Description

SDOG

ALPS Sector Dividend Dogs ETF Update | December 31, 2015

YIELD – DOGS THEORY – S&P 500®

The ALPS Sector Dividend Dogs ETF [SDOG] is an Exchange Traded Fund that

applies the ‘Dogs of the Dow Theory’ on a sector-by-sector basis using the S&P

500® as its starting universe of eligible securities. This strategy provides the following

potential benefits:

ƒƒ High Dividend Yield Relative to US Large Cap Indices – Starting with a smaller,

quality universe such as the S&P 500® diminishes the likelihood of troubled and financially

distressed companies entering the index and allows dividend yield to be the primary

selection criterion for the index.

ƒƒ Sector and Stock Diversification – SDOG provides high dividend exposure across all

10 sectors of the market by selecting the five highest yielding securities in each sector and

equally weighting them. This provides diversification at both the stock and sector level.

ƒƒ Dogs Theory – SDOG isolates the S&P 500® constituents with the highest dividend yield

in their respective sectors providing the potential for price appreciation as market forces

bring their yield into line with the overall market.

ETF Stats

Ticker:

SDOG

Underlying Index:

SDOGXTR

Listing Exchange:

NYSE Arca

CUSIP:

00162Q 858

Fund Inception:

6/29/2012

Dividends Paid:

Quarterly

Most Recent Dividend*:

$0.3121

Gross Expense Ratio:

0.40%

NAV**:

$35.54

Shares Outstanding:

27.809 Million

* Dividend Paid on 12/31/15

** As of 12/31/15

Investment Objective

The Fund seeks investment results that

replicate as closely as possible, before

fees and expenses, the performance of the

S-Network® Sector Dividend Dogs Index (the

“Underlying Index”).

PERFORMANCE as of 12/31/15

Cumulative

Annualized

Since

Inception

Since

Inception1

Total Returns

1 Month 3 Month

ALPS Sector Dividend Dogs

ETF (Net Asset Value)

-1.04%

5.88% -3.20% 61.99% -3.20%

14.34% 14.75%

ALPS Sector Dividend Dogs

ETF (Market Price)2

-1.13%

5.85% -3.22% 61.95% -3.22%

14.29% 14.74%

S&P 500 Total Return Index

(Benchmark)

-1.58%

7.04%

1.38% 61.67% 1.38%

15.13% 14.68%

6.03% -2.83% 64.67% -2.83%

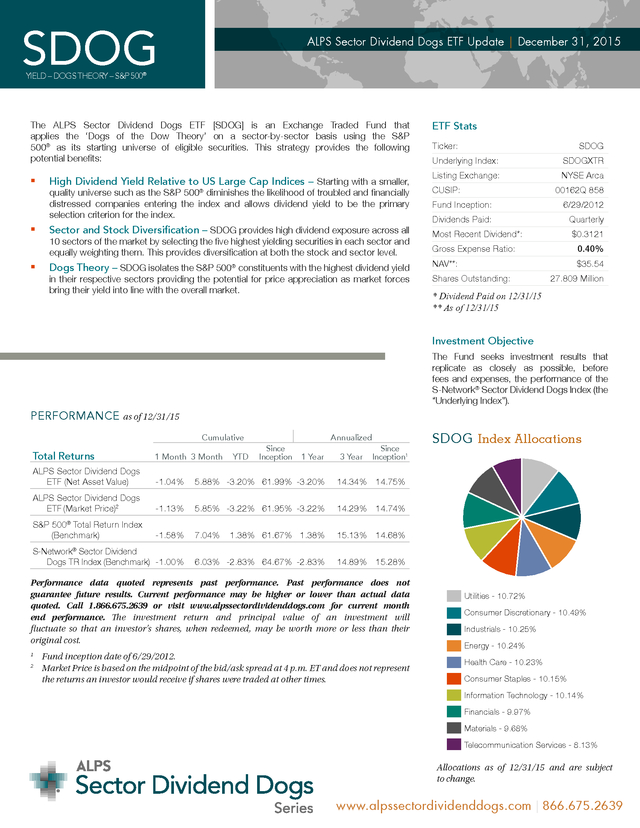

SDOG Index Allocations

14.89% 15.28%

YTD

1 Year

3 Year

®

S-Network Sector Dividend

Dogs TR Index (Benchmark) -1.00%

®

Performance data quoted represents past performance. Past performance does not

guarantee future results.

Current performance may be higher or lower than actual data quoted. Call 1.866.675.2639 or visit www.alpssectordividenddogs.com for current month end performance. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund inception date of 6/29/2012. 2 Market Price is based on the midpoint of the bid/ask spread at 4 p.m.

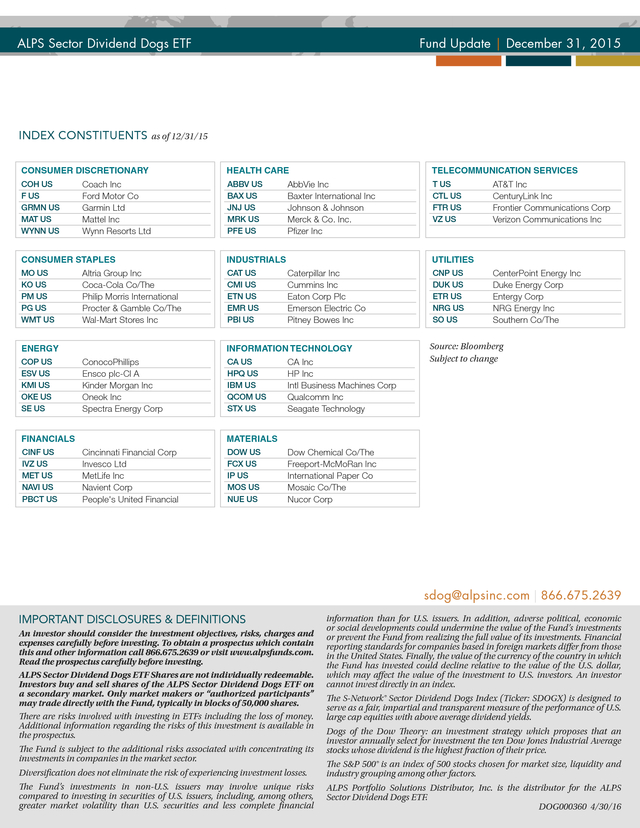

ET and does not represent the returns an investor would receive if shares were traded at other times. 1 Utilities - 10.72% Consumer Discretionary - 10.49% Industrials - 10.25% Energy - 10.24% Health Care - 10.23% Consumer Staples - 10.15% Information Technology - 10.14% Financials - 9.97% Materials - 9.68% Telecommunication Services - 8.13% Allocations as of 12/31/15 and are subject to change. www.alpssectordividenddogs.com | 866.675.2639 . ALPS Sector Dividend Dogs ETF Fund Update | December 31, 2015 INDEX CONSTITUENTS as of 12/31/15 CONSUMER DISCRETIONARY COH US F US GRMN US MAT US WYNN US Coach Inc Ford Motor Co Garmin Ltd Mattel Inc Wynn Resorts Ltd CONSUMER STAPLES MO US KO US PM US PG US WMT US Altria Group Inc Coca-Cola Co/The Philip Morris International Procter & Gamble Co/The Wal-Mart Stores Inc ENERGY COP US ESV US KMI US OKE US SE US ABBV US BAX US JNJ US MRK US PFE US TELECOMMUNICATION SERVICES AbbVie Inc Baxter International Inc Johnson & Johnson Merck & Co. Inc. Pfizer Inc INDUSTRIALS CAT US CMI US ETN US EMR US PBI US ConocoPhillips Ensco plc-Cl A Kinder Morgan Inc Oneok Inc Spectra Energy Corp CA US HPQ US IBM US QCOM US STX US T US CTL US FTR US VZ US AT&T Inc CenturyLink Inc Frontier Communications Corp Verizon Communications Inc UTILITIES Caterpillar Inc Cummins Inc Eaton Corp Plc Emerson Electric Co Pitney Bowes Inc INFORMATION TECHNOLOGY FINANCIALS CINF US IVZ US MET US NAVI US PBCT US HEALTH CARE CA Inc HP Inc Intl Business Machines Corp Qualcomm Inc Seagate Technology CNP US DUK US ETR US NRG US SO US CenterPoint Energy Inc Duke Energy Corp Entergy Corp NRG Energy Inc Southern Co/The Source: Bloomberg Subject to change MATERIALS Cincinnati Financial Corp Invesco Ltd MetLife Inc Navient Corp People's United Financial DOW US FCX US IP US MOS US NUE US Dow Chemical Co/The Freeport-McMoRan Inc International Paper Co Mosaic Co/The Nucor Corp sdog@alpsinc.com | 866.675.2639 IMPORTANT DISCLOSURES & DEFINITIONS An investor should consider the investment objectives, risks, charges and expenses carefully before investing. To obtain a prospectus which contain this and other information call 866.675.2639 or visit www.alpsfunds.com. Read the prospectus carefully before investing. ALPS Sector Dividend Dogs ETF Shares are not individually redeemable. Investors buy and sell shares of the ALPS Sector Dividend Dogs ETF on a secondary market. Only market makers or “authorized participants” may trade directly with the Fund, typically in blocks of 50,000 shares. There are risks involved with investing in ETFs including the loss of money. Additional information regarding the risks of this investment is available in the prospectus. The Fund is subject to the additional risks associated with concentrating its investments in companies in the market sector. Diversification does not eliminate the risk of experiencing investment losses. The Fund’s investments in non-U.S.

issuers may involve unique risks compared to investing in securities of U.S. issuers, including, among others, greater market volatility than U.S. securities and less complete financial information than for U.S.

issuers. In addition, adverse political, economic or social developments could undermine the value of the Fund’s investments or prevent the Fund from realizing the full value of its investments. Financial reporting standards for companies based in foreign markets differ from those in the United States.

Finally, the value of the currency of the country in which the Fund has invested could decline relative to the value of the U.S. dollar, which may affect the value of the investment to U.S. investors.

An investor cannot invest directly in an index. The S-Network® Sector Dividend Dogs Index (Ticker: SDOGX) is designed to serve as a fair, impartial and transparent measure of the performance of U.S. large cap equities with above average dividend yields. Dogs of the Dow Theory: an investment strategy which proposes that an investor annually select for investment the ten Dow Jones Industrial Average stocks whose dividend is the highest fraction of their price. The S&P 500® is an index of 500 stocks chosen for market size, liquidity and industry grouping among other factors. ALPS Portfolio Solutions Distributor, Inc. is the distributor for the ALPS Sector Dividend Dogs ETF. DOG000360 4/30/16 .

Current performance may be higher or lower than actual data quoted. Call 1.866.675.2639 or visit www.alpssectordividenddogs.com for current month end performance. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund inception date of 6/29/2012. 2 Market Price is based on the midpoint of the bid/ask spread at 4 p.m.

ET and does not represent the returns an investor would receive if shares were traded at other times. 1 Utilities - 10.72% Consumer Discretionary - 10.49% Industrials - 10.25% Energy - 10.24% Health Care - 10.23% Consumer Staples - 10.15% Information Technology - 10.14% Financials - 9.97% Materials - 9.68% Telecommunication Services - 8.13% Allocations as of 12/31/15 and are subject to change. www.alpssectordividenddogs.com | 866.675.2639 . ALPS Sector Dividend Dogs ETF Fund Update | December 31, 2015 INDEX CONSTITUENTS as of 12/31/15 CONSUMER DISCRETIONARY COH US F US GRMN US MAT US WYNN US Coach Inc Ford Motor Co Garmin Ltd Mattel Inc Wynn Resorts Ltd CONSUMER STAPLES MO US KO US PM US PG US WMT US Altria Group Inc Coca-Cola Co/The Philip Morris International Procter & Gamble Co/The Wal-Mart Stores Inc ENERGY COP US ESV US KMI US OKE US SE US ABBV US BAX US JNJ US MRK US PFE US TELECOMMUNICATION SERVICES AbbVie Inc Baxter International Inc Johnson & Johnson Merck & Co. Inc. Pfizer Inc INDUSTRIALS CAT US CMI US ETN US EMR US PBI US ConocoPhillips Ensco plc-Cl A Kinder Morgan Inc Oneok Inc Spectra Energy Corp CA US HPQ US IBM US QCOM US STX US T US CTL US FTR US VZ US AT&T Inc CenturyLink Inc Frontier Communications Corp Verizon Communications Inc UTILITIES Caterpillar Inc Cummins Inc Eaton Corp Plc Emerson Electric Co Pitney Bowes Inc INFORMATION TECHNOLOGY FINANCIALS CINF US IVZ US MET US NAVI US PBCT US HEALTH CARE CA Inc HP Inc Intl Business Machines Corp Qualcomm Inc Seagate Technology CNP US DUK US ETR US NRG US SO US CenterPoint Energy Inc Duke Energy Corp Entergy Corp NRG Energy Inc Southern Co/The Source: Bloomberg Subject to change MATERIALS Cincinnati Financial Corp Invesco Ltd MetLife Inc Navient Corp People's United Financial DOW US FCX US IP US MOS US NUE US Dow Chemical Co/The Freeport-McMoRan Inc International Paper Co Mosaic Co/The Nucor Corp sdog@alpsinc.com | 866.675.2639 IMPORTANT DISCLOSURES & DEFINITIONS An investor should consider the investment objectives, risks, charges and expenses carefully before investing. To obtain a prospectus which contain this and other information call 866.675.2639 or visit www.alpsfunds.com. Read the prospectus carefully before investing. ALPS Sector Dividend Dogs ETF Shares are not individually redeemable. Investors buy and sell shares of the ALPS Sector Dividend Dogs ETF on a secondary market. Only market makers or “authorized participants” may trade directly with the Fund, typically in blocks of 50,000 shares. There are risks involved with investing in ETFs including the loss of money. Additional information regarding the risks of this investment is available in the prospectus. The Fund is subject to the additional risks associated with concentrating its investments in companies in the market sector. Diversification does not eliminate the risk of experiencing investment losses. The Fund’s investments in non-U.S.

issuers may involve unique risks compared to investing in securities of U.S. issuers, including, among others, greater market volatility than U.S. securities and less complete financial information than for U.S.

issuers. In addition, adverse political, economic or social developments could undermine the value of the Fund’s investments or prevent the Fund from realizing the full value of its investments. Financial reporting standards for companies based in foreign markets differ from those in the United States.

Finally, the value of the currency of the country in which the Fund has invested could decline relative to the value of the U.S. dollar, which may affect the value of the investment to U.S. investors.

An investor cannot invest directly in an index. The S-Network® Sector Dividend Dogs Index (Ticker: SDOGX) is designed to serve as a fair, impartial and transparent measure of the performance of U.S. large cap equities with above average dividend yields. Dogs of the Dow Theory: an investment strategy which proposes that an investor annually select for investment the ten Dow Jones Industrial Average stocks whose dividend is the highest fraction of their price. The S&P 500® is an index of 500 stocks chosen for market size, liquidity and industry grouping among other factors. ALPS Portfolio Solutions Distributor, Inc. is the distributor for the ALPS Sector Dividend Dogs ETF. DOG000360 4/30/16 .