The gap: What consumers want and what financial professionals are providing

Allianz Life Insurance Company of North America

Description

White Paper

The gap: What consumers want and what

financial professionals are providing

Allianz Life Insurance Company of North America

Allianz Life Insurance Company of New York

ENT-1194-N

Page 1 of 8

. Methodology

Allianz Life Insurance Company of North America (Allianz) contracted Larson Research

and Strategy Consulting, Inc., and DSS Research to field a nationwide online survey of 3,257

U.S. adults, aged 44-75. The online survey was conducted in the United States between

May 6, 2010 and May 12, 2010.

Along with polling a representative sample of 1,642 U.S. households, the survey targeted

subsamples of more affluent households and households that own annuities.

Results were weighted by age, gender, education, race/ethnicity, and income to account for disproportionate sampling of certain populations. The margin of error for the total sample was approximately +/- 1.7%. Concurrently, a nationwide qualitative research study was conducted among financial professionals who do not currently sell annuities. The research was entirely anonymous, using in-depth, one-on-one interviews to determine general practice strategies and strategies for generating income in retirement, as well as perceptions, beliefs, feelings about, and objections to annuities. About the study The market downturn that began in 2008 – 2009 caused a profound financial shift for Americans, particularly in how they think about retirement.

Despite being the largest, wealthiest, and most influential segment of the U.S. population, the baby boomer “power generation” is facing one of the most pronounced retirement income challenges in history. To better understand the effects of this downturn on behavior, The 2010 Allianz Reclaiming the Future Study was conceived and designed to be one of the most extensive examinations of baby boomers’ preparation for and expectations of retirement. This study considered the unique needs, perceptions, and strategies that define this generation’s need to rethink retirement. It also explored consumers’ and financial professionals’ attitudes toward annuities and the annuity’s role in providing retirement income. One of the most striking findings was that a majority surveyed either somewhat or absolutely agree that the U.S.

was facing a retirement crisis. And while there are no easy answers to this crisis, The 2010 Allianz Reclaiming the Future Study helps point the way to options for planning for retirement in ways that can address concerns over diminishing sources of income, the risks of longevity, and continued market volatility. Page 2 of 8 . New opportunities for financial professionals in the aftershocks of the market crisis Consumers are still displaying worry and concern over their long-term financial prospects, with high levels of uncertainty about whether their income will last and how prepared they are for the future. But if there is a silver lining to be found in this dark cloud, it’s in the validation of the importance of a financial professional to consumers. At the same time, people are changing their expectations of their financial professionals. The old model of financial professionals who merely focus on investments and getting the highest return is being replaced with an emphasis on preserving wealth and providing long-term guarantees. The Allianz Reclaiming the Future Study found that 90% of boomers believe an important function of their financial professional was to “ensure the safety of a significant part of my nest egg.” Another 84% said their financial professional should “make sure I have adequate and guaranteed income for life.” Sixty-eight percent of consumers surveyed (and 67% of older boomers ages 55-60) agreed with the statement, “A good financial professional is worth every penny.” And though trust in a financial professional remains an issue with 66% of consumers (with the economic downturn a major reason), it is important to note that consumers’ level of trust in their financial professional nonetheless ranks second-highest (59%), exceeded only by trust in a spouse or significant other. • 25% of boomers wanted a focus on creating more safety and security in their nest egg. • 29% of boomers wanted their financial professional to help them understand the financial “big picture.” Receptivity to financial professionals is also increasing. At the time of the survey, most boomers (46%) work with or are receptive to (29%) professionals. Nearly a third of those without a financial professional say they are receptive to the idea or definitely planning to get one. New expectations for financial professionals Even those who don’t have financial professionals reported being highly interested in having a serious plan for retirement and in learning how to create security for the long term. In terms of financial products, consumers say that “Guaranteed not to lose value” is a more important attribute than “Provides a high return” by a factor of more than two to one (69% vs.

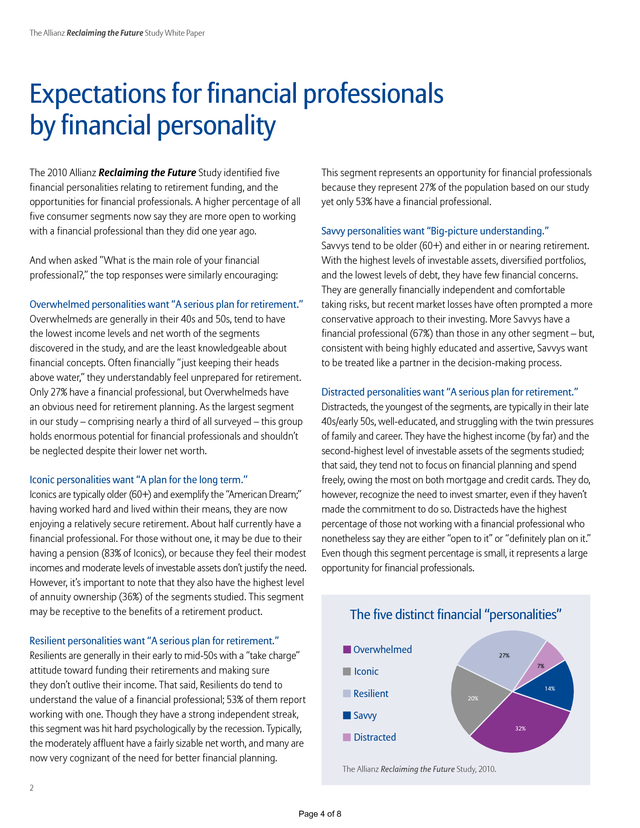

31%). While their general roles haven’t changed, financial professionals are now spending more time helping clients reassess their financial goals in light of recent market downturns – particularly now that many consumers are questioning their ability to retire with enough assets. A majority of boomers want help in ensuring guaranteed income for life. 1 Page 3 of 8 . The Allianz Reclaiming the Future Study White Paper Expectations for financial professionals by financial personality The 2010 Allianz Reclaiming the Future Study identified five financial personalities relating to retirement funding, and the opportunities for financial professionals. A higher percentage of all five consumer segments now say they are more open to working with a financial professional than they did one year ago. And when asked ”What is the main role of your financial professional?,” the top responses were similarly encouraging: Overwhelmed personalities want “A serious plan for retirement.” Overwhelmeds are generally in their 40s and 50s, tend to have the lowest income levels and net worth of the segments discovered in the study, and are the least knowledgeable about financial concepts. Often financially “just keeping their heads above water,” they understandably feel unprepared for retirement. Only 27% have a financial professional, but Overwhelmeds have an obvious need for retirement planning. As the largest segment in our study – comprising nearly a third of all surveyed – this group holds enormous potential for financial professionals and shouldn’t be neglected despite their lower net worth. Iconic personalities want “A plan for the long term.” Iconics are typically older (60+) and exemplify the “American Dream;” having worked hard and lived within their means, they are now enjoying a relatively secure retirement.

About half currently have a financial professional. For those without one, it may be due to their having a pension (83% of Iconics), or because they feel their modest incomes and moderate levels of investable assets don’t justify the need. However, it’s important to note that they also have the highest level of annuity ownership (36%) of the segments studied. This segment may be receptive to the benefits of a retirement product. This segment represents an opportunity for financial professionals because they represent 27% of the population based on our study yet only 53% have a financial professional. Savvy personalities want “Big-picture understanding.” Savvys tend to be older (60+) and either in or nearing retirement. With the highest levels of investable assets, diversified portfolios, and the lowest levels of debt, they have few financial concerns. They are generally financially independent and comfortable taking risks, but recent market losses have often prompted a more conservative approach to their investing.

More Savvys have a financial professional (67%) than those in any other segment – but, consistent with being highly educated and assertive, Savvys want to be treated like a partner in the decision-making process. Distracted personalities want “A serious plan for retirement.” Distracteds, the youngest of the segments, are typically in their late 40s/early 50s, well-educated, and struggling with the twin pressures of family and career. They have the highest income (by far) and the second-highest level of investable assets of the segments studied; that said, they tend not to focus on financial planning and spend freely, owing the most on both mortgage and credit cards. They do, however, recognize the need to invest smarter, even if they haven’t made the commitment to do so.

Distracteds have the highest percentage of those not working with a financial professional who nonetheless say they are either “open to it” or “definitely plan on it.” Even though this segment percentage is small, it represents a large opportunity for financial professionals. Resilient personalities want “A serious plan for retirement.” Resilients are generally in their early to mid-50s with a “take charge” attitude toward funding their retirements and making sure they don’t outlive their income. That said, Resilients do tend to understand the value of a financial professional; 53% of them report working with one. Though they have a strong independent streak, this segment was hit hard psychologically by the recession.

Typically, the moderately affluent have a fairly sizable net worth, and many are now very cognizant of the need for better financial planning. The five distinct financial “personalities” Overwhelmed 27% 7% Iconic Resilient 14% 20% Savvy 32% Distracted The Allianz Reclaiming the Future Study, 2010. 2 Page 4 of 8 . The gap: What financial professionals are providing is quite different from what consumers want Overall, 29% of boomers say they want their financial professional to provide big-picture thinking and help them plan for a stable and secure retirement. Ensuring the safety of a significant part of their nest egg is somewhat/very or extremely important to 90% of boomers. Trust in a financial professional ranks second highest (59%) exceeded only by trust in a spouse or significant other. Yet it appears there is a gap between what consumers want and what their financial professional is providing. Overall, 44% of consumers say they should be learning about financial strategies from a financial professional compared to that of the next highest alternative: self-discovery and self-teaching at 26%. But compared to those who said they’ve learned about financial strategies from their financial professional, three times as many said they have not. The feeling that financial professionals are not addressing “the big picture” is most obvious concerning annuities. Annuities are one of the few financial products that offer a lifetime income stream. An overwhelming number – 80% – say they want an annuity-like solution.

Among the affluent (household incomes of $150,000 or more), 29% own annuities. The concept of annuities is clearly attractive and relevant to consumers, despite confusion about annuities in the marketplace. Boomers want products that provide guaranteed income for life (26%), or helping them plan for a stable and secure retirement (18%) – two of the benefits annuities are designed to provide. Several financial professionals we surveyed mentioned that clients had independently come in asking about annuities, particularly following the market downturn of 2008. “Many were in a panic and wanted guarantees above all,” was how one financial professional explained it. By a dramatic and conclusive margin – four to one – consumers say they prefer a retirement income product with a 4% return that’s guaranteed not to lose value versus a product with a higher 8% return that includes the possibility of losing value. Yet consumers say they are not being offered the option. A surprising 46% of all respondents say their financial professional has never recommended an annuity. When asked why they don’t have an annuity, most consumers cite lack of knowledge about them, while a number of them said they had no idea why not. Consumers are discovering annuities on their own. Our study reveals that annuities have clearly risen in relevance and appeal for a significant number of their clients who are pre-retirees and retirees. 3 Page 5 of 8 . The Allianz Reclaiming the Future Study White Paper The need for change by financial professionals Growing recognition of an annuity’s value Certainly, financial professionals recognize that Americans are facing tough retirement funding challenges amidst a confluence of negative factors (market volatility, disappearance of pensions, solvency questions about Social Security). And many financial professionals do see a clear marketplace need for retirement income solutions that can provide guaranteed lifetime income. According to the study, annuities are enjoying more positive “buzz,” and more interest among consumers across all groups. And in spite of their own misgivings about the product, many financial professionals have found themselves needing to offer annuities as a solution to their clients’ financial goals and concerns. That said, there remain numerous barriers to selling annuities as part of retirement income solutions in the mind of the financial professional, beginning with the perception of the product as very complicated and confusing. Non-sellers believe it is more complicated to sell an annuity, given the need to educate clients on all of the options and conditions.

By comparison, financial professionals believe that mutual funds are much easier for consumers to grasp. Moreover, some financial professionals believe and are concerned that selling variable annuities involves more compliance, suitability, and/or auditing issues that are less common when using other products. Expense, or the perception of being expensive, comes up for annuities again and again – perhaps causing some financial professionals to convince themselves that the cost/benefit trade-off is just not there. Beyond these issues, there’s a perception among some financial professionals that the use of an annuity is contrary to a hands-on, active approach to a client’s portfolio. There are also concerns about under-delivering results versus what the financial professional thinks could be achieved for the client with other financial vehicles. 35% of annuity owners say they have purchased one because their financial professionals recommended it. Most financial professionals agree that annuities aren’t for everyone but they could be positioned to clients as products that provide protection and/or a guaranteed stream of income for retirement. A surprising number of non-sellers – even those who describe themselves as “against” annuities – could identify situations and people where annuities could furnish a suitable solution. Even more encouraging is that 76% of annuity owners say they are very happy with their purchase.

The more consumers understand about their annuities, the better they feel about them. 76% of annuity owners say they are very happy with their purchase. 4 Page 6 of 8 . Learn more about about how annuities are helping Americans prepare for retirement. For more information, log on to www.allianzlife.com. Page 7 of 8 . True to our promises … so you can be true to yours. ® As leading providers of annuities and life insurance, Allianz Life Insurance Company of North America (Allianz) and its subsidiary, Allianz Life Insurance Company of New York (Allianz Life® of NY), base each decision on a philosophy of being true: True to our strength as an important part of a leading global financial organization. True to our passion for making wise investment decisions. And true to the people we serve, each and every day. Through a line of innovative products and a network of trusted financial professionals, Allianz and Allianz Life of NY together help people as they seek to achieve their financial and retirement goals. Founded in 1896, Allianz, together with Allianz Life of NY, is proud to play a vital role in the success of our global parent, Allianz SE, one of the world’s largest financial services companies. While we pride ourselves on our financial strength, we’re made of much more than our balance sheet. We believe in making a difference with our clients by being true to our commitments and keeping our promises.

People rely on Allianz and Allianz Life of NY today and count on us for tomorrow – when they need us most. Guarantees are backed solely by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America and Allianz Life Insurance Company of New York. Variable annuity guarantees do not apply to the performance of the variable subaccounts, which will fluctuate with market conditions. • Not FDIC insured • May lose value • No bank or credit union guarantee • Not a deposit • Not insured by any federal government agency or NCUA/NCUSIF Products are issued by Allianz Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. www.allianzlife.com.

In New York, products are issued by Allianz Life Insurance Company of New York, One Chase Manhattan Plaza, 38th Floor, New York, NY 10005-1423. www.allianzlife.com/new-york. Only Allianz Life Insurance Company of New York is authorized to offer annuities and life insurance in the state of New York.

Variable products are distributed by their affiliate, Allianz Life Financial Services, LLC, member FINRA, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. www.allianzlife.com Page 8 of 8 (R-1/2015) .

Results were weighted by age, gender, education, race/ethnicity, and income to account for disproportionate sampling of certain populations. The margin of error for the total sample was approximately +/- 1.7%. Concurrently, a nationwide qualitative research study was conducted among financial professionals who do not currently sell annuities. The research was entirely anonymous, using in-depth, one-on-one interviews to determine general practice strategies and strategies for generating income in retirement, as well as perceptions, beliefs, feelings about, and objections to annuities. About the study The market downturn that began in 2008 – 2009 caused a profound financial shift for Americans, particularly in how they think about retirement.

Despite being the largest, wealthiest, and most influential segment of the U.S. population, the baby boomer “power generation” is facing one of the most pronounced retirement income challenges in history. To better understand the effects of this downturn on behavior, The 2010 Allianz Reclaiming the Future Study was conceived and designed to be one of the most extensive examinations of baby boomers’ preparation for and expectations of retirement. This study considered the unique needs, perceptions, and strategies that define this generation’s need to rethink retirement. It also explored consumers’ and financial professionals’ attitudes toward annuities and the annuity’s role in providing retirement income. One of the most striking findings was that a majority surveyed either somewhat or absolutely agree that the U.S.

was facing a retirement crisis. And while there are no easy answers to this crisis, The 2010 Allianz Reclaiming the Future Study helps point the way to options for planning for retirement in ways that can address concerns over diminishing sources of income, the risks of longevity, and continued market volatility. Page 2 of 8 . New opportunities for financial professionals in the aftershocks of the market crisis Consumers are still displaying worry and concern over their long-term financial prospects, with high levels of uncertainty about whether their income will last and how prepared they are for the future. But if there is a silver lining to be found in this dark cloud, it’s in the validation of the importance of a financial professional to consumers. At the same time, people are changing their expectations of their financial professionals. The old model of financial professionals who merely focus on investments and getting the highest return is being replaced with an emphasis on preserving wealth and providing long-term guarantees. The Allianz Reclaiming the Future Study found that 90% of boomers believe an important function of their financial professional was to “ensure the safety of a significant part of my nest egg.” Another 84% said their financial professional should “make sure I have adequate and guaranteed income for life.” Sixty-eight percent of consumers surveyed (and 67% of older boomers ages 55-60) agreed with the statement, “A good financial professional is worth every penny.” And though trust in a financial professional remains an issue with 66% of consumers (with the economic downturn a major reason), it is important to note that consumers’ level of trust in their financial professional nonetheless ranks second-highest (59%), exceeded only by trust in a spouse or significant other. • 25% of boomers wanted a focus on creating more safety and security in their nest egg. • 29% of boomers wanted their financial professional to help them understand the financial “big picture.” Receptivity to financial professionals is also increasing. At the time of the survey, most boomers (46%) work with or are receptive to (29%) professionals. Nearly a third of those without a financial professional say they are receptive to the idea or definitely planning to get one. New expectations for financial professionals Even those who don’t have financial professionals reported being highly interested in having a serious plan for retirement and in learning how to create security for the long term. In terms of financial products, consumers say that “Guaranteed not to lose value” is a more important attribute than “Provides a high return” by a factor of more than two to one (69% vs.

31%). While their general roles haven’t changed, financial professionals are now spending more time helping clients reassess their financial goals in light of recent market downturns – particularly now that many consumers are questioning their ability to retire with enough assets. A majority of boomers want help in ensuring guaranteed income for life. 1 Page 3 of 8 . The Allianz Reclaiming the Future Study White Paper Expectations for financial professionals by financial personality The 2010 Allianz Reclaiming the Future Study identified five financial personalities relating to retirement funding, and the opportunities for financial professionals. A higher percentage of all five consumer segments now say they are more open to working with a financial professional than they did one year ago. And when asked ”What is the main role of your financial professional?,” the top responses were similarly encouraging: Overwhelmed personalities want “A serious plan for retirement.” Overwhelmeds are generally in their 40s and 50s, tend to have the lowest income levels and net worth of the segments discovered in the study, and are the least knowledgeable about financial concepts. Often financially “just keeping their heads above water,” they understandably feel unprepared for retirement. Only 27% have a financial professional, but Overwhelmeds have an obvious need for retirement planning. As the largest segment in our study – comprising nearly a third of all surveyed – this group holds enormous potential for financial professionals and shouldn’t be neglected despite their lower net worth. Iconic personalities want “A plan for the long term.” Iconics are typically older (60+) and exemplify the “American Dream;” having worked hard and lived within their means, they are now enjoying a relatively secure retirement.

About half currently have a financial professional. For those without one, it may be due to their having a pension (83% of Iconics), or because they feel their modest incomes and moderate levels of investable assets don’t justify the need. However, it’s important to note that they also have the highest level of annuity ownership (36%) of the segments studied. This segment may be receptive to the benefits of a retirement product. This segment represents an opportunity for financial professionals because they represent 27% of the population based on our study yet only 53% have a financial professional. Savvy personalities want “Big-picture understanding.” Savvys tend to be older (60+) and either in or nearing retirement. With the highest levels of investable assets, diversified portfolios, and the lowest levels of debt, they have few financial concerns. They are generally financially independent and comfortable taking risks, but recent market losses have often prompted a more conservative approach to their investing.

More Savvys have a financial professional (67%) than those in any other segment – but, consistent with being highly educated and assertive, Savvys want to be treated like a partner in the decision-making process. Distracted personalities want “A serious plan for retirement.” Distracteds, the youngest of the segments, are typically in their late 40s/early 50s, well-educated, and struggling with the twin pressures of family and career. They have the highest income (by far) and the second-highest level of investable assets of the segments studied; that said, they tend not to focus on financial planning and spend freely, owing the most on both mortgage and credit cards. They do, however, recognize the need to invest smarter, even if they haven’t made the commitment to do so.

Distracteds have the highest percentage of those not working with a financial professional who nonetheless say they are either “open to it” or “definitely plan on it.” Even though this segment percentage is small, it represents a large opportunity for financial professionals. Resilient personalities want “A serious plan for retirement.” Resilients are generally in their early to mid-50s with a “take charge” attitude toward funding their retirements and making sure they don’t outlive their income. That said, Resilients do tend to understand the value of a financial professional; 53% of them report working with one. Though they have a strong independent streak, this segment was hit hard psychologically by the recession.

Typically, the moderately affluent have a fairly sizable net worth, and many are now very cognizant of the need for better financial planning. The five distinct financial “personalities” Overwhelmed 27% 7% Iconic Resilient 14% 20% Savvy 32% Distracted The Allianz Reclaiming the Future Study, 2010. 2 Page 4 of 8 . The gap: What financial professionals are providing is quite different from what consumers want Overall, 29% of boomers say they want their financial professional to provide big-picture thinking and help them plan for a stable and secure retirement. Ensuring the safety of a significant part of their nest egg is somewhat/very or extremely important to 90% of boomers. Trust in a financial professional ranks second highest (59%) exceeded only by trust in a spouse or significant other. Yet it appears there is a gap between what consumers want and what their financial professional is providing. Overall, 44% of consumers say they should be learning about financial strategies from a financial professional compared to that of the next highest alternative: self-discovery and self-teaching at 26%. But compared to those who said they’ve learned about financial strategies from their financial professional, three times as many said they have not. The feeling that financial professionals are not addressing “the big picture” is most obvious concerning annuities. Annuities are one of the few financial products that offer a lifetime income stream. An overwhelming number – 80% – say they want an annuity-like solution.

Among the affluent (household incomes of $150,000 or more), 29% own annuities. The concept of annuities is clearly attractive and relevant to consumers, despite confusion about annuities in the marketplace. Boomers want products that provide guaranteed income for life (26%), or helping them plan for a stable and secure retirement (18%) – two of the benefits annuities are designed to provide. Several financial professionals we surveyed mentioned that clients had independently come in asking about annuities, particularly following the market downturn of 2008. “Many were in a panic and wanted guarantees above all,” was how one financial professional explained it. By a dramatic and conclusive margin – four to one – consumers say they prefer a retirement income product with a 4% return that’s guaranteed not to lose value versus a product with a higher 8% return that includes the possibility of losing value. Yet consumers say they are not being offered the option. A surprising 46% of all respondents say their financial professional has never recommended an annuity. When asked why they don’t have an annuity, most consumers cite lack of knowledge about them, while a number of them said they had no idea why not. Consumers are discovering annuities on their own. Our study reveals that annuities have clearly risen in relevance and appeal for a significant number of their clients who are pre-retirees and retirees. 3 Page 5 of 8 . The Allianz Reclaiming the Future Study White Paper The need for change by financial professionals Growing recognition of an annuity’s value Certainly, financial professionals recognize that Americans are facing tough retirement funding challenges amidst a confluence of negative factors (market volatility, disappearance of pensions, solvency questions about Social Security). And many financial professionals do see a clear marketplace need for retirement income solutions that can provide guaranteed lifetime income. According to the study, annuities are enjoying more positive “buzz,” and more interest among consumers across all groups. And in spite of their own misgivings about the product, many financial professionals have found themselves needing to offer annuities as a solution to their clients’ financial goals and concerns. That said, there remain numerous barriers to selling annuities as part of retirement income solutions in the mind of the financial professional, beginning with the perception of the product as very complicated and confusing. Non-sellers believe it is more complicated to sell an annuity, given the need to educate clients on all of the options and conditions.

By comparison, financial professionals believe that mutual funds are much easier for consumers to grasp. Moreover, some financial professionals believe and are concerned that selling variable annuities involves more compliance, suitability, and/or auditing issues that are less common when using other products. Expense, or the perception of being expensive, comes up for annuities again and again – perhaps causing some financial professionals to convince themselves that the cost/benefit trade-off is just not there. Beyond these issues, there’s a perception among some financial professionals that the use of an annuity is contrary to a hands-on, active approach to a client’s portfolio. There are also concerns about under-delivering results versus what the financial professional thinks could be achieved for the client with other financial vehicles. 35% of annuity owners say they have purchased one because their financial professionals recommended it. Most financial professionals agree that annuities aren’t for everyone but they could be positioned to clients as products that provide protection and/or a guaranteed stream of income for retirement. A surprising number of non-sellers – even those who describe themselves as “against” annuities – could identify situations and people where annuities could furnish a suitable solution. Even more encouraging is that 76% of annuity owners say they are very happy with their purchase.

The more consumers understand about their annuities, the better they feel about them. 76% of annuity owners say they are very happy with their purchase. 4 Page 6 of 8 . Learn more about about how annuities are helping Americans prepare for retirement. For more information, log on to www.allianzlife.com. Page 7 of 8 . True to our promises … so you can be true to yours. ® As leading providers of annuities and life insurance, Allianz Life Insurance Company of North America (Allianz) and its subsidiary, Allianz Life Insurance Company of New York (Allianz Life® of NY), base each decision on a philosophy of being true: True to our strength as an important part of a leading global financial organization. True to our passion for making wise investment decisions. And true to the people we serve, each and every day. Through a line of innovative products and a network of trusted financial professionals, Allianz and Allianz Life of NY together help people as they seek to achieve their financial and retirement goals. Founded in 1896, Allianz, together with Allianz Life of NY, is proud to play a vital role in the success of our global parent, Allianz SE, one of the world’s largest financial services companies. While we pride ourselves on our financial strength, we’re made of much more than our balance sheet. We believe in making a difference with our clients by being true to our commitments and keeping our promises.

People rely on Allianz and Allianz Life of NY today and count on us for tomorrow – when they need us most. Guarantees are backed solely by the financial strength and claims-paying ability of Allianz Life Insurance Company of North America and Allianz Life Insurance Company of New York. Variable annuity guarantees do not apply to the performance of the variable subaccounts, which will fluctuate with market conditions. • Not FDIC insured • May lose value • No bank or credit union guarantee • Not a deposit • Not insured by any federal government agency or NCUA/NCUSIF Products are issued by Allianz Life Insurance Company of North America, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. www.allianzlife.com.

In New York, products are issued by Allianz Life Insurance Company of New York, One Chase Manhattan Plaza, 38th Floor, New York, NY 10005-1423. www.allianzlife.com/new-york. Only Allianz Life Insurance Company of New York is authorized to offer annuities and life insurance in the state of New York.

Variable products are distributed by their affiliate, Allianz Life Financial Services, LLC, member FINRA, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. www.allianzlife.com Page 8 of 8 (R-1/2015) .