Description

10 Hidden Risks to

the Global Economy

www.bmiresearch.com

. 10 Hidden Risks to the Global Economy

Published by: BMI Research

Publication Date: January 2015

BMI Research

Senator House

85 Queen Victoria Street

London

EC4V 4AB

United Kingdom

Tel: +44 (0) 20 7248 0468

Fax: +44 (0) 20 7248 0467

Email: subs@bmiresearch.com

Web: www.bmiresearch.com

© 2015 Business Monitor International Ltd, trading as BMI Research, a Fitch Group Company

All rights reserved.

All information contained in this publication is copyrighted in the name of Business Monitor International Ltd, and as such no part of this

publication may be reproduced, repackaged, redistributed, resold in whole or in any part, or used in any form or by any means graphic,

electronic or mechanical, including photocopying, recording, taping, or by information storage or retrieval, or by any other means, without

the express written consent of the publisher.

Disclaimer

All information contained in this publication has been researched and compiled from sources believed to be accurate and reliable at the

time of publishing. However, in view of the natural scope for human and/or mechanical error, either at source or during production, Business

Monitor International Ltd accepts no liability whatsoever for any loss or damage resulting from errors, inaccuracies or omissions affecting

any part of the publication. All information is provided without warranty, and Business Monitor International Ltd makes no representation

of warranty of any kind as to the accuracy or completeness of any information hereto contained.

© Business Monitor International Ltd

2

. Contents

Executive summary

4

10 Hidden Risks to the Global Economy

4

Table: Summary – 10 Hidden Risks to the Global Economy

5

Geopolitical risks from aerial confrontations

6

6

Europe and East Asia are major flashpoints

New crisis in the Caucasus or Central Asia

8

8

Russia’s periphery could test relations with west again

UK holds two elections in 2015

11

11

May election likely to produce fragile government

Ebola spreads to Asia or MENA

15

15

Vigilance needs to be maintained

A new ‘Plaza Accord’ on currencies

17

Global coordination looks unlikely, but not impossible

17

Endgame hard to see

17

Coordination might prove more likely if the US falters

17

EM corporate debt crisis

19

19

Rising corporate external debt creating new vulnerabilities

Oman succession crisis

21

After Qaboos: rising risks to political stability

21

Table: Oman – frontrunners for the succession

22

East Med gas development fades

24

24

Political wrangling to stymie natural gas bonanza

Table: Major gas fields with export potential

24

Rising piracy in South East Asia

26

26

Malacca Strait to see higher operational costs

Water shortages worldwide

28

28

Rising problems, with no solutions in sight

© Business Monitor International Ltd

3

. Executive Summary

10 Hidden Risks to the Global Economy

Most of the main risks to global economic and geopolitical stability are well known. These include a new crisis in

the eurozone; a ‘hard landing’ in China; and a war involving the US and its allies against Iran. However, there are

plenty of other risks that, while not necessarily ‘global’ in scope, have the ability to destabilise their regions. This

in turn would have negative consequences for business and investment, and add to the sense of a dangerous

world.

In this report, we outline 10 of these ‘hidden risks’. Not all of them represent our core views, and we certainly do not afford them equal probability. In some cases, the risks represent pure speculation on our part. When we say ‘hidden risks’, we do not mean ‘black swan’ or completely unpredictable events, such as a largescale natural disaster affecting a key economic region, or a new ‘9/11’-scale terror attack.

Those are certainly plausible risks, but they are events whose probability or timing simply cannot be estimated with any degree of confidence. Our list of ‘hidden risks’ also excludes perennial risks such as a geopolitical crisis on the Korean Peninsula or clash between China and Japan, and a large European state quitting the eurozone, because these risks are all widely recognised, in our view. Rather, the ‘hidden risks’ we identify are all developments which, while not necessarily unknown, are sufficiently ‘under the radar’ to most business decision-makers or under-reported by the mainstream media. Our selection of risks was also determined by our belief that each could play out or become more prominent over the next 12 months, rather than an indefinite timeframe spanning many years. As it happens, several of the hidden risks are political, although most also have economic implications.

For example, we believe that the rising number of military aircraft interceptions between Russia and NATO and between China and Japan could lead to collisions or the destruction of a civilian airliner, creating a new geopolitical crisis that would prove economically disruptive too (recall the downing of Malaysia Airlines MH17 over Eastern Ukraine in July 2014 was the trigger for much tougher Western sanctions against Russia). At the same time, while international attention remains focused on the Russia-Ukraine conflict, we see scope for a new flashpoint to emerge in the Caucasus or Central Asia in 2015. Ebola turned out to be one of the ‘hidden’ risks of 2014, prompting considerable speculation among the Western media that the virus could spread to North America and Europe. However, we caution that Asia and MENA are in fact more at risk from the spread of Ebola, due to much more dense urban populations and poorer healthcare systems.

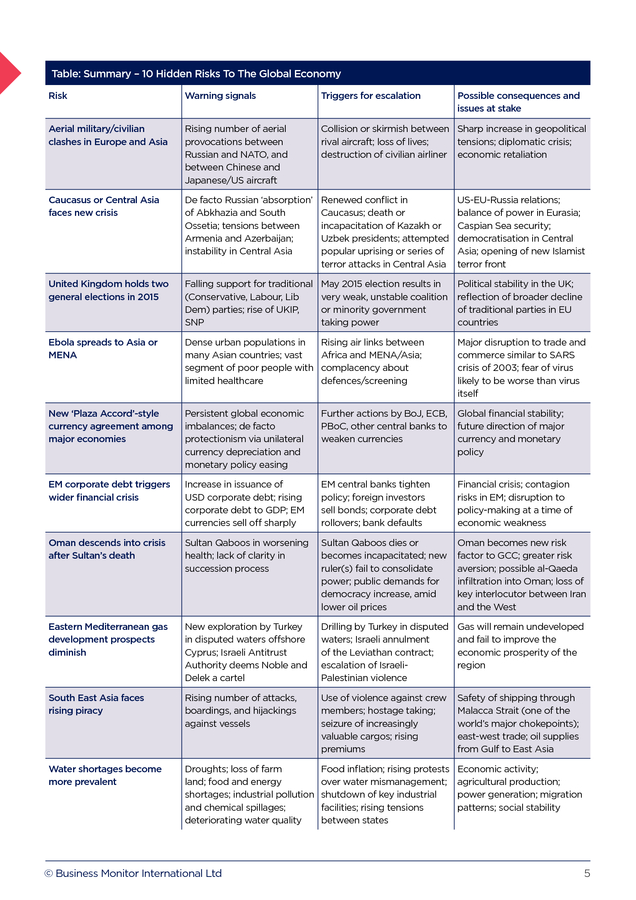

An Ebola outbreak in Asia would disrupt business and commerce, similar to the SARS outbreak in 2003. As regards purely economic risks, we highlight the danger of a new financial crisis triggered by emerging market (EM) corporate debt. We also speculate that current moves by various central banks to weaken their currencies and loosen their monetary policies could lead to mayhem and a worsening of global imbalances, and that this could eventually necessitate an international ‘Plaza Accord’-style effort to coordinate policy. Among other hidden risks we highlight are rising piracy in South East Asia, and rising water shortages worldwide. No doubt, there will be other risks that emerge over the course of the year, completely out of the blue. Nevertheless, we hope that the risks below provide considerable food for thought and serve as an early warning for what could lie ahead. © Business Monitor International Ltd 4 . Table: Summary – 10 Hidden Risks To The Global Economy Risk Warning signals Triggers for escalation Aerial military/civilian clashes in Europe and Asia Rising number of aerial provocations between Russian and NATO, and between Chinese and Japanese/US aircraft Collision or skirmish between Sharp increase in geopolitical rival aircraft; loss of lives; tensions; diplomatic crisis; destruction of civilian airliner economic retaliation Caucasus or Central Asia faces new crisis De facto Russian ‘absorption’ of Abkhazia and South Ossetia; tensions between Armenia and Azerbaijan; instability in Central Asia Renewed conflict in Caucasus; death or incapacitation of Kazakh or Uzbek presidents; attempted popular uprising or series of terror attacks in Central Asia US-EU-Russia relations; balance of power in Eurasia; Caspian Sea security; democratisation in Central Asia; opening of new Islamist terror front United Kingdom holds two general elections in 2015 Falling support for traditional (Conservative, Labour, Lib Dem) parties; rise of UKIP, SNP May 2015 election results in very weak, unstable coalition or minority government taking power Political stability in the UK; reflection of broader decline of traditional parties in EU countries Ebola spreads to Asia or MENA Dense urban populations in many Asian countries; vast segment of poor people with limited healthcare Rising air links between Africa and MENA/Asia; complacency about defences/screening Major disruption to trade and commerce similar to SARS crisis of 2003; fear of virus likely to be worse than virus itself New ‘Plaza Accord’-style currency agreement among major economies Persistent global economic imbalances; de facto protectionism via unilateral currency depreciation and monetary policy easing Further actions by BoJ, ECB, PBoC, other central banks to weaken currencies Global financial stability; future direction of major currency and monetary policy EM corporate debt triggers wider financial crisis Increase in issuance of USD corporate debt; rising corporate debt to GDP; EM currencies sell off sharply EM central banks tighten policy; foreign investors sell bonds; corporate debt rollovers; bank defaults Financial crisis; contagion risks in EM; disruption to policy-making at a time of economic weakness Oman descends into crisis after Sultan’s death Sultan Qaboos in worsening health; lack of clarity in succession process Sultan Qaboos dies or becomes incapacitated; new ruler(s) fail to consolidate power; public demands for democracy increase, amid lower oil prices Oman becomes new risk factor to GCC; greater risk aversion; possible al-Qaeda infiltration into Oman; loss of key interlocutor between Iran and the West Eastern Mediterranean gas development prospects diminish New exploration by Turkey in disputed waters offshore Cyprus; Israeli Antitrust Authority deems Noble and Delek a cartel Drilling by Turkey in disputed waters; Israeli annulment of the Leviathan contract; escalation of IsraeliPalestinian violence Gas will remain undeveloped and fail to improve the economic prosperity of the region South East Asia faces rising piracy Rising number of attacks, boardings, and hijackings against vessels Use of violence against crew members; hostage taking; seizure of increasingly valuable cargos; rising premiums Safety of shipping through Malacca Strait (one of the world’s major chokepoints); east-west trade; oil supplies from Gulf to East Asia Water shortages become more prevalent Droughts; loss of farm land; food and energy shortages; industrial pollution and chemical spillages; deteriorating water quality Food inflation; rising protests over water mismanagement; shutdown of key industrial facilities; rising tensions between states Economic activity; agricultural production; power generation; migration patterns; social stability © Business Monitor International Ltd Possible consequences and issues at stake 5 . Geopolitical risks from aerial confrontations Europe and East Asia are major flashpoints BMI View: The rising number of aerial interceptions between Russian and NATO aircraft in Northern Europe and between Chinese and US/Japanese aircraft in Asia increases the risks of a major geopolitical crisis. They also pose a risk to civil aviation. Rising numbers of aerial interceptions between Russian and NATO aircraft in Europe, and between Chinese and Japanese/US aircraft in Asia, raise the risk of a new geopolitical crisis. The rise in interceptions is itself a manifestation of elevated geopolitical tensions on opposite ends of Eurasia. In Europe, this reflects mutual antagonism between Russia and the West over the former’s annexation of Crimea in March 2014 and its subsequent intervention in Eastern Ukraine. By late 2014, NATO was reporting a threefold increase from 2013 in the number of interceptions of Russian aircraft. Meanwhile, Japanese interceptions of Chinese and Russian aircraft in FY2014-15 (April-March) were on track to exceed the 810 intercepts recorded in the previous fiscal year.

In East Asia, this reflects growing military activity by Japan and China over the Japanese-administered Senkaku Islands (called Diaoyu in Chinese) in the East China Sea, which are also claimed by China. In addition, Tokyo and Moscow continue to dispute ownership of the Kuril Islands. Further south, Beijing is becoming increasingly assertive in its claims over the vast majority of the South China Sea, and this has raised tensions with rival claimants Vietnam and the Philippines in particular, prompting them to seek increased cooperation with the US. Rising risk of military skirmishes Reckless interceptions or overzealous flying could lead to a collision, dogfight, or shoot-down between rival aircraft, resulting in fatalities.

In extreme circumstances, they could even lead to a near-war situation. For example, in 1969, a North Korean jet shot down a US reconnaissance plane, with the loss of 31 lives. The US Nixon administration subsequently considered using tactical nuclear weapons against military targets in North Korea, but refrained from action, presumably because of the risks of triggering a new Asian war at a time when the US was bogged down in Vietnam. More recently, in April 2001, a Chinese fighter jet collided with a US reconnaissance plane, forcing it to make an emergency landing on China’s Hainan island.

China detained the American crew of 24 for almost two weeks, and at one stage threatened to put them on trial. A diplomatic standoff followed. Back then, the US was far more powerful than China.

Although the power gap is still in the US’s favour, it has narrowed, and Beijing would feel much more confident about standing up to Washington in any such future dispute. Consequently, any military stand-off between the two resulting from an aerial or naval incident would be viewed very seriously, especially if it were to happen during a period of already heightened tensions. The latter could be triggered by a major US military exercise or deployment in the region. © Business Monitor International Ltd 6 .

Significant risks to civilian aviation There is also a danger that civilian aircraft could get caught up in aerial military entanglements, with deadly results. In September 1983, Korean Airlines flight 007 was shot down after violating Soviet airspace in the Far East, resulting in the loss of 269 lives. The Soviet air force reportedly mistook the airliner for an American reconnaissance aircraft. At the time, Cold War tensions were already running extremely high, as the then-US president, Ronald Reagan, was pursuing a much tougher policy towards the USSR.

The KAL incident further raised geopolitical tensions, making 1983 one of the most dangerous years in the Cold War. Later that year, NATO carried out a major military exercise, ‘Able Archer 83’, which some Kremlin leaders feared was a genuine preparation for a first strike on the USSR. Five years later, a US warship in the Gulf shot down an Iranian airliner with the loss of 290 lives, because it reportedly mistook the airliner for an Iranian fighter jet in attack mode. The incident occurred in the closing phase of the Iran-Iraq War (1980-1988), and many Iranians were convinced that the US had deliberately shot down the aircraft to pressure Iran into agreeing a peace treaty with Iraq (which was backed by the US). In November 2013, China declared a new ‘Air Defense Identification Zone’ over the East China Sea.

Japan refused to accept this demarcation, but airlines agreed to cooperate with its protocols to reduce the risks that commercial aircraft not notifying Chinese air controllers could be mistakenly shot down as enemy planes. More recently, the downing of Malaysia Airlines flight 17 (MH17) over Eastern Ukraine in July 2014 with the loss of 298 lives underscored the dangers of airliners passing through conflict zones. Although Russia and Ukraine continue to blame each other for the destruction of MH17, the incident led to a significant hardening of Western attitudes towards Russia, presaging much tougher economic sanctions. Several months earlier, in March 2014, an SAS airliner flying from Copenhagen to Rome had to change course to avoid colliding with a Russian surveillance aircraft. That same month, a Chinese airliner reportedly had a near miss with a North Korean rocket test. Risk mitigation depends on geopolitical rapprochement and better communications The key to reducing risks of aerial military skirmishes or the destruction of civilian airliners ultimately rests upon improving relations between Russia and the West, and between China and Japan.

Geopolitical tensions in Europe and Asia are arguably at their highest levels in a generation. At the same time, the number of international flights to and from Europe, and Asia, and within these regions, has risen dramatically as a result of greater affordability and budget airlines. Given the difficulties in reducing geopolitical tensions, governments and airlines can mitigate risks of deadly incidents through improved military-to-military communications, and stricter rules about airliners entering conflict zones. Although incidents such as Hainan island in 2001 and MH17 in 2014 are very rare, they will have significant geopolitical consequences if and when they occur. © Business Monitor International Ltd 7 . New crisis in the Caucasus or Central Asia Russia’s periphery could test relations with west again BMI View: The Caucasus and Central Asia are among flashpoints that could emerge on Russia’s periphery in 2015, further raising tensions with the West. In the event of new crises that are perceived as instigated or exploited by Russia, tougher Western sanctions would be forthcoming. Russia’s relations with the West will remain strained in 2015, and may even worsen, given the strong possibility of new flashpoints emerging in the Caucasus and Central Asia. These two regions are part of a wider Eurasian zone of intense geopolitical competition on Russia’s southern flank, and Moscow already has a substantial military presence there. However, any new crises in the Caucasus and Central Asia are likely to be more complex than that between Russia and the West over Ukraine, because Turkey and Iran have strong interests in the Caucasus, and China is vying for influence in Central Asia. South Caucasus: old wounds could re-open Georgia: In late 2014, Russia moved to strengthen political and military ties with Abkhazia and South Ossetia, which both seceded from Georgia following direct Russian intervention on their behalf in the brief war of August 2008.

Although Abkhazia and South Ossetia have been de facto independent since Georgia’s civil war in the early 1990s, Russia’s formal recognition of their sovereignty in 2008 essentially precluded their reintegration back into the Georgian state. The West was largely powerless to oppose Russia, demonstrating the futility of Tbilisi’s ambitions to join NATO. The major risk now is that Russia could formally annex Abkhazia and South Ossetia as a means to pressure Georgia not to join NATO.

If such annexation were to happen, it would constitute yet another redrawing of European borders by Moscow, and would certainly lead to tougher sanctions from the West. Russia would increasingly be seen as an expansionist power, one that necessitates a tough Western response. Armenia-Azerbaijan: Although the frozen conflict between Armenia and Azerbaijan over the disputed territory of Nagorno-Karabakh is a perennial flashpoint in the South Caucasus, tensions between the two countries have been rising in recent years, raising the risk of conflict by miscalculation. Azerbaijan has repeatedly threatened to take Karabakh by force, having lost control of the territory to Armenia in the 1991-1994 war.

Armenia’s economic weakness in 2015 on the back of its strong trade links with Russia could prompt Baku to adopt a more hawkish stance - although it will still have to be cautious, given that lower global energy prices will take a toll on the Azeri economy. The biggest risk is that a second Armenia- Azerbaijan conflict could draw in NATO and Russia on opposing sides, given that Turkey (a member of NATO) has a strategic pact with Azerbaijan, and Russia has a military presence in Armenia. However, the West’s desire to draw Armenia into its fold and Russia’s desire to maintain good relations with Azerbaijan mean that a future conflict would be more complicated than a straightforward proxy war, especially since Iran has an interest in maintaining the status quo in the South Caucasus.

Tehran fears that a strong Azerbaijani state could act as a magnet for its own ethnic Azeri population in Iran’s north-west. © Business Monitor International Ltd 8 . North Caucasus: Islamist militancy could surge on the back of ISIS Russia’s troubled North Caucasus saw a reduction in Islamist militant violence in late 2013 and 2014, as a major security crackdown ahead of and after the Sochi Winter Olympics took effect, and many militants went to Syria to fight in the civil war there. However, we believe violence could rebound in 2015 for three reasons. Firstly, increasing numbers of North Caucasian militants have pledged their support for the Islamic State of Iraq and the Levant (ISIS, ISIL), and are likely to have become further radicalised in Syria. Some of them will return home in 2015, and use their newly acquired combat skills to carry out terror attacks in the North Caucasus, or even in major Russian cities.

Secondly, Russia’s military build-up on Ukraine’s border has led to the redeployment of troops from the North Caucasus, leaving the region less guarded. Thirdly, Russia’s severe economic crisis is likely to lead to a reduction in federal subsidies to the North Caucasus, on which the region is extremely dependent. Chechnya, Dagestan, and Ingushetia will require vigilance from the Kremlin.

Moscow will also be wary of Islamist militancy spreading from the Caucasus to Tatarstan, which is arguably the most politically significant ethnic Republic within the Russian Federation. Central Asia: entering a more turbulent period Central Asia also looks set to face greater risks of instability in 2015, for a variety of reasons. Firstly, the region’s close economic ties with Russia are set to take a severe toll on GDP growth. Central Asian currencies such as Kazakhstan’s tenge are facing tremendous downward pressure, due to the sharp fall of the Russian rouble.

Kazakhstan’s economy is heavily dependent on hydrocarbons, meaning it will suffer from lower oil prices. Secondly, there is virtually no clarity on the question of who will succeed Kazakh president Nursultan Nazarbayev and Uzbek president Islam Karimov, both of whom are in their 70s and have completely dominated their republics since independence in 1991. Any severe economic dislocation in the region could prove politically destabilising at a sensitive time.

Karimov will almost certainly be re-elected as Uzbekistan’s president in March 2015, but doubts about his future will increase. Thirdly, the withdrawal of the vast majority of Western troops from Afghanistan at the end of 2014 will provide opportunities for Islamist militant groups to expand their influence in Central Asia. This will not necessarily happen immediately, but regional governments are already worried that ISIS, too, could expand its support base into Central Asia. Further risks to the region include the mismatch of borders and ethnic populations (a legacy of the Soviet era) and tensions over water usage between upstream states Kyrgyzstan and Tajikistan (which want to build hydroelectric power dams) and downstream states Kazakhstan and Uzbekistan, which are bigger economies. Tajikistan vies with Kyrgyzstan as the most unstable country in Central Asia.

It has long been a weak state, which is a legacy of its 1992-1997 civil war, and it shares a border with Afghanistan, which has a large ethnic Tajik population (around 27%). Tajikistan is also very heavily dependent on remittances, mostly from Russia, which comprise around 40-50% of GDP. A wild card scenario would involve clashes between ethnic Russians and Kazakhs in northern Kazakhstan, which could provoke Russian military intervention. This would certainly raise tensions with the West, but also China, which, despite its growing energy partnership with Russia, does not want Moscow to dominate Central Asia, not least because Beijing is quietly building up its own influence in the region. © Business Monitor International Ltd 9 .

Russia’s western flank not to be overlooked Amidst all this, Russia’s western flank should not be overlooked, for the country’s military doctrine sees the US and NATO as its biggest threats. Moscow is unlikely to destabilise the Baltic states, given that they are EU and NATO members, and that any Russian interference there could lead to a geopolitical crisis that could escalate out of control. However, there is a salient risk of renewed fighting in Eastern Ukraine, if current attempts to form a durable ceasefire fail to produce one. As we noted previously, Russia also has the means to destabilise Moldova by encouraging the formal separation of the breakaway territory of Transnistria or separatism among the pro-Russian Gagauz minority, if the next Moldovan government, which is still in negotiations over its formation after general elections last November, seeks to shift the country decisively towards the EU.

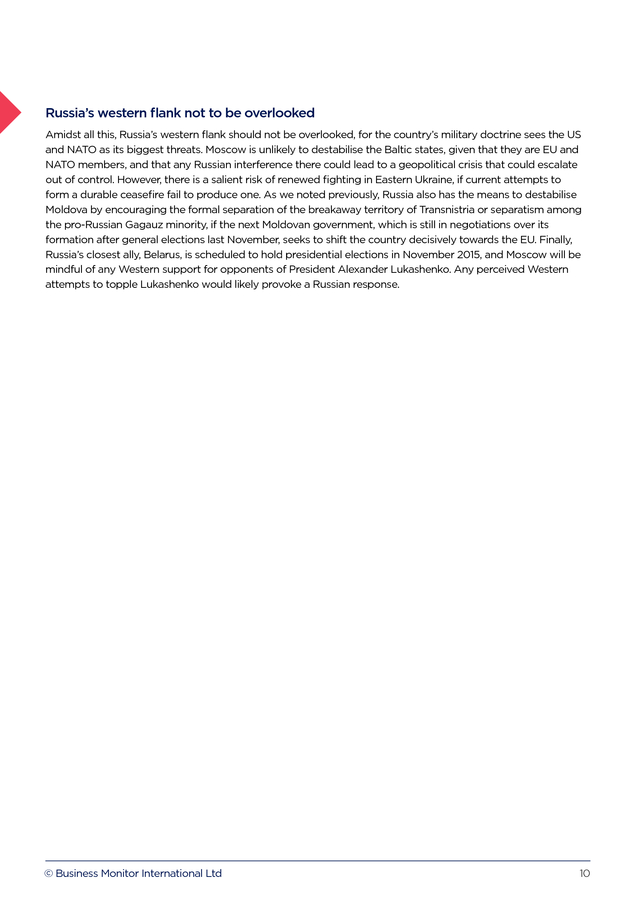

Finally, Russia’s closest ally, Belarus, is scheduled to hold presidential elections in November 2015, and Moscow will be mindful of any Western support for opponents of President Alexander Lukashenko. Any perceived Western attempts to topple Lukashenko would likely provoke a Russian response. © Business Monitor International Ltd 10 . UK holds two elections in 2015 May election likely to produce fragile government BMI View: Given that the UK’s May 2015 election is likely to result in a weak coalition or minority government, there is a salient risk that the country will be forced to hold a second general election before the end of the year to produce a more stable and durable government. With the Conservative-Liberal Democrat coalition government coming to the end of its five-year term of office, the first two-party administration since the Second World War has proven to be remarkably stable. However, with elections set for 7 May, there is a very real risk that the low support levels for the major parties could combine with the vagaries of the British electoral system to create a ‘perfect storm’ in which no stable and credible administration can be built. Could the next parliament be ungovernable? Opinion Polls in Great Britain (LHS) and Scotland (RHS) Source: UK Polling Report Polling Average 15 January 2015 (LHS), Ipsos Mori Scottish Poll 21 January 2015 Neither Conservatives nor Labour are galvanising the electorate: Both of the main parties are stuck in the low 30s in the opinion polls - 32% according to the latest UK Polling Report poll of polls - with the Conservatives down 4% from their 2010 showing, while Labour is up 3% . This is not far above the core votes of either party, around 29% for Labour and 30% for the Conservatives, and on a uniform swing basis would not be sufficient to give either party a majority. The Conservatives have yet to convince the electorate that their economic package will deliver higher take-home wages, while Labour’s perceived economic competency remains shattered following the global financial crash of 2008-2010.

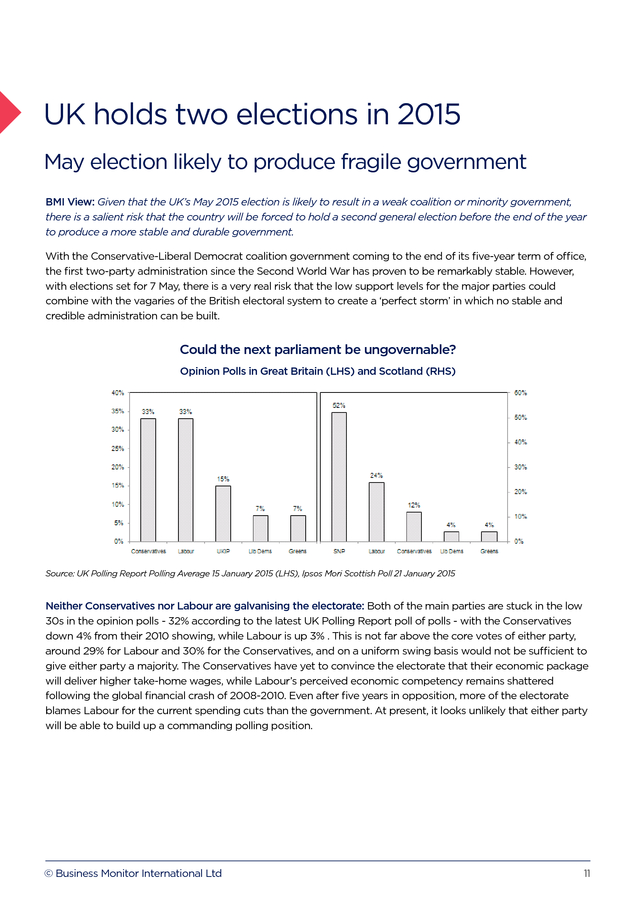

Even after five years in opposition, more of the electorate blames Labour for the current spending cuts than the government. At present, it looks unlikely that either party will be able to build up a commanding polling position. © Business Monitor International Ltd 11 . Voters still playing the blame game YouGov January 2015 opinion poll: “Who do you think is responsible for the current spending cuts?” Source: Yougov Voters are choosing protest parties over alternative governments: At the last election, the UK had a threeparty system, with the three main parties taking 621 of the 650 seats in parliament with a combined 88% of the vote. However, the polls are now showing a move towards a five-party system. The populist anti-EU United Kingdom Independence Party (UKIP) has leapfrogged the Liberal Democrats into third place on 15%, while the fringe Green Party is polling at 7%. Such polling numbers could be enough to put a serious dent into the Conservative and Labour performances, respectively, in May.

Perhaps more crucially, in Scotland the separatist Scottish National Party is riding high on 52% against Labour’s 24%. This could cost Labour as many as 40 parliamentary seats, and add to the 68 gains needed for a majority based on their 2010 performance. When all of these factors are taken together, there is the potential for a much higher degree of uncertainty amongst both individual results and the overall tallies than in previous elections. ‘First past the post’ can lead to perverse results: The British electoral system is based on 650 separate constituency elections, with no proportional balancing on the national level.

This rewards parties that can concentrate their vote effectively, and are active locally. Indeed, Liberal Democrat MPs have proven very difficult to unseat historically, and even at 7% in the polls the party may well be able to win 35 seats, while the Greens could struggle to hold onto their sole parliamentarian. Moreover, experience from previous elections suggests that there is a ‘first time incumbency bonus’ for MPs facing their first election – as they reap the benefits of greater name recognition and have the advantage of greater support staff than in their first campaign.

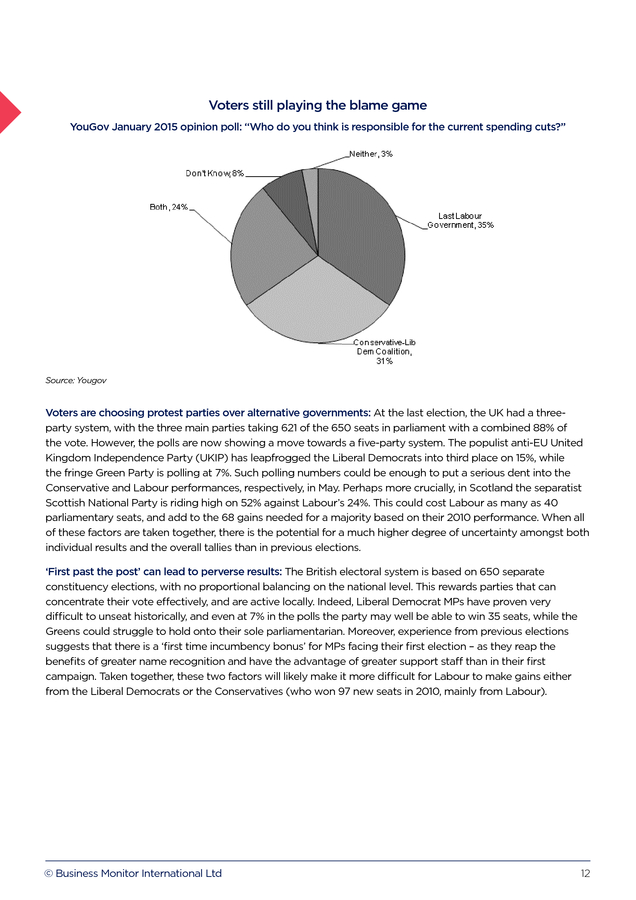

Taken together, these two factors will likely make it more difficult for Labour to make gains either from the Liberal Democrats or the Conservatives (who won 97 new seats in 2010, mainly from Labour). © Business Monitor International Ltd 12 . A majority may prove as elusive in 2015 as 2010 Seats won by party, General Election May 2010 Source: www.parliament.uk Election Scenarios Most Likely: A Labour ‘Win’. In 2010, Labour were 68 seats short of a majority. We expect the party to gain seats from both the Conservatives and the Liberal Democrats, but not in sufficient numbers to secure a workable majority, especially when losses to the SNP are taken into account. In such a scenario, it is likely that Labour would seek to come to an agreement with the Liberal Democrats, either through a formal coalition or a ‘Confidence and Supply’ arrangement which would see the Lib Dems prop up a Labour minority administration. However, we would expect this to prove problematic.

Lib Dem losses will reduce the range of outcomes in which a Labour-Liberal Democrat tie-up would move Labour from a minority to majority administration. In addition, we expect many left-leaning Liberal Democrats to lose their seats to Labour, leaving the rump of the party more economically liberal and closely associated with the 2010-2015 coalition. Less Likely: Another Conservative-Liberal Democrat Coalition. The current coalition has provided stable government, but has left elements in both parties unhappy with having to compromise on core policies. However, this in itself is unlikely to be a major hindrance.

A greater issue is likely to be whether the two parties can muster sufficient MPs to re-enter government together. Nevertheless we view a Conservative-Lib Dem arrangement as much more likely than a Conservative-UKIP pact, given that the latter will likely win no more than a handful of seats and has considerable animosity towards the Conservatives. Key Risk: No Workable Two-Party Coalition Is Possible. Based upon a scenario in which the Liberal Democrats lose 10 seats each to the Conservative and Labour, while Labour lose 20 seats to the SNP, Labour would be on just 288 seats and the Lib Dems on 37.

This would leave them one short of a majority. This would mean that a multi-party administration could be on the cards. The problem with such a scenario would be that the Liberal Democrats have already refused to work with UKIP, and the SNP have ruled out sitting alongside the Conservatives.

Moreover, a SNP-Labour deal could well come unstuck on issues including further autonomy for Scotland and unilateral nuclear disarmament, and the vitriol with which the 2015 campaign looks set to be fought north of the border. The only other significant coalition partner would be Northern Ireland’s © Business Monitor International Ltd 13 . Democratic Unionist Party (likely to win 9 seats), which would risk introducing Ulster’s internal political issues into Westminster politics. As a result, we believe that if neither the Conservatives nor Labour are able to either win an outright majority, or form a coalition with the Liberal Democrats, there is a very real risk of there being a second general election in 2015. The last time there were two elections in one year was 1974, when polls were held in February and October. We would imagine that a second 2015 election would result in a more clear-cut result. Although voters have seemingly become more accepting of the potential for another coalition after May, signs that an ungovernable House of Commons had resulted from the May election would likely allow both the Conservatives and Labour to squeeze the vote share of the minor parties. © Business Monitor International Ltd 14 . Ebola spreads to Asia or MENA Vigilance needs to be maintained BMI View: There is a greater risk of the Ebola epidemic spreading internationally in emerging and frontier markets than developed states. Healthcare systems in the US and Western Europe are well equipped to deal with infected patients and contain outbreaks. Extreme poverty and associated factors make emerging and frontier markets, particularly in Africa but also Asia and other regions, the most likely locations for international spread of the disease. The Ebola virus epidemic in West Africa had resulted in over 20,000 cases and 8,000 deaths as of midJanuary 2015. While the rate of increase in new infections has declined, the public health emergency is still a major concern, and the risk of international spreading remains.

The mainstream media extensively cover cases that reach developed states, and some outlets could be accused of sensationalism, given that further transmission in these countries is highly unlikely. An under-appreciated risk is Ebola transmission from West Africa and subsequent outbreaks in emerging and frontier markets. Ebola Transmission Risk Factors Airline traffic Air traffic connections from the three countries most affected by the epidemic – Guinea, Liberia and Sierra Leone – to the rest of the world are relatively limited. There are only a few direct flights to developed states.

In contrast, neighbouring Nigeria, being the populous country in West Africa with an estimated 150mn people, has many flights leaving its airports to Western Europe, the US, the Middle East and Asia. Spread of Ebola internationally will most likely happen through air traffic, rather than road or ship transportation. There are fewer flights from West Africa to Latin America and Central and Eastern Europe, meaning that these two regions are less likely see the ‘importation’ of Ebola. Extreme poverty Guinea, Liberia and Sierra Leone are among the poorest countries in the world, with annual per capita GDP figures of USD732, USD509 and USD1,193, respectively, in 2014.

Low wealth often means poor infrastructure, lack of communication networks, and insufficient legal frameworks. Sierra Leone and Liberia have also been blighted by civil wars and political instability well into the 2000s. All of these factors facilitate the emergence of an infectious disease outbreak. Low healthcare spending Another key characteristic of frontier markets is low healthcare spending.

These countries have few hospitals and clinics, where overstretched doctors and nurses utilise outdated equipment, especially in remote rural areas. Quality of care also lacks sophistication. There is reliance on imported pharmaceuticals and foreign aid is commonplace.

Healthcare systems in developed states are well-equipped to deal with Ebola cases because they have the resources to isolate cases. In contrast, patients affected in West Africa are treated in wards of clinics, their homes, or not at all. © Business Monitor International Ltd 15 . Cultural practices Funeral practices in West Africa have been identified a key factor in enabling the current Ebola epidemic. It is common for family members to wash and dress the body before burial, as well as cutting hair and trimming nails. A recently deceased Ebola victim has a high viral load and is very infectious. Usage of traditional medicine/practitioners and distrust of healthcare workers restrict the adoption of best clinical practice. High average household sizes The early symptoms of Ebola are non-specific – fever, chills, muscle pain and malaise – and can be confused with many other diseases, including flu, typhoid fever and malaria.

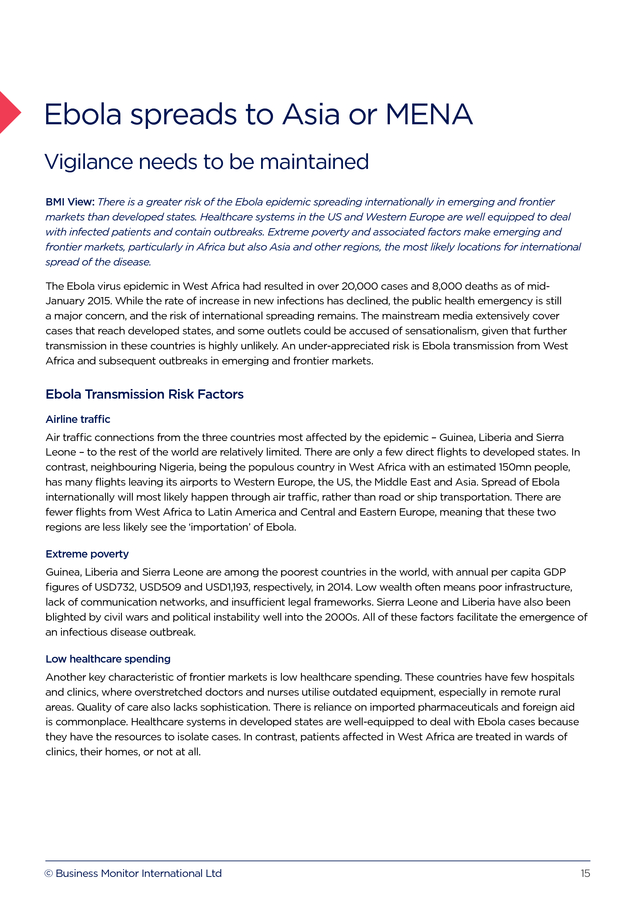

Due to West Africa’s poor healthcare services, which are generally paid for out-of-pocket, relatives will often care for family members affected by Ebola. If there are many people living in the same household, particularly multigenerational residences, the risk of transmission increases. Some of the highest average household sizes are found in the Middle East.

This is primarily due to elevated birth rate and declining infant mortality, which itself is due to improved access to healthcare, such as childhood vaccines. Countries in the region, particularly those in the Gulf Co-operation Council, rely on migrant workers, mainly from South Asia. These generally unskilled labourers often reside in dormitories that house dozens of individuals. Many In MENA Average household size, number of persons Source: National Sources, BMI Population Density The rate of infection will be also driven by the overall population density.

Ebola only spreads between people through the direct contact of blood or body fluids of a person exhibiting symptoms of disease. These interactions are more frequent when people are in close proximity. Population density is closely correlated with urbanization, which is a trend in many emerging markets.

The top six most densely populated subregions the Indo-Gangetic Plain, the Greater North China Plain, Sichuan Basin, Java Island, Taiheiyo Belt (Japan), and southeast China coast - are all in Asia. As a result of the SARS and avian flu outbreaks in the early 2000s, countries in Asia have much improved infectious disease control mechanisms. There are thermal checks in airports to identify passengers with fever, information-sharing with agencies such as the World Health Organization (WHO) is more common, and there is increased and better access to isolation rooms and protective equipment. © Business Monitor International Ltd 16 . A new ‘Plaza Accord’ on currencies Global coordination looks unlikely, but not impossible BMI View: Global growth and trade remain sluggish, and is likely to remain sub-standard for the foreseeable future as most countries engage in competitive currency depreciation and monetary easing. The only solution to this ‘race to the bottom’ would be a coordinated multilateral effort to boost global growth, but that looks extremely unlikely to happen. One scenario could involve a downturn in economic activity in the US - which is currently the solo growth engine of global demand - forcing global policymakers to come together. NB: This article is part of a series on ‘hidden risks’ to the global economy, in which we analyse potential events in the next few years that are off most investors’ radar but which could plausibly have a major impact. We have written several times about the sub-optimal rebalancing that is occurring in the global economy. This period is reminiscent of previous historical episodes in which failure to coordinate economic policy led to poor growth outcomes for each country and for the global economy as a whole. In other words, what is economically rational for each country is not rational for the collective of countries.

Global trade is well below its long-term historic trend in both volume and nominal terms, and looks as though it will stagnate further in the coming year, hurting global growth (see ‘Global Strategy – Trade Recovering, But Boom Times Are Over’, October 2 2014). This is being exacerbated by de facto protectionist trade policies. With deflation a much clearer risk than inflation, most countries are attempting to maintain their share of global export markets by keeping a lid on their currencies and/or easing monetary policy in an attempt at currency depreciation. This is exemplified in the eurozone, where the main problem in our view is not the lack of reforms in the periphery per se, but the binding together of different countries that need to pursue very different economic policies in order for the euro area as a whole to prosper (Germany’s resistance to rebalance towards greater consumption and investment comes to mind).

And the eurozone’s policies are in turn forcing its trading partners to ease policy in order to retain global market share and avoid massive capital inflows. With Japan doing the same, and with high nominal debt loads in many countries, and the traditional recipe of low interest rates combined with elevated nominal growth failing to do the job of eroding that debt amid weak growth and global deflation, it is difficult to see how this feedback loop ends until things have gone too far. Endgame Hard To See Our core view is that global imbalances have fallen since the 2008-09 crisis, and our country-by-country forecasts suggest that external imbalances will be more or less gradually settled by 2018-19 (see ‘Global Strategy – Global Rebalancing: A Progress Report’, 13 November 2014). However, these imbalances are not going to be resolved in an ‘optimal’ fashion, with the big surplus countries beginning to consume more.

Rather, it is increasingly clear that the adjustment is taking place amid a collapse of demand in the deficit countries, amid the resistance of surplus countries to rebalance. And there is a risk that the competitive landscape is only going to become worse over the next couple of years. The United States is the only major economy that is clearly hitting exit velocity in terms of trend growth and demand, but it is not large enough to support global demand at a time when most countries are retrenching.

The soaring dollar versus the euro, yen, and most other currencies puts this in sharp relief. © Business Monitor International Ltd 17 . And the dichotomy is likely to get worse, with the European Central Bank about to launch quantitative easing alongside Japan and the UK’s existing programme, at a time when the US Federal Reserve’s asset purchases have peaked. The US remains a current account deficit country despite the fact that its shortfall has fallen by more than half (to below 3.0% of GDP) since the middle of the last decade, and in the current global economic set-up, they are likely to become the consumer of last resort. Furthermore, we expect that China is unlikely to countenance further currency appreciation and there is a risk that the Chinese authorities allow the yuan to depreciate. This in turn would spur other EM countries to keep their currencies on the weak side.

Despite the Bank of Japan’s surprisingly large QE programme announced on October 31 2014, the yen has strengthened back to its level on that date versus the euro, given the downside pressure put on the EUR by the ECB’s implicit promise to engage in QE of its own. Coordination might prove more likely if the US falters Were we to see a disorderly increase in the nominal and real value of the dollar, it could stunt the US recovery, which is not yet strong enough to shoulder the burden of global demand. In this case, we could get the US pulling back on monetary tightening and once again easing. This would help beleaguered EM countries in particular, but it would set the stage for another round of competitive easing.

At some point it must end, but there is no end in sight without some sort of coordinated policy discussion. The September 1985 ‘Plaza Accord’ – in which the big five economies of the US, UK, West Germany, France and Japan agreed that the yen and deutsche mark should strengthen versus the US dollar – comes to mind as one of the few such coordinated discussions. The macroeconomic context for that decision was rather different than the current circumstances, but the accompanying statement had shades of the present: ‘The interaction of these factors - relative growth rates, the debt problems of developing countries, and exchange rate development - has contributed to large, potentially destabilizing external imbalances among major industrial countries.’ Additionally, the big five economic policymakers worried about ‘protectionist pressures which, if not resisted, could lead to mutually destructive retaliation with serious damage to the world economy: world trade would shrink, real growth rates could even turn negative, unemployment would rise still higher, and debt-burdened developing countries would be unable to secure the export earnings they vitally need.’ Replace the word ‘developing’ with ‘developed’ countries, and the story sounds familiar today. In a new global accord, the major policymakers would coordinate their easing trajectories, putting an end to the race to the bottom for monetary easing and currencies.

Importantly they would take more concrete steps to maintain free trade, which is at risk given that competitive devaluations by their very nature are effectively protectionist measures designed to subsidise exporters. Given that interest rates are at rock bottom and private sector demand has failed to recover, they might even consider a mutual pact to increase domestic demand by expanding fiscal policy where appropriate. If such a pact were to materialise, it would be significantly beneficial to global growth. Of course, such coordination appears very unlikely.

Germany for instance remains in a deadlock with the rest of the eurozone over rebalancing, and is highly unlikely to have the ability or willingness to make a deal with the rest of the world until the euro area’s problems are addressed. The Japanese are unlikely to deviate from Abenomics. And the US may be content with the status quo, particularly given the recent drop in oil prices improving its external deficit. Furthermore, the global economy is much more multi-polar than it was in 1985 (when five countries could make such a deal), and it is difficult to imagine China for example countenancing any agreement without having its many export competitors in Asia and elsewhere also signing up.

As such, a coordinated policy initiative to more optimally rebalance the global economy is likely to remain a pipe dream for the foreseeable future or absent a major crisis (such as the April 2009 G20 summit in the wake of the 2008-09 financial crisis). The depressionary 1930s also provide a cautionary example. While the current situation is not completely analogous to the early 1930s in which global policy was uncoordinated to everyone’s detriment, the risk is that lack of coordination leads to a race to the bottom, with sub-standard economic growth being the result. © Business Monitor International Ltd 18 . EM corporate debt crisis Rising corporate external debt creating new vulnerabilities BMI View: The rise of emerging market external corporate debt in the years since the 2008-09 financial crisis has created a potential vulnerability in the global financial system. A downturn in the corporate debt market could disrupt policymaking at a time when EM economies are already finding it difficult to cope with tougher global conditions. NB: This article is part of a series on ‘hidden risks’ to the global economy, in which we analyse potential events in the next few years that are off most investors’ radar but which could plausibly have a major impact. One of the hallmarks of previous emerging market economic crises has been the increasing risk of sovereign debt defaults, with Asia 1997-98 and Argentina 2001 providing some of the more spectacular recent examples. But with external debt as a percentage of GDP down significantly in many emerging markets in the past two decades and foreign reserves rising to be of ample cover for such debt, the risk of a major EM country defaulting has likewise decreased (apart from a few cases such as Ukraine and Venezuela). But as sovereign external issuance has fallen by the wayside, corporate external borrowing has increased substantially. Data from the Bank for International Settlements shows that EM non-bank private sector borrowers issued nearly USD400bn of dollar-denominated debt between 2009 and 2012 (with preliminary 2013 data showing a further uptick).

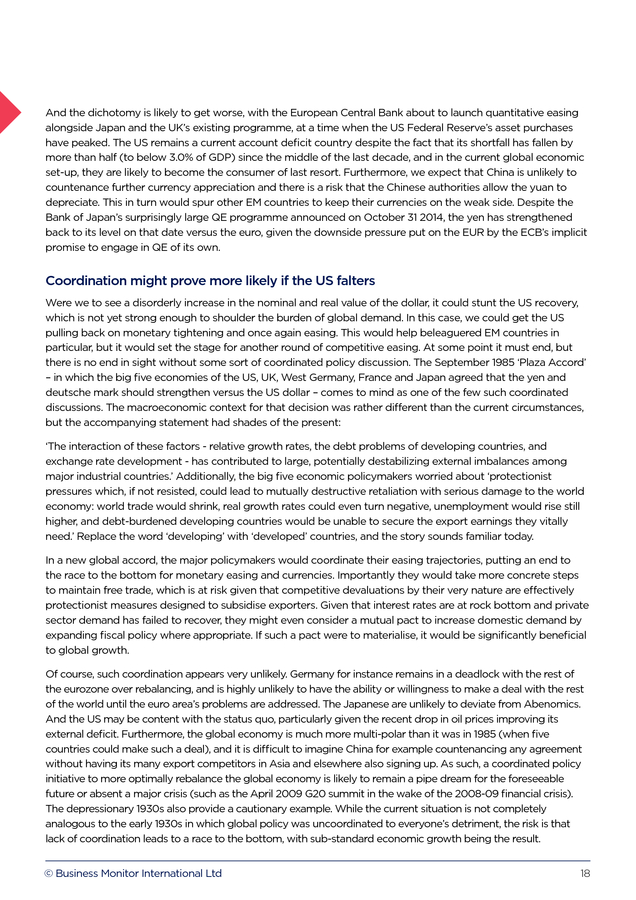

This came alongside a decline in global hard currency bond yields, and a concomitant search for yield among investors. For EM companies, borrowing in dollars is usually cheaper on an interest rate basis than borrowing on domestic markets, all else being equal. In an improving global economy, such financing makes sense, but when the cycle turns, debtors can be exposed. EM corporate debt issuance soared after 2008 crisis Emerging markets private nonfinancial sector external securities, issued and outstanding (USDbn) By residence rather than by nationality.

Source: BiS, Macrobond, BMI © Business Monitor International Ltd 19 . Overall, the exposure of emerging markets to a corporate debt crisis appears to be reassuringly small. EM corporate debt represents around 10% of Latin American GDP and under 5% of Asia ex-Japan GDP – which on the surface appears to be of manageable magnitude. Three-quarters of the EM corporate debt issues are of investment grade. Even when the Fed ‘taper’ was discussed in mid-2013, causing EM sovereign debt and currencies to sell off considerably, corporate external issuance merely dropped off for two months before resuming, and yields did not rise significantly enough to cause a funding squeeze. However, there are clearly significant risks of a crisis in the next year or two.

Prior to its crisis beginning in late 2014, Russian dollar-denominated corporate debt had reached over 10% of GDP (a proportion which may now be higher given that dollar-denominated GDP has fallen alongside the rouble and recession). While borrowing in dollars made sense for some commodity companies, given that their revenues are denominated in dollars, the fall in global commodity prices will hurt their ability to repay debt. The flipside of the prevalence of investment grade debt is that one-quarter of it is junk.

And even at ‘just’ 10% of GDP, the balance sheet mismatch for companies and indeed countries can mean that crises can escalate quickly, particularly if there is significant currency depreciation against the dollar. In a scenario in which domestic funding costs rise and sentiment deteriorates, perhaps as EM FX sells off further versus the USD, EM central banks tighten policy and foreign investors head for the exits, we could see rising risks that corporate debt rollovers (which the BiS estimates will be USD90bn in 2015) do not go smoothly. This would exacerbate the pressures that are already facing EM economies as weakening corporate balance sheets could lead to domestic banking defaults and deteriorating investor sentiment. EM companies could withdraw bank deposits, triggering a negative knock-on effect on domestic lenders.

We have had a bearish view on US junk bond spreads for the best part of a year, and would expect EM corporate debt to dive if their US counterparts sell off considerably. In countries where the central bank is not quite independent, circumstances could lead to preferential FX reserves sales to influential corporates (such as in Russia). In this sense, developments could disrupt policymaking at a time when EM economies are already finding it difficult to cope with tougher global conditions. © Business Monitor International Ltd 20 .

Oman succession crisis After Qaboos: rising risks to political stability BMI View: Uncertainty over the health of Sultan Qaboos bin Said al-Said, who has governed Oman since 1970, is bringing the succession question to the fore. We see major risks in the succession process. Governance is set to become more unpredictable in the future, and the Omani political system – with the Sultan enjoying allencompassing powers - is largely unsustainable in its current form. The prolonged absence from public life of Oman’s Sultan Qaboos bin Said al-Said, amidst persistent concerns over his health, brings the question of leadership succession to the fore. The 74-year old Qaboos has exercised almost complete control in Oman since overthrowing his father in a British-backed palace coup in 1970, serving as head of both state and government as well as commander of the armed forces and governor of the Central Bank.

However, he has no children or siblings, is divorced after a brief marriage, and has never publicly nominated an heir. We have long regarded the succession question as the main risk to Oman’s longterm political stability, and believe that a leadership crisis could flare up over the coming years (see ‘Royal Succession: Who Is Next In Line?’, October 7, 2014). The exact state of Qaboos’ health is unknown, with the Omani royal court disclosing few details on his condition. The Sultan has not been seen in Oman since travelling to Germany in July 2014 for medical treatment, and missed his country’s annual National Day military parade on November 18 (also the date of his birthday) for the first time since taking power.

Although he addressed Omanis in a four-minute video message broadcast on state television on November 5, his drawn appearance and brief speech have only accentuated concerns over his ailment. The succession process is procedurally simple, but clouded with uncertainty. Rules set out in the 1996 Basic Law - the closest document Oman has to a constitution – state that the ruling family council, composed of male members of the al-Said family, should choose a new Sultan within three days of the position falling vacant. In the event that the council fails to agree, a letter drafted by Qaboos that names his preferred successor should be opened.

Two copies of the letter are known to exist – one in the capital Muscat and one in Salalah, in the southern Dhofar region. The officials authorised to witness the opening include members of the defence council, chiefs of the Supreme Court, and heads of the consultative and state councils (which advise the Sultan on legislative matters). Any successor would have to come from the ruling dynasty, which is relatively small in comparison to its peers in the Gulf. The number of eligible candidates is estimated at between 50 and 60, compared to thousands in Saudi Arabia’s Al Saud family.

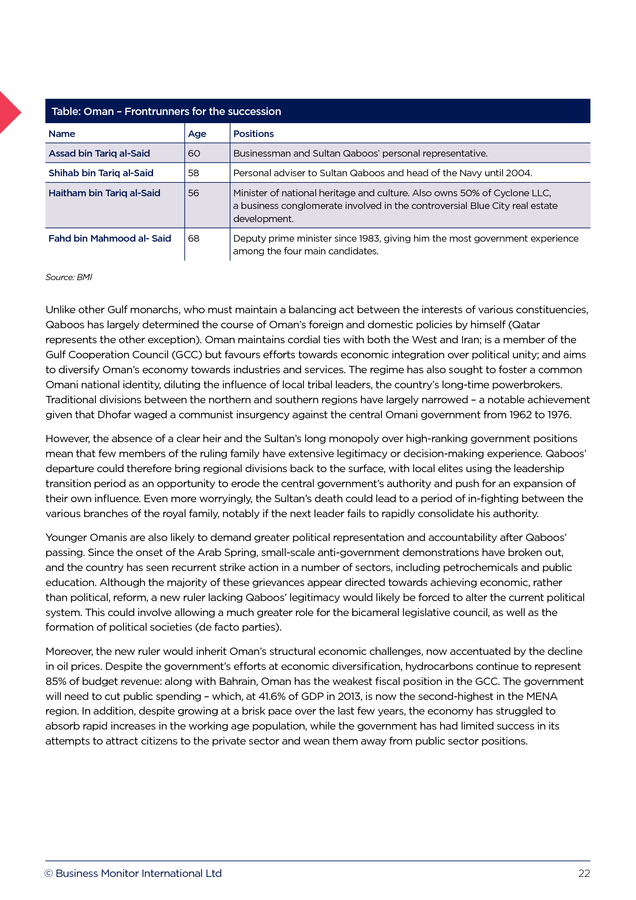

Four cousins of Sultan Qaboos are generally perceived as the frontrunners for the succession, three of whom are the children of the late Tarik bin Taimur al-Said (a former influential prime minister and father of Qaboos’ divorced wife). © Business Monitor International Ltd 21 . Table: Oman – Frontrunners for the succession Name Age Positions Assad bin Tariq al-Said 60 Businessman and Sultan Qaboos’ personal representative. Shihab bin Tariq al-Said 58 Personal adviser to Sultan Qaboos and head of the Navy until 2004. Haitham bin Tariq al-Said 56 Minister of national heritage and culture. Also owns 50% of Cyclone LLC, a business conglomerate involved in the controversial Blue City real estate development. Fahd bin Mahmood al- Said 68 Deputy prime minister since 1983, giving him the most government experience among the four main candidates. Source: BMI Unlike other Gulf monarchs, who must maintain a balancing act between the interests of various constituencies, Qaboos has largely determined the course of Oman’s foreign and domestic policies by himself (Qatar represents the other exception). Oman maintains cordial ties with both the West and Iran; is a member of the Gulf Cooperation Council (GCC) but favours efforts towards economic integration over political unity; and aims to diversify Oman’s economy towards industries and services. The regime has also sought to foster a common Omani national identity, diluting the influence of local tribal leaders, the country’s long-time powerbrokers. Traditional divisions between the northern and southern regions have largely narrowed – a notable achievement given that Dhofar waged a communist insurgency against the central Omani government from 1962 to 1976. However, the absence of a clear heir and the Sultan’s long monopoly over high-ranking government positions mean that few members of the ruling family have extensive legitimacy or decision-making experience.

Qaboos’ departure could therefore bring regional divisions back to the surface, with local elites using the leadership transition period as an opportunity to erode the central government’s authority and push for an expansion of their own influence. Even more worryingly, the Sultan’s death could lead to a period of in-fighting between the various branches of the royal family, notably if the next leader fails to rapidly consolidate his authority. Younger Omanis are also likely to demand greater political representation and accountability after Qaboos’ passing. Since the onset of the Arab Spring, small-scale anti-government demonstrations have broken out, and the country has seen recurrent strike action in a number of sectors, including petrochemicals and public education.

Although the majority of these grievances appear directed towards achieving economic, rather than political, reform, a new ruler lacking Qaboos’ legitimacy would likely be forced to alter the current political system. This could involve allowing a much greater role for the bicameral legislative council, as well as the formation of political societies (de facto parties). Moreover, the new ruler would inherit Oman’s structural economic challenges, now accentuated by the decline in oil prices. Despite the government’s efforts at economic diversification, hydrocarbons continue to represent 85% of budget revenue: along with Bahrain, Oman has the weakest fiscal position in the GCC.

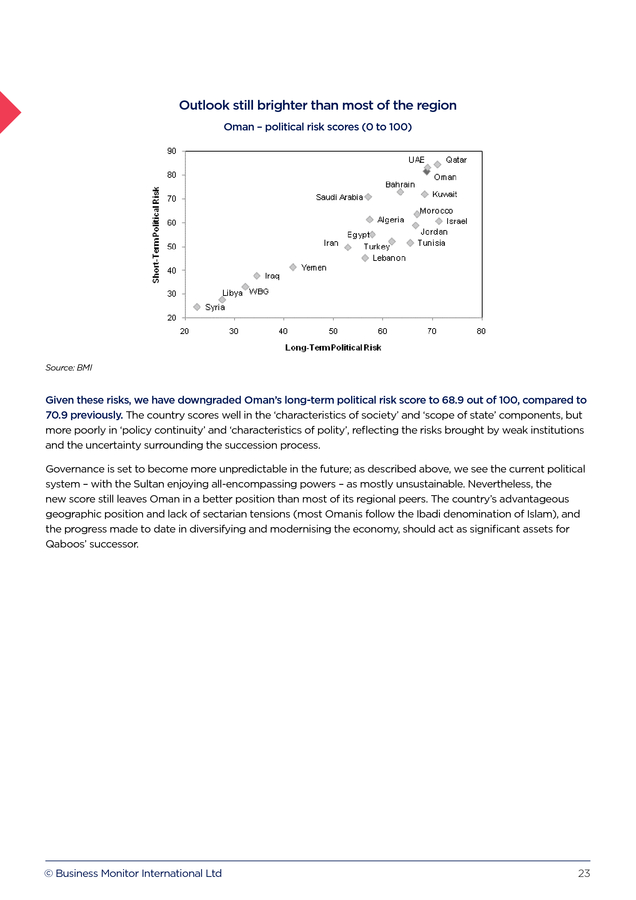

The government will need to cut public spending – which, at 41.6% of GDP in 2013, is now the second-highest in the MENA region. In addition, despite growing at a brisk pace over the last few years, the economy has struggled to absorb rapid increases in the working age population, while the government has had limited success in its attempts to attract citizens to the private sector and wean them away from public sector positions. © Business Monitor International Ltd 22 . Outlook still brighter than most of the region Oman – political risk scores (0 to 100) Source: BMI Given these risks, we have downgraded Oman’s long-term political risk score to 68.9 out of 100, compared to 70.9 previously. The country scores well in the ‘characteristics of society’ and ‘scope of state’ components, but more poorly in ‘policy continuity’ and ‘characteristics of polity’, reflecting the risks brought by weak institutions and the uncertainty surrounding the succession process. Governance is set to become more unpredictable in the future; as described above, we see the current political system – with the Sultan enjoying all-encompassing powers – as mostly unsustainable. Nevertheless, the new score still leaves Oman in a better position than most of its regional peers. The country’s advantageous geographic position and lack of sectarian tensions (most Omanis follow the Ibadi denomination of Islam), and the progress made to date in diversifying and modernising the economy, should act as significant assets for Qaboos’ successor. © Business Monitor International Ltd 23 .

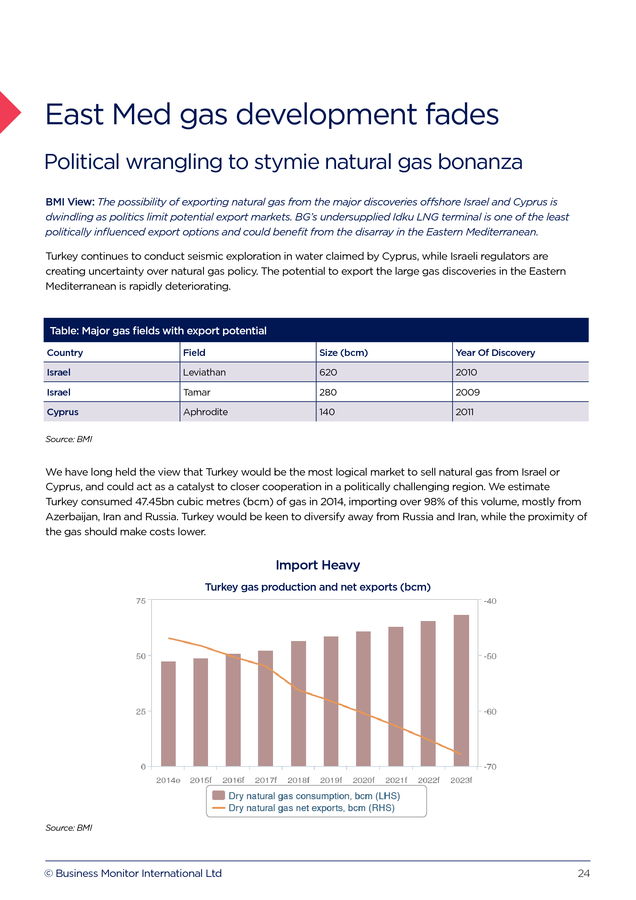

East Med gas development fades Political wrangling to stymie natural gas bonanza BMI View: The possibility of exporting natural gas from the major discoveries offshore Israel and Cyprus is dwindling as politics limit potential export markets. BG’s undersupplied Idku LNG terminal is one of the least politically influenced export options and could benefit from the disarray in the Eastern Mediterranean. Turkey continues to conduct seismic exploration in water claimed by Cyprus, while Israeli regulators are creating uncertainty over natural gas policy. The potential to export the large gas discoveries in the Eastern Mediterranean is rapidly deteriorating. Table: Major gas fields with export potential Country Field Size (bcm) Year Of Discovery Israel Leviathan 620 2010 Israel Tamar 280 2009 Cyprus Aphrodite 140 2011 Source: BMI We have long held the view that Turkey would be the most logical market to sell natural gas from Israel or Cyprus, and could act as a catalyst to closer cooperation in a politically challenging region. We estimate Turkey consumed 47.45bn cubic metres (bcm) of gas in 2014, importing over 98% of this volume, mostly from Azerbaijan, Iran and Russia.

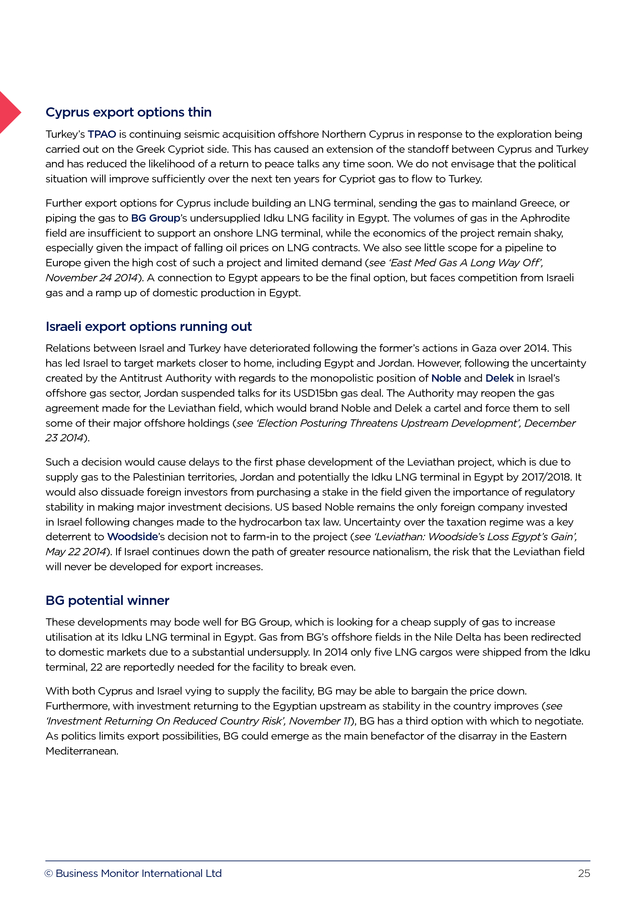

Turkey would be keen to diversify away from Russia and Iran, while the proximity of the gas should make costs lower. Import Heavy Turkey gas production and net exports (bcm) Source: BMI © Business Monitor International Ltd 24 . Cyprus export options thin Turkey’s TPAO is continuing seismic acquisition offshore Northern Cyprus in response to the exploration being carried out on the Greek Cypriot side. This has caused an extension of the standoff between Cyprus and Turkey and has reduced the likelihood of a return to peace talks any time soon. We do not envisage that the political situation will improve sufficiently over the next ten years for Cypriot gas to flow to Turkey. Further export options for Cyprus include building an LNG terminal, sending the gas to mainland Greece, or piping the gas to BG Group’s undersupplied Idku LNG facility in Egypt. The volumes of gas in the Aphrodite field are insufficient to support an onshore LNG terminal, while the economics of the project remain shaky, especially given the impact of falling oil prices on LNG contracts.

We also see little scope for a pipeline to Europe given the high cost of such a project and limited demand (see ‘East Med Gas A Long Way Off’, November 24 2014). A connection to Egypt appears to be the final option, but faces competition from Israeli gas and a ramp up of domestic production in Egypt. Israeli export options running out Relations between Israel and Turkey have deteriorated following the former’s actions in Gaza over 2014. This has led Israel to target markets closer to home, including Egypt and Jordan.

However, following the uncertainty created by the Antitrust Authority with regards to the monopolistic position of Noble and Delek in Israel’s offshore gas sector, Jordan suspended talks for its USD15bn gas deal. The Authority may reopen the gas agreement made for the Leviathan field, which would brand Noble and Delek a cartel and force them to sell some of their major offshore holdings (see ‘Election Posturing Threatens Upstream Development’, December 23 2014). Such a decision would cause delays to the first phase development of the Leviathan project, which is due to supply gas to the Palestinian territories, Jordan and potentially the Idku LNG terminal in Egypt by 2017/2018. It would also dissuade foreign investors from purchasing a stake in the field given the importance of regulatory stability in making major investment decisions.

US based Noble remains the only foreign company invested in Israel following changes made to the hydrocarbon tax law. Uncertainty over the taxation regime was a key deterrent to Woodside’s decision not to farm-in to the project (see ‘Leviathan: Woodside’s Loss Egypt’s Gain’, May 22 2014). If Israel continues down the path of greater resource nationalism, the risk that the Leviathan field will never be developed for export increases. BG potential winner These developments may bode well for BG Group, which is looking for a cheap supply of gas to increase utilisation at its Idku LNG terminal in Egypt.

Gas from BG’s offshore fields in the Nile Delta has been redirected to domestic markets due to a substantial undersupply. In 2014 only five LNG cargos were shipped from the Idku terminal, 22 are reportedly needed for the facility to break even. With both Cyprus and Israel vying to supply the facility, BG may be able to bargain the price down. Furthermore, with investment returning to the Egyptian upstream as stability in the country improves (see ‘Investment Returning On Reduced Country Risk’, November 11), BG has a third option with which to negotiate. As politics limits export possibilities, BG could emerge as the main benefactor of the disarray in the Eastern Mediterranean. © Business Monitor International Ltd 25 . Rising piracy in South East Asia Malacca strait to see higher operational costs BMI View: The risk of heightened operational costs due to an uptick in piracy in South East Asia is a major threat to the shipping industry. The prevalence of hijackings on tankers in 2014 presents a specific risk for the liquid bulk shipping sector in 2015. The rise in pirate activity in South East Asia in 2014 will require greater vigilance in 2015. Piracy places additional operating costs on shipping companies operating in the region. The hijacking of a product tanker and 18 crew members, and subsequent siphoning of 1,400 tonnes of diesel off the coast of Malaysia in October 2014 is part of a growing trend in South East Asia.

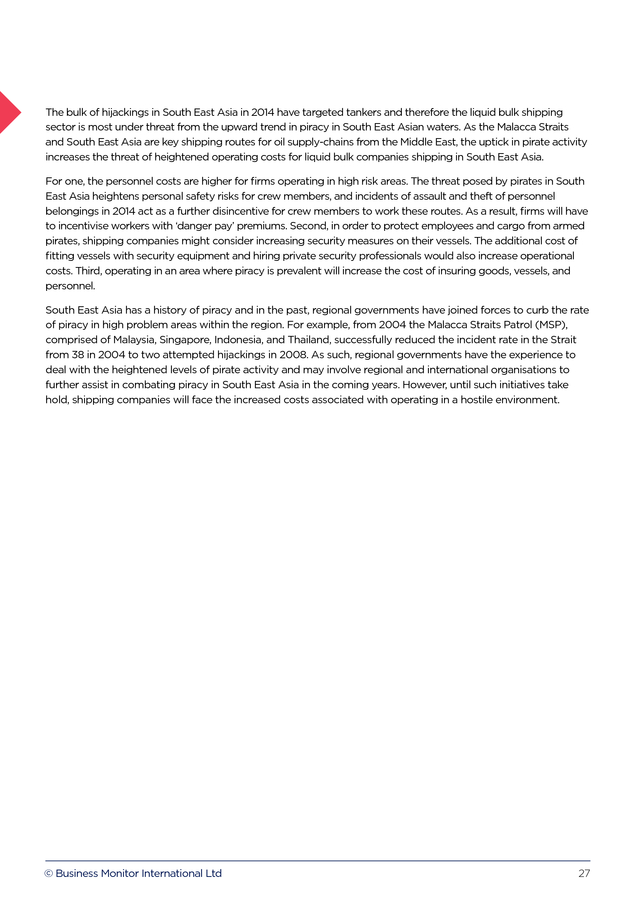

The number of successful hijackings reached 15 in 2014, compared to just three in the region throughout 2013. Attacks vary in sophistication, with most of the hijackings in 2014 occurring in and around Indonesia and Malaysia. According to the International Maritime Bureau, South East Asia had the most pirate-infested waters in the world in 2014. The number of actual attacks (boardings and hijackings) stood at 123 in South East Asia out of a worldwide total of 204.

This far exceeded the 30 attacks in and around the whole of Africa. The uptick in hijackings has implications for the shipping sector at large, as South East Asia is a major conduit for global trade. The region is home to the Malacca Straits, a narrow 500-mile waterway between the Malay Peninsula and the Indonesian island of Sumatra, that handles shipments from the oil-rich Persian Gulf. Up to 80% of the oil imported by Japan and China passes through the Malacca Strait, according to the United Nations Institute for Training and Research (UNITAR).

The Strait itself contains a number of inlets and connections to rivers flowing into Indonesia and Malaysia thereby providing hospitable terrain for pirates to hide and evade capture. It is also located in proximity to the port of Singapore – one of Asia’s primary transhipment hubs – meaning that a large proportion of goods flowing into and out of the region will pass through or near the Strait. South East Asia top piracy watch list Total piracy incidents by region (2014) Source: ICC International Maritime Bureau © Business Monitor International Ltd 26 . The bulk of hijackings in South East Asia in 2014 have targeted tankers and therefore the liquid bulk shipping sector is most under threat from the upward trend in piracy in South East Asian waters. As the Malacca Straits and South East Asia are key shipping routes for oil supply-chains from the Middle East, the uptick in pirate activity increases the threat of heightened operating costs for liquid bulk companies shipping in South East Asia. For one, the personnel costs are higher for firms operating in high risk areas. The threat posed by pirates in South East Asia heightens personal safety risks for crew members, and incidents of assault and theft of personnel belongings in 2014 act as a further disincentive for crew members to work these routes. As a result, firms will have to incentivise workers with ‘danger pay’ premiums.

Second, in order to protect employees and cargo from armed pirates, shipping companies might consider increasing security measures on their vessels. The additional cost of fitting vessels with security equipment and hiring private security professionals would also increase operational costs. Third, operating in an area where piracy is prevalent will increase the cost of insuring goods, vessels, and personnel. South East Asia has a history of piracy and in the past, regional governments have joined forces to curb the rate of piracy in high problem areas within the region.

For example, from 2004 the Malacca Straits Patrol (MSP), comprised of Malaysia, Singapore, Indonesia, and Thailand, successfully reduced the incident rate in the Strait from 38 in 2004 to two attempted hijackings in 2008. As such, regional governments have the experience to deal with the heightened levels of pirate activity and may involve regional and international organisations to further assist in combating piracy in South East Asia in the coming years. However, until such initiatives take hold, shipping companies will face the increased costs associated with operating in a hostile environment. © Business Monitor International Ltd 27 .

Water shortages worldwide Rising problems, with no solutions in sight BMI View: Water scarcity is a pressing global issue and one that will worsen over 2015 and beyond – as population growth, climate change, rapid urbanisation and poor water resource management place increasing pressure on water resources. This represents a threat to energy, food, and industrial production, potentially triggering sub-national conflicts and threatening livelihoods across the developed and developing world. Water-related problems will continue to mount over 2015, posing both political and macroeconomic threats. Access to and management of water resources will continue to be a key challenge for governments and has the potential to act as triggers for conflicts on a sub-national, national and regional level. We do not expect a single crisis related to this issue; rather, growing challenges which will be exacerbated by prolonged drought, industrial activity, population growth and urbanisation, continued resource mismanagement and over-reliance on water. The water issue will eventuate in a number of guises, through the energy, natural resource and agriculture sectors, where water is crucial for operations, to water quality creating animosity, political backlash and guiding urbanisation patterns. The implications of this risk pose a major challenge to political leaders to better manage and secure water resources to support economic growth and prevent conflict. Energy shortages Energy production consumes vast quantities of water, in the process of power generation, fuel extraction (including in the process of mining – see ‘Tax And Regulatory Changes To Increase Cost Pressures’, April 22 2014), transportation and component manufacturing.

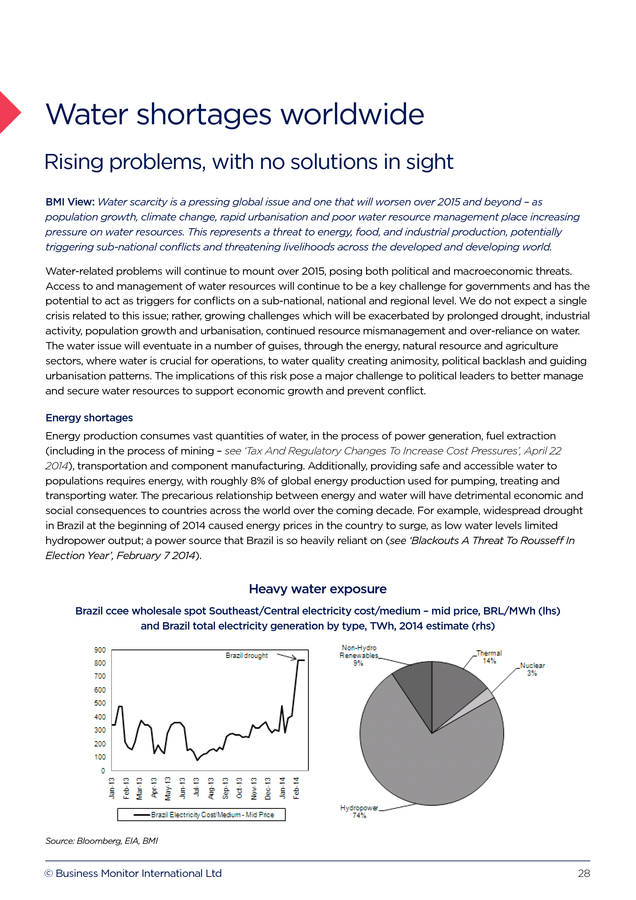

Additionally, providing safe and accessible water to populations requires energy, with roughly 8% of global energy production used for pumping, treating and transporting water. The precarious relationship between energy and water will have detrimental economic and social consequences to countries across the world over the coming decade. For example, widespread drought in Brazil at the beginning of 2014 caused energy prices in the country to surge, as low water levels limited hydropower output; a power source that Brazil is so heavily reliant on (see ‘Blackouts A Threat To Rousseff In Election Year’, February 7 2014). Heavy water exposure Brazil ccee wholesale spot Southeast/Central electricity cost/medium – mid price, BRL/MWh (lhs) and Brazil total electricity generation by type, TWh, 2014 estimate (rhs) Source: Bloomberg, EIA, BMI © Business Monitor International Ltd 28 .

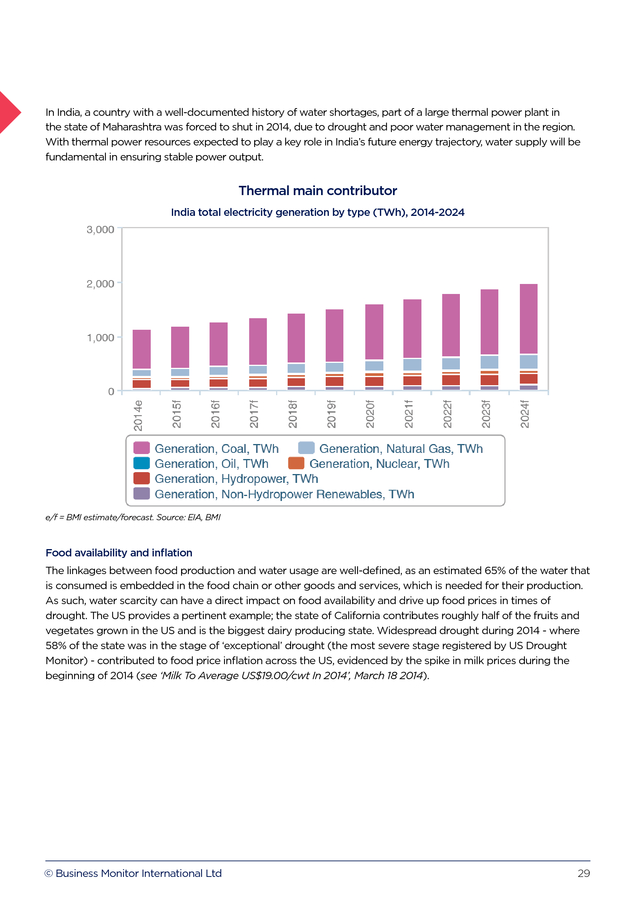

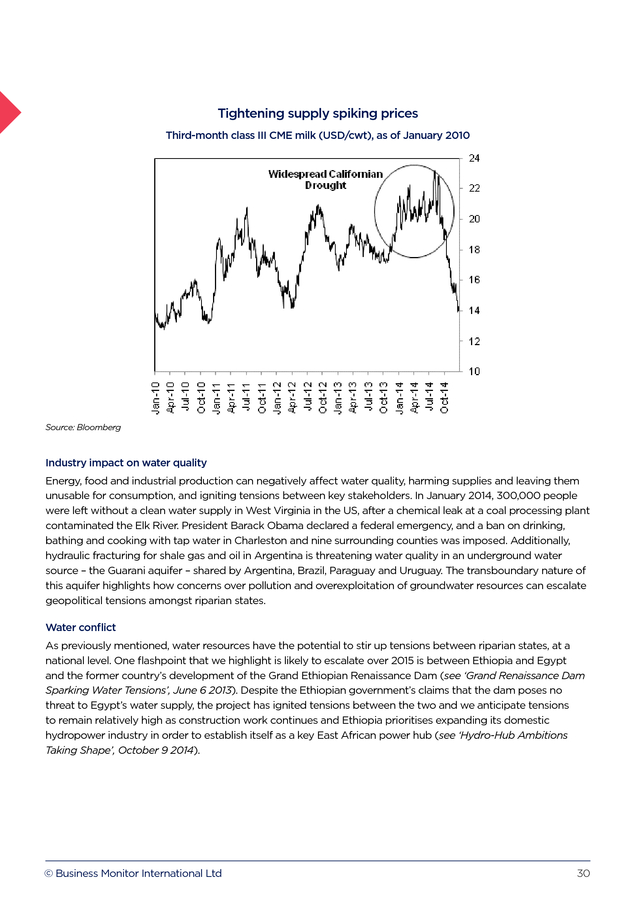

In India, a country with a well-documented history of water shortages, part of a large thermal power plant in the state of Maharashtra was forced to shut in 2014, due to drought and poor water management in the region. With thermal power resources expected to play a key role in India’s future energy trajectory, water supply will be fundamental in ensuring stable power output. Thermal main contributor India total electricity generation by type (TWh), 2014-2024 e/f = BMI estimate/forecast. Source: EIA, BMI Food availability and inflation The linkages between food production and water usage are well-defined, as an estimated 65% of the water that is consumed is embedded in the food chain or other goods and services, which is needed for their production. As such, water scarcity can have a direct impact on food availability and drive up food prices in times of drought. The US provides a pertinent example; the state of California contributes roughly half of the fruits and vegetates grown in the US and is the biggest dairy producing state. Widespread drought during 2014 - where 58% of the state was in the stage of ‘exceptional’ drought (the most severe stage registered by US Drought Monitor) - contributed to food price inflation across the US, evidenced by the spike in milk prices during the beginning of 2014 (see ‘Milk To Average US$19.00/cwt In 2014’, March 18 2014). © Business Monitor International Ltd 29 .

Tightening supply spiking prices Third-month class III CME milk (USD/cwt), as of January 2010 Source: Bloomberg Industry impact on water quality Energy, food and industrial production can negatively affect water quality, harming supplies and leaving them unusable for consumption, and igniting tensions between key stakeholders. In January 2014, 300,000 people were left without a clean water supply in West Virginia in the US, after a chemical leak at a coal processing plant contaminated the Elk River. President Barack Obama declared a federal emergency, and a ban on drinking, bathing and cooking with tap water in Charleston and nine surrounding counties was imposed. Additionally, hydraulic fracturing for shale gas and oil in Argentina is threatening water quality in an underground water source – the Guarani aquifer – shared by Argentina, Brazil, Paraguay and Uruguay.

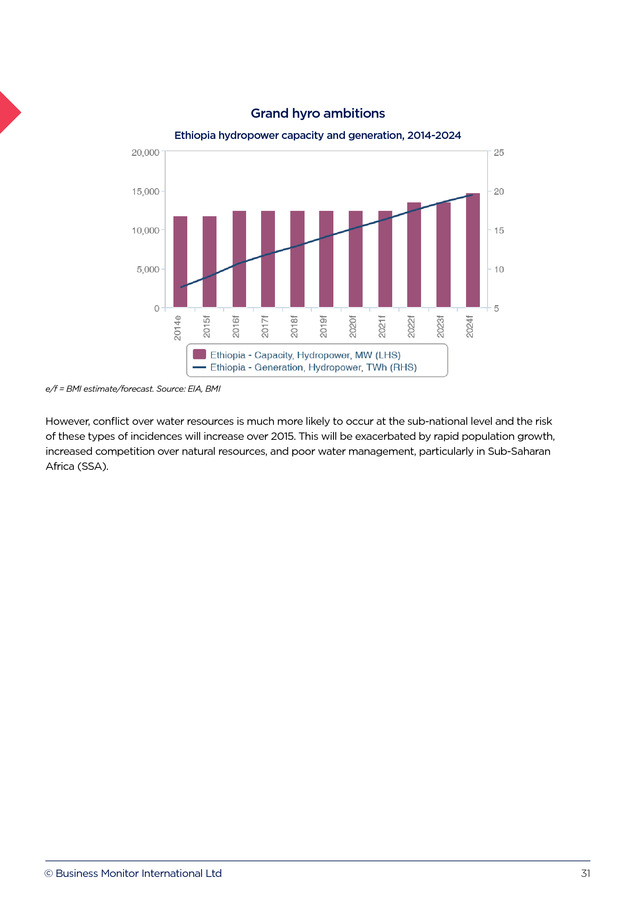

The transboundary nature of this aquifer highlights how concerns over pollution and overexploitation of groundwater resources can escalate geopolitical tensions amongst riparian states. Water conflict As previously mentioned, water resources have the potential to stir up tensions between riparian states, at a national level. One flashpoint that we highlight is likely to escalate over 2015 is between Ethiopia and Egypt and the former country’s development of the Grand Ethiopian Renaissance Dam (see ‘Grand Renaissance Dam Sparking Water Tensions’, June 6 2013). Despite the Ethiopian government’s claims that the dam poses no threat to Egypt’s water supply, the project has ignited tensions between the two and we anticipate tensions to remain relatively high as construction work continues and Ethiopia prioritises expanding its domestic hydropower industry in order to establish itself as a key East African power hub (see ‘Hydro-Hub Ambitions Taking Shape’, October 9 2014). © Business Monitor International Ltd 30 .

Grand hyro ambitions Ethiopia hydropower capacity and generation, 2014-2024 e/f = BMI estimate/forecast. Source: EIA, BMI However, conflict over water resources is much more likely to occur at the sub-national level and the risk of these types of incidences will increase over 2015. This will be exacerbated by rapid population growth, increased competition over natural resources, and poor water management, particularly in Sub-Saharan Africa (SSA). © Business Monitor International Ltd 31 .

In this report, we outline 10 of these ‘hidden risks’. Not all of them represent our core views, and we certainly do not afford them equal probability. In some cases, the risks represent pure speculation on our part. When we say ‘hidden risks’, we do not mean ‘black swan’ or completely unpredictable events, such as a largescale natural disaster affecting a key economic region, or a new ‘9/11’-scale terror attack.

Those are certainly plausible risks, but they are events whose probability or timing simply cannot be estimated with any degree of confidence. Our list of ‘hidden risks’ also excludes perennial risks such as a geopolitical crisis on the Korean Peninsula or clash between China and Japan, and a large European state quitting the eurozone, because these risks are all widely recognised, in our view. Rather, the ‘hidden risks’ we identify are all developments which, while not necessarily unknown, are sufficiently ‘under the radar’ to most business decision-makers or under-reported by the mainstream media. Our selection of risks was also determined by our belief that each could play out or become more prominent over the next 12 months, rather than an indefinite timeframe spanning many years. As it happens, several of the hidden risks are political, although most also have economic implications.

For example, we believe that the rising number of military aircraft interceptions between Russia and NATO and between China and Japan could lead to collisions or the destruction of a civilian airliner, creating a new geopolitical crisis that would prove economically disruptive too (recall the downing of Malaysia Airlines MH17 over Eastern Ukraine in July 2014 was the trigger for much tougher Western sanctions against Russia). At the same time, while international attention remains focused on the Russia-Ukraine conflict, we see scope for a new flashpoint to emerge in the Caucasus or Central Asia in 2015. Ebola turned out to be one of the ‘hidden’ risks of 2014, prompting considerable speculation among the Western media that the virus could spread to North America and Europe. However, we caution that Asia and MENA are in fact more at risk from the spread of Ebola, due to much more dense urban populations and poorer healthcare systems.