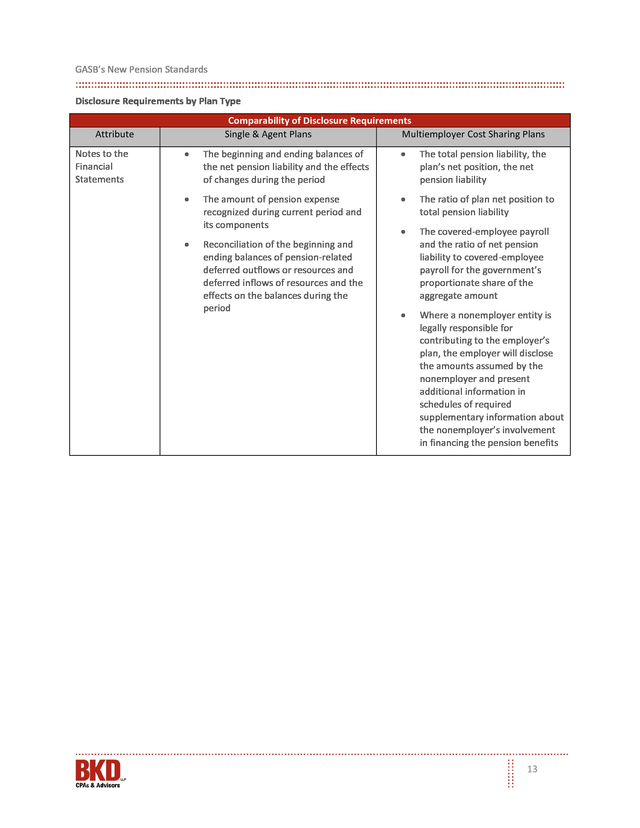

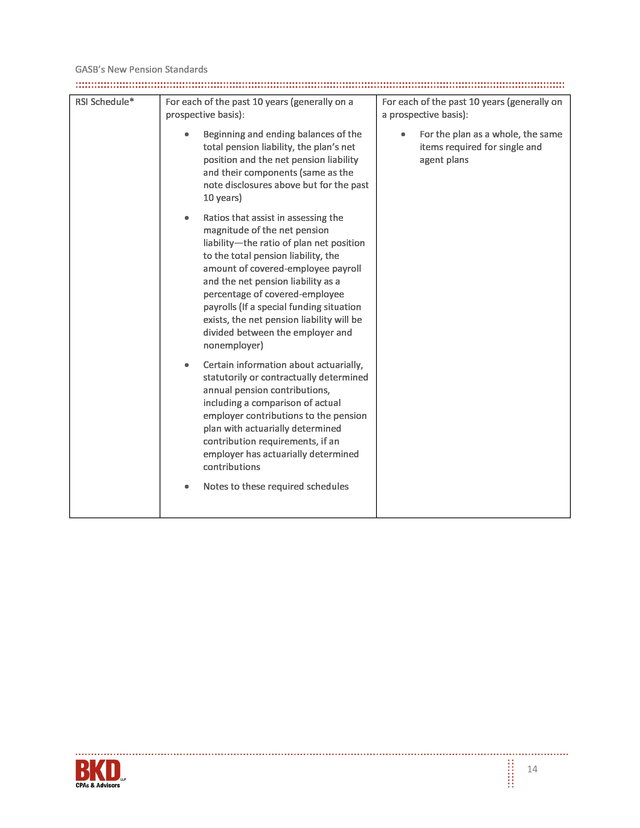

GASB’s New Pension Standards Disclosure Requirements by Plan Type Comparability of Disclosure Requirements Single & Agent Plans Multiemployer Cost Sharing Plans Attribute Notes to the Financial Statements • The beginning and ending balances of the net pension liability and the effects of changes during the period • The total pension liability, the plan’s net position, the net pension liability • The amount of pension expense recognized during current period and its components • The ratio of plan net position to total pension liability • • Reconciliation of the beginning and ending balances of pension-related deferred outflows or resources and deferred inflows of resources and the effects on the balances during the period The covered-employee payroll and the ratio of net pension liability to covered-employee payroll for the government’s proportionate share of the aggregate amount • Where a nonemployer entity is legally responsible for contributing to the employer’s plan, the employer will disclose the amounts assumed by the nonemployer and present additional information in schedules of required supplementary information about the nonemployer’s involvement in financing the pension benefits 13 . GASB’s New Pension Standards RSI Schedule* For each of the past 10 years (generally on a prospective basis): • Beginning and ending balances of the total pension liability, the plan’s net position and the net pension liability and their components (same as the note disclosures above but for the past 10 years) • Ratios that assist in assessing the magnitude of the net pension liability—the ratio of plan net position to the total pension liability, the amount of covered-employee payroll and the net pension liability as a percentage of covered-employee payrolls (If a special funding situation exists, the net pension liability will be divided between the employer and nonemployer) • Certain information about actuarially, statutorily or contractually determined annual pension contributions, including a comparison of actual employer contributions to the pension plan with actuarially determined contribution requirements, if an employer has actuarially determined contributions • For each of the past 10 years (generally on a prospective basis): • Notes to these required schedules For the plan as a whole, the same items required for single and agent plans 14 . GASB’s New Pension Standards Third-Party Funding Situation • Where a nonemployer entity is legally responsible for contributing to the employer’s plan, and the nonemployer’s commitment is defined in terms of a fixed amount (or if the nonemployer is the only party required to make contributions to the plan), the employer would disclose the amounts assumed by the nonemployer and present additional information in schedules of RSI about the nonemployer’s involvement in financing the pension benefits • Where the nonemployer is responsible for a “substantial” portion of one or more employers’ pension liabilities, the nonemployer will present information regarding those amounts in its notes and RSI • Same requirements as single and agent plans *Regarding the required RSI 10-year schedules, government employers would include information initially available and measured in accordance with the new standard. The information required in 10-year RSI schedules will give readers a historical perspective on the government’s track record into its fiscal accountability. Implementation & Transition GASB recommends full retrospective application to the extent practical. Governmental employers would report accounting changes made to comply with the standard as adjustments of prior periods; financial statements presented for the periods presented should be restated to the extent possible. It may not be practical to determine all net inflows and outflows of resources related to pensions, as applicable, at the beginning of the period the statements are adopted. In such circumstances, full retrospective application is most probably not practical and the cumulative effect adjustment of applying the statement would be reported as a restatement to the beginning net position of the beginning of the earliest period presented (the transition date). Beginning balances for deferred inflows of resources and deferred outflows of resources related to pensions should not be reported. Statement 67 Preparers of financial statements, as well as auditors, will benefit from the Guide to Implementation of GASB Statement 67 on Financial Reporting for Pension Plans. Although the guide’s comprehensive question-and-answer section includes nearly 100 questions, many constituents consider the comprehensive illustrations, expanded from those included in the standard, equally beneficial.

Also included is a glossary definition of terms and an appendix summarizing the standard and transition sections from Statement No. 67. 15 . GASB’s New Pension Standards Statement 68 GASB 71 modifies guidance in Statement 68, eliminating a potential source of understatement of beginning net position and expense in the first year of implementation. The potential understatement relates to contributions made by a state or local government employer or nonemployer contributing entity to a defined benefit pension plan after the measurement date of the government’s beginning net pension liability. The exposure draft requires that, at transition, an employer or nonemployer contributing entity must recognize a deferred outflow of resources for contributions made to a pension plan subsequent to the measurement date of the net pension liability and before the end of the prior reporting period. An organization would recognize the deferred outflow regardless of whether other changes in the net pension liability—deferred outflows of resources and deferred inflows of resources arising from other types of events—can be determined.

The update amends the provision in Statement No. 68 requiring, when not practical for an employer or nonemployer contributing entity to determine the amounts for all deferred outflows of resources and deferred inflows of resources, the beginning balances for deferred outflows of resources and deferred inflows not be reported. The provisions are effective simultaneously with the provisions of Statement No. 68, applicable for fiscal years beginning after June 15, 2014. How These Changes Could Affect You New Process & Procedures Roll-forward of the actuarial assumptions will be a new requirement for governmental employers.

Employers will need to define the process to be used to perform the roll-forward and the resources required. Government employers will want to perform this evaluation in a timely manner to identify instances where a roll-forward is not allowed, but a new actuarial valuation is required to comply with the new standard. Financial Ratios Increased liabilities and anticipated increases in salary, wages and benefit expense affect key financial ratios, including debt service coverage. The governmental employer (and nonemployer plan contributor) will want to plan ahead and have discussions with bond and debt holders considering the potential implications on restrictive debt covenants. Special Considerations for Multiemployer Cost-Sharing Plans Constituents agree that the new standards are expected to have a significant resource impact especially on employers participating in multiemployer cost-sharing plans, as well as larger governments with separately audited departments.

These employers may need additional expertise or resources to compute the allocation of costs at the individual employer level. Separately audited funds, programs and departments with costs allocated to them must consider the presentation of these costs in accordance with U.S. GAAP and the recovery of these costs to avoid insolvency. Conclusion GASB has aligned pension accounting to its economic resources measurement focus and U.S.

GAAP’s conceptual framework. Namely, financial statements should provide decision-useful, transparent information that supports assessments of accountability. For governmental financial statements, these principles are particularly useful for municipal investors and lender decision-making.

The updates require recognition of the entire net pension liability and a more comprehensive measure of pension expense. Some observers believe the changes will help financial statements users more clearly see the consequences of future proposed benefit increases and understand the extent to which the total pension liability is covered by resources held by the pension plan. 16 . GASB’s New Pension Standards The changes brought about by Statements No. 67 and 68 are substantial and complex, involving comprehensive disclosures and time-sensitive, subjective computations. With new standards come new risks to material financial reporting misstatements. Efforts to mitigate those risks generally translate into significant advance planning for financial statement preparers.

Governments should assess their existing resources, policies and procedures and the impact on their compliance requirements. If you have additional questions regarding governmental pension accounting issues, contact your BKD advisor. Contributor Connie Spinelli Director 303.861.4545 cspinelli@bkd.com 17 .

15 STATEMENT 67 ............................................................................................................................................................15 STATEMENT 68 ............................................................................................................................................................16 HOW THESE CHANGES COULD AFFECT YOU ......................................................................................................... 16 NEW PROCESS & PROCEDURES .......................................................................................................................................16 FINANCIAL RATIOS ........................................................................................................................................................16 SPECIAL CONSIDERATIONS FOR MULTIEMPLOYER COST-SHARING PLANS .................................................................................16 CONCLUSION ....................................................................................................................................................... 16 CONTRIBUTOR .....................................................................................................................................................

17 2 . GASB’s New Pension Standards Implementation of GASB Statement No. 67 is effective now—with fiscal years beginning after June 15, 2013. Statement No. 68 is effective one year later, for fiscal years beginning after June 15, 2014. Since their issuance in 2012, the effects of pension accounting and reporting changes have been on the minds of the Governmental Accounting Standards Board (GASB) and government employers alike.

Early implementation is encouraged, retrospective application is required to the extent practical and the measurement and recognition amendments are significant. To clarify and elaborate on the standard, GASB developed implementation guides for statements No. 67 and No.

68, and in November 2013, issued GASB Statement No. 71, Pension Transition for Contributions Made Subsequent to the Measurement Date—an amendment of GASB Statement No. 68, addressing the transition provisions of Statement No.

68. Statement No. 67 defines the financial reporting standards for pension plans. In most respects, the requirements for pension plan financial statements remain unchanged from the prior standards.

A defined benefit pension plan will continue to present two financial statements: a statement of fiduciary net position (the amount held in a trust for paying retirement benefits) and a statement of changes in fiduciary net position. Statement No. 67 enhances note disclosures and required supplementary information (RSI) for defined benefit and defined contribution pension plans. Statement No.

68 significantly revamps accounting and financial reporting for government employers (and nonemployer contributing entities) that provide pension benefits through a qualifying trust—requiring a “net pension liability” on the statement of net position. Historically, an unfunded pension obligation for employers in a cost-sharing plan was considered a liability to be reported in future periods, and information about the total liability—unfunded and funded—was disclosed only in the notes to the financial statements and as required supplemental information. Financial statements of governments participating in cost-sharing plans now will reflect a net pension liability based on a model similar to single- and agent-employer plans.

Single- and agent-employer plans must adhere to more stringent requirements for total pension liability measurement including projecting and discounting of benefit payments, as well as a more comprehensive measure of pension expense. Because of these changes, affected governmental employers may realize a larger pension expense and liabilities than under current standards. Annual pension expense will be based on a comprehensive measurement of the annual cost of pension benefits and no longer will be a simple function of annual funding amounts. In essence, GASB de-linked annual funding in relation to the plan document from pension accounting.

Government employers also will feel the effect of significantly increased note disclosure and RSI requirements. Governments participating in defined contribution benefit plans are covered under the scope of GASB 68 but will be minimally affected by the new requirements and will essentially continue to follow the existing requirements. Background & Overview This article provides in-depth measurement and reporting guidance for governmental entities with pensions affected by Statements No. 67, Financial Reporting for Pension Plans – an amendment of GASB Statement No. 25, and No.

68, Accounting and Financial Reporting for Pensions – an amendment of GASB No.27, including a discussion of the potential employer ramifications. The revised standards will apply to most defined benefit pension plans. Accounting Overview Major fund accounting applies to governmental funds and proprietary funds but does not apply to fiduciary funds such as pension trust funds. Resources such as pension plan assets cannot be used to finance a governmental entity’s activities and, therefore, financial statements of fiduciary funds are not presented in governmentwide financial statements.

Instead, an entity reports fiduciary funds in the financial statements by fund type at the fund level, e.g., pension trust fund. Because the governmental entity is financially accountable for those resources and obligations, even though they belong to other parties, the balances and activities of pension trust funds are presented in the government’s financial statements in a Statement of Fiduciary Net Position and a Statement of Changes in Fiduciary Net Position at the fund financial statement level. The Statement of Plan Net Position reports 3 .

GASB’s New Pension Standards the pension plans’ assets and liabilities; net position is identified as “net position held in trust for pension benefits.” At the governmental employer level, Statement No. 68 establishes standards affecting all elements of employer pension plan accounting including expense and liability recognition and the recognition of deferred outflows of resources and inflows of resources. Employers will recognize the unfunded pension benefits promised to their employees through a qualified trust in their financial statements, regardless of the type of benefit plan arrangement used. In addition, the statement more narrowly defines the methods and assumptions to project benefit payments, discount projected benefit payments to their actuarial present value and attribute that present value to periods of employee service. Scope Similar to the broad application of Statement No.

67, the new financial reporting requirements of Statement No. 68 will apply to most governments that provide their employees with pensions, as well as nonemployer governments with a legal obligation to contribute to those plans. Issuance of Statements No. 67 and No.

68 represents a conceptual alignment with the GASB and U.S. GAAP accounting and reporting frameworks. During their pension project deliberations, the board affirmed that a government employer’s net pension liability meets the definition of a liability under Concepts Statement No.

4, Elements of Financial Statements, issued in June 2007. Concepts Statement No. 4 also establishes that deferred outflows of resources and deferred inflows of resources— an integral part of pension accounting—are not assets and liabilities and should not be reported as such in a statement of financial position. (Deferrals result from inflows and outflows of resources that have already taken place but are not ready to be recognized in the financial statements as revenues and expenses because some future event has yet to occur).

Likewise, GASB Statement No. 34, Basic Financial Statements – and Management’s Discussion and Analysis – for State and Local Governments, issued in June 1999, paved the way for pension accounting and reporting change by requiring government financial statements to be prepared using the economic resources measurement focus and the accrual basis of accounting. Neither Concepts Statement No.

4 nor Statement No. 34 was drafted when the existing pension standards were issued in 1994. “Deferred outflow” and “deferred inflow” accounts are new concepts to GASB pension accounting. For financial statement presentation purposes, the deferred accounts are reported in a separate section below the assets and liabilities section, depending on whether the difference is favorable or unfavorable, respectively. The scope of the standard does not include other postemployment benefits (OPEB).

GASB is considering the possibility of improvements to the current standards of accounting and financial reporting for OPEBs. The project entails assessing the effectiveness of current OPEB standards (Statements No. 43 and No.

45) and applying a common framework to all post-employment benefits considering the changes made to pension reporting by the issuance of Statements No. 67 and No. 68. Key Provisions Overview The general requirement for recognition of a liability is the recording of obligations for goods or services received and unpaid as of a specified point in time.

Statements 67 and 68 provide an alignment of this economic matching principle. Under the new standards, for government employers participating in single-employer and agent multiemployer plans, and nonemployer contributing entities, the employer’s share is 100 percent of the liability and related pension components. Employers participating in cost sharing plans will be required to report their proportionate share of the amount of unfunded pension obligation as a liability on the statement of net position. The pension liability will be measured based on accounting principles and no longer on the government’s 4 .

GASB’s New Pension Standards intentions relevant to the plan document. Each employer likewise will be required to recognize its estimated allocated share of the plan’s collective pension expense in the applicable flows statement (100 percent of the pension expense for single employer or agent plans). Statement 68 establishes standards for a more comprehensive measure of pension expense. It has changed pension expense variables by identifying the method and assumptions that should be used to project and discount benefit payments, as well as how to attribute the actuarial present value to periods of employee service. A government’s current period pension expense primarily results from changes in the components of the net pension liability (NPL). NPL is computed as the difference between the employer’s obligation to provide pension benefits earned and funding of those benefits (the plan assets held in trust); pension amounts earned by current and former employees for past services are recorded as a liability in current statements, not in future statements. Most causes of change in the net pension liability will be included in pension expense immediately.

Changes resulting from certain causes will be introduced into pension expense over multiple periods. NPL is a new concept for multiemployer government employers. Cost-sharing employers will reflect an obligation for their proportionate share of the collective total pension liability not covered by pension assets and are expected to be the most affected by the new standards. Prior to Statement 68, cost-sharing multiemployer government employers could be in a position of substantial unfunded NPL and show little or no liability for defined pension benefit obligations in their consolidated annual financial report (CAFR).

Statement No. 68 affects special funding situations in a similar manner, where an entity other than the employer government is legally responsible for making some or all of the employer’s contributions to the plan, often defined in terms of a fixed amount. Disclosure of pension information in the notes to the financial statements and the information following the notes or RSI still is important. However, financial statement notes and RSI now are supplemental to the liability recorded on the face of the financial statement, rather than its replacement. Governments will be required to report the net pension liability in their accrual-based financial statements, e.g., the governmentwide statement of net position, disclosing the pension liability on an equal footing with other long-term liabilities and clearly denoting the unfunded liability as an obligation of the plan employer and not the plan itself. Types of Benefit Plans & Benefit Plan Arrangements Consistent with the prior requirements, two sets of criteria are used to differentiate and classify pension plans. Plans first are classified based on how the benefit terms are defined as either a defined benefit or defined contribution plan.

Defined benefit plans then are classified based on the number of governments participating in a particular plan and whether pension plan assets and pension obligations are shared among the participating governments. For purposes of pension plan classification, a primary government and its separately audited component units, funds, programs or departments are considered one employer. Under a defined benefit plan, an employee’s income or benefits to be received post-employment are defined by the benefit terms. Under a defined contribution plan, an employee’s income or benefits will depend on the contributions to the employee’s account and actual earnings on investments of those contributions, notwithstanding other plan and nonplan-related factors.

Governments with defined contribution pensions will recognize pension expenses equal to the amount of contributions or credits to the employees’ accounts, absent forfeited amounts. These governments will recognize a pension liability for the difference between amounts recognized as the expense and actual contributions made to the defined contribution pension plan. Consistent with the prior rules, the new standards classify employers into either single employer or agent employer depending on the type of defined benefit plan arrangement they provide to their employees. Single employer pension plans are plans where one employer participates and benefits are provided to the employees of that one employer.

Multiemployer pension plans provide pension benefits to the employees of more than one employer. Agent multiemployer plans are plans where assets of multiple employers are pooled for investment 5 . GASB’s New Pension Standards purposes but legally segregated by employer to pay the benefits of only that employer’s employees, i.e., agent multiple-employer defined benefit pension plans. Cost-sharing multiemployer plans are plans where participating employers pool or share their obligations to provide pensions to their employees. Plan assets of cost sharing plans are available to pay employee pension obligation of any participating plan. All employers, regardless of the type of benefit plan arrangement used, are required to recognize the obligation associated with the pension benefits promised to their employees through a qualified trust in their financial statements. Accounting Changes Changes Affecting Single-Employer & Agent-Employer Plans Under Statement 68, government employers no longer are required to disclose information related to the adequacy of their funding policy in comparison to actuarially calculated funding benchmarks, or the annual required contribution (ARC).

Statement 68’s objective is to focus instead on a government’s present obligation to pay projected future pension benefit payments, in comparison to the amount of plan assets available for paying benefits to current employees, retirees and their beneficiaries. Net Pension Liability A single or agent employer that does not have a special funding situation is required to recognize a liability equal to the net pension liability, calculated as the difference between the total pension liability and the pension plan’s net position. A government’s total pension liability is the government’s present obligation to pay the pension benefits in the future, calculated as the present value of the projected future benefit payments attributable to current and former employees’ services rendered—in other words, that part of an employee’s compensation earned and deferred. The pension plan’s net position is equivalent to the net plan assets formally set aside in a trust and restricted to paying pension plan benefits to current employees, retirees and their beneficiaries.

The pension plan’s net position available for paying benefits is to be measured using the same valuation methods used by the pension plan for purposes of preparing its financial statements, including measuring investments at fair value. The net pension liability is measured as of a date no earlier than the end of the employer’s prior fiscal year, consistently applied from period to period, i.e., the measurement date. If the employer reports a net pension liability measured as of a date other than its fiscal year-end and significant changes occur between the measurement date and its fiscal year-end, the employer should disclose information about the nature of the change and, if known, an estimate of the financial impact of the change. 6 . GASB’s New Pension Standards Unfunded Liability (Net Pension Liability) Calculation Pre-GASB 67 & 68 GASB 67 & 68 Actuarial accrued liability less actuarial value of the plan’s assets • The actuarial value of assets is not the fair value of the plan’s investments as of the measurement date of the liability; instead, the annual changes in the fair value of the plan’s investments are “smoothed” into the actuarial value of assets—added to the actuarial value incrementally, generally over three to five years. Total pension liability less the fair value of the plan’s assets, i.e., plan net position, available for paying pension benefits • No smoothing of changes in fair value of the plan’s investments. Impact of Changes to GASB 67 & GASB 68 • Unfunded liability (net pension liability) measurement will be more up to date and better reflect current conditions. • The pension liability will be treated in the same manner as other governmental long-term liabilities. The net pension liability is the difference between the total pension liability and the assets (generally valued at fair value) set aside to pay benefits earned to past and current employees and beneficiaries. The assets set aside are equivalent to the plan’s “fiduciary net position,” or the net position of the plan available to pay benefits. Calculating Total Pension Liability Single or agent employers are required to determine the total pension liability component of the net pension liability as of the measurement date, calculated in three steps: 1. Projecting future benefit payments for current and former employees and their beneficiaries 2. Discounting projected future benefit payments to their present value 3. Allocating present value to past, present and future years Step 1: Projecting future benefit payments Unchanged is the general current practice of incorporating expectations about future events when projecting future benefit payments. New with Statement No. 68, however, is the incorporation of a more subjective category: “substantively automatic” change.

Substantively automatic post-employment benefit changes are defined as those “ad hoc” changes that should be included in the benefit projection when the employer determines based on its past practice and future expectations of granting the change that the item will be granted in the future. In essence, the change occurs on such regularity that it is “substantively automatic,” e.g., cost of living adjustments (COLA) increases based on management’s discretion. Employers will continue to include contract-based and employer-initiated changes into their expectations of projected employment-related events affecting future pension benefit payments. Projections generally include terms outlined in employment agreements, statute or ordinances, such as automatic plan-determined COLA adjustments, salary changes and service credits, as well as subjective employer-initiated items such as merit-based salary increases. 7 .

GASB’s New Pension Standards The potential of including “substantively automatic” post-employment benefit changes in measuring the government’s total pension liability may result in an increased net pension liability compared to prior years. Actuarial Valuations Unchanged is the requirement that single and agent government employers have actuarial valuations performed at least every two years, with more frequent valuations encouraged. Actuarial valuations can be performed as of the measurement date, but when not performed as of the measurement date, the total pension liability will be based on a roll-forward of the information from a prior actuarial valuation to the measurement date. The rollforward valuation must be dated no more than 30 months and one day prior to the employer’s most recent fiscal year. Step 2: Discounting projected future benefit payments to their present value Discount Rate Governments will continue to apply a discount rate equal to the long-term expected rate of return on the investments of the pension plan. In accordance with the new standards, the long-term rate of return on plan assets is used only to the extent plan assets are projected to be greater than the projected benefit payments.

In other words, the long-term rate of return will be used to discount only that portion of the liability expected to be paid with plan assets. At the crossover point where plan assets cease to be greater than projected benefit payments, governments will discount projected benefit payments using a tax-exempt, high-quality 20-year municipal bond index rate. Although the present value of the projected benefits includes projected benefits for future expected years of service, only the portion attributable to the employees’ past and current periods of service is recognized on the face of the financial statements as net pension liability. This concept is in line with GASB’s matching principle. For example, for each future year of projected pension plan payments, the amount of the projected plan assets would be compared to the projected benefit payments.

If the plan assets are projected to be equal to or greater than the projected benefit payments, governments will discount those projected benefit payments using the expected rate of return on the investments of the pension plan over the long term. Instances where the projected plan assets are less that the projected benefit payments in a given year, the liability is discounted beginning at the crossover point where projected benefit payments exceeds projected plan assets. The change in methodology depicts the obligation as ultimately that of the employer government to be paid with its general resources— consistent with other long-term liabilities.

Unchanged from the old standards, the return on assets in an irrevocable trust, not the assets themselves, will be used to offset the recorded liability. When the municipal bond index rate component is lower than the rate of return on the plan’s investments, the blended rate will be lower than under the prior rules, resulting in a higher liability present value. In future years, the reverse may be true, causing volatility based on the plan’s investment portfolio and the overall investment market. Step 3: Allocating Present Value of Projected Benefits to Past, Present & Future Years Once the projected benefit payments are discounted to their present value, they are to be allocated between past, present and future years of employee service (years during which employees are expected to work for a government and earn benefits). Under the new statements, governments will use a single entry-age actuarial cost method to allocate present value and do so as a level percentage of payroll.

The present value is attributed to each plan member’s expected periods of employment starting from when the employee first begins to earn benefits through to plan member retirement. 8 . GASB’s New Pension Standards The use of one actuarial method by all employers is considered by most a contributing factor to improving the consistency and comparability between government financial statements, versus the six available allocation methods available under the current standards. Annual Pension Expense Annual pension expense measurement is no longer plan-based or ARC-driven. Instead, pension expense in the employer’s accrual-based financial statements is based on changes in the related net pension liability, representing a comprehensive measurement of the annual cost of pension benefits. Most changes in the net pension liability will be included in pension expense immediately in the year of change. Other components of pension expense will be recognized over a closed period determined by the average remaining service period of the plan members (both current and former employees, including retirees), or over a closed five-year period resembling a typical market cycle.

Those not included in pension expense in the year of change are recorded on the statement of net position as either “deferred outflow of resources” or “deferred inflow of resources,” respectively. Similar to the total pension liability, the annual pension expense calculation will be more comprehensive under the new standards. A government’s net pension liability changes from year to year due to changes in two components: total pension liability and the fair value of pension plan net position available to pay pension benefits. The cumulative effect of these changes from year to year is the annual pension expense. 9 . GASB’s New Pension Standards Comparability of Annual Pension Expense Calculation Attribute Pre-GASB 68 Post GASB 68 Pension Expense Calculation Method Annual required contribution (ARC) Included in Pension Expense in Current Year Benefits earned each year (service costs) x x Interest accrued on the outstanding total pension liability x x Changes in plan assets other than from investments, such as contributions made and benefit paid x x (1) x x x The effects of differences between expected earnings on plan investments and actual earnings on plan investments (1) x The effects of differences between assumed and actual economic and demographic factors, e.g., experience gains and losses (1) x The effects of selecting different economic and demographic assumptions (1) x Effect of changes in net pension liability Effect of changes in benefit terms Projected earnings on plan’s investments (reduces expense) Recorded initially as deferred outflows or inflows of resources amortized into expense over a closed, five-year period, beginning in the year in which they occur Recorded initially as deferred outflows or inflows of resources amortized into pension expense systematically and rationally over a closed period equal to the average of the expected remaining service lives all employees that are provided with benefits through the pension plan (active and inactive), beginning in the year in which they occur x x (1) Deferred and amortized into pension expense over a period of up to 30 years, beginning with the current period 10 . GASB’s New Pension Standards Comparability of Annual Pension Expense Calculation Impact of GASB 67 & GASB 68 • The potential for including ad hoc COLAs in the projection of benefits will mean the amount of projected future pension benefit payments may be higher for some governments under the new requirements. Consequently, the present value of the future benefit payments and the net pension liability will be larger than without COLA. • Pension expense will be closely linked with the period over which the pension benefits are earned, as the employees provide service. • The full impact of changes in pension benefit features would be recognized as an expense immediately, rather than gradually over up to 30 years as has been allowed. • Deferred outflows of resources and deferred inflows of resources attributable to economic and demographic factors and changes in assumptions would be included in pension expense over the average remaining years of employment of employees (active employees and inactive employees, including retirees), expected to be significantly shorter than 30 years under current standards. • Changes in the value of plan assets were recognized as expense over a period up to 30 years. The new, accelerated five-year expense recognition period is intended to reflect a typical market cycle. The revised annual expense recognition calculation results in an accelerated operating statement impact, most probably accelerated expense recognition attributed at least partially to benefit changes recognized solely in the current period under the new standards. Changes Affecting Multiemployer Cost-Sharing Plans As defined above, a defined benefit pension plan used to provide pensions to the employees of more than one employer is classified for financial reporting purposes as a multiemployer defined benefit pension plan. One of the primary objectives of GASB 68 is to align the measurement, reporting and disclosure concepts of multiemployer cost-sharing plans with single-employer and agent-employer plans. Prior to Statements No. 67 and 68, employers participating in cost-sharing multiemployer plans were not required to record a liability for the net pension liability and only disclosure information relating to the plan’s actuarial information was required in the employer’s financial statements. The only required liability relating to pensions for these types of employers was the difference between the required contributions, statutorily or otherwise established, and the contributions actually made.

Instead, detailed information relating to the plan’s unfunded liability was presented in the pension plan’s own financial statement disclosures for all of the participating governments combined. To give users of the financial statements of cost-sharing employers information comparable with single and agent employers, cost-sharing employers now are required to report a net pension liability, pension expense and pension-related deferred inflows and outflows of resources based on their proportionate share of the collective amounts for the plan. An employer’s proportion is required to be determined on a basis consistent with the manner in which contributions to the pension plan are determined. Each government’s share of the liability is calculated as that entity’s projected portion of future contributions into the plan (the plan’s expected contributions to the plan divided by those of all governments in the plan).

The net liability is measured as of a date no earlier than the end of the employer’s prior fiscal year. This allows employers with plan years differing from their fiscal year to continue to measure the net pension liability as of the plan year-end when it falls within the employer’s fiscal yearend. 11 . GASB’s New Pension Standards Governments participating in multiemployer plans now are required to measure and recognize a liability effectively corresponding to their single-employer and agent-employer counterparts. Pre Statement No. 68, this information was required to be disclosed only in the cost-sharing pension plan’s own financial statement footnotes for all of the participating governments combined. Likewise, and as required by single and agent plans, employers participating in multiemployer cost sharing plans will be required to recognize their proportionate share of the plan’s collective pension expense and deferred outflows/inflows of resources related to pensions. With equivalent information required about cost-sharing plans, financial statement readers will have essentially the same pension information about individual governments’ pensions irrespective of the type of plan they participate in—increasing transparency and comparability. Special Funding Situations Special funding situations are defined as circumstances in which a nonemployer entity is legally responsible for making contributions directly to a pension plan that is used to provide benefits to the employees of another entity or entities, when certain contribution criteria are met. Statement No.