The Women, Money, and Power Study - Empowered and Underserved

Allianz Life Insurance Company of North America

Description

The Allianz

Women, Money,

and Power Study:

Empowered

and Underserved

Allianz Life Insurance Company of North America

Allianz Life Insurance Company of New York

ENT-1462-N

Page 1 of 12

. Women today:

New roles, new responsibilities,

and new financial needs

Methodology

In 2012, Allianz Life Insurance

Company of North America (Allianz)

commissioned Larson Research +

Strategy for a quantitative survey

using a respondent sample of 2,213

women, age 25-75, with household

incomes of $30,000 or higher.

Along with age breakouts,

subsegments surveyed included

six life stage groups:

• Single, never married, with children

• Single, never married, no children

• Divorced, with or without children

• Married, with or without children

• Widowed

• Partnered, living as married

Despite their rising workforce participation and escalating income, it appears

that American women still have major gaps and unmet needs when it comes

to achieving comfort and confidence with money.

Our survey indicates new and changing social dynamics have made the

so-called “typical family” anything but typical. Women may be choosing to

marry later – or to not marry at all. They may be having children on their own.

Nontraditional family structures are practically the norm – blended families,

stay-at-home dads, same-sex couples, aging parents moving in, children

returning after college.

As the definition and composition of families have changed,

so has the “traditional female role” with respect to money

and financial strategies

Whether by circumstance or by choice, women are finding themselves in roles

where they must be responsible for long-term financial needs and security.

These changes are creating new opportunities for financial services providers

who better understand and better respond to the financial needs for women.

The Allianz Women, Money, and Power Study: Empowered and Underserved

offers new insights on how women surveyed responded regarding their

current attitudes and behaviors; what women want and need; and how

financial professionals can better serve them. The results presented in this

paper represent the percentages of those women who responded to each

respective question or set of questions.

Allianz Life Insurance Company of North America (Allianz) and Allianz Life Insurance Company of New York (Allianz Life® of NY) are affiliated companies.

Page 2 of 12

.

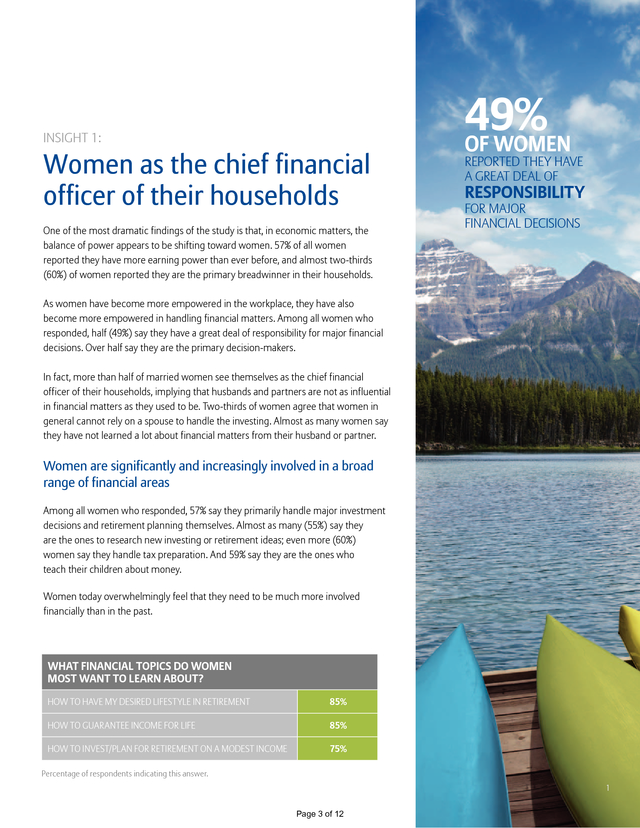

INSIGHT 1: Women as the chief financial officer of their households One of the most dramatic findings of the study is that, in economic matters, the balance of power appears to be shifting toward women. 57% of all women reported they have more earning power than ever before, and almost two-thirds (60%) of women reported they are the primary breadwinner in their households. 49% OF WOMEN REPORTED THEY HAVE A GREAT DEAL OF RESPONSIBILITY FOR MAJOR FINANCIAL DECISIONS As women have become more empowered in the workplace, they have also become more empowered in handling financial matters. Among all women who responded, half (49%) say they have a great deal of responsibility for major financial decisions. Over half say they are the primary decision-makers. In fact, more than half of married women see themselves as the chief financial officer of their households, implying that husbands and partners are not as influential in financial matters as they used to be.

Two-thirds of women agree that women in general cannot rely on a spouse to handle the investing. Almost as many women say they have not learned a lot about financial matters from their husband or partner. Women are significantly and increasingly involved in a broad range of financial areas Among all women who responded, 57% say they primarily handle major investment decisions and retirement planning themselves. Almost as many (55%) say they are the ones to research new investing or retirement ideas; even more (60%) women say they handle tax preparation.

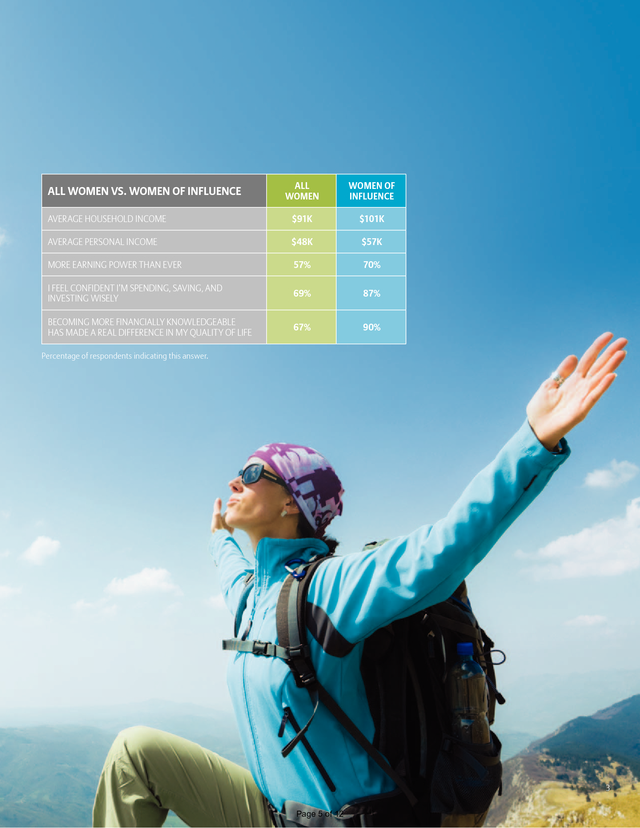

And 59% say they are the ones who teach their children about money. Women today overwhelmingly feel that they need to be much more involved financially than in the past. WHAT FINANCIAL TOPICS DO WOMEN MOST WANT TO LEARN ABOUT? HOW TO HAVE MY DESIRED LIFESTYLE IN RETIREMENT 85% HOW TO GUARANTEE INCOME FOR LIFE 85% HOW TO INVEST/PLAN FOR RETIREMENT ON A MODEST INCOME 75% Percentage of respondents indicating this answer. 1 Page 3 of 12 . 90%OF WOMEN OF INFLUENCE REPORTED SAYING INCREASED FINANCIAL INVOLVEMENT HAS IMPROVED THEIR QUALITY OF LIFE What makes a Woman of Influence? Our survey responses indicate: • She has more earning power. • She’s active in major investment decisions. • She has a good understanding of financial products. • She’s interested in learning about financial matters. • She became more involved since the 2008 financial crisis. INSIGHT 2: The rise of the “Woman of Influence” Has this sea change in how women relate to money given rise to a type of woman who exemplifies today’s more empowered, informed, and active woman, with respect to her financial destiny? An important part of The 2013 Allianz Women, Money, and Power Study was determining if indeed this type of woman could be identified, and quantifying how large a subset of all women she represented. In our survey, a respondent would qualify as a “Woman of Influence” based on her responses to a selection of questions we felt were good indicators of her financial savvy and empowerment. Our findings confirm that Women of Influence represent a considerable portion (20%) of women and are an enormous opportunity for both financial professionals and the financial industry. Women of Influence are distinguished by their higher incomes (an average of $57,000 – 19% higher than the norm for women), and higher incidence of post-graduate education. They also tend to be more successful in the workplace, being 38% more likely to have their own business, and 90% more likely to have achieved a director or vice president position. Women of Influence have a higher need for financial control, and more desire for increasing their financial knowledge They reported more confidence when it came to saving, spending, and investing money wisely. In fact, compared to women in general, Women of Influence are 25% more likely to feel financially secure.

They also tend to be among the savviest about starting their retirement savings early – 47% of Women of Influence begin saving while in their 20s. Given this, it’s not surprising that Women of Influence are also 36% more likely to have a financial professional, and credit their financial professional for helping them feel more confident and prepared for their financial future; helping them earn a better return; and helping them understand financial terminology and issues better. 2 Page 4 of 12 . ALL WOMEN WOMEN OF INFLUENCE AVERAGE HOUSEHOLD INCOME $91K $101K AVERAGE PERSONAL INCOME $48K $57K MORE EARNING POWER THAN EVER 57% 70% I FEEL CONFIDENT I’M SPENDING, SAVING, AND INVESTING WISELY 69% 87% BECOMING MORE FINANCIALLY KNOWLEDGEABLE HAS MADE A REAL DIFFERENCE IN MY QUALITY OF LIFE 67% 90% ALL WOMEN VS. WOMEN OF INFLUENCE Percentage of respondents indicating this answer. 3 Page 5 of 12 . WOMEN IN NONTRADITIONAL FAMILIES SAY THEY NEED TO BE MORE ACTIVE IN FINANCIAL STRATEGIES INSIGHT 3: The modern family has put more demands on women The majority of households surveyed responded with at least one nontraditional element (i.e., single mother, same-sex couple, parent or adult children in the home), creating new demands and new roles for women. Among those surveyed women currently married, 33% had already been through a divorce. But an even greater number of divorced women – 42% – had never remarried or partnered since. There are actually fewer women today who are married than the combined number of women who are single or divorced. About one in five of all women have chosen to live with their partner without being married. Of these nonmarried-but-partnered women, 33% are in a same-sex relationship. Same-sex couples appear to have healthier relationships in several financially related areas Only 8% of women in same-sex relationships reported they had “a secret stash of money my partner doesn’t know about.” Married women are twice as likely to have secretly set aside money.

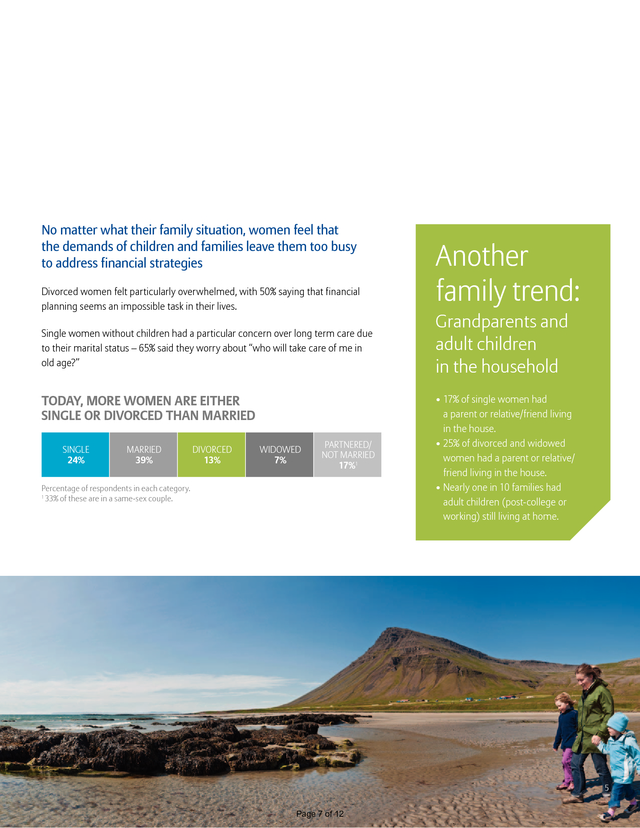

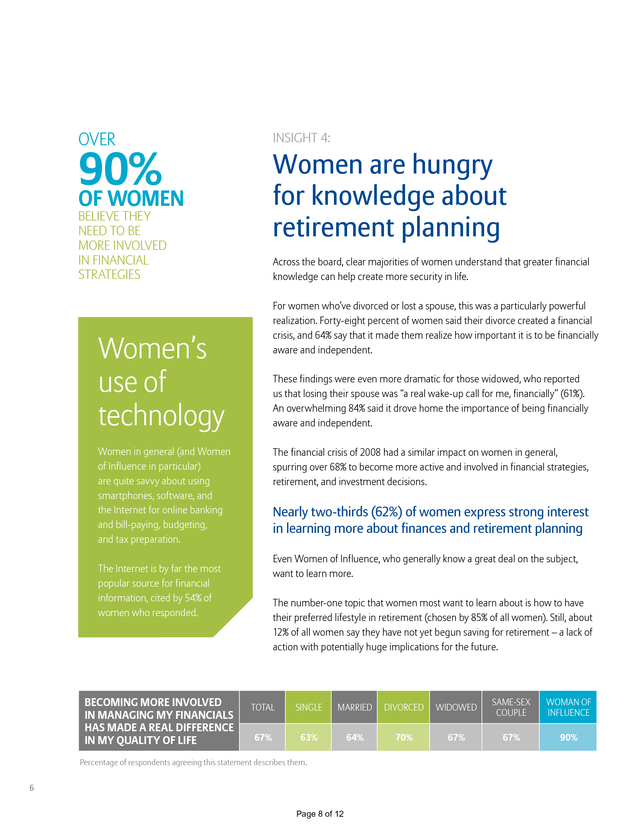

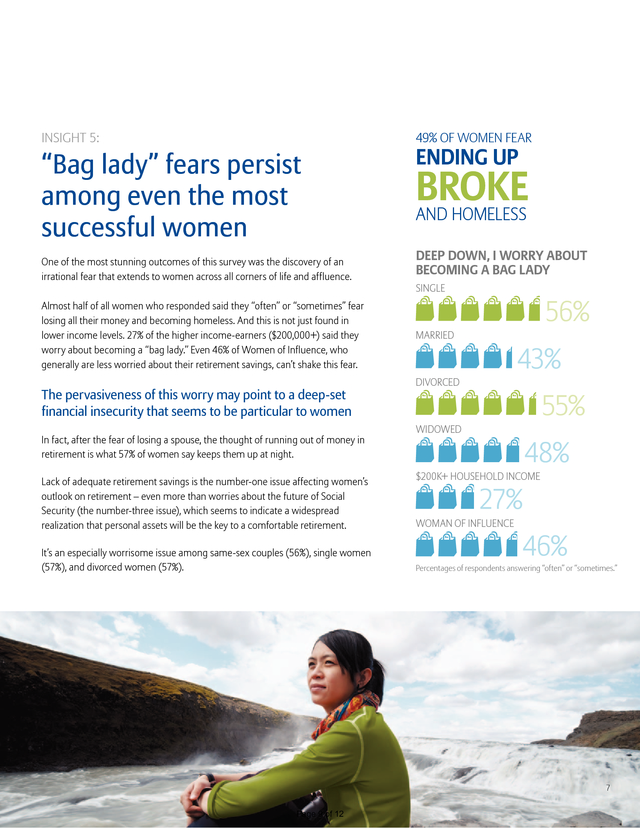

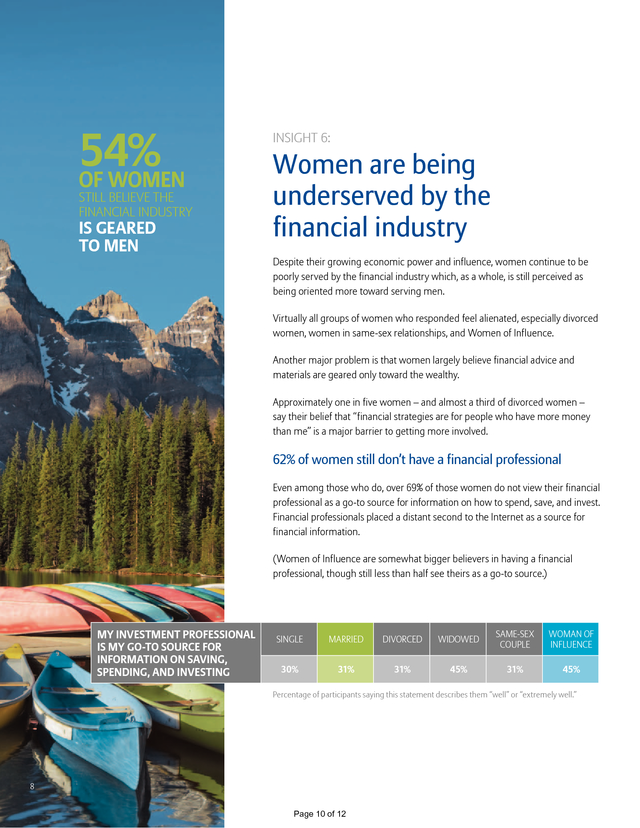

Married women are also five times as likely to believe that making more money than their partner/spouse could create tension in the relationship. Among women in same-sex couples, 22% had children under 18 living at home. Fully 80% of these same-sex couples reported that their nontraditional family structure creates a whole new level of need for financial awareness – few of them believe that their unique situation allows them to put off any serious thinking about financial issues. This view toward financial preparedness is shared by 92% of single mothers, who agree that their situation has increased their need for more financial awareness. 4 Page 6 of 12 . No matter what their family situation, women feel that the demands of children and families leave them too busy to address financial strategies Divorced women felt particularly overwhelmed, with 50% saying that financial planning seems an impossible task in their lives. Single women without children had a particular concern over long term care due to their marital status – 65% said they worry about “who will take care of me in old age?” TODAY, MORE WOMEN ARE EITHER SINGLE OR DIVORCED THAN MARRIED SINGLE 24% MARRIED 39% DIVORCED 13% WIDOWED 7% PARTNERED/ NOT MARRIED 17%1 Percentage of respondents in each category. 1 33% of these are in a same-sex couple. Another family trend: Grandparents and adult children in the household • 17% of single women had a parent or relative/friend living in the house. • 25% of divorced and widowed women had a parent or relative/ friend living in the house. • Nearly one in 10 families had adult children (post-college or working) still living at home. 5 Page 7 of 12 . OVER INSIGHT 4: 90% OF WOMEN Women are hungry for knowledge about retirement planning BELIEVE THEY NEED TO BE MORE INVOLVED IN FINANCIAL STRATEGIES Across the board, clear majorities of women understand that greater financial knowledge can help create more security in life. For women who’ve divorced or lost a spouse, this was a particularly powerful realization. Forty-eight percent of women said their divorce created a financial crisis, and 64% say that it made them realize how important it is to be financially aware and independent. Women’s use of technology These findings were even more dramatic for those widowed, who reported us that losing their spouse was “a real wake-up call for me, financially” (61%). An overwhelming 84% said it drove home the importance of being financially aware and independent. Women in general (and Women of Influence in particular) are quite savvy about using smartphones, software, and the Internet for online banking and bill-paying, budgeting, and tax preparation. The financial crisis of 2008 had a similar impact on women in general, spurring over 68% to become more active and involved in financial strategies, retirement, and investment decisions. Nearly two-thirds (62%) of women express strong interest in learning more about finances and retirement planning Even Women of Influence, who generally know a great deal on the subject, want to learn more. The Internet is by far the most popular source for financial information, cited by 54% of women who responded. BECOMING MORE INVOLVED IN MANAGING MY FINANCIALS HAS MADE A REAL DIFFERENCE IN MY QUALITY OF LIFE The number-one topic that women most want to learn about is how to have their preferred lifestyle in retirement (chosen by 85% of all women). Still, about 12% of all women say they have not yet begun saving for retirement – a lack of action with potentially huge implications for the future. TOTAL SINGLE MARRIED DIVORCED WIDOWED SAME-SEX COUPLE WOMAN OF INFLUENCE 67% 63% 64% 70% 67% 67% 90% Percentage of respondents agreeing this statement describes them. 6 Page 8 of 12 . INSIGHT 5: 49% OF WOMEN FEAR “Bag lady” fears persist among even the most successful women ENDING UP One of the most stunning outcomes of this survey was the discovery of an irrational fear that extends to women across all corners of life and affluence. BROKE AND HOMELESS DEEP DOWN, I WORRY ABOUT BECOMING A BAG LADY SINGLE Almost half of all women who responded said they “often” or “sometimes” fear losing all their money and becoming homeless. And this is not just found in lower income levels. 27% of the higher income-earners ($200,000+) said they worry about becoming a “bag lady.” Even 46% of Women of Influence, who generally are less worried about their retirement savings, can’t shake this fear. 56% MARRIED 43% DIVORCED The pervasiveness of this worry may point to a deep-set financial insecurity that seems to be particular to women In fact, after the fear of losing a spouse, the thought of running out of money in retirement is what 57% of women say keeps them up at night. Lack of adequate retirement savings is the number-one issue affecting women’s outlook on retirement – even more than worries about the future of Social Security (the number-three issue), which seems to indicate a widespread realization that personal assets will be the key to a comfortable retirement. It’s an especially worrisome issue among same-sex couples (56%), single women (57%), and divorced women (57%). 55% WIDOWED 48% $200K+ HOUSEHOLD INCOME 27% WOMAN OF INFLUENCE 46% Percentages of respondents answering “often” or “sometimes.” 7 Page 9 of 12 . 54% OF WOMEN STILL BELIEVE THE FINANCIAL INDUSTRY IS GEARED TO MEN INSIGHT 6: Women are being underserved by the financial industry Despite their growing economic power and influence, women continue to be poorly served by the financial industry which, as a whole, is still perceived as being oriented more toward serving men. Virtually all groups of women who responded feel alienated, especially divorced women, women in same-sex relationships, and Women of Influence. Another major problem is that women largely believe financial advice and materials are geared only toward the wealthy. Approximately one in five women – and almost a third of divorced women – say their belief that “financial strategies are for people who have more money than me” is a major barrier to getting more involved. 62% of women still don’t have a financial professional Even among those who do, over 69% of those women do not view their financial professional as a go-to source for information on how to spend, save, and invest. Financial professionals placed a distant second to the Internet as a source for financial information. (Women of Influence are somewhat bigger believers in having a financial professional, though still less than half see theirs as a go-to source.) MY INVESTMENT PROFESSIONAL IS MY GO-TO SOURCE FOR INFORMATION ON SAVING, SPENDING, AND INVESTING SINGLE MARRIED DIVORCED WIDOWED SAME-SEX COUPLE WOMAN OF INFLUENCE 30% 31% 31% 45% 31% 45% Percentage of participants saying this statement describes them “well” or “extremely well.” 8 Page 10 of 12 . Women want a different way of learning To make inroads in this market, we believe financial professionals need to understand that for many women, service-related issues are as important as concerns about returns on investments. Women place a high value on interpersonal skills and feeling personally cared about. They are put off by a lack of responsiveness and the sense that they’re simply getting cookie-cutter solutions. It appears there’s also a need for more engaging and more clearly written materials. The majority of women find most financial information hard to understand, dull, and boring – even Women of Influence feel information is hard to comprehend. Women who responded to the survey tend to prefer a more social way of learning that’s based in relatability and affordability (free or at minimal cost). This includes learning in a non-intimidating environment with other women, and learning in a group with others of similar life experience (divorced, widowed, same-sex relationship, etc.). Group learning and role modeling could help dispel a shockingly persistent stereotype women themselves hold regarding financially savvy women.

Over 40% of women who responded said they think that being financially independent will make them intimidating and unattractive to men, and almost a third responded it can alienate other women. There’s still much work to do in assuring women that being financially capable can have a hugely positive impact on their confidence, long-term security, and enjoyment of life It’s also worth noting that, while women generally want to become more involved in their financial strategies, the need for the high-touch, full-service approach still exists: Nearly one in five women who responded openly admit that they “just want someone else to do this for them.” Clearly, financial professionals who can better orient their service toward the needs of women clients will find many new opportunities. Page 11 of 12 Who chooses the financial professional? Married women have a high involvement, but women in partnerships (including same-sex partnerships) hold even more influence. Referrals (particularly from a friend) are the single most important factor – women almost never use the Internet to find a financial professional. . True to our promises … so you can be true to yours. ® As leading providers of annuities and life insurance, Allianz Life Insurance Company of North America (Allianz) and its subsidiary, Allianz Life Insurance Company of New York (Allianz Life® of NY), base each decision on a philosophy of being true: True to our strength as an important part of a leading global financial organization. True to our passion for making wise investment decisions. And true to the people we serve, each and every day. Through a line of innovative products and a network of trusted financial professionals, Allianz and Allianz Life of NY together help people as they seek to achieve their financial and retirement goals. Founded in 1896, Allianz, together with Allianz Life of NY, is proud to play a vital role in the success of our global parent, Allianz SE, one of the world’s largest financial services companies. While we pride ourselves on our financial strength, we’re made of much more than our balance sheet. We believe in making a difference with our clients by being true to our commitments and keeping our promises.

People rely on Allianz and Allianz Life of NY today and count on us for tomorrow – when they need us most. All contract and rider guarantees, including optional benefits or annuity payout rates, are backed by the claims-paying ability of the issuing company. They are not backed by the broker/dealer from which this annuity is purchased, by the insurance agency from which this annuity is purchased, or any affiliates of those entities and none makes any representations or guarantees regarding the claims-paying ability of Allianz Life Insurance Company of North America or Allianz Life Insurance Company of New York. • Not FDIC insured • May lose value • No bank or credit union guarantee • Not a deposit • Not insured by any federal government agency or NCUA/NCUSIF Products are issued by Allianz Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. www.allianzlife.com.

In New York, products are issued by Allianz Life Insurance Company of New York, One Chase Manhattan Plaza, 38th Floor, New York, NY 10005-1423. www.allianzlife.com/new-york. Variable products are distributed by their affiliate, Allianz Life Financial Services, LLC, member FINRA , 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. www.allianzlife.com.

Only Allianz Life Insurance Company of New York is authorized to offer annuities and life insurance in the state of New York. Product and feature availability may vary by state and broker/dealer. Page 12 of 12 (R-3/2015) .

INSIGHT 1: Women as the chief financial officer of their households One of the most dramatic findings of the study is that, in economic matters, the balance of power appears to be shifting toward women. 57% of all women reported they have more earning power than ever before, and almost two-thirds (60%) of women reported they are the primary breadwinner in their households. 49% OF WOMEN REPORTED THEY HAVE A GREAT DEAL OF RESPONSIBILITY FOR MAJOR FINANCIAL DECISIONS As women have become more empowered in the workplace, they have also become more empowered in handling financial matters. Among all women who responded, half (49%) say they have a great deal of responsibility for major financial decisions. Over half say they are the primary decision-makers. In fact, more than half of married women see themselves as the chief financial officer of their households, implying that husbands and partners are not as influential in financial matters as they used to be.

Two-thirds of women agree that women in general cannot rely on a spouse to handle the investing. Almost as many women say they have not learned a lot about financial matters from their husband or partner. Women are significantly and increasingly involved in a broad range of financial areas Among all women who responded, 57% say they primarily handle major investment decisions and retirement planning themselves. Almost as many (55%) say they are the ones to research new investing or retirement ideas; even more (60%) women say they handle tax preparation.

And 59% say they are the ones who teach their children about money. Women today overwhelmingly feel that they need to be much more involved financially than in the past. WHAT FINANCIAL TOPICS DO WOMEN MOST WANT TO LEARN ABOUT? HOW TO HAVE MY DESIRED LIFESTYLE IN RETIREMENT 85% HOW TO GUARANTEE INCOME FOR LIFE 85% HOW TO INVEST/PLAN FOR RETIREMENT ON A MODEST INCOME 75% Percentage of respondents indicating this answer. 1 Page 3 of 12 . 90%OF WOMEN OF INFLUENCE REPORTED SAYING INCREASED FINANCIAL INVOLVEMENT HAS IMPROVED THEIR QUALITY OF LIFE What makes a Woman of Influence? Our survey responses indicate: • She has more earning power. • She’s active in major investment decisions. • She has a good understanding of financial products. • She’s interested in learning about financial matters. • She became more involved since the 2008 financial crisis. INSIGHT 2: The rise of the “Woman of Influence” Has this sea change in how women relate to money given rise to a type of woman who exemplifies today’s more empowered, informed, and active woman, with respect to her financial destiny? An important part of The 2013 Allianz Women, Money, and Power Study was determining if indeed this type of woman could be identified, and quantifying how large a subset of all women she represented. In our survey, a respondent would qualify as a “Woman of Influence” based on her responses to a selection of questions we felt were good indicators of her financial savvy and empowerment. Our findings confirm that Women of Influence represent a considerable portion (20%) of women and are an enormous opportunity for both financial professionals and the financial industry. Women of Influence are distinguished by their higher incomes (an average of $57,000 – 19% higher than the norm for women), and higher incidence of post-graduate education. They also tend to be more successful in the workplace, being 38% more likely to have their own business, and 90% more likely to have achieved a director or vice president position. Women of Influence have a higher need for financial control, and more desire for increasing their financial knowledge They reported more confidence when it came to saving, spending, and investing money wisely. In fact, compared to women in general, Women of Influence are 25% more likely to feel financially secure.

They also tend to be among the savviest about starting their retirement savings early – 47% of Women of Influence begin saving while in their 20s. Given this, it’s not surprising that Women of Influence are also 36% more likely to have a financial professional, and credit their financial professional for helping them feel more confident and prepared for their financial future; helping them earn a better return; and helping them understand financial terminology and issues better. 2 Page 4 of 12 . ALL WOMEN WOMEN OF INFLUENCE AVERAGE HOUSEHOLD INCOME $91K $101K AVERAGE PERSONAL INCOME $48K $57K MORE EARNING POWER THAN EVER 57% 70% I FEEL CONFIDENT I’M SPENDING, SAVING, AND INVESTING WISELY 69% 87% BECOMING MORE FINANCIALLY KNOWLEDGEABLE HAS MADE A REAL DIFFERENCE IN MY QUALITY OF LIFE 67% 90% ALL WOMEN VS. WOMEN OF INFLUENCE Percentage of respondents indicating this answer. 3 Page 5 of 12 . WOMEN IN NONTRADITIONAL FAMILIES SAY THEY NEED TO BE MORE ACTIVE IN FINANCIAL STRATEGIES INSIGHT 3: The modern family has put more demands on women The majority of households surveyed responded with at least one nontraditional element (i.e., single mother, same-sex couple, parent or adult children in the home), creating new demands and new roles for women. Among those surveyed women currently married, 33% had already been through a divorce. But an even greater number of divorced women – 42% – had never remarried or partnered since. There are actually fewer women today who are married than the combined number of women who are single or divorced. About one in five of all women have chosen to live with their partner without being married. Of these nonmarried-but-partnered women, 33% are in a same-sex relationship. Same-sex couples appear to have healthier relationships in several financially related areas Only 8% of women in same-sex relationships reported they had “a secret stash of money my partner doesn’t know about.” Married women are twice as likely to have secretly set aside money.

Married women are also five times as likely to believe that making more money than their partner/spouse could create tension in the relationship. Among women in same-sex couples, 22% had children under 18 living at home. Fully 80% of these same-sex couples reported that their nontraditional family structure creates a whole new level of need for financial awareness – few of them believe that their unique situation allows them to put off any serious thinking about financial issues. This view toward financial preparedness is shared by 92% of single mothers, who agree that their situation has increased their need for more financial awareness. 4 Page 6 of 12 . No matter what their family situation, women feel that the demands of children and families leave them too busy to address financial strategies Divorced women felt particularly overwhelmed, with 50% saying that financial planning seems an impossible task in their lives. Single women without children had a particular concern over long term care due to their marital status – 65% said they worry about “who will take care of me in old age?” TODAY, MORE WOMEN ARE EITHER SINGLE OR DIVORCED THAN MARRIED SINGLE 24% MARRIED 39% DIVORCED 13% WIDOWED 7% PARTNERED/ NOT MARRIED 17%1 Percentage of respondents in each category. 1 33% of these are in a same-sex couple. Another family trend: Grandparents and adult children in the household • 17% of single women had a parent or relative/friend living in the house. • 25% of divorced and widowed women had a parent or relative/ friend living in the house. • Nearly one in 10 families had adult children (post-college or working) still living at home. 5 Page 7 of 12 . OVER INSIGHT 4: 90% OF WOMEN Women are hungry for knowledge about retirement planning BELIEVE THEY NEED TO BE MORE INVOLVED IN FINANCIAL STRATEGIES Across the board, clear majorities of women understand that greater financial knowledge can help create more security in life. For women who’ve divorced or lost a spouse, this was a particularly powerful realization. Forty-eight percent of women said their divorce created a financial crisis, and 64% say that it made them realize how important it is to be financially aware and independent. Women’s use of technology These findings were even more dramatic for those widowed, who reported us that losing their spouse was “a real wake-up call for me, financially” (61%). An overwhelming 84% said it drove home the importance of being financially aware and independent. Women in general (and Women of Influence in particular) are quite savvy about using smartphones, software, and the Internet for online banking and bill-paying, budgeting, and tax preparation. The financial crisis of 2008 had a similar impact on women in general, spurring over 68% to become more active and involved in financial strategies, retirement, and investment decisions. Nearly two-thirds (62%) of women express strong interest in learning more about finances and retirement planning Even Women of Influence, who generally know a great deal on the subject, want to learn more. The Internet is by far the most popular source for financial information, cited by 54% of women who responded. BECOMING MORE INVOLVED IN MANAGING MY FINANCIALS HAS MADE A REAL DIFFERENCE IN MY QUALITY OF LIFE The number-one topic that women most want to learn about is how to have their preferred lifestyle in retirement (chosen by 85% of all women). Still, about 12% of all women say they have not yet begun saving for retirement – a lack of action with potentially huge implications for the future. TOTAL SINGLE MARRIED DIVORCED WIDOWED SAME-SEX COUPLE WOMAN OF INFLUENCE 67% 63% 64% 70% 67% 67% 90% Percentage of respondents agreeing this statement describes them. 6 Page 8 of 12 . INSIGHT 5: 49% OF WOMEN FEAR “Bag lady” fears persist among even the most successful women ENDING UP One of the most stunning outcomes of this survey was the discovery of an irrational fear that extends to women across all corners of life and affluence. BROKE AND HOMELESS DEEP DOWN, I WORRY ABOUT BECOMING A BAG LADY SINGLE Almost half of all women who responded said they “often” or “sometimes” fear losing all their money and becoming homeless. And this is not just found in lower income levels. 27% of the higher income-earners ($200,000+) said they worry about becoming a “bag lady.” Even 46% of Women of Influence, who generally are less worried about their retirement savings, can’t shake this fear. 56% MARRIED 43% DIVORCED The pervasiveness of this worry may point to a deep-set financial insecurity that seems to be particular to women In fact, after the fear of losing a spouse, the thought of running out of money in retirement is what 57% of women say keeps them up at night. Lack of adequate retirement savings is the number-one issue affecting women’s outlook on retirement – even more than worries about the future of Social Security (the number-three issue), which seems to indicate a widespread realization that personal assets will be the key to a comfortable retirement. It’s an especially worrisome issue among same-sex couples (56%), single women (57%), and divorced women (57%). 55% WIDOWED 48% $200K+ HOUSEHOLD INCOME 27% WOMAN OF INFLUENCE 46% Percentages of respondents answering “often” or “sometimes.” 7 Page 9 of 12 . 54% OF WOMEN STILL BELIEVE THE FINANCIAL INDUSTRY IS GEARED TO MEN INSIGHT 6: Women are being underserved by the financial industry Despite their growing economic power and influence, women continue to be poorly served by the financial industry which, as a whole, is still perceived as being oriented more toward serving men. Virtually all groups of women who responded feel alienated, especially divorced women, women in same-sex relationships, and Women of Influence. Another major problem is that women largely believe financial advice and materials are geared only toward the wealthy. Approximately one in five women – and almost a third of divorced women – say their belief that “financial strategies are for people who have more money than me” is a major barrier to getting more involved. 62% of women still don’t have a financial professional Even among those who do, over 69% of those women do not view their financial professional as a go-to source for information on how to spend, save, and invest. Financial professionals placed a distant second to the Internet as a source for financial information. (Women of Influence are somewhat bigger believers in having a financial professional, though still less than half see theirs as a go-to source.) MY INVESTMENT PROFESSIONAL IS MY GO-TO SOURCE FOR INFORMATION ON SAVING, SPENDING, AND INVESTING SINGLE MARRIED DIVORCED WIDOWED SAME-SEX COUPLE WOMAN OF INFLUENCE 30% 31% 31% 45% 31% 45% Percentage of participants saying this statement describes them “well” or “extremely well.” 8 Page 10 of 12 . Women want a different way of learning To make inroads in this market, we believe financial professionals need to understand that for many women, service-related issues are as important as concerns about returns on investments. Women place a high value on interpersonal skills and feeling personally cared about. They are put off by a lack of responsiveness and the sense that they’re simply getting cookie-cutter solutions. It appears there’s also a need for more engaging and more clearly written materials. The majority of women find most financial information hard to understand, dull, and boring – even Women of Influence feel information is hard to comprehend. Women who responded to the survey tend to prefer a more social way of learning that’s based in relatability and affordability (free or at minimal cost). This includes learning in a non-intimidating environment with other women, and learning in a group with others of similar life experience (divorced, widowed, same-sex relationship, etc.). Group learning and role modeling could help dispel a shockingly persistent stereotype women themselves hold regarding financially savvy women.

Over 40% of women who responded said they think that being financially independent will make them intimidating and unattractive to men, and almost a third responded it can alienate other women. There’s still much work to do in assuring women that being financially capable can have a hugely positive impact on their confidence, long-term security, and enjoyment of life It’s also worth noting that, while women generally want to become more involved in their financial strategies, the need for the high-touch, full-service approach still exists: Nearly one in five women who responded openly admit that they “just want someone else to do this for them.” Clearly, financial professionals who can better orient their service toward the needs of women clients will find many new opportunities. Page 11 of 12 Who chooses the financial professional? Married women have a high involvement, but women in partnerships (including same-sex partnerships) hold even more influence. Referrals (particularly from a friend) are the single most important factor – women almost never use the Internet to find a financial professional. . True to our promises … so you can be true to yours. ® As leading providers of annuities and life insurance, Allianz Life Insurance Company of North America (Allianz) and its subsidiary, Allianz Life Insurance Company of New York (Allianz Life® of NY), base each decision on a philosophy of being true: True to our strength as an important part of a leading global financial organization. True to our passion for making wise investment decisions. And true to the people we serve, each and every day. Through a line of innovative products and a network of trusted financial professionals, Allianz and Allianz Life of NY together help people as they seek to achieve their financial and retirement goals. Founded in 1896, Allianz, together with Allianz Life of NY, is proud to play a vital role in the success of our global parent, Allianz SE, one of the world’s largest financial services companies. While we pride ourselves on our financial strength, we’re made of much more than our balance sheet. We believe in making a difference with our clients by being true to our commitments and keeping our promises.

People rely on Allianz and Allianz Life of NY today and count on us for tomorrow – when they need us most. All contract and rider guarantees, including optional benefits or annuity payout rates, are backed by the claims-paying ability of the issuing company. They are not backed by the broker/dealer from which this annuity is purchased, by the insurance agency from which this annuity is purchased, or any affiliates of those entities and none makes any representations or guarantees regarding the claims-paying ability of Allianz Life Insurance Company of North America or Allianz Life Insurance Company of New York. • Not FDIC insured • May lose value • No bank or credit union guarantee • Not a deposit • Not insured by any federal government agency or NCUA/NCUSIF Products are issued by Allianz Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. www.allianzlife.com.

In New York, products are issued by Allianz Life Insurance Company of New York, One Chase Manhattan Plaza, 38th Floor, New York, NY 10005-1423. www.allianzlife.com/new-york. Variable products are distributed by their affiliate, Allianz Life Financial Services, LLC, member FINRA , 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. www.allianzlife.com.

Only Allianz Life Insurance Company of New York is authorized to offer annuities and life insurance in the state of New York. Product and feature availability may vary by state and broker/dealer. Page 12 of 12 (R-3/2015) .